- PA Daily | CZ "calls" Mubarak on Binance Square; VanEck applies to the US SEC to launch Avalanche ETF

- February blockchain game report: Daily activity decreased by 16%, but user stickiness was strong, and blockchain game investment increased by 243% month-on-month

- This week's highlights: Crypto market encounters "Black Monday"; Binance receives $2 billion investment from UAE sovereign fund; Hyperliquid and whales play offensive and defensive games

-

PA一线 · 11 hours ago

Next week's macro outlook: Trump's "bitter tactics" force the Fed to cut interest rates, super central bank week is coming

PA一线 · 11 hours ago

Next week's macro outlook: Trump's "bitter tactics" force the Fed to cut interest rates, super central bank week is comingFor gold investors, this week is a week worth "recording in history". Next week, global investors will usher in a "super central bank week".

-

PA一线 · 11 hours ago

Analyst: The key to Bitcoin avoiding further decline is that the closing price this week cannot fall below $81,000

PA一线 · 11 hours ago

Analyst: The key to Bitcoin avoiding further decline is that the closing price this week cannot fall below $81,000PANews reported on March 15 that according to Cointelegraph, Bitcoin needs to close above the key $81,000 weekly line to avoid more downside volatility before next week's Federal Open Market Committee (FOMC) meeting. Bitget Research chief analyst Ryan Lee said that a closing price above $81,000 this week will be key to avoiding further declines in Bitcoin. Staying above this level will show resilience, but if it falls below $76,000, it could trigger more short-term selling pressure.

-

PA日报 · 13 hours ago

PA Daily | CZ "calls" Mubarak on Binance Square; VanEck applies to the US SEC to launch Avalanche ETF

PA日报 · 13 hours ago

PA Daily | CZ "calls" Mubarak on Binance Square; VanEck applies to the US SEC to launch Avalanche ETFBefore taking office, "Crypto Czar" David Sacks sold more than $200 million in digital assets through individuals and his company; Shardeum launched an airdrop activity before the launch of the mainnet, and airdrop registration is now online; Binance Wallet announced the launch of an exclusive TGE, and early project applications are now open.

-

PA一线 · 13 hours ago

Viewpoint: The US GENIUS Act stablecoin bill may lead to the privatization of the US dollar and face the risk of de-dollarization

PA一线 · 13 hours ago

Viewpoint: The US GENIUS Act stablecoin bill may lead to the privatization of the US dollar and face the risk of de-dollarizationPANews reported on March 15 that according to Cointelegraph, the U.S. Senate Banking Committee voted to pass the GENIUS Act, a bill to regulate stablecoin issuers, paving the way for the adoption of stablecoins as a means of payment outside of cryptocurrency trading. However, the bill may trigger potential privatization and de-dollarization of the U.S. dollar because the bill allows stablecoin issuers to be free from the same federal consumer financial protections as credit cards and peer-to-peer payment platforms, and to invest in money market funds, repurchase agreements and uninsured bank deposits, which have been rescued in past financial crises, thereby indirectly affecting the U.S. dollar. Data shows that the proportion of the U.S. dollar in global foreign exchange reserves has dropped from more than 70% in the early 21st century to below 60%.

- PA Daily | CZ "calls" Mubarak on Binance Square; VanEck applies to the US SEC to launch Avalanche ETF PA Daily | The US court approved 3AC to expand its claim against FTX for $1.53 billion; the whale that was 50 times long on ETH began to go long on LINK PA Daily | Six members of Trump’s cabinet hold BTC or related investments; Ripple obtains Dubai license

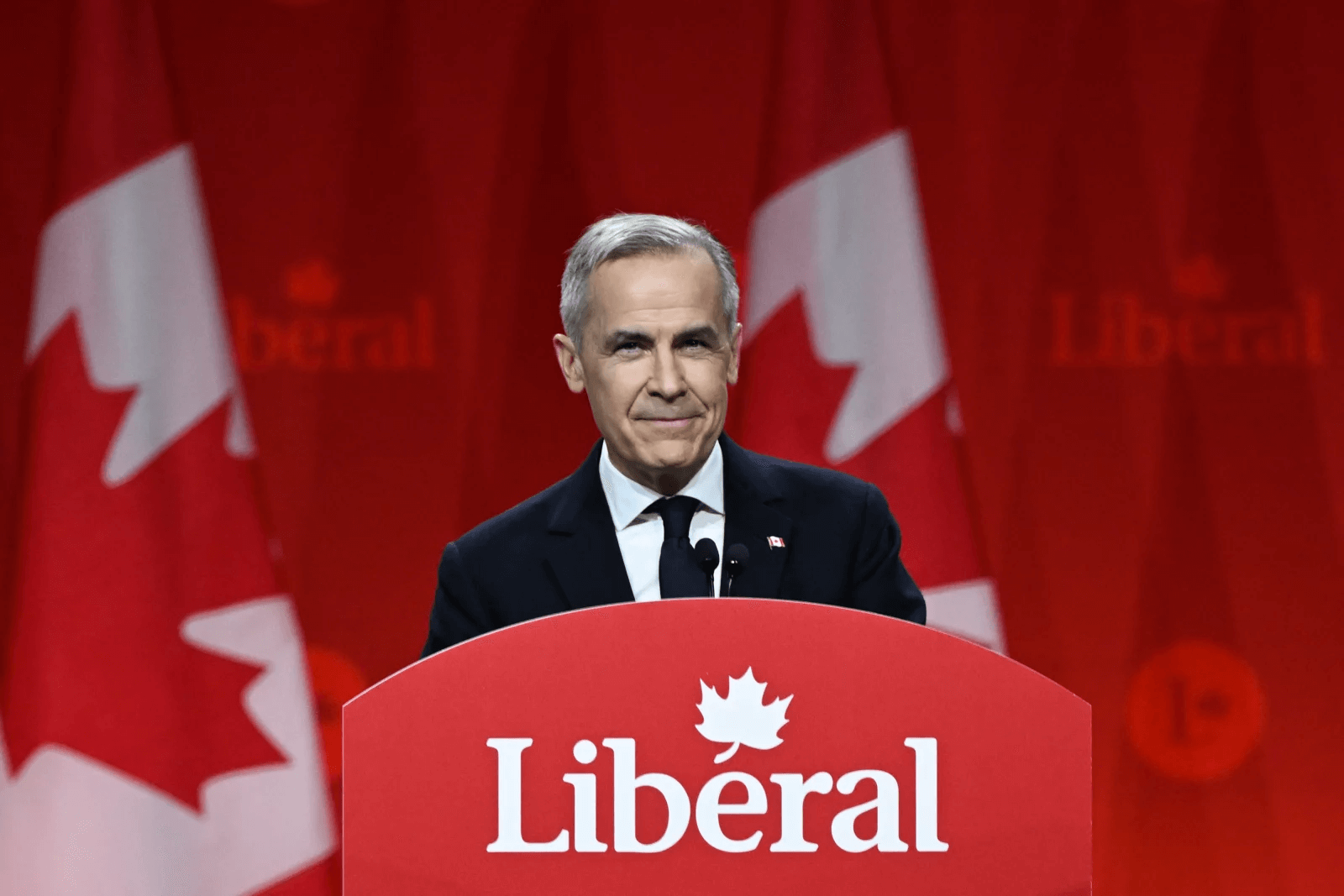

PA荐读 · 14 hours ago

Crypto survival rules: Buy coins in a bear market and trade them in a bull market

PA荐读 · 14 hours ago

Crypto survival rules: Buy coins in a bear market and trade them in a bull marketThe most important thing is to lower your expectations first.

-

PA一线 · 16 hours ago

10x Research: Bitcoin is "very likely" to consolidate for another 8 months

PA一线 · 16 hours ago

10x Research: Bitcoin is "very likely" to consolidate for another 8 monthsMarkus Thielen, chief cryptocurrency researcher at 10x Research, said it is "very likely" that Bitcoin will repeat its 2024 trend and enter a long period of consolidation after hitting a record high. It hit a record high of $73,679 in March last year, then entered a consolidation phase, fluctuating in a range of around $20,000 until Donald Trump was elected president of the United States in November. Bitcoin's technical chart resembles a "high and tight flag," which, although usually a bullish continuation pattern, is also showing signs of weakness. At the same time, the spot Bitcoin exchange-traded fund (ETF) market shows no signs of a "buy on dips" mentality.

-

深潮TechFlow · 17 hours ago

Artificially created economic recession: the direction and enlightenment of the cycle alternation

深潮TechFlow · 17 hours ago

Artificially created economic recession: the direction and enlightenment of the cycle alternationWe are in the midst of a systemic or environmental shift, and this period of adjustment may be nothing more than a market correction and economic contraction.

-

Felix · 18 hours ago

February blockchain game report: Daily activity decreased by 16%, but user stickiness was strong, and blockchain game investment increased by 243% month-on-month

Felix · 18 hours ago

February blockchain game report: Daily activity decreased by 16%, but user stickiness was strong, and blockchain game investment increased by 243% month-on-monthBlockchain gaming investments rose to $55 million, up 243% from January, with infrastructure accounting for 92% of all investments.

-

PA一线 · 18 hours ago

Hong Kong Asia Holdings changes its board of directors and senior executives. The new CEO has over 10 years of experience in the crypto industry

PA一线 · 18 hours ago

Hong Kong Asia Holdings changes its board of directors and senior executives. The new CEO has over 10 years of experience in the crypto industryHong Kong-listed company Hong Kong Asia Holdings (1723.HK) announced a series of new appointments to the board and senior management positions, including director, chairman, CEO, CFO and CIO. New CEO John Riggins said that the company's comprehensive changes in directors have been completed and Bitcoin-related (₿ig) products are about to enter the most important market in Asia.

-

PA一线 · 19 hours ago

Base ecosystem game project Henlo Kart has a contract loophole, and HENLO tokens fell 96.5%

PA一线 · 19 hours ago

Base ecosystem game project Henlo Kart has a contract loophole, and HENLO tokens fell 96.5%The Base ecosystem game project Henlo Kart tweeted, "A snapshot of all HENLO holders and LP positions has been taken. A vulnerability was found in the HENLO contract. The team is actively looking for a solution. Henlo has withdrawn the LP of all team tokens. All liquidity removed from current LP positions will be redeposited into new LP positions." The market shows that Henlo Kart's token HENLO has fallen 96.5% in the past 24 hours.

- Crypto Circulating Market Cap (7d)$2,799,956,491,965Market CapFear and Greed Index (Last 30 Days)Extreme Fear6 Days(20%)Fear11 Days(36.67%)Neutral13 Days(43.33%)Greed0 Days(0%)Extreme Greed0 Days(0%)

MarsBit · 20 hours ago

With the influx of funds and the record-breaking 11.4 million contracts, is the hype wave on the Base chain coming?

MarsBit · 20 hours ago

With the influx of funds and the record-breaking 11.4 million contracts, is the hype wave on the Base chain coming?The arrival of Base Season stems from the explosive growth of TVL and transaction volume, the strategic support of Coinbase, and the resonance of technological innovation and the meme coin craze.

-

PA一线 · 21 hours ago

Kentucky Cryptocurrency Bill HB701 Passed Senate and Sends to Governor for Signature

PA一线 · 21 hours ago

Kentucky Cryptocurrency Bill HB701 Passed Senate and Sends to Governor for SignatureAccording to market news, Kentucky's cryptocurrency bill HB701 has been passed by the Senate and sent to the governor for signature. The bill protects custody rights, exempts nodes from currency transfer rules, and prohibits new taxes on payments. The bill was passed in both houses without a single vote against it.

-

PA一线 · 21 hours ago

CZ surges over 150% after posting a meme with Mubarak on Binance Square

PA一线 · 21 hours ago

CZ surges over 150% after posting a meme with Mubarak on Binance SquareCZ posted a message on Binance Square saying "I'm going to meet a friend this weekend" and attached a Mubarak-related meme picture. According to GMGN data, after the post, Mubarak rose by more than 150%, with a market value of over $20 million and now at $24 million.

-

一周精选 · 21 hours ago

This week's highlights: Crypto market encounters "Black Monday"; Binance receives $2 billion investment from UAE sovereign fund; Hyperliquid and whales play offensive and defensive games

一周精选 · 21 hours ago

This week's highlights: Crypto market encounters "Black Monday"; Binance receives $2 billion investment from UAE sovereign fund; Hyperliquid and whales play offensive and defensive gamesThe macro environment continued to deteriorate, the crypto market suffered a "Black Monday", and Bitcoin fell below $80,000 at one point; Binance accepted a $2 billion investment from the UAE sovereign fund, perhaps in an effort to seek a safety umbrella; Hyperliquid and the giant whales staged an offensive and defensive game, with the HLP vault losing $4 million.

-

PA一线 · 21 hours ago

“Hyperliquid 50x Whale” closed its LINK position 4 hours ago and shorted BTC with 40x leverage, with a position value of $160 million

PA一线 · 21 hours ago

“Hyperliquid 50x Whale” closed its LINK position 4 hours ago and shorted BTC with 40x leverage, with a position value of $160 millionAccording to the monitoring of on-chain analyst Yu Jin, the "Hyperliquid 50x Whale" closed its long LINK positions in both spot and contract positions 4 hours ago, with a loss of $1.27 million. Subsequently, it shorted 1,937 BTC with 40x leverage on the Hyperliquid platform with a margin of $3.75 million, with an opening price of $84,287, a position value of $160 million, and a liquidation price of $85,158.

-

PA一线 · a day ago

David Sacks, the “Crypto Czar”, sold more than $200 million in digital assets through individuals and companies before taking office

PA一线 · a day ago

David Sacks, the “Crypto Czar”, sold more than $200 million in digital assets through individuals and companies before taking officeAccording to a memorandum dated March 5 issued by the White House, American AI and cryptocurrency czar David Sacks sold more than $200 million in digital assets through his personal and company Craft Ventures before taking office to reduce potential conflicts of interest. Of this, at least $85 million directly belonged to David Sacks, but Craft Ventures still holds some fund investments involving crypto assets.

-

PA一线 · a day ago

CryptoQuant: Bitcoin demand has continued to weaken since December last year

PA一线 · a day ago

CryptoQuant: Bitcoin demand has continued to weaken since December last yearOn-chain analysis platform CryptoQuant tweeted that it is witnessing the weakest period of Bitcoin demand this year. Compare the new supply with the supply that has been idle for more than a year to understand the current demand dynamics. When the ratio is below 0, it indicates that demand has turned negative, which means that the number of Bitcoins actively acquired has decreased. It can be seen that demand has been weakening since December and has continued to decline over time. This suggests that investors have become more cautious amid ongoing political and economic uncertainty and may turn to lower-risk assets.

-

比推BitPush · a day ago

Bitcoin Magazine: Decoding Bitcoin’s Correlation with the Stock Market

比推BitPush · a day ago

Bitcoin Magazine: Decoding Bitcoin’s Correlation with the Stock MarketThe correlation between Bitcoin and the stock market continues to grow.

-

PA一线 · a day ago

Goldman Sachs mentions cryptocurrencies in annual shareholder letter for the first time, acknowledging their growing role

PA一线 · a day ago

Goldman Sachs mentions cryptocurrencies in annual shareholder letter for the first time, acknowledging their growing roleGoldman Sachs mentioned cryptocurrencies in its annual shareholder letter, acknowledging their growing role in financial markets and competition. "The growth of electronic trading and the introduction of new products and technologies, including trading and distributed ledger technologies (such as cryptocurrencies) and artificial intelligence technologies, have increased competition," Goldman Sachs said in the letter. "In some cases, our competitors may offer financial products that we do not offer and that our customers may prefer, including cryptocurrencies and other digital assets that we cannot or may choose not to offer."

-

PA一线 · a day ago

Coinbase Derivatives plans to launch natural gas and ADA futures

PA一线 · a day ago

Coinbase Derivatives plans to launch natural gas and ADA futuresCoinbase Derivatives has submitted an application to the CFTC to self-certify Natural Gas (NGS) futures and Cardano (ADA) futures, thereby expanding its product range in the energy and cryptocurrency derivatives markets. The products are expected to go live on March 31.

PANews - Your Web3 Information Officer

Download PANews to track in-depth articles