Original article: Peter Schroeder

Compiled by: Yuliya, PANews

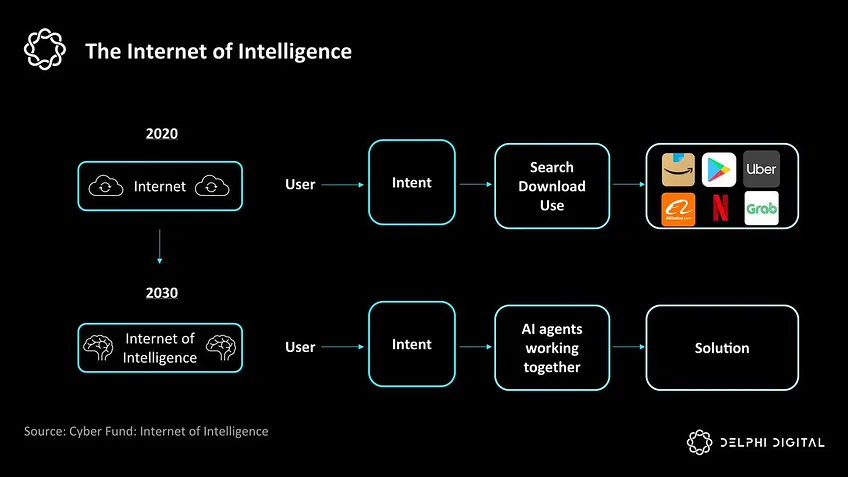

Before the advent of the Internet, personal computers had already demonstrated their revolutionary power. In the 1990s, the popularization of personal computers completely changed the way people handled daily tasks, significantly improving work efficiency and quality of life. However, despite the powerful functions of these computers, they were still isolated and independent systems, and their capabilities were limited to a closed environment.

The advent of the Internet changed this landscape forever. Computers suddenly gained the ability to connect to a vast world of information and a global network of users. These once independent machines were transformed into a portal to infinite possibilities, enabling instant communication, collaboration, and knowledge sharing on a global scale. This groundbreaking innovation ultimately shaped today's modern, technology-driven society.

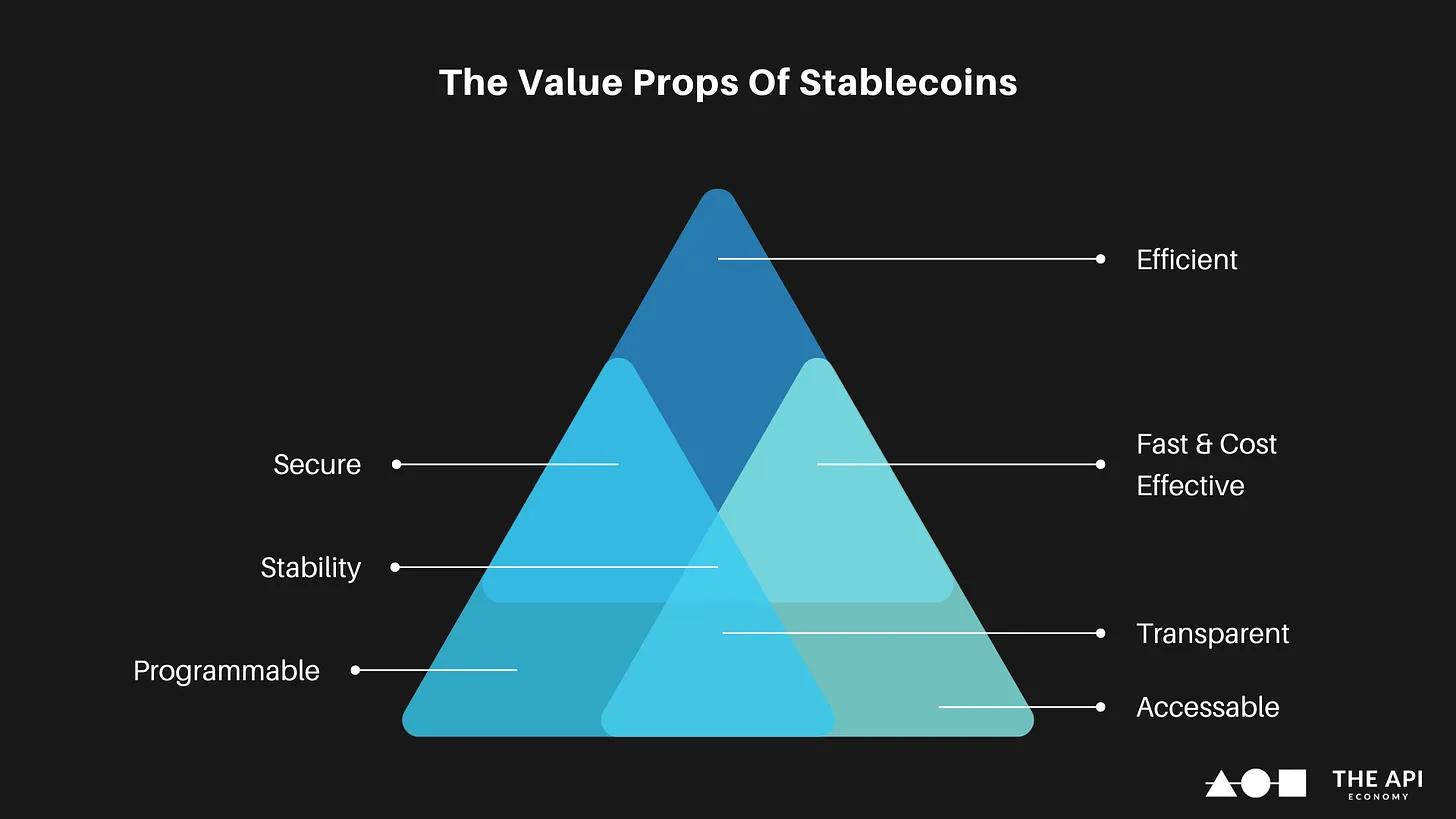

At present, currency is undergoing a similar historical transition. Traditionally, currency mainly undertakes three basic functions: medium of exchange, value storage and unit of account. With the emergence of stablecoins, currency begins to gain all the advantages of the Internet and creates conditions for the rise of AI agents. As industry expert Nic Carter said: "Stablecoin is the Starlink in the financial field."

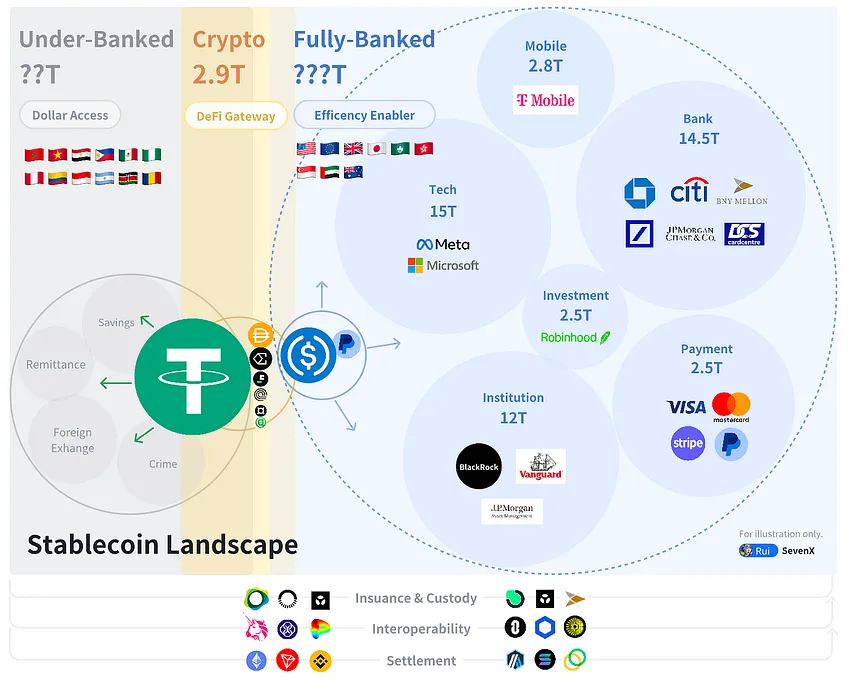

The market value of stablecoins has now reached $200 billion, and trillions of dollars in transactions are processed every month. By combining the stability of fiat currencies with the programmability of digital assets, stablecoins have become the infrastructure of Internet native currencies, opening up new possibilities for the global decentralized financial system.

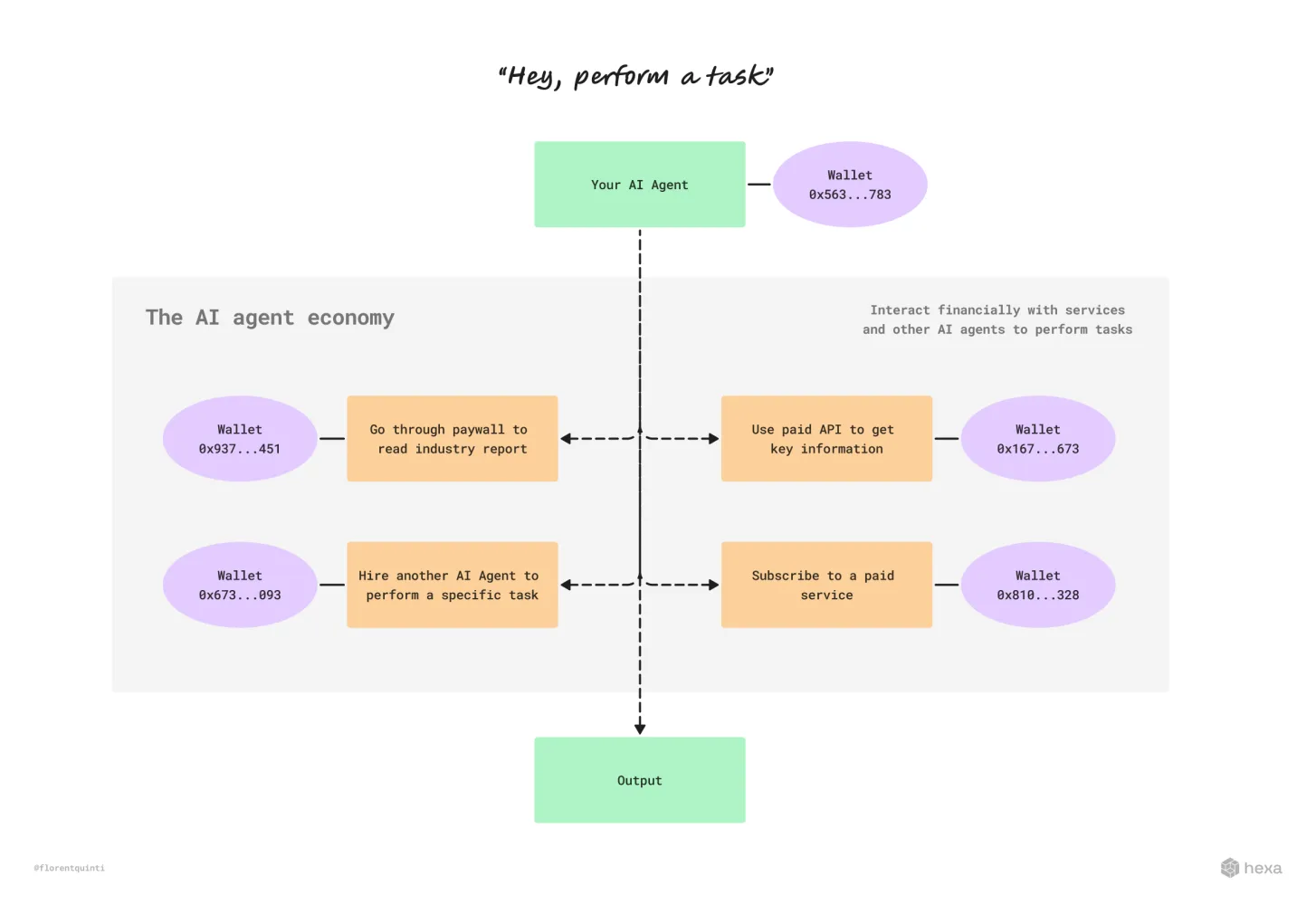

Artificial intelligence brings intelligence to this new currency system. AI agents can:

- Analyzing massive amounts of data

- Predicting market trends

- Automate operations at unprecedented scale

When this intelligence is combined with the seamless value transfer provided by stablecoins, a whole new world of possibilities opens up. For example, investors can use AI to perform real-time analysis of global financial data while using stablecoins for instant and secure trade execution.

The combination of stablecoins and AI has created an efficient and intelligent new financial ecosystem. AI can not only analyze data and perform tasks autonomously, but also interact directly with blockchain protocols. This is not a simple automation of financial processes, but a fundamental change to the traditional financial system.

The three-stage evolution of stablecoins

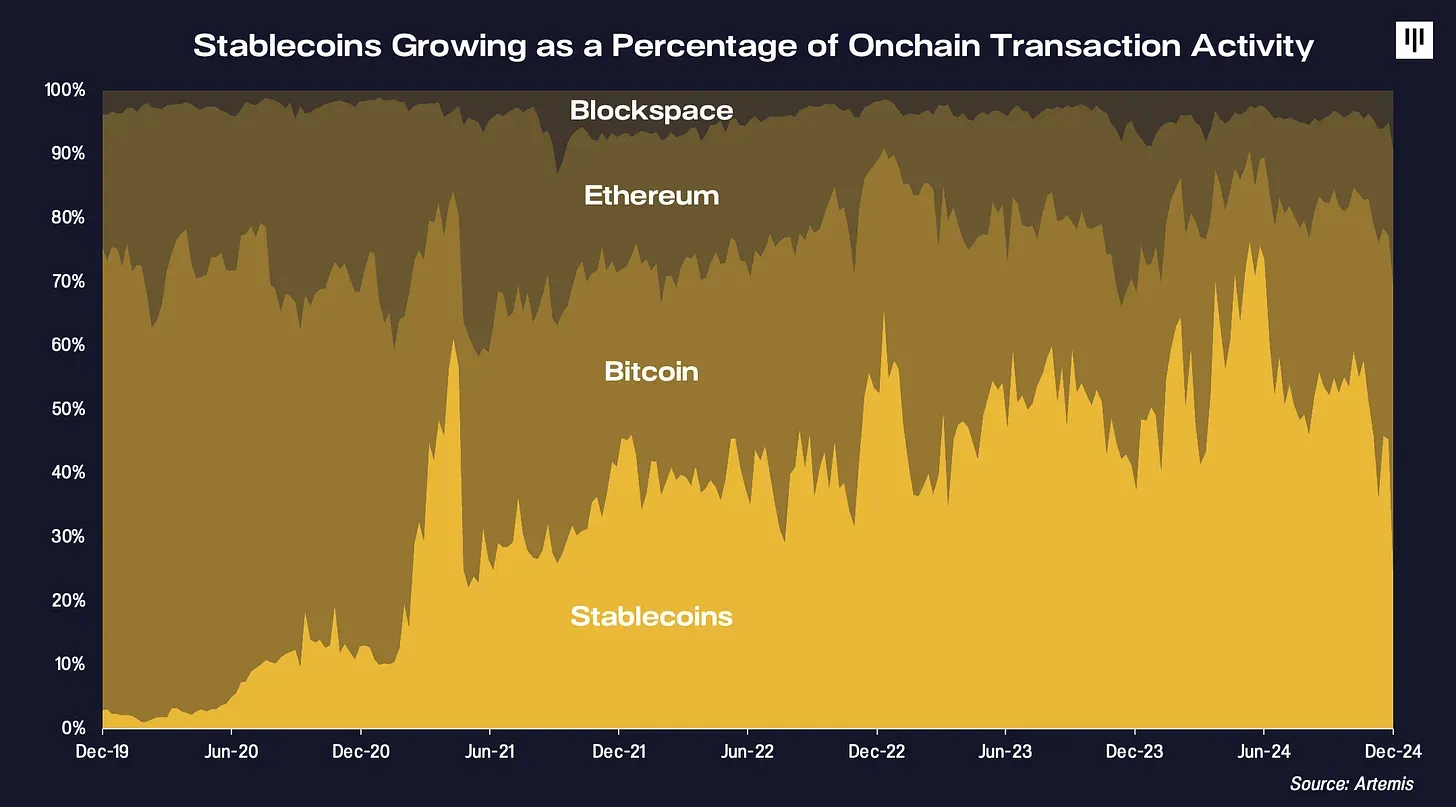

Stablecoins provide AI agents with the required scalability and reliability to operate autonomously.

Since their introduction in 2014, stablecoins have processed over $60 trillion in transaction volume and currently account for approximately half of all on-chain transactions.

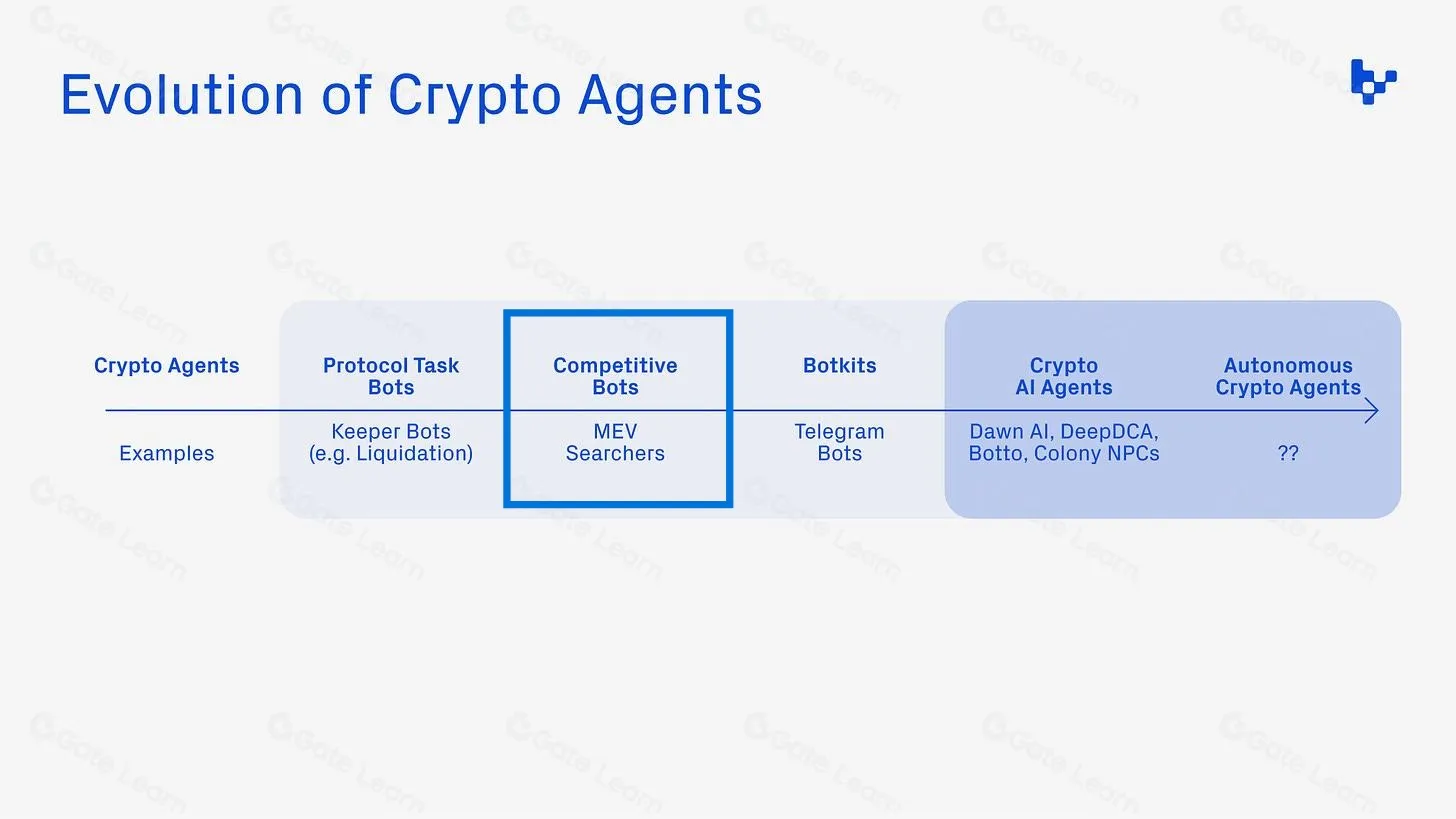

Although stablecoins have found a clear product-market fit and are ready for the development of AI agents, their use cases will be gradually developed in stages. As Robbie Petersen described in the article "The Role of Cryptocurrency in the Agent Economy", this process will go through three distinct stages:

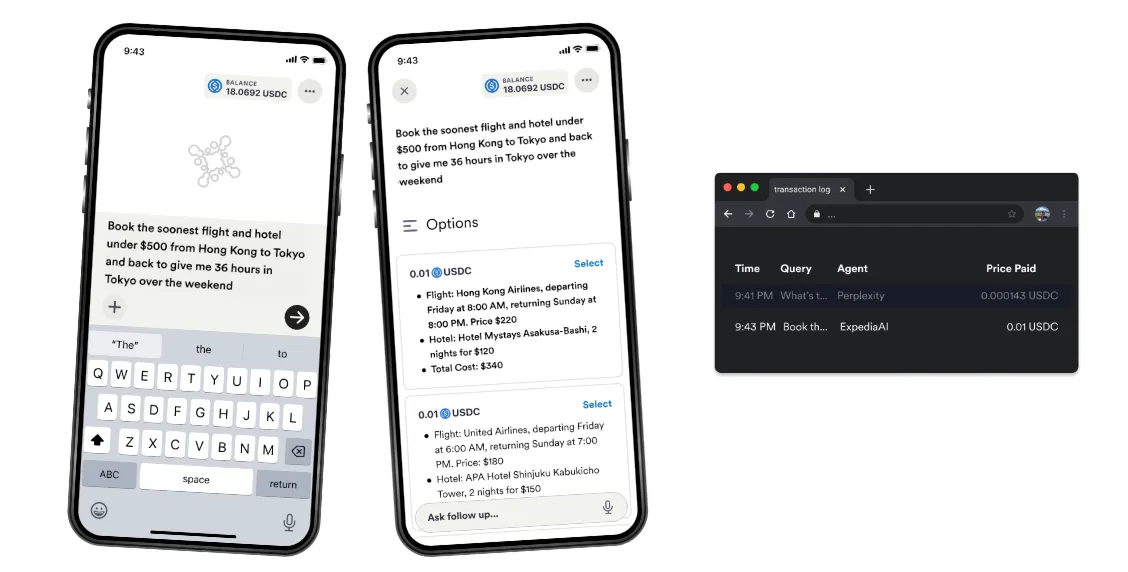

Phase 1: Human-Computer Interaction (Present)

Currently, the closest to this stage is Perplexity, which recently launched a shopping feature that enables agents to make purchases on behalf of users. While stablecoin functionality has not yet been integrated, the full launch of such features is not far away.

As Social Capital founder Chamath Palihapitiya said: "AI is ruthless because it has no emotions. It will not be impressed by a steak dinner, taken to a basketball game, or persuaded by a CEO. It is just an agent that looks at an API endpoint and writes code to get the job done." This shows that AI agents will choose the most accessible and efficient system without being influenced by human factors such as marketing and business development. Crossmint is building tools so that AI agents can take advantage of stablecoins such as USDC.

Phase 2: Robot-Human Interaction (Emerging)

This phase is developing rapidly. According to Robbie, a researcher at Delphi Digital, this phase is characterized by AI agents being able to autonomously initiate transactions with humans. This trend has already emerged in specific areas, including AI trading systems executing transactions, smart home systems purchasing electricity based on time-of-use electricity prices, and automated inventory management systems replenishing stocks based on demand forecasts.

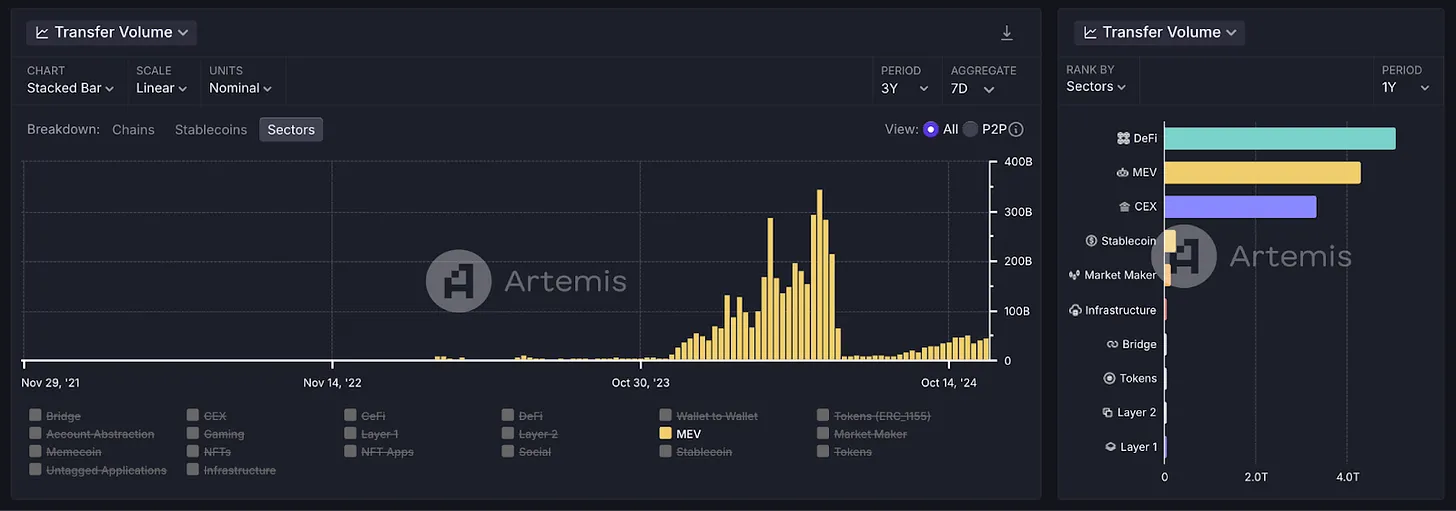

MEV (Maximum Extractable Value) bots are typical representatives of this stage. In the past three years, these bots have processed more than $430 million in trading volume using stablecoins and completed nearly 200 million transactions.

MEV robots are automated programs that can identify and exploit opportunities such as arbitrage, liquidation, and front-running in blockchain transactions. Traditional MEV robots operate based on rule-based algorithms, monitoring trading pools, executing transactions, and reordering transactions through preset strategies to make profits.

These robots use machine learning technology to predict market trends, optimize trading layouts, and adapt to market changes in real time, demonstrating the technological advancement of cryptocurrency brokers. In this process, stablecoins play a key role, providing robots with the stability and liquidity needed to execute high-frequency, low-risk strategies.

The increasing sophistication of this robot reflects a broader trend: AI agents, robots, and automated systems are becoming dominant in the blockchain ecosystem. The success of the MEV robot is just one example of the large-scale application of stablecoins, but it clearly shows how AI agents and robots are beginning to widely influence market operations. This expansion of influence indicates that the cryptocurrency market is entering a new era of greater automation and intelligence.

Phase 3: Machine-to-machine interaction (future)

This stage is already beginning to take shape. In August this year, Coinbase incubated the first AI-to-AI transaction using USDC.

As Coinbase CEO Brian Armstrong said: "Although AI agents cannot open bank accounts, they can have cryptocurrency wallets. They can now use USDC on Base to conduct instant, global, and free transactions with humans, merchants, or other AIs."

Stablecoins provide AI agents with an efficient, liquid, and permissionless medium of exchange, while AI injects intelligence into blockchain operations, enabling smarter, faster, and more efficient systems. The impact of AI on AI transactions will be far-reaching and extensive, and the development of this field deserves continued attention.

The perfect match between stablecoins and AI-driven application scenarios

Programmable liquidity

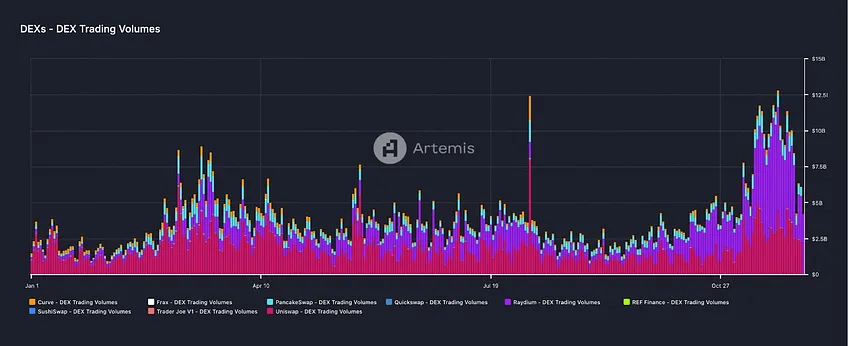

Currently, one of the most attractive application scenarios for stablecoins is programmable liquidity, which enables AI agents to instantly access and deploy funds . Since 2024, the global DeFi market has a transaction volume of more than 1.3 trillion US dollars, of which stablecoins account for a considerable share of liquidity.

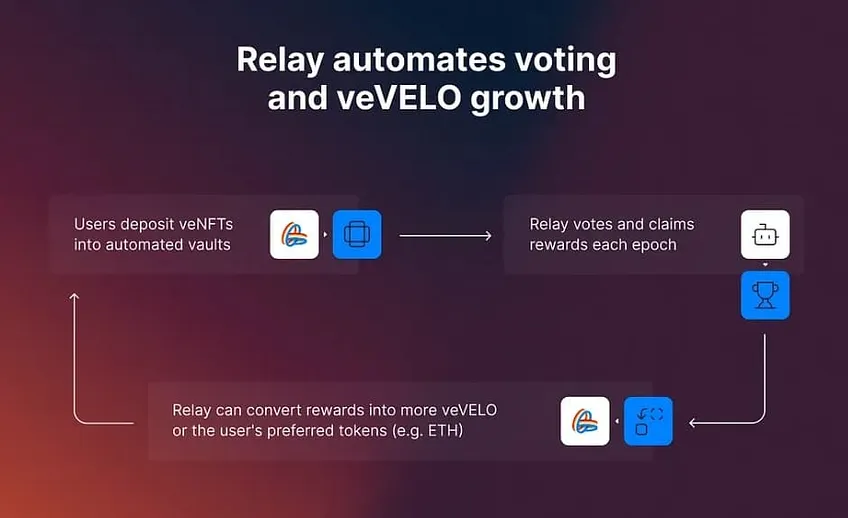

Companies like Velodrome and Aerodrome Finance are innovating automated market maker (AMM) mechanisms by introducing a voting custody (ve) token model that facilitates community-driven liquidity allocation. By integrating Layer 2 networks such as Optimism and Base, this model ensures efficient and scalable capital deployment.

AI can improve the efficiency and adaptability of stablecoin liquidity provision by enabling programmable liquidity and dynamically optimizing fund pool allocation, fee structure, and rewards based on market conditions and user behavior.

These developments have fueled the continued growth of the DeFi market. According to VanEck’s forecast, by 2025, DeFi will hit new highs, with DEX trading volume reaching $4 trillion and total locked value reaching $200 billion, mainly driven by liquidity and adoption driven by AI-related tokens, consumer-facing dApps, and tokenized assets.

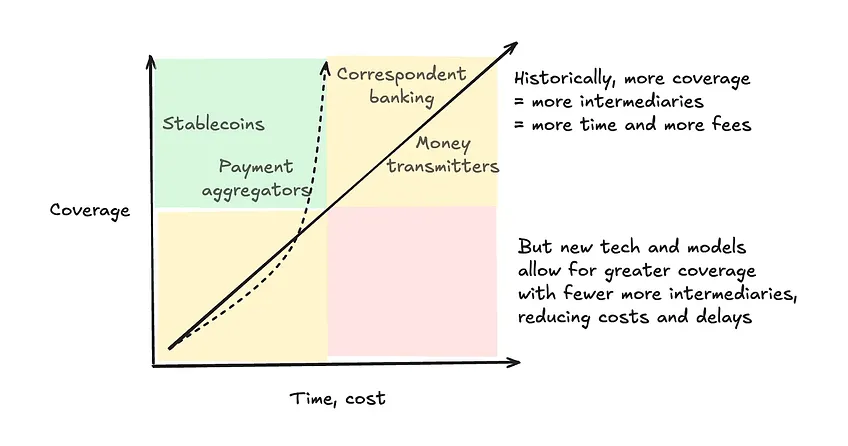

Cross-border payments

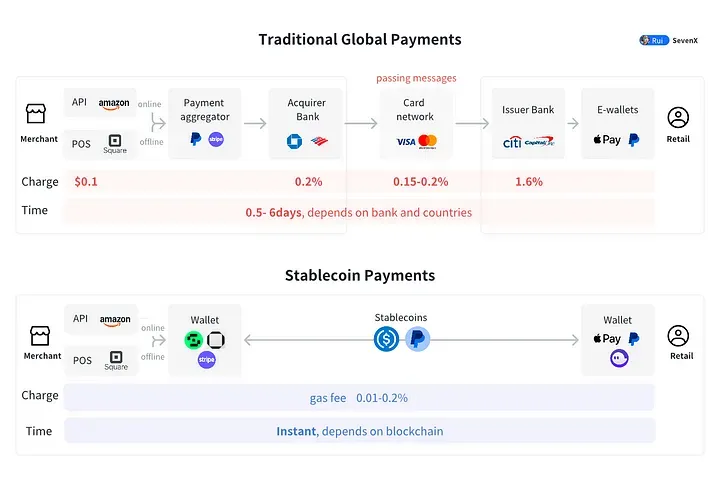

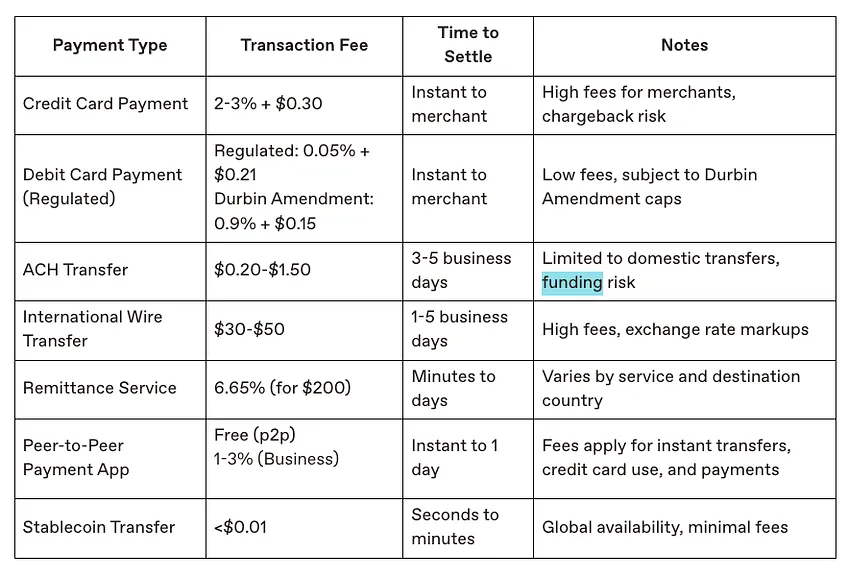

Cross-border payments is another area with great potential for stablecoins and AI agents. The global remittance market reached $883 billion in 2023 and is expected to grow to $913 billion by 2025. Traditional remittances suffer from high fees (around 6% on average globally) and long processing times (which can take days). Stablecoins are disrupting this market with their instant settlement and extremely low costs. When combined with AI agents, the process becomes even more seamless: AI agents can analyze exchange rates, identify the most cost-effective routes, and autonomously execute transfers.

As Circle co-founder Jeremy Allaire discussed at the Circle Forum in Hong Kong, stablecoins are ideal tools for AI agents because of their focus on programmability, trust, and transparency . They provide an immutable record of transactions on the chain, ensuring that the behavior of AI agents can be audited and verified. This programmable trust is essential to connecting the human and machine economies.

AI agents, powered by this stable, programmable liquidity, are transforming these transactions into smarter, faster, and more cost-effective workflows. From optimizing DeFi strategies to automating global commerce, the synergy between stablecoins and AI agents is upgrading the way value flows between systems.

Future Outlook

As the share of AI-driven economic activity continues to increase, stablecoins are becoming a critical infrastructure for this transformation. Their stability, speed, and accessibility make them an ideal monetary carrier for AI agents, driving the formation of a smarter, more efficient, and more inclusive financial system.

Stablecoin-powered AI agents make complex financial tasks accessible to anyone with an internet connection. Users can create wallets and transact with stablecoins simply by talking to the AI agent, without having to understand all the complexities of finance. For example, someone who lacks professional financial knowledge can delegate portfolio management of any amount to an AI agent and earn stablecoin returns through DeFi. All the user sees is a stable dollar-based savings account generating passive income.

These agents can automatically rebalance investments, optimize returns, and even obtain loans, lowering the barrier to entry for participating in decentralized finance behind the scenes while presenting a simple user interface. This has far-reaching implications for financial inclusion, especially in areas with limited coverage of traditional banking services.

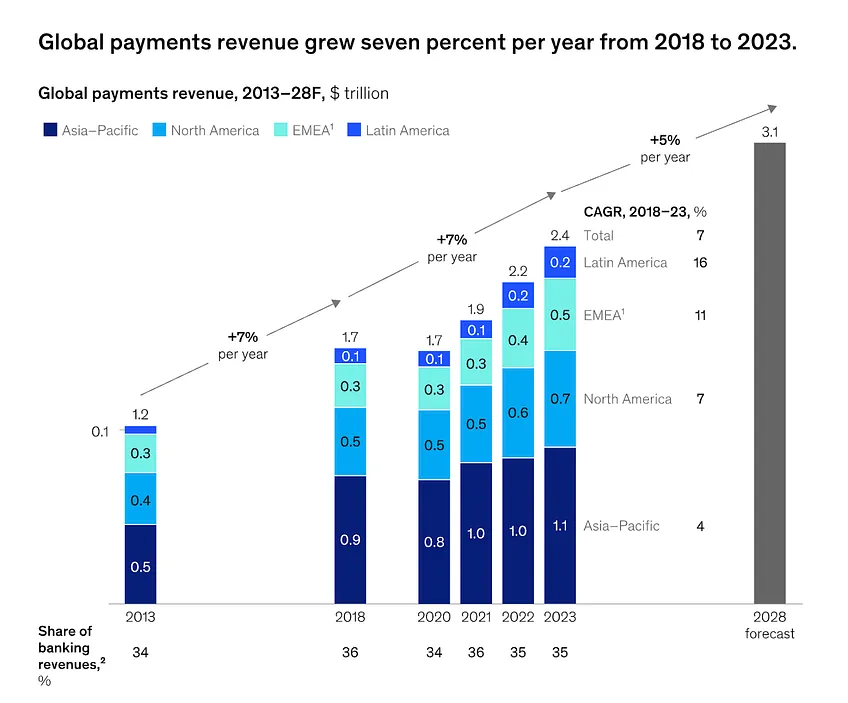

In the payment sector, the benefits of increased efficiency have already begun to emerge. In 2023, the global payment industry processed $1.8 quadrillion in transactions and generated $2.4 trillion in revenue, mostly from fees.

AI agents reduce friction in financial workflows by automating trading and decision-making processes. With the near-zero transaction costs of stablecoins, AI agents can reduce this "payment tax" and provide businesses and consumers with a faster and more economical way to transact.

Even more exciting is the creation of new economic models and markets. As AI agents use stablecoins to trade autonomously, entirely new industries and ecosystems are emerging, and a machine-to-machine economy (in which autonomous devices and systems directly exchange value) is becoming a reality. This has the potential to significantly increase global economic productivity, reduce efficiency losses and eliminate intermediaries, freeing up resources for growth and innovation.

The fusion of stablecoins and AI agents is changing the way value flows, enabling an unprecedentedly fast, intelligent, and efficient autonomous economic system.

As the ecosystem develops, stablecoins will continue to serve as the backbone of this revolution, providing the necessary stability and liquidity for AI agents to thrive. When programmable money meets intelligent automation, this is just the beginning of the possibilities, and the future opportunities are as vast as the digital economy itself.