1. Market observation

Keywords: OM, ETH, BTC

The market on the Solana chain is gradually recovering, and the trading volume of Meme coins has returned to the level of early February. Institutional investors have also begun to increase their layout of SOL. Janover, a US listed company, announced that it had purchased 80,567 SOL worth about US$10.5 million. The total amount of SOL currently held has reached 163,000, worth about US$21.2 million. At the same time, the partners of Multicoin Capital seem to be quietly increasing their holdings. There are signs that they have transferred US$7 million of USDC to Coinbase, and they may be preparing for the future of SOL.

In addition, the recent performance of Bitcoin has made many industry OGs confused and disappointed. Arca Chief Investment Officer Jeff Dorman admitted that he left Wall Street to join the crypto field in order to escape the market environment completely dominated by macro factors, but now Bitcoin has become an after-hours trading tool for large funds, almost in sync with the trend of Nasdaq, and has lost its independence. In the recent days of violent stock market fluctuations, the high correlation between Bitcoin and the S&P 500 and Nasdaq 100 is particularly obvious. Crypto analyst Eugene also admitted that as the crypto market is increasingly affected by macro factors, his trading strategy has to turn to more cautious, keeping low trading volume and setting strict stop losses until the market direction becomes clear again. However, McKenna of Arete Capital pointed out that the market often bottoms out in the worst news, and the panic when Bitcoin fell to $74,000 was in place. Unless Sino-US relations deteriorate further, future news may only cause market fluctuations rather than trend changes. Despite the obvious short-term fluctuations, institutional interest in Bitcoin is still growing steadily. According to Bitwise data, listed companies purchased 95,000 bitcoins in the first quarter of 2025, a 16% increase from the previous quarter. The number of companies holding bitcoins reached 79, accounting for 3.28% of the total supply of bitcoins. In addition to Janover, CleanSpark, Value Creation, Metaplanet and Semler Scientific have also announced their bitcoin investment plans.

Although institutions are constantly increasing their holdings of BTC, the central bank's attitude towards BTC has not yet been clarified. The latest survey results of the Bank for International Settlements are not so optimistic. The proportion of central banks considering investing in digital assets in the next 5-10 years has dropped sharply from 15.9% last year to 2.1% this year. Among the 91 central banks that manage $7 trillion in reserves, none currently holds digital assets. However, 11.6% of central banks still believe that cryptocurrencies are becoming a more credible investment option. As for whether to establish a strategic reserve of Bitcoin, 50 central banks (59.5%) are opposed. In addition, Google announced that it will implement MiCA crypto advertising rules in the EU from April 23, indicating that large technology companies are adapting to the new regulatory environment.

In terms of the macroeconomic environment, although the recent tariff policy of the Trump administration has caused market fluctuations, Cathie Wood, founder of ARK Invest, is optimistic. She believes that this may be a kind of "shock therapy" with the ultimate goal of reducing trade barriers and stimulating economic growth. Wood predicts that GDP may show negative growth in the first half of 2025, which will provide more room for the government and the Federal Reserve to stimulate the economy.

2. Key data (as of 12:00 HKT on April 16)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, GMGN, Tomars)

Bitcoin: $83,525.29 (-10.94% year-to-date), daily spot volume $26.17 billion

Ethereum: $1,579.83 (-53.06% year-to-date), with a daily spot volume of $11.98 billion

Fear and corruption index: 29 (panic)

Average GAS: BTC 1.05 sat/vB, ETH 0.35 Gwei

Market share: BTC 62.9%, ETH 7.3%

Upbit 24-hour trading volume ranking: AERGO, ARDR, XRP, SNT

24-hour BTC long-short ratio: 1.0088

Sector gains and losses: AI sector fell 5.23%, Meme sector fell 4.95%

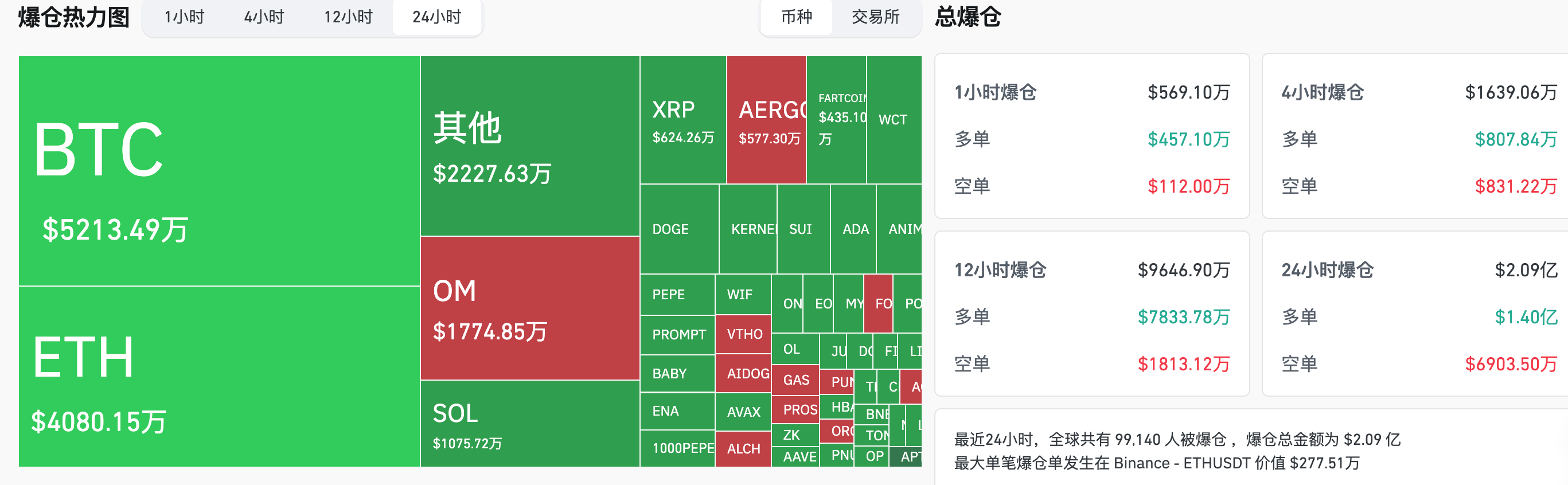

24-hour liquidation data: A total of 99,140 people were liquidated worldwide, with a total liquidation amount of US$209 million, including BTC liquidation of US$52.13 million, ETH liquidation of US$40.8 million, and OM liquidation of US$17.74 million

BTC medium and long-term trend channel: upper channel line ($83721.28), lower channel line ($82063.44)

ETH medium and long-term trend channel: upper channel line ($1665.45), lower channel line ($1632.47)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of April 15 EST)

Bitcoin ETF: $76,415,100

Ethereum ETF: -$14,182,100

4. Today’s Outlook

Binance launches second round of “vote to delist” mechanism, voting will last until April 17

Coinbase International will launch COMP-PERP, UXLINK-PERP and ATH-PERP on April 17

EigenLayer will launch a slashing mechanism on the mainnet on April 17

Arbitrum (ARB) will unlock approximately 92.65 million tokens at 9:00 pm on April 16, accounting for 2.01% of the current circulation and worth approximately US$28.5 million.

deBridge (DBR) will unlock approximately 1.14 billion tokens at 8:00 am on April 17, accounting for 63.24% of the current circulation, worth approximately $26.5 million;

Omni Network (OMNI) will unlock approximately 8.21 million tokens at 8:00 am on April 17, accounting for 42.89% of the current circulation, worth approximately $1,630.

ApeCoin (APE) will unlock about 15.6 million tokens at 8:30 pm on April 17, accounting for 1.95% of the current circulation and worth about $680;

Number of initial jobless claims in the United States as of the week ending April 12 (10,000 people) (20:30, April 17)

Actual: To be announced / Previous value: 22.3 / Expected: 22.6

The biggest increases in the top 500 stocks by market value today: ARDR up 125.22%, FUEL up 35.88%, SNT up 35.06%, GFI up 31.67%, and OM up 29.40%.

5. Hot News

Japanese listed company Value Creation plans to spend another 100 million yen to buy Bitcoin

Metaplanet announces $10 million bond issuance to increase Bitcoin holdings

Towns will launch TOWNS tokens in Q2, with an initial airdrop ratio of 10%

Semler Scientific Files for $500 Million Securities Offering to Buy More Bitcoin

Multicoin Capital partner lent $7 million USDC to Coinbase, possibly to increase SOL holdings

Bitcoin's 14-year return rate is 7.2 million%, far exceeding the S&P 500's 306% and gold's 116%.

A certain address deposited 710,000 AVAX to Coinbase, with an estimated loss of $12.19 million

Terra: Deadline to submit loss claims to the Terraform Liquidation Trust is May 17

Google to implement MiCA crypto advertising rules in EU from April 23

CoinShares: Net outflow of funds from digital asset investment products was $795 million last week

Canada approves Solana spot ETF, which will be launched this week and support staking