Crypto lending

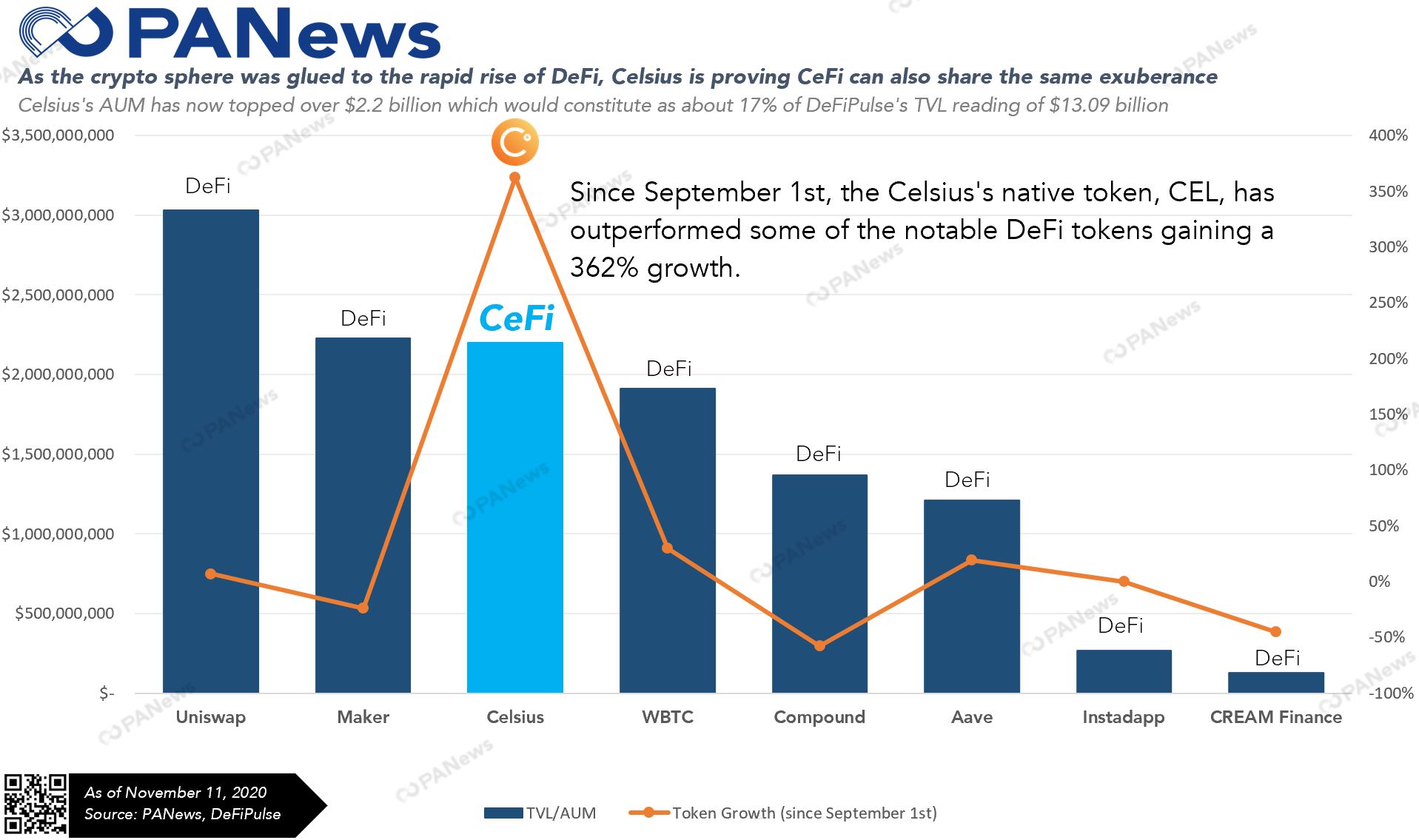

platform, Celsius, just recently announced in a press release that it now holds

more than $2.2 billion in AUM. This amount alone would constitute as 16.8% of

the total amount of Total Value Locked in DeFi platforms currently, making it

ranked #3 on the DeFiPulse list.

Although these

comparisons might be a bit unjust considering the fact that Celsius is a

centralized lending platform, it does give weight to the players in the CeFi

market after we’ve seen an explosion in DeFi over the past year.

Since June,

active users on the Celsius platform have increased from 108k to over 215k with

the number of BTC deposits nearly doubling during that timeframe. Celsius does

have its own native ERC-20 token, CEL, which is not a governance token per se,

but it’s been a utility token allowing users to earn more interest when

electing to earn in CEL and lower interest costs when paying back in CEL.

During the month of September when DeFi tokens were experiencing a massive correction,

the price of CEL popped 143% and is

currently up 1278% YTD.

As we see DeFi

tokens continuing to make headlines resonating with crypto believers on the

ethos of decentralized finance, Celsius is proving that a section of the market

values the ease and simplicity of CeFi products.