Written by: Ignas, DeFi Research

Compiled by: Glendon, Techub News

It’s surprising how little impact cryptocurrencies have on our lives outside of the crypto community.

Unless you actively get in touch with the world of encryption, your daily life is almost completely isolated from it - you can still go to work, shop, and watch TV series as usual, and blockchain technology is hidden beneath the surface like a deep-sea undercurrent.

The problem, however, is that when “minimum exposure to cryptocurrencies” occurs, the public is almost always fed negative images. Imagine this scenario:

In the second season of Netflix's hit drama "Squidward", you see a character who is set as a "crypto scam KOL". The screenwriter labels him as follows: he can't stop checking the price of the currency for a minute, and strongly demands that his phone be returned, with an almost morbid paranoia - but I must admit that this portrayal makes me empathize.

And when you scroll through your news feed, you see the following (unimaginably negative) headlines:

North Korean hackers steal $1.5 billion: Biggest cryptocurrency heist in history

Trump's issuance of Meme coin was ridiculed by the public, and the crypto community angrily denounced it as a "presidential rug pull"

Woman loses £154,000 in bitcoin scam

Cryptocurrency trader "MistaFuccYou" commits suicide during live broadcast

Fraud, pyramid schemes, pump and dump… all the financial crime scenarios you can think of can be found in this industry. This reflects a cruel reality: society’s perception of cryptocurrency is being torn apart by two extreme narratives. Within the crypto community, we talk about the “blockchain revolution” and “decentralized financial paradigm shift”; but in the outside world, media reports have long been dominated by negative events such as fraud and pyramid schemes.

Cryptocurrency has a terrible public image, but even those of us who are crypto natives know that it’s full of garbage.

But at the same time, we know why we are still here: we want to get rich in the process of disrupting the outdated traditional financial system. Yes, the label of "get rich quick" is one of the reasons why crypto natives are often unpopular, but who can deny this fact? After all, investors in any field are eager to make big money.

Cryptocurrency is still one of the few industries where the average person can start from scratch. In today’s economy, it’s very difficult to slowly get rich from salary. Gen Z realizes this and (quietly) exits the job market, only they know what cryptocurrencies can bring to their lives…

Unfortunately, our industry has been quite poor at communicating its core mission, explaining the necessity of cryptocurrency, and articulating key narratives such as "making money with cryptocurrency is not a sin." A highly praised comment under a report in the Financial Times accurately summarizes the general mentality of skeptics: "Bitcoin has zero intrinsic value, and the computing power consumed is increasing the load on world electricity production and carbon emissions."

Some skeptics even claim that "cryptocurrency is the alchemy of the 21st century - turning electricity into speculative bubbles and packaging greed as technological innovation."

If you read the posts on Reddit, you’ll know how much the average person dislikes crypto, but I hope to see more constructive narratives about crypto and the technology in the mainstream media.

Objectively speaking, the Financial Times has always viewed the crypto industry through a skeptical filter, but Bloomberg's coverage has improved over the years - they have begun to introduce real industry insights. But ironically, a recent Bloomberg report that seemed innocuous, "Meet the Seven Top Personal Finance Influencers in the United States," actually included a cryptocurrency KOL on the list. The KOL mainly focuses on Memecoins and is dedicated to promoting his Memecoin Telegram group.

People Hate Cryptocurrency

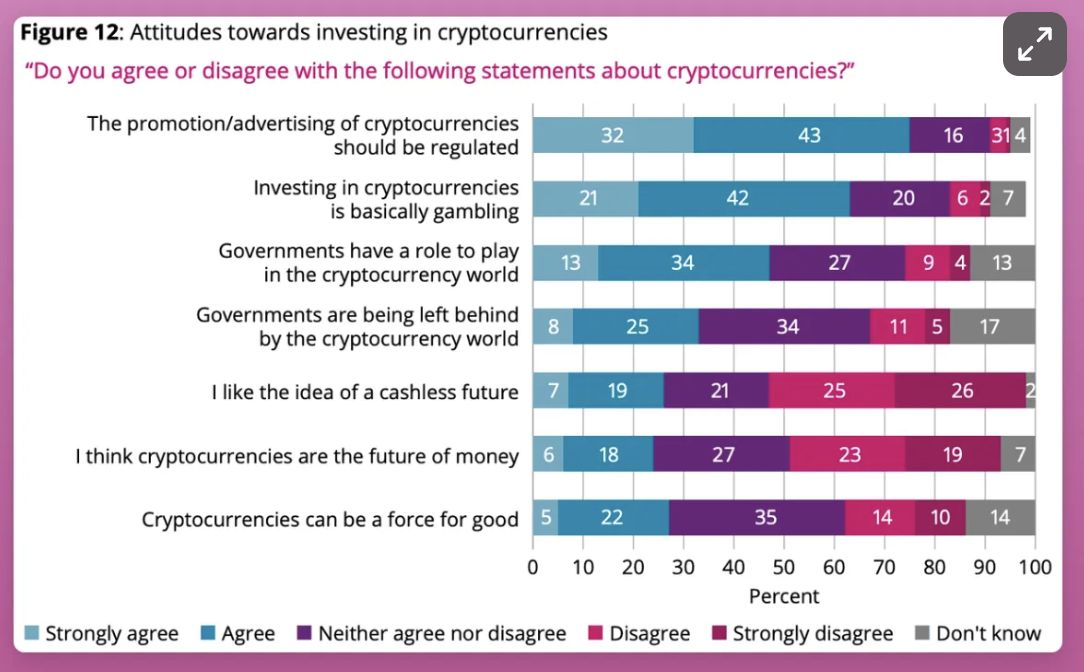

Since this is a "research" article, let's use a few key data sets to understand the public's negative sentiment towards cryptocurrencies. Multiple surveys have shown that non-cryptocurrency investors generally view cryptocurrencies as high-risk speculative tools rather than legitimate financial assets.

According to the report "UK Financial Services Compensation Scheme (FSCS) Consumer Research: Attitudes towards Investing in Cryptocurrencies", 64% of consumers surveyed who are familiar with cryptocurrencies believe that "investing in crypto assets is essentially gambling."

A 2024 Pew Research Center survey found that 75% of Americans do not trust the reliability and security of cryptocurrencies, mainly due to frequent scams and volatile market conditions.

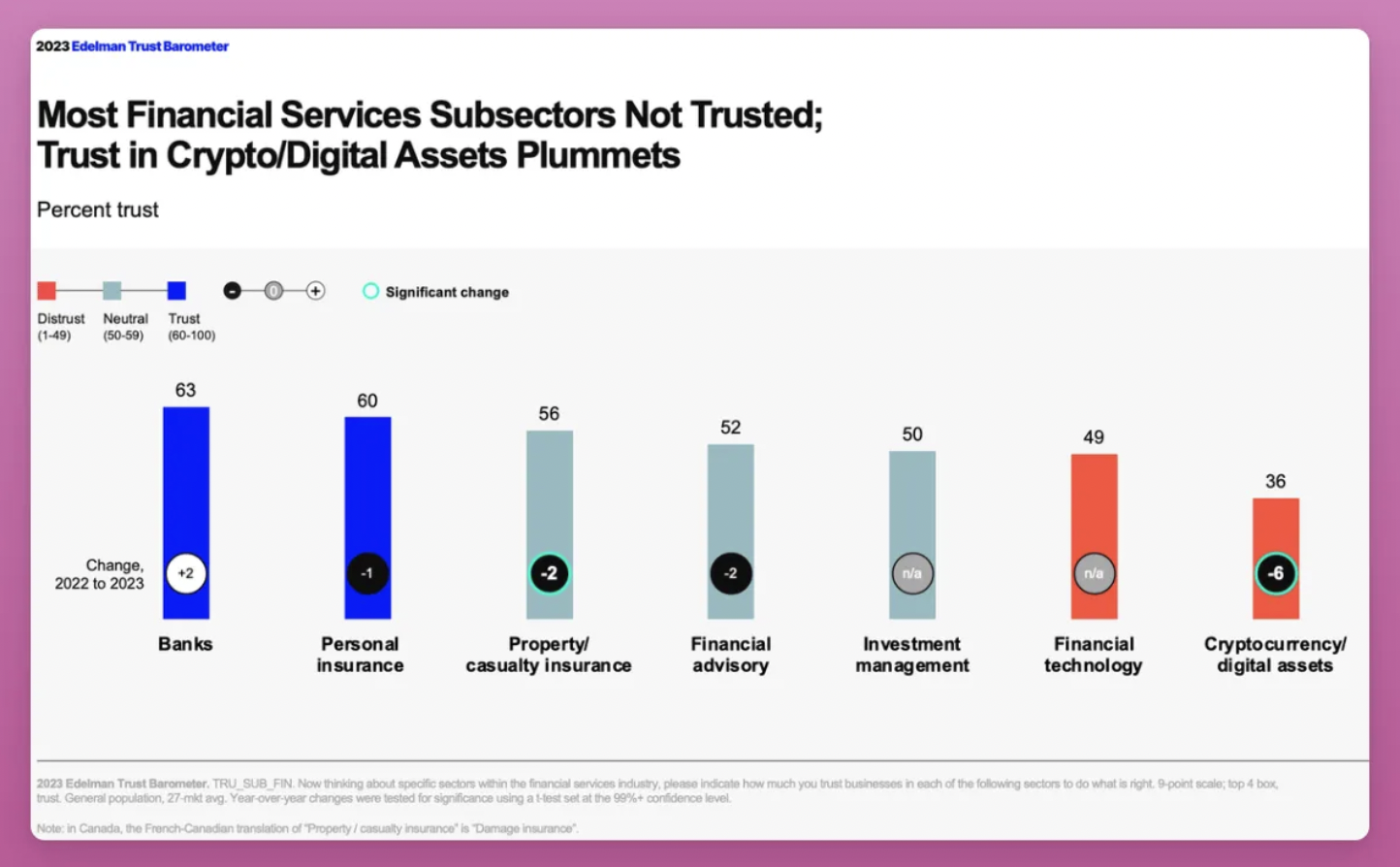

And in Edelman’s 2023 Global Trust Survey, cryptocurrency ranked last in trust across all demographic dimensions, far lower than the traditional banking system that we claim to be overhauling - this is undoubtedly a fatal blow to the narrative of the "decentralized financial revolution."

Granted, the FTX crash dealt a heavy blow to the cryptocurrency industry’s reputation in 2023, but the Memecoin hype in 2024 is also fueling public dislike.

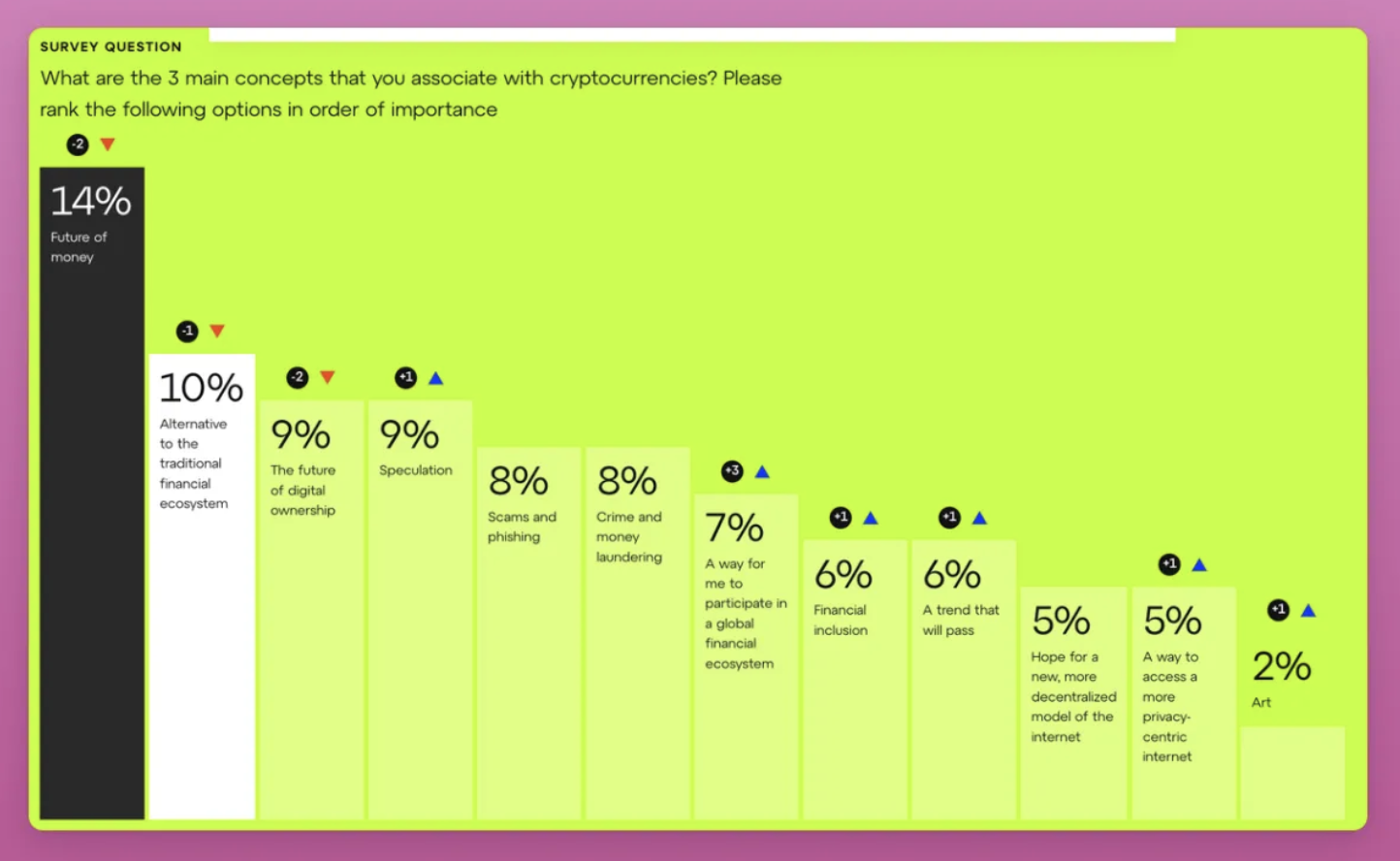

The Consensys 2024 report shows that the narrative of cryptocurrency as the "future of money" is declining. The mention rate of negative labels such as speculation, fraud and phishing, crime and money laundering has become equal to the recognition of cryptocurrency as an alternative to traditional finance.

The conclusion is clear: outside the crypto community, there is widespread skepticism about whether digital assets can be a safe financial instrument.

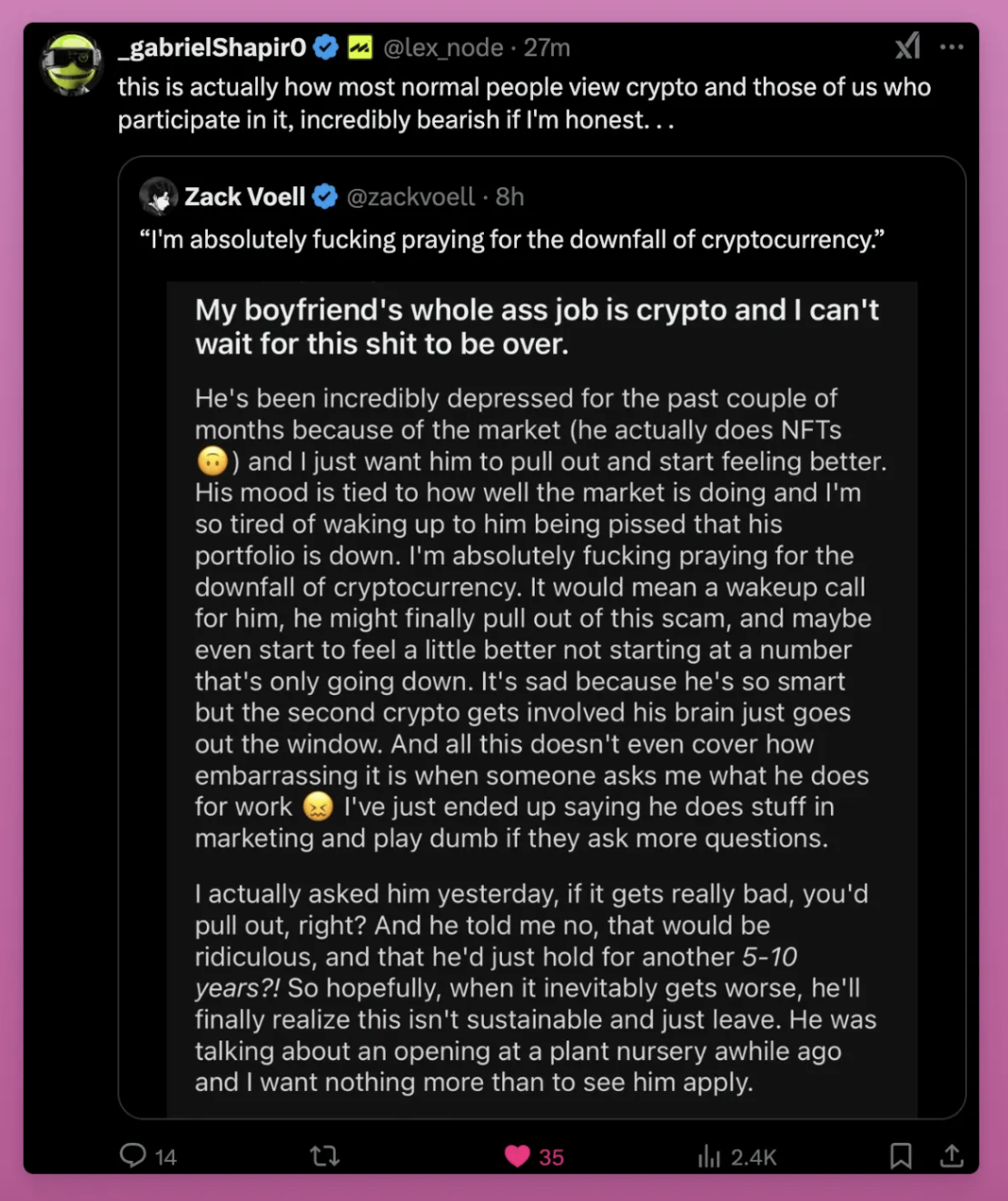

As I was writing this article, I happened to see a tweet that sums up the public sentiment pretty well: “I absolutely pray for the fall of cryptocurrencies.”

Why Crypto Cultural Narratives Matter

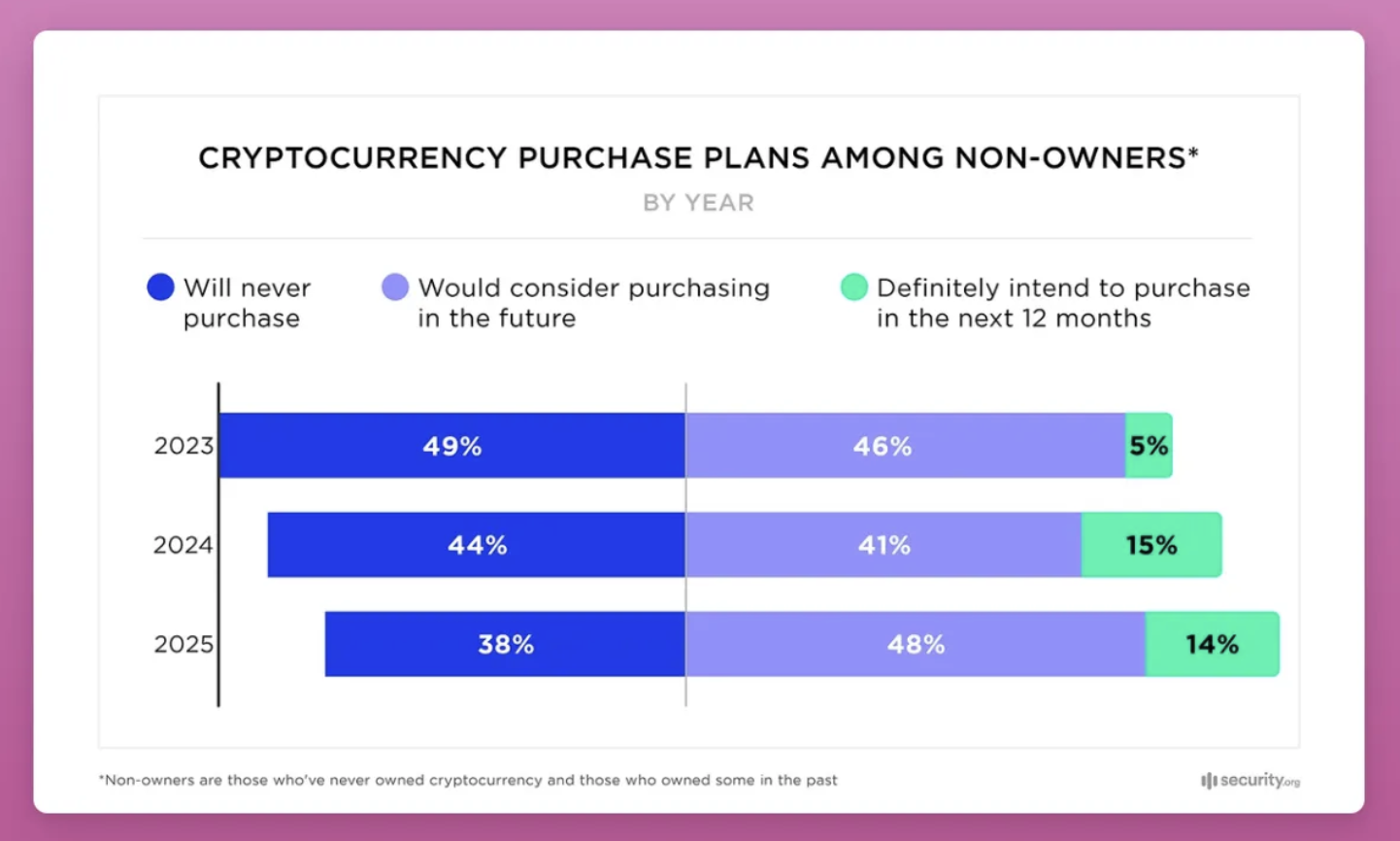

Despite the bad public image of cryptocurrencies, more and more people are trying to get started with cryptocurrencies. I believe that as the perception of cryptocurrencies continues to improve, the crypto industry has the potential to attract millions of new members.

So, we should and must do better. The original intention of cryptocurrency is to build a decentralized financial system: "In this system, individuals can fully control their assets without interference from intermediaries such as banks or governments. It aims to create a borderless, uncensorable, trust-minimized ecosystem where anyone can trade, store value and build an economic system without relying on centralized institutions."

However, this vision is being drowned out by the noise and speculative frenzy surrounding Memecoin.

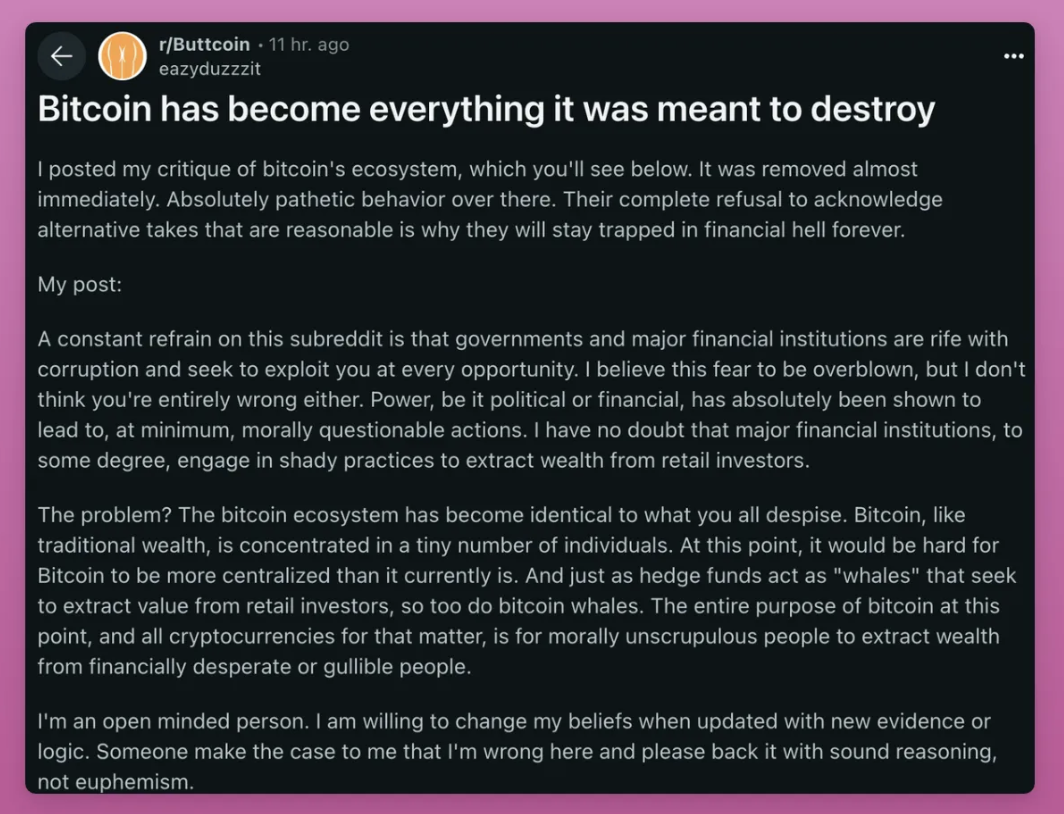

Worse still, the public no longer sees cryptocurrency as a tool to revolutionize the financial system. As one post that sparked a lot of discussion put it: "The Bitcoin ecosystem has become no different from the traditional finance you once despised - money and power are concentrated in the hands of a few whales, who use contract leverage and project pre-sales to squeeze wealth from the financially desperate."

In addition, cryptocurrencies are facing a crisis of politicization. Trump's high-profile embrace of cryptocurrencies has also brought new risks - among non-supporters, cryptocurrencies are being labeled as the "MAGA Movement" (Make America Great Again). As expected, this politicization trend quickly aroused international vigilance, and the European Union regarded Trump's support for cryptocurrencies as a threat to Europe's monetary sovereignty.

Of course, there is a good side to this. The end of the previous US government's cryptocurrency regulation is undoubtedly a big boon to the industry. But we have to admit that the current cryptocurrency industry is walking a tightrope under the influence of the Trump administration's policies.

How to change people’s perception of cryptocurrency

Crypto’s reputation will not repair itself, and if we want to achieve mainstream adoption, we must proactively reshape the narrative framework - this is not easy, and change must start from within the industry: because even crypto natives are beginning to lose confidence in the industry.

To this end, we need to focus on three key areas.

Make Crypto Great Again

In previous cycles, newcomers to the cryptocurrency market were able to profit from early participation in projects. However, the Memecoin Group’s excessive issuance of Meme coins and venture capital firms (VCs) supporting low-circulation, high-FDV projects have left new entrants with no advantage.

And while we have successfully resisted low-volume projects during this cycle, we have been caught in the collective madness of Memecoin. Projects such as Legion and Echo have attempted to adopt fairer funding models, but their barriers to entry still keep ordinary investors out.

Therefore, the industry needs to create and promote ecological game rules that can create real value (rather than destroy value) so that early participants can share the growth dividend. Kyle's market reconstruction plan based on "first principles" is worth learning from.

However, the prevalence of short-termism, the rampant culture of exploitation, and the loss of integrity have trapped us in a self-destructive cycle of eternal financial nihilism. When everyone is chasing after scam coins with the mentality of "I can get out before the scammers run away", the emergence of this phenomenon is to some extent already inevitable.

In this regard, we must monitor bad actors. The industry should do more to expose scams and hold influential people accountable for misleading propaganda. On-chain detective ZachXBT has done this before, but the degree of crime is beyond personal control. As practitioners, we ourselves must stay away from value extraction. Investors should actually make money while expanding the cryptocurrency market. After all, when new entrants continue to be harvested or even bankrupted, the industry will eventually lose its future.

Transforming the narrative from speculative carnival to practical value

Cryptocurrency is more than a digital casino—it creates real-world value.

Therefore, what we really need to focus on are use cases such as cross-border remittances, financial inclusion, and transparent governance, rather than Memecoin culture.

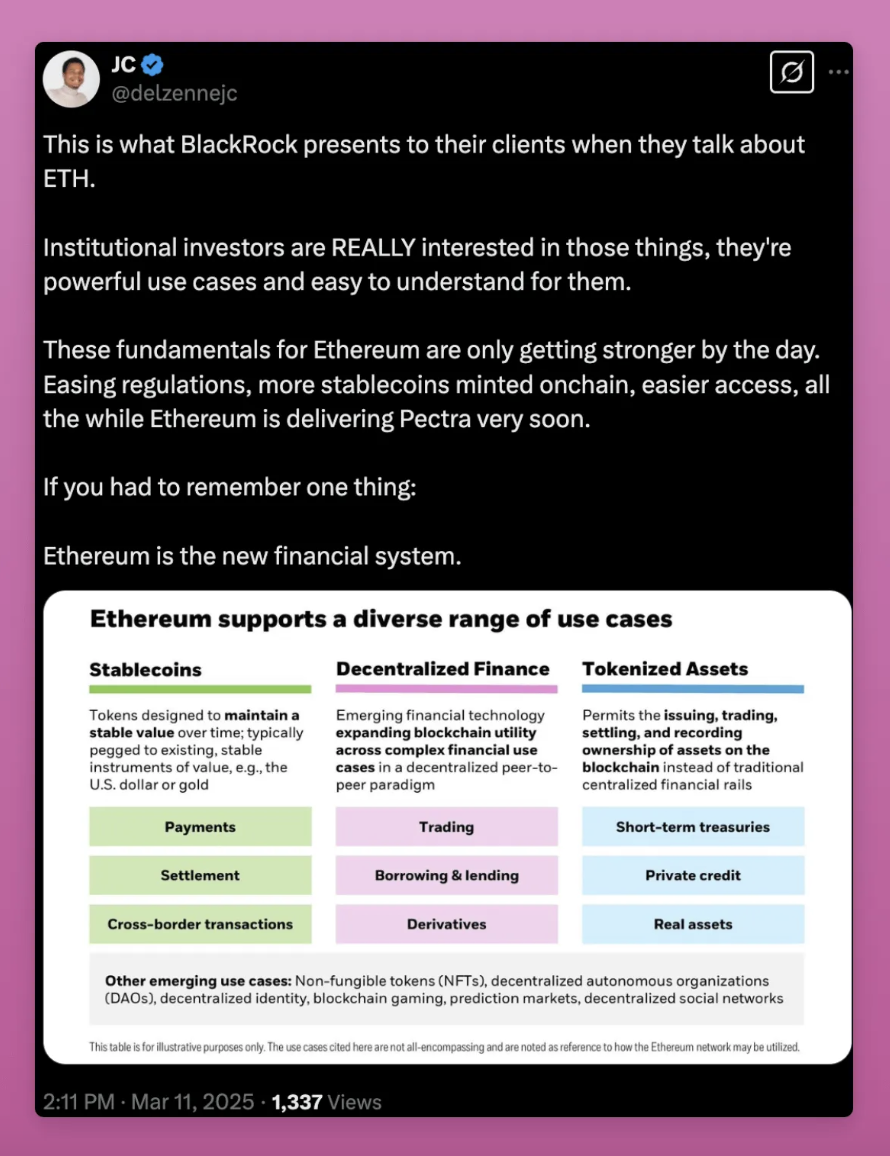

At the same time, the DeFi ecosystem is continuing to expand, and new social networks are emerging with innovative profit models, such as Lens, Abstract, and Farcaster. Most importantly, the widespread adoption of stablecoins and RWA (real world assets) helps preserve and increase wealth, rather than destroy it.

However, crypto influencers on Platform X may be indifferent to these developments - but we need to be clear that Crypto Twitter is just the tip of the iceberg of the wider crypto industry culture.

On the other hand, the advantage of Bitcoin is that it has gradually established its status as "digital gold", but public chains such as Ethereum and Solana are still seen as speculative tools rather than basic platforms for an open digital economy.

If we have to define the output of crypto culture, I believe that IPs such as Pudgy Penguins will penetrate into Web2, rather than reversely introducing Web2 memes such as Doge and Pepe - the latter are accelerating the infantilization of the industry.

Redefining the Narrative Sovereignty of Bitcoin and Ethereum

Cryptocurrency culture is not monolithic, but includes multiple subcultures, the most notable of which are "Bitcoin Minimalism" and "Ethereum Diverse Ecosystem".

"Bitcoin is becoming the financial system it was supposed to destroy" - this argument makes me angry. Only those who store Bitcoin in cold wallets can truly understand the peace of mind that comes with "self-custody and being out of the system."

ETFs are undoubtedly good for our wallets, but they are also a double-edged sword, preventing ETF buyers from experiencing the freedom that comes with self-custody.

More importantly, we need to be wary of Bitcoin being tied to the MAGA movement. Bitcoin is global and should remain absolutely neutral.

This is one of the reasons why I like Ethereum. Although many critics have accused the Ethereum Foundation of failing to approach the Trump team, in the long run, this will prove to be a successful strategy.

In this era where privacy is disappearing, AI is confusing reality, and digital ownership cannot be guaranteed, Ethereum, with its trusted neutrality, depoliticization, decentralization, and globality, provides not only a technical solution but also a refuge for value.

Unfortunately, people outside of the cryptocurrency space don’t understand this, so it’s our job to spread the word and build products that truly demonstrate the value of Ethereum.

Optimistic Outlook: The Path to Value Return in the Crypto Industry

As of the time of writing, CoinMarketCap data shows that the total market value of cryptocurrencies is approximately US$2.7 trillion, but can this report card withstand the test of value?

Since Vitalik published this post in 2017, cryptocurrencies have changed. Although speculation and zero-sum games still exist, the industry has also nurtured a core of real value.

As I wrote in my post, 1.4 billion people in the world do not have a bank account. Even in the United States, the proportion is only 4.5%. The Federal Reserve found that high-income people use cryptocurrencies as investments, but to a lesser extent for transactions. Among those who use cryptocurrencies for transactions, 60% have an income of less than $50,000 and 13% do not have a bank account.

Additionally, Venezuela ranked 40th on the 2023 Chainalysis Crypto Adoption Index, with stablecoins serving as a lifeline against hyperinflation. This is similar to Argentina, where stablecoin purchases have soared as the national currency has depreciated — a sign of widespread cryptocurrency adoption.

In addition to protecting against inflation, cryptocurrencies are also used to resist oppressive regimes. For example, during the COVID-19 pandemic, cryptocurrencies were used to directly aid doctors and nurses in Venezuela without interference from the corrupt regime; at the beginning of the war, Ukraine raised $225 million in cryptocurrency donations, etc.

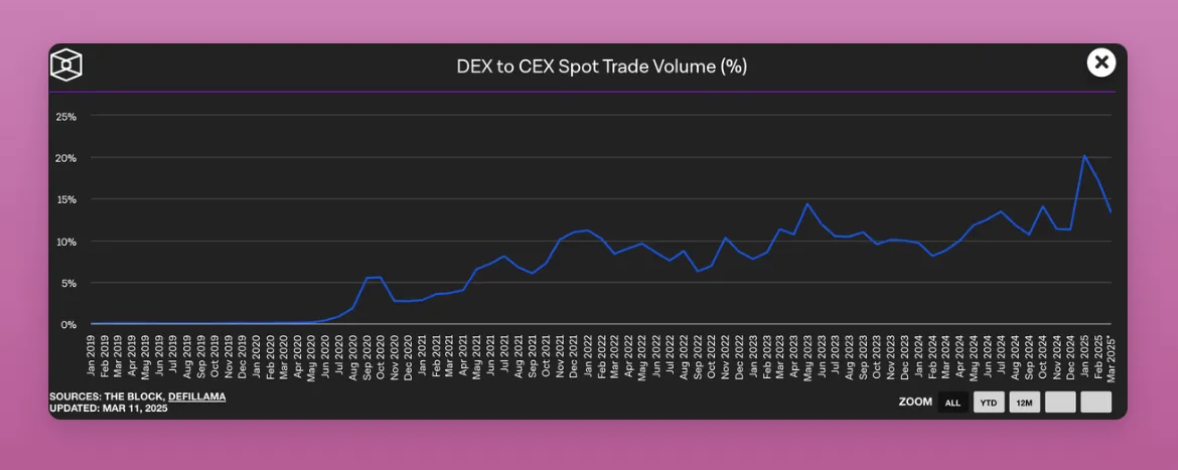

As DeFi TVL rebounds to $88 billion, DEX is gradually challenging CEX, and Maker and other companies are also introducing RWA on-chain.

It is worth mentioning that the adoption rate of non-speculative decentralized social applications is increasing, such as Farcaster and Polymarket, which have more than 10,000 daily active users and are still growing. We now have real DApps that can be used, but these developments seem to have disappeared in the X timeline. It has to be said that we have not done a good job in communication.

Nevertheless, the current market is experiencing a value cleansing, and the plunge may not be all bad. It will help the industry recover and continue to progress. As the old saying goes, the cold winter will eventually pass, and when speculators leave, the real builders will stay and will export the positive side of cryptocurrency.