Author: 0xEdwardyw

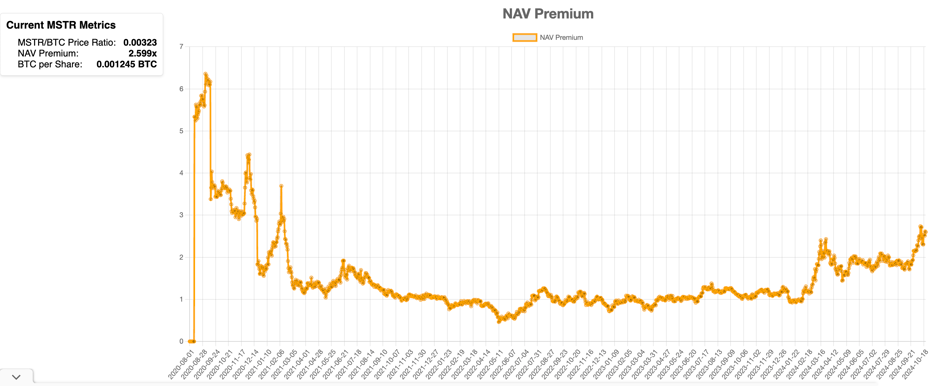

- MicroStrategy's stock market value is 2.7 times higher than the value of its Bitcoin holdings, a phenomenon known as the NAV premium.

- The company uses this NAV premium to issue more shares and use the proceeds to purchase Bitcoin. While issuing new shares typically dilutes shareholder value, in this case the number of Bitcoins per share increases.

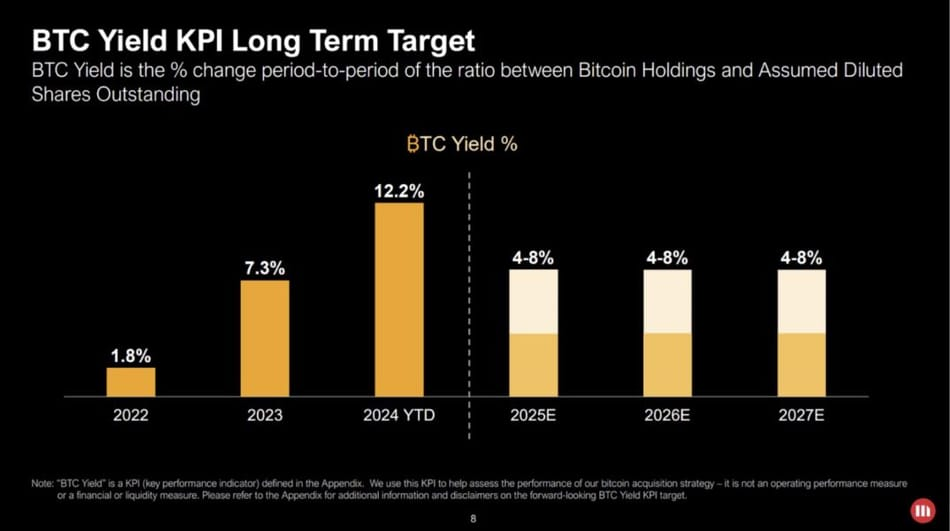

- MicroStrategy introduced the concept of "BTC Yield" to measure the growth of Bitcoin holdings per share.

- The company has achieved a 17% year-to-date BTC gain this year, and expects future BTC gains to remain between 4% and 8%, showing a continued growth trend in Bitcoin holdings per share.

MicroStrategy and Michael Saylor

MicroStrategy was founded by Michael J. Saylor in 1989 as a company focused on business intelligence (BI) and analytical software. The company is committed to providing solutions for enterprises, using advanced analytics, reporting, and decision support tools to help organizations dig deep into operational data to achieve data-driven decisions.

As a key figure in the technology and business intelligence fields, Saylor has led MicroStrategy through many years of growth and innovation in the BI industry, allowing it to maintain its leading position in the field. However, a historic turning point for MicroStrategy came in 2020 when the company decided to turn its attention to Bitcoin.

In August 2020, MicroStrategy announced its first acquisition of 21,454 Bitcoins for $250 million as a strategic investment. Saylor and management believe that Bitcoin is a better store of value than cash, especially as inflation and fiat currency devaluation risks increase. Since then, MicroStrategy has transformed from a pure software company to a leader in companies using Bitcoin as a financial asset. The strategy of borrowing through a variety of capital market instruments and investing in Bitcoin has made MicroStrategy's stock one of the best performing stocks in the market.

MicroStrategy’s Net Asset Value (NAV) Premium

As of October 2024, MicroStrategy holds approximately 244,800 bitcoins, with an average cost of approximately $38,585 per bitcoin and a total investment of approximately $9.45 billion. The market value of these holdings has exceeded $16 billion, meaning that its bitcoin investment has achieved a return of more than 1.6 times.

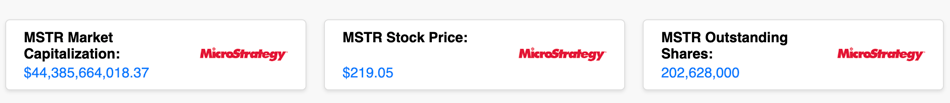

Although MicroStrategy's Bitcoin holdings are valued at over $16 billion on its balance sheet, the company's stock is worth much more than that. As of October 2024, MicroStrategy's market capitalization on U.S. stock exchanges has exceeded $44 billion, about 2.75 times the value of its Bitcoin holdings.

Net Asset Value (NAV) Premium

MicroStrategy's net asset value (NAV) premium is the ratio of a company's market value to the value of its Bitcoin holdings, which reflects the premium investors are willing to pay for MicroStrategy shares relative to the intrinsic value of its Bitcoin assets.

As of late October 2024, MicroStrategy's NAV premium has reached approximately 2.7 times its Bitcoin holdings, marking the highest level since February 2021. This suggests that investors value MicroStrategy significantly higher than the value of its Bitcoin assets.

There may be two reasons for this premium. First, although MicroStrategy's business focus is Bitcoin investment, its software business also generates positive cash flow, about $12 million in 2023. Although this cash flow is small relative to the huge scale of Bitcoin investment, it provides certain business support for the company. Second, investors are optimistic about the rise in Bitcoin prices, which may reflect the potential increase of more than 100% in Bitcoin in the valuation, thus driving the company's stock to a 2.75 times premium relative to the value of its Bitcoin holdings.

Bitcoin Securitization Strategy

Securitization is a financial engineering method that realizes value by converting an asset or a portfolio of assets into tradable securities. In traditional finance, this usually applies to mortgages and loans, "securitizing" the future cash flows of assets into bonds, stocks or other financial products, and then selling them to investors. Investors get returns based on the performance of the underlying assets of these financial products.

In the context of Bitcoin, securitization means using Bitcoin holdings as an underlying asset. Companies issue securities (such as bonds, stocks, or convertible debt) backed by their Bitcoin holdings, and investors are indirectly exposed to the performance of Bitcoin.

MicroStrategy holds billions of dollars worth of Bitcoin on its balance sheet and considers it "permanent capital," meaning the company has no intention of selling it.

MicroStrategy used its Bitcoin holdings as collateral to issue convertible bonds to investors. Convertible bonds are a type of debt that can be converted into company shares under certain conditions. The company used the proceeds from these bonds to buy more Bitcoin, further increasing its holdings.

In addition to debt instruments, MicroStrategy is raising funds by issuing shares to leverage its market NAV premium (i.e., the difference between the market value of its shares and the value of its Bitcoin holdings).

The “Money Printing Machine” Strategy Using NAV Premium

MicroStrategy's stock is trading at a premium of 2.7 times the value of its Bitcoin holdings, meaning that when the company issues new shares, investors are willing to pay 2.7 times more for those shares than their actual Bitcoin holdings are worth. For example, one share actually corresponds to 1 Bitcoin, but the market is pricing it at a value of 2.7 Bitcoins. When the company issues one new share, it is able to raise cash equivalent to 2.7 Bitcoins and use those funds to purchase 2.7 Bitcoins. As a result, 2 shares of stock will be backed by a total of 3.7 Bitcoins, increasing the Bitcoin holdings per share from 1 to 1.85.

Here are the detailed steps:

1. Current situation:

- Stock: 1 outstanding share

- Bitcoin holdings: 1 Bitcoin

- Market Valuation: Due to the premium, the market values the stock at 2.7 BTC

2. Issuance of new shares:

- New Shares Issued: MicroStrategy Issues 1 New Share

- Fundraising: The company raised 2.7 bitcoins in cash from new share issuance

3. Buy more Bitcoins:

- Use of proceeds: The company used 2.7 bitcoins in cash to purchase an additional 2.7 bitcoins

- New Bitcoin holdings: 1 + 2.7 = 3.7 Bitcoins

4. Number of shares after issuance:

- Total shares: 2 outstanding (1 original + 1 newly issued)

5. Bitcoin holdings per share:

- Bitcoin per share: Total Bitcoin holdings 3.7 ÷ Total number of shares 2 = 1.85 Bitcoins/share

By issuing new shares at a price 2.7 times higher than the actual Bitcoin value per share, MicroStrategy effectively increased its holdings per Bitcoin. This strategy took advantage of investor optimism and premium valuations, increasing not only the support value of each Bitcoin share, but also the value of the Bitcoin assets of existing shareholders.

Surprisingly, although issuing new shares usually dilutes shareholders, MicroStrategy actually increased its Bitcoin holdings per share due to the premium issuance. The key is that the new shares were sold at a price higher than the net asset value (NAV) per share, and the amount of funds raised to purchase Bitcoin exceeded the dilution effect, effectively enhancing the Bitcoin-backed value of each share.

Maximizing Bitcoin Per Share and “BTC Yield”

MicroStrategy plans to maximize its Bitcoin holdings per share by issuing more capital using its Bitcoin holdings and then using the funds to buy more Bitcoin. The company introduced the concept of "BTC Yield" to measure the returns that Bitcoin strategies bring to shareholders. Although it is called "BTC Yield", this is not a traditional return (such as interest or dividends), but refers to the company's use of Bitcoin holdings for financial operations, raising capital, increasing Bitcoin holdings, and increasing the relative value of stocks to Bitcoin reserves, thereby increasing the value of shareholders' stocks over time.

BTC Yield reflects the growth of MicroStrategy’s Bitcoin holdings. When a company issues equity or debt on favorable terms and uses the capital raised to purchase Bitcoin, the Bitcoin holdings per share increase, thereby increasing shareholder value.

BTC Yield measures the growth of Bitcoin holdings per share, specifically the percentage change in the ratio of a company's Bitcoin holdings to the number of diluted shares outstanding, visually showing how the number of Bitcoins per share changes over time.

As of the latest report, MicroStrategy has achieved a 12% BTC Yield in 2024 (according to a recent interview with Michael Saylor, the BTC Yield so far this year has reached 17%). This data shows that the company has increased its Bitcoin holdings per share, thereby increasing shareholder value. The company expects BTC Yield to remain between 4% and 8% over the next three years, which means that shareholders' actual Bitcoin holdings may continue to increase.

Summarize

MicroStrategy maximizes its Bitcoin holdings per share through financial engineering. The company uses its Bitcoin holdings to raise funds through premiums from bond and stock issuances, and continuously reinvests the proceeds in Bitcoin.

The success of this strategy relies on the long-term appreciation of Bitcoin. If the price of Bitcoin continues to rise, MicroStrategy can continue to issue capital at a premium and reinvest it in Bitcoin, further increasing its Bitcoin holdings per share.

However, if the price of Bitcoin stagnates or falls sharply, the value of the company's holdings will be damaged and the market may lose confidence in the company's ability to earn a return on its Bitcoin investment. This could cause the stock price to fall, reduce the equity premium, and make it difficult for the company to issue new capital under favorable conditions.