Written by: Attorney Mankiw, Mankiw LLP

"Safe deposit and withdrawal" is a challenge that cannot be avoided by cryptocurrency players, especially those in mainland China. Under the current legal framework, how to avoid fraud, frozen cards, and reduce friction losses is a topic of concern to every cryptocurrency player. Lawyer Mankiw often hears friends around him talking about "how to deposit and withdraw safely." From the market perspective, although there are many different answers, the operating methods are nothing more than a few methods:

Withdrawal by acquaintance/introduction

Offline face-to-face transactions

Use U card/VCC card

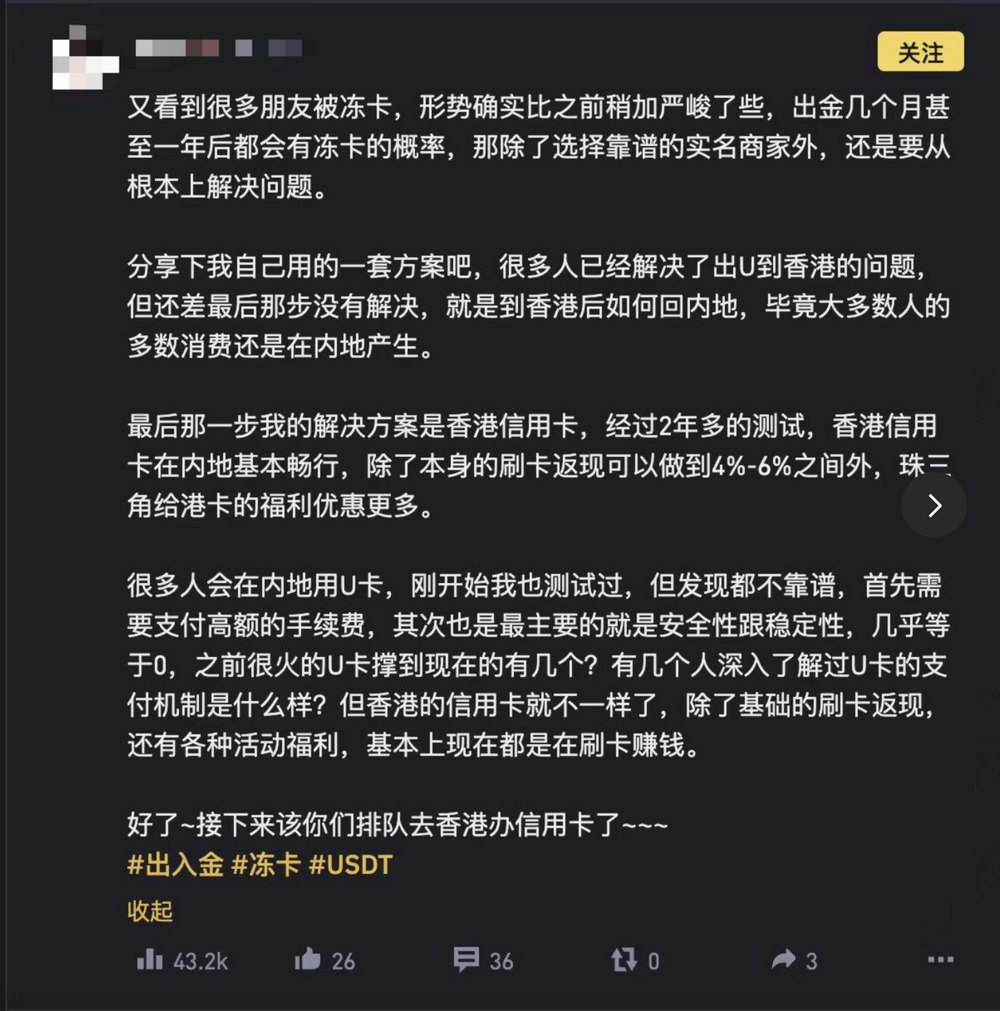

Recently, with the opening of virtual currency exchange policies in Hong Kong, attorney Mankiw has heard another answer: go directly to Hong Kong to withdraw funds . In addition, while surfing the Internet at a certain An Plaza, attorney Mankiw saw a very "interesting" withdrawal plan, which he would like to share with you here.

Hong Kong credit card payment in Mainland China

According to the sharing, cryptocurrency players who want to withdraw money can do so through Hong Kong credit cards. The specific process is that players can apply for a Hong Kong credit card at a bank in Hong Kong and then go to the mainland to make purchases. According to the sharing experience, he has used Hong Kong credit cards for more than two years. This type of card is basically unimpeded in the mainland, and can also enjoy the 4%-6% cashback or points reward discounts provided by some banks.

In practice, cardholders can use Hong Kong credit cards in mainland China for daily consumption, such as shopping, dining, etc., and then sell virtual currencies (such as USDT) in Hong Kong and repay the money. Ideally, this withdrawal method can meet most of the withdrawal needs of mainland users:

Reduce transaction friction costs. Through credit card consumption cashback or discounts, players can reduce friction costs and improve the efficiency of capital use.

Avoid fund supervision issues. Spending with Hong Kong credit cards and repaying in Hong Kong can avoid some of the mainland's supervision of large-scale fund flows and reduce the risk of being frozen or investigated.

Security is relatively high. Since Hong Kong has opened virtual currency transactions, cryptocurrency players usually believe that withdrawing money from licensed virtual currency exchanges in Hong Kong not only does not require them to worry too much about being scammed, but also reduces the risk of receiving black and gray money and causing their cards to be frozen.

However, no matter what, the core point of this gameplay is: for players in the cryptocurrency circle in mainland China, is it safe to withdraw money from Hong Kong? This further extends to whether this way of using credit cards is really reliable?

Is it safe to withdraw funds from Hong Kong?

Although the Hong Kong Securities and Futures Commission (SFC) has implemented the latest virtual asset regulatory policy, all licensed virtual currency exchanges (VASPs) can legally provide virtual asset trading services to Hong Kong retail investors . However, it should be noted that the definition of Hong Kong retail investors is very limited.

On the one hand, according to the relevant regulations of the Hong Kong Securities and Futures Commission, the services of licensed exchanges are mainly for local residents holding Hong Kong identity cards or overseas personnel holding long-term visas , which also means that mainland Chinese residents cannot be directly classified as retail investors in Hong Kong. In actual operation, even if mainland Chinese residents can register on virtual currency exchanges, including OSL, HashKey Exchange and HKVAX, KYC is currently not possible because the conditions are very strict.

On the other hand, mainland China has very strict supervision over virtual asset transactions. The "Notice on Further Preventing and Dealing with Virtual Currency Trading Speculation Risks" issued in September 2021 clearly prohibits mainland residents from participating in virtual currency transactions. Therefore, even if mainland residents can register and participate in virtual asset transactions in Hong Kong through certain means, they may still face the impact of policy changes, such as account freezing during the compliance process of virtual asset exchanges, especially when it involves cross-border transfers of large amounts of funds.

If you think you can withdraw funds through unlicensed virtual asset exchanges, such as Bybit, which is open to Chinese residents, or through offline face-to-face or introductions by acquaintances, then the player's safety may be greatly reduced.

First, once a transaction dispute occurs, users may lack legal protection.

Secondly, such platforms or OTC traders may have major hidden dangers in terms of transparency, fund security, account privacy, etc.

In addition, they are more vulnerable to the influence of black and gray market funds, causing their accounts to be targeted by regulatory authorities and even triggering money laundering risks, thereby facing more serious legal consequences.

If you have completed the registration and passed KYC through some means, then you should also pay attention to some compliance issues involved in the use of credit cards.

Are Hong Kong credit cards reliable?

According to the sharing and analysis above, you can use Hong Kong credit cards as a tool and path for withdrawing funds. But you may not know that using credit cards also has restrictions and compliance issues.

Monitoring of frequent cross-border consumption

Large and frequent cross-border consumption may trigger risk monitoring by banks.

If mainland cryptocurrency players need to use Hong Kong credit cards for their daily consumption, or make large purchases in mainland China, or use credit cards frequently in a short period of time, it may attract the attention of banks’ risk control. The credit card transaction monitoring mechanism will identify such abnormal consumption patterns and may trigger the bank’s review or restriction measures, such as requiring additional information on the purpose of the transaction.

You may think that applying for more credit cards can avoid this problem. However, according to the Foreign Exchange Management Regulations and Anti-Money Laundering Law of mainland China, the annual foreign exchange quota for individuals in mainland China is limited to US$50,000 per person per year. This means that if your total annual spending exceeds this limit, the credit card route is not applicable.

Review of the source of repayment funds

Although repayments in Hong Kong dollars avoid the direct use of virtual currency, banks still have compliance requirements for large repayments. Banks may trace the source of abnormal high-value repayments to ensure the legitimacy of the source of funds. If the source of funds is unknown or there is a risk of money laundering, the bank may temporarily freeze or restrict transactions on the account and may require the cardholder to provide proof of the legitimacy of the funds.

In addition, during the tracing process of repayment funds, if it is discovered that the source of USDT funds involves RMB or other foreign currencies, forming a "legal currency-USDT-Hong Kong dollar" link, it may cause foreign exchange violations and even involve criminal risks.

Attorney Mankiw's Summary

Although the operation of withdrawing virtual currency through Hong Kong credit cards provides convenience for cryptocurrency players in certain situations, the compliance of cross-border withdrawals is still worthy of attention in the current increasingly stringent regulatory environment for funds and anti-money laundering. For mainland cryptocurrency players, the legal risks of virtual currency transactions and strict monitoring of capital flows may trigger fund freezes or legal investigations at any time. When choosing whether to participate in virtual currency transactions and any withdrawal methods, do not only focus on the immediate convenience and ignore the potential legal risks. A prudent strategy should be legal and compliant, and do not pay a high legal price for a moment of negligence.