By Alex Liu, Foresight News

On March 18, 2025, at the Tokenize Summit in New York, Ethena, the leader of synthetic dollar protocols, and Securitize, an asset tokenization platform, announced the launch of Converge, a blockchain network designed specifically for institutional investors. The project is positioned as the "settlement layer for traditional finance and digital dollars" and will achieve smooth migration of existing smart contracts and DApps through seamless compatibility with the Ethereum Virtual Machine (EVM). It is planned to be officially launched in the second quarter of 2025.

Securitize CEO Carlos Domingo and Ethena founder Guy Young announce Converge

Converge: An institutional-grade DeFi platform driven by compliance and performance

Converge aims to provide traditional financial institutions with an infrastructure platform that meets strict compliance requirements without sacrificing technical performance.

The platform makes full use of the EVM compatibility to achieve seamless integration of Ethereum smart contracts and decentralized applications, thereby significantly reducing the migration costs of developers and users. At the same time, the architecture draws on technologies such as Rollup to ensure the system's dual advantages in scalability and security. In order to meet the multiple requirements of global supervision, Converge has introduced strict compliance measures including KYC/KYB verification, institutional-level custody services (provided by Anchorage, Fireblocks, etc.), and licensed verification nodes.

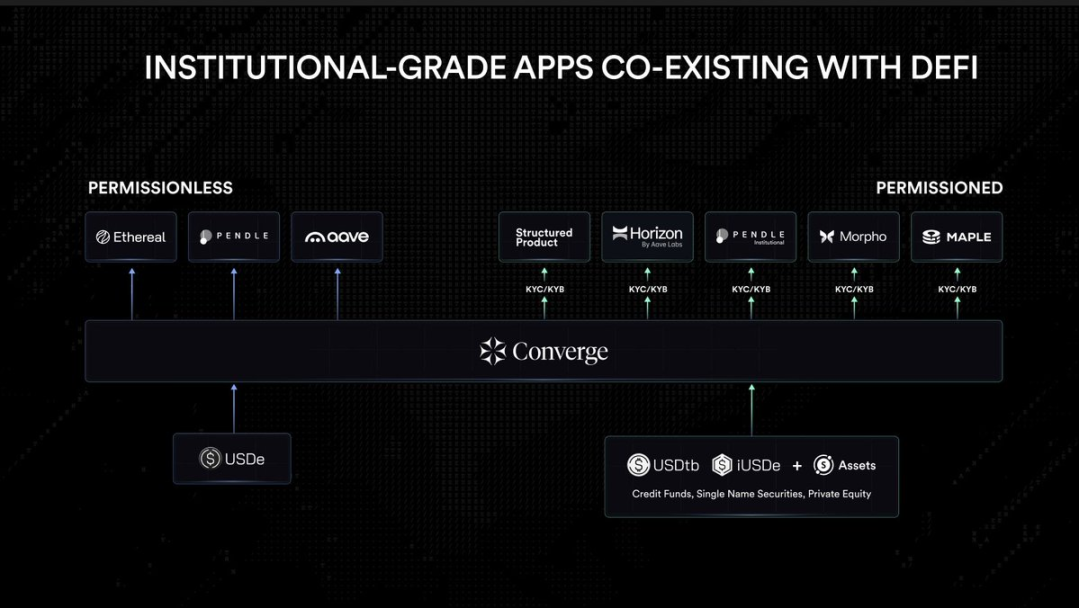

The Converge network will support two parallel operating modes - on the one hand, it will ensure the free development of completely permissionless DeFi applications, and on the other hand, it will create compliant products for traditional financial institutions. For example, the tokenized securities issued by Securitize can not only participate in the customized money market as on-chain collateral, but the compliance design behind it also provides a reliable access point for institutional investors.

Core assets and network security protection

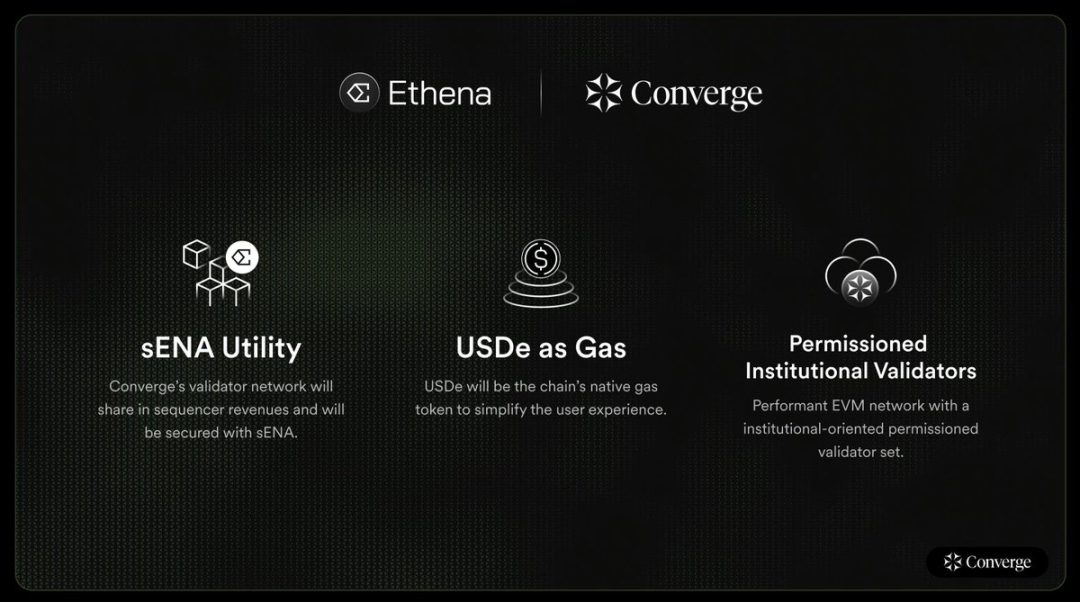

In Converge's design, USDe, USDtb and sENA will play a vital role as core financial assets supporting the entire chain. At the same time, the network will be built on a set of licensed institutional-level verification node systems, and these verifiers need to stake Ethena governance tokens ENA to ensure the security and stability of the network. In addition, USDe and USDtb will serve as network native GAS tokens, allowing users to trade at a lower friction cost, thereby improving the overall transaction efficiency and user experience of the platform.

Complementary Strengths: Ethena and Securitize Join Forces

This cooperation demonstrates the complementary effect between crypto-native protocols and traditional financial license holders. With a TVL of more than $6 billion in synthetic USDe, Ethena has occupied a pivotal position in the DeFi ecosystem. Its operation mode of ensuring the value of stablecoins through Delta hedging strategies has attracted the attention of many institutions including BlackRock. Securitize, as a pioneer in asset tokenization regulated by the SEC, has issued more than $2 billion in on-chain securities, serving traditional asset management giants such as Blackrock and KKR.

The two parties decided to inject their respective core resources and technological advantages into Converge. Ethena plans to migrate its nearly $6 billion ecosystem to the new chain as a whole, and issue native stablecoin USDe, USDtb supported by BlackRock BUIDL Fund, and iUSDe designed for asset management institutions on the platform; while Securitize will deploy its complete tokenized securities issuance and management system on Converge, covering various asset categories such as stocks, bonds, real estate, and actively explore new application scenarios such as on-chain stock trading.

Diversified Ecosystem: Top DeFi Applications and Institutional Custody Work Together to Empower

Converge also shows strong appeal in terms of ecological layout. The platform has attracted DeFi application parties such as Pendle, Horizon under Aave Labs, and Morpho, and will jointly develop customized institutional products in the future to meet various financial needs. In terms of asset security and custody, many institutions such as Anchorage and Copper will provide full support; while cross-chain interoperability solutions such as LayerZero and Wormhole and RedStone Oracle ensure the stable operation of the platform in terms of cross-chain asset transmission and data accuracy.

In addition, Converge's verification nodes are jointly composed of traditional financial institutions and centralized exchanges, and require staking of Ethena governance tokens ENA. Although this design may trigger discussions about the degree of decentralization, the team believes that the introduction of regulated entities will greatly enhance institutions' trust in the platform and lay a solid foundation for large-scale capital flows in the future.

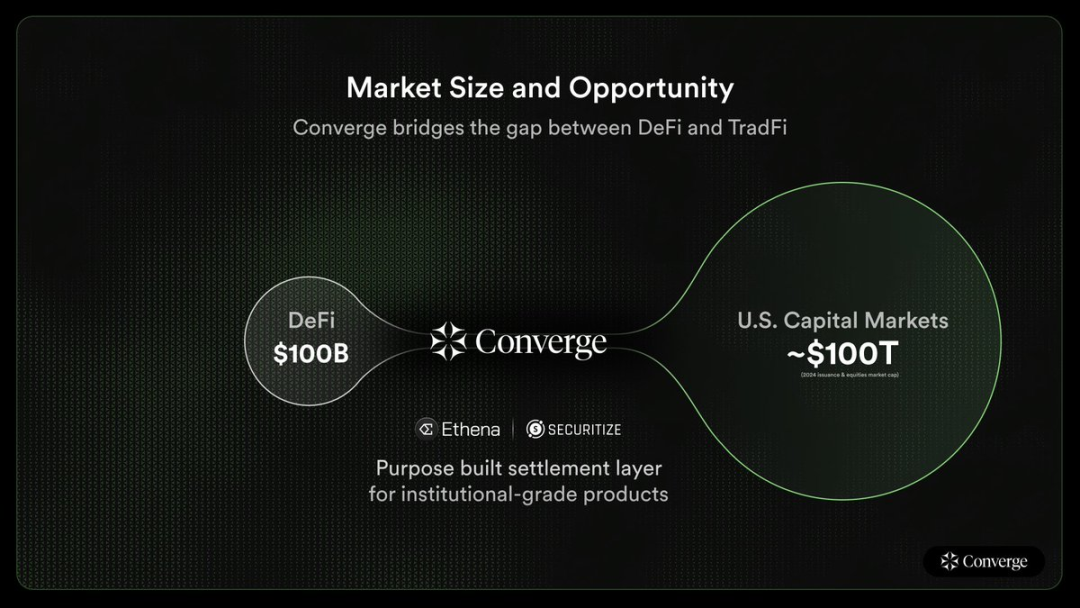

Challenges and prospects: Exploring the trillion-dollar market

Converge has received widespread attention from the market, but it faces many challenges in its future development. First, the differences in compliance requirements in different jurisdictions around the world require the platform to continuously adapt and adjust the issuance and trading rules of security tokens; secondly, whether it can prove the efficiency and cost advantages of on-chain finance in the cold start phase of the ecosystem and attract more institutions to actively participate will also be the key to the success of the project.

The total amount of locked-in DeFi in the world continues to rise, and the scale of the traditional capital market far exceeds one trillion US dollars. Even if only a very small proportion of capital flows into the chain, it will bring huge increments. As the founder of Ethena said, the crypto industry needs to go beyond the internal circulation of existing funds. Converge's goal is to become the entrance for trillion-level traditional capital to enter the chain.