A. Market View

1. Macro liquidity

Monetary liquidity has improved. The chaotic implementation of Trump's tariff policy, regardless of the final outcome, has rapidly undermined market confidence in the US economy and may continue to disrupt the market in the next three months. US bonds and the US dollar have also returned to a downward spiral, and the historic surge in US stocks mostly occurred in the middle of a bear market. The crypto market has followed the violent turbulence of US stocks.

2. Market conditions

The top 300 companies by market capitalization:

This week, BTC rebounded from oversold levels, and small coins were delisted and plummeted. The market lacks main hot spots.

Top 5 gainers | Increase | Top 5 decliners | Decline |

XCN | 110% | BERA | 40% |

FARTCOIN | 100% | EOS | 20% |

GAS | 60% | MEW | 20% |

LAYER | 40% | W | 20% |

UXLINK | 30% | NEAR | 20% |

- BERA: Defi public chain fell to a new low, breaking through the long-term shock support level. The stablecoin on the chain fell by $300 million in the past week.

- FARTCOIN: It is a meme coin on the SOL chain. It has risen several times against the market bottom and is the leader of this round of rebound.

- BABY: It is the leader of BTC ecological pledge. After listing, its market value returned to the last round of institutional investment of 800 million US dollars. The re-pledge track was falsified.

3. On-chain data

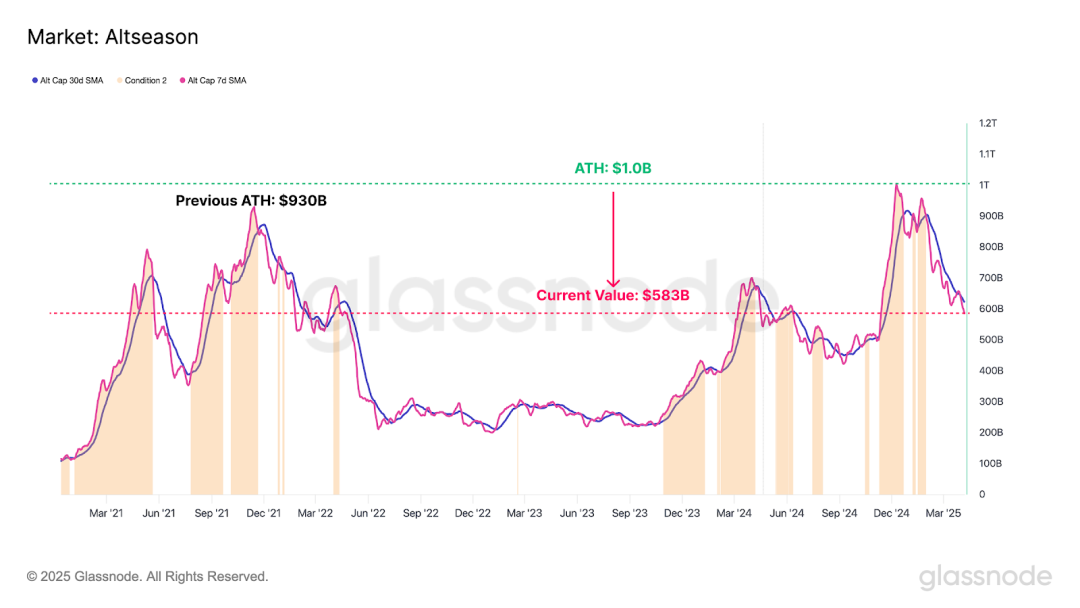

Capital inflows into the BTC market have stagnated. Liquidity has shrunk rapidly, and the market value of altcoins has depreciated from $1 trillion at the end of 24 to $600 billion. This decline seems to be universal, with all sectors experiencing significant depreciation.

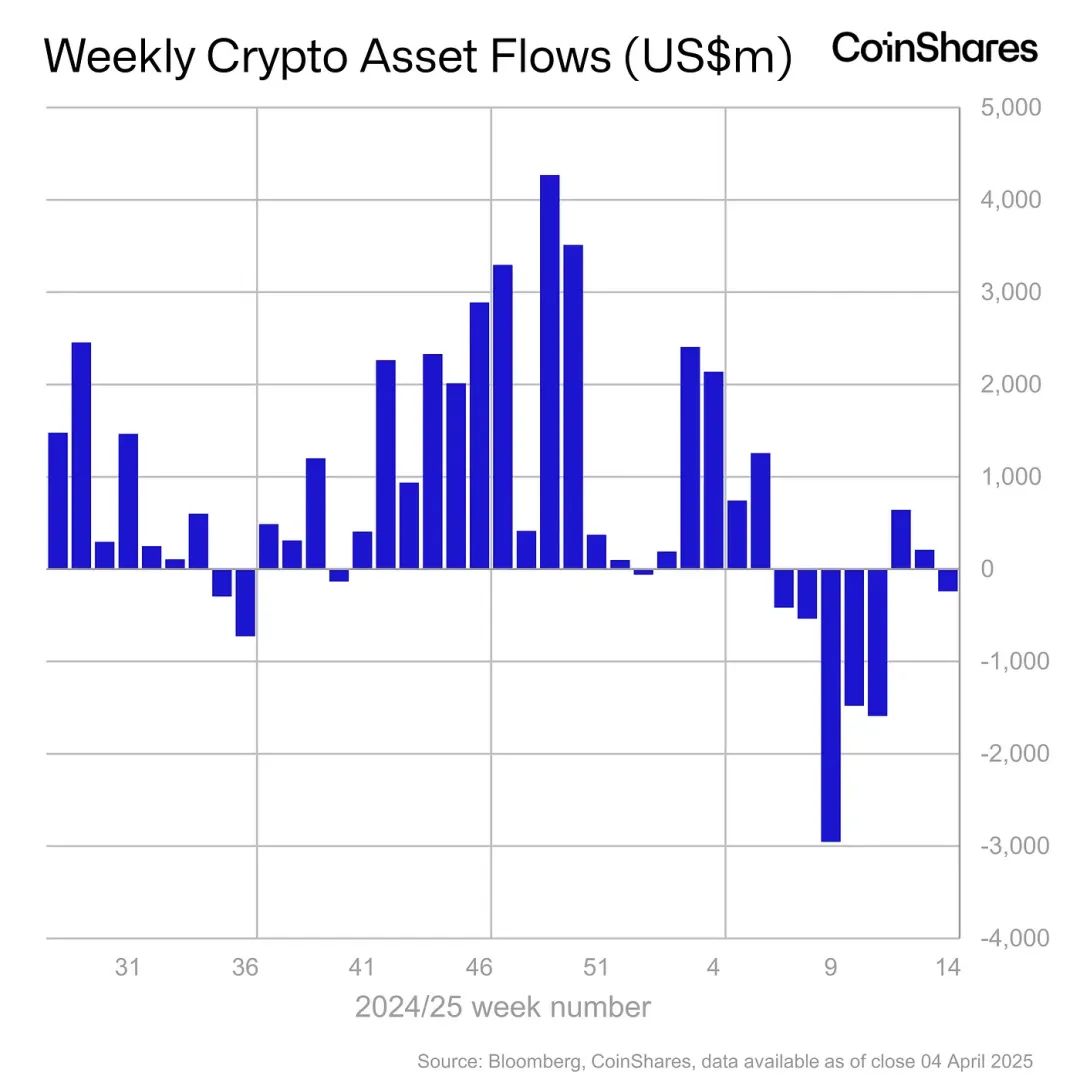

Institutional funds began to outflow slightly again, and panic broke out in global markets.

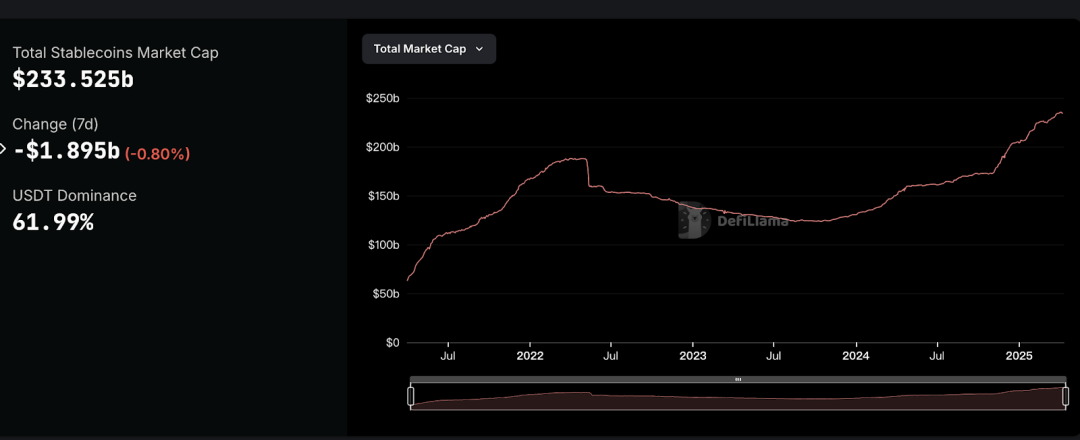

The market value of stablecoins has declined slightly, and investors are clearly risk-averse.

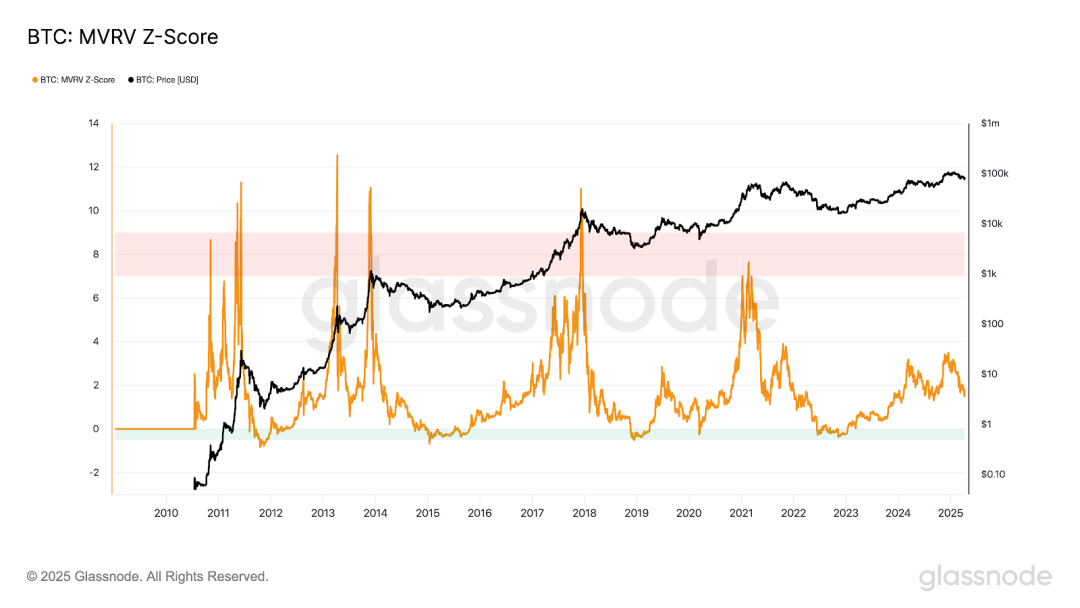

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is the top range; when the indicator is less than 2, it is the bottom range. MVRV falls below the key level of 1, and the holders are generally in a loss state. The current indicator is 1.6, close to the bottom range.

4. Futures Market

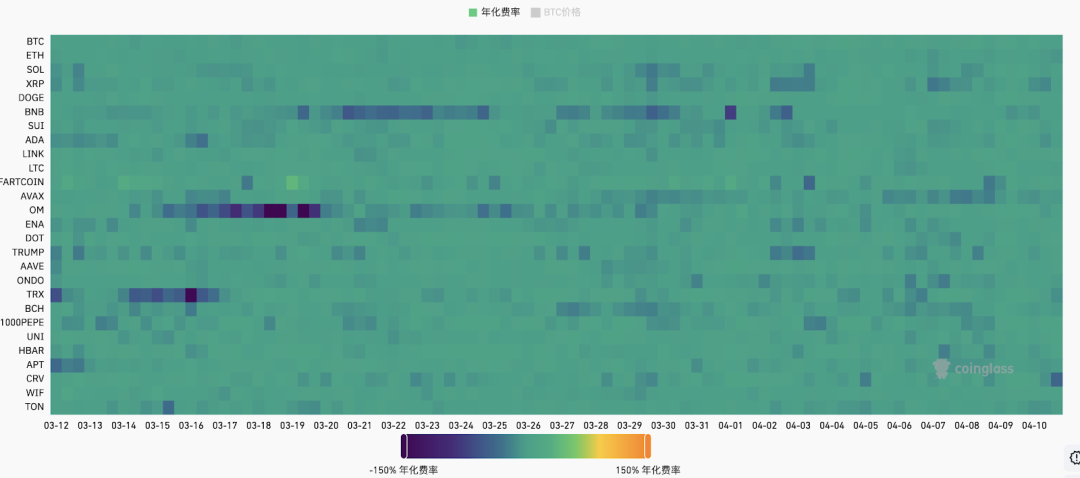

Futures funding rate: This week's rate is 0.00%, which is relatively low. The rate is 0.05-0.1%, with more long leverage, which is the short-term top of the market; the rate is -0.1-0%, with more short leverage, which is the short-term bottom of the market.

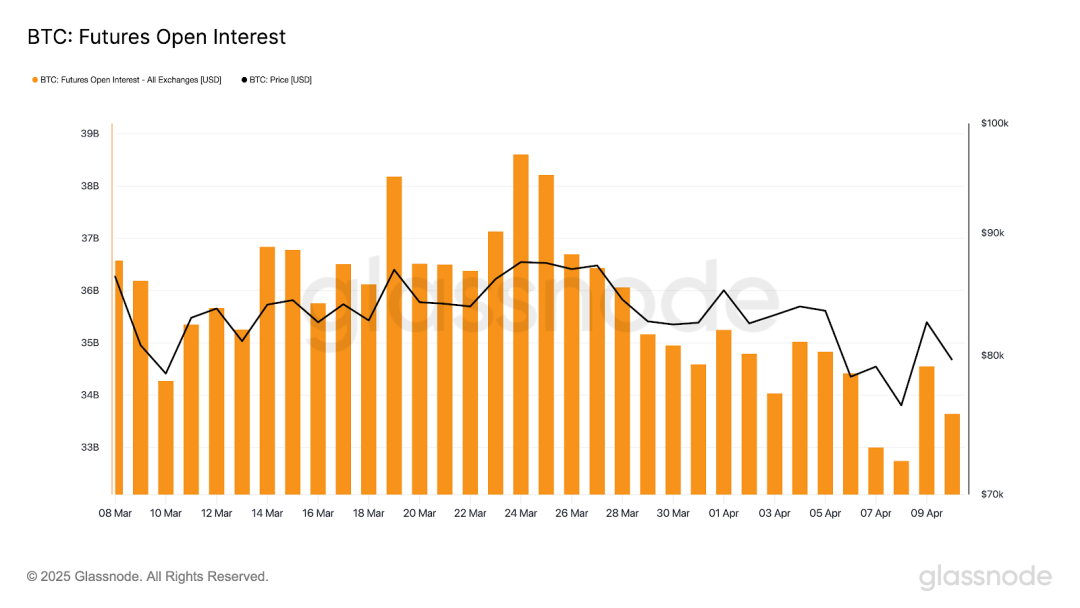

Futures open interest: BTC open interest continued to decline this week, with major market players leaving the market.

Futures long-short ratio: 1.9, market sentiment is greedy. Retail investor sentiment is mostly a reverse indicator, below 0.7 is more fearful, above 2.0 is more greedy. The long-short ratio data fluctuates greatly, and its reference value is weakened.

5. Spot Market

BTC has been volatile this week, and altcoins lack new narratives. Pressure on global financial markets continues to intensify due to the growing uncertainty of the US tariff regime. This weakness has spread to almost all asset classes, and the crypto asset market is also deeply trapped in a bear market.