1. Asian Web3 Market

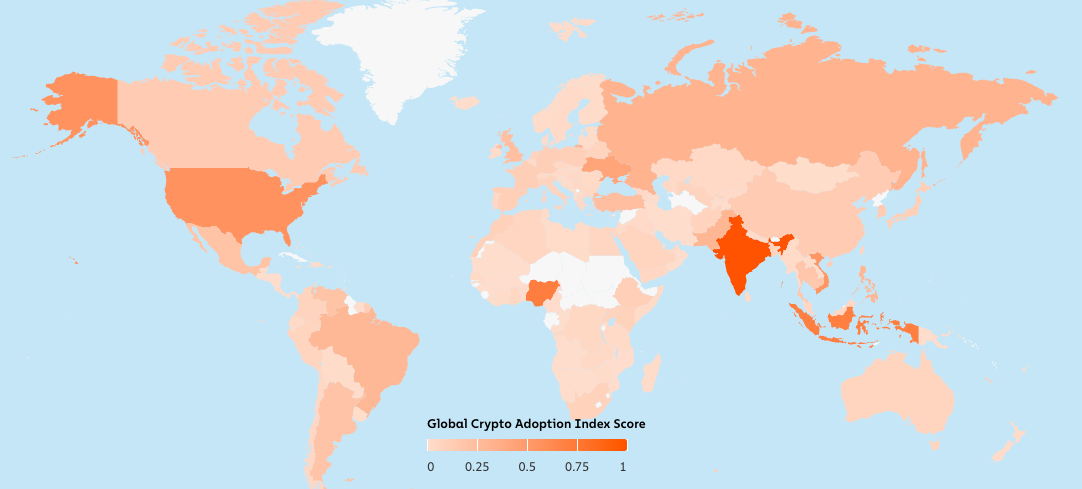

Source: Chainalysis

Asia’s characteristics include: 1) a young Web3 population, 2) strong technology adoption, 3) a mature regulatory framework, and 4) active corporate participation. These factors make Asia a leading force in the global Web3 space. Among the many countries in the region, we highlight the following key markets:

South Korea: Enterprise-level companies are entering the Web3 space, and blockchain game development plays an important role. Large gaming companies are actively preparing for the release of blockchain games, marking a shift in the industry.

Japan: Initiatives to revitalize the Web3 industry are driving more corporate participation. Globally renowned IP players such as Sony and Bandai Namco are expected to bring new developments.

Indonesia: Indonesia has a large population and a rapidly growing market with considerable long-term potential. The positive attitude of regulation includes the launch of a state-owned Crypto trading platform.

Vietnam: Vietnam is expected to become a leader in Asia, especially with high Web3 penetration among young people and a competitive developer group.

Thailand: Both the financial sector and the public are actively involved in the crypto market. Traditional financial institutions are leading the way in Web3 initiatives.

Singapore: Despite the government’s clear regulatory framework and role in areas such as STOs, RWAs, and payments, Singapore faces the challenge of seeing a recent decline in corporate support.

India: With a large talent pool and a thriving startup ecosystem, India has great potential in the Web3 space. Success stories like Polygon highlight the country’s ability to drive global Web3 infrastructure projects.

Each of these countries is shaping the future of the Asian Web3 market with unique advantages. Below is a tracking of news from these countries throughout Q3, providing some insights into emerging trends and opportunities in the Asian Web3 space.

2. New regulatory framework

South Korea

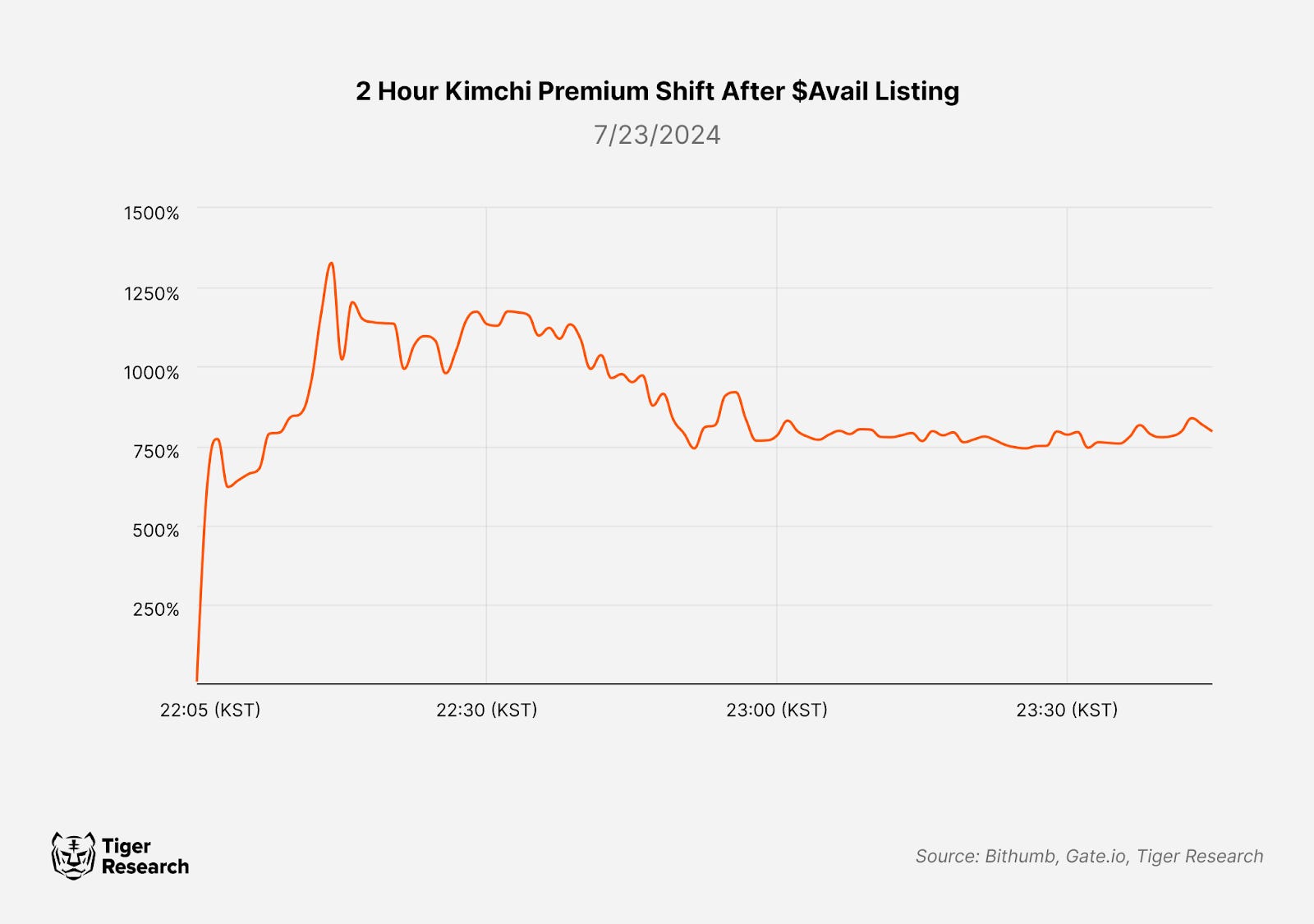

On July 19, 2024, South Korea introduced the Virtual Asset User Protection Act, which aims to enhance investor protection and ensure the future development of the market. The main provisions of the bill include 1) a clearer definition of virtual assets, 2) mandatory interest payments on customer deposits, 3) requiring insurance coverage for unexpected situations, 4) tightening regulations on unfair trading, and 5) imposing penalties for market manipulation (MM) without exception.

The new regulations are being actively applied to market supervision. In the future, relevant departments will continue to evaluate the effectiveness of these regulations and track the market's response to them.

Source: Bithumb, Gate.io, Tiger Research

2.2. Indonesia

Indonesia’s Financial Supervisory Authority (OJK) launched the sandbox framework in June 2024 as part of Regulation No. 3/2024 on Technological Innovation in the Financial Sector (POJK 3/2024). The regulation covers a wide range of blockchain-related technologies and is expected to bring previously unregulated financial services into the formal system.

Areas of focus include virtual asset services such as staking and stablecoins, which now have the opportunity to be tested and potentially recognized within the regulatory framework, promoting the development of new financial services, especially at the intersection of blockchain and traditional finance, and the tokenization of real assets (RWAs). These innovations are expected to revolutionize Indonesia's financial markets.

The sandbox regulation reflects Indonesia’s proactive approach to supporting financial innovation while ensuring consumer protection and market stability. This move is expected to further accelerate the growth of Indonesia’s fintech industry.

Participating businesses must meet specific criteria, such as demonstrating innovative and unique services for Indonesian consumers and businesses. In addition, they must submit the required documents as part of their application to the OJK. Approved companies will have one year to test their services and, if they pass the assessment, a six-month window to obtain a full license. This balanced approach provides flexibility for companies to enter the market quickly while ensuring sufficient time to experiment and perfect their services.

2.3. Thailand

The Securities and Exchange Commission of Thailand (SEC) has taken significant steps to promote innovation in the digital asset and Web3 sectors. In August 2024, the SEC introduced a digital asset sandbox, which complements its existing detailed licensing framework. This allows for the testing of key initiatives that are in line with emerging market trends.

These measures provide space for experiments in multiple areas such as RWA tokenization, payment systems, security protocols, decentralized finance (DeFi), etc.

This move is also expected to directly benefit users, who will gain access to new features and products in the digital asset and Web3 space. A notable example is RealX, Thailand’s first tokenized RWA, which was listed on Bitkub due to the SEC’s openness to innovation.

Looking ahead, more groundbreaking projects are expected to emerge as new possibilities unfold. At the same time, the development of clear and comprehensive laws and regulations is expected to enhance market stability. Thailand’s proactive attitude will play a key role in shaping the future of the country’s digital asset ecosystem.

3. Initiatives

3.1. India: Blockchain Framework (NBF)

On September 4, 2024, Indian regulators released the National Blockchain Framework (NBF), an important step in the country’s digital transformation strategy. NBF is not only about technology adoption, but also an ambitious plan to create a more secure and efficient digital infrastructure by addressing the limitations of legacy systems that have emerged in India’s rapid digitalization process.

NBF has several key goals: to increase transparency in the public sector, fight corruption, promote technological innovation, and drive economic growth. In addition, the program aims to improve citizen-centric services. By leveraging the immutability and transparency of blockchain, NBF aims to improve the reliability of regulatory transactions and records, significantly increase the difficulty of tampering with data, and enhance citizens' trust in the regulatory system.

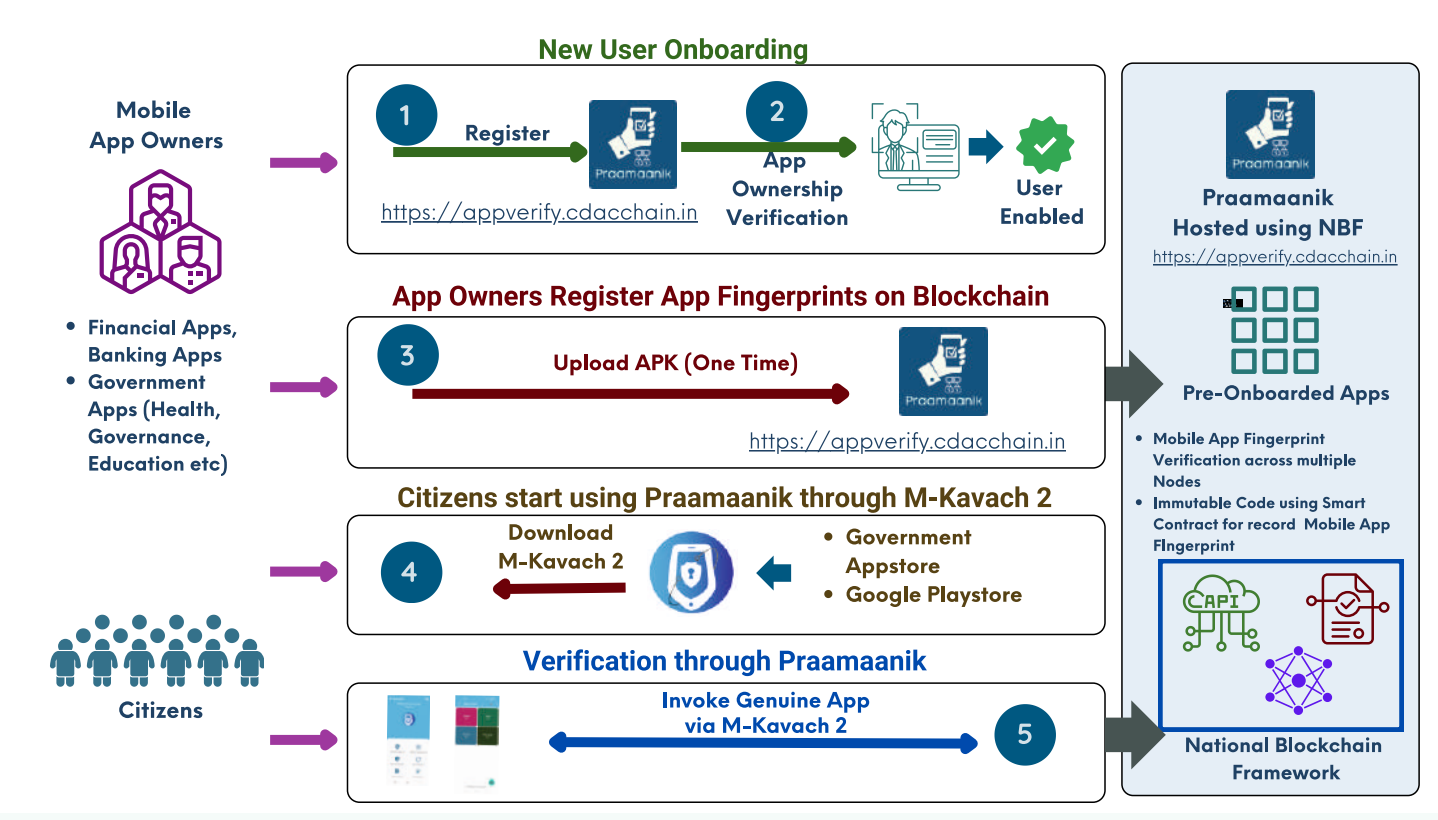

Source: NBF-brochure

The key components of NBF include:

Vishvasya Blockchain Stack: This Blockchain-as-a-Service (BaaS) offering provides decentralized infrastructure that enables startups and enterprises to quickly develop new blockchain services. By leveraging data, the stack aims to accelerate the adoption of blockchain in the public and private sectors.

NBFLite: A lightweight blockchain platform designed for startups and academia, supporting rapid prototyping, research, and education. It aims to promote blockchain innovation and talent development.

Praamaanik: A blockchain-based mobile app provenance verification solution, Praamaanik improves the security of the Indian mobile ecosystem, preventing the spread of malicious or fake apps, thereby enhancing user trust and system integrity.

National Blockchain Portal: This comprehensive platform provides the latest information on blockchain technology, including news, events, and educational resources. The portal aims to increase public awareness and accessibility of blockchain knowledge.

India's NBF is one of the few state-led initiatives in the world aimed at supporting blockchain technology in multiple industries. It considers blockchain as critical infrastructure and is expected to change the country's digital landscape. If successful, NBF could become a model for other countries, showing how blockchain can be integrated into national infrastructure.

4. Enterprise-driven market

4.1. Japan

Japan's blockchain ecosystem continues to be shaped by the financial sector. A notable recent development is Sony's foray into the blockchain space, partnering with blockchain company StarTale to launch its new Ethereum Layer2 solution, Soneium. Announced in August 2024, Soneium aims to provide scalable infrastructure for Web3 applications by leveraging Sony's extensive global presence and user base.

Source: Soneium

Sony also launched an incubation project, Soneium Spark. The project supports developers by providing infrastructure access, mentorship, industry partnerships and funding opportunities of up to $100,000. The move comes after Sony Bank announced plans to launch a yen-based stablecoin, further demonstrating Sony's growing involvement in the Web3 ecosystem and exploring new opportunities in blockchain technology.

Currently, Soneium is in the testnet stage called Minato, and the mainnet is expected to be launched in the first quarter of 2025. More than 50 projects are being developed or planned to be deployed on Soneium. This marks an important step for a large technology company to enter the blockchain field.

On the political front, Japan is also going through major changes. Ishiba, who is expected to become the next prime minister, is from the same Liberal Democratic Party as the current prime minister, Kishida. However, his stance on the blockchain market remains uncertain. Although Ishiba's policy proposals include using blockchain and NFT technology to revitalize rural areas, the initiative is mainly focused on regional development rather than promoting the broader blockchain industry. It is unclear how his policies will affect Japan's blockchain sector once he forms a cabinet.

Vietnam

Vietnam’s blockchain ecosystem is growing rapidly, and the strategic combination of education and industry development is driving this progress. The efforts of the Vietnam Blockchain Association (VBA) and the Blockchain and Artificial Intelligence Innovation Academy (ABAII) are at the heart of this process.

Source: ABAII

VBA has partnered with Tether to host educational conferences in major cities in Vietnam. Additionally, VBA has partnered with ABAII to provide blockchain education to university students through the UniTour program, a series of university visits designed to spark student interest in blockchain technology. In addition to education, VBA has also played a key role in helping students and young professionals transition into the blockchain industry. One notable initiative is the SwitchUp accelerator program, which provides mentorship, support, and investment to Web3 startups and projects.

Since its official launch on January 10, 2024, ABAII has carried out an active educational campaign. Accredited by the Ministry of Science and Technology and supported by the VBA, ABAII aims to become a leading center for blockchain research, development, and application in Vietnam. Its long-term goal is to provide blockchain education to 1 million Vietnamese citizens by 2030. In the short term, ABAII plans to train 100,000 students in 30 universities.

This coordinated approach of integrating education and startup incubation has laid a solid foundation for the sustainable growth of Vietnam’s blockchain industry. With a clear strategy, Vietnam is positioning itself to become a key player in the global blockchain market.

5. Observation of emerging market countries

5.1 Cambodia

Cambodia’s Crypto market has been in the spotlight lately, but not for good reasons. In August 2024, a major scandal broke out at the Huione Guarantee company for alleged illegal transactions worth $49 billion. As a result, much of the news in Cambodia’s crypto market has been dominated by crime and fraud.

However, Cambodia’s blockchain story is not defined solely by this turmoil. Until 2022, Cambodian regulators have been actively exploring Crypto adoption. For example, the central bank developed a blockchain payment system called Bakong, highlighting its early efforts to embrace digital finance.

Currently, the Cambodian market seems somewhat stagnant. However, this state presents opportunities for businesses that recognize the potential for growth. Recent industry trends show that more and more businesses are beginning to utilize blockchain technology, indicating that entrepreneurial activity is on the rise.

Cambodia is a market to watch. Despite its chaotic state, businesses that proactively work with regulators and take prudent risks may still succeed. However, this is not a market for large global companies, but rather an area where small and medium-sized enterprises (SMEs) can thrive with a proactive and flexible approach.

Cambodia offers a first-mover advantage to SMEs willing to survive in a turbulent regulatory environment. Close communication with regulators and a deep understanding of local regulations will be key to mitigating risks and seizing opportunities. However, caution is still necessary. Legal risks and market instability remain significant concerns.

Ultimately, Cambodia’s Crypto market is a “double-edged sword” that offers both risks and rewards. Businesses with strong risk management capabilities and a willingness to adapt to local conditions may find promising opportunities in this dynamic and evolving market.

6. Conclusion

While African markets, including Nigeria, are gradually gaining momentum in the crypto space, Asia remains the fastest growing region. To date, many of the changes in Asia have been driven primarily by regulators, large institutions, and corporations, while services for everyday consumers are still in the early stages of development. Nonetheless, these developments represent key steps for future growth.

The Crypto market in Asia is evolving rapidly, driven by positive regulatory policies, significant corporate investment, and strong interest from the younger generation. While mass adoption is still on the road ahead, the current phase is critical to laying the necessary foundation. We will continue to monitor the Asian market as it continues to mature.

Author: Ryan Yoon, Yoon Lee