The next step of DeFi may have started with Unichain.

Written by: Luke, Mars Finance

In the field of decentralized finance (DeFi), whether in terms of transaction volume, user base, or technological innovation, Uniswap has always occupied an unshakable leading position. Two months ago, Uniswap Labs officially launched Unichain, an Ethereum Layer2 network based on OP Stack, and launched the test network. This news not only attracted widespread attention in the industry, but also injected new imagination into the DeFi market.

As the largest position in Grayscale's DeFi holdings, $UNI's influence has already transcended the scope of DeFi. The launch of Unichain is undoubtedly a redefinition of Uniswap's own positioning: from a single protocol to a chain-level platform as a DeFi infrastructure.

Since Uniswap labs announced Unichain on October 10, the price of $UNI has soared 134% in one month.

Now, Unichain is about to go live. Why does Uniswap want to build its own chain? What changes can Unichain bring to the DeFi market? From technological innovation to token empowerment, to market positioning and value measurement, this article will comprehensively analyze Unichain's core highlights and future potential.

From the rise of application chains to the birth of Unichain

The concept of AppChain was first promoted by Cosmos SDK, and has experienced a new explosion in recent years as Ethereum's expansion solutions mature. As a blockchain designed for specific applications, AppChain can provide highly customized performance optimization to meet the dual needs of top projects in terms of performance and narrative. From Cosmos' Terra to chains built on the Optimism OP Stack such as Base and Mantle, AppChain has gradually formed a new development trend.

Under this trend, Uniswap launched Unichain, which not only follows this trend, but also attempts to break through the limitations of existing DeFi protocols with groundbreaking technology and economic models. The launch of Unichain marks that Uniswap has entered a new stage from a single application to a chain-level architecture, reflecting its ambition to reshape the DeFi market landscape.

The rise of application chains stems from their ability to provide unique technical advantages for specific protocols. Traditional public chains (such as Ethereum) are general platform chains where all protocols need to share the same network resources, while application chains are blockchain environments tailored for a specific protocol. This design has the following advantages:

Customization: Optimize the consensus mechanism, fee structure, and privacy model to fully meet the needs of the protocol.

Performance optimization: Support faster transaction confirmation speed and lower handling fees to improve user experience.

Autonomy: Give the protocol greater freedom in development and governance, and reduce dependence on the main chain.

From the launch of Cosmos SDK in 2018 to the popularization of modular tools such as Optimism's OP Stack and Arbitrum Orbit in 2023, the technical threshold of application chains has been significantly lowered. This has created conditions for more protocols to enter the application chain field.

As a leader in the DeFi field, Uniswap has been exploring how to further expand its protocol capabilities. The launch of Unichain is not only to solve the performance bottleneck problem, but also out of the following two considerations:

Performance requirements: Although the Ethereum main chain has extremely high security and decentralization, its transaction speed and cost have always been important bottlenecks that limit the Uniswap user experience. Based on the technical framework of OP Stack, Unichain can achieve a block speed of 250 milliseconds and significantly reduce transaction costs, providing users with a near real-time transaction experience.

Narrative breakthrough: The launch of the application chain has transformed Uniswap from a single protocol to a chain-level platform that can carry a larger narrative, bringing new value empowerment to its $UNI token. This transformation not only helps to consolidate its position in the DeFi market, but also opens up more possibilities for its future ecological layout.

Unichain’s Technological Innovation

In order to address the bottlenecks currently encountered by Uniswap, Unichain's design ranges from performance to fairness to cross-chain interoperability. Each innovation is dedicated to solving practical problems encountered by DeFi users and developers in the existing blockchain ecosystem. Among them, there are 5 major technological innovations that are most worthy of attention.

1. Separation of Rollup-Boost and Sequencer Builder: Redefining the Fairness Rules of MEV

In traditional blockchain architecture, the dual roles of sequencer and block builder are often concentrated in a single entity. This centralization leads to the rampant MEV (miner extractable value) problem. Unichain's Rollup-Boost technology completely separates sequencer from block builder by introducing Sequencer Builder Separation (SBS), providing a new solution for the fair distribution of MEV.

In the specific implementation, Unichain introduced Block Builder Sidecar as a module that connects the sorter and external block builders, allowing builders to submit block proposals through market competition. When the sorter receives block proposals from multiple parties, it selects the best solution and submits it to the chain. This design not only disperses the power of block construction, but also ensures that MEV revenue is no longer monopolized by a single sorter. This mechanism directly alleviates the problem of reduced user experience caused by front-running transactions or censorship, while making the distribution of MEV more transparent and fair.

2. Trusted Execution Environment (TEE): A new cornerstone for transaction privacy and fairness

The privacy and fairness of blockchain transactions have always been the core of technical challenges, and Unichain has taken these two points to a new level with the help of Trusted Execution Environment (TEE) technology. TEE provides a hardware-level secure space for processing sensitive logic when sorting transactions and building blocks.

The biggest highlight of TEE is that it can simulate multiple possible paths for transaction execution and eliminate potentially failed transactions to ensure the final block construction efficiency. In user interaction, this mechanism significantly reduces the number of failed transactions caused by network congestion or malicious behavior. In addition, TEE also supports the generation of execution proofs, allowing users to verify whether the ordering of each transaction complies with the principle of fairness. For DeFi users who have long been troubled by the MEV problem, this is a significant optimization.

Privacy protection is another core function of TEE. During the block construction process, the specific details of the transaction are not visible to the outside world, which effectively prevents malicious behaviors such as preemption and provides a more stable environment for high-frequency transactions.

3. Flashblock: Smooth trading experience every 250 milliseconds

The length of block generation time directly affects the user experience, and Unichain's Flashblock technology compresses this indicator to the extreme - a partial confirmation can be completed every 250 milliseconds. Traditional blockchains often have low block generation efficiency due to delays in state root calculations, while Flashblock breaks down complete blocks into multiple small parts, significantly improving transaction speed through parallel processing.

The benefits of this mechanism are not only reflected in speed. For liquidity providers (LPs), shorter confirmation time significantly reduces the risk of adverse selection caused by market fluctuations, while reducing slippage losses. For ordinary users, Flashblock means lower transaction failure rates and almost instant transaction feedback. The ability to quickly confirm not only optimizes the user experience in the Uniswap ecosystem, but also provides an excellent environment for high-frequency traders.

4. Unichain Verification Network (UVN): Security Shield for Sorters

To address the potential risks of sequencer centralization, Unichain designed the Verification Network (UVN) as an additional layer of security. In this architecture, UVN validators run independently of the sequencer and are responsible for reviewing the legitimacy and consistency of blocks.

UVN's parallel verification not only reduces the risk of single point failure of the sorter, but also speeds up the finality confirmation of the block. Through this design, Unichain has found a new balance between decentralization and efficiency, providing users with higher security.

5. ERC-7802 cross-chain intention: building a bridge for a multi-chain world

In the context of a multi-chain ecosystem, cross-chain liquidity of assets is the key to determining the efficiency of inter-chain cooperation. The Uniswap team and the Optimism team jointly proposed the ERC-7802 cross-chain token standard, with the goal of maintaining a unified standard for tokens when they are transferred across chains. ERC-7802 defines a standardized minting and destruction interface to ensure that the total supply remains constant when assets are transferred between chains.

Application scenarios of this standard include fast cross-chain operations of tokens on Unichain. For example, users can seamlessly transfer ERC-20 tokens from the Ethereum mainnet to Unichain, and then reverse operations to other ecosystems. The modular design of ERC-7802 further reduces the dependence on specific bridge protocols, leaving more room for the expansion of cross-chain technology in the future.

Through these five technological innovations, Unichain not only solves the performance, privacy and fairness issues in the existing blockchain ecosystem, but also takes an important step in the field of multi-chain interoperability. These breakthrough technologies lay the foundation for Unichain's core competitiveness in the DeFi market and provide a new paradigm for the future development of the industry.

$UNI Token Empowerment: From Governance to Revenue

The launch of Unichain is not only a technological innovation, but also brings new usage scenarios and economic value to the $UNI token. From a governance tool to a productive asset, the transformation of the $UNI token has enabled it to play a more important role in the Uniswap ecosystem.

Validators and staking mechanisms: the core driving network operation

In Unichain's architecture, validators are the core of ensuring network security and efficiency, and the prerequisite for becoming a validator is to stake $UNI tokens. Unichain's verification network adopts a unique economic model that encourages users to stake $UNI tokens to participate in network governance and revenue distribution.

The operating mechanism is as follows:

Staking on the mainnet: Validators need to stake $UNI tokens on the Ethereum mainnet, and the staking data is synchronized to the chain through Unichain’s native bridging technology.

Revenue distribution: At the beginning of each verification cycle (Epoch), the validator with the highest stake weight is selected as the active node, responsible for block verification and receiving fuel fee rewards. Nodes that do not participate in verification cannot receive any revenue.

This mechanism adds a practical function of staking to $UNI, making it no longer just a governance token, but a productive asset. While staking, users can not only help maintain network stability, but also obtain actual benefits through transaction fees and block rewards.

MEV Revenue Distribution: Innovation of Fair Incentives

MEV (Miner Extractable Value) is an important part of Unichain's economic model. In traditional blockchains, the benefits of MEV are usually monopolized by sorters or miners, which not only leads to the concentration of resources, but also increases the transaction costs of users. Unichain has changed this unfair situation by introducing the MEV redistribution mechanism.

On Unichain, the sorter distributes the revenue of MEV to the validators and liquidity providers (LP) in the network according to the rules through the trusted execution environment (TEE). This mechanism allows all roles participating in the ecosystem to share the value of MEV fairly, rather than being monopolized by a single entity.

Specifically:

MEV Tax: Applications can set priority sorting rules for their transactions, allocating part of the MEV revenue to LPs or directly giving it back to users.

Revenue pool distribution: The MEV revenue generated in each transaction is injected into the reward pool of validators and users in proportion to increase the enthusiasm for network participation.

This innovation not only reduces the participation risk of LPs, but also attracts more users to join the ecosystem, providing strong support for Unichain's liquidity growth.

$UNI’s value transformation: from voting rights to core ecosystem assets

In the early days of Uniswap, $UNI served as a governance token, and its functions were mainly focused on protocol governance and community decision-making. However, with the launch of Unichain, the functions of $UNI have been significantly expanded:

Staked assets: Validators can earn block rewards by staking $UNI, making the token an important economic tool for validating the network.

Cross-chain bridging: Through the ERC-7802 standard, the flow of $UNI between Unichain and other ecosystems is more efficient, further enhancing its liquidity and adaptability.

Yield Growth: The introduction of MEV redistribution and gas fees has brought real yield growth to users holding $UNI.

More importantly, $UNI's new role in Unichain has enabled it to enter a positive cycle of "empowerment-value-added-feedback". The staking needs of validators, the distribution of MEV revenue, and users' pursuit of lower transaction costs have jointly driven the growth of demand for $UNI, making it more attractive in the DeFi market.

By redefining the use cases of $UNI, Unichain not only strengthens Uniswap's core position in decentralized finance, but also brings more diversified economic benefits to ecosystem participants. This token-enabled innovation makes Uniswap's ecosystem more sustainable and provides a new reference paradigm for the DeFi market.

Unichain's market positioning and future prospects

The birth of Unichain is not only an upgrade of its own ecology, but also a precise response to the development trend of the blockchain industry.

Comparison with Application Chain and Universal Rollup: Unique Positioning in Multiple Dimensions

Unichain is positioned as a dedicated Layer 2 chain based on the Optimism OP Stack. This choice makes it different from traditional application chains and the development model of general Rollups.

Different from the flexibility of application chains: application chains are often tailored for a single protocol, such as dYdX Chain, which is built on Cosmos and focuses on perpetual contract transactions. Although Unichain is a dedicated chain for Uniswap, it retains the interoperability of general Rollup. The design of Unichain allows other DeFi applications to be easily deployed, forming a super ecosystem for liquidity sharing.

Different from the specialization of general-purpose Rollup: General-purpose Rollup, such as Arbitrum and zkSync, focuses on providing scalability for a wide range of application scenarios. In contrast, Unichain is deeply optimized for DeFi transactions, and the Flashblock and priority sorting mechanism ensure extremely low latency and efficient transaction execution. This customization gives it a clear competitive advantage in DeFi applications.

This positioning between application chains and general Rollups allows Unichain to focus on the development of its own ecosystem while retaining interoperability and compatibility in the larger Ethereum ecosystem. In addition, Unichain's interoperability is not only reflected in the technical level, but also in its support for Ethereum's Rollup-Centric strategy. As a member of the OP Superchain ecosystem, Unichain fully utilizes the cross-chain communication capabilities provided by Optimism, while expanding the flexibility of cross-chain operations through the ERC-7802 standard.

OP Superchain's ecological advantages: Unichain can achieve seamless flow of assets and information with Base, Mantle and other chains through the native interoperability of Optimism. This ability to share ecological resources allows Unichain to quickly establish liquidity advantages at the startup stage.

Application of ERC-7802 cross-chain intention: Through standardized cross-chain operation interfaces, Unichain is able to simplify the process of transferring tokens between different chains. For example, users can easily cross $UNI from the Ethereum mainnet to Unichain for efficient DeFi transactions, and then return to other chains for further operations. This design reduces the complexity of cross-chain operations and provides users with a better experience.

This efficient ecological integration capability makes Unichain not only a technical extension of Uniswap, but also an important pillar of the entire Ethereum multi-chain ecosystem.

After UniChain went online, UNI took off directly?

Michael Nadeau, founder of DeFi Report, said that Uniswap's new L2 blockchain Unichain could be a boon to the creator Uniswap Labs and the project's token holders, who could earn nearly $468 million a year in fees that would otherwise be paid to the Ethereum network. Uniswap Labs and UNI token holders will benefit the most from Unichain, while ETH holders could suffer the most. Potential sources of income are as follows:

Settlement Fees: Instead of paying $368 million to Ethereum validators, Uniswap Labs (and most likely UNI token holders) will collect this fee when launching Unichain.

MEV: In addition to collecting settlement fees in Ethereum, Uniswap will also be able to earn MEV since they will have validators on Unichain. It is estimated that MEV accounts for about 10% of the total fees paid by Uniswap ($100 million last year). They can also choose to share some of this with token holders.

Liquidity Providers: Liquidity providers will continue to receive 100% of trading fees and may also participate in settlement and MEV once Unichain goes live.

Let’s first look at the composition of the $468 million: $368 million in transaction fees (i.e., the Gas fees paid to Ethereum validators when transactions are made) and $100 million in MEV value (extra income generated by validators through reordering transactions, jam attacks, etc.).

As a Layer 2 technology based on Optimistic Rollup, Unichain can process transactions in its independent network and then submit these batch transaction data to the Ethereum main chain. In this process, Unichain has the opportunity to capture transaction fees and MEV revenue. However, whether this vision can become a reality depends on an important premise: all liquidity pools’ LPs and trading activities must be completely migrated from the Ethereum main network to Unichain, and the MEV capture efficiency must reach 100%.

Obviously, such conditions are difficult to achieve.

Although there are many Layer 1 and Layer 2 solutions emerging in the market, Ethereum is still the preferred platform for most altcoins and DeFi liquidity. Ethereum has become an unshakable core barrier for liquidity migration with its mature ecosystem and market recognition. In addition, liquidity migration itself requires high costs and risks, so it is almost impossible to completely transfer large-scale liquidity to Unichain.

Of course, Unichain can also encourage some funds and trading activities to shift to its platform through attractive incentives, such as low transaction fees and liquidity mining. However, even so, the scale of such migration is still limited.

So, how much value can Unichain actually capture?

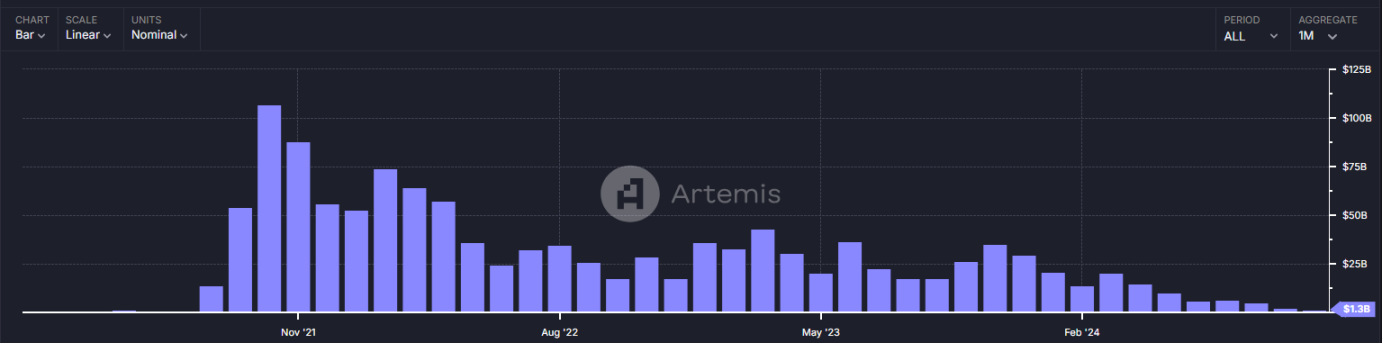

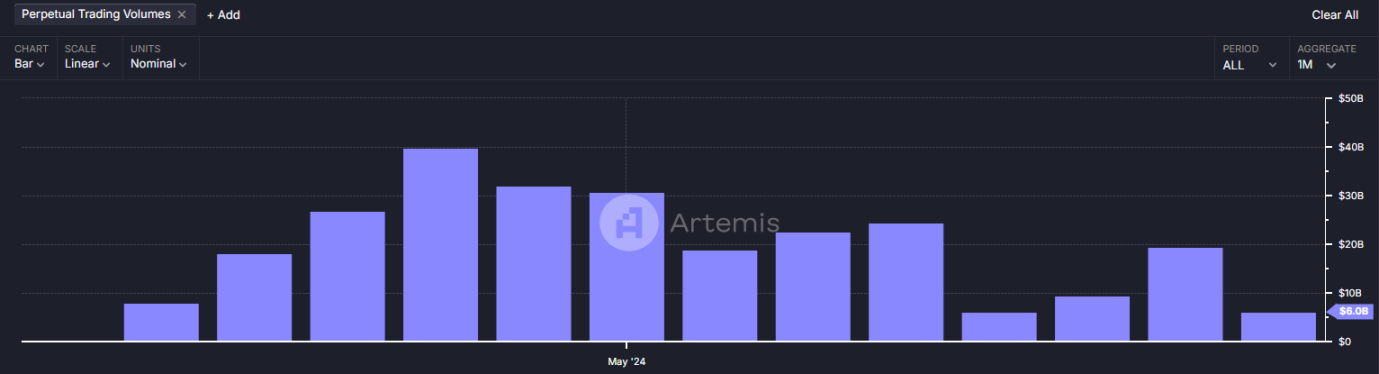

Taking dYdX, the first to launch the application chain, as a reference, after the launch of its V4 version (dYdX Chain), the monthly transaction volume has quadrupled that of the V3 version, accounting for 82% of the total transaction volume of the protocol. However, compared with perpetual contract transactions, the performance requirements of spot trading and asset exchange are relatively low, so Unichain is unlikely to reach the transaction volume or TVL of dYdX in the short term. According to conservative estimates, Unichain's value capture may be only 30% of the theoretical value, which means it will bring about $140 million in revenue to Uniswap each year.

In addition, $UNI has long been criticized for failing to effectively capture the value of the protocol, and the launch of Unichain provides a solution to this problem. Through the empowerment of Unichain, $UNI can directly capture the value generated by the protocol, which is crucial to the token economic model.

It can be seen that the launch of Unichain will undoubtedly have a profound impact on the ecosystem. Unlike the abstract and far-reaching concept of Uniswap X, Unichain is a major benefit that can be implemented and show results.

As the undisputed leader in the DeFi track, Uniswap will not miss this bull market. We can boldly predict that ATH will be reached within 3 months, and this is just the beginning.

Conclusion

Uniswap's Unichain is not only a technological breakthrough, but also a strategic layout for the future of DeFi. Through five core innovations, Unichain has brought new imagination space to the DeFi market in terms of performance optimization, privacy protection, liquidity aggregation, and ecological integration.

As Ryan Watkins, co-founder of Syncracy Capital, said, blockchain applications are undergoing a major transformation from relying on the base layer to controlling their own economy. The launch of Unichain not only strengthens Uniswap's core position in the DeFi market, but also injects new impetus into the Ethereum ecosystem. Driven by both technological innovation and economic transformation, the success of Unichain will become an important touchstone in the era of blockchain diversification.

The next step of DeFi may have already started with Unichain. Let's wait and see.