Written by: @CumberlandLabs

Compiled by: Vernacular Blockchain

After a few weeks of lurking in Discord, watching Telegram groups, browsing Twitter, and talking to multiple research analysts and traders, I have a comprehensive understanding of how all kinds of people - from algorithmic trading professionals to my wife's brother - think about memecoin. In the process, my research has covered everything from how to improve the UI/UX for limit orders and complex order execution to asking friends if they think "Moo Deng" is really cute or if they have heard of "Peanut the Squirrel".

In-depth research from Discord

What you’re about to see is a field-based research effort that aggregates existing public data around this space and includes anonymous feedback on this narrative. We at Cumberland Labs believe that this narrative is both compelling and will continue for many years to come. On the surface, this may seem like a lack of depth and an overly simplistic narrative, but in reality, it represents a shift in user behavior—a shift that will drive billions of dollars of idle funds onto the chain, whether these token traders realize it or not.

In-depth research from my wife

1. What is Memecoin?

The story of Memecoin is one of constant evolution. From DOGE’s creation as a parody of Bitcoin that captured the attention of Elon Musk, to SHIB and PEPE capturing the imagination of retail investors, to today’s fair launch phenomenon on Solana – we’ve seen this market constantly reinvent itself.

@elonmusk's first Doge-related tweet

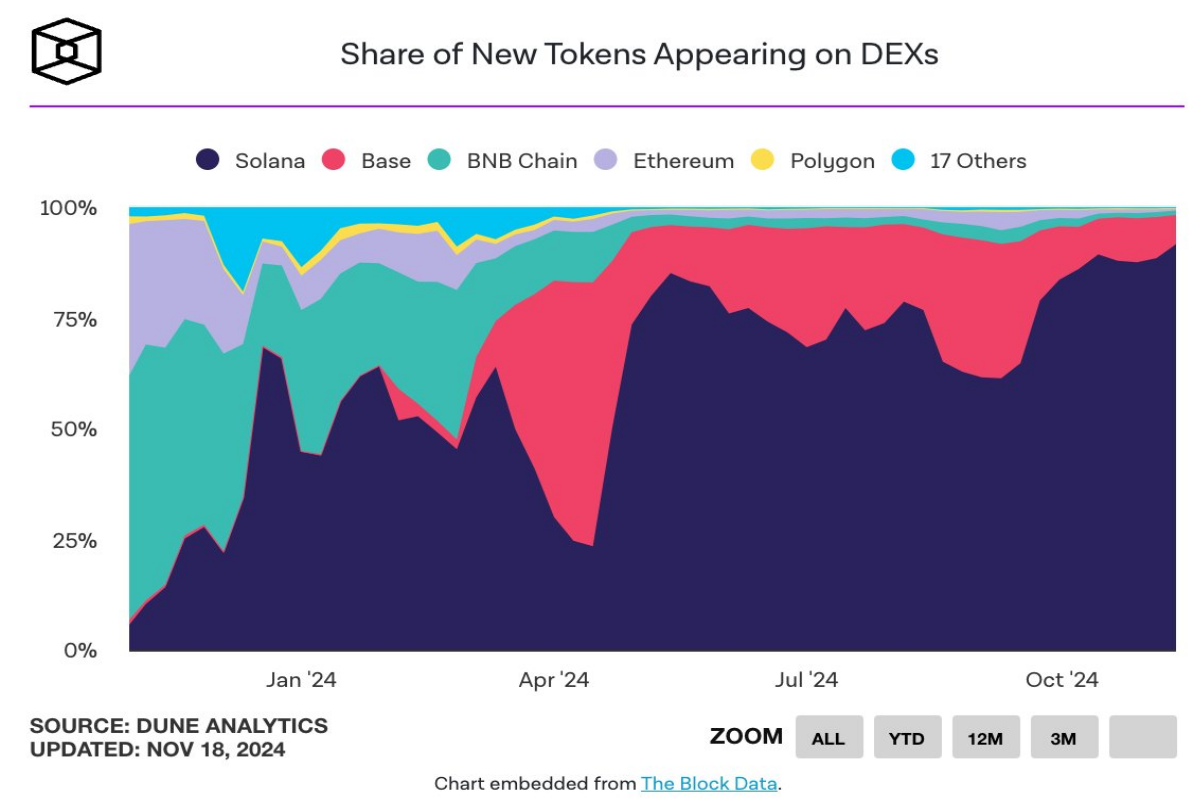

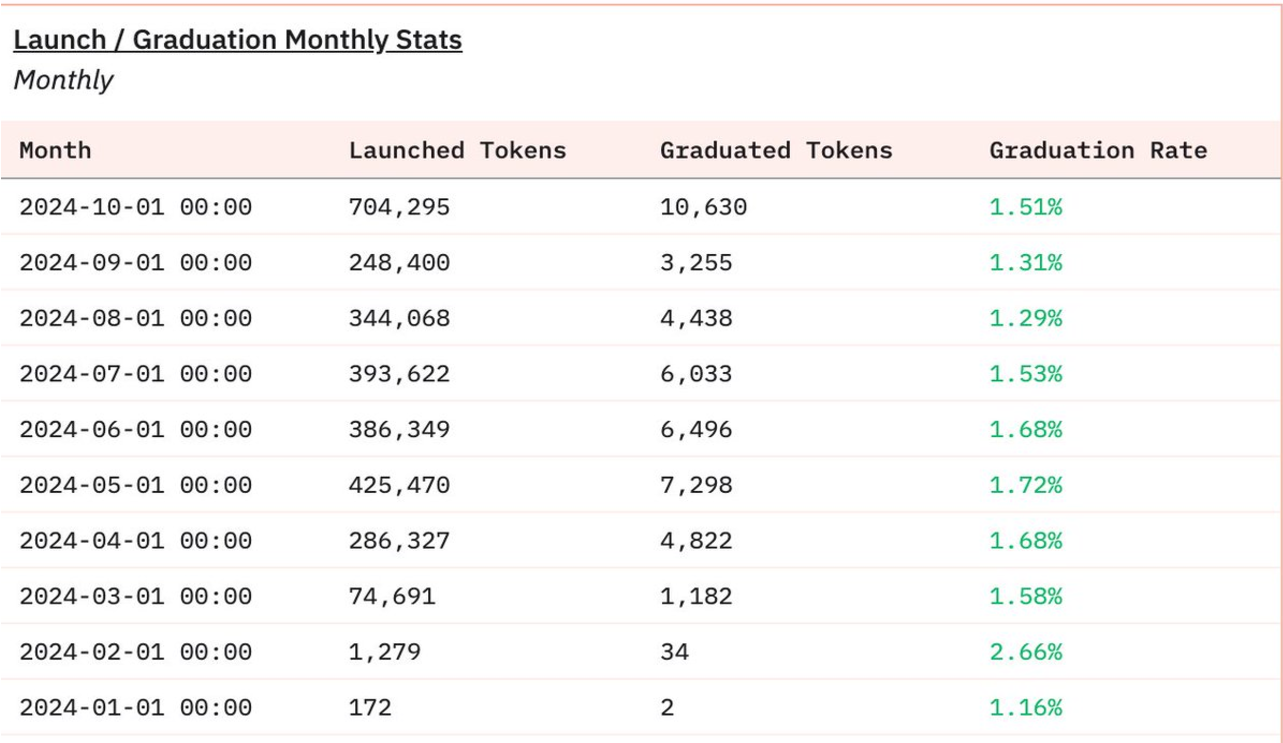

Today, Solana dominates the space, supporting 89% of new token issuance. Last week alone, 181,000 new tokens were launched on decentralized exchanges (DEX). This is not just an increase in volume, but also an increase in accessibility. Platforms like pump.fun have made token issuance accessible to everyone, but the success rate reveals an important fact: less than 2% of tokens can enter Raydium, and only 0.0045% of tokens have a market value of more than $1 million.

Source: @TheBlock__

So what is the difference between a memecoin and a “shitcoin”? The key lies in the core characteristics of success:

The most successful tokens — from DOGE to Moo Deng — all have some common elements: strong meme potential, catalysts that attract attention, and high community engagement. DOGE stood out thanks to Elon Musk’s attention and first-mover advantage, while Moo Deng captured people’s imagination through viral social media influence. But most importantly, they built communities, turning ordinary bystanders into passionate supporters.

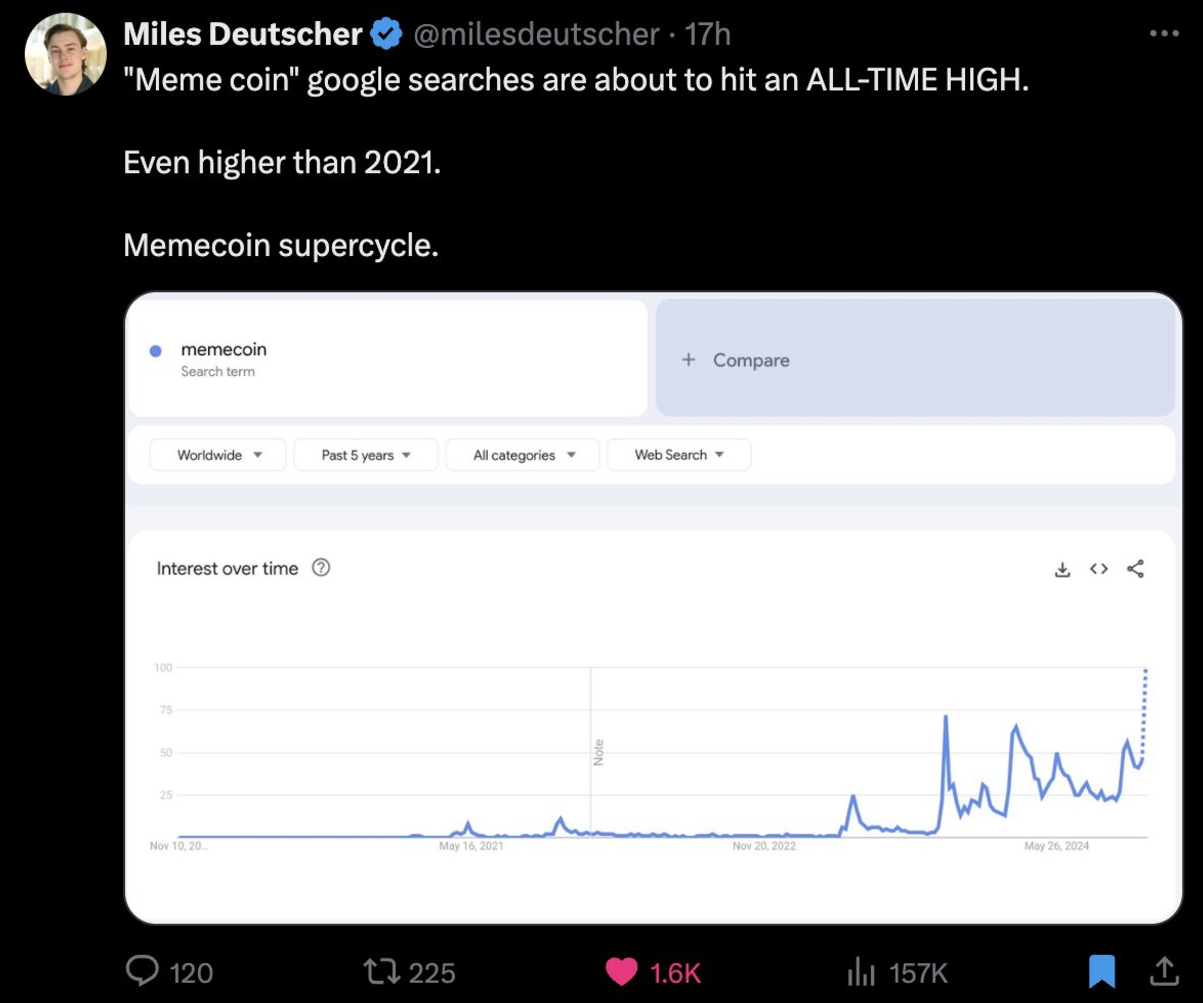

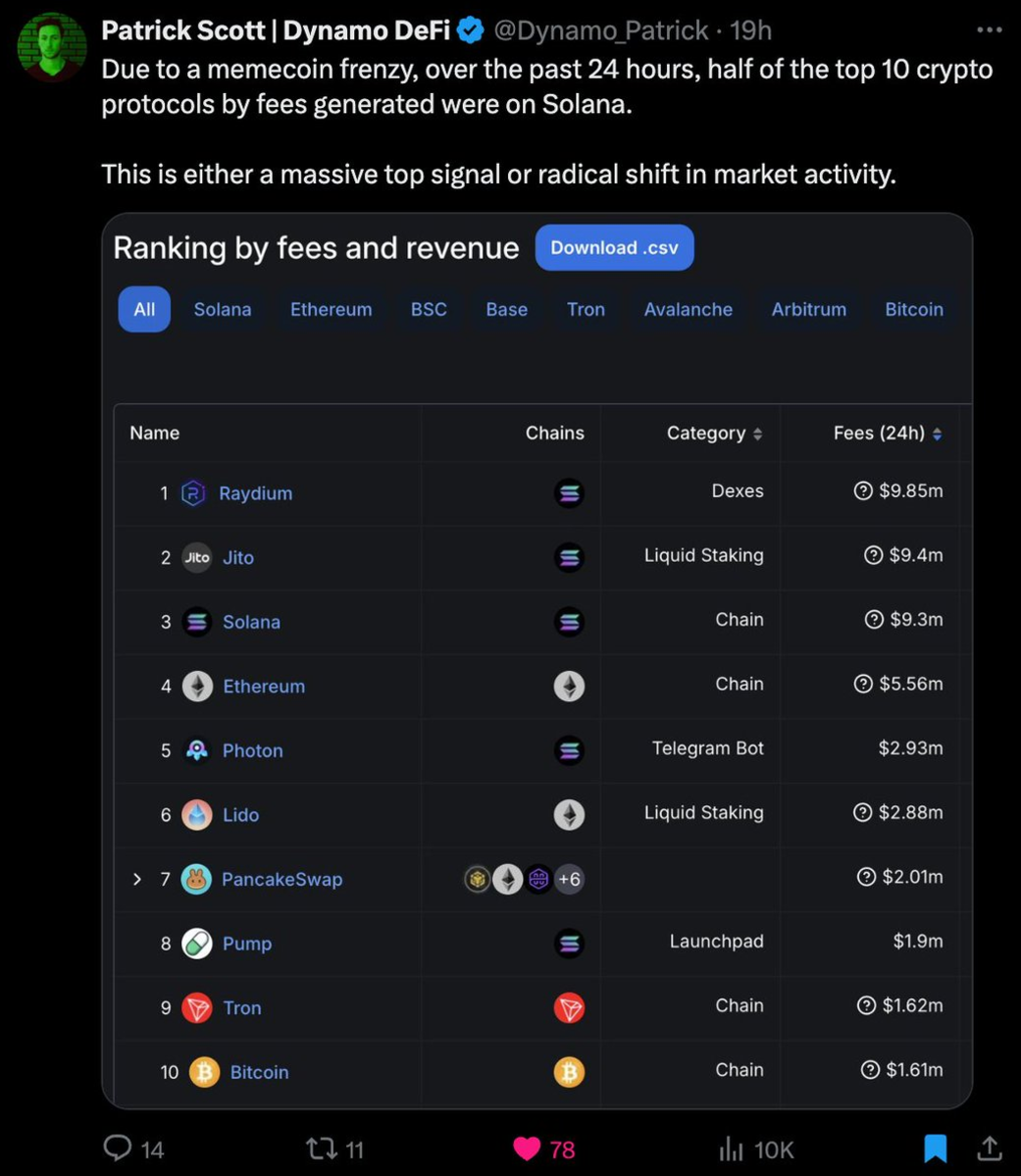

2. Data doesn’t lie

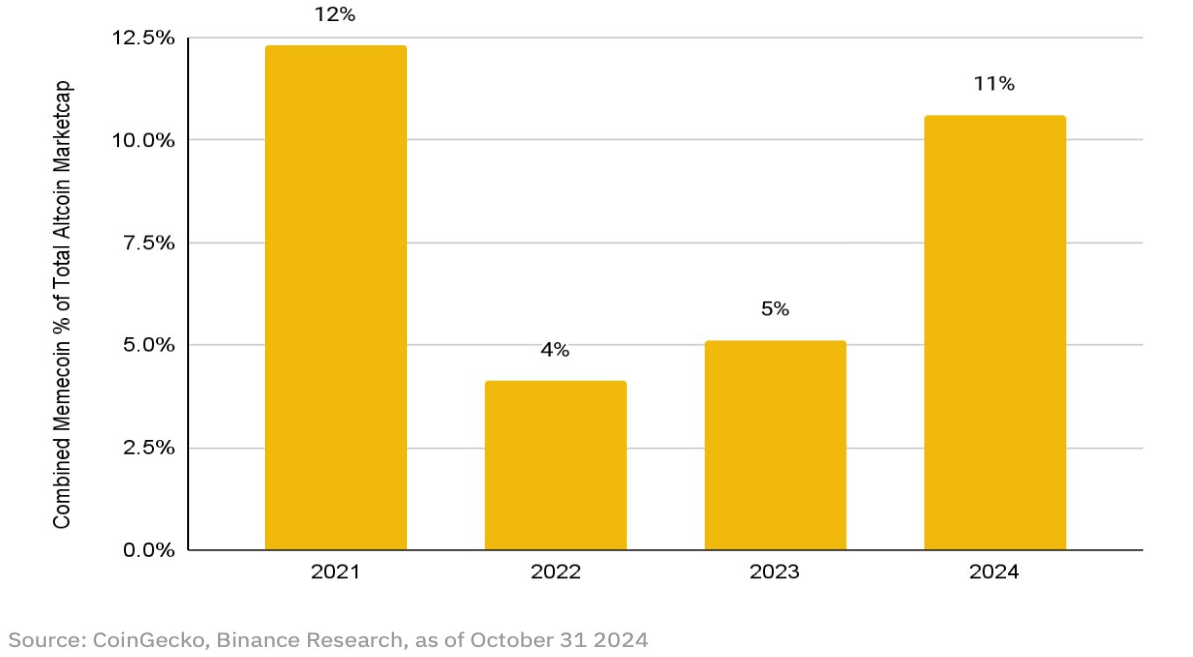

The recent growth of memecoin is far from a flash in the pan. According to BN Research, since 2022, memecoin’s market capitalization as a percentage of non-BTC/ETH/stablecoin assets has soared from 4% to 11% in just two years, nearly tripling its market share and achieving significant growth in a highly competitive market.

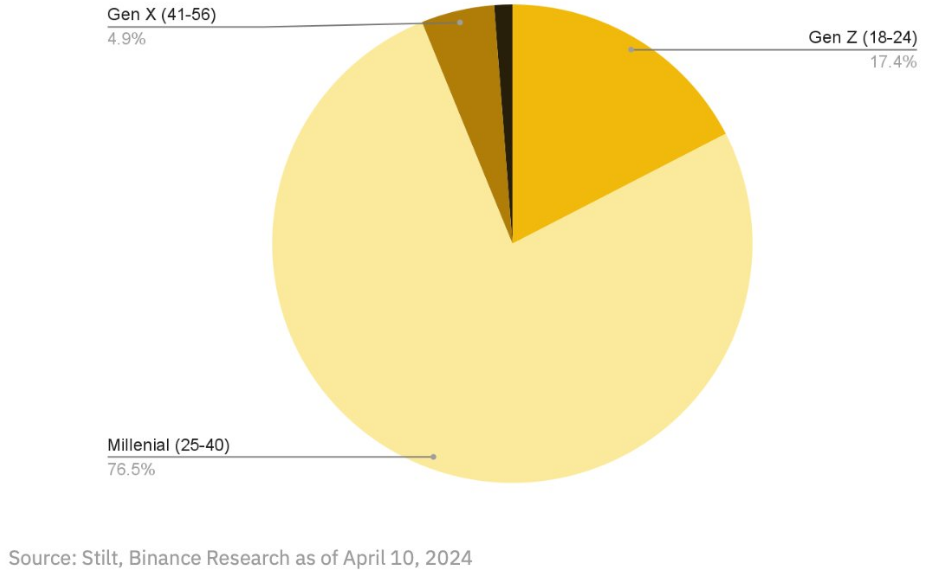

Millennials and Gen Z now make up 94% of digital asset buyers. This isn’t just a demographic coincidence, but an entire generation’s response to the environment they find themselves in. They’re not just buying tokens, but a rejection of their parents’ generation’s traditional path to financial security. On the surface, memecoins may seem like a joke, but to these traders, they represent a real opportunity to earn rewards away from a traditional system that has consistently failed them.

Andrew Edgecliffe-Johnson summed it up best: “When people lose confidence in getting rich slowly, it’s hard to blame them for wanting to get rich quickly.” That confidence has been eroding for years. In 1963, it took only 4.4 years of the average wage to buy a home, but now it takes 8.1 years. Coupled with the fact that inflation has soared in recent years, reaching 7% in 2021, it’s clear that the younger generation is looking for other financial opportunities.

This trend is not just about a chance to get rich quick (although that is certainly part of it). More importantly, they are using their money to express their protest against a system that has lost trust. The memecoin phenomenon is a high-risk, high-reward game, and it is this feature that strongly attracts today's traders. This is not just a game, it is a vote of no confidence in the old way of wealth accumulation.

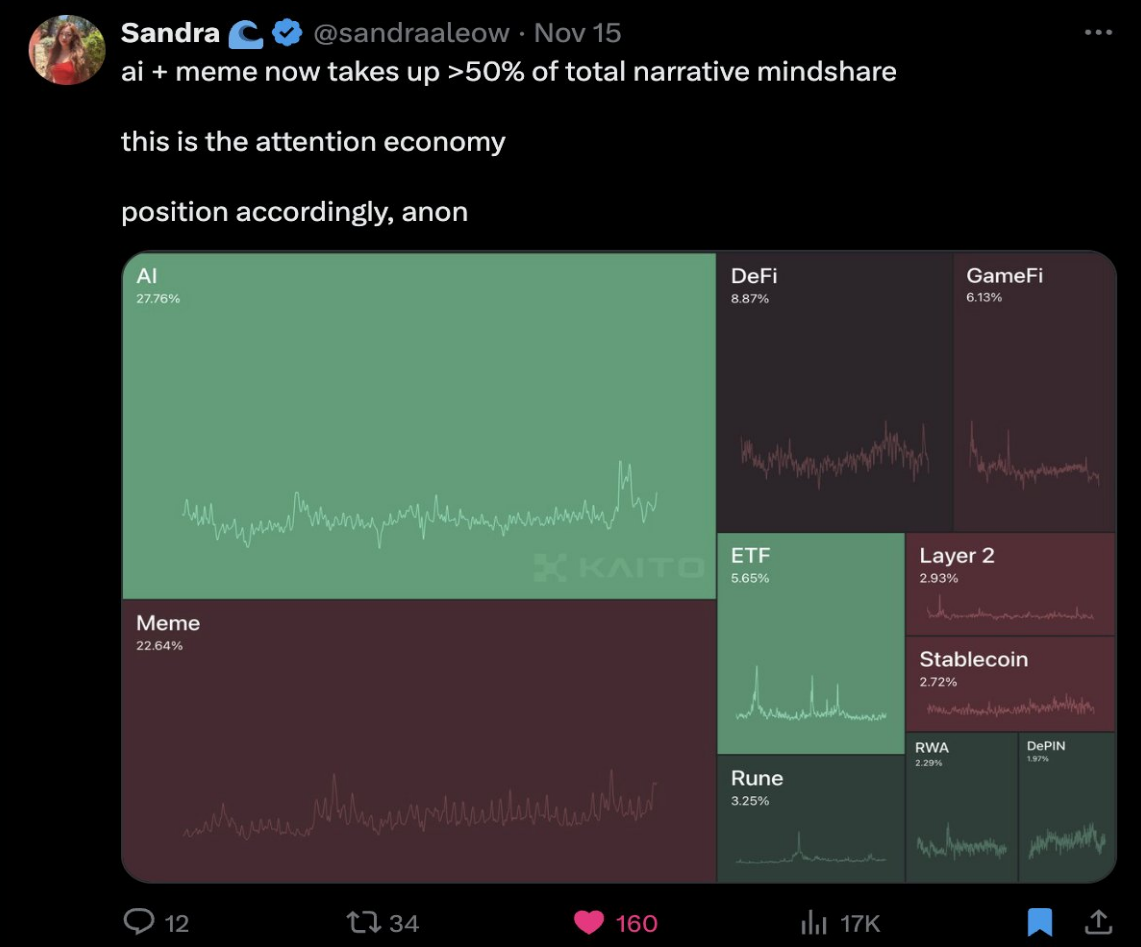

@sandraaleow

3. Understanding the Memecoin phenomenon

The speed at which this market evolves is astonishing. Our research shows that $BOME reached a $1 billion market cap in 2 days, $PNUT took 14 days, $WIF took 104 days, SHIB took 279 days, and DOGE took a full eight years. Capturing and maintaining the attention of traders is the key to success.

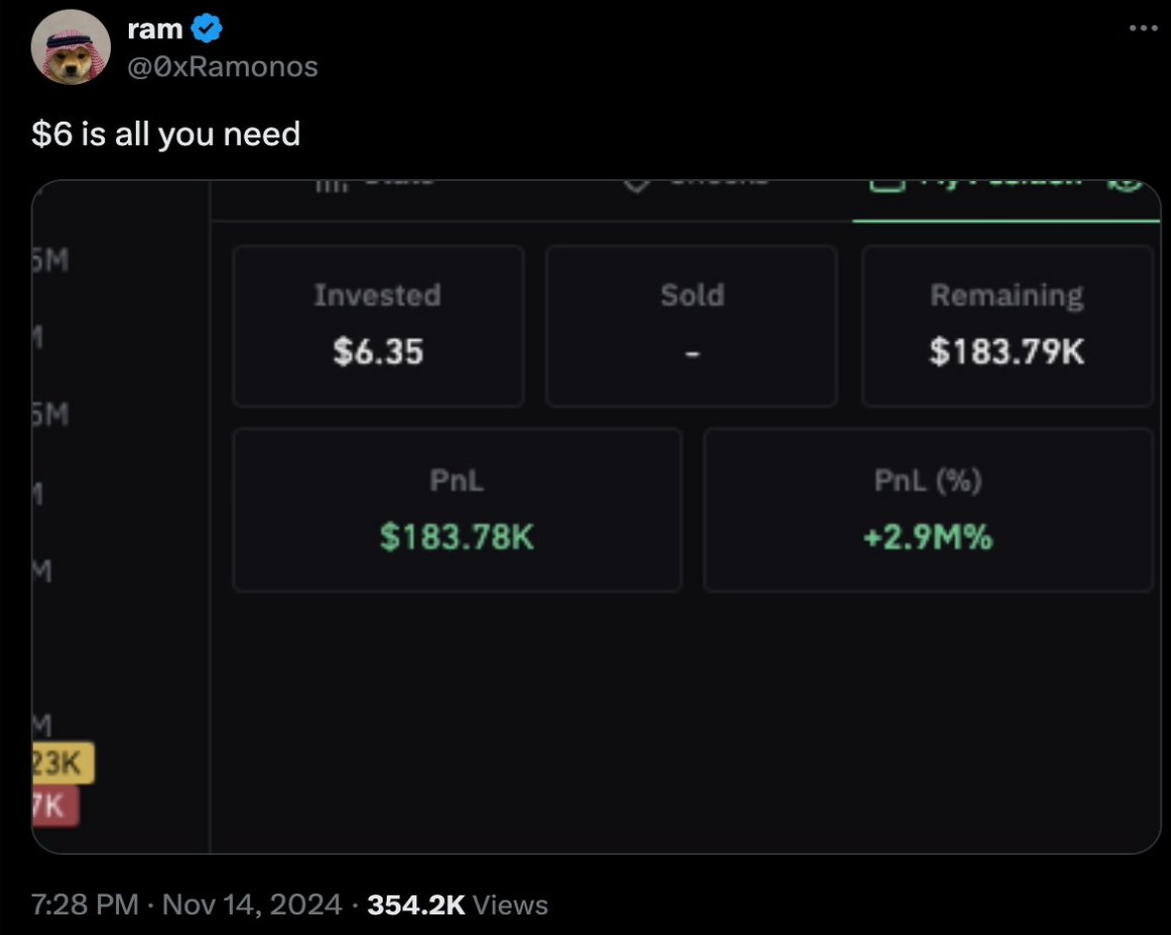

Screenshots of the Phantom wallet displayed on the X platform showing a 633x and +10,520% return highlight a broader theme: accessibility and fairness have become core. Looking back at the ICO boom in 2017, one of its notable features was universal participation - no fundraising rounds, no VC allocations, and no complicated unlocking plans.

@0xRamonos

Today’s memecoin traders are fighting back against what one Discord user calls the “VC exit liquidity simulator” of modern token issuance. A new memecoin with no team allocations and market-driven pricing is bringing back the level playing field of the early cryptocurrency era, where community and network effects were key.

@paulemmanuelng

The memecoin craze makes more sense when viewed as a fair chance to play without worrying about VC unlocking and token unlocking. People are tired of being used as an exit liquidity tool, and fair launch platforms like pump.fun make it easy for anyone to launch a token, giving everyone a chance to participate.

4. Achieving Escape Velocity – Anatomy 100x

What separates the winners from the thousands of failed launches? The numbers are clear — less than 2% of tokens from pump.fun make it to Raydium, and only a paltry 0.0045% maintain a market cap of more than $1 million. But some tokens do achieve what we call “escape velocity,” breaking free from the nameless gravitational pull.

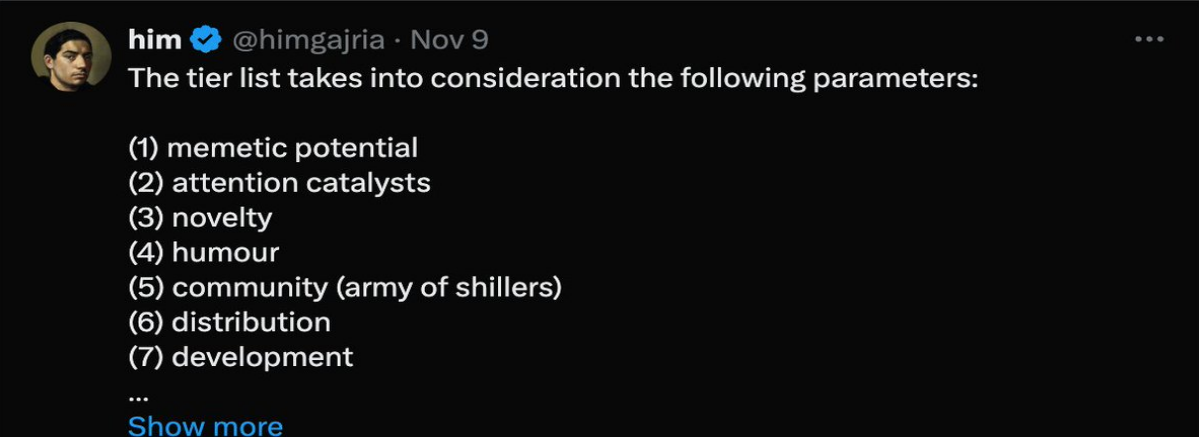

Success stories follow observable patterns. The strongest tokens excel in at least one of seven key areas: meme potential, attention catalyst, innovation, humor, community, distribution, and development. Look at any successful memecoin and you’ll see these elements in play, with attention catalyst, meme potential, community, and distribution emerging as the most critical factors.

Source: https://dune.com/queries/4048901/6817482/

Take Moo Deng for example — its success was no accident. The project attracted a lot of attention through its social media presence on Twitter, Telegram, and TikTok. Its cute and meme-friendly characters constantly appeared in the news feed, creating a viral awareness and sharing cycle. Although it is not particularly humorous, its strong attention catalyst and distribution strategy created sustained momentum.

@himgajria

Solana’s role in this evolution cannot be ignored. The network now supports 89% of new token issuance and processes approximately 41 million non-voting transactions. This dominance is no accident — Solana’s low fees and fast transaction times create an environment where rapid experimentation can occur, even if most experiments will fail.

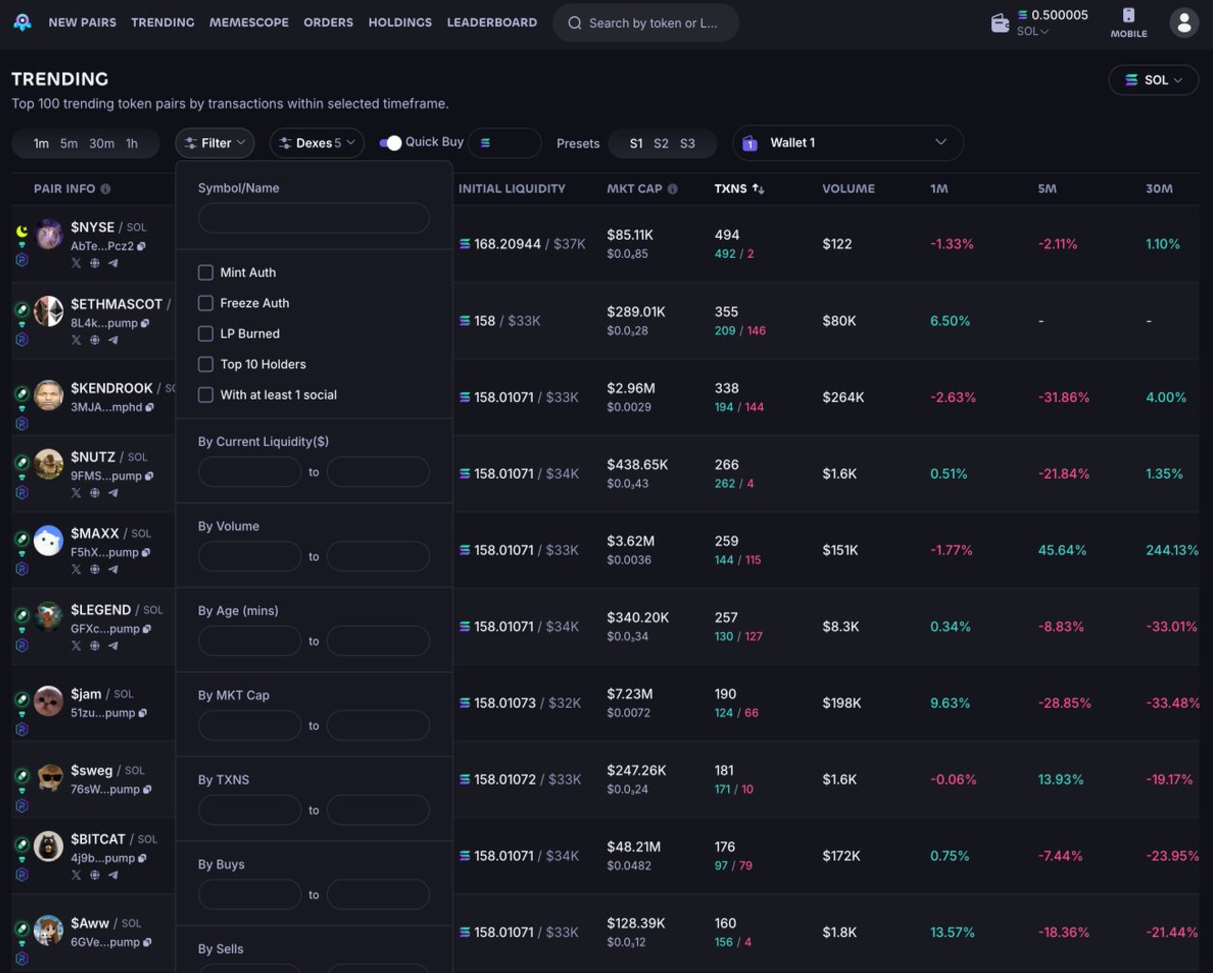

5. Current market structure: looking at the current situation through data

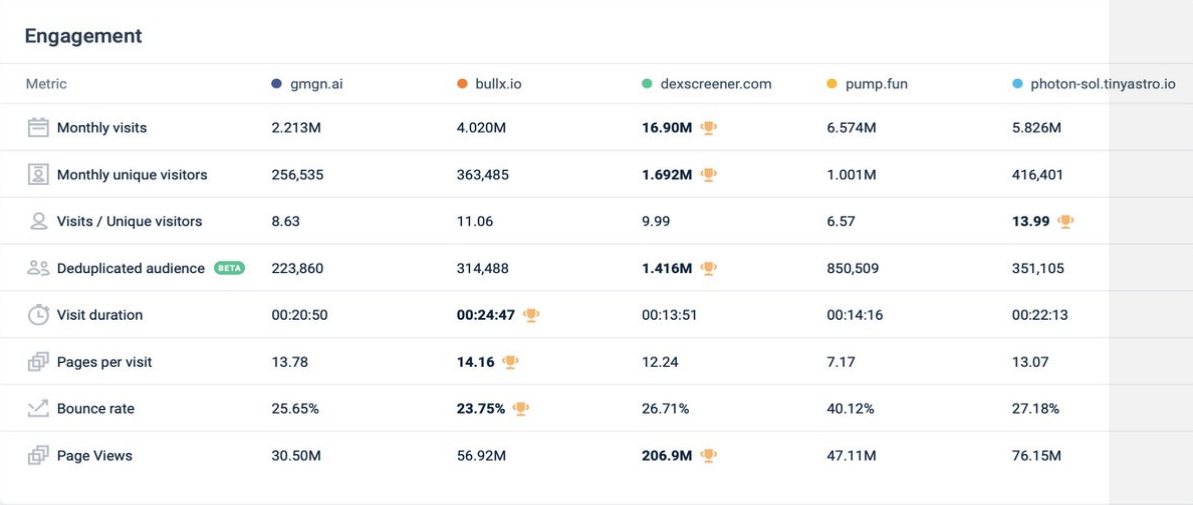

The data provides valuable insights into how traders interact with different memecoin platforms and highlights key gaps in the market.

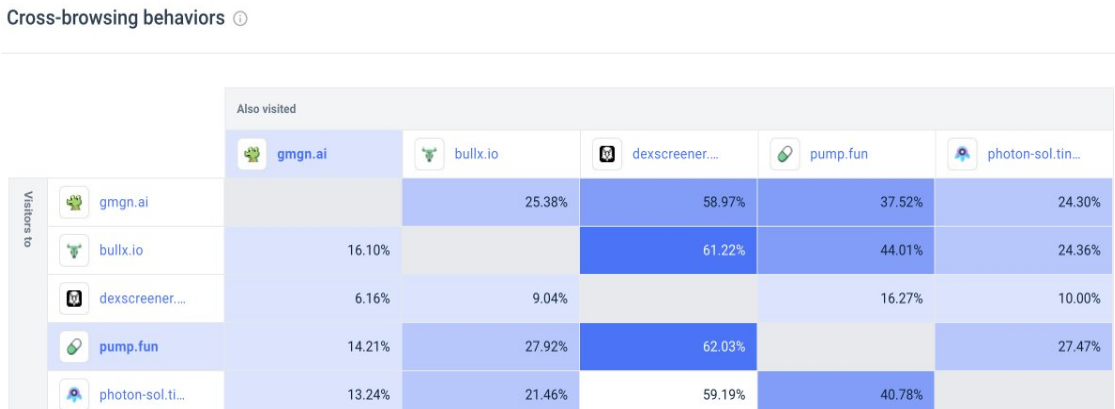

First, it’s worth noting that around 60% of users still visit DexScreener after using their preferred trading terminal. They use DexScreener because of the insights, advanced filters, and analytical tools it provides, which suggests that existing platforms are not fully meeting their needs. However, even though these terminals are superior to DexScreener’s interface in terms of customizability and parameterization, only 10-12% of DexScreener users end up using trading and execution terminals. This shows a gap in user satisfaction - these trading terminals may have better functionality, but they are underutilized.

Source: SimilarWeb

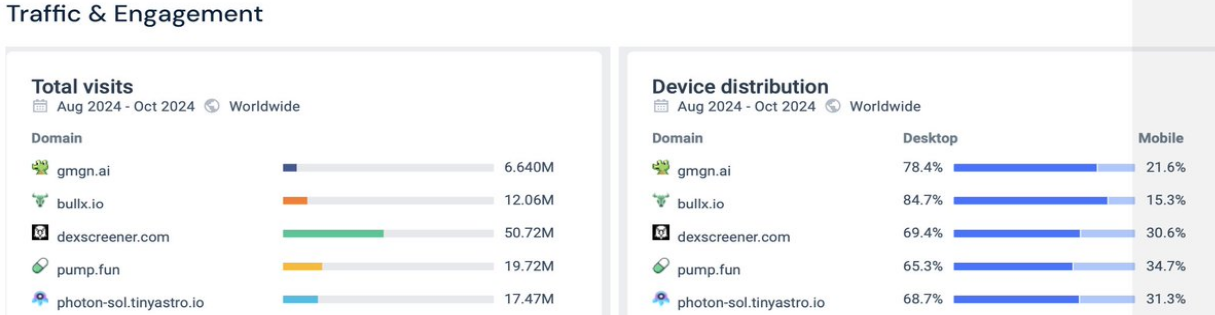

When we compare mobile vs desktop usage, Photon stands out. Of the three main trading terminals - gmgn.ai, BullX and Photon, Photon has the highest usage on mobile, while BullX has the most desktop users. Despite BullX's large desktop user base, a significant portion of its traffic comes from Telegram links. This shows that even when distributed on Telegram, a mobile-focused platform, users ultimately interact with BullX on desktop. This hints at the complexity of these terminals and suggests that users prefer to operate them in an environment where they can more comfortably manage all functions.

Source: SimilarWeb

This trend points to a broader problem: the complexity of existing trading terminals. Their dominance on desktops suggests that these terminals are too cumbersome for mobile devices and that the market lacks a trading terminal that can be used seamlessly across devices. Traders want powerful tools that can be accessed on mobile devices and have the flexibility to switch to a simplified interface when needed. The market needs an all-in-one solution - an intuitive platform that combines advanced features with ease of use, whether the user is on desktop or mobile.

The current experience is fragmented, inefficient and inconvenient. Traders have to switch between multiple platforms to get the insights they need and execute trades effectively. A unified solution that provides depth and functionality, while also being accessible on mobile and with an adaptive UI, will significantly improve the trading experience.

@TaikiMaeda2 @MustStopMurad

6. In-depth discussion: Trader’s perspective

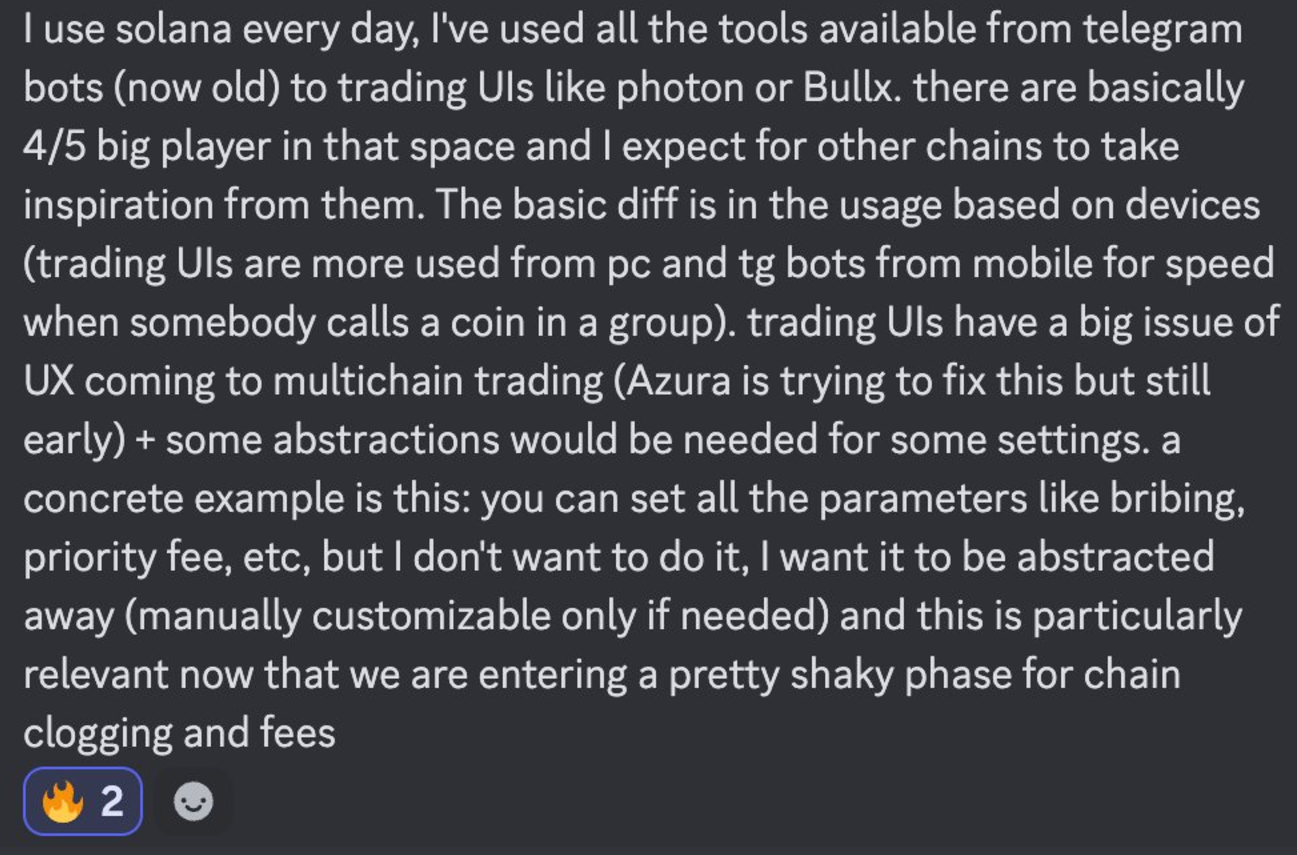

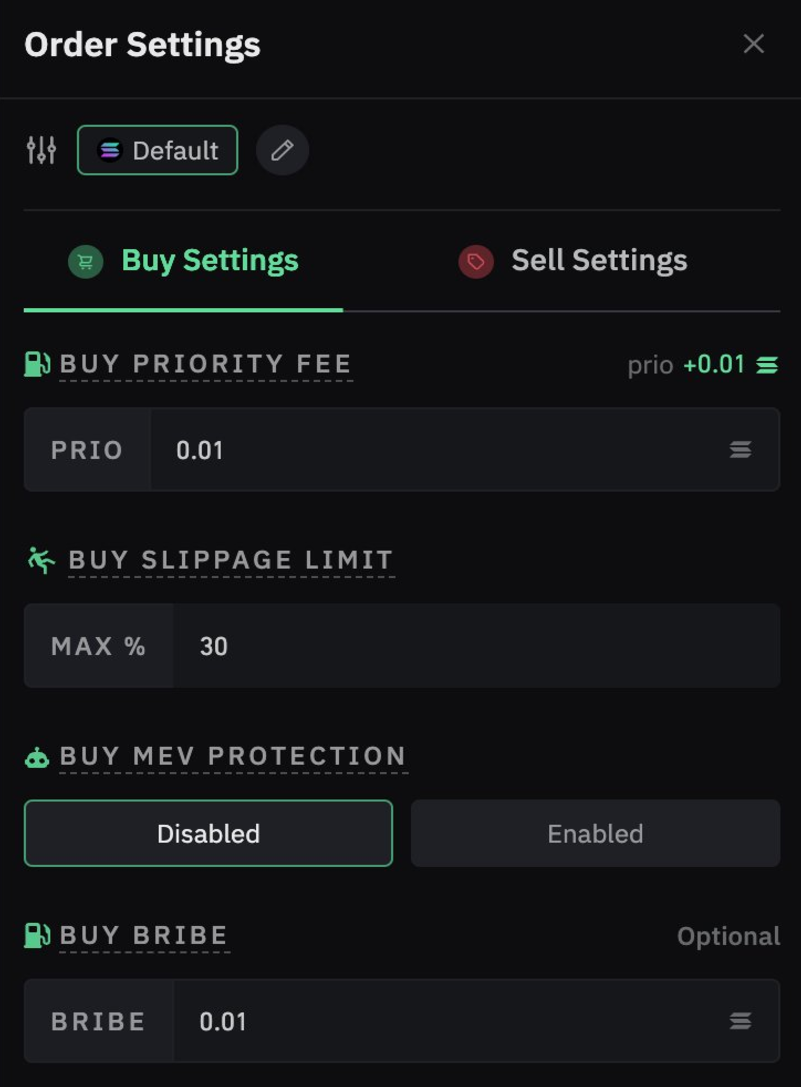

Conversations with traders revealed a consistent theme — they want powerful features without the complexity. “I still need to set priority fees and bribes when the network load is high,” one trader explained. “I want smart defaults that work out of the box but can be adjusted when needed.”

This balance between simplicity and control comes up over and over again. Existing platforms either simplify everything or throw all the complexity on the user. There is no middle ground that allows functionality out of the box while providing deep customization when needed.

“Some interface that combined the exchange, charts, and recent trade lists in one interface would be much better. Fewer clicks, and all the key information in one place,” one high-frequency trader told me. Another trader mentioned that he spent hours explaining basic concepts, such as gas fee optimization, to his team—time that could have been spent actually trading.

@blankspac_e

One recurring complaint centered on limit orders. “I got filled, but all the positive slippage was eaten up by the platform,” one trader noted. Another trader mentioned that limit orders on one platform always seemed to be filled before others, creating an unfair situation that no one understood.

7. Market structure: the real problem

Current platforms are designed for crypto-native users and on-chain traders who already understand terms like “slippage tolerance,” “preferred fees,” and “bribes.” But most traders just want to know how much they’ll pay in fees and whether their trades will get filled. One trader who manages more than 100 wallets told me that he can’t even keep track of his positions anymore.

The mobile experience is even worse. While Telegram bots fill some gaps, they are not a real solution. They are just a temporary patch for a system that needs to be fundamentally rethought.

This fragmentation comes with real costs. Traders jump between different interfaces, miss opportunities due to failed trades, and lose money due to poor execution. The current ecosystem forces users to choose between expensive tools and poor performance - there is no middle ground.

8. Build solutions: Beyond temporary fixes

The current memecoin trading environment feels like a patchwork system that is barely satisfactory but can be improved. When a trader tells us, "It would be great if someone could develop a tool that allows you to customize LP strategies," or complains about "having to set priorities and bribes when fees are high," or "Wish there was better execution on stop-loss and take-profit order strategies," they are actually pointing out a fundamental problem: the existing solutions are not real solutions at all.

Most platforms feel like they were designed for people who are already familiar with on-chain transactions, bridging, and DeFi, with all the complexity that comes with that. But speaking to several different traders, it seems that traders want to be able to access complex features without a complex interface. The existing "advanced" interface still does not provide the parameterization of features that complex traders need, and the default interface is too simple and hides features that can have a huge impact on profit and loss. For example, as one trader said, even a feature like "automatically tell me how much this transaction (including gas and fees) will cost to ensure that the transaction can be completed smoothly" can allow professional users to say "hmm, this fee looks high, I may not want to pay this much", while also allowing ordinary users to understand roughly how much they are about to pay.

The solution isn’t just to simplify the interface — it’s to completely rethink how traders interact with these markets. When someone compares memecoin trading to a “game,” they’re not oversimplifying anything. They actually want elements associated with a gamified experience. They want analytics that show win rates, a sensible performance tracking system, and tools to help them understand trading patterns.

The Path Forward: Cumberland Labs’ Vision

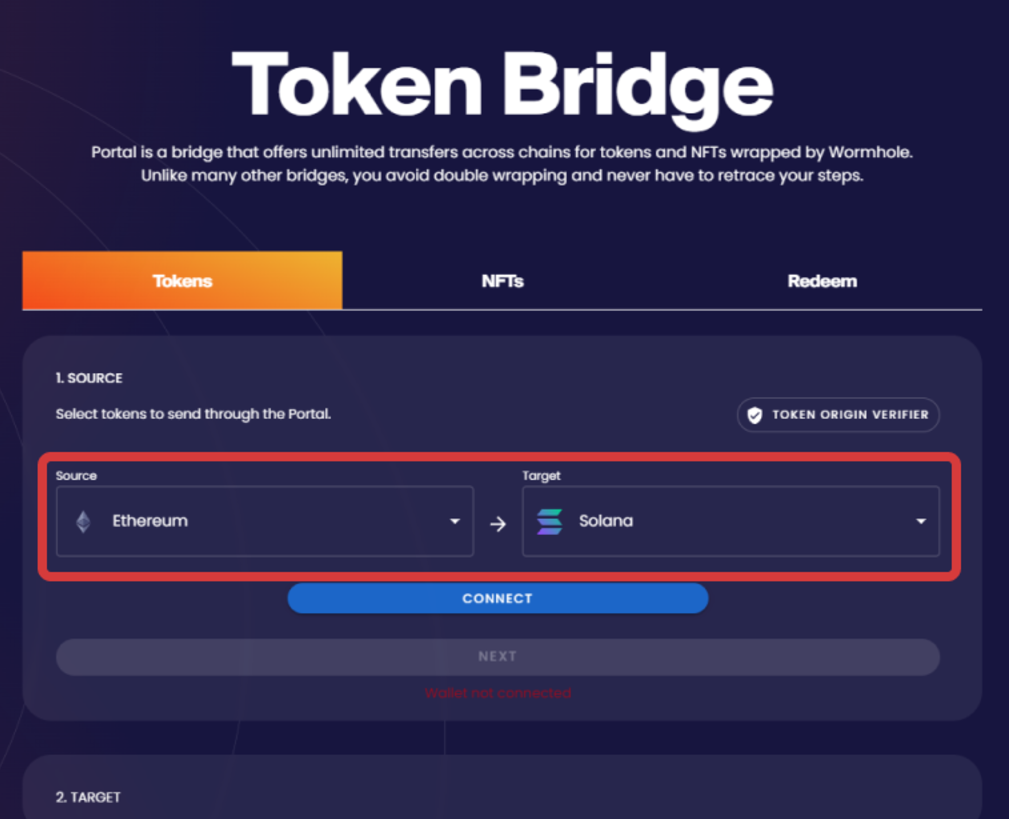

We are not here to build another trading terminal or launch another Telegram bot. We see a much bigger opportunity: to create an interface that bridges the gap between the simplicity of Moonshot and the power of advanced trading terminals. A platform that evolves with user needs, providing an easy entry point while meeting the depth and sophistication needs of experienced traders. More retail traders means more volume, deeper liquidity, and better opportunities - from experienced on-chain traders to newcomers just entering the space.

This means:

- Abstract complexity without taking away functionality—intelligent defaults, full customization when necessary

- A unified trading experience that combines charting, execution and analysis into a single window

- Practical cross-chain portfolio management

- Real-time performance tracking helps traders understand their strategies

- Provide protection against significant risks without limiting opportunities

The current platform lays a solid foundation for today’s crypto-native on-chain traders. But the next wave of retail traders will need something different — a platform that starts simple and grows with them. They need intuitive interfaces that educate while they trade, gradually introducing more complex features until they are ready. The existing “Advanced” vs. “Default” UI settings could improve existing features to better suit these two goals. It’s not just a matter of simplification — it’s about creating multiple layers of complexity that users can explore at their own pace.

The memecoin market is growing faster than ever. While 75% of memecoins have been created in the past year, we saw an opportunity to build tools that welcome newcomers while empowering experienced traders.

@Dynamo_Patrick

9. Beyond the transaction: building community

Trading is only one piece of the puzzle. Community, education, and shared experiences drive the memecoin ecosystem. While there are already some forms of integration through existing platforms such as Discord and Telegram, being able to bring the community to the platform for execution is a novel concept. One of the reasons existing Telegram bots are active on mobile is the ability to copy the contract address from the TG group to the bot and complete the purchase faster than on the trading interface.

@blknoiz06 Telegram Group

We envision a more integrated approach. Imagine you can track progress with other traders, share strategies when needed, and build a reputation based on actual performance. Not metrics set in a vacuum, but real insights into what works and what doesn’t.

This social layer is not intended to create another crypto echo chamber, but rather to provide context and understanding that helps traders make better decisions. Whether it’s seeing how different entry points affect returns, understanding performance patterns before and after migrations, or learning successful strategies, every feature is closely tied to improving trading results.