Crypto Market Briefing: February 3, 2025 - February 7, 2025

BTC is still in a range of fluctuations. The altcoin needs to wait for BTC to stabilize before it can experience a corrective rebound.

This week (February 3 to February 7), the crypto market showed some volatility, mainly affected by macroeconomic indicators and market capital flows:

1. Macroeconomic impact

This week's macro data showed that economic growth slowed down and the job market cooled, but the service industry performed strongly, causing the Fed's expectations of rate cuts to fluctuate. The weak performance of ISM manufacturing PMI and ADP non-farm payrolls data has strengthened the market's expectations for rate cuts, which is good for BTC in the short term. However, the ISM service PMI and the lower-than-expected unemployment rate show that the economy is still resilient, which has suppressed the room for BTC to rise further. In addition, the surge in the one-year inflation rate in February announced on Friday has greatly affected BTC's upward trend.

Key Impacts:

- Increased expectations for interest rate cuts provided some support for BTC, but expectations for inflation rates much higher than the previous value limited the gains.

- With the decrease in capital inflows and the cautious market sentiment, BTC will fluctuate and consolidate in the short term.

2. Fund flow analysis

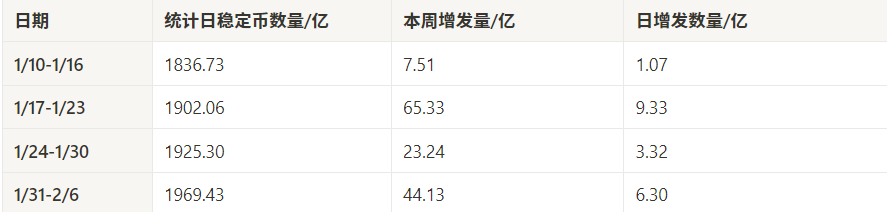

- The flow of stablecoins has increased significantly. From February 3 to February 7, an additional $4.413 billion of stablecoins were issued. The inflow of stablecoins enhanced the market's potential purchasing power, but it was not fully converted into BTC demand.

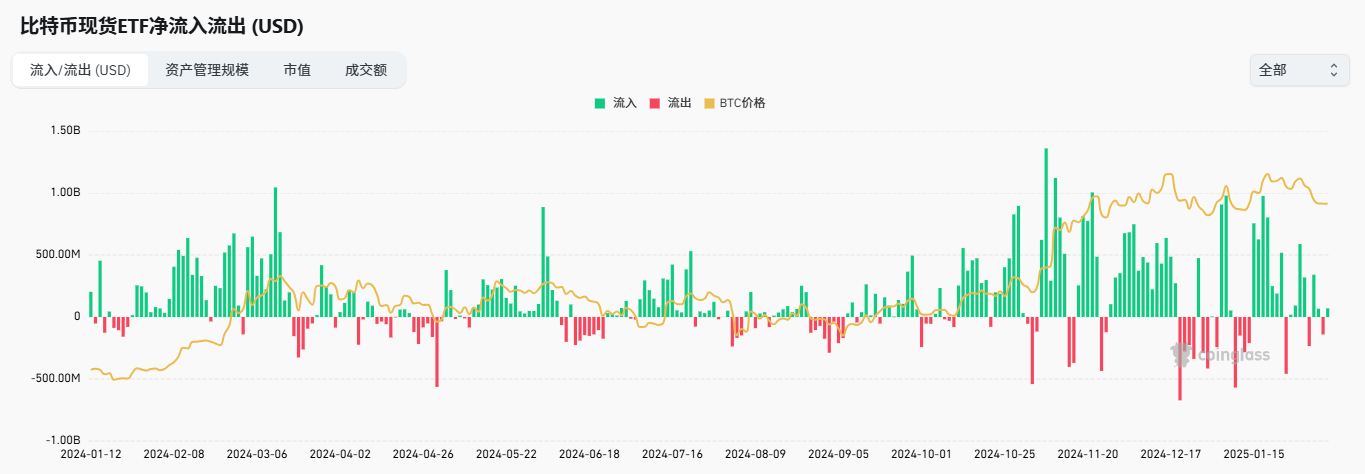

- ETF inflows were $103 million, falling for four consecutive weeks and hitting a four-week low. The reduction in ETF funds puts short-term pressure on BTC, and the market remains on the sidelines.

- The OTC premium rebounded from underwater to above water levels. The market demand for crypto assets has increased, but it has not yet translated into obvious BTC price support. Further capital inflows may be needed to confirm the trend.

3. BTC market performance

- BTC's market share remained at 61.88%, with an upward trend, reflecting increased risk aversion in the market and pressure on the altcoin market.

- The overall BTC trading volume this week showed a trend of first increasing and then decreasing, and the price gradually fell after the violent fluctuations. The current market trading heat has declined, and the BTC price may continue to face adjustment pressure in the short term.

4. Altcoin market

- Altcoins plummeted : Affected by DeepSeek and tariff policies, altcoins became more volatile and generally fell below the December 2023 platform. Many altcoins are about to return to the platform before September 23, recovering the gains since an entire bull market.

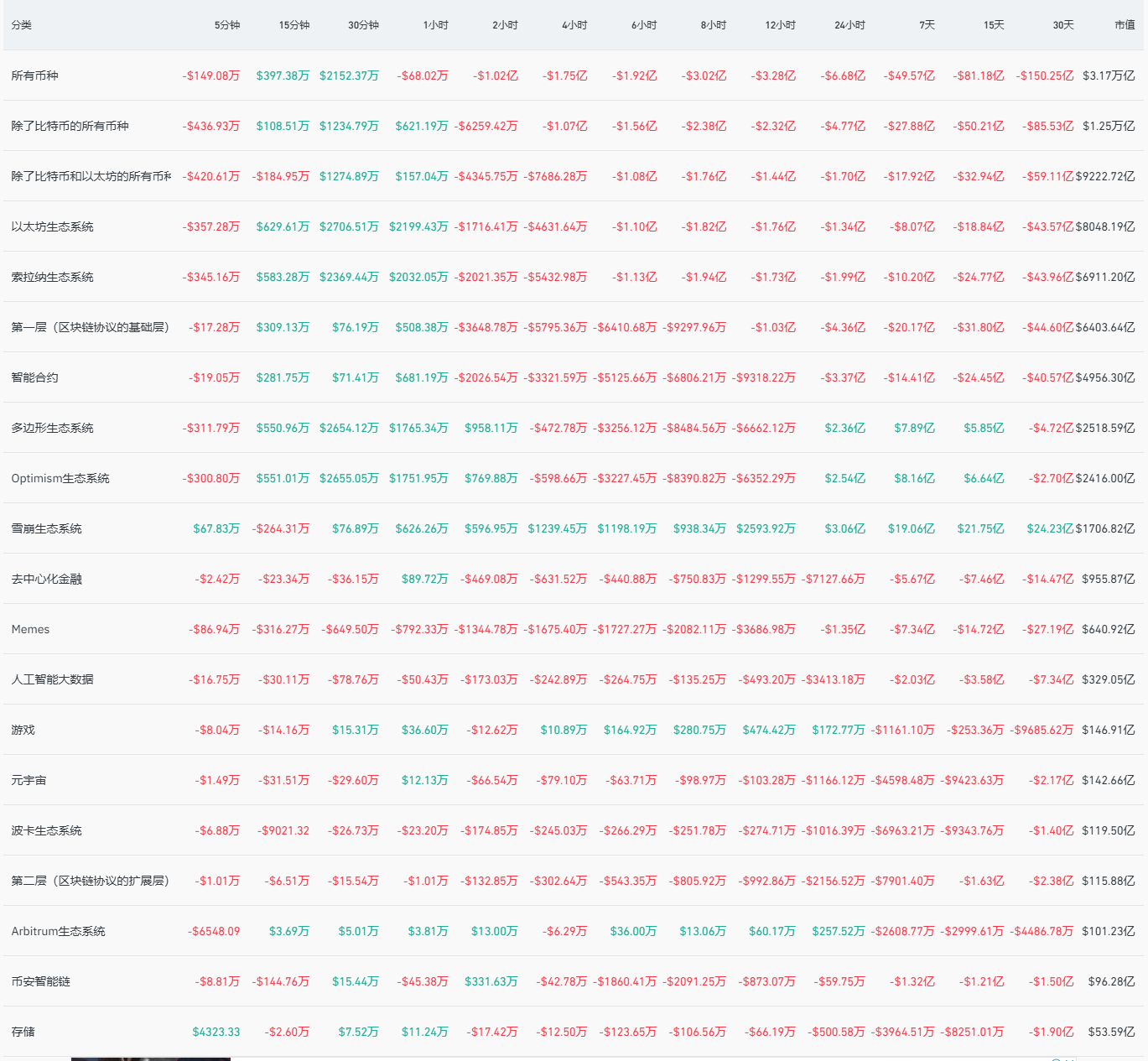

- Capital outflow intensified : All-currency capital outflows showed a large amount of outflows this week, and the 30-day level outflows have reached an extremely high level.

- Three major market share indicators: The three major market share indicators have completely broken through the range we originally expected. This is undoubtedly huge bad news for the copycat market and we need to wait for mid-term repair.

in conclusion

This week, the BTC market as a whole showed a trend of consolidation and fluctuation , affected by the repeated expectations of the Fed's interest rate cut. The issuance of stablecoins provided some support to the market, but the decrease in ETF fund inflows showed the cautious attitude of institutional investors. The increase in the premium of OTC USDT and USDC showed that the market demand still existed, but it had not yet formed a strong driving force. In the short term, BTC maintained a range of 95,000-97,000 USDT, and market sentiment tended to be cautious.

Future Focus

- Short term: Pay attention to the CPI data next week. If inflation falls and the Fed's expectations of rate cuts increase, BTC may rebound. If inflation exceeds expectations, the market may face further downward pressure.

- Medium term: ETF fund inflows are still a barometer of the BTC market. If funds flow back, BTC may break through 97,000 USDT.

- Long term: If the Fed's monetary policy turns dovish, the market may enter a new round of rising cycle. The altcoin market needs to wait for BTC to stabilize before it can usher in a restorative rebound.

1. Macro

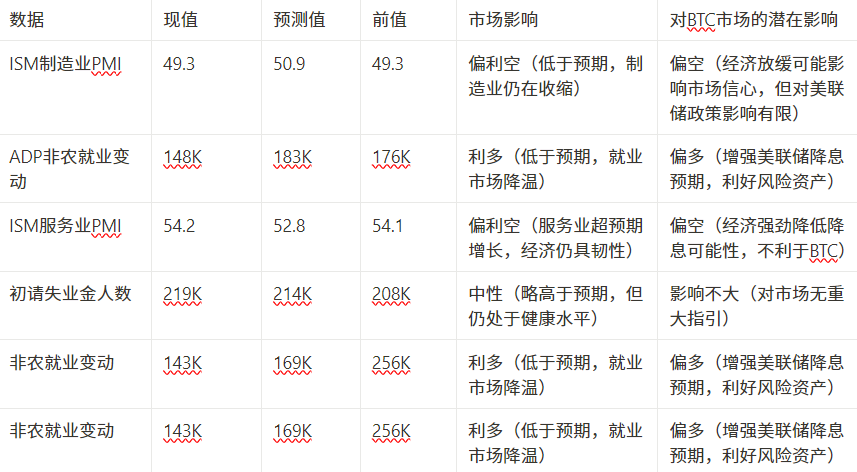

1.1 Macro indicator trigger signal table-BTC market trend guidance

From these data:

- Weak manufacturing data → economic growth slowed down , but the market's impact on the Fed's policy was limited, and the BTC market was under pressure for a short time.

- Weaker employment data (ADP & non-farm) → expectations of rate cuts increased , BTC received some support.

- Strong service sector data and falling unemployment rate → limit the Fed’s room for rate cuts and weaken BTC’s upward momentum.

- The market is still trying to find a balance between slowing economic growth and expectations of interest rate cuts , causing BTC to fluctuate this week.

BTC has been fluctuating this week . Affected by the game between economic growth slowdown and interest rate cut expectations , it lacks a clear direction in the short term.

Macroeconomic data to watch next week

Based on the current macroeconomic dynamics, the following factors are worth paying attention to and may have a significant impact on the cryptocurrency market:

2. Industry Analysis

Interpretation of the impact of this week's on-chain data on BTC

Combined with this week’s on-chain data, the following analyzes the impact of these data on the BTC market from the aspects of capital flow , price indicators , and trading volume , and evaluates the key risks and opportunities in future trends.

2.1 Fund Flow

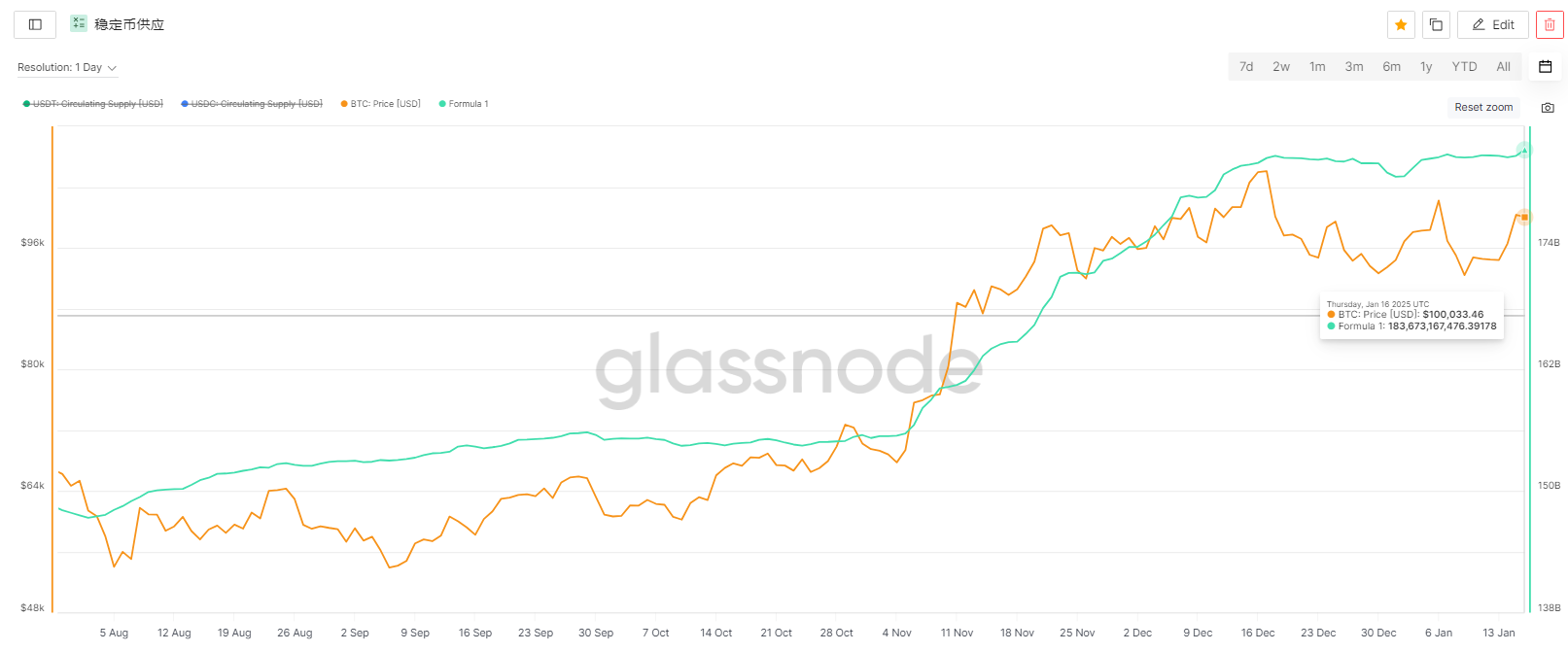

2.1.1 Stablecoin Fund Flow

- Growth in the total amount of stablecoins : From January 31 to February 6, the total amount of stablecoins increased by 4.413 billion , with a daily increase of 630 million. The number of stablecoins increased significantly this week, indicating an increase in market capital inflows, which may help enhance short-term liquidity.

Impact on BTC market:

- Increased liquidity : The issuance of more stablecoins usually represents an increase in market liquidity, providing a potential source of funds for the BTC market. If these funds are converted into BTC purchasing power, they may provide support for the rise in BTC prices.

- Stablecoin issuance trend : If the issuance continues to maintain a high level, it may mean that market funds continue to flow in, which is conducive to further rise of BTC.

2.1.2 ETF Fund Flow

- ETF fund inflows : This week (2/3-2/7), BTC ETF fund inflows were $103 million , a decrease of $456 million from the previous week, and a decline for four consecutive weeks, hitting the lowest level in nearly four weeks, indicating that institutional investors' buying has significantly weakened. In the short term, the reduction in fund inflows has put pressure on BTC prices, and the market may continue to fluctuate downward.

Impact on BTC market:

- Fund inflows have dropped significantly and market sentiment has become cautious: ETF fund inflows have continued to decline over the past four weeks, reflecting the gradual cooling of market investor sentiment, which may mean that buying support in the BTC market has weakened in the short term.

- BTC price is under pressure, and short-term correction pressure is increasing: ETF inflows are highly correlated with BTC price trends. As capital inflows have decreased significantly, BTC prices fell back to $96,926 this week , indicating that the market lacks new buying support, and BTC may continue to face adjustment pressure in the short term.

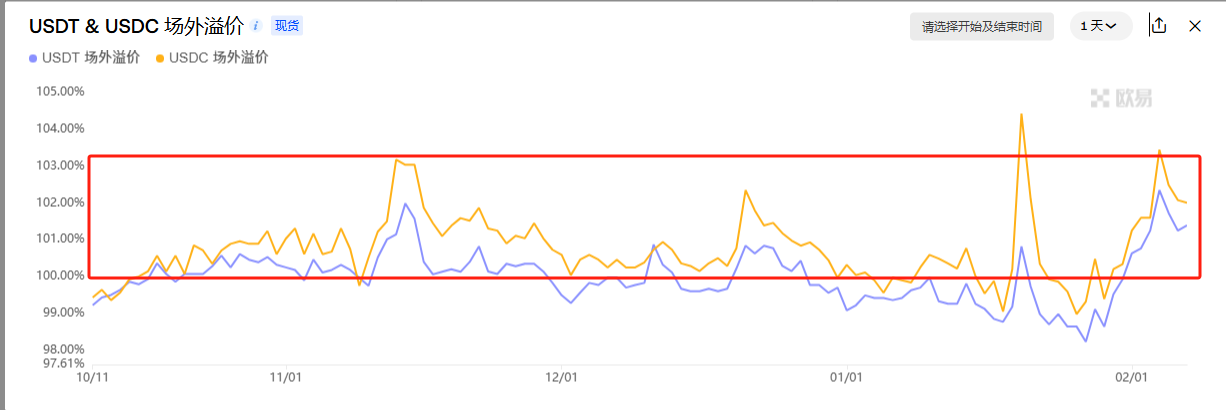

2.1.3 Premium or discount in over-the-counter transactions

- February 3rd - February 5th (USDT & USDC premiums increased)

- An increase in the premium usually indicates that funds are flowing into the market . At this time, the BTC price rebounded to the range of 95,000-96,000 US dollars, and the rebound trend was obvious.

- February 6th - February 7th (BTC price breaks through $99,000)

- While the BTC price broke through $99,000, the USDT & USDC premiums remained at a high level (101%-103%). This steady increase in premiums indicates that funds are flowing into the crypto market, and the rise in BTC prices is supported by funds.

Impact on BTC market:

- Positive market sentiment : The rising premium shows that investors have confidence in the crypto market, and BTC has also ushered in a strong rebound in the short term.

- BTC pullback : Although the BTC price broke through $99,000, it pulled back to $96,000 on February 7, and the premium did not drop significantly, indicating that market sentiment remained stable and there were no obvious signs of capital outflow.

2.2 Related price indicators

2.2.1 Cryptocurrency Market Value

Total market value fell, BTC market share rose : As of 2/7, the total market value of the global crypto market was approximately 3.26 trillion , showing a downward trend during the week, a drop of 10.9% (2/1 market value 3.66 trillion), BTC's dominant position in the market remains solid, and its market share has returned to the upper track of parallel access, remaining near 61.88%.

Impact on BTC market:

- The total market value fell, and BTC's market share rose: This indicates that the market as a whole is selling off, but funds are relatively more inclined to BTC, which may be due to increased risk aversion (such as macroeconomic uncertainty). BTC may have a relatively resistant performance, while the altcoin market is facing correction pressure.

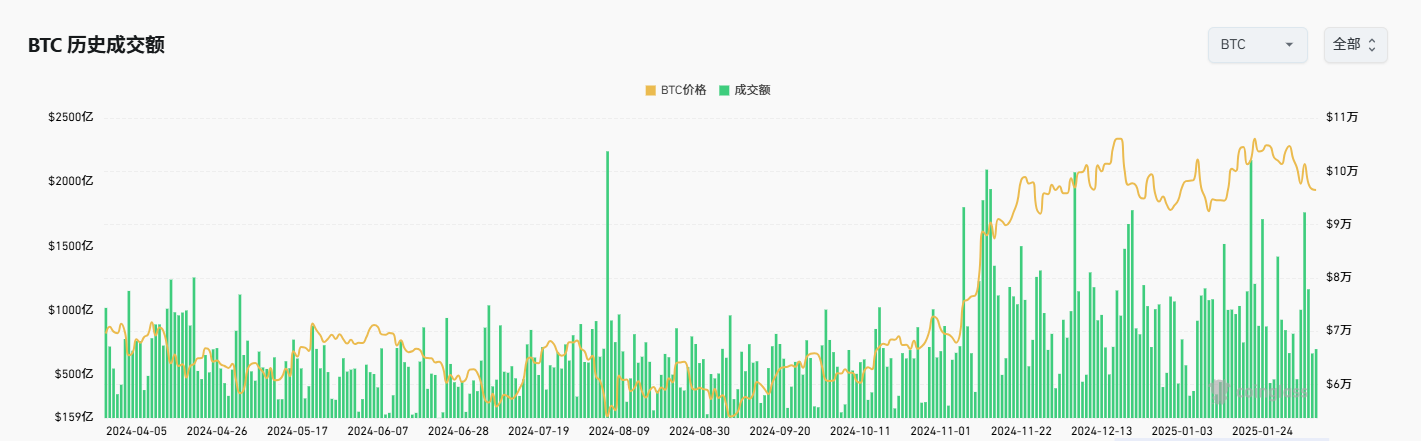

2.2.2 BTC overall transaction volume

- This week, the overall BTC trading volume showed a trend of first increasing and then decreasing , and the price fluctuated violently and then gradually fell . The current market trading enthusiasm has declined, and the BTC price may continue to face adjustment pressure in the short term.

Impact on BTC market:

Market liquidity declines, short-term rebound is weak

The trading volume has gradually declined since the peak in 2/4, indicating that the market trading enthusiasm has weakened. In the short term, BTC lacks the momentum to rebound and may continue to fluctuate at a low level.

Market sentiment is cautious and prices are still at risk of falling

As trading volume decreases, BTC prices continue to fall, indicating that market sentiment is cautious. If trading volume continues to remain low in the next few days, BTC may test the $94,000-95,000 support area.

in conclusion

Current market conditions:

- Stablecoin issuance increased significantly, but the direction of capital flow is still unclear; ETF capital inflows decreased significantly, and institutional buying weakened; BTC trading volume expanded and then shrunk, BTC price fluctuated around 97,000, and market sentiment was cautious

Key risks and opportunities for future trends:

- Risks : ETF funds continue to weaken, market liquidity declines, short-term trading enthusiasm weakens; altcoin selling pressure increases

- Opportunity : The issuance of stablecoins will bring potential capital inflows. If BTC can effectively defend the 94,000-95,000 support area, BTC may stabilize and have a chance to rebound.

Analysis of the copycat section

Combining this week's macroeconomic indicators and market data analysis, the altcoin market is experiencing continuous adjustments and capital outflow pressure. The following is an analysis of this week's altcoin market performance from multiple dimensions, including altcoin season indicators, capital flows, BTC market share, OTHERS market share, and USDT market share , and looks forward to possible future development paths.

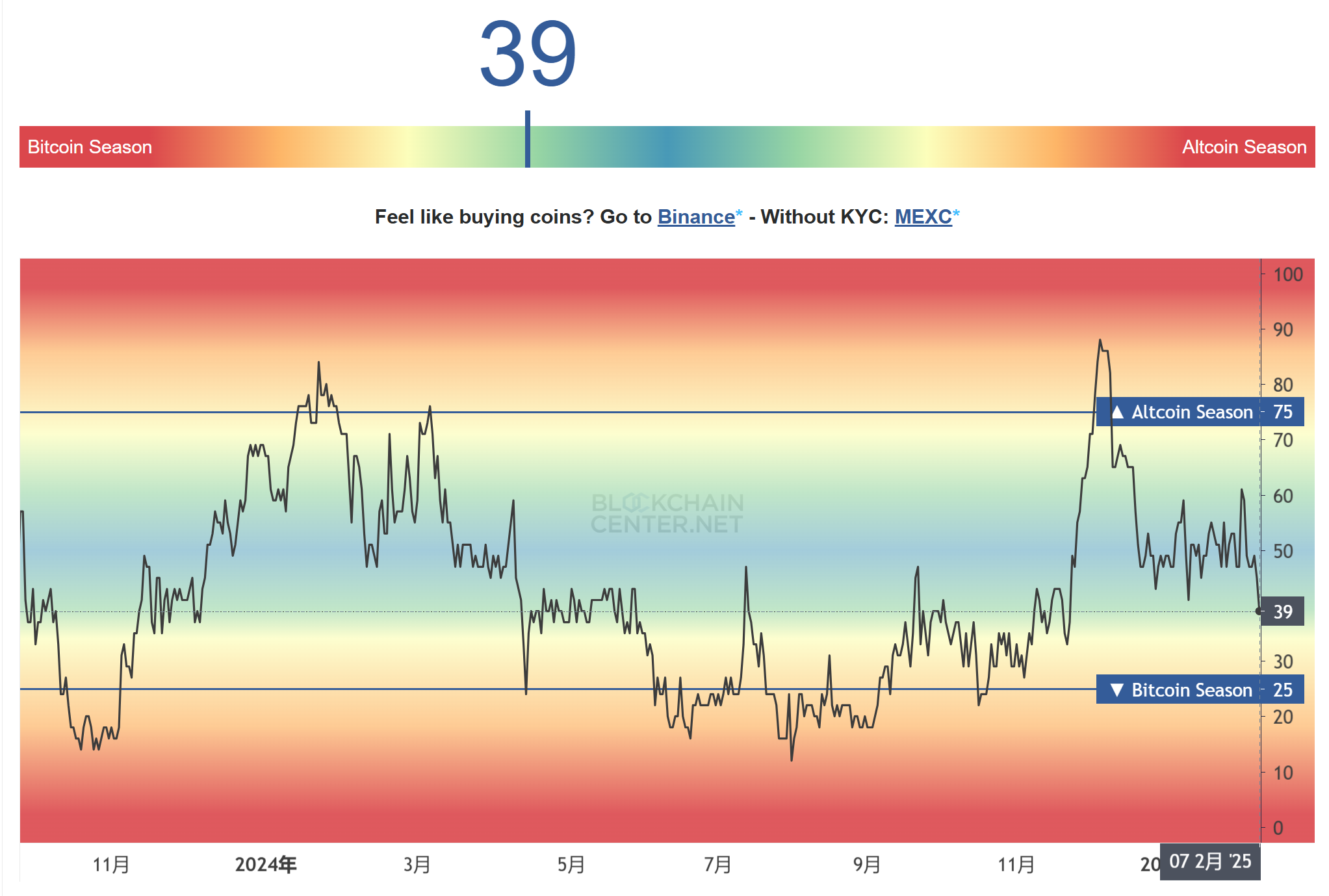

1. Shanzhai Season Indicators

This Friday, the Altcoin Index was 39. The index showed that after more than a month of volatility, it officially fell below the middle range. The Altcoin market failed to hold its interim low point, and BTC’s dominance further increased, which was bad news for all Altcoins.

Cryptobubbles shows us the current bloodbath in the altcoin market: all altcoins have fallen by more than 20 points.

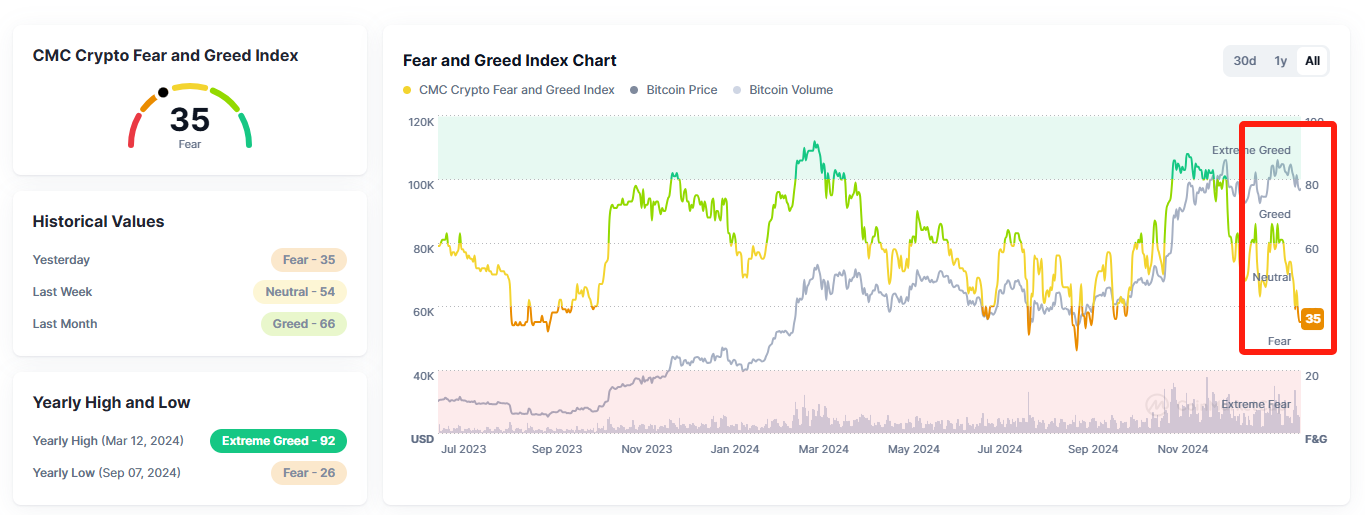

*2025.02.07*Comparing the CMC market sentiment index, we can clearly see the divergence between BTC price and altcoin price:

*2025.02.07*Therefore, at this stage, BTC and other currencies are almost completely two different markets. The return of the alt season may require more new favorable factors to be achieved, such as the increase in funds brought by interest rate cuts and QE, or the birth of killer applications/tracks with PMF.

The former requires a longer time period and is closely related to Trump’s own policy inclinations, while the track that is currently closest to this condition for the latter is the AI Agent track, but it is also in the de-bubble stage and may take some time to build a bottom and wait for the product to be launched on a large scale before a new round of outbreak can begin.

2. Bull market escape indicator list

The market conditions this week were extremely bad, and none of the top escape signals were hit, but in order to stay sensitive to signal trends, we will still keep records every week.

3. Inflow of copycats

This week, the market was greatly affected by Trump's tariff policy, with a net outflow of $4.957 billion in all currencies on the 7th. Fortunately, this outflow level is almost the same as the last data we counted before the New Year, and it has not deteriorated further. However, the 30-day net outflow has reached $15 billion. Combined with the ETF data in the past two weeks, it is not optimistic. We need to wait for the macro-positive factors to get BTC back on track before discussing the conversion rate of altcoins.

*2025.02.07*4. BTC market share

We have already warned of the risks of BTC’s rising market share in our weekly report before the New Year:

The overall upward trend of BTC market share this week is relatively obvious...Under the premise that there is no significant breakthrough in price, the market share has further increased due to the decline of the cottage. It has now reached the upper edge of the resistance range, and it is likely to break through this range, which means it is unfavorable for the cottage. Therefore, investors need to pay attention to the risk of cottage retracement. The current support platform may not be sufficient, and a new support platform needs to be found.

Compared with the year before, the current BTC market share has completely broken through the upper edge of the triangle pattern in one go. This is mainly due to the impact of two factors on altcoins:

- DeepSeek hits US stocks

- Trump's tariff policy triggers market panic

It can be seen that the technical resistance of BTC market share is vulnerable to market black swans and macro policies. From a pessimistic point of view, with the implementation of BTC reserve plans in various continents, the market share indicator may return to 70%, which is the peak range of the previous round:

If this round of trends is really realized, then in the process of rising about 10 points from now (61%) to the top (~71%), almost all altcoins will fall back to the platform before September 2023, which means that the gains since October 2023 will be completely recovered. If this surge stage is survived, then this round of real altcoin season will most likely come, and it is expected to replicate the large-scale plunge trend between Q1 and Q2 of 21.

On the other hand, Matrixport pointed out another reason for BTC’s strength in its report:

The number of wallets holding more than 10,000 SOL has dropped sharply in the past two months, indicating that large holders are selling, which may suppress the continued rise in SOL prices. However, it may also indicate that early whales who accumulated SOL before the meme coin cycle in late 2023 are now cashing out and reallocating their gains to Bitcoin. This rotation may explain why Bitcoin remains resilient despite the overall correction in the mountain currency market.

Matrixport: Solana whales are cashing in their gains, and the hype of meme coins is receding

But no matter when the altcoin season comes, this round of bull market will be extremely torturous for long-term holders of altcoins and ETH believers. Before ETH returns, it will be difficult for the altcoin market as a whole to rise significantly.

5.OTHERS.D

As for OTHERS.D, the OTHERS.D triangle pattern we previously portrayed has also temporarily failed. The long-term support line for 16 years has been directly broken through, and the pin has returned to the Fibonacci bottom level. The failure of this pattern shows that BTC is too strong and the cottage is too weak. Overall, ETH is in a weak position in this round of bull market, and has not been able to drive the development of the industry as a whole, and has been criticized; there is no complete killer narrative among the cottage that can match the previous round of DeFi, and the Agent market, MEME market, etc. mostly occur on the chain, and the tokens in the exchange have basically not experienced a general rise. Coupled with BTC's current special status in the US political game, the break of the long-term support line may be inevitable.

We have previously deduced the cyclical trend of OTHER.D, which can be roughly divided into four stages: decline (bear market), rebound (Bull trap), further decline (Bear trap), and the start of the copycat season (Alt szn).

Although there is some damage in the shape, it can still be determined from the volume that it is now in the yellow Bear trap despair range, which can basically correspond to the previous re-falling range. **After experiencing this period of desperate decline, we still believe that the copycat season will eventually come.

6. USDT market share

Finally, after many failed attempts, USDT's market share undoubtedly returned to above the long-term support line due to the panic caused by Trump's tariff policy.

BTC market share increased, USDT market share increased (while the issuance volume decreased), but OTHERS market share decreased. This basically means that most investors have exchanged their altcoins for stablecoins or bought BTC. The focus of the subsequent market is still on the macro level rather than the circle itself. Please pay attention to the risks caused by the macro level to avoid capital withdrawal.

Special thanks

Creation is not easy. If you need to reprint or quote, please contact the author in advance for authorization or indicate the source. Thank you again for your support.

Written by: Sylvia / Jim / Mat / Cage / WolfDAO

Edited by: Punko / Nora

Thanks to the above partners for their outstanding contributions to this weekly report. This weekly report is published by WolfDAO for learning, research or appreciation only.