1. BTC.D (tradingview)

Today's market share is 55.36%. After an accelerated decline, it has entered a relatively stable sideways trend, and a trend of slowing down the decline has temporarily appeared.

The market share continued to decline last Friday, reporting 55.39%, which is undoubtedly good for altcoins, but how it affects the price of BTC itself in general still needs to be compared with the relevant data on US dollars flowing into ETFs.

2. USDT OTC discount/premium rate and stablecoin market value changes (investing, coinglass)

Currently, USDT's premium to the U.S. dollar is +0.0005%, a significant drop from last week's +0.013%, but overall it remains stable in the high premium range.

The following figure shows the market value of stablecoins. In an environment where BTC is fluctuating at a high level, it is still rising steadily. Whether it is a peak signal or a continued upward trend after adjustment remains to be seen. In the data on Friday last week, the market value of USDT was 135.95B USD. Today, the latest market value of USDT is 138.02B USD, an increase of about 2B USD.

The following figure shows the overall trend of stablecoin market value, which is consistent with the trend shown in the classification chart. The overall market value increased by about 2B USD, which is in line with the growth trend of USDT.

3. BTC and ETH spot ETF inflows (SoSoValue)

It can be seen that during the period when Bitcoin prices surged, the net inflow trend of BTC ETF remained stable.

At the same time, ETH continues to maintain net inflow and still maintains incremental growth. The price of ETH also reflects the boost in investor confidence. However, the price of ETH has shown a correction trend recently, falling below 4,000 USD. How sustainable it is still needs to be observed.

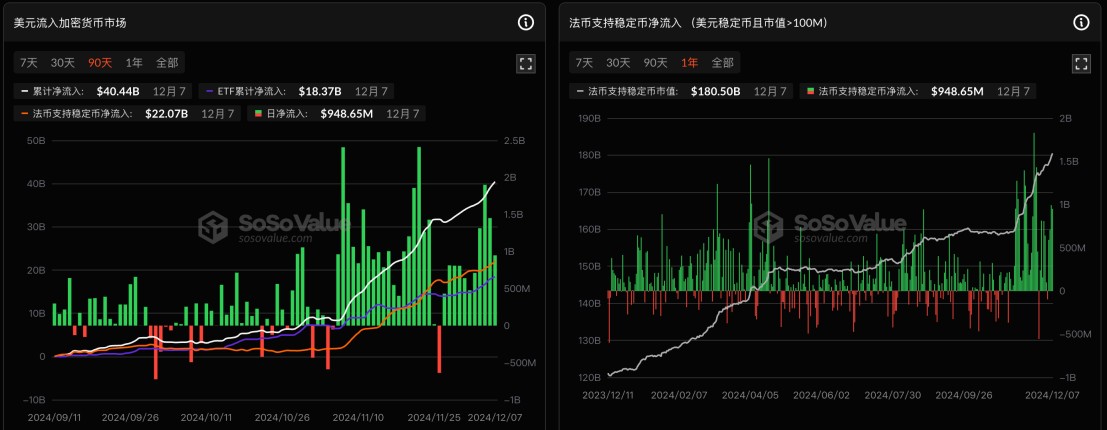

4. US dollar inflow (SoSoValue)

As can be seen from the chart, the momentum of US dollar inflows remains stable.

5. BTC, ETH NUPL indicator (glassnode)

The previous BTC NUPL index was 0.6097, and the latest is 0.6222, which has risen significantly. In general, the overall confidence is still sufficient, and the previous breakthrough of the $100,000 mark on Friday also brought a positive emotional effect.

From the data in the figure, we can see that the current ETH NUPL index is 0.5481, and the previous ETH NUPL index was 0.5267, which has increased significantly compared with last Friday. Recently, the overall price of ETH has been on an upward trend, and the blue indicator representing the possible top has not yet appeared. The sentiment has completely left the Anxiety section and has entered the Belief-Denial position and can be said to have basically stabilized in this position.

6. Overall LIQ (CoinKarma) (BTC/USDT)

Currently, the Overall LIQ is -0.22. Currently, the overbought signal has basically disappeared, and the trading flow has fallen back to the normal range. There is no red line for the time being.

7. BTC/USDT (Perpetual) Funding Rate

The funding rate is currently 0.0304%, and the premium has increased.