Author: Zuo Ye

- YBS’s native income is de-US debt-based, for example, more pure on-chain assets are used, such as BTC/ETH/SOL pledge forms;

- YBS "Lego" combination, Pendle is just the beginning, more DeFi protocols are needed to support YBS until the emergence of USDT on the chain;

- Payment products are not technically difficult, and interest-bearing products are also easy to acquire customers, but the main difficulty lies in compliance and business expansion. Even for USDT/USDC, payment is more of a "middleware" role in the background clearing, and is less directly used as a transaction medium.

Within 100 days, stocks, bonds and currencies all suffered a triple kill, and the legal currency order was accelerating its collapse.

The 2008 financial crisis gave birth to the earliest believers of Bitcoin. The "suicide" of the fiat currency system in 2025 will also promote the growth of on-chain stablecoins, especially non-US dollar, non-fully-reserved interest-bearing stablecoins (YBS, Yield-Bearing Stablecoins).

However, non-full-reserve stablecoins are still in the theoretical realm, and the aftermath of the collapse of Luna-UST in 2022 is still lingering, but driven by capital efficiency, partial-reserve stablecoins will surely become the mainstream of the market.

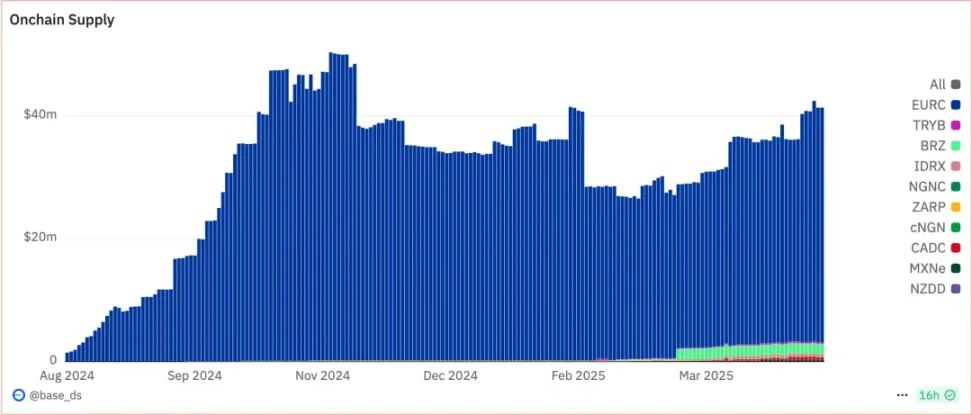

Non-US dollar stablecoins are still in the trial stage, and the US dollar's global currency status is still widely recognized. In order to maintain industrial capacity and employment, the renminbi will not actively internationalize on a large scale, and replacing the US dollar will be a very long process.

Image description: Non-US dollar stablecoins, Image source: https://dune.com/base_ds/international-stablecoins

Based on the above two points, this article mainly examines the latest stage of existing stablecoins, that is, the overall appearance of YBS, a US dollar-based, fully-reserved on-chain stablecoin system, which contains the basic appearance of post-US dollar, non-fully-reserved stablecoins.

The seigniorage manifests itself internally as inflation, commonly known as domestic debt which is not debt, and externally as the US dollar tidal cycle.

Trump abandons dollar hegemony

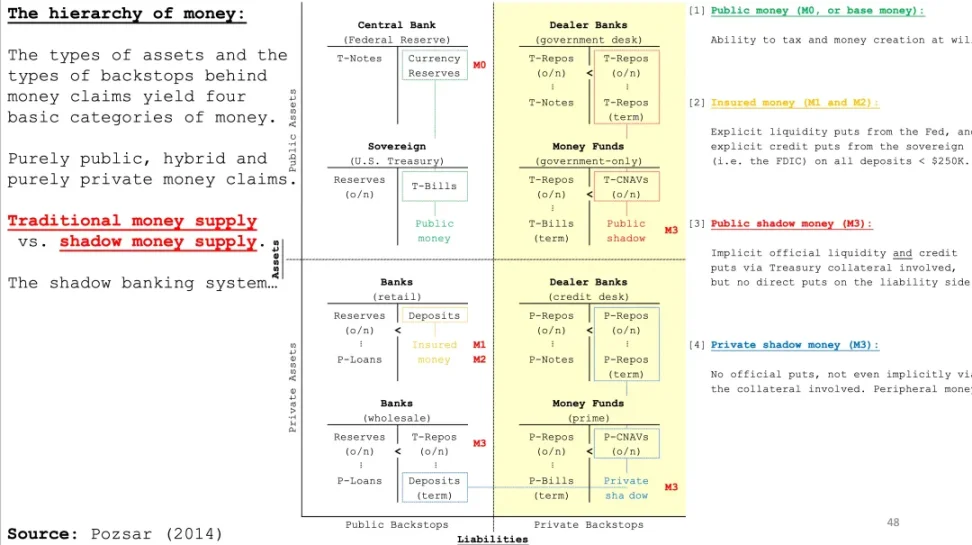

From a technical point of view, the issuance of US dollars is a counter-trade between the Federal Reserve and the Treasury Department, which then uses the credit relationship of commercial banks to amplify the money multiplier, creating different statistical levels of money circulation such as M0/M1/M2/M3...

Under this issuance model, U.S. debt (T-Bills, T-Notes, T-Bonds) are divided into long and short terms, maintaining the slow inflation of the U.S. dollar and short-term currency stability. The U.S. debt interest rate becomes the pricing basis for the entire financial world, and the U.S. dollar becomes the world currency. The cost is the U.S. external deficit and the dependence of various countries on the dollar.

The cost has always been two-way. The only product of the United States is actually the US dollar itself, and countries around the world need to obtain the US dollar and convert it into purchasing power.

The purchasing power of the US dollar will depreciate in the long term and will not be affected by Trump's will. Countries must obtain US dollars to minimize transaction intermediary costs. Barter is not impossible, but it is more cost-effective to use US dollars directly.

The hard-earned US dollars must be spent quickly, either on production or financial arbitrage, in order to preserve purchasing power and maintain the competitiveness of exports to the United States in the next stage.

Now this cycle is being destroyed by Trump's Schrodinger-style tariff system. Trump is increasing tariffs and forcing Powell to cut interest rates. Countries no longer want to hold dollars and are fleeing the U.S. bond market. The dollar/U.S. bond has become a risky asset.

Image caption: US dollar operation process, Image source: Pozsar

The slow inflation of the US dollar is a way to collect seigniorage from various countries. Only when all countries are required to hold or partially invest in US debt can the damage to the US dollar itself be reduced.

Assume the following scenario:

- Alice is a textile worker who toils in a sweatshop and earns $1,000 in cash;

- Bob is a U.S. bond salesman. Alice invests $100/200/200 in short-term, medium-term, and long-term U.S. bonds, and the remaining $500 is invested in expanded reproduction.

- Bob uses the bonds purchased by Alice as collateral, adds 100x leverage, and borrows $50,000 from Cindy at the bank;

- Bob spends $25,000 on the property, $20,000 on Mag7 stock, and the remaining $5,000 on Alice's new bag.

In the above cycle, Alice's motivation is to exchange labor for US dollars and use reproduction and US bonds to resist depreciation. Bob's motivation is to recover US dollars and magnify the asset value of US bonds. Cindy's motivation is to collect risk-free US bonds and earn fees.

There are two dangers. First, if Alice invests all her $1,000 in U.S. Treasury bonds, Bob and Cindy will have nothing to wear, and $500,000 cannot even buy a piece of bread. Second, the U.S. Treasury bonds in Bob's hands cannot be used as risk-free collateral to borrow dollars, so Cindy will be unemployed, and Bob will not be able to buy Alice's bag, but can only buy pants. Alice will also face the loss of expanded reproduction.

Once the arrow is shot, there is no turning back. After Trump abandons the dollar hegemony, the seigniorage collected by the dollar from the whole world will also face the Luna-UST death spiral, but it will take longer.

The fragmented world trade and financial system is, on the contrary, a catalyst for the "globalization" of cryptocurrencies. Embracing the center of power will create a single point of obstacle. The U.S.-debtization of Bitcoin will not harm Bitcoin, but the dollarization of cryptocurrency will make it disappear.

What’s more interesting is that in the coming period, the shocks in the global economic system will cause the offense and defense between stablecoins to continue. The increasingly fragmented world will always need glue language and cross-chain bridges. The era of global arbitrage will inevitably exist in the form of on-chain stablecoins.

Sad Frog entertains the public, and Funny People change the world. Let us explain why this is so.

The tail wags the dog, stablecoins drive out volatile coins

The crypto market capitalization is "fake", and the stablecoin issuance is "real".

The $2.7 trillion cryptocurrency market cap is just a sense of the "capacity" of the crypto market, and the $230 billion stablecoin is at least backed by real reserves, although the 60% USDT reserves are questionable.

With the USDCization of DAI or USDS, sufficient or excess stablecoins based on on-chain assets have virtually disappeared. The other side of real reserves is capital efficiency, or a significant reduction in the money multiplier. For every $1 USD issued, $1 of stablecoin is used to buy $1 of Treasury bonds off-chain and to borrow on-chain, with a maximum re-issuance of 4 times.

In contrast, the value of BTC and ETH is "created out of nothing", worth $84,000 and $1,600. Compared with the US dollar, the M0 of cryptocurrency should be BTC+ETH, that is, 19.85 million BTC and 120.68 million ETH. M1 should be added with $230 billion of Stablecoin, and the YBS re-issuance based on pledge and lending relationships and the DeFi ecosystem constitute M2 or M3, depending on the statistical caliber.

This presentation will better reflect the current state of the crypto market than market capitalization and TVL. Calculating the market value of BTC lacks practical significance because you cannot fully exchange it for USDT or USD, and the market lacks sufficient liquidity.

The crypto market is an "inverted" market, where volatile cryptocurrencies do not have corresponding stablecoins of sufficient value.

Only under this structure does YBS make sense, because the volatility of cryptocurrencies can be minted into stablecoins, but this is only a theory and has never been realized in reality. Even 230 billion stablecoins need to provide liquidity and entry and exit channels for a 2.7 trillion market.

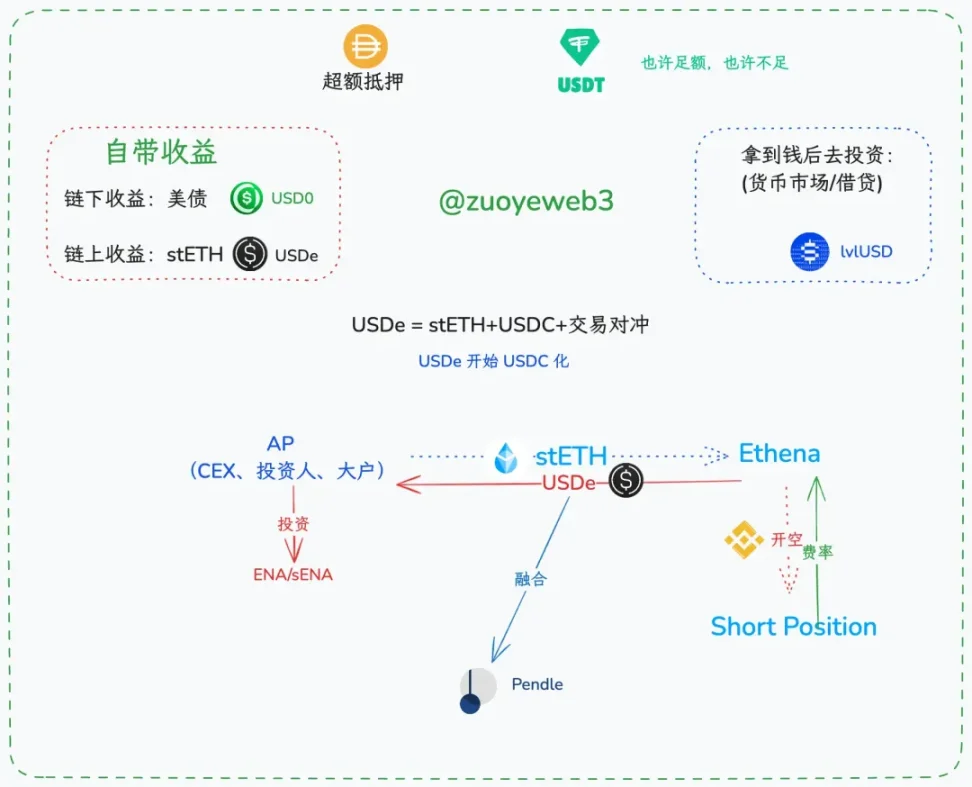

Ethena eclecticism, an unsuccessful replication of the U.S. debt and dollar system.

Ethena's USDe has expanded from 620 million at the beginning of its issuance to 6.2 billion US dollars in February this year, with a maximum market share of 3%. It was once second only to USDT and USDC. It is the most successful non-fiat currency reserve stablecoin since UST.

USDe's hedging model is actually very simple. AP (authorized issuer) deposits interest-bearing assets such as stETH, and Ethena opens a short position on Perp CEX. Based on historical backtest data, in most cases, longs provide funds to shorts, and funding rate arbitrage becomes Ethena's native protocol income.

As for why Hyperliquid is not responsible for the short position, it is because Perp DEX is still a derivative of Spot CEX, and the core source of Hyperliquid's price oracle is Binance. USDe simply goes to the most liquid CEX.

But that’s not all, Ethena goes a step further in imitating the real dollar system.

Image description: YBS classification and operation process, Image source: @zuoyeweb3

On the surface, Ethena has four token systems: USDe and sUSDe, ENA and sENA, but the core of Ethena has always been USDe. The most important scenario is the adoption rate of USDe in addition to "pledge and financial management", such as transactions and payments.

Recalling the operation process of the US dollar, the US dollar cannot be fully reinvested in US bonds. The most reasonable situation is that a small amount of US dollars flows back to the bond market, while most of the US dollars remain in the hands of other countries. This can not only maintain the global currency status of the US dollar, but also maintain the purchasing power of the US dollar.

At the beginning of this year, USDe attracted about 60% of USDe to be pledged as sUSDe with a 9% yield. In essence, this is the liability of the protocol. In theory, the remaining 40% of USDe has to pay 9% yield for 60% of people, which is obviously unsustainable.

Therefore, the interest alliance between ENA and CEX is extremely important. For example, Circle has to share profits for holding USDC for Coinbase and Binance. In essence, ENA also has to bear the responsibility of "bribing" AP. If large investors do not sell, everything will be fine. sENA is another guarantee for stabilizing large investors.

Nested layer by layer, the best object to emulate is not the US dollar or USDC, but USDT. The $14 billion profit belongs to Tether, and the $160 billion risk is shared by CEX and retail investors.

There is no other reason. P2P transfers, spot trading pairs, U-based contracts, and the assets of retail investors and institutions all require USDT as the most widely recognized trading intermediary, but USDe does not even have a spot trading pair.

Of course, it will take some time for the cooperation between Ethena and Pendle to reshape the DeFi ecosystem and shift it from lending-centered to Yield-centered. I will introduce this separately in a later article.

YBS is essentially a customer acquisition cost

In 2014, USDT initially explored the Bitcoin ecosystem, and then reached a cooperation with Bitfinex, taking root in the CEX trading scene. Later, in 2017/18, it settled in Tron and became the absolute leader in the P2P scene.

The subsequent USDC/TUSD/BUSD/FDUSD were just imitating and never surpassed (a complaint is that Binance is naturally in conflict with stablecoins and has killed several stablecoins).

Ethena, on the other hand, relied on the "bribery" mechanism to seize part of the CEX market, but it hardly seized the compliance scenarios of USDC, nor did it squeeze out the trading and transfer scenarios dominated by USDT.

However, YBS cannot enter the trading scenario, nor the CEX scenario, nor the payment scenario, nor the off-chain scenario. If it relies solely on income, the only way out is DeFi.

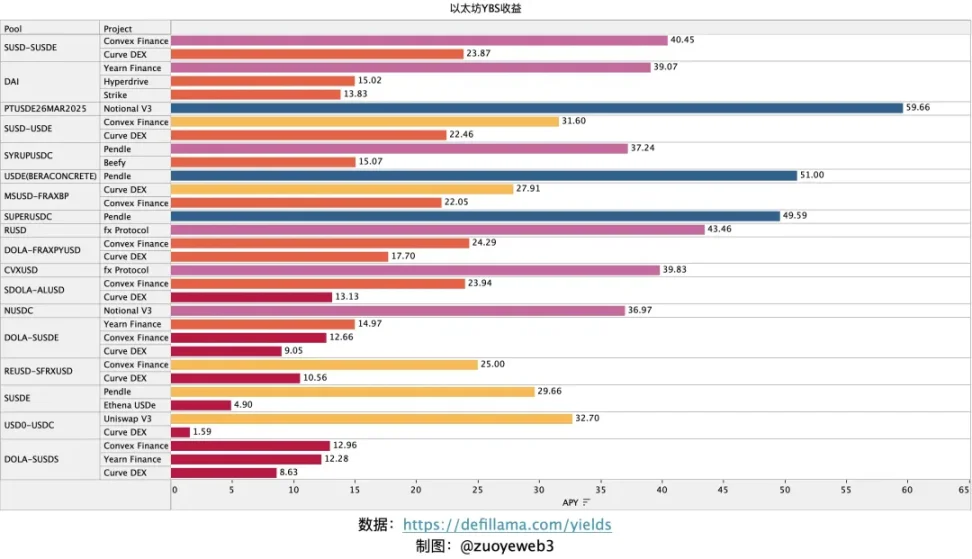

Existing YBS can be divided into the following categories:

The income of YBS is the liability of the protocol, which is essentially the cost of acquiring customers. It requires more users to recognize the standard of its USD equivalent and hold it themselves rather than investing it in the pledge system in order to maintain it.

Among the current top 50 stablecoins by market capitalization, there is a split of exactly 50 million USD, and the APY list of YBS is as follows:

Image description: Ethereum YBS income, image source: @zuoyeweb3

According to DeFillama’s data, Ethereum’s current YBS revenue can be reduced to Ethena and Pendle, which is in stark contrast to the thousand-fold returns since the DeFi Summer.

The era of huge profits is over, and the era of low-interest financial management is coming.

Profits and losses come from the same source. Today, U.S. Treasury bonds have become the underlying income pillar of most YBS, which is not safe. Secondly, on-chain income requires extremely strong secondary liquidity support. Without enough user participation, income guarantee will become the mountain that crushes the YBS project.

This is not surprising. Usual, invested by Binance, manually modified the anchor ratio. Sun Ge’s USDD can still guarantee a 20% yield. Kids, this is not funny. If the most successful USDe native yield is only 4.9%, then where does USDD’s 20% come from? I can’t figure it out.

We need to make a distinction here. The yields in the above figure are the yields of each pool, and even include the yields of the LSD assets themselves. They are not completely equivalent to the yields given by each YBS natively. The source of the yield for participating in DeFi is likely to be the participants themselves. This truth has always existed.

More and more YBS are emerging. There is no doubt that the focus of competition is still market share. Only when the vast majority of people want to use Stable rather than pursue Yield, can YBS maintain high yields while squeezing out the usage space of USDT.

Otherwise, if 100% of users pursue returns, the source of income will disappear. Whether it is Ethena's fee arbitrage or the listing of US bonds on the chain, there will be counterparties who lose income or principal. If everyone is making money, then the world will be a huge Ponzi scheme.

Add some trivial points for discussion

- This article omits the introduction of Aave/Curve's GHO/crvUSD and other CDP mechanisms. It seems that it is difficult for them to become the mainstream of the market. MakerDAO has not taken the route of the central bank on the chain. If it is replaced by other lending protocols, it is likely that this road will not work.

- Regarding stablecoins, such as UST and AMPL, the market no longer pays attention to these outdated products. People prefer those based on real assets or mainstream assets on the chain.

- Pendle and Berachain, the former represents the new trend of DeFi, and the latter is the fusion mechanism of public chain + YBS. This part is too important, so I will dig a hole and write it separately;

- This article does not involve institutional issuance or adoption, as well as off-chain payments, transactions, etc., but focuses on the revenue sources and potential market opportunities of YBS.

- In addition, I am currently working on a visualization tool for on-chain revenue strategies. If any entrepreneurs/developers are interested, please send me a private message to chat.