Hash (SHA1):

fa6d9ad280df3833ce55165a572d491d984b902412e66e23d9dda52f43de7781

No.: Lianyuan Security Knowledge No.059

The Bitcoin ecosystem was once considered one of the most promising ecosystems in this bull market. After the inscription craze ended, the Bitcoin ecosystem gradually cooled down. However, as the price of Bitcoin continued to rise to a record high of $100,000, the market's attention returned to the Bitcoin ecosystem. The Bitcoin ecosystem is currently mixed. We use a technical perspective to understand the prospects of each Bitcoin ecosystem.

From a technical perspective, the Bitcoin ecosystem can be divided into three categories:

1. Various derivative assets such as inscriptions: There are both BRC-20 series and UTXO series. This type of protocol mainly inscribes data in the script data of the isolated witness, and relies on the off-chain indexer for indexing and accounting.

2. Bitcoin Layer 2 Network: It is divided into UTXO camp and EVM camp. This can be further divided into many sub-areas, such as state channel, side chain, Rollup, client verification, etc.

3. Infrastructure projects based on the Bitcoin network: wallets, exchanges, cross-chain bridges, modular indexers, etc.

Next, let’s briefly sort out the main protocol classifications of the Bitcoin ecosystem:

Ordinals

The emergence of the Ordinals protocol has opened a new chapter in the Bitcoin ecosystem. It is a system for numbering Satoshis (SATS). By giving each Satoshi a serial number and then attaching additional data (text, pictures, codes, etc.), each Satoshi can be turned into a unique NFT. This process is called "engraving" or "burning."

At present, there are many derivative protocols based on Ordinals, such as BRC-20, BRC-100, BRC-420, Runes, BRC-721, BRC-69, etc. Let us briefly introduce a few of them.

1:BRC-20

BRC-20 is a homogeneous token issuance standard on the Bitcoin network. However, because BRC20 transfers are not executed on the BTC main chain, they must be collected in the sorter before being transferred. This operation generates a large number of junk transactions, which results in the expansion of the UTXO set of the Bitcoin network, which is also a waste of resources. Therefore, the core developers and miners of Bitcoin launched a fierce debate on this, but no consensus was reached in the end.

But this does not affect the popularity of tokens issued based on BRC-20, such as Ordi, Sats, etc.

2: BRC-420

BRC-420 is the first metaverse protocol developed on the basis of Ordinals, which enables inscription assets to run across engines, games and chains. At the same time, it also gives inscriptions and other assets a "royalty" function. The most representative one is the blue box that once cost tens of thousands of dollars. Although this idea is good, the development of BRC-420 still has major shortcomings due to the underlying infrastructure of the Bitcoin network.

3: Runes

Designed for ease of use, the Runes protocol promises to bring some impactful changes to the Bitcoin token ecosystem. By following Bitcoin's UTXO model, Runes provides a form of "harm reduction" by reducing unnecessary bloat in the UTXO set, a significant problem for protocols like BRC-20. Its simpler design could attract more developer interest and participation, potentially accelerating innovation in Bitcoin.

A seamless user experience can attract more mainstream adoption, as users do not need to handle native tokens or deal with off-chain complexity. This allows for flexible allocation and transfer of Rune balances, with invalid protocol messages resulting in Rune burning as a safeguard for future upgrades. Additionally, Runes can be issued in specific human-readable notations and decimal configurations, and transfers do not require the use of native tokens, making the protocol less cumbersome and more user-friendly. Overall, Runes provide a simpler and more intuitive way to deal with fungibles on the Bitcoin blockchain.

Lightning Network Protocol

4. Lightning Network

The concept of Lightning Network was born in 2015. It can be regarded as the Layer 2 protocol of Bitcoin. Its core mechanism is to build a payment channel between the two parties of the transaction, thereby enabling the speed and privacy of Bitcoin transactions.

The implementation process of the Lightning Network is roughly as follows: users must deposit Bitcoin into the Lightning Network in advance, specifically, lock it in a multi-signature wallet. This operation is similar to fund custody. After completion, the user will receive the corresponding transaction amount. After that, users can quickly complete transactions through the Lightning Network, and the entire process does not require the intervention of a third party to record accounts. These transactions will not be immediately uploaded to the chain when they are in progress, but the transaction data in the channel will not be pushed to the chain for processing until the transaction is completely completed.

This payment channel is established between nodes to form a unique transaction link. At present, the Lightning Network has 21,875 nodes. In theory, the expansion of the number of nodes (channels) will lead to an exponential increase in the speed of off-chain transactions. The operating logic of the Lightning Network is similar to that of offline ATMs. Banks deposit cash in ATMs in various places in advance to meet user transaction (deposit and withdrawal) needs. The denser the distribution of ATMs, the more congestion in over-the-counter transactions can be alleviated. The more nodes there are in the Lightning Network, the more efficient and smoother the transaction processing, which greatly improves the overall performance and user experience of Bitcoin transactions.

5: Taproot Assets

The Taproot Assets protocol was officially launched by Lightning Labs, the developer of the Lightning Network, in October 2023. As a Taproot native asset layer built on top of Bitcoin, this protocol gives users the ability to create assets on the Bitcoin blockchain and supports asset sending with the help of the Lightning Network, thereby achieving the goal of fast and large-scale transactions at extremely low costs.

The Taproot Assets protocol is powerful and can be used to issue both homogeneous assets such as stablecoins and non-homogeneous assets such as NFTs. Assets issued under this protocol will be properly stored in Bitcoin UTXOs, which effectively avoids the inflation of the Bitcoin network, and these assets can also be freely transferred or destroyed.

However, the Taproot Assets protocol is not without flaws. Its main problem is its reliance on third-party storage indexers. Once separated from the storage indexer, the assets (tokens) issued based on the protocol are likely to be lost forever, and this third-party indexer has obvious centralized characteristics.

Despite the above problems, this has not hindered the continued development of the Taproot Assets protocol. So far, many assets have emerged based on this protocol. For details, please refer to the following diagram:

6: Nostr

Many people may be confused about this protocol. Currently, there are two common Nostrs, namely Nostr Protocol and Nostr Assets.

Nostr (Notes and Other Stuff Transmitted by Rrelays) Protocol is a protocol for sharing relatively small amounts of data (such as text posts) that does not rely on any central server, but is based on encryption keys and signatures, making it resilient and tamper-proof. To put it simply, Nostr is a concise and open source decentralized messaging (social) protocol. At its core, every message is signed, so that the user's data is not controlled by any central agency or company, making social information tamper-proof and decentralized.

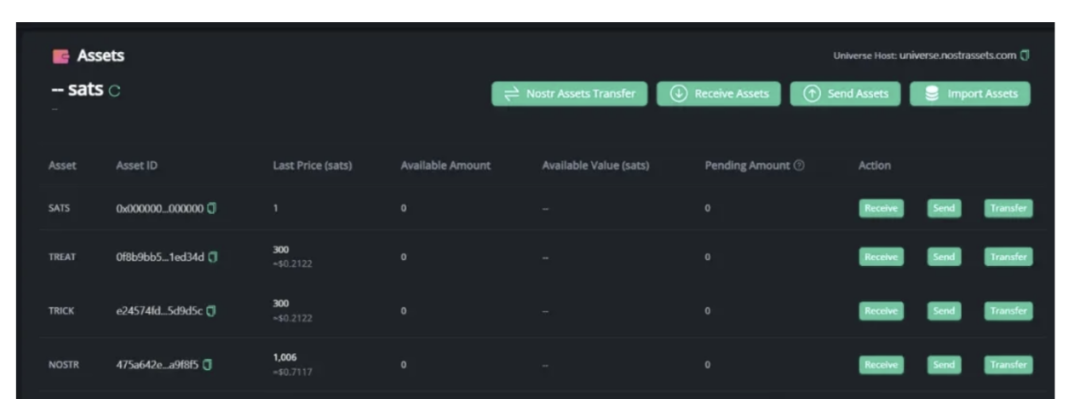

Nostr Protocol was actually launched in late 2020, but it attracted more attention last year with the popularity of the Bitcoin ecosystem and the emergence of Damus. At this time, a protocol called Nostr Assets appeared (a project that was not launched until July 2023), which is a new open source protocol designed to introduce Taproot assets and native Bitcoin payments into the Nostr ecosystem.

Nostr Assets allows users to use the Nostr account as a wallet, with the public key becoming the wallet address and the private key having the authority to manage content events and currency events. Moreover, the protocol also allows interaction with other payment protocols (such as the Lightning Network). In December last year, Nostr Assets announced its first Fair Mint (NOSTR), and with the help of the Bitcoin ecosystem, it became popular, so many people confused Nostr Protocol with Nostr Assets.

However, many people did make considerable profits through Fair Mint at that time. For example, someone only invested 3,000 double Ts (Treat and Trick tokens) in the lottery and directly won 2,160 NOSTR.

That’s why the Nostr developers later publicly pointed out that Nostr Assets was committing fraud in the name of Nostr. However, this matter seems to have been no longer mentioned by everyone. After all, users vote with their feet and only care about the money-making effect. As for the relationship between Nostr Protocol and Nostr Assets, they don’t care at all.

Atomicals

The Atomicals Protocol was born on September 17 last year (2023). The protocol can be used to implement the minting, transfer and update of digital objects on the blockchain based on the UTXO model. The protocol uses the UTXO of the smallest unit of Bitcoin, sat, as the "atom" that constitutes everything. It rethinks from the bottom how to issue tokens (or digital items) on Bitcoin in an immutable and fair manner. Atomicals contains the complete history of digital objects, making it the basis for proving the authenticity and ownership transfer of digital objects without relying on external verification processes.

Let's briefly compare the main differences between the Ordinals protocol and the Atomicals protocol mentioned above:

The information of Ordinals' tokens is written in the script data of the isolated witness. When you verify an Ordinals transfer, you need to download the isolated witness first, then parse the json content, and finally query the corresponding token information in the sorter. Therefore, each transfer operation based on Ordinals' BRC-20 requires sending two transactions.

Atomicals uses Satoshis, the smallest unit of Bitcoin, as its basic "atom". Each Satoshis UTXO is used to represent the Token itself. When verifying an Atomicals transaction, you only need to query the UTXO of the corresponding sat on the BTC chain to complete the verification.

7: ARC-20

Just as BRC-20 is a token issuance standard based on the Ordinals protocol, ARC-20 is a token issuance standard based on the Atomicals protocol. It is also the first token protocol with a unit of account backed by native Satoshis.

Tokens issued based on ARC-20 are backed by 1 Satoshis, which means that the value of each ARC-20 token will not be less than 1 Satoshis, because ARC-20 uses Satoshis to represent the ownership unit of the deployed tokens. ARC-20 tokens can be split and combined, and anyone can mint ARC-20 tokens freely and transfer them through the Bitcoin network.

In addition, because ARC-20 has a built-in naming system, once a name is given, it will be globally unified and there will not be a second one. For example, after it is named ATOM, there will not be a second ARC-20 token with the name ATOM, which is unique.

The ATOM token we just mentioned is the representative token (leader) of ARC-20, but it should be noted that it only has the same name as ATOM (Cosmos). ATOM (ARC-20) and ATOM (Cosmos) are two completely different tokens.

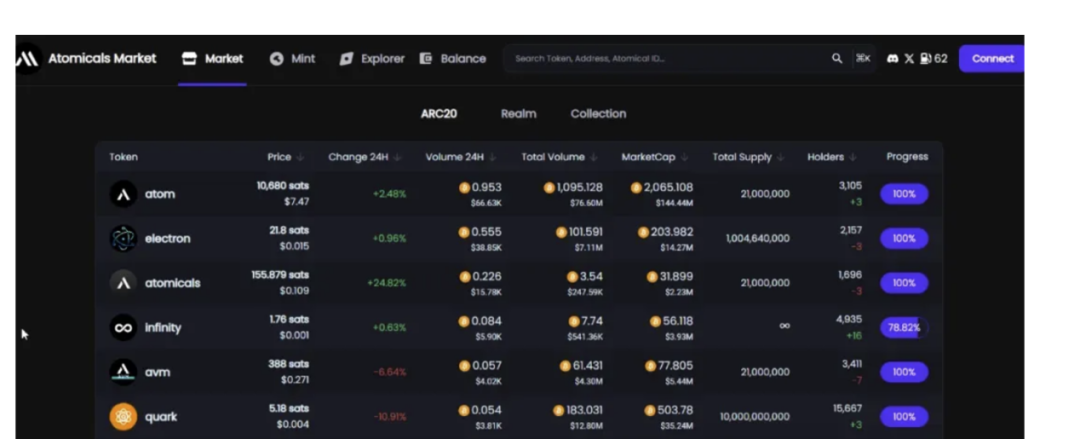

Of course, in addition to ATOM tokens, there are also many tokens based on ARC-20, as shown in the figure below.

From the above picture, we can also see that, in addition to ARC-20, there are two other categories of assets based on the Atomicals protocol: Realm (i.e., a domain that aims to become a global alternative to DNS and all other blockchain naming systems) and Collection (NFT collection). Interested partners can learn more about it on their own.

STAMPS

STAMPS is an "improved version" of the Counterparty protocol (a protocol that was born in 2014), that is, an NFT protocol based on Bitcoin. Its biggest feature is that it can always exist on the BTC chain, and all nodes must synchronize the data. That is, it can embed image data in base64 format into the transaction output on the Bitcoin chain, thereby permanently saving the corresponding image data on the Bitcoin chain.

If we still compare STAMPS with Ordinal: Ordinals record data to a single Satoshis, and node operators may prune this data to improve efficiency. Stamp chooses to be directly embedded in the UTXO set of the Bitcoin blockchain. This integration means that the data truly becomes a permanent part of the blockchain, immutable and inerasable. But the biggest problem with STAMPS is that the handling fee is relatively expensive, and the handling fee for a transaction costs tens of dollars (or even hundreds of dollars).

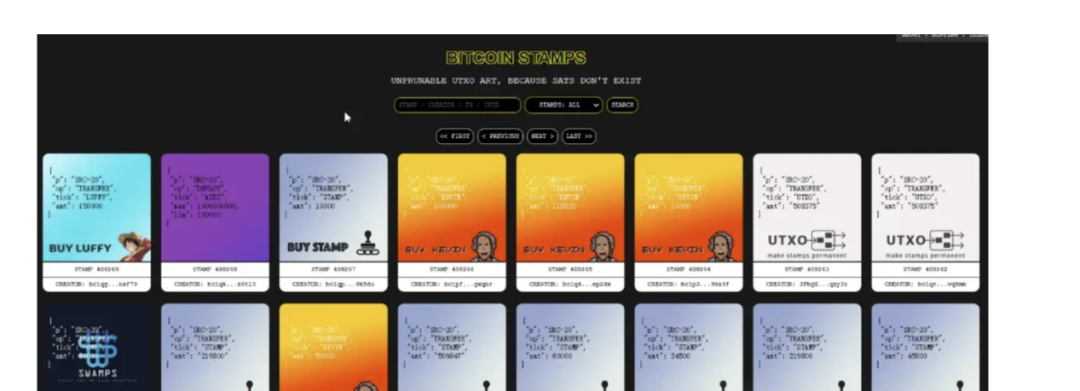

8: SRC-20

In addition to supporting the issuance of non-fungible tokens (NFTs, NFTs issued based on this protocol are also called Bitcoin stamps), the STAMPS protocol can also issue homogeneous SRC-20 tokens, which is a token issuance standard based on the STAMPS protocol.

SRC-20 is also based on the JSON code format, which is almost the same as BRC-20 and can be used to deploy, mint and transfer text of SRC-20 tokens. However, the storage data of SRC-20 can only accept images with a maximum of 24x24 pixels or 8 colors.

There are many tokens (bit stamps) based on the SRC-20 standard, the more representative ones are STAMP (same name as STAMPS), Kevin, etc. As shown in the figure below.

RGB/BitVM

The RGB protocol, which originated from the concept of "coloring", the classic expansion plan of Bitcoin, has been recognized as one of the most elegant expansion plans of Bitcoin in the past many years. We can simply understand it as a protocol for issuing and managing assets at the Bitcoin layer.

The design idea of RGB is to bind the off-chain RGB transactions with the UTXO of Bitcoin transactions and seal the RGB asset ownership in the UTXO of Bitcoin. The result of this design is to allow the asset ownership and contract status of RGB to be and must be operated and controlled through the UTXO of Bitcoin, thereby ensuring the security of RGB transactions and assets through Bitcoin UTXO, thereby preventing the possibility of double spending (i.e. double spending attack, which means that a sum of money can be spent twice).

Or to put it in plain words: because Bitcoin’s structure does not have the ability of smart contracts, UTXO can only verify and control BTC’s own assets, and it cannot manipulate non-BTC assets. The design of RGB provides such a solution.

At present, there are many representative projects based on RGB, such as:

BitRGB: A Bitcoin asset management platform based on the RGB protocol and also compatible with the Lightning Network.

UniPort: A full-chain interoperability protocol that seamlessly integrates Bitcoin ecosystem assets (such as BRC-20/ARC-20, etc.) into the smart contract ecosystem, enabling such assets to be transferred to Ethereum or other EVM-compatible networks.

In addition, there are wallet projects such as Iris Wallet, MyCitadel, Bitmask, Shiro, DeFi projects such as Bitswap, Pandora Prime, and infrastructure projects such as Cosminmart, Infinitas, etc.

In addition to the RGB protocol, there is also a BitVM protocol. BitVM is the abbreviation of Bitcoin Virtual Machine, which is equivalent to ETH's EVM. The technology it uses is somewhat similar to Optimistic Rollups, allowing developers to run complex contracts on Bitcoin without changing the basic rules of Bitcoin.

The concept of BitVM was proposed by robin_linus (the head of the ZeroSync project), who published a white paper titled "BitVM: Compute Anything on Bitcoin" last year (2023). As shown in the figure below.

Then, in February of this year, RGB++ appeared. This is an extension protocol based on RGB (launched by CKB), which uses one-time seals and client verification technology to manage state changes and transaction verification. It maps Bitcoin UTXO to the Cell of Nervos CKB through isomorphic binding, and uses script constraints on the CKB chain and the Bitcoin chain to verify the correctness of state calculations and the validity of ownership changes. That is to say, under the RGB++ protocol, users can directly use their Bitcoin accounts to operate their RGB assets on UTXO chains such as CKB/Cardano without cross-chain. In other words, under RGB++, everyone's RGB asset data is stored on the CKB or Cardano chain, which may cause certain security or privacy issues (of course, if you trust CKB or Cardano, this problem can be ignored).

Both RGB and BitVM protocols are committed to expanding the functionality of Bitcoin, but they have some key differences in design. BitVM mainly emphasizes off-chain computing and fraud protection to ensure the integrity of contract execution and transactions, while RGB focuses more on privacy.

Layer2

Layer2 types can be roughly divided into: State Channel, Sidechain, Rollup, Off-chain verification, etc. based on data availability and consensus mechanism. In fact, the Lightning Network (State Channel) and RGB (Client Verification) mentioned above can also be classified into Layer2, but we still decided to introduce this as a separate category. Next, let's briefly list a few major protocols.

Sidechain solution:

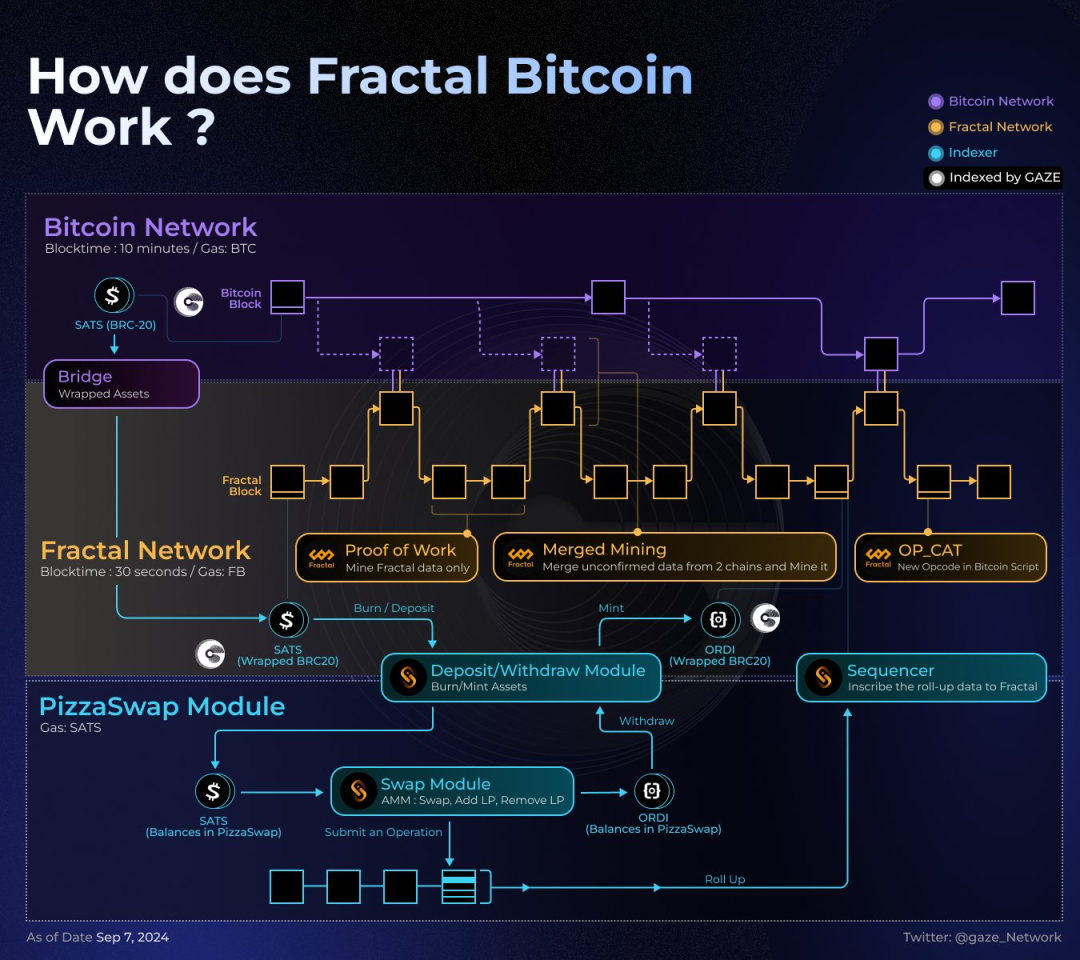

9. Fractal Bitcoin

“Fractal Bitcoin is the only Bitcoin scaling solution that uses the Bitcoin Core code itself to recursively scale infinite layers on top of the world’s most secure and most-held blockchain,” the Fractal website reads.

Fractal Bitcoin's Bitcoin-native approach is supported by the integration of the OP_CAT opcode, which aims to expand Bitcoin's functionality without relying on external protocols. According to the project, the network provides block confirmation times of less than 30 seconds, which is much faster than Bitcoin's base layer, thanks to its recursive layered structure and efficient consensus mechanism. For traditional Layer2, most of them use side chains or state channels to transfer part of the calculation or storage to the off-chain, and make final settlement through the main chain. According to the official introduction, Fractal's recursive layered structure achieves expansion by continuously superimposing layers on the Bitcoin main chain while maintaining compatibility with Bitcoin, so that the capacity of each layer can be increased by 20 times.

Traditional L2 has relatively weak compatibility with the main chain, and new tools and protocols need to be developed to achieve interoperability. The Fractal network is said to natively support Bitcoin protocols such as BRC-20, Ordinals and Runes, and is designed to meet the needs of a wide range of applications from decentralized finance (DeFi) to non-fungible tokens (NFTs).

Fractal also introduced a new mining structure called "Cadence Mining". Unlike the usual merged mining (miners protect two blockchains at the same time), this method splits the block rewards, allowing Bitcoin (BTC) miners to mine a Fractal Bitcoin block every three blocks. This structure combines permissionless mining with merged mining with Bitcoin, improving network security and providing miners with more profit opportunities.

Finally, Fractal activated OP_CAT, (an old Bitcoin opcode that many developers are working to reincorporate into Bitcoin L1), which makes it possible to enable a variety of applications on Fractal, including easy-to-build ZK rollups, which the crypto space is hailing as the premier solution for scaling blockchains and adding new programmability to Bitcoin.

Rollup solution:

If you are familiar with Ethereum L2, then you must be familiar with the word Rollup. Rollup is also considered by many to be one of the most orthodox Layer2 solutions. Compared with state channels, it has a wider range of usage scenarios, and compared with side chains, it inherits the security of the main network.

Currently, the more representative projects based on the Rollup solution include: Merlin Chain, B² Network, etc.

Merlin Chain is a Layer2 launched by Bitmap Tech, the development team of Bitmap and BRC-420, which improves the scalability of Bitcoin through ZK-Rollup. This project has been specially introduced in an article before. Interested friends can search for historical articles for reference.

B² Network provides an off-chain transaction platform that supports Turing-complete smart contracts, which not only improves transaction efficiency and reduces costs, but also distinguishes itself from side chains and expansion solutions in that Rollup better inherits the security of the Bitcoin blockchain.

In addition to state channels, client verification, side chains, and Rollups, there are actually other solutions such as Sidechain (a capacity expansion technology for BTC off-chain transfers, similar to the Lightning Network, but the implementation method is not exactly the same), Ark (an alternative to the Lightning Network that allows users to send and receive funds without introducing liquidity restrictions), etc. Due to limited space, we will not elaborate on them here. Interested partners can search for relevant information on their own to learn more.

Additional knowledge: How many formats are there for Bitcoin wallet addresses?

There are four common formats of Bitcoin wallet addresses, namely ordinary address, native segregated witness address, compatible segregated witness address, and Taproot address.

Ordinary address (i.e. P2PKH address, Pay-to-Public-Key-Hash): It is the earliest Bitcoin address format. This address starts with "1" and consists of 26 to 35 characters, including numbers and uppercase letters.

Native Segwit Address (also called P2WPKH address): This is a new address format that starts with "bc1" or "tb1" and consists of 41 to 62 characters, including numbers and lowercase letters.

Compatible Segregated Witness Address (Nested Segwit Address, also called P2SH-P2WPKH Address): This is a new address format that mixes traditional ordinary addresses and native segregated witness addresses. It starts with "3" and consists of 26 to 35 characters, including numbers and uppercase and lowercase letters.

Taproot address: Taproot is an important upgrade to the Bitcoin protocol (activated in November 2021) that aims to improve Bitcoin's privacy, security, and scalability. Taproot addresses usually start with "bc1".

In short, SegWit addresses are currently used more frequently because bc1 addresses include more advantages, such as higher capacity and lower transaction fees. Although Bitcoin has different addresses, they can transfer money between each other because they all use the same basic encryption technology and underlying protocol for transactions. The only difference between different addresses is that the gas fee will be different, and using SegWit addresses will be relatively cheaper. As for the difference between SegWit and Taproot, the former is mainly to simplify transaction data, and the latter is mainly to improve privacy and efficiency.

Conclusion

In general, current Bitcoin developers are working hard and trying different directions such as state channels, side chains, and Rollups, and various new projects are emerging in an endless stream. Although "new" means some new opportunities, everyone's time and energy are limited, and it is impossible for one person to seize all opportunities, so it is recommended that you only focus on the areas that you are most interested in.