Source: VanEck

By Matthew Sigel and Patrick Bush

Compiled by: BitpushNews

Note: VanEck may hold the following digital assets.

Before we get into our 2025 predictions, let’s take a moment to review our 2024 predictions. Of those predictions, we were accurate in 8.5 of them, for a 56.6% accuracy rate. While not perfect, considering Bitcoin broke $100,000 and Ethereum broke $4,000, 2024 will still be a year to remember even if some predictions were inaccurate.

A Review of Cryptocurrency Predictions for 2024

Spot BTC ETP Debuts – (1 point)

Bitcoin halving is going well – (1 point)

Bitcoin hits new all-time high in Q4 2024 – (1 point)

Ethereum still ranks second to Bitcoin – (1 point)

L2 dominates Ethereum activity (but L2 TVL is still lower than Ethereum) – (0.5 points)

Stablecoin market capitalization hits all-time high – (1 point)

Decentralized exchanges’ spot trading volume accounts for a record proportion – (1 point)

SOL outperforms ETH - (1 point)

DePIN Network adoption continues to grow – (1 point)

Now, let’s get down to business: our cryptocurrency predictions for 2025.

Top 10 Cryptocurrency Predictions for 2025

Cryptocurrency bull run reached an interim peak in Q1, set new highs in Q4

US Embraces Bitcoin with Strategic Reserve and Increased Crypto Adoption

Tokenized securities value exceeds $50 billion

Stablecoin daily settlement volume reaches $300 billion

AI Agents’ on-chain activity exceeds 1 million agents

Bitcoin Layer 2 TVL Reaches 100,000 BTC

Ethereum blob space generates $1 billion in fees

DeFi hits record high, DEX trading volume reaches $4 trillion, TVL reaches $200 billion

NFT market recovers, with trading volume reaching $30 billion

The performance gap between DApp tokens and L1 tokens is narrowing

1. The cryptocurrency bull market reached its mid-term peak in the first quarter and set a new high in the fourth quarter

We believe that the cryptocurrency bull run will continue until 2025 and reach its first peak in the first quarter. At the peak of the cycle, we predict that Bitcoin (BTC) will be worth around $180,000, while Ethereum (ETH) will trade at over $6,000. Other well-known projects, such as Solana (SOL) and Sui (SUI), could exceed $500 and $10, respectively.

After the first peak, we expect BTC to see a 30% retracement, with altcoins facing significant declines of up to 60% as the market consolidates over the summer. However, a recovery is likely in the fall, with major coins regaining momentum and reclaiming their previous all-time highs by the end of the year. To determine when the market is nearing a top, we are monitoring the following key signals:

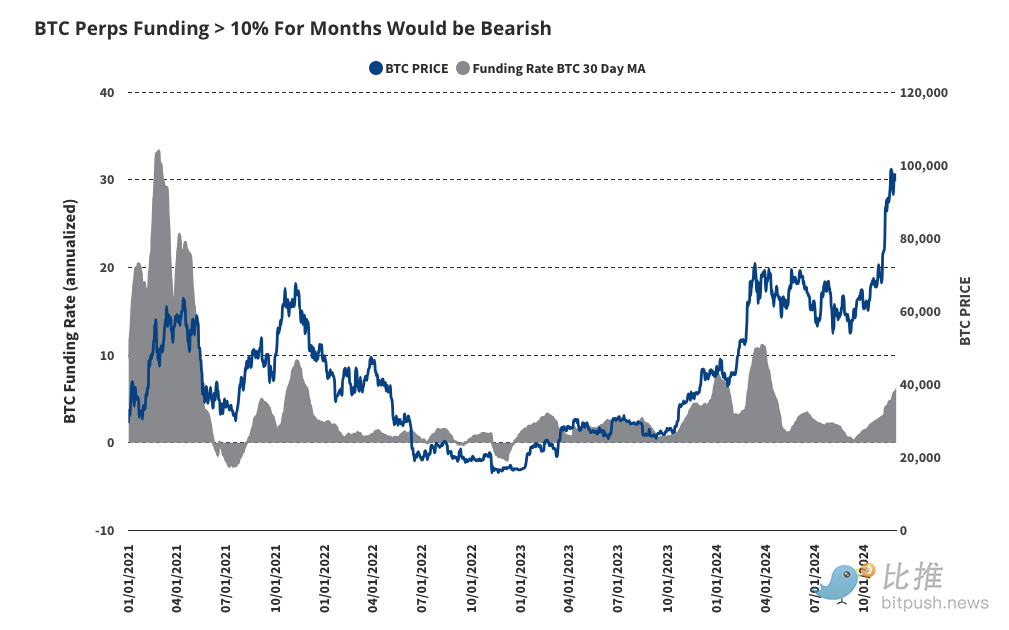

Sustained high funding rates: When traders borrow funds to bet on rising BTC prices, they are willing to pay funding rates of more than 10% for three months or more, which indicates excessive speculation.

BTC Perps funding rate > 10% for several months will be a negative factor

Source: Glass Node, as of December 8, 2024. Past performance is no guarantee of future results. This is not a recommendation to buy or sell any security mentioned in this article.

Excessive unrealized profits: If the percentage of BTC holders with large paper gains (profit-to-cost ratio of 70% or more) stabilizes, it indicates market optimism.

Market capitalization is overvalued relative to realized value: When the MVRV (market capitalization to realized value ratio) score exceeds 5, it indicates that the BTC price is well above the average purchase price, which usually indicates an overheated situation.

Declining Bitcoin dominance: If Bitcoin’s share of the total cryptocurrency market falls below 40%, it would signal a speculative shift toward riskier altcoins, a typical late-cycle behavior.

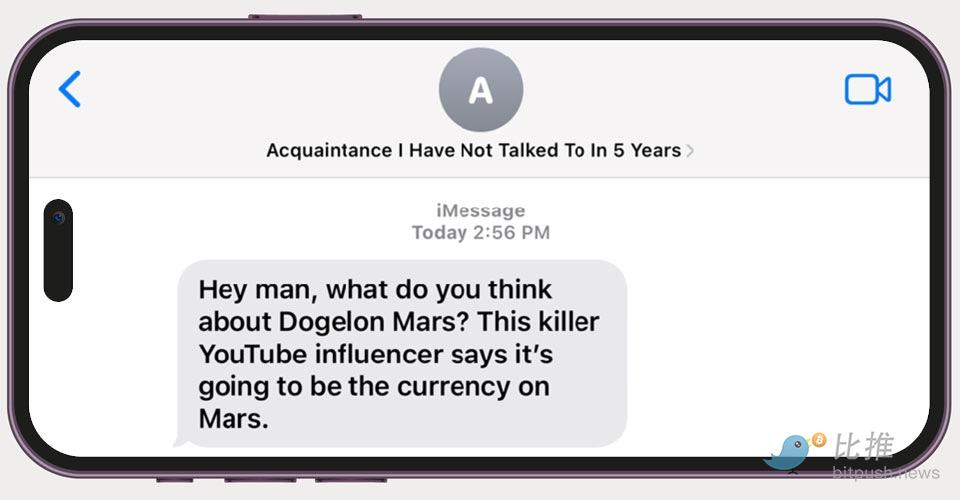

Mainstream speculation: A flood of text messages from crypto-illiterate friends asking about dubious projects is a reliable sign of a speculative frenzy approaching the top.

Historically, these indicators have been reliable signals of market prosperity and will guide our outlook as we navigate the expected market cycle through 2025.

For example: a “Top Signal” text from a friend I met five years ago.

2. The United States embraces Bitcoin through strategic reserves and increased cryptocurrency adoption

The election of Donald Trump has already injected a huge amount of momentum into the cryptocurrency market, with his administration appointing crypto-friendly leaders to key positions, including Vice President JD Vance, National Security Advisor Michael Waltz, Commerce Secretary Howard Lutnick, Treasury Secretary Scott Bessent, SEC Chairman Paul Atkins, FDIC Chairman Jelena McWilliams, and Health and Human Services Secretary RFK Jr. These appointments not only signal the end of anti-crypto policies, such as the systematic crackdown on the banking of cryptocurrency companies and their founders, but also the beginning of a policy framework that positions Bitcoin as a strategic asset.

Crypto ETPs: Physical Creation, Staking, and New Spot Approvals

New SEC leadership (or possibly the CFTC) will approve multiple new spot cryptocurrency exchange-traded products (ETPs) in the U.S., including the VanEck Solana product. Ethereum ETP functionality expanded to include staking, further enhancing its utility for holders, while both Ethereum and Bitcoin ETPs support physical creation/redemption. Either the SEC or Congress repeals SEC Rule SAB 121, which will pave the way for banks and brokers to custody spot cryptocurrencies, further integrating digital assets into traditional financial infrastructure.

Sovereign Bitcoin Adoption: Federal, State, and Mining Expansion

We predict that by 2025, the federal government or at least one U.S. state (likely Pennsylvania, Florida, or Texas) will have established a Bitcoin reserve. From the federal side, this is more likely to happen through an executive order leveraging the Treasury’s Exchange Stabilization Fund (ESF), although bipartisan legislation remains an unknown. Meanwhile, state governments may act independently, looking to Bitcoin as a hedge against fiscal uncertainty or a tool to attract crypto investment and innovation.

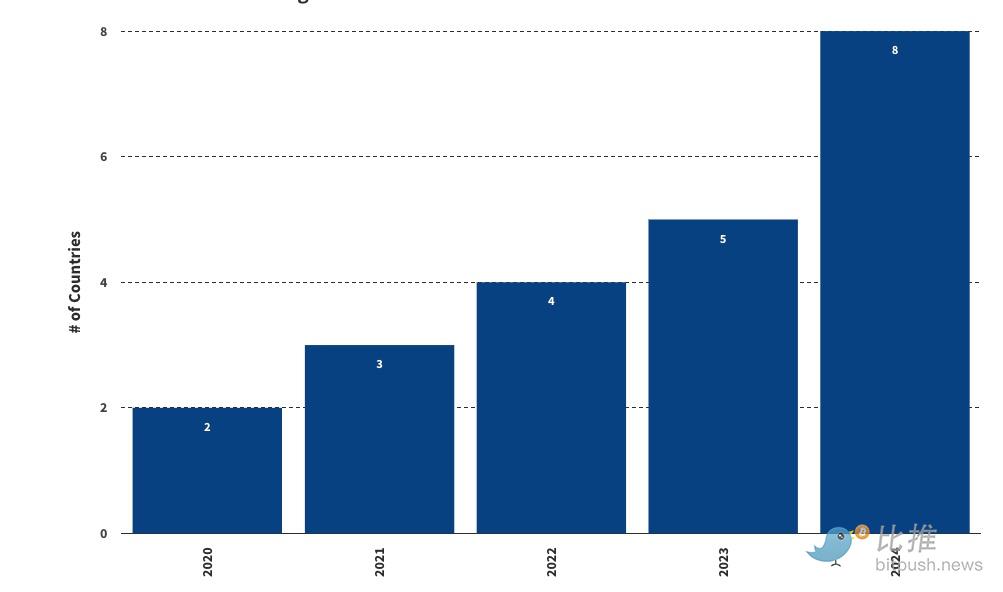

In terms of Bitcoin mining, the number of countries mining Bitcoin with government resources is expected to reach double digits (currently seven) as adoption increases in the BRICS countries. Russia’s stated interest in settling international trade in cryptocurrency has fueled this trend, highlighting Bitcoin’s growing importance in global economic strategy.

Number of countries using government resources to mine Bitcoin

Source: VanEck Research, as of December 2024.

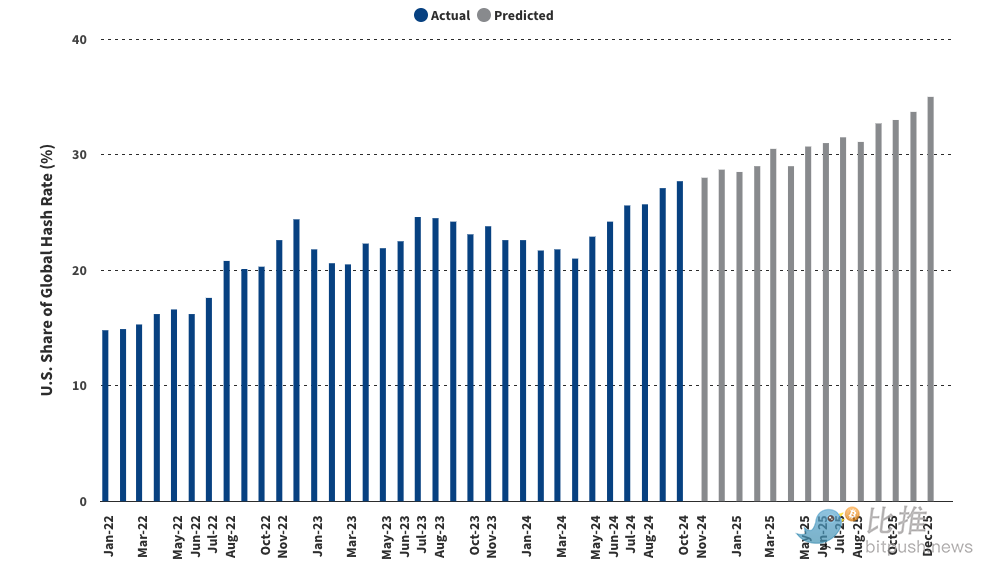

We expect this pro-Bitcoin stance to ripple through the entire U.S. crypto ecosystem. The share of global crypto developers headquartered in the U.S. will rise from 19% to 25% as regulatory clarity and incentives attract talent and companies back. At the same time, U.S. Bitcoin mining will boom, with the U.S. share of global mining hashrate rising from 28% in 2024 to 35% by the end of 2025, driven by cheap energy and potentially favorable tax policies. Together, these trends will solidify the U.S.’ leadership in the global Bitcoin economy.

US public companies’ share of Bitcoin hash rate to reach 35%

Source: JPMorgan Chase, VanEck Research as of December 6, 2024. Past performance is no guarantee of future results.

Corporate Bitcoin Holdings Expected to Surge 43%

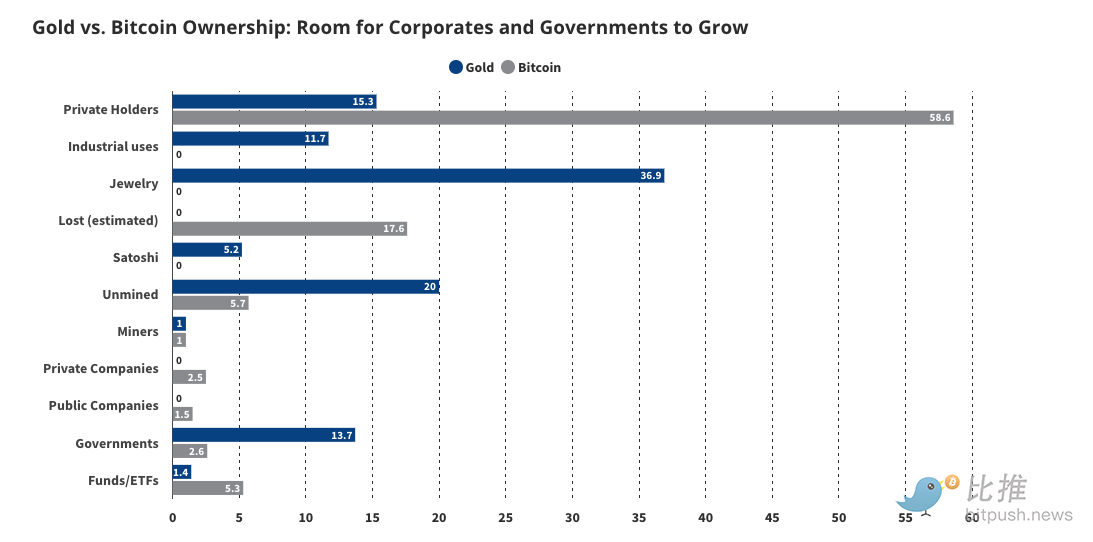

In terms of enterprise adoption, we expect businesses to continue to accumulate Bitcoin from retail investors. Currently, 68 public companies hold Bitcoin on their balance sheets, and we expect this number to reach 100 by 2025. Notably, we boldly predict that the total amount of Bitcoin held by private and public companies (currently 765,000 BTC) will exceed Satoshi's 1.1 million BTC next year. This means that corporate Bitcoin holdings will grow at a staggering 43% rate over the next year.

Gold vs. Bitcoin Ownership: Room for Growth for Corporations and Governments

Source: VanEck Research, as of December 2024.

3. The value of tokenized securities exceeds $50 billion

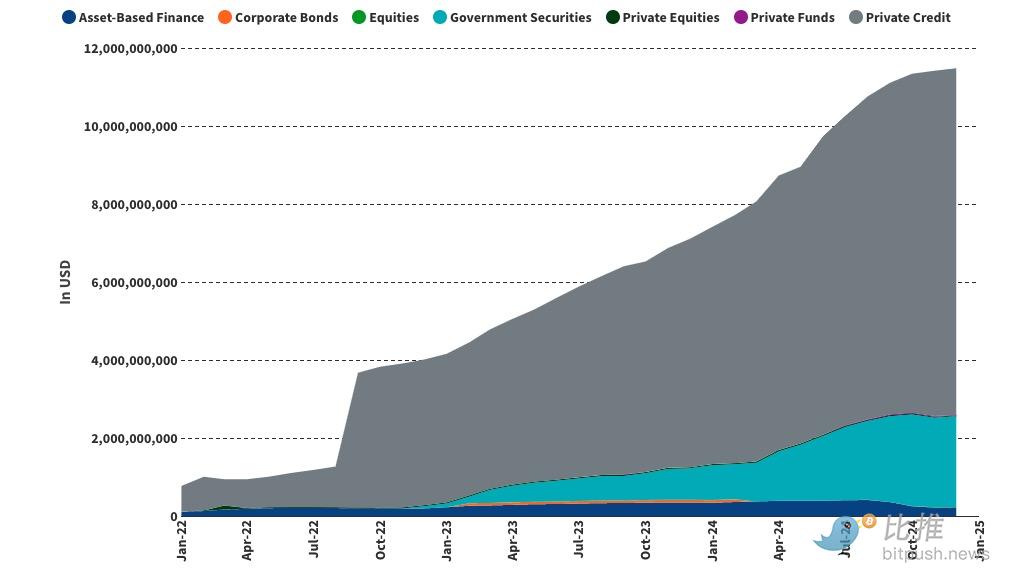

Onchain Securities to Grow 61% by 2024

Source: RWA.xyz, Deflama, as of December 6, 2024. Past performance is no guarantee of future results.

Crypto rails are expected to improve the financial system by increasing efficiency, decentralization, and transparency. We believe 2025 will be the year that tokenized securities take off. Currently, there are approximately $12 billion worth of tokenized securities on blockchains, the majority of which ($9.5 billion) are tokenized private credit securities listed on Figure’s semi-permissioned blockchain, Provenance.

In the future, we see great potential for tokenized securities to be issued on public blockchains. We believe there are many motivations for investors to drive tokenized equity or debt securities to be issued exclusively on-chain. Next year, we expect entities like the DTCC to enable tokenized assets to be seamlessly transferred between public blockchains and private closed infrastructures. This dynamic will set the standard for on-chain investors to enforce AML/KYC. As a wild card, we predict that Coinbase will take the unprecedented step of tokenizing COIN shares and deploying them on its BASE blockchain.

4. Daily settlement volume of stablecoins reaches $300 billion

Monthly stablecoin transfers (USD) in 2024 increased by 180% year-on-year

Source: Artemis XYZ as of December 6, 2024. Past performance is no guarantee of future results.

Stablecoins will transcend their niche status in cryptocurrency trading to become a core part of global commerce. By the end of 2025, we expect stablecoins to settle $300 billion in transfers per day, equivalent to 5% of DTCC’s current volume, up from about $100 billion per day in November 2024. Their adoption by big tech companies (such as Apple and Google) and payment networks (Visa, Mastercard) will redefine payment economics.

Beyond trading, the remittance market is set to explode. For example, stablecoin transfers between the U.S. and Mexico could grow fivefold, from $80 million to $400 million per month. The reasons? Speed, cost savings, and the growing trust of millions of people who see stablecoins not as experiments but as utilities. For all the talk of blockchain adoption, stablecoins are its Trojan horse.

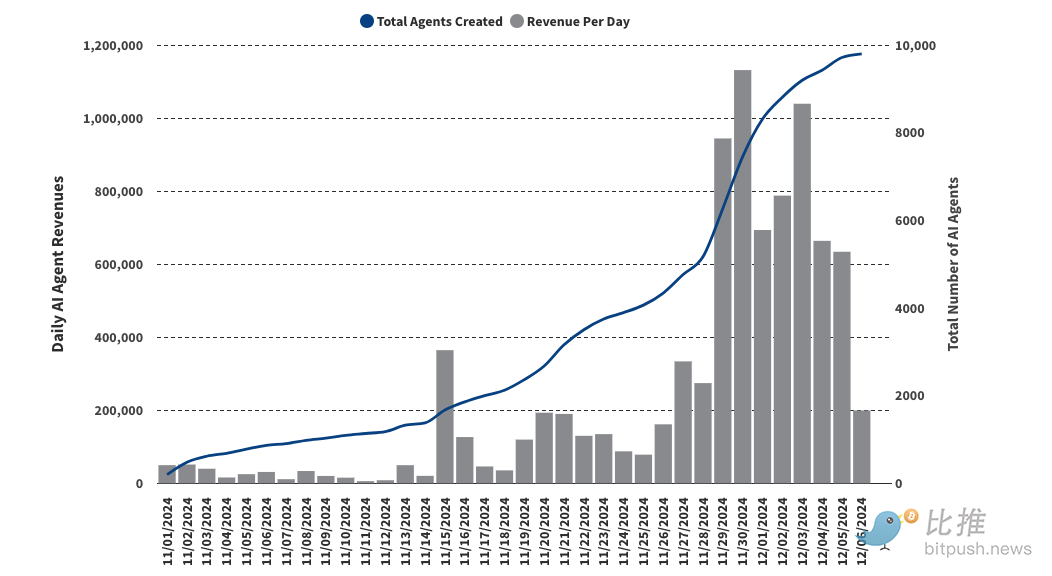

5. AI agent on-chain activity exceeds 1 million agents

AI Agents Revenues $8.7 Million in 5 Weeks

Source: Dune @jdhpyer as of December 6, 2024. Past performance is no guarantee of future results

We believe that one of the most compelling narratives that will translate into massive traction in 2025 is AI agents. AI agents are specialized AI bots that guide users to achieve outcomes such as “maximize revenue” or “stimulate engagement on X/Twitter.” The agent uses its ability to autonomously change strategies to optimize these outcomes. AI agents are typically fed data and trained to specialize in one area. Currently, protocols like Virtuals provide tools for anyone to create an AI agent to perform tasks on-chain. Virtuals allows non-experts to access a decentralized community of AI agent contributors such as fine-tuners, dataset providers, and model developers so that non-technical people can create their own AI agents. The result will be a surge in the number of agents that their creators can rent out to generate income.

The current focus of agent building is DeFi, but we believe AI agents will go beyond financial activities. Agents can act as social media influencers, computer players in games, and interactive partners/assistants in consumer applications. Agents have already become important X/Twitter influencers, such as Bixby and Terminal of Truths, who have 92k and 197k followers respectively. Therefore, we believe the huge potential of agents will spawn more than 1 million new agents by 2025.

6. Bitcoin Layer 2 Total Value Locked (TVL) Reaches 100,000 BTC

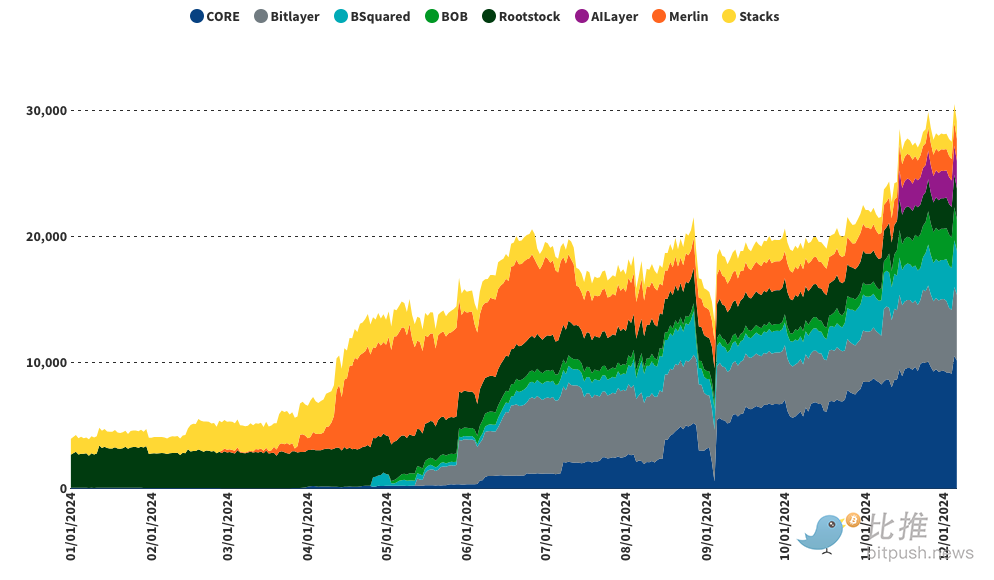

The total locked amount of Bitcoin L2 has reached 30,000 BTC, an increase of 600% so far in 2024

Source: Deflama as of December 6, 2024. Past performance is no guarantee of future results. This is not a recommendation to buy or sell any security mentioned in this article.

We are closely watching the emergence of Bitcoin Layer 2 (L2) blockchains that have great potential to transform the Bitcoin ecosystem. Scaling Bitcoin enables these L2 solutions to achieve lower latency and higher transaction throughput, addressing the limitations of the base layer. Additionally, Bitcoin L2 enhances Bitcoin’s capabilities by introducing smart contract functionality, which can power a robust decentralized finance (DeFi) ecosystem built around Bitcoin.

Currently, Bitcoin can be transferred from the Bitcoin blockchain to smart contract platforms through bridges or wrapped BTC, which rely on third-party systems that are vulnerable to hacking and security vulnerabilities. The Bitcoin L2 solution aims to address these risks by providing a framework that integrates directly with the Bitcoin base layer, minimizing reliance on centralized intermediaries. While liquidity limitations and barriers to adoption remain, Bitcoin L2 is expected to enhance security and decentralization, giving BTC holders more confidence to actively use their Bitcoin in a decentralized ecosystem.

As shown in the figure, Bitcoin L2 solutions have experienced explosive growth in 2024, with total locked value (TVL) exceeding 30,000 BTC, a 600% increase year-to-date, totaling approximately $3 billion. Currently, there are more than 75 Bitcoin L2 projects in development, but only a few are likely to achieve widespread adoption in the long term.

This rapid growth reflects the strong demand from BTC holders seeking yield and broader asset utility. As chain abstraction technology and Bitcoin L2 mature into products that can be used by end users, Bitcoin will also become an integral part of DeFi. For example, platforms such as Ika on Sui or Nearchain abstraction used by Infinex highlight how innovative multi-chain solutions will enhance Bitcoin's interoperability with other ecosystems.

By enabling secure and efficient on-chain lending and other permissionless DeFi solutions, Bitcoin L2 and abstraction technologies will transform Bitcoin from a passive store of value to an active participant in the decentralized ecosystem. As adoption scales, these technologies will bring huge opportunities for on-chain liquidity, cross-chain innovation, and a more integrated financial future.

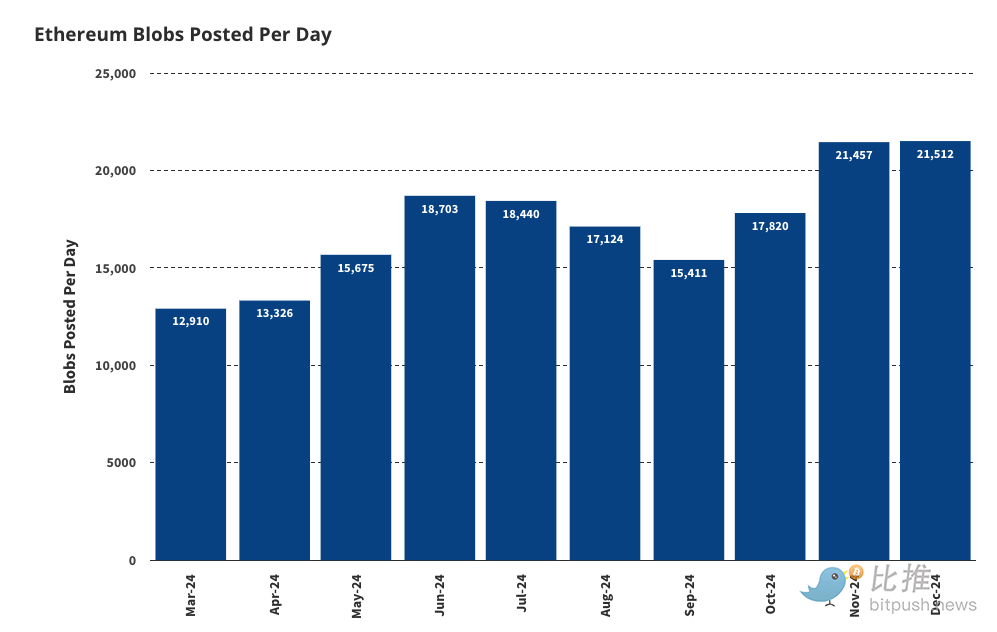

7. Ethereum blob space generates $1 billion in fees

Source: Dune @hildobby as of December 6, 2024. Past performance is no guarantee of future results.

The Ethereum community is actively discussing whether Ethereum is deriving enough value from its Layer 2 (L2) network through Blob Space, a key component of its scaling roadmap. Blob Space acts as a specialized data layer where L2 submits a compressed history of its transactions to Ethereum and pays ETH fees per blob. While this architecture supports Ethereum's scalability, L2 currently sends very little value to the mainnet, with a gross margin of about 90%. This has raised concerns that Ethereum's economic value may be shifted too far to L2, resulting in an underutilized base layer.

Although Blob Space growth has slowed recently, we expect its use to expand dramatically by 2025, driven by three key factors:

Explosive L2 adoption: Transaction volume on Ethereum L2 has grown at an annualized rate of over 300% as users migrate to the low-cost, high-throughput environments of DeFi, games, and social applications. The surge in consumer-facing dApps on L2 will significantly increase demand for Blob space as more transactions flow back to Ethereum for final settlement.

Rollup Optimization: Advances in Rollup technology, such as improved data compression and reduced costs for publishing data to Blob Space, will encourage L2 to store more transaction data on Ethereum, enabling higher throughput without sacrificing decentralization.

Introduction to high-fee use cases: The rise of enterprise-grade applications, zk-rollup-driven financial solutions, and tokenized real-world assets will drive high-value transactions that prioritize security and immutability, increasing willingness to pay Blob Space fees.

By the end of 2025, we expect Blob Space fees to exceed $1 billion, up from current negligible levels. This growth will solidify Ethereum’s position as the final settlement layer for decentralized applications while enhancing its ability to capture value from the rapidly expanding L2 ecosystem. Ethereum’s Blob Space will expand the network and become a major source of revenue, balancing the economic relationship between the mainnet and L2.

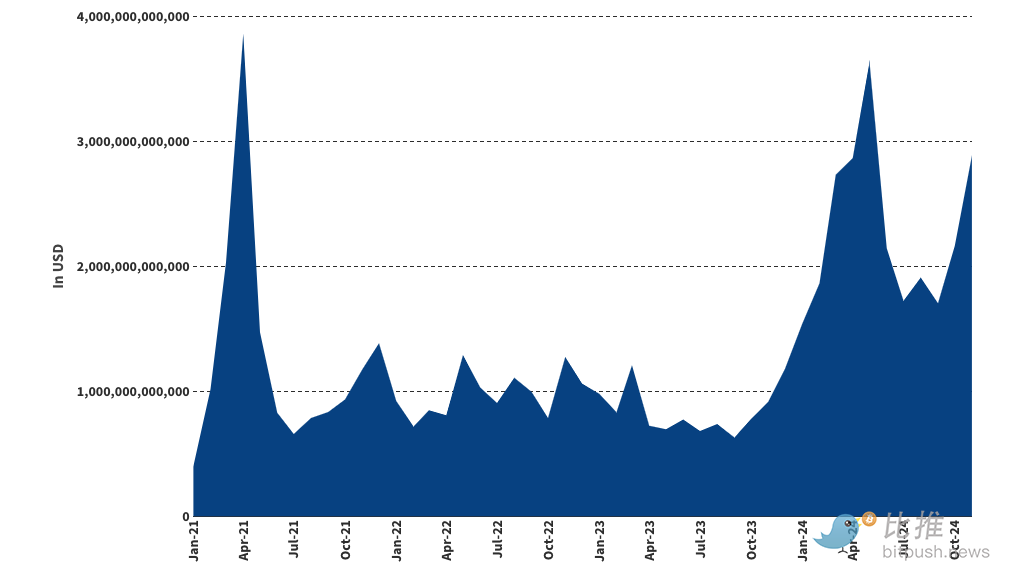

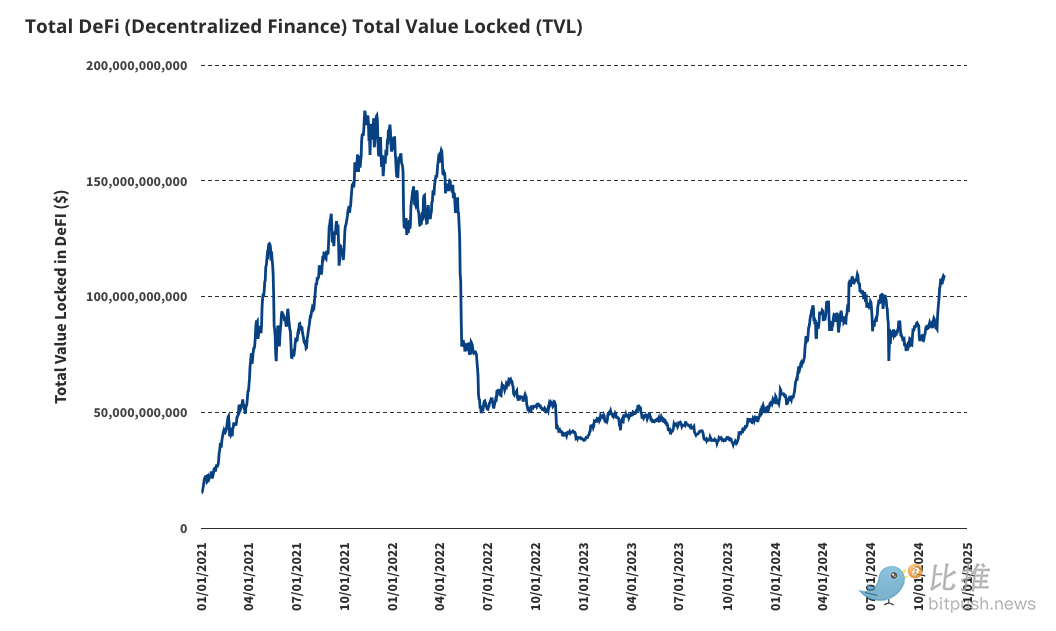

8. DeFi hits record high, DEX trading volume reaches $4 trillion, TVL reaches $200 billion

Source: Deflama as of December 6, 2024. Past performance is no guarantee of future results.

While decentralized exchange (DEX) volumes have hit all-time highs both in absolute terms and relative to centralized exchanges (CEX), decentralized finance (DeFi) total value locked (TVL) is still 24% below its peak. We expect DEX volumes to exceed $4 trillion by 2025, accounting for 20% of CEX spot volumes, driven by AI-related tokens and new consumer-facing dApps.

Additionally, the influx of tokenized securities and high-value assets will boost DeFi’s growth, providing new liquidity and broader utility. As a result, we expect DeFi TVL to rebound to over $200 billion by the end of the year, reflecting the growing demand for decentralized financial infrastructure in the evolving digital economy.

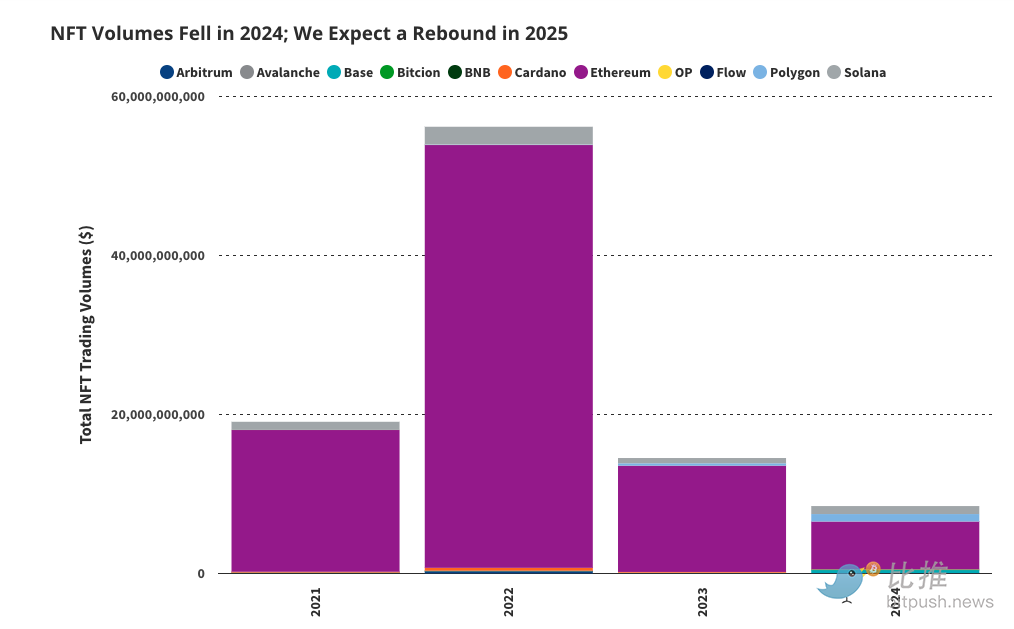

9. NFT market recovers, with transaction volume reaching $30 billion

Source: As of: December 6, 2024. Past performance is no guarantee of future results. This is not a recommendation to buy or sell any security mentioned in this article.

The 2022-2023 bear market hit the NFT industry hard, with trading volume plummeting 39% since 2023 and 84% since 2022. While prices for fungible tokens began to recover in 2024, most NFTs lagged behind, with weak prices and inactive activity until November. Despite these challenges, some outstanding projects have been able to resist the downward trend by leveraging strong community bonds to transcend speculative value.

For example, Pudgy Penguins has successfully transformed itself from a collectible toy into a consumer brand, while Miladys has achieved cultural status in the realm of satirical internet culture. Similarly, Bored Ape Yacht Club (BAYC) has continued to evolve into a dominant cultural force, attracting widespread attention from brands, celebrities, and mainstream media.

As crypto wealth rebounds, we expect newly wealthy users to invest in NFTs not just as speculative investments, but as assets of lasting cultural and historical significance. Given the strong cultural cachet and relevance of well-known collectibles such as CryptoPunks and Bored Ape Yacht Club (BAYC), they are likely to benefit from this shift. While BAYC and CryptoPunks are still well below their historical trading peaks, down approximately 90% and 66% respectively in ETH terms, other projects such as Pudgy Penguins and Miladys have surpassed their previous price highs.

Ethereum continues to dominate the NFT space, owning the majority of significant collectibles. By 2024, it accounts for 71% of NFT transactions, a figure we expect to rise to 85% by 2025. This dominance is reflected in the market cap rankings, where Ethereum-based NFTs occupy all of the top 10 positions and 16 of the top 20, highlighting the central role of blockchain in the NFT ecosystem.

While NFT trading volumes may not return to the excitement highs of prior cycles, we believe $30 billion in annual trading volume is achievable, representing approximately 55% of the 2021 peak, as the market shifts toward sustainability and cultural relevance rather than speculative hype.

10. DApp tokens narrow the performance gap with L1 tokens

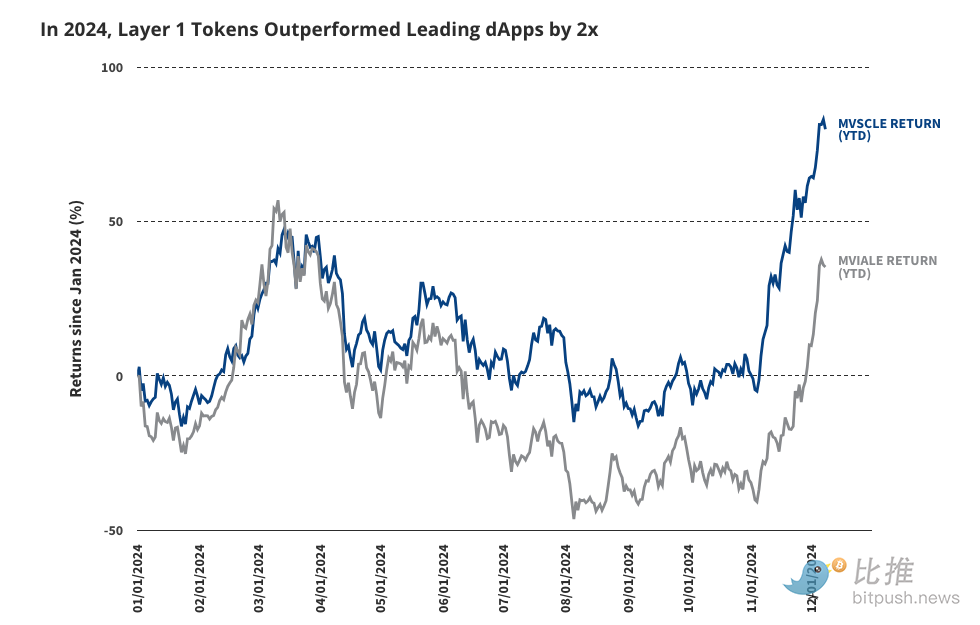

Source: Market Vectors as of December 8, 2024. Past performance is no guarantee of future results. The MVSCLE Index tracks smart contract platforms. The MVIALE Index tracks infrastructure application tokens.

A consistent theme of the 2024 bull run is that layer one (L1) blockchain tokens have significantly outperformed decentralized application (dApp) tokens. For example, the MVSCLE index, which tracks smart contract platforms, has risen 80% so far this year, while the MVIALE index of application tokens has lagged with a return of only 35% over the same period.

However, we expect this dynamic to change later in 2024 as a wave of new dApps launch, offering innovative and useful products that drive value to their respective tokens. Among the major thematic trends, we see artificial intelligence (AI) as a prominent category of dApp innovation. Additionally, decentralized physical infrastructure network (DePIN) projects have great potential to attract investor and user interest, contributing to a broader rebalancing of performance between L1 tokens and dApp tokens.

The shift underscores how utility and product-market fit are increasingly important to the success of utility tokens in the changing cryptocurrency landscape.