Author:Gary

Recently, innovations in asset issuance methods on Base have continued to emerge: after the release of the article "Can You Really Play Base Golden Shovel Clanker?", many new products have emerged in the community, and Larry is one of the most distinctive ones.

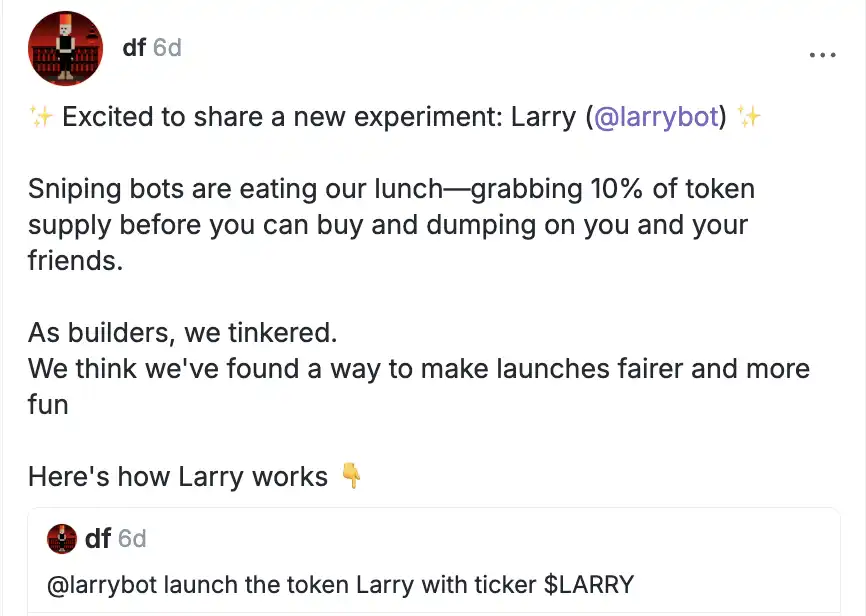

At 12 noon on December 5, David Fulong (@df), senior developer of Farcaster and founder of the Frame protocol, released a cast announcing the birth of Larry.

Team Background: Larry vs Clanker

Clanker was founded by @_proxystudio and @JackDishman, and Larry was founded by @davidvfurlong and @stephancill.

Farcaster veteran player @0xLuo explains: Clanker's founding team is the new developers of Farcaster, Larry's founding team is Farcaster OG, and @davidvfurlong's resume is particularly impressive: his company received investment from A16Z (note that A16Z did not invest in Larry), and he himself is also the proposer of the Frame protocol - Frame is a major innovation of Farcaster, and it is also the key to the Farcaster team's "open" $150 million.

In contrast, Larry's team is more politically advanced; but Farcaster's OG status is a negative buff for the distribution of the plate, after all, it is well known that Farcaster is a mosque...

From an operational perspective, Clanker does understand memes better. Its founder @proxystudio.eth often contributes various "good comments" on Farcaster, and the Clanker official account (@_proxystudio) is also very funny:

On the other hand, Larry, perhaps because it was launched less than a week ago, the entire team has focused all its energy on product development and mechanism design, and has almost not provided any support for ecological projects or operated the official brand and community. This is an important reason why its flagship token $LARRY (currently around 3M, with a maximum of 7M) lags far behind Clanker's flagship token $CLANKER (currently around 50M, with a maximum of 150M) in market value.

Asset issuance mechanism: Larry vs Clanker

In a nutshell, Larry and Clanker are both AI Agents that issue coins as soon as they post. Larry's asset issuance method imitates Pumpfun's internal and external pool mechanism, while Clanker's asset issuance method is fair launch - the former's shortcoming is that the threshold restricts retail investors from participating in the early stage, while the latter's shortcoming is that it is difficult to overcome robot sniping.

Asset issuance mechanism: Clanker

Specifically, by tagging Clanker on Farcaster and stating the token name, ticker, and header image, Clanker can add a Uniswap pool with a starting market value of approximately US$30,000 on Base for free (the threshold is that the Farcaster account Neynar score must be high enough, which means it is difficult for newcomers to issue coins). All deployed tokens can be viewed on the official website.

Unlike PumpFun, which charges a 1% transaction fee + 2 Sols on Raydium during the bonding curve, Clanker does not have a bonding curve, but instead charges a 1% handling fee from Uni v3 as income: 40% goes to the issuer and 60% to the Clanker team - this split ratio may change, see the official documentation for details.

Asset issuance mechanism: Larry

Like Clanker, Larry also issues coins by posting, which is subject to a certain threshold.

After receiving the message, Larry AI Agent will launch an internal market on its official website Larry.club: the latest rule is that the upper limit of the internal market fundraising time is changed to 69 minutes, each person can put in a maximum of 0.25E, and all people can put in a total of 3E. After it is full, it will be opened on V3 after a while. (Previously it was 15 minutes and could be over-raised)

The specific details are that a launch button will appear on the page, and then an internal user is required to confirm and pay the gas fee (Note: the dev sold shown on GMGN is actually the user who clicked the launch button, not the real developer...)

One point that has been criticized a lot in the whole mechanism is that the neynar score needs to be higher than 0.8 to fill the inner plate, and ordinary retail investors can't fill it at all. They can only watch Farcaster OG fill the inner plate, and then take their chips in the outer plate. In fact, the intention of the mechanism designer can be understood: after all, this is an era where whoever has the bottom chips is the dealer, and the team hopes that the "dealers" will cherish their feathers and not smash them as soon as the market opens. But the reality is that many plates on Larry are buried in 10 seconds, because the people in the inner plate know how bad the experience of the people in the outer plate is. If the angle is not tricky enough, no one will come to take it, thus forming a stampede in the inner plate...

At present, the voice of FUD Larry tokens dominates the mainstream. Apart from the leading $LARRY, no other token can survive the second wave of drilling, let alone take off like $ANON $CLANKER $LUM on Clanker... (For the launch of various tokens on Larry in the past few days, see this tweet)

But everything is still early, the mechanism design may change at any time, and the team is also constantly thinking about how to best couple the internal mechanism with the real-name PVP social game - let us continue to observe. (For a more detailed comparison between Clanker and Larry, see this tweet.)

Larry's development process: from drilling to V

BUG Storm: Exploding Pull and Drilling

Open the K-line chart of $LARRY, and you will find that it pulled up on the first day, and then continued to fall for the next two days.

Why? The most important reason is that Larry’s software crashed at the beginning. On the one hand, it could not issue coins. On the other hand, it was caught in a public opinion storm that the software had a bug and introduced insider trading: An anonymous person said that two participants used 0.6 ETH and 1.05 ETH at the bottom to sell when the market was rising, and each earned 90k and 12k...

The founder @davidvfurlong admitted the software bug and apologized, then fixed the vulnerability. He also spent the next two days fixing the bug, which was quite embarrassing: the price of the coin plummeted from the highest 7M to less than 1M...

Continuing construction: Drilling is on the rise again

With bug fixes and mechanism optimization, the K-line of Drilling has risen again and is currently fluctuating between 2M and 4M.

Two days ago, the founder @davidvfurlong did something big again: he released a Farcaster AI template as an open source for developers to quickly deploy AI Agents on Farcaster. This led to a series of AI Agents interacting with Larry, including the @freysa_ai "man-machine game" story that went viral on Twitter, which was reproduced on Farcaster by dqau (the corresponding token is $GRVM).

Larry, what's the future?

The editor observed the community and found that the community members' evaluation of Larry can be summarized in eight words: "Pity his misfortune and be angry at his lack of struggle."

“It’s unfortunate” means that Larry’s release was not in time: on the day of Larry’s release, Clanker was making a fortune and was the talk of the town; in addition, the liquidity of the Farcaster ecosystem was far from sufficient for people to chase after Dragon II; and who would have thought that the products of the two super developers would have so many bugs as soon as they were launched - the leading token $LARRY and its ecological tokens were continuously suppressed, and many “precious angles” were wasted…

"Angry at their lack of fighting spirit" means that Larry's team is too pure, does not know how to make things happen, and more importantly, does not know how to make markets - this is actually a common problem for all Farcaster tokens.

This wave of memes is a key step in Farcaster's de-halalization process. People will gradually flock in: from the lone P players to the real dealers, who can pull up the lever to bring about a flood - I hope this day will come soon.