Highlights of this issue

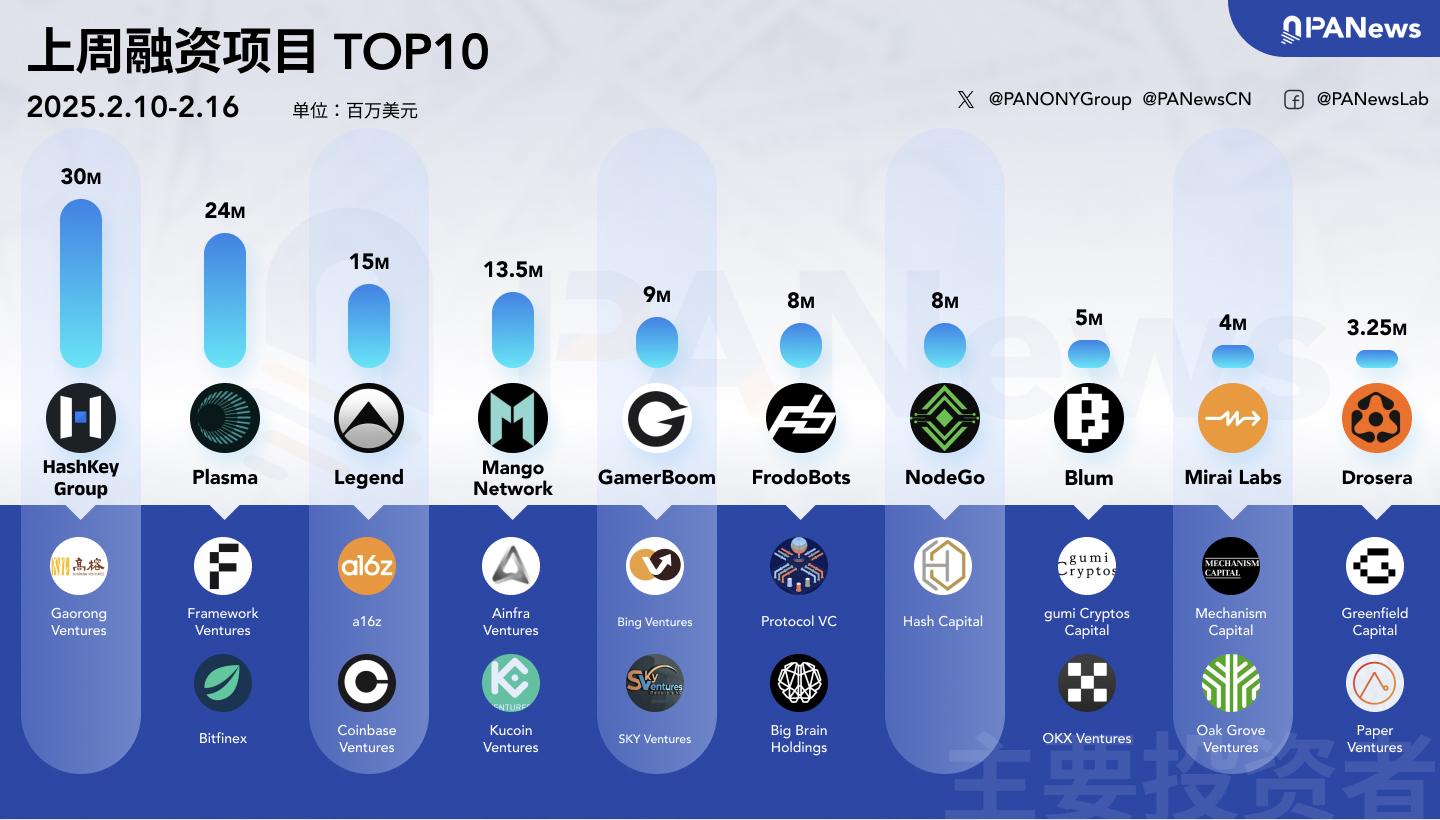

According to incomplete statistics from PANews, there were 21 investment and financing events in the global blockchain last week (2.10-2.16), with a total funding amount of over 139 million US dollars, which increased compared with the previous week. The overview is as follows:

- DeFi announced 7 investment and financing events, among which the decentralized financial platform Legends announced that it raised $15 million from a16z and Coinbase Ventures;

- The Web3 gaming track announced three investment and financing events, among which Solana ecosystem AI game data analysis and incentive protocol GamerBoom raised $9 million;

- Two investment and financing events were announced in the AI+Web3 field. Among them, FrodoBots completed $8 million in financing and plans to launch the BitRobot network that combines encryption and robotics technology;

- The Infrastructure & Tools sector announced 6 investment and financing events, among which Plasma announced that it had raised $24 million in its first round of financing, led by Framework Ventures;

- In the Others category, one investment and financing event was announced. Fireverse, an AI-driven music generation platform, announced the completion of a USD 2.5 million Series A financing.

- Centralized finance announced two investment and financing events, among which Gaorong Ventures invested $30 million in HashKey Group

DeFi

DeFi platform Legends completes $15 million financing, with a16z and Coinbase Ventures participating

Decentralized financial platform Legends announced its first round of financing, raising $15 million from Andreessen Horowitz (a16z) and Coinbase Ventures. According to reports, Legends was launched by Jayson Hobby, the former CEO of Compound, and two other former Compound executives, and will improve on the foundation they and their colleagues built at Compound. Legends will provide users with decentralized financing instead of forcing them to log in to multiple different applications to use their cryptocurrencies. The company's current focus is to strive to be listed on the Apple App Store and build a reliable user base. In the future, Legend plans to generate revenue through subscriptions.

Web3 innovative trading application Blum announced $5 million in pre-seed and seed round financing

OKX Ventures announced a seed round investment in Blum, an innovative trading app that aims to create a trading experience that connects DEX and CEX for 90 million users. This round of financing was led by gumi Cryptos Capital, with participation from Spartan and No Limit Holdings. It also received continued investment from pre-seed round supporters YZi Labs and Top.co, as well as participation from well-known institutions such as Bitscale Capital and Wintermute. Currently, Blum has received a total of US$5 million in pre-seed and seed round financing.

DeFi.app Completes $4 Million in Funding, Total Valuation at $100 Million

DeFi trading platform DeFi.app raised another $4 million in the latest seed extension round, maintaining a token valuation of $100 million. The financing was jointly participated by venture capital institutions and Cobie's Echo platform, of which Mechanism Capital, DCF Capital Partners, Balaji Srinivasan, Pentoshi and other institutions invested $2 million, and Echo's Comfy Capital and George Beall team contributed $2 million. So far, DeFi.app's total financing amount has reached $6 million. In addition, DeFi.app announced the official opening of public beta, providing "gas-free" cross-chain token exchange, decentralized asset management and fiat currency purchase functions, and plans to launch perpetual contract trading, yield farms and lending services in the future.

DeFi project InfiniFi completes $3 million Pre-Seed round of financing, led by Electric Capital

DeFi project InfiniFi announced the completion of a $3 million Pre-Seed round of financing, led by Electric Capital, with participation from New Form Capital, Kraynos Capital, BaboonVC, etc. According to reports, InfiniFi is a DeFi system driven by depositors, and its upcoming InfiniFi deposit receipt token (DRT) will be launched as an asset pegged to the US dollar and will be integrated with AAVE, Pendle and Ethena (and other companies) in the second quarter of this year.

The revenue-generating protocol Cabal announced the completion of a $3 million financing round, with participation from Hack VC, Delphi Ventures, Nascent, CitizenX, etc. According to reports, Cabal is a revenue-generating protocol built on the Layer1 network Initia, designed to accumulate governance rights and reward VIP users. It allows users to deposit INIT and Enshrined Liquidity positions in exchange for liquid, income-generating assets, thereby enhancing participation and rewards in the Initia ecosystem.

Whetstone announced the completion of a $1.3 million Pre-Seed round of financing, with investors including Variant, Nascent, Credibly Neutral, Uniswap Ventures, Ambush, Figment and several angel investors. Whetstone launched the Doppler protocol, which aims to optimize on-chain asset issuance and liquidity guidance, reduce robot buying, improve price discovery efficiency, and introduce programmable and auditable vesting periods to enhance the long-term incentive alignment between project parties and the community. Doppler has been deployed to Unichain and is the first to provide front-end support through Pure Markets.

TaoFi Completes DCG-led Financing, to Build AI Financial Layer on Bittensor

TaoFi, a decentralized AI financial platform, has completed strategic financing led by DCG, with participation from Pantera Capital, Taostats, Lyrik Ventures, etc. TaoFi will launch DeFi infrastructure such as TAO USD stablecoin, TAO Swap decentralized exchange and stTAO liquidity pledge on Bittensor EVM to promote the integration of decentralized AI and crypto finance.

Web3 Games

Solana Ecosystem AI Game Data Analysis and Incentive Protocol GamerBoom raised $9 million in its latest round of financing, bringing its total financing to over $11 million. This round of financing attracted investors including Bing Ventures, SKY Ventures, MBK Capital, INK Capital, CLF Capital, Metaverse Group, New Heights, and Tuna, and received strategic support from NVIDIA and Solana. According to reports, GamerBoom uses artificial intelligence data annotation and analysis to increase the value and utility of Web3 game data. The latest investment will accelerate the development of its advanced analytical solutions and provide deeper insights into the gaming industry. GamerBoom plans to launch a new season of the points reward program and launch core NFT sales later this month to further attract the Web3 gaming community.

Web3 development studio Mirai Labs completes $4 million seed round led by Mechanism Capital

Web3 development studio Mirai Labs has completed a $4 million seed round of financing, led by Mechanism Capital, with participation from Oak Grove Ventures, Sophon Capital, Selini Capital, Bitscale Capital, Manifold, Rubik Capital, Protagonist, and Lhava. It is reported that Mirai Labs is developing a product called Partnr, which allows artificial intelligence agents to perform consumer-oriented encryption tasks, such as managing wallets, while understanding user needs over time.

Beamable receives funding from Sui Foundation to promote Web3 game development

The company has once again received funding from the Sui Foundation to expand its Web3 game development capabilities and strengthen its integration with the Sui blockchain. New features include dynamic NFTs, closed-loop tokens, storage wallets, and seamless Web2 login through zkLogin (supports Google and Twitch accounts to create Sui wallets). Game developers using Unity and Unreal Engine will be able to easily integrate blockchain features to improve the security, scalability, and immersive experience of their games. Related technologies will be first applied to projects such as Warped Games.

AI

FrodoBots Completes $8 Million in Funding and Will Launch Crypto Robot Network BitRobot

FrodoBots has completed $8 million in financing and plans to launch the BitRobot network, which combines encryption and robotics technology, focusing on promoting the development of Embodied AI. This round of financing was led by Protocol VC, with participation from Big Brain Holdings, Fabric, Zee Prime Capital, Tioga Capital, Sfermion, Solana Ventures, etc. Solana co-founders Anatoly Yakovenko and Raj Gokal and several DePIN project founders also participated in the investment. BitRobot will use cryptographic incentive mechanisms to bring together computing resources, storage, manual operations, physical robots and researchers to accelerate the development of Embodied AI, and plans to open source some research results to give back to the robotics research community.

NodeGo, a decentralized AI computing infrastructure provider, has completed a $8 million financing round led by Hash Capital. The funds will be used to expand its decentralized AI computing network, improve real-time AI processing capabilities, and advance the layout of the Solana ecosystem. NodeGo aims to solve the problem of AI computing resource shortages, distribute computing power through blockchain technology, reduce cloud computing costs, and improve scalability. Currently, NodeGo has more than 1.5 million active users.

Infrastructure & Tools

Plasma Completes $24 Million Funding, Led by Framework Ventures

Stablecoin company Plasma announced that it has raised $24 million in its first round of financing, led by Framework Ventures, with participation from cryptocurrency exchange Bitfinex, well-known venture capitalist Peter Thiel and Tether CEO Paolo Ardoino. According to reports, Plasma is tailoring a blockchain for the most popular stablecoins and hopes to launch it in the coming months. The blockchain aims to attract stablecoin users by offering zero-fee USDT transactions. Paul Faecks, co-founder of Plasma, said he chose to build on top of the Bitcoin blockchain because it is considered one of the most secure and decentralized blockchains. Although the two chains are interconnected, Plasma has its own consensus mechanism-a set of rules that determine the scalability, security and decentralization of the blockchain.

Multi-VM full-chain infrastructure network Mango Network completes $13.5 million in financing

Mango Network, a multi-VM full-chain infrastructure network, announced the completion of a $13.5 million financing round, with participation from Ainfra Ventures, Kucoin Ventures, Tido Capital, Connectico Capital, Becker Ventures, Mobile Capital, T Labs, CatcherVC, etc. According to reports, Mango Network is a multi-VM full-chain infrastructure network, claiming to have integrated the core advantages of OPStack and Move. Mango Network said that the next step will be the mainnet and TGE.

Ethereum security platform Drosera has completed a $3.25 million financing, bringing its total financing to $4.75 million. This round of financing was led by Greenfield Capital, with participation from Anagram, Paper Ventures, Arrington Capital, UDHC and Pulsar. Drosera focuses on developing the "Traps" smart contract, which can detect and eliminate security threats on the Ethereum network in real time. The company plans to use the funds to continue to optimize the Traps technology, expand to other EVM-compatible chains, and launch the mainnet in the second quarter of this year.

Decentralized platform Teneo Protocol completes $3 million seed round of financing

The decentralized platform Teneo Protocol announced the completion of a $3 million seed round of financing, led by RockawayX, Borderless and Generative Ventures, with participation from Moonrock Capital, CertiK Ventures, Outlier Ventures, X Ventures, Token Ventures, EOT Ventures, MN Capital, Advanced Blockchain, and Venionaire Web3. According to reports, Teneo is a decentralized platform that connects real-world data with Web3 applications, focusing on data utilization and tokenization for decentralized physical infrastructure networks (DePIN) and artificial intelligence (AI).

Index Completes A$3.5 Million Seed Round, Led by Blackbird and Bain Capital Ventures

B2B product management platform Index announced the completion of a AUD 3.5 million (approximately USD 2.2 million) seed round of financing, led by Blackbird and Bain Capital Ventures, with participation from BOND, Y Combinator and others. Since the platform was officially launched two months ago, it has attracted well-known companies such as Ramp, Uniswap, Clerk, Semgrep and others to join the reservation list. Index aims to solve the fragmentation problem of traditional product management tools, providing real-time collaboration, customer feedback integration, demand management and engineering docking with Linear. After the financing, Index has opened Early Access, and users can use it without reservation. The team plans to use the funds to accelerate product development and expand into the global market.

Tether announces strategic investment in self-custodial crypto wallet Zengo Wallet

Tether announced that it has completed a strategic investment in the self-custodial crypto wallet Zengo Wallet. Tether said that this investment demonstrates Tether's commitment to promoting the development of secure self-custodial solutions and promoting the global popularity of stablecoins. This investment will enable Zengo to further enhance its cross-blockchain capabilities, thereby seamlessly supporting Tether's stablecoins in major blockchain ecosystems. This investment will also support the development of Zengo Pro, a premium service designed to enhance the user experience through features such as anti-theft protection, inheritance transfer capabilities, and real-time assistance.

other

AI-driven Web3 music generation platform Fireverse completes $2.5 million Series A financing

AI-driven music generation platform Fireverse announced the completion of a $2.5 million Series A financing round, which was co-led by Nobody and supported by OKX Ventures. T-Fund, BingX, Gate.io, Chain Capital, TCC Capital, Central Research and Stratified Capital also participated. According to reports, Fireverse is an AI-based music creation platform that enables users to create, promote and monetize music through the Web3 business model. The platform provides one-click AI music processing tools that allow users to create music works. In addition, Fireverse also provides functions such as gamification, event building and blockchain-based copyright protection.

Centralized Finance

Gaorong Capital invests $30 million in Hong Kong-licensed crypto exchange HashKey Group

Gaorong Ventures has invested $30 million in Hong Kong’s largest licensed crypto exchange operator, a rare foray by the venture capital giant into digital assets. Gaorong Ventures — an early backer of Chinese internet companies such as Meituan and PDD Holdings — invested in HashKey Group at a pre-money valuation of more than $1 billion, according to people familiar with the matter; a valuation that remained virtually unchanged from a year ago when HashKey Group raised $100 million and entered unicorn status. A HashKey Group spokesperson said Gaorong Ventures’ $30 million investment was made at a post-money valuation of nearly $1.5 billion.

Digital payment provider KUN completes "multi-million dollar" seed round led by BAI Capital

Digital payment provider KUN announced the completion of its seed round of financing, led by BAI Capital, with participation from GSR Ventures, Hash Global and other strategic investors. The specific amount of this round of financing has not been disclosed, only disclosed to be "millions of dollars". KUN currently provides Web2+Web3 digital payment services that support stablecoins. The new funds are intended to be used to build digital payment solutions for cross-border trade, overseas business, Web3 enterprises and high-net-worth individuals.