1. Market observation

Keywords: Trump, ETH, BTC

Trump recently stated that he has no intention of firing Fed Chairman Powell, while admitting that tariffs on Chinese exports are too high and hinting that the tax rate will be significantly reduced. At the same time, the geopolitical situation has also shown signs of easing, and Putin has proposed to stop the offensive against Ukraine on the current front as part of efforts to reach a peace agreement with Trump. These easing signals have directly affected the performance of safe-haven assets. Spot gold has fallen by about $160 from yesterday's high of $3,500 and is now quoted at $3,339 per ounce.

Crypto assets have seen a sharp rebound. Bitcoin broke through the key resistance level of $90,000 yesterday and rose above $94,000 this morning. Its market value has surpassed silver and Amazon, rising to sixth place in the global asset market value ranking. 10x Research pointed out that the current key resistance area is between $94,000 and $95,000. Traders in the Greeks.live community believe that after Bitcoin breaks through $90,000, the next target will be $93,000/$100,000; while those who are cautious are paying attention to possible pullbacks, and it is expected that there will be a significant increase after a retracement to the $84,000 or $74,000 level. Cantor Fitzgerald, led by Brandon Lutnick, son of U.S. Commerce Secretary Howard Lutnick, is working with multiple institutions to build a multi-billion dollar Bitcoin acquisition platform, which will become another powerful buyer of Bitcoin.

In addition, Arthur Hayes is optimistic about the future of Bitcoin, believing that Bitcoin will break away from its association with technology stocks and become a safe-haven asset in the market together with gold. It is expected that Bitcoin may rise all the way to $200,000 after breaking through $110,000, triggering funds to flow from Bitcoin to altcoins. Geoff Kendrick of Standard Chartered Bank is also optimistic. He expects that if market concerns about the independence of the Federal Reserve continue, Bitcoin may hit a record high and predicts that it will reach $200,000 by the end of 2025.

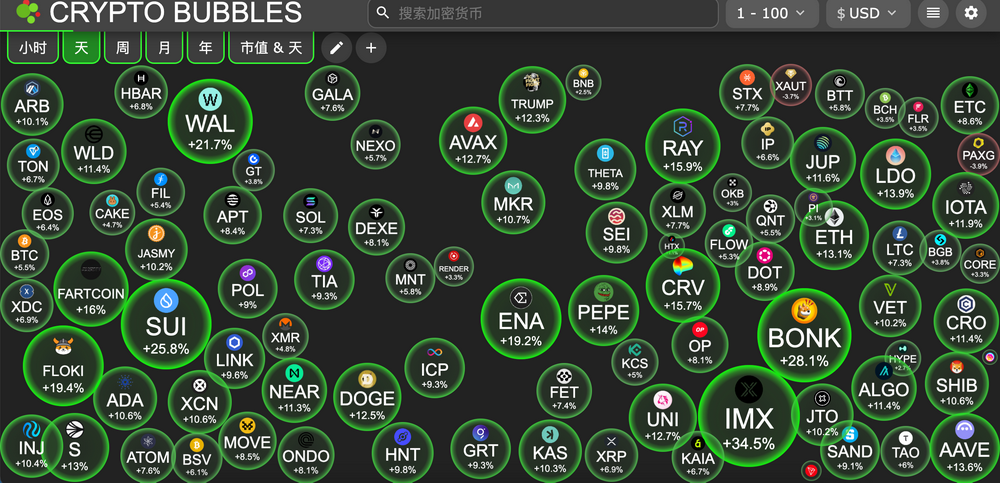

In terms of altcoins, Solana rebounded with the rise of the market, rising above $150 this morning. This rise was supported by institutional funds. Galaxy Digital exchanged $100 million of ETH for SOL, the US listed company DeFi Dev Corp increased its holdings of $11.5 million of SOL, and the blockchain payment provider Astra Fintech also set up a $100 million fund to support Solana's development in Asia. In this atmosphere, the AI Meme sector rebounded the most, ZEREBRO doubled its daily increase, and Fartcoin's market value exceeded $1 billion.

In terms of macroeconomics, U.S. Treasury Secretary Benson said the tariff stalemate is unsustainable and the situation is expected to ease. Trump's attitude towards the Federal Reserve has also eased. He said, "We think the Federal Reserve should lower interest rates, and now is a perfect time. We hope that our chairman can (cut interest rates) ahead of schedule or on time." At the same time, he also expressed satisfaction with the performance of the stock market rally. According to CME's "Fed Watch" data, the probability of the Federal Reserve keeping interest rates unchanged in May is 91.7%, and the probability of a 25 basis point rate cut is 8.3%. The probability of the Federal Reserve keeping interest rates unchanged by June is 32.8%, the probability of a cumulative 25 basis point rate cut is 61.8%, and the probability of a cumulative 50 basis point rate cut is 5.3%.

2. Key data (as of 12:00 HKT on April 23)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

Bitcoin: $93,203.77 (-0.45% year-to-date), daily spot volume $55.665 billion

Ethereum: $1,794.45 (-46.28% year-to-date), with a daily spot volume of $25.673 billion

Fear of Greed Index: 72 (Greed)

Average GAS: BTC 1.05 sat/vB, ETH 0.67 Gwei

Market share: BTC 63.3%, ETH 7.4%

Upbit 24-hour trading volume ranking: DEEP, XRP, BTC, AERGO, TT

24-hour BTC long-short ratio: 1.005

Sector gains and losses: MemeAI sector rose 14.52%, Ai sector rose 13.81%

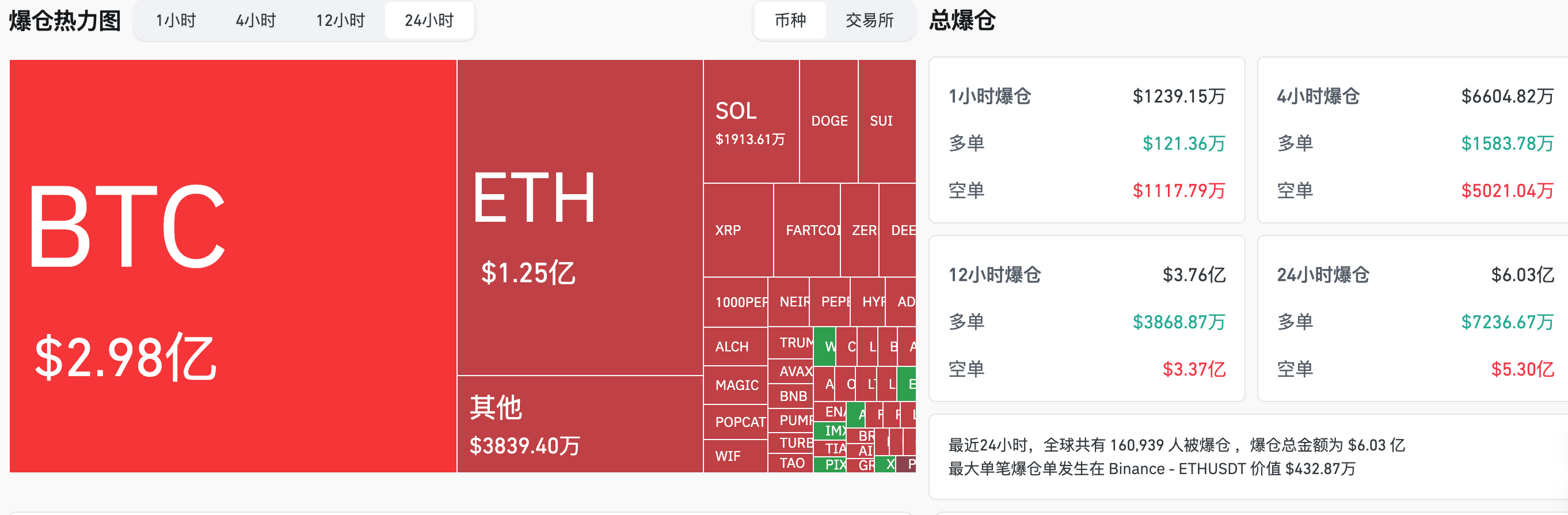

24-hour liquidation data : A total of 160,939 people were liquidated worldwide, with a total liquidation amount of US$603 million, including BTC liquidation of US$298 million, ETH liquidation of US$125 million, and SOL liquidation of US$19.13 million

BTC medium and long-term trend channel : upper channel line ($87457.52), lower channel line ($85725.69)

ETH medium and long-term trend channel : upper channel line ($1652.44), lower channel line ($1619.72)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of April 22 EST)

Bitcoin ETF: $936 million

Ethereum ETF: $38.74 million

4. Today’s Outlook

Lending protocol Dolomite will hold a TGE on April 24 and will airdrop 20% of DOLO

Coinbase International Station launches four perpetual contract transactions including WCT and BABY

Binance will terminate withdrawal services for AMB, CLV, STMX and VITE on April 24

The Federal Reserve released the Beige Book on economic conditions. (April 24, 02:00)

Karrat (KARRAT) unlocked approximately 21.25 million tokens, accounting for 8.79% of the current circulation, worth approximately $1.3 million

Murasaki (MURA) unlocked approximately 10 million tokens, which is 1.00% of the current circulation, worth approximately $4 million

Eigenlayer (EIGEN) unlocked approximately 1.29 million tokens, accounting for 0.53% of the current circulation, worth approximately $1.1 million

The biggest gains among the top 500 stocks by market value today: ZEREBRO up 151.13%, DEEP up 126.82%, TURBO up 50.83%, ARC up 48.62%, and ALCH up 39.56%.

5. Hot News

Bloomberg: U.S. strategic Bitcoin reserves may reveal details in the coming weeks

Today's Fear and Greed Index rose to 72, and market sentiment is in a greedy state

Bitcoin surpasses silver and Amazon to become the sixth largest asset in the world

Trump: No intention to fire Powell, but Fed should lower rates

The three major U.S. stock indexes closed sharply higher, all up more than 2%.

Cantor to form $3 billion crypto venture with SoftBank and Tether to invest in Bitcoin

US listed company DeFi Dev Corp (formerly Janover) increased its holdings of SOL worth $11.5 million

A whale withdrew another 1,000 BTC from Binance and currently holds 19,112 BTC

A whale bought 4 million worth of Fartcoin tokens and 3.5 million dollars worth of TRUMP tokens

Metaplanet currently holds 4,855 BTC and plans to hold 10,000 BTC by the end of the year

Ouyi will delist five spot trading pairs including KISHU and MAX on April 29