Author: Spirit, Golden Finance

Preface

As the cryptocurrency market matures, exchange-traded funds (ETFs) have become an important bridge between traditional finance and digital assets. This article summarizes the latest progress of crypto ETF applications, covering in detail the application institutions, feasibility analysis, introduction to underlying assets, token price performance in the past month, and SEC review and response deadlines, etc., to provide readers with comprehensive market insights and future prospects.

1. Overview of the latest crypto ETF applications

As of February 19, 2025, the crypto ETF market continues to heat up, especially after the approval of Bitcoin and Ethereum spot ETFs, more institutions have submitted applications for other cryptocurrencies. The following are the main developments:

ADA (Cardano) Spot ETF

- Applicant/Organization: Grayscale Investments

- Progress: Grayscale submitted the world's first ADA spot ETF application to the US SEC in the second week of February 2025. After the news was announced, the price of ADA rose by 16%. The application has now entered the preliminary review stage of the SEC.

- Final Response and Review Period: The SEC generally has a 45-day initial response period after receipt of the application (ending approximately March 25, 2025), which can be extended to 90 days (approximately May 10, 2025).

XRP Spot ETF

- Applicants/Institutions: Bitwise Asset Management, Grayscale, 21Shares, WisdomTree, Canary Capital

- Progress: Bitwise formally submitted an application for an XRP spot ETF through the Cboe BZX exchange in February 2025, and the SEC confirmed receipt on February 18. Other institutions such as Grayscale and 21Shares also submitted similar applications in late 2024 and early 2025, and are currently under review.

- Final response and review period: Taking Bitwise as an example, the SEC needs to give a preliminary response within 45 days (approximately April 4, 2025), which can be extended to 90 days (approximately May 19, 2025).

SOL (Solana) Spot ETF

- Applicants/Institutions: VanEck, Grayscale, Bitwise, 21Shares, Canary Capital

- Progress: Multiple institutions submitted SOL spot ETF applications in late 2024 or early 2025, of which Grayscale and VanEck’s applications have entered the 21-day public comment period.

- Final response and review period: Taking Grayscale as an example, the SEC has 45 days for a preliminary response after the comment period (approximately the end of March 2025), which can be extended to 90 days (approximately mid-May 2025).

LTC (Litecoin) Spot ETF

- Applicants/Institutions: Grayscale, Canary Capital, Nasdaq (on behalf of undisclosed issuers)

- Progress: Nasdaq submitted an application for LTC spot ETF on January 29, 2025, and the SEC has accepted it and entered a 45-day preliminary review (as of approximately March 15, 2025). Grayscale and Canary Capital's applications are also progressing simultaneously.

- Final response and review period: Initial response deadline is March 15, 2025, and can be extended to 90 days (approximately April 29, 2025).

DOGE (Dogecoin) Spot ETF

- Applicants/Institutions: NYSE Arca (on behalf of undisclosed issuers), Grayscale Investments, Bitwise Asset Management, 21Shares, WisdomTree, Canary Capital

- Progress: The DOGE ETF application submitted in early 2025 is still in the early stages, and the SEC has not yet disclosed more details, so progress is slow.

- Final response and review period: An initial response period of 45 days is expected (approximately mid-March 2025), which can be extended to 90 days (approximately the end of April 2025).

2. Through feasibility analysis

The feasibility of crypto ETFs is affected by regulation, market demand, legal risks, and technological maturity:

Regulatory environment

- Positive factors: The new SEC leadership (Paul Atkins) is more crypto-friendly, and expectations for policy easing in 2025 are increasing. The success of Bitcoin and Ethereum ETFs sets a precedent for other currencies.

- Challenges: SOL and XRP were once questioned by the SEC as "securities" and their legal status needs to be clarified; ADA and LTC are more likely to be approved due to their decentralized characteristics; DOGE faces greater uncertainty due to its meme attributes.

- Possibility of approval (Bloomberg analyst prediction): LTC (85%), ADA (70%), SOL (60%), XRP (50%), DOGE (20%).

Market demand

- LTC and ADA have certain demand due to their mature technology and community support; SOL benefits from the DeFi and NFT ecosystem, but is negatively affected by the downward trend of the MEME market; XRP has the attention of institutional investors; DOGE relies more on retail sentiment and may be limited in scale.

3. Introduction to ETF underlying assets and token price performance in the past month

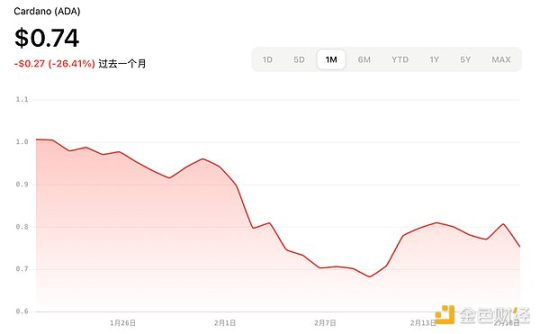

ADA (Cardano)

Introduction: Cardano is an open source blockchain platform that focuses on academic research and sustainability, and supports smart contracts and DApp development.

Performance in the past month (January 18, 2025 - February 18, 2025): The price dropped from $1 to $0.74, a drop of about 26.41%.

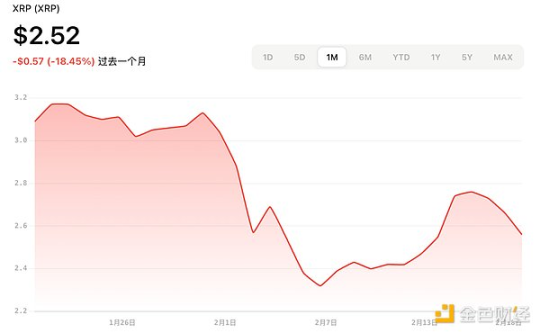

XRP (Ripple)

Introduction: XRP is supported by Ripple Labs and focuses on cross-border payments, emphasizing fast and low-cost transactions.

Performance in the past month: The price dropped from about $3.09 to $2.56, a drop of about 18.45%.

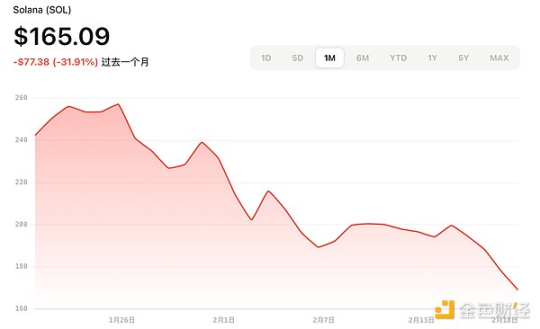

SOL (Solana)

Introduction: Solana is a high-performance public chain known for its high throughput and low latency, and is widely used in MEME, RWA, DeFi and NFT.

Performance in the past month: The price dropped from about $242 to $169, a drop of about 31.91%.

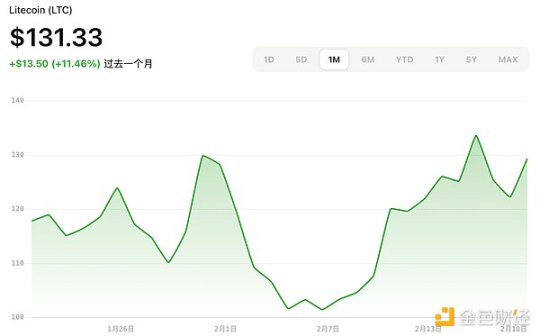

LTC (Litecoin)

Introduction: Litecoin is a Bitcoin fork, positioned as the "silver of Bitcoin", with faster transactions and lower fees.

Performance in the past month: The price rose from about US$117 to US$131.33, an increase of about 11.46%, boosted by ETF applications and market sentiment.

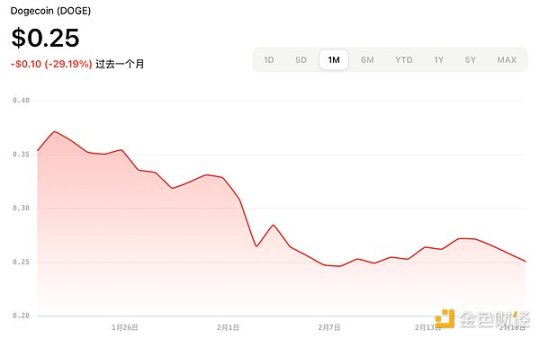

DOGE (Dogecoin)

Introduction: Dogecoin originated from meme culture and is now a top cryptocurrency by market value, driven by the community and celebrities (such as Musk).

Performance in the past month: The price dropped from about $0.35 to $0.25, a drop of about 29.19%, with high volatility.

summary

As of February 19, 2025, the crypto ETF market has ushered in a new wave of enthusiasm. Many institutions have submitted spot ETF applications for ADA (Cardano), XRP, SOL (Solana), LTC (Litecoin) and DOGE (Dogecoin), promoting the further integration of crypto assets into traditional finance. Grayscale, Bitwise, VanEck and other asset management giants are leading the application, with different progress: LTC and ADA have a higher probability of approval due to their mature technology and regulatory friendliness, SOL and XRP need to overcome the definition of "securities", and DOGE faces greater uncertainty due to its meme attributes. The review period is mostly concentrated in March to May 2025, and the open attitude of the new SEC leadership injects optimistic expectations into the approval.

In terms of the performance of the underlying assets, the decline in the past month has been between 20% and 30% due to the overall market correction. Feasibility analysis shows that regulatory relaxation, market demand and technological maturity are key drivers for ETF approval, but legal risks remain the main challenge. In the coming months, investors and industry observers need to pay close attention to the final response from the SEC. Crypto ETFs may become an important indicator of the crypto market in 2025.