Written by: Shisijun

Preface

Solana has been around for five years, and Jito (the leader in MEV infrastructure on Solana) has been around for less than three years, but its market share has grown rapidly from the initial 15% to 95% today. It can be said that most of the Meme buying and selling transactions on Solana have to go through it!

There is no exaggeration in the whole process, please sit down and collect it, and let Shisijun go deep into the underlying principles and gradually reveal them to you:

- What is Jito-solana? Why can it dominate the market in just 2 years?

- The differences in the core mechanisms of Solana compared to Ethereum.

- Why do your transactions always get squeezed?

- How will Solana’s MEV landscape develop in the future?

1. What is Jito-solana?

Of course, it is not just Jito-solana (the leader with 95% market share) that is building mev infrastructure on Solana. There are also other manufacturers with different entry points, such as Paladin, Deeznode, BlockRazor, BloxRoute, Galaxy, Nozomi, etc.

This article will start with the development history and technical principles of the core leaders, and will comment on the advantages, disadvantages and entry points of these companies in the future.

1.1. Jito’s development timeline

First, let’s use the timeline to look at the magic of its market share growth rate. Please pay attention to the pledge rate and related partners.

- Established at the end of 21

- The Solana mainnet was launched in June 2022, and in September of the same year, there were 200 validators, covering 15% of the staked amount.

- From 2022 to 2023, financing + iteration + cooperation with Solana foundation, Jito client was included in the official recommendation

- In the 23rd year of TGE, staking Jito will earn MEV income bonus, forming a staking and re-staking model.

- In Q1 of 24, due to strong opposition from the community, the channel for jito-solana to send transactions to jito-blockengine was closed.

- In Q2 of 24 years, there are more than 500 cooperating validators, covering 70% of Solana MEV, and processing 3 billion transactions in 24 years

- In Q1 of 2025, the pledge coverage rate has reached 94.71%. Today, the importance of cross-chain bridges is still self-evident.

[Image source: https://www.jito.network/zh/stats/]

Therefore, it can be said that Jito is the leader of infrastructure in the MEV ecosystem on Solana today, and he has been developing for the past three years.

A solid base of support from Solana validators has been established, so that the vast majority of transactions must go through the Jito system.

It was his system diversion that caused Solana's downtime to drop significantly.

It was he who made the clamps earn high profits.

It was also him who allowed Solana's validators to increase their MEV income by an additional 30%, and steadily.

It was him who changed from the original dragon slayer into a dragon, and jumped back and forth between the warrior and the dragon, sometimes ferocious and sometimes kind.

In the mainstream meme narrative of today's market, he has become a double-edged swordsman who can play both sides.

1.2. What kind of system does Jito build?

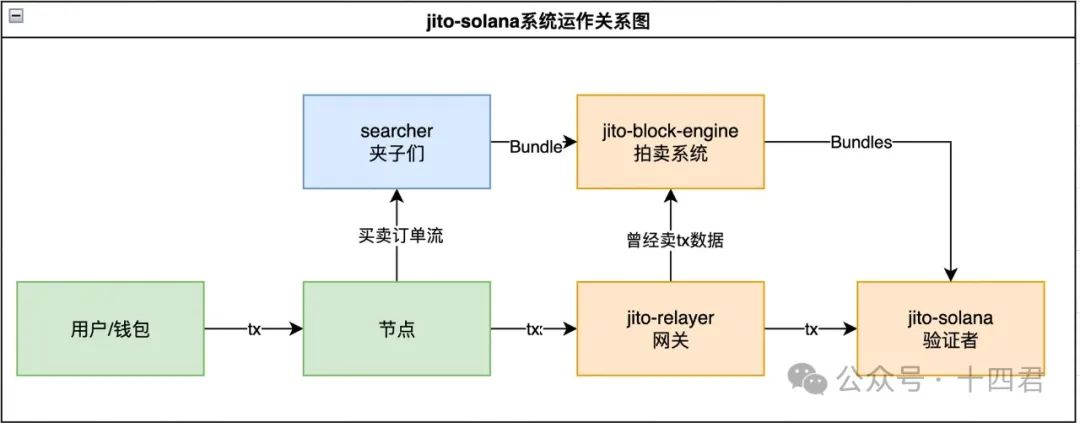

It actually consists of three core services: block-engine, jito-solana, and jito-relayer. The relationship between them is as follows:

[Image source: Made by Shisijun]

The first is block-engine, which is an auction system.

A typical scenario is that the clampers can submit a fixed order of no more than 5 transactions in the form of a Bundle package consisting of multiple transactions for auction. An additional transaction called Tips can be sent to the validators as an additional tip, so that the validators are willing to package the Bundle package first.

Other scenarios include dex platforms like OKX, GMN, and BN Wallet. In order to prevent users from being squeezed, tips can be added to users' transactions individually, taking the auction route, so as to reach the end point of the transaction chain faster.

The second is jito-solana, which is a client that replaces the validator to verify transactions and produce blocks.

Its core function is to allow the validator to receive the Bundle package sent by the block-engine, so as to give priority to the transaction and finally complete the construction of the transaction sequence. At its peak, the number of Bundles processed per day can reach 25 million (recently 10 million), and almost every transaction is profitable.

The tips fees collected here are ultimately paid to a unified account, which is then divided between 95-97% for the validator and 3-5% for Jito itself.

Among them, the most controversial is jito-relayer, which can be understood as the gateway of the validator and is used to receive transactions.

Initially, when the relayer receives a transaction, it will delay 200ms before sending it to jito-solana, while the synchronous one will send the transaction to block-engine without delay. Obviously, this is selling order data. Therefore, the earliest rise of jito is due to the spread that users suffer.

It should be noted that in March 24, this rule was officially announced to no longer transmit data, but to this day, the forwarding switch and 200ms delay setting items can still be found in jito-relayer.

So, do validators sell user data now? As blockengine is closed source, it is unknown.

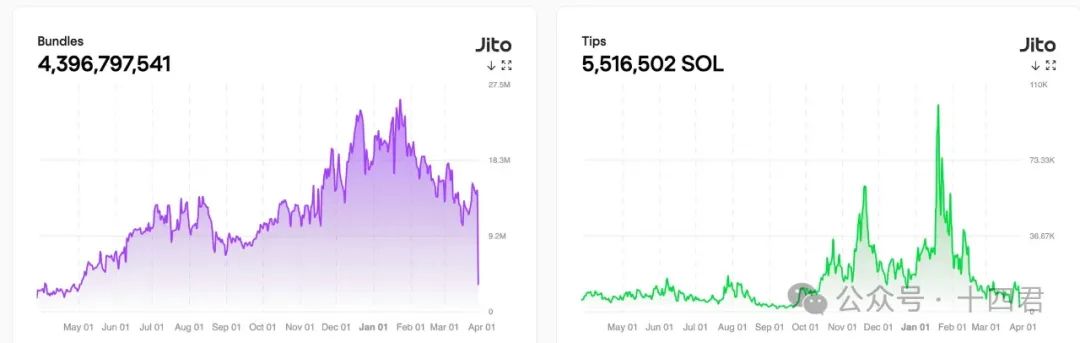

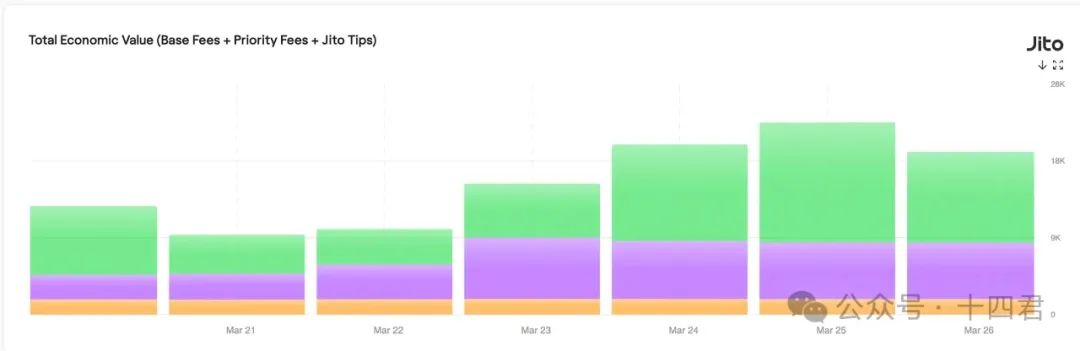

1.3. How much money does the Jito system make?

Obviously, the spread between transactions with and without a transaction will be introduced with the introduction of the tips mechanism and eventually given to the validator, thus causing his market share to soar. Who would refuse 30% more profit?

Therefore, the total number of bundles launched in the past year has reached 4.3 billion, and the total tips fees generated have reached 5.51 million SOLs. Based on the market price of 140, the jito infrastructure has generated an additional profit of US$7.7 billion.

[Image source: https://explorer.jito.wtf/]

However, not all of this revenue goes to Jito, the system provider. As mentioned earlier, there is a 3-5% platform profit sharing between Jito and the validators, so the actual revenue of Jito itself was about 200,000-270,000 SOLs, or about 35 million US dollars, in the past year.

It’s about the same as the revenue of King of Glory for two days, doesn’t it seem high? Actually, it’s not necessarily, because this is the actual platform revenue after all, when most industries in the web3 field cannot talk about the specific revenue.

He has achieved oligopoly and has exclusivity over other competitors (after all, a validator can only run one client), and the benefits come from the recent meme weakness. If Solana explores more trading scenarios in the long run.

Even when there are no market competitors for a long time, the platform adjusts its profit sharing from 3-5% to 30% (this is actually a common platform fee rate after Internet applications monopolize the market).

Then they can all give very high PE estimates. According to the 30PE of the web2 industry leader, the valuation can reach 1 billion, and according to the 300 times valuation of the common web3 based on the expected monopoly and potential industry growth, it can reach the level of 10 billion. For similar estimation methods, please refer to "Super Intermediary or Business Wizard? Another look at the cross-chain bridge leader LayerZero from V1 to V2 in the past year"

However, our purpose today is not to sort out such a macro conclusion, nor to understand it by relying on a fantasy virtual valuation. Instead, we hope to go into the details, understand its deeper principles, and analyze the future development of the market.

1.4. What demand scenarios can jito support?

This topic is actually what types of attacks are currently being launched by MEV?

The most common type is the Frontrun type, for example:

- Arbitrage, arbitrage, like Ethereum, risk-free arbitrage.

- Sandwitch Attack, a typical sandwich attack. On SOL, the profit of a sandwich is about $2.

- JIT - Just in time liquidity, an operation that provides instant liquidity.

There is also a large category of Backrun trailing type:

Refers to inserting arbitrage transactions after target transactions (such as large DEX transactions, liquidation events), and taking advantage of the market fluctuations caused by the target transactions to make profits. The specific scenarios are:

- DEX arbitrage: You can understand that any transaction will cause a direct spread between different DEXs. Then follow up to smooth out the spread.

- Liquidation Follow-up: After the user's collateral is liquidated, the follow-up transaction acquires the assets at a discount and resells them.

- Oracle delay: before the oracle updates the price, the reverse operation is performed based on the outdated price.

In addition to the obvious attack scenarios, other acceleration scenarios are also suitable for Jito. So objectively speaking, Jito cannot be said to only serve mev, but serves all scenarios with acceleration and batch transaction bundling requirements.

For example, in the lively opening event on Solana, the dealer will actually use the bundling mechanism and acceleration mechanism of the Bundle to open the market + deploy chips and other operations.

For example, major exchanges can actually avoid being attacked by bundling tips for users with large transactions. However, it should be noted that these cannot actually prevent the verifier from doing evil (in fact, you cannot determine which verifier is doing evil).

2. In-depth understanding of the system differences between Solana and ETH

Why is Jito such a good fit for Solana?

Why is there no bullish competition in this market like ETH?

We need to start from the system differences between the two. You may have heard of POH consensus many times, but in fact, Solana’s transaction life cycle is different from ETH, which also creates completely different ecosystems for the two.

2.1. ETH’s MEV pattern

Two years ago, on the first anniversary of the Ethereum merger, the author once systematically analyzed: "MEV landscape one year after the Ethereum merger"

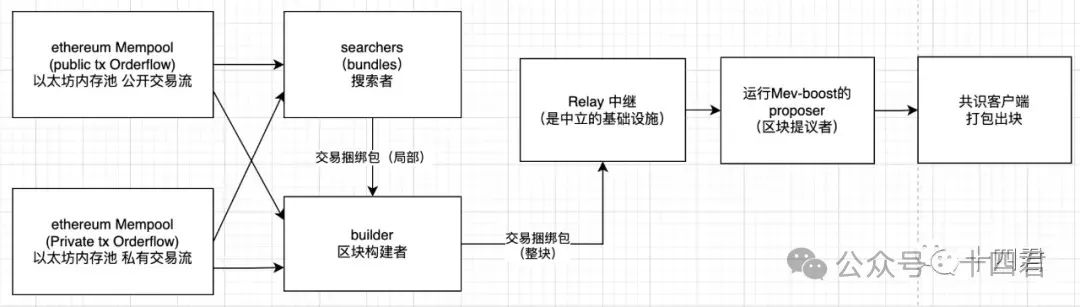

It can be clearly seen that the system life cycle of Ethereum is very clear:

[Image source: https://mp.weixin.qq.com/s/IepFvVpIxLpkXV5qgF68Rw]

This is because after the merger, two very important points emerged for MEV:

1. The interval between Ethereum blocks has become stable. It is no longer the relatively discrete random interval of 3-30 seconds. This has both advantages and disadvantages for MEV. Although Searchers do not need to rush to send out slightly profitable transactions, they can accumulate a better total transaction sequence and hand it over to the validator before the block is generated. However, it also intensifies the competition among Searchers.

2. Reduced incentives for miners. This has made validators more willing to accept MEV transaction auctions, allowing MEV to reach a 90% market share in just 2-3 months.

So there are roles such as Searcher, Builder, Relay, Proposer, and Validator.

The life cycle of each block is:

- Builders create a block by receiving trades from users, searchers, or other (private or public) order flows

- The builder submits the block to the relayer (i.e. there are multiple builders)

- The relay verifies the validity of the block and calculates the amount it should pay to the block producer.

- The relay sends the transaction sequence package and the revenue price (also the auction bid) to the block producer of the current slot.

- Block producers evaluate all the bids they receive and choose the sequence that gives them the highest return.

- The block producer sends this signed header back to the relay (which completes the auction round)

- After the block is released, the rewards are distributed to the builders and proposers through the transactions in the block and the block rewards.

Therefore, the author believes that Ethereum's MEV must be a situation where there is a high degree of internal competition between Searchers and Builders.

The actual data is also true: the overall yield rate has dropped significantly by 62%.

- One year before the merger, the average profit calculated from MEV-Explore was 22MU/M (starting from September 21 and ending before the merger in September 22, the numerical merger has Arbitrage and Liquidation modes)

- One year after the merger, the average profit calculated from Eigenphi is 8.3MU/M (starting from December 22 to the end of September 23, the value combines Arbitrage and Sandwich modes)

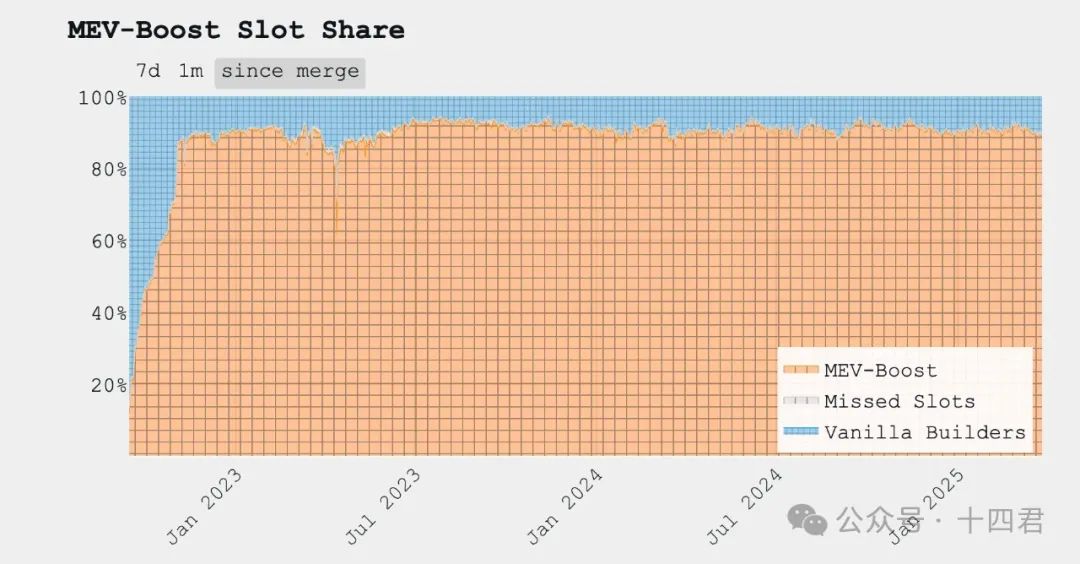

Of course, you may think that MEV-boost on ETH is growing faster, right? Indeed!

But fast growth does not mean high profits? We have just analyzed how much profit is. The root cause of Ethereum’s fast growth is that the incentives for miners have been reduced, which has prompted validators to be more willing to accept MEV transaction auctions, so that it can reach a 90% market share in just 2-3 months.

[Image source: https://mevboost.pics/]

The biggest difference between ETH and Solana is that there are multiple builders, and their different final returns affect the decision-making of validators, thus forming competition among builders.

Because of competition, searcher’s profits are constantly shrinking. Because of competition, besides the algorithm, the only thing that affects the builder is the amount of data.

Searchers that cannot compete will exit the market, while builders that can obtain large amounts of data often have their own infrastructure and market reputation to form a stable total order flow, rather than relying on the propagation of Mempool between nodes.

This will result in ETH's MEV market being more market-oriented than a purely oligopolistic platform system like Solana, thus being able to give users some respite.

2.2. Solana’s Blockchain Mechanism

After understanding the ETH system, please clear your mind, because many things in Solana are different from Ethereum, even the traditional blocks are different.

It is these mechanisms that are the root cause of the rampant mev in the Solana system.

We can use a table to quickly compare these four core features

The key lies in the two features of no memory pool and direct connection to the leader. The former brings transaction delays and the latter brings about malicious verifiers.

2.2.1. Solana actually has no memory pool

The 200ms delay of jito mentioned earlier, as well as its synchronous transmission to the blockengine, is actually a kind of monetized memory pool. So objectively speaking, if it does not have a memory pool mechanism (this is actually an optimization function of Solana to increase speed and protect privacy), how will it affect the block generation mechanism of transactions?

If you are an ordinary user, you initiate a transaction and send it to a certain node, which is equivalent to broadcasting.

Then under the default configuration, this node will immediately look for the current leader and the next leader (a total of 2 validators) and submit your transaction.

As for the transaction order, we need to distinguish between native Solana and jito-solana:

- Native Solana: After the leader receives the transaction, in theory, it will follow the FIFO (first in, first out) principle and whoever gets to the leader first will be included in the transaction sequence. Combined with the POH mechanism, it is equivalent to dividing a block into a large number of small ticks for synchronization.

- Jito-Solana: Normal transactions to the leader have a queue for calculating the current gaslimit (called CU in the SVM system, computing resources), and its weight is lower than that of Bundle transactions, so normal transactions will be behind Bundle transactions. If it is the same transaction (if someone attacks you), then Jito-Solana will prioritize the transactions that attack you. Here, 80% is given to Bundle, and only 20% is given to traditional normal transactions.

Therefore, Solana does not have a memory pool, but only reduces public transfers, rather than completely eliminating transfers (which is also impossible).

This feature makes the Searcher on Solana exclusive to high-end players.

2.2.2. The leader of subsequent blocks is predictable

Validators will take each epoch as a unit (about 2-3 days), during which time they will continuously randomly sample from 1,300 validators. The VDF algorithm is used here, and there will be a weighted effect of staking weight.

For example, if the total sol staked is 2 million, and you have staked 200,000 sol, then you will have a 10% chance of being drawn in each random draw.

If you win the lottery, you will be responsible for the next 4 slots (the benchmark concept of blocks in Solana) of about 1.6 seconds.

This speed is very fast, so any valid node can calculate who the subsequent validator is, and try to connect with him to submit the user's transaction. Due to network delays, it is also easy for the transaction to miss the current leader and be delivered to the next leader.

2.2.3. Leader’s linking strategy also has stake weighting

That is, the SWQoS mechanism. The current leader's total p2p connection capacity is 2,500, of which 80% (2,000 connections) are reserved for SWQoS (that is, the nodes that have made pledges).

The remaining 20% (500 connections) are allocated to transaction messages from non-stake nodes.

It sounds confusing, but it is actually a new mechanism to prevent spam and enhance Sybil resistance. The purpose is to allow the leader to prioritize transaction messages proxied by other staking validators.

2.3. Why is Solana vulnerable to attacks?

Even many ordinary users, in order to prevent their transactions from being squeezed, think that they can also pay high Priority Fees (transaction priority fees) so that miners can package their transactions first? In this way, they will not be squeezed?

The truth is, it does have a little effect, but not much, and in extreme cases it can even have the opposite effect.

[Image source: https://explorer.jito.wtf/feestats]

From the above figure, we can see that the Priority Fees given by users are actually similar and proportional probabilities, while tips are prone to fluctuations and competition. Moreover, tips are essentially a separate transaction. From an external perspective, it is actually unknown which transactions are in the Bundle.

Therefore, no matter how high your priority fee is, you can only be ranked in the last 20% of the validator's queue for block generation in this slot. However, for the Searcher who can find your order at the beginning and launch a clamp attack on you, the average CU unit price of the Bundle with your high Priority Fees will be higher, and naturally it will be given priority in the validator's Bundle consumption queue and broadcast synchronously.

Similarly, other scattered Solana mechanisms seem to be mechanisms that help users not to be easily trapped. So why is Solana the most rampant? The key points are:

It is difficult to prove that the leader has done evil

There are AB2 leaders before and after the leader, and both can obtain all users' transactions, so the cost and ambiguity of leaderB doing evil are reduced.

You can imagine that, as the second leader, I see a profitable transaction, so I quickly construct a clamp attack and submit it to the blockengine for auction. Then, under the 80% Bundle priority mechanism, my attack will naturally take effect first, but the one packaged in it is leaderA.

So how do you determine that leader B is an attacker?

Of course, you can say that leaderA finally packaged the attack transaction, so he is the attacker, but in the default logic, 95% of the validators will do the same thing, so the chance of intervening with them becomes smaller.

The punishment of A is indeed unreasonable. After all, there are other links in the middle, which may also lead to information leakage, as follows.

Transaction retry, long stay time

Each slot only takes 400ms, but have you ever experienced a transaction on Solana that inexplicably stayed for more than 23 seconds?

You may have hastily thought that the performance of the node you are connecting to is not good enough, but it is not.

Because of the Swqos mechanism, if you are connected to a normal node, it will calculate and find the leader to submit the transaction. However, when the network is congested, it only has 500 connection pools for normal nodes. Once the connection fails and the submission fails, it will retry all transactions of the node every 2 seconds.

The above parameters are the underlying default parameters of the Solana node. Different nodes can have different settings (for example, change to 1s retry).

For ordinary users, how can the probability of encountering a retry be measured?

As of March 2025, Solana currently has approximately 1,300 validators and 4,000 RPC nodes.

Once the connection pool is crowded, 2700 nodes will compete for 500 connection pools within 1.6 seconds (4 slots). If the leader's space is not full, the next one will continue to look for the next one.

So let's assume that your transaction stays in the node for a long time, how will they treat it? If your CU price is not high enough, and the leader is full, and he has seen the transaction, what should he do?

Yes, they sell data. For nodes with large traffic, some searchers will buy them for 10,000 US dollars a month and acquire the order flow.

Meme narrative and the scale of staking income

First, in the meme market stage, because Solana’s mainstream narrative is the meme ecosystem, the pool on the chain is very shallow, which makes it easy for users to trade with a loose slippage setting in order to complete the transaction, which also amplifies the searcher’s attack revenue (currently, a few samples have been sampled, and all can reach a revenue of 2 US dollars, which is very high compared to ETH’s revenue of almost 0.1 US dollars)

[Image source: https://www.jito.network/zh/stats/]

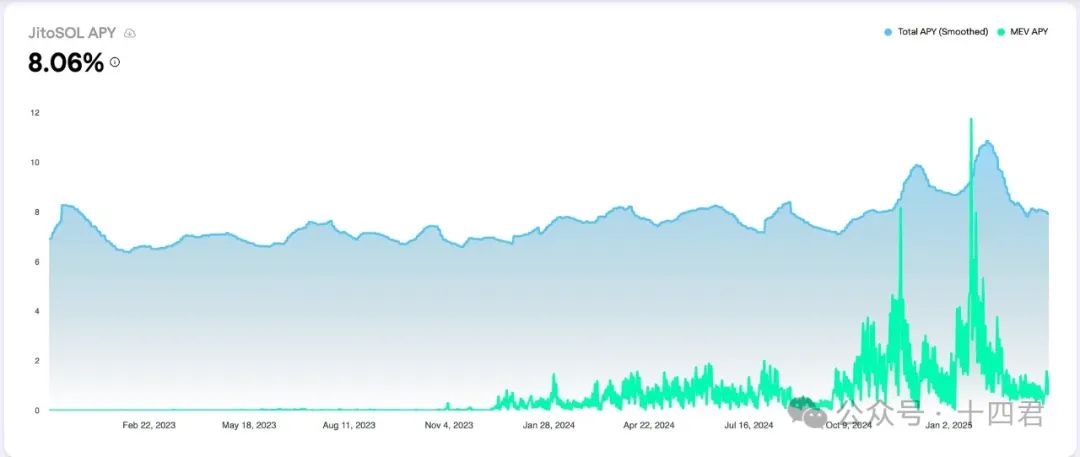

The second is Solana’s validator staking income, which is about 8% annualized, a relatively stable value over the years.

The enhanced annualized return of mev is about 1.5%.

The combination of the two means that if the staker runs the jito-solana client, they can get an additional 15-30% staking yield. When the local market explodes, the yield of mev can even exceed the staking yield itself.

2.4. Why are Solana’s validators prone to rebellion?

The profits are simply too high, and the costs are also very high, forcing validators to continuously expand their sources and increase their revenue.

The voting cost of the validator is about 300-350 SOL per year (estimated at $42,000 at the market price of $140) and the hardware cost is $4,200 (not including the cost of the dynamic network)

Solana's huge node configuration burden requires node performance to be at least 24 cores, 256GB of memory, and 2*1.9TBNVME.

The custom Latitude model that is common on the market is currently used by 14% of validators and costs $350 per month.

This ultimately resulted in only 458 of Solana’s 1,323 validators being profitable, which is why the SIMD-0228 proposal was voted down.

Judging from the results, this proposal will further reduce the incentives for block production, which will inevitably force smaller validators to withdraw. This will even lead to an irreversible change in the centralization of the platform. And when the income of mev increases and the income of essential work decreases, what do you think will happen?

Let’s take a look at the strategies of competitors other than Jito.

3. Other competitors of MEV on Solana

3.1. Paladin: VIP preemption and transaction protection

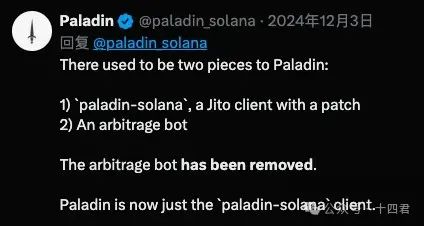

Current market share: 5%. It will be launched at the end of 2023. As of March 2025, the official announcement is that 205 validator nodes have deployed Paladin and pledged 53M SOL. Using the Paladin client can increase node income by approximately 12.5%.

In fact, it is essentially based on a forked and modified version of the Jito-Solana client.

The core selling point of the launch is

- P3 priority port: Let the leader of the block open this fast VIP channel and process it again according to the original FIFO rules.

- Identify and eliminate sandwich attacks: While this may initially seem detrimental to validator rewards, Paladin validators are compensated through a trust-based mechanism. Validators that avoid sandwiches can attract direct transactions, thereby creating an ecosystem of trust and increasing returns.

- Paladin Bot: This is an open-source high-frequency arbitrage robot that runs directly on the local validator node and is only started when the node is elected as a Leader. When a Leader has Paladin Bot, it will quickly execute simple and risk-free MEV strategies (such as two-to-two DEX spread arbitrage, centralized exchange and on-chain spread arbitrage, etc.), and the profits will be directly included in the validator's income.

As of December 3, 2024, the last bot has been officially deleted.

3.2. bloXroute: Network layer optimization + private channel protection

bloXroute Labs is an infrastructure company that provides the Blockchain Data Distribution Network (BDN), which has previously accelerated transaction broadcasts and reduced latency on chains such as Ethereum.

bloXroute does not directly participate in MEV allocation, but by providing faster channels, it can help front-running transactions reach the Leader faster.

Unlike Jito/Paladin, bloXroute does not directly modify the Solana verification client or introduce a transaction auction mechanism, but instead provides a faster message channel for all nodes at the network layer.

The main idea is to relay Solana's block "shreds" to all validators more quickly through a global acceleration node network, reducing the delay in data broadcast when the Leader generates blocks and the forks caused by poor network conditions. So the services provided are:

- Solana BDN acceleration: According to official documentation, bloXroute Solana BDN can reduce block fragment propagation latency by 30–50 milliseconds

- The MEV-Protect RPC service is similar to Ethereum’s protected private transaction port, which indicates that bloXroute plans to allow users to send transactions privately to Leaders through its RPC to avoid being seen by third parties, thereby preventing front-running or preemption.

3.3. BlockRazor: Network layer optimization + private channel protection

BlockRazor is a newly established MEV infrastructure project in 2024, with a team mainly from Asia. It is positioned as an "intention-centric network service provider" and plans to provide MEV Protect RPC, high-performance network acceleration, MEV Builder and other services on mainstream blockchains.

Scutum MEV Protect RPC: This is a private transaction gateway service launched by BlockRazor, similar to Flashbots Protect. Users can submit transaction bundles through Scutum RPC.

BlockRazor will ensure that these transactions are not published through the public mempool and are sent directly to block producers to avoid front-running or sandwiching.

4. Summary

4.1. How do you view the MEV competition landscape on Solana?

Just the day before yesterday, a new competitor entered the market

Warlock Labs raised $8 million on March 27, 2025, aiming to reshape on-chain order flow.

However, he focuses on the Ethereum track, planning to provide some kind of proof for the order flow data and register it on the chain to ensure that they are accurate and responsible in processing user transactions.

This is my point of view: in a truly good market, new competitors will continue to enter, but an oligopolistic market will lead to the blockage of challengers. So what kind of market does the platform expect to become?

Let us think more deeply about what is really important in this mev infrastructure?

Paladin is built on jito-solana, which means that jito can actually upgrade a version and no longer support the so-called P3 channel, just like the 3Q war of the year. In the end, whoever has a stronger need (obviously social) will win. The same thing happened when WeChat banned NetEase Cloud Music and other friends from sharing. If there were no larger layer of rule machines, this set of exclusive competition strategies could be used in any track indefinitely. And now paladin's 5% market share is also because of the early use of built-in bots to increase the profit of validators. Although his open source bot is only centered on non-strong offensiveness (i.e., doing brick-moving, not sandwiches, etc., which obviously damage the interests of users), it was still pushed offline by market opinion.

Moreover, several other competitors, such as bloXroute and BlockRazor, all take the route of acceleration + privacy channel. The so-called privacy is limited to providing only one leader at the moment, thus preventing the next company from doing evil, and directly attacking both parties when facing evil.

The acceleration capability is indeed a solid technical strength today, and it is also the focus of the next wallet/Dex market war.

Objectively speaking, Solana's original client code still has some historical debts, so someone once came out and modified the client to make the configuration lower and the synchronization faster. In addition, combined with the Swqos mechanism, being a validator can actually improve the connection stability and success rate.

In addition, Jito's blockengine system is actually a multi-center system, but no matter how multi-center it is (not completely decentralized), there will still be single points of failure. Since it is also the core link of the upstream, once it goes down, it is roughly equivalent to Solana going down.

Therefore, in order to achieve multi-node disaster recovery and speed up, the system still has to go through a wave of stress testing challenges. This is why there are more bugs in the Binance wallet, and many historical technologies have not yet been caught up.

But the issue of technical strength will eventually be resolved.

Any company can perform multi-node global optimization and establish the shortest channel based on the continent where the leader is located, so that their transactions can reach the leader quickly. They can also establish a multicast strategy to divert different user needs. The future competition results will inevitably be the result of refined operations.

But what cannot be solved is the problem of market competition crowding out.

If jito-solana takes advantage of its oligopoly and modifies the Bundle priority strategy from 80% to 90% or even 95%, then ordinary users will have to raise the Priority Fees infinitely to compete for the remaining 5% CU space.

However, when the total CU is underutilized, it will eventually affect the total value of the validator's revenue (and because a large number of transactions are piled up in the unprocessed queue, the validator has a stronger motivation to do evil), so Jito will not start such a competition mode unless it is absolutely necessary.

So why is ETH's market competition more open, while Solana's competition is more exclusive?

The author believes that the root cause is the lack of the Builder bidding role.

ETH can have multiple builders produce multiple final block sequences, and the validator only verifies and selects which one.

However, Solana has only multiple blockengines (all of which are owned by the same company), and the transaction queue it provides to the validator is actually a single Bundle (5 transactions), which eliminates the need for multiple Builders to compete.

Objectively speaking, it can be seen from the development history of ETH that this competition will significantly increase the income of validators and reduce the income of searchers. When the income of searchers decreases, the number of attacks will also decrease, and eventually a balance will be reached.

In the future when technology and market are balanced, what is real competitiveness?

I believe that when the technological gap is eliminated with talent competition and investment, and when the market is centralized and decentralized, it will eventually affect the overall SOL ecosystem, and all will be resolved. Solana has already started discussions on multiple builders, and even further started discussions on solutions for multiple leaders to generate random blocks.

Although more leaders also mean that more people will get your order, since the person who finally produces the block is a random one from multiple simultaneous queues, it also realizes the competition among multiple builders in disguise, and the market impact will be the same as before.

Then the real competitiveness will be transferred to the data island of order flow.

For example, Jupiter has occupied more than 80% of the DEX market share, so its order flow is the most popular. It depends on how it balances providing the best price or randomly picking some "lucky geese" to make a profit, even if it loses some brand reputation.

I think the reason why they don't build their own mev infrastructure is probably that in the face of the developing market stage, no one can say that they are as strong as the traditional big companies, so focusing on profits at this time will give competitors the opportunity to overtake.

And mev is always a game theory issue. Once it reaches a monopoly position, with the support of the validators on which the monopoly relies, they will push the facilities to make profits.

Any dragon slayer seems to have the unstoppable potential to become a dragon, and become a combination of dragon and warrior.

Of course, you may say that Jito was originally an infrastructure aimed at MEV, so how could it be a dragon slayer?

4.2. What are Jito’s contributions and demerits to Solana?

A lot of what I talked about before were all Jito’s fault, so did Jito have any merits?

Objectively speaking, Jito has made contributions.

When I started looking at Solana three years ago, I sneered at it (ok, I admit I was too loud at that time), but the root of such analysis was that its downtime rate was too high.

Why is there such a high downtime rate?

On the one hand, there were too many pitfalls in the early code, but later it was discovered that paying money could solve most of the problems (machine configurations continued to improve).

On the other hand, there is the FiFo strategy. When there is a highly profitable transaction on the chain, even if it is just a backrun attack, whoever follows closest will make a higher profit from the transaction.

Obviously, each Searcher will build a set of facilities to send transactions to the leader as quickly as possible, so early leaders are always vulnerable to flood attacks.

With the emergence of blockengine, Jito has further created a bidding process. If you see profit, you can bid first, and the traffic will be diverted here.

The auction here also has a function to intercept failed transactions. Because if your transaction conflicts with someone else's, and the other person's price is higher, then since the two Searchers are holding the same person's transaction, there must be a storage conflict. So if you cannot win the bid, the blockengine will directly reject you, and you can raise the price again and continue the auction (it may also reject you randomly, making you mistakenly believe that you must bid further. OK, how friendly is big data killing the familiar).

Of course, you may ask, why do we still see so many failed transactions on Solana?

Of course, because the blockengine is multi-center, the block generation speed of 400ms between different centers makes it impossible to synchronize data quickly, thereby eliminating the auction errors caused by different blockengines.

Therefore, the author believes that Jito also has a contribution, after all, he has significantly reduced Solana's downtime rate.

In addition to downtime, his bundled transactions also provide the market with multiple application scenarios.

For a market to be prosperous, it actually needs to serve market makers well. Solana’s most explosive market is the Meme market, which is inseparable from the group that opens the market. They need to "implicitly" start collecting low-priced chips at the same time as the launch. This is a highly sniped scenario. If the operator of the market cannot collect enough profitable low-priced chips, then he may simply give up pulling up the market and reopen it directly.

In fact, it was disadvantageous to both parties. After all, his initial move was wasted.

There are also other transactions that need to be accelerated, such as various dex. Now they trust that jito-solana will not sell data as blatantly as before. Therefore, for high-value transactions, users will be asked to pay an additional tip fee and take the fast route of blockengine, directly occupying 80% of the CU processing queue, thereby increasing transaction speed and avoiding being squeezed.

Increase the returns of Solana stakers and improve the overall decentralization

The previous data has been analyzed. Solana’s own staking income is about 8% annualized, and through Jito’s mevtip income, it can reach about 10%, which is a good space.

And only 458 of Solana’s 1,323 validators are profitable, and the others are not completely unprofitable (otherwise who would do it). In fact, the others are either directly malicious, indirectly malicious, or have no motivation to make money (for example, just to speed up Swqos). In essence, the above statistics are based on staking income, rather than fully incorporating mev income.

Therefore, it is because of the existence of jito that the remaining 800 validators can be profitable and that Solana is less centralized today.

Therefore, on the whole, Jito-Solana still has some merits. At least for now, it has not completely adopted an exclusive competition strategy. At this time, there is still an opportunity for a third party to enter.

4.3. How will the MEV landscape develop in the future?

I have mentioned several key points before. I think that although it seems that there is one dominant player and many strong companies now, it is actually a time when opportunities are lurking.

First, because the MEV profits on Solana are generally higher (around 2U, better than ETH's 0.1U), the meme trend will continue to be traded forever with different narrative scenarios, so new Searchers will enter. Although the higher order flow acquisition cost on Solana has blocked some small players, the competition among large players will also increase investment along with profits.

Second, there are a lot of opposing voices on Solana, competing with the MEV infrastructure. This forced Jito to announce the closure of the channel for selling data, and also forced Paladin to delete the built-in bot function. Among proposals such as Simd-228, there is also the Simd-96 proposal that has been passed.

The original half of the base fee + Priority Fees of the validator's reward will be destroyed, but now only half of the base fee will be destroyed. This indirectly increases the income of the validator from packaging normal user transactions, thereby increasing their motivation to fight against Jito's reduction of the weight of ordinary transactions. There are constantly new proposals participating in the game of Solana's macro decision-making.

Third, the profit margin of mev is large enough. For example, last year, Jito Labs' fee income in October was US$78.92 million, twice the record of US$39.45 million set in May, and higher than old DeFi protocols such as Lido and Uniswap. Even if Jito itself has to share dividends with validators, the overall spread is the lower limit of the scale of users' losses.

The greater the loss, the greater the motivation, and users' expectations for reliable services can also be quantified, which is the opportunity for BlockRazor and bloXroute.

Moreover, I am looking forward to some more cutting-edge explorations:

- Starting from privacy transactions: There are threshold encryption, delayed encryption, and SGX encryption, which basically require decryption conditions from encrypted transaction information, or time locks, multi-signatures, or trusted hardware models.

- Starting from fair trading: there are fair sorting FSS and order flow auction MEV Auction, as well as MEV-Share, Mev-Blocker, etc. The difference lies from no profit at all to sharing profits to weighing profits, that is, it is up to the user to decide what cost to use to obtain the relative fairness of the transaction.

- Improve PBS at the protocol level. Currently, PBS is actually a proposal of the Ethereum Foundation, but it has been separated with the help of MEV-boost. In the future, such core mechanism will be transformed into the protocol mechanism of Ethereum itself.

Most of these have already been proposed on Ethereum itself, but the compatibility differences have prevented them from coming to the attention of users. However, these are also areas where Solana itself can learn from.

5. Final words

The end of the competition is often not surpassed by the efforts of the same track. What will kill Jito will not be the next Jito (he also has his merits and faults), but a completely new form of application.

In my previous study [UniswapX Protocol Interpretation], I summarized the profit sources of UniswapX’s operating process and wanted to fully depict the specific rate of return of MEV. After all, this is the source of what it fights against and distributes dividends to users (essentially losing the real-time nature of transactions but in exchange for a better exchange price).

Similarly, order book exchanges (even decentralized exchanges) are also good tools to fight MEV. When computing power is further improved and daily transactions are further expanded in the future, the AMM mechanism and the corresponding MEV attack scenario will disappear. However, the other challenges faced by order books are no less than the MEV problem.

From the recent twists and turns of Hyperliquid, we can see that, putting aside the concerns about centralization, as web3 as a whole moves towards compliance regulation, the players at the table have already put on suits and stepped into the international arena.

At this time, compliance is an all-round sword. After all, at this time, it stands on the side of the user.