Crypto Market Briefing: January 13, 2025 - January 17, 2025

This week, the market benefited from the slowdown in US economic data, the recovery of stablecoin supply and the inflow of ETF funds. The price of BTC broke through US$100,000, and funds flowed back into the altcoin market. In the short term, BTC maintained an upward trend, but we need to be wary of volatility risks.

Macroeconomic impact

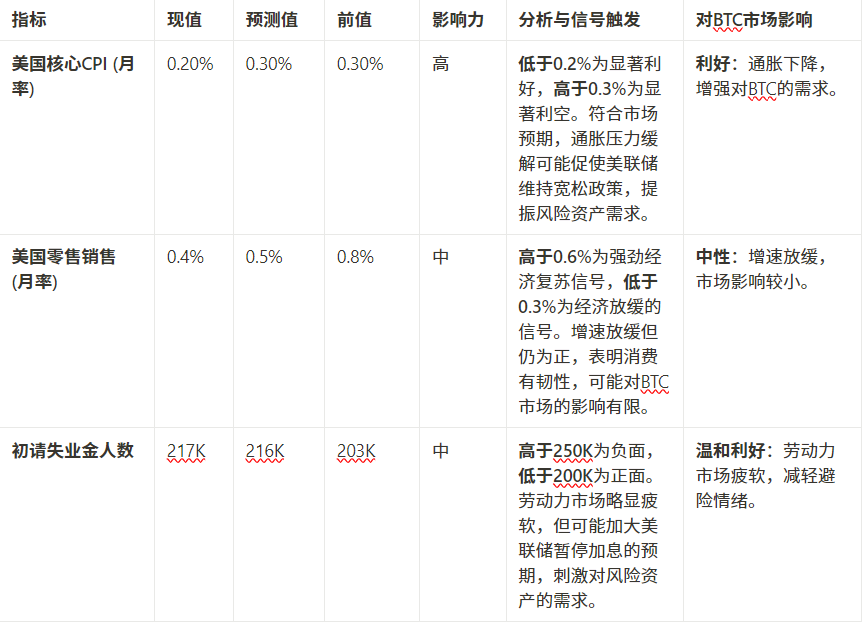

- U.S. core CPI : increased by 0.20% month-on-month, lower than the expected 0.30%, easing inflationary pressure, which is conducive to maintaining the Fed's loose policy, promoting demand for risky assets, and is good for BTC .

- US Retail Sales : +0.4% MoM, slower but still positive, neutral to BTC .

- Initial jobless claims : 217K, slightly higher than expected, indicating a weak labor market, which may prompt the Fed to pause rate hikes, mildly positive for BTC

Market capital flow

- Stablecoin Flow : This week’s issuance volume rebounded to USD 751 million , indicating that market liquidity has recovered and supported BTC .

- ETF fund inflows : The inflow was USD 887 million , an increase of USD 574 million from last week, supporting the BTC price to break through USD 100,000 and enhancing market confidence .

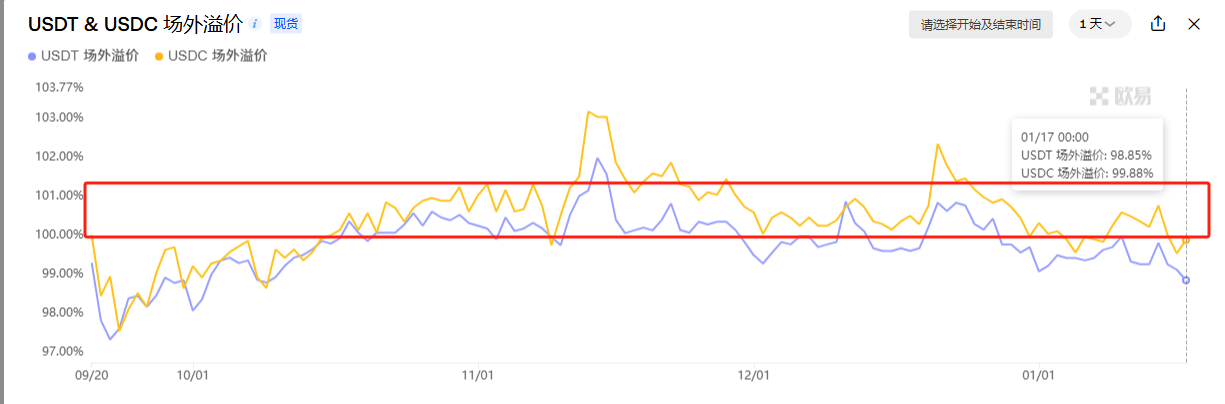

- USDT demand decreases : The OTC premium drops to 99.85% , indicating that the market demand for USDT has weakened and funds are flowing to the more compliant stablecoin USDC, which may affect BTC price fluctuations .

Market Volume and Market Capitalization

- BTC trading volume : On January 16, the trading volume was 100.496 billion USD, and the price rose to 100,465 USD . The market activity rebounded, and it is expected that the BTC price may further exceed 105,000 USD .

- BTC market share : Currently 57.55% , with a slight decline. Funds are flowing into the altcoin market. BTC may face capital outflow pressure in the short term.

- Total crypto market capitalization : $3.4 trillion on January 17, market expansion and fund diversification suggest that altcoins may see inflows.

Altcoin Market

- Capital inflows are picking up : Capital inflows into the altcoin market are gradually recovering and may rebound in the short term.

- BTC market share is declining : If it continues to fall, the alt season may begin, but we need to be wary of the impact of BTC price fluctuations on the market.

- USDT market share declines : If BTC continues to fluctuate, it may exacerbate market uncertainty and increase liquidity pressure in the short term.

in conclusion

- BTC trend : BTC is expected to keep rising in the short term. After breaking through $100,000 , the market sentiment is positive. If liquidity is maintained, it may challenge $105,000 .

- Performance of altcoins : Capital flows to altcoins are expected to resume, and AI, public chains, and L2 expansion platforms may benefit, but we need to be wary of the impact of BTC’s short-term fluctuations on the market.

Market advice : Keep an eye on BTC in the short term. Altcoins can be moderately deployed, but risks need to be controlled.

1. Macro

1.1 Macro indicator trigger signal table-BTC market trend guidance

Lowering interest rates usually increases the money supply, thereby stimulating economic growth. In traditional theory, interest rate cuts are intended to promote consumption and investment and stimulate economic activity by reducing borrowing costs. However, in a high-inflation environment, interest rate cuts may exacerbate inflation because they increase the money supply in the market, further pushing up the price level. Therefore, the market's response to interest rate cuts is not always "anti-inflationary", but may have the opposite effect - market reflexivity.

In this case, the market may believe that raising interest rates and tightening are the effective means to curb inflation. If the Fed continues to raise interest rates or suspends interest rate cuts, it means that the Fed may believe that inflation has not been effectively controlled. Such policy expectations will increase the market's demand for Bitcoin as an anti-inflation asset . Therefore, tightening policies (such as raising interest rates or not cutting interest rates) may promote the inflow of funds into anti-inflation assets such as Bitcoin, driving up Bitcoin prices.

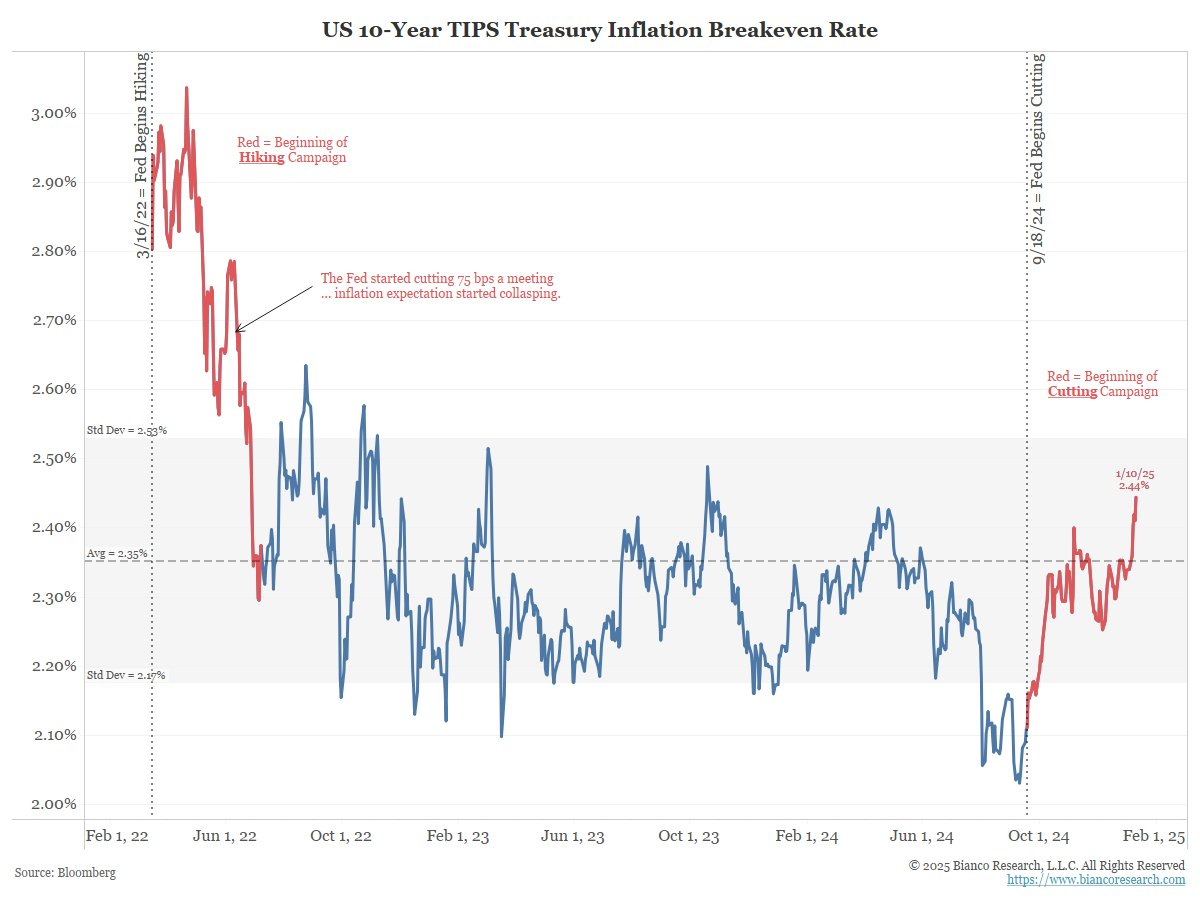

The price and yield of TIPS (Inflation-Protected Securities) are important indicators of market inflation expectations. When the market expects inflation to rise, the yield of TIPS will increase because investors demand higher inflation compensation. This means that if the yield of TIPS rises, it indicates that the market's concerns about inflation are increasing, and it may even reflect the market's negative reaction to future interest rate cuts.

The chart shows that since October 2024, the TIPS yield has rebounded and gradually approached 2.44% . This shows that the market's expectations for future inflation are increasing. Especially after the Federal Reserve began to cut interest rates, the market believes that inflationary pressure may rise again.

The increased linkage between US stocks and Bitcoin means that the volatility of the US stock market may directly affect the trend of BTC, but when the market is worried about inflation, Bitcoin may rise independently as a tool to combat currency depreciation. The passage of spot ETFs has promoted the maturity of the Bitcoin market and made it more relevant to the volatility of traditional asset classes (such as US stocks), but at the same time, Bitcoin's safe-haven properties remain strong in the case of rising inflation.

Macroeconomic data to watch next week

Based on the current macroeconomic dynamics, the following factors are worth paying attention to and may have a significant impact on the cryptocurrency market:

2. Industry Analysis

Interpretation of the impact of this week's on-chain data on BTC

Combined with this week’s on-chain data, the following analyzes the impact of these data on the BTC market from the aspects of capital flow , price indicators , and trading volume , and evaluates the key risks and opportunities in future trends.

2.1 Fund Flow

2.1.1 Stablecoin Fund Flow

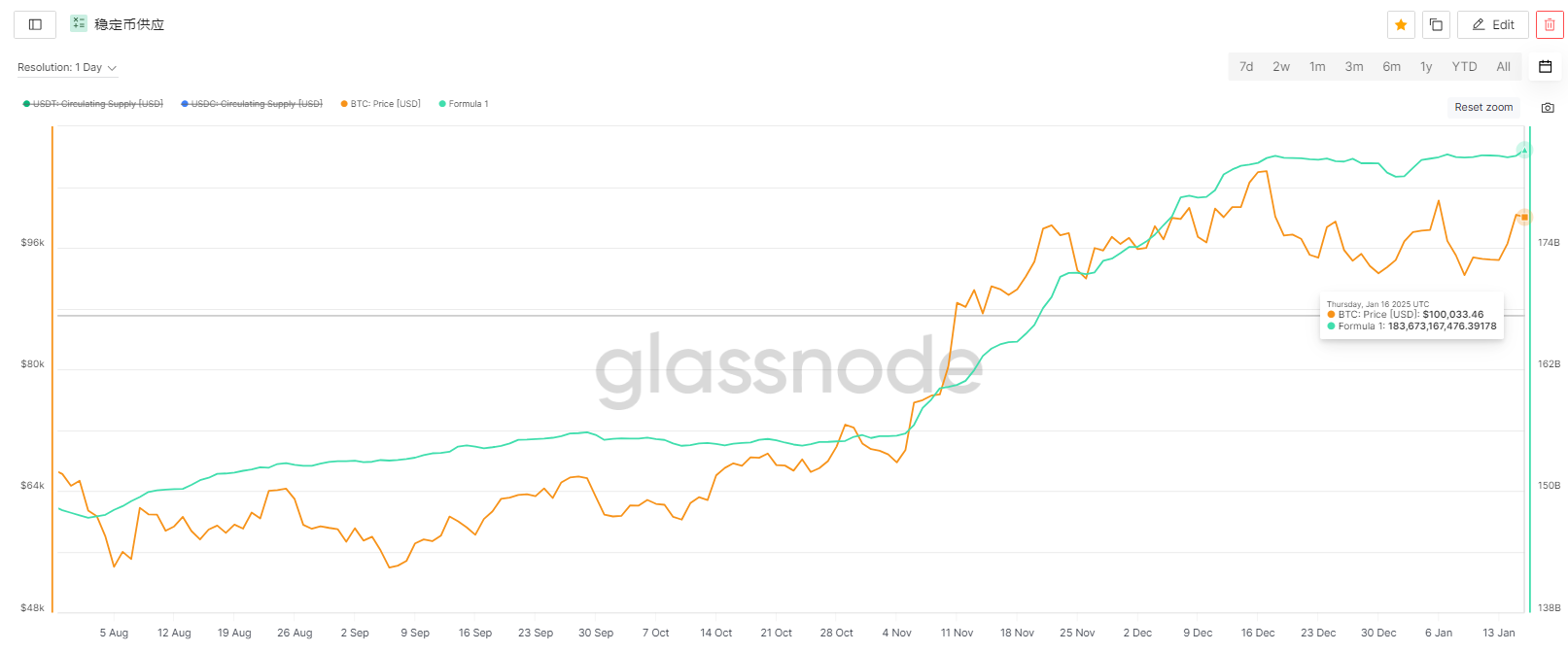

Data Overview

- January 10th-January 16th : The number of stablecoins is 183.673 billion , with an increase of +751 million this week and an average daily increase of +107 million .

- The increase in the supply of stablecoins has rebounded, indicating that market liquidity has recovered and funds are gradually flowing back into the market.

Impact Analysis

- Stablecoin issuance and market liquidity :

- The continued issuance of stablecoins indicates that market liquidity has recovered, especially compared with the previous two weeks (December 27 to January 2, 2025), the supply has decreased. The return of stablecoins may provide more financial support for the future crypto market, especially the BTC market.

- The decline in USDT’s premium (about 99.85% ) indicates that market demand for USDT remains weak, which may prompt funds to flow to compliant stablecoins such as USDC.

- Market Sentiment :

- The growth in the supply of stablecoins is usually a sign of improving market sentiment, reflecting the recovery of risk appetite among some investors.

2.1.2 ETF Fund Flow

Data Overview

- January 13 to January 17 : ETF inflows were USD 1.863 billion , an increase of USD 1.55 billion from last week’s USD 313 million . The BTC price rose to USD 100,344 , and the inflow of BTC this week was 18,591.27 BTC , accounting for 0.094% of the circulation.

Impact Analysis

- Capital Flow Back and Market Support :

- This week’s strong ETF inflows provided significant financial support to the BTC market, with inflows increasing by nearly USD 1.55 billion and the proportion of inflows increasing to 0.094% , indicating that the driving effect of funds is increasing.

- The increase in inflows , especially after the BTC price broke through the $100,000 mark, shows a positive recovery in market sentiment and a restoration of investor confidence.

- Changes in market sentiment :

- Strong ETF fund inflows support the rise in BTC prices, indicating that the participation of institutional investors is gradually increasing. As funds gradually flow back and market liquidity improves, prices are expected to rise further.

2.1.3 Premium or discount in over-the-counter transactions

Data Overview

- USDT OTC premium : about 99.85% (January 17), indicating a decline in USDT demand.

- USDC OTC premium : relatively stable, maintained at 100.14% .

Impact Analysis

- USDT demand drops :

- The premium in the USDT market has gradually narrowed, indicating that the market demand for it has decreased, which may reflect the rising risk sentiment in the market and investors' gradual shift to more compliant stablecoins such as USDC.

- Changes in liquidity in the stablecoin market could lead to increased price volatility for BTC, especially as reduced demand for USDT could affect its liquidity as a trading pair.

2.2 Related price indicators

2.2.1 Cryptocurrency Market Value

Data Overview

- Total market value : According to Coingecko data, the total market value of the global crypto market was approximately US$3.4 trillion on January 17.

- BTC market share : Currently, BTC’s market share is 57.55% , a slight decrease.

Impact Analysis

- Changes in BTC market share :

- BTC's market share continues to decline slightly, indicating that funds are flowing into other areas, especially altcoins. The current 57.55% is still at a high level, but if the market share continues to decline, it may prompt more funds to flow into the altcoin market.

- The increase in market capitalization (breaking through $3 trillion on January 17) provides strong support for the market and indicates market diversification and expansion.

- Impact on the altcoin market :

- The diversion of funds in the market indicates that altcoins (especially AI, public chain, and meme-related projects) are expected to continue to attract capital inflows. BTC may face certain capital outflow pressure in the short term, and the rebound of altcoins may have a positive impact on the overall market.

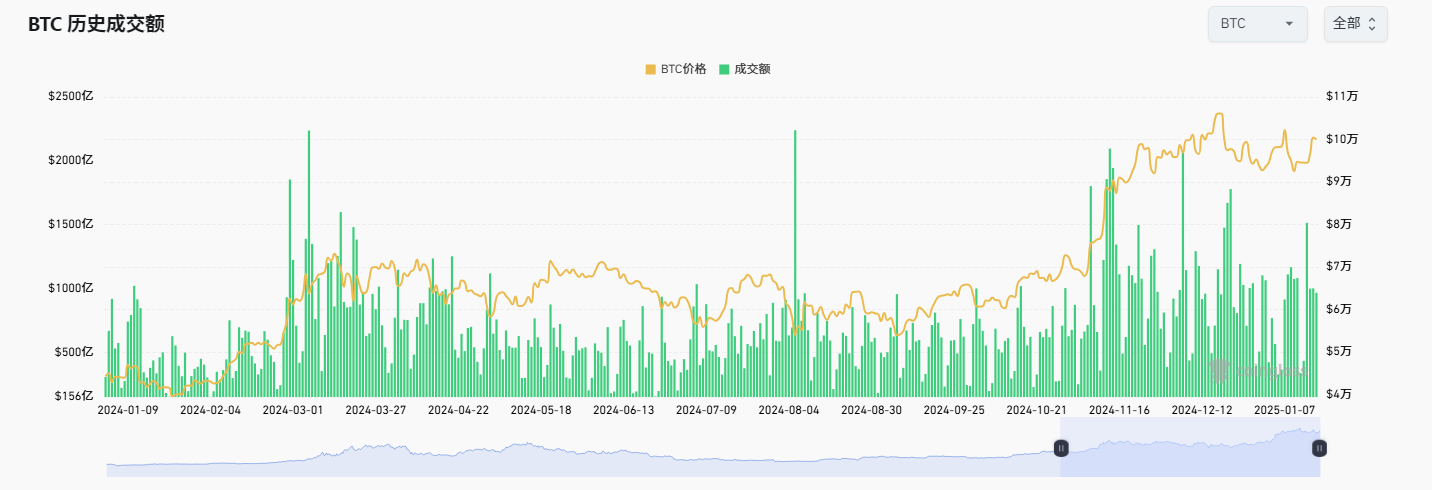

2.2.2 BTC overall transaction volume

Data Overview

- January 11th - January 17th :

- Trading volume : recorded USD 100.496 billion on January 16, a significant increase from the lowest point of USD 34.342 billion on January 12.

- Price fluctuations : BTC price increased from $94,728 (January 11) to $99,994 (January 17).

Impact Analysis

- Volume Fluctuations and Market Participation :

- The sharp fluctuations in trading volume (especially the significant increase in trading volume on January 13 and January 14) indicate that market activity has picked up and the inflow of funds has helped drive prices higher.

- Despite fluctuations in trading volume, the recovery in overall trading volume indicates that market sentiment is recovering and BTC's upward momentum is gradually supported by funds.

- Signals of market trends :

- The high trading volume and the upward trend in price indicate that the BTC market is likely to continue its upward trend in the short term. If the trading volume can continue to increase, BTC may further challenge the price level above $105,000 .

in conclusion

BTC market trends

- BTC price is expected to continue to rise :

- Benefiting from the dual support of ETF fund inflows and the recovery of stablecoin supply, BTC prices are expected to continue to rise in the short term, especially after breaking through US$100,000 , market sentiment is relatively positive.

- Support level : $100,000. If it falls below, it may fall back to the $96,500 area.

- Potential risks :

- If liquidity tightens (USDT discount widens, stablecoin supply decreases), it may lead to greater market volatility and the risk of a pullback in the short term.

Altcoin market performance ( see Altcoin section analysis for details )

- Altcoin inflows pick up :

- As BTC’s market share declines, capital inflows into the altcoin market are expected to recover further. AI tracks, ETH-related projects, and L2 expansion platforms may benefit from the influx of funds.

- The high volatility of the market and capital diversion will bring rebound opportunities to altcoins, but we need to be wary of volatility risks brought about by insufficient liquidity and macro uncertainties.

- Mid-term outlook :

- The altcoin market may enter a rebound cycle, but we still need to pay attention to the trend of BTC prices and changes in liquidity in the stablecoin market in order to determine whether funds will continue to flow into the altcoin market.

Analysis of the copycat section

Summarize

- Altcoin rebound : The altcoin market generally rebounded this week, and the altcoin market gradually flowed back to the exchange from the chain.

- Capital outflow slowed down : Net outflow slowed down this week, and short-term net inflows reflected strong short-term bottom-fishing sentiment.

- Three major market share indicators: BTC market share has returned to the long-term support line, and OTHERS.D and USDT.D are still waiting for BTC's next move.

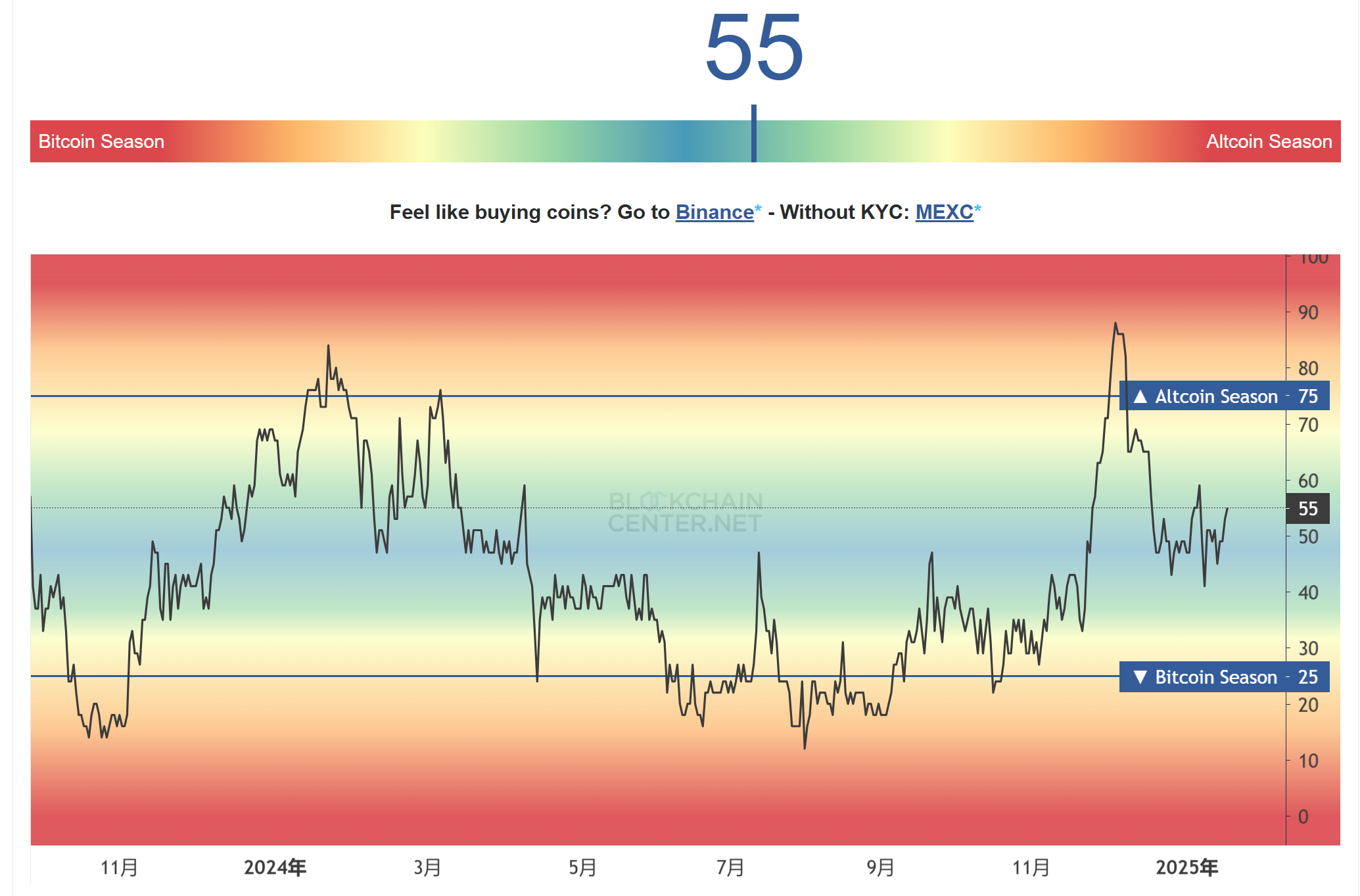

Combining this week's macroeconomic indicators and market data analysis, the altcoin market is experiencing continuous adjustments and capital outflow pressure. The following is an analysis of this week's altcoin market performance from multiple dimensions, including altcoin season indicators, capital flows, BTC market share, OTHERS market share, and USDT market share , and looks forward to possible future development paths.

Cottage Season Indicators

This Friday, the copycat index was 55, which did not change much from last week’s 51 and is still oscillating in the middle range, indicating that the copycat is accumulating strength. If it can continue to oscillate in the middle range, the copycat season is expected to arrive in the medium term.

From Cryptobubbles, we can see that almost all altcoins have seen a 5-20% increase during the week, and many have seen increases of more than 30%. Also, it should be noted that most tokens are exchange tokens, and AI16Z has seen the largest drop of 18%, indicating that market liquidity has begun to return to exchanges, and the Agent market may have come to a temporary end and will soon cease.

Bull market escape indicator list

Currently, none of the 30 indicators has entered the top escape range, and the comprehensive recommendation is to continue holding the spot.

Inflow of copycats

The market was still in a state of net outflow this week, with a net outflow of US$1.518 billion in all currencies, a decrease of -56.7% from last week (US$3.507 billion). BTC's repeated fluctuations caused many investors to suffer losses, but the net inflow in 24 hours was US$549 million, indicating that many users were bottom-fishing and right-side trading after the decline.

BTC market share

BTC market share has fallen below the new small-level support in the short term and stepped on the long-term support line. The downward trend of the oscillating triangle has been confirmed. We hope that this decline can be maintained and fall below the long-term support line, thus establishing the trend of the altcoin season or even starting it. However, there are two situations that will cause BTC market share to rise again:

- BTC launch: Trump came to power and confirmed the revitalization of the crypto industry and support for BTC, causing a sharp rise in prices, ushering in another surge;

- BTC plummeted: Trump came to power, good news came into effect, BTC was smashed by short sellers, and altcoins followed suit and fell sharply.

Since this is a relatively lagging indicator, we can only keep an eye on the BTC trend and use the market share indicator to judge the altcoin season. Any short-term trend may be broken. In addition, the recent Trump market has fallen and volatility has intensified, so altcoin traders should also pay attention to risks.

OTHERS.D

The market share of all tokens outside the top ten is still being tested this week. After falling below the Fibonacci 0.236 level, it found support in the lower range and rebounded again. It continues to be tested without any major progress.

USDT Market Share

Finally, this week USDT.D was rejected by the long-term support line again and continued to fall back to the support range. If BTC continues to fluctuate, such shock tests may continue.

Special thanks

Creation is not easy. If you need to reprint or quote, please contact the author in advance for authorization or indicate the source. Thank you again for your support.

Written by: Sylvia / Jim / Mat / Cage / WolfDAO

Edited by: Punko / Nora

Thanks to the above partners for their outstanding contributions to this weekly report. This weekly report is published by WolfDAO for learning, communication, research or appreciation only.