By: Bitcoin Magazine

Compiled by: Wuzhu, Golden Finance

Michael Saylor, you are forced to realize that all store of value assets are flawed and force you to focus on the only asset that is not flawed. This does not mean that you are immune to the medium of exchange situation. When you look at the housing market from one perspective, you can see how huge it is and how terrible it is from another perspective. But if you go through pain and force you to maintain billions of dollars of purchasing power, then housing is a good tool.

Your obsession with SoV is completely off the mark. The biggest aspect of Bitcoin is a medium of exchange. While the fiat system is increasingly separating the functions of money, that doesn't mean it should. I understand saying Bitcoin is a medium of exchange is stirring up a hornet's nest, and all the other money lords will try to stop Bitcoin. It would be great if they joined instead of fighting it. It would convince all the billionaires that they can put their money in it, but using Bitcoin just to store value is attacking it. This approach would turn it into digital gold 2.0, be captured.

Without a medium of exchange there is no store of value! The medium of exchange comes first. You receive transactions, then store the Bitcoin. If the store of value is the point, imagine announcing that you have lost the keys to your Bitcoin stack - you can still store it perfectly, but without the medium of exchange functionality, the market will erase the fictitious fiat value on top. This value is precisely because it can be liquid and can still be used as a medium of exchange.

Oxygen tanks are essential for storage, but breathing is more important. Store of value is secondary and relies on the ability to trade. Without the ability to trade, store of value is meaningless. Michael, you experienced this firsthand when your million dollar holdings in Argentina were diluted by 90%. You fought to preserve the value, not because you didn't see it coming, but because you couldn't use it as a medium of exchange. It's true that a poor store of value weakens the medium of exchange, but why does the latter take precedence? Because the ability to trade is what allows you to react.

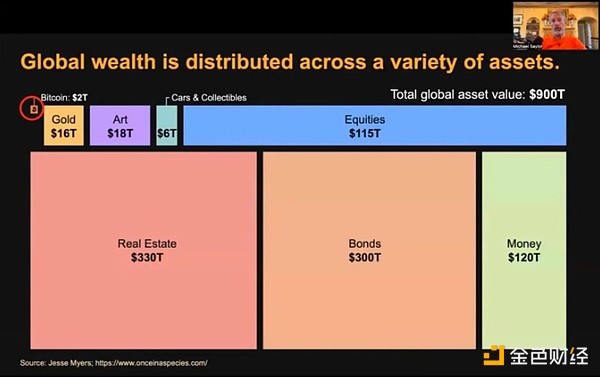

By now, most people who have been exposed to Bitcoin know about the Jesse Meyers chart you popularized. You claimed there is no better idea than a $900 trillion clean store of value, then immediately called Bitcoin one of the most liquid markets in the world, running 24/7. Guess what? Liquidity means medium of exchange.

Now, let’s break down Jesse’s chart, starting with the real estate market. It’s worth $330 trillion, but it’s a very poor medium of exchange, with only $1.3 trillion traded annually. Regulations and taxes make it much harder to trade real estate. Still, because it’s 100x better as a store of value, billionaires are embracing it, increasingly dominating the market and excluding younger generations.

A house may be valuable, but its value increases not only from itself but from its connection to nearby utilities. Build a road to it, and the value goes up. Add a supermarket or gas station, or connect it to the grid, and the value climbs again. The network creates opportunities for energy to flow into the area, increasing the chances of converting that energy into economic value, like money. So the transactions that happen in the network are what increase the value of the house. But I see the flip side: if you were a billionaire and everyone was coveting your resources, you wouldn't want to build a large network around your house. You'd prioritize privacy. The house might go down in value, but the goal would shift to raising the cost for others to reach you, thus reducing the chances of being attacked.

What about the bond market? Bonds as a store of value are worth $300 trillion, with $140 trillion traded annually and $25 trillion in new issuance. This means that about 50% of their value is lost as a medium of exchange each year. In that sense, it’s better than houses, but the numbers still suggest that people use it primarily as a store of value.

Next up are stocks. They are valued at $115 trillion and trade about $175 trillion. This suggests that their strength as a medium of exchange outweighs their role as a store of value. Take MicroStrategy stock for example - you know it better than anyone. How much value has it stored and how much value has been traded through it in the last year?

The next two parts are interesting. The annual transaction volume in the art industry is so small that it doesn’t even show up on the chart. Meanwhile, the auto and collectibles industries have nearly $4 trillion in annual transaction volume. This highlights that they are primarily viewed as stores of value each year, but also reveals how poorly the real estate market performs as a medium of exchange—even worse than the auto market.

Oh, gold! Gold lovers rave about gold having been around for over 5,000 years, calling it the ultimate store of value, for whatever reason – yet it only accounts for 1.78% of the store of value market. This shows how easy it is to capture and manipulate once its medium of exchange role is stripped away. Sorry, gold lovers, that genie isn’t coming back into the lamp. Gold holds $16 trillion in value, and gold lovers claim it can store $120 trillion worth of money in it. They’re desperate to make a killing, but the market disagrees, deeming flawed fiat currencies ten times better than shiny, lifeless rocks. So is gold a better medium of exchange? It trades $54 trillion per year, and driven by derivatives, its medium of exchange usage is 3.5 times greater than its store of value role.

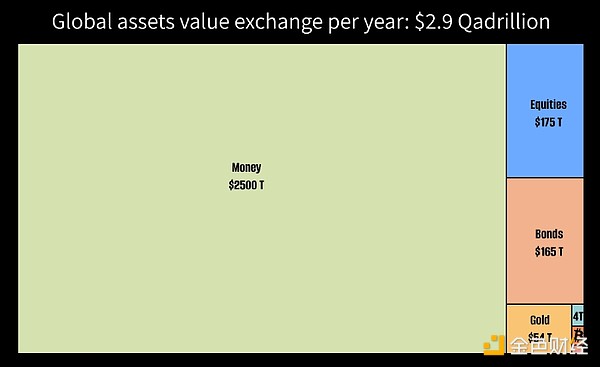

Currency may not be dominant in terms of asset value storage, but it is by far the leading medium of exchange. Other store of value assets don’t even come close. What happens if the USD (the top currency) becomes a store of value? It will destroy the USD network, and the value of non-US assets will rise as non-US asset networks step in to meet the demand. Over time, their store of value assets will rise, while USD assets will plummet. Total global currency is about $120 trillion, but look at the top central bank transaction volumes: Fedwire is about $1,182 trillion, TARGET2 is about $765 trillion, CHAPS is about $145 trillion, and others (partially) are about $500 trillion (conservative estimate due to incomplete data). So while the store of value is $120 trillion (according to Jesse’s chart), the medium of exchange utility of these networks is over 20 times that, about $2.5 trillion. What would the medium of exchange value be if the 2 billion unbanked people were included? How many transactions would this trigger? What would the situation be like if microtransactions were possible?

Where does Bitcoin fit in all of this? The dominant narrative urges holders to never sell, positioning Bitcoin as a store of value. Yet the markets tell a different story. In 2024, Bitcoin’s market cap reaches $2 trillion, while $3.4 trillion is transacted on its first layer — the blockchain. Taking into account the Lightning Network (though its exact figures remain elusive), the total is likely closer to $4 trillion. This suggests that Bitcoin doubles as a medium of exchange as it does as a store of value. So what happens if the long-standing “hold forever” narrative begins to fade?

Because fiat currencies are flawed, bonds and stocks are financial “instruments” pretending to be money. This creates a market that prevents most people from protecting their wealth, further fragmenting the store of value role of money. But how inclusive are these instruments? Or are they simply vehicles for siphoning value from fiat mediums of exchange, channeling it into the hands of privileged individuals, billionaires, and others who need to hoard it?

Globally, only 10-20% of people have exposure to bonds, mostly indirectly through pensions or investment funds, rather than directly. For stocks, 15-25% of the population has access. This means that up to 80% of humanity does not have these tools to protect themselves, leaving them vulnerable to exploitation. Separating the store of value from the medium of exchange creates a dynamic of exploiters and exploited. This amplifies the "Cantillion effect": those who can print the medium of exchange buy up the store of value assets, marginalizing 80% or more of the population. This is a feedback loop that weakens the system and widens the gap between the haves and have-nots. The more money is printed, the weaker the store of value function of the currency becomes.

Another very important part of this whole system is fees. Sending dollars through the banking system costs money, which is a service, but when you want to go from a medium of exchange to a store of value, what are the fees? Much more. This creates so much friction in the whole system and prevents the poor from storing their value. At this point, the medium of exchange becomes more and more a medium of extraction rather than a medium of exchange. This is also why the store of value case is more attractive in the fiat system.

Bitcoin doesn’t pretend to be money like anything else; it’s the first artificial currency that doesn’t corrode like melting ice and doesn’t discriminate. It’s money for those who choose it. Since there are no printers, no one wants to trade it for a “better” store of value — there’s no second best. Even people who don’t have Bitcoin can use it to shape the life they want. Instead of chasing money to store something, they build anything on top of Bitcoin that enriches their life.

The overarching idea is not to store value, but to transfer value. But to transfer value, you first need to store some. And again, to store some, someone needs to move some your way first. That’s why the wealthy prefer assets that don’t evaporate like melting ice cubes. Meanwhile, those just starting their careers are more focused on acquiring value rather than storing something they don’t already have.

Why is the store of value case getting so much attention? One reason might be the effort involved. With a store of value, you buy and hold — no work is required to improve your life. With a medium of exchange, you have to work to grow your savings and convince others to pay for your goods or services with Bitcoin. Another factor: for most people, their fiat portfolio still exceeds their Bitcoin portfolio. Only when Bitcoin exceeds their fiat holdings will they consider using it to improve their lives. This transition wouldn’t be difficult for a large portion of the world’s population that lacks savings or assets. This might explain why the current system refuses to let them exit, instead driving dependency by offering Bitcoin custody — trading one dependency for another.

Even rigidity is related to the need for more medium of exchange. Michael, you are a strong proponent of rigidity, but if Bitcoin is not used to reach more people, you are delaying it. Unlike you, the US knows that to make the dollar the world's reserve currency, they must distribute it widely to lock in the network effect. They believe that the network is the key to rigidity, and it is easy to work because the cost of printing and sharing bills is low. For Bitcoin, its absolute scarcity requires a balance between the amount of dissemination and storage. However, this does not mean that you should not spend a penny.

The metaphor of storing fat in the body as the key to long-term survival is true, but it ignores the need for a steady income of food to sustain life before storing fat. Without income, there is nothing to store - so trading comes first. However, for someone who is not worried about starvation, the focus shifts to storing food to prevent spoilage. I keep making this point to highlight your bias towards stores of value, which can distort your judgment and mislead others.

At this stage in my Bitcoin journey, I am convinced of this: Chasing money corrupts you. Bitcoin changes that - it stops you from endlessly chasing money and lets you use it to live the life you want. What happens when you have enough of what you want? And then what? With Bitcoin, this is entirely possible, and every Bitcoin user should be prepared with an answer for that scenario. However, chasing money is a bottomless pit you can never fill. The Bible says that the love of money is the root of all evil. I agree, but how does it work? What is the mechanism? Chasing money - making it a priority and letting everything else become secondary - is a mechanism.

You are not building the Bitcoin standard - you are stacking the deck. Just like gold in the past, this time you are hoarding Bitcoin from individuals and institutions, further entrenching the fiat standard. Saylor, you are not attacking the dollar as some believe - you are supporting it by boosting your stock and its ecosystem. Instead, you are speculatively attacking those who are funding your purchases of Bitcoin. Not only are you hurting them; by strengthening the dollar, you are exacerbating the pain of holders of other currencies. Hoarding Bitcoin while the world watches? This is not a cyber city - this is a closed estate funded with their own money.

I wonder if people would be willing to invest their Bitcoin in your securities. How many people would actually do that? I’m sure the true Bitcoin maximalists wouldn’t trade their perfectly good store of value asset for a fiat “instrument”. Ask yourself: at this point, would you buy Apple shares with your Bitcoin? After all, you did invest in them before. It makes no sense — I’m giving you Bitcoin just for you to turn it into something fiat, pay fiat fees, support fiat custodians and third parties, just so you can buy Bitcoin again on the other end.

Finally, I have no proof, but I am fairly certain you already know everything I say in this post/message. While this is addressed to you, Michael, it is directed to those who view you as the new Bitcoin Jesus and who blindly follow you without questioning your actions. They make reckless bets on their lives – bets that could wipe out their Bitcoin – lacking the financial security and interest rates you have. The message they are delivering does not apply to most people.

Bitcoin is not just another asset or financial instrument - it is borderless, permissionless money. Treating it otherwise diminishes its true value. Simply storing it does not bring freedom. Keeping Sats flowing builds networks. Keeping Sats flowing fosters collaboration for a better future. Keeping Sats flowing strengthens the ecosystem. Save some for tomorrow, but don't be the richest man in the grave - save them for later plans.