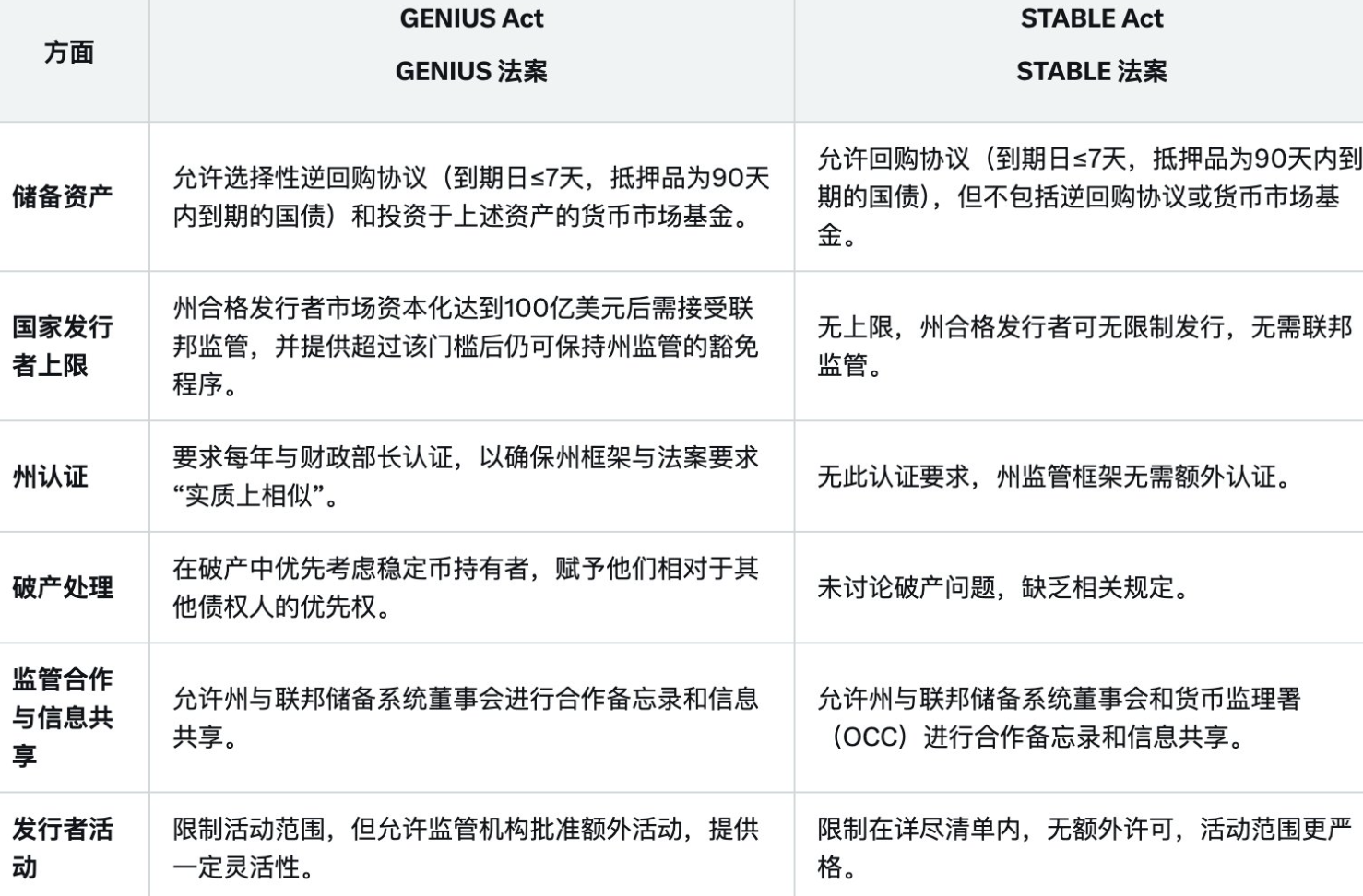

PANews reported on March 28 that according to the analysis of independent researcher ningning, the STABLE Act and GENIUS Act introduced by the U.S. House of Representatives and Senate, respectively, have significant differences in the regulation of stablecoins. The STABLE Act focuses on protecting consumers and maintaining the hegemony of the U.S. dollar, requiring issuers to have 1:1 cash reserves, U.S. debt or highly liquid assets, with no issuance cap and no state certification required, but with strict restrictions on the scope of issuer activities; while the GENIUS Act focuses more on improving transaction efficiency and increasing demand for U.S. debt, allowing reverse repurchase agreements and money market fund investments, and requiring issuers to accept federal supervision after capitalization exceeds $10 billion, giving priority to protecting the rights and interests of stablecoin holders in the event of bankruptcy, while providing more flexible regulatory space.