Social scalability is an important factor in the success of Bitcoin and will also be Ethereum’s biggest opportunity in the future.

Written by Nick Tomaino, Founding Partner of 1confirmation

Compiled by: Luffy, Foresight News

Social scalability refers to the ability of an institution to allow as many people as possible to participate and profitably participate in it. This property is the core driver of cryptocurrency’s rise to a $2.9 trillion asset class. In this article, I will explain what it is and why it is so important.

In 2017, Nick Szabo published an article titled "Money, Blockchain, and Social Scalability" describing Bitcoin as a social breakthrough. Most people view cryptocurrencies purely as technology and focus on technical scalability, but I agree with Szabo's point of view. Technical scalability plays a role in social scalability, but it is not the main factor. In the long run, the most successful cryptocurrencies will be those that provide the most practical value through credible neutrality, thereby achieving social scalability.

1. Bitcoin’s Social Scalability

Bitcoin is the first credibly neutral, internet-based native store of value. By “credibly neutral,” we mean fair, unbiased, and unaffected by small groups. Credibly neutral is a social construct that is often based on technology, but ultimately based on many dynamic factors that influence people’s trust.

This credible neutrality is something that the Bitcoin protocol has earned over time, and Bitcoin was initiated by the public from the beginning. Bitcoin was launched as open source software that anyone can read, run, write, and own on a level playing field. It was launched fairly, with no side deals for insiders and no celebrities, companies, or countries involved. The rules were established from the beginning and have never been changed. The community openly discusses all things Bitcoin on forums like Bitcointalk. To understand the spirit of this, read Hal Finney's early remarks.

Bitcoin’s trusted neutrality and utility are the main reasons why the crypto industry has grown. Bitcoin has gone from a grassroots movement started by the pseudonymous founder Satoshi Nakamoto, with no insider ownership, no clear jurisdiction of origin, and a new product for anyone in the world to use, to a $1.7 trillion asset that is actively used as a store of value by some of the world’s largest governments and companies. The rules of the Bitcoin system remain difficult to change, which is a big reason for its continued adoption.

Bitcoin’s growth has been amazing, but the community’s early cultural decision to focus on its currency-only function has limited new Bitcoin developers and companies from using it for more than just money. Despite the claims of Bitcoin maximalists over the past 15 years that Bitcoin’s potential is limitless, decentralized systems do have tremendous opportunities to bring more freedom and progress to the world beyond currency.

2. Does social scalability really matter?

Social scalability is an important factor in Bitcoin's success, but in 2025, a question any investor must ask is: Does social scalability really matter? Today, of the top nine cryptocurrencies by total market cap, four are actually "company tokens" (XRP, BNB, SOL, TRON). The total market cap of these four coins exceeds $312 billion.

These tokens all have strong narratives but have not achieved credible neutrality. They were launched by small teams in known jurisdictions (Silicon Valley and China) and allocated more than 50% of tokens to insiders (founding teams and venture capitalists). They have highly coordinated marketing campaigns, insiders involved in government lobbying, and many corporate-style top-down activities. These protocols have not yet proven themselves to be resilient, secure, and resistant to single points of failure. They make radical trade-offs for performance, sacrificing decentralization.

Then, we move on to their utility. Some people find these four protocols useful, but they have yet to spawn new use cases or become more widely adopted. Regardless, the stunning success of these four tokens justifies the argument that what I’m saying about social scalability doesn’t matter. If you can build a narrative and get enough people to believe in it, that seems to be what really matters.

However, I think social scalability is critical in the long run and will drive over $2 trillion in value over the next decade. That’s why we’re focusing on it. If you’re looking at shorter time frames, I understand why you might disagree. But I encourage you to look at the bigger picture.

Time will tell, and things may change. If you agree that social scalability is critical and look at the facts, it is clear that there are only two cryptocurrencies that are both credibly neutral and useful enough to achieve long-term social scalability: Bitcoin and Ethereum.

Bitcoin dominates the crypto space, but Ethereum may be more socially scalable than Bitcoin.

as follows:

3. Ethereum’s Trusted Neutrality

Similar to Bitcoin, Ethereum’s credible neutrality has been there from the beginning. Ethereum does not have a legendary “fair launch” like Bitcoin, but in the initial stage, only 9.9% of its token supply was allocated to insiders, and anyone in the world can easily own Ethereum tokens by sending Bitcoin to the Initial Coin Offering (ICO) address, without any behind-the-scenes deals with venture capital institutions, and no well-known people, companies or countries are involved.

Ethereum was also originally a Proof of Work (PoW) chain and used the Proof of Work mechanism for the first 7 years, which ensured a more balanced distribution of tokens before moving to the Proof of Stake (PoS) mechanism. In the beginning, you did not need to own or buy Ethereum to participate in consensus and receive rewards, you only needed to contribute computing resources. Native Proof of Stake chains often have the problem of early large holders of tokens dominating token rewards. This helped Ethereum have a large and diverse number of stakeholders in the early days, and enables a wider range of people to participate in consensus and receive Ethereum rewards today.

Ethereum’s founder is Vitalik Buterin. Critics of Ethereum will point to Vitalik’s leadership and say that the fact of having such a powerful and well-known founder compromises Ethereum’s credible neutrality. But those who have observed Vitalik’s leadership in a transparent and authentic manner from the beginning know that he has established a culture that emphasizes credible neutrality.

You won't see Vitalik pushing investment narratives on social media, chasing money, attention, and power, like many important figures in the crypto space. He has been the person in the industry who has the easiest access to all of this for more than a decade, but he doesn't do it. Instead, he does it his own way, emphasizing values such as censorship resistance, inclusivity, and transparency, and is primarily focused on setting the best technical architecture and long-term values for developers.

In fact, the governance of Bitcoin and Ethereum is the same. Modifications to the protocols of Bitcoin and Ethereum require a rough consensus among miners, users, and developers, so Ethereum's upgrade speed is much slower than many venture capital institutions would like. But in the long run, this helps to enhance its credible neutrality, and it is also a conscious trade-off made by Ethereum's leadership.

The Ethereum mainnet now has 4 execution clients (Geth, Nethermind, Besu, and Erigon) and 5 consensus clients (Prysm, Lighthouse, Teku, Nimbus, and Lodestar) actively maintained. Client diversity and avoiding single points of failure have always been the focus. In addition, the Ethereum mainnet and L2 have become the most trusted building platform for developers and companies.

Today, Michael Saylor’s company owns a much larger percentage of Bitcoin’s total supply than Vitalik and the Ethereum Foundation own a larger percentage of Ethereum’s total supply. Bitcoin leaders have been quicker to align with governments by supporting politicians and lobbying. This may be because Bitcoin is more mature and attracts a wider group of stakeholders than Ethereum.

But the risk of Saylor and government lobbying undermining Bitcoin’s credible neutrality is real, and it’s encouraging to see Vitalik and the Ethereum Foundation resist the urge to chase investment narratives in response to market conditions. Ethereum’s leadership is focused on developers, and Ethereum is now far beyond any one person or group. The most important people for Ethereum’s future may well be the developers who are still unknown today.

4. The practicality of Ethereum

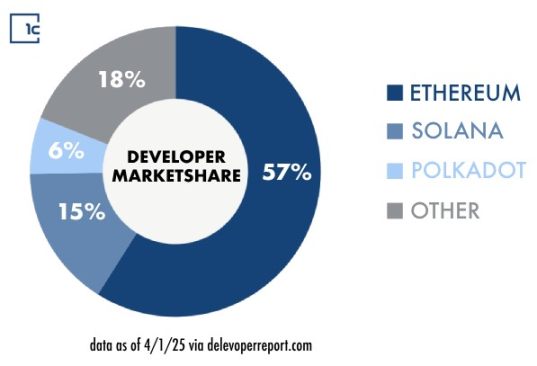

Ethereum Virtual Machine (EVM) Dominant Market Share and Strong Network Effects: Since Bitcoin introduced the world to a trusted, neutral, internet-based native store of value, Ethereum has captured the majority of mindshare among developers and has been the home to every innovation that has introduced a large number of new users to crypto, beyond currency. Ethereum is the birthplace of decentralized finance, non-fungible tokens (NFTs), prediction markets, decentralized social networks, decentralized identity, real-world assets (RWAs), stablecoins, and more. All of these new use cases promote EVM wallets and Ethereum as a trusted, neutral, internet-based native store of value.

Some of these use cases started on the Ethereum mainnet and are now moving to L2 blockchains built on top of Ethereum. Many of the best companies and developers developing in crypto prefer a trusted developer environment that gives them more control and better economics than on an L1 blockchain, which is exactly what Ethereum’s L2 architecture provides. Those who develop on L2 or L3 will not only gain more benefits in it, but also enjoy the security of Ethereum, the network effects of the EVM, and the promotion of Ethereum as a trusted, neutral, native Internet-based store of value. Some L2s will thrive, and some may not. For some use cases, developers may realize that they can get significant liquidity advantages on the mainnet that L2 does not have. Either outcome is good for Ethereum.

There has been a lot of discussion about whether L2 contributes to the value of Ethereum or cannibalizes mainnet fees and reduces the value of Ethereum. Standard Chartered recently lowered its target price for Ethereum from $10,000 to $4,000, citing the fact that Coinbase's L2 (Base) will cannibalize mainnet fees. This view misses the forest for the trees.

The main benefit of L2 is not contributing fees to the mainnet, but promoting EVM wallets to new users and promoting Ethereum as a trusted, neutral, internet-based native store of value. Usage of the Ethereum ecosystem (both mainnet and L2) can reduce the supply of Ethereum, which is a good feature that already makes Ethereum more deflationary than Bitcoin. But fees are not the main benefit of applications and L2.

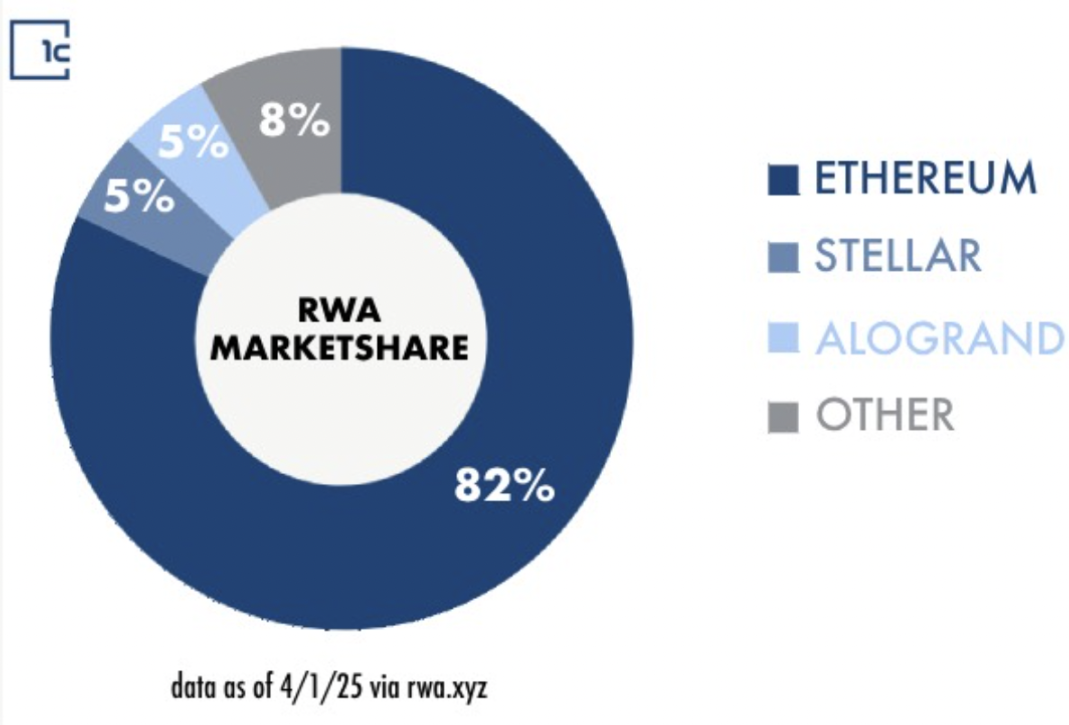

Ethereum has a dominant market share in stablecoins, real-world assets, and NFTs: Ethereum is now the primary ecosystem for new developers and large companies like JPMorgan, BlackRock, Coinbase, Robinhood, etc. to tokenize assets. This trend started with crypto-native assets like fungible tokens and NFTs, but is now increasingly touching on areas such as the US dollar, treasuries, stocks, bonds, private credit, real estate, etc. Whether this activity occurs on the mainnet or L2, and how much fees L2 ultimately pays to the mainnet, will affect the amount of Ethereum burned. But even if all of this activity occurs on L2, and L2 pays very little fees to the mainnet, the popularity of these use cases will promote Ethereum as a trusted, neutral, internet-based native store of value.

5. Opportunities worth more than $100 trillion

Trusted, neutral, internet-based native store of value is the world’s largest market opportunity today. The total market value of gold is about $20 trillion, and the global broad money supply (M2) is about $100 trillion, so it can be said that this is a market opportunity worth more than $100 trillion.

Cryptocurrencies that achieve social scalability through credible neutrality and utility have the best chance of seizing this opportunity. There is not yet a strong narrative around this, but I know from experience in life and crypto that often the stronger the narrative, the further away from the truth it may be. Those who focus on their core purpose and resist the urge to chase short-term gains will be rewarded.