Author | defioasis

Editor | Colin Wu

This article is for information only and does not constitute any financial advice. Readers are requested to strictly abide by the laws and regulations of their location.

Memecoin once attracted a lot of attention and investment with its unique culture, humorous image and community-driven characteristics. The pump fun fair launch mechanism pushed the Meme craze to a new peak. However, with the intensification of PvP and the rapid birth of new projects, the so-called narrative logic, Meme symbols and community culture have long disappeared. Who shouts the order has become the key. The identity, status, background and resources of the shouter determine the peak that the Memecoin price can reach in a short period of attention. After the emotions and attention are gone, it will be a mess. With the US President Trump and the founder of the largest exchange Binance, CZ, successively "shouting orders", Memecoin's role as a carrier of pure attention game tools seems to have reached its peak, because there are few people with higher status than the two, and many users are also tired. As the opposite of fair launch, although VCcoin has problems such as high valuation and low efficiency, those sustainable projects with clear business models, real income and empowerment are expected to stand out in the impetuous crypto market. This article will review 5 projects in the current market that have strong real income and are used for empowerment.

Hyperliquid: Repurchases from transaction fees

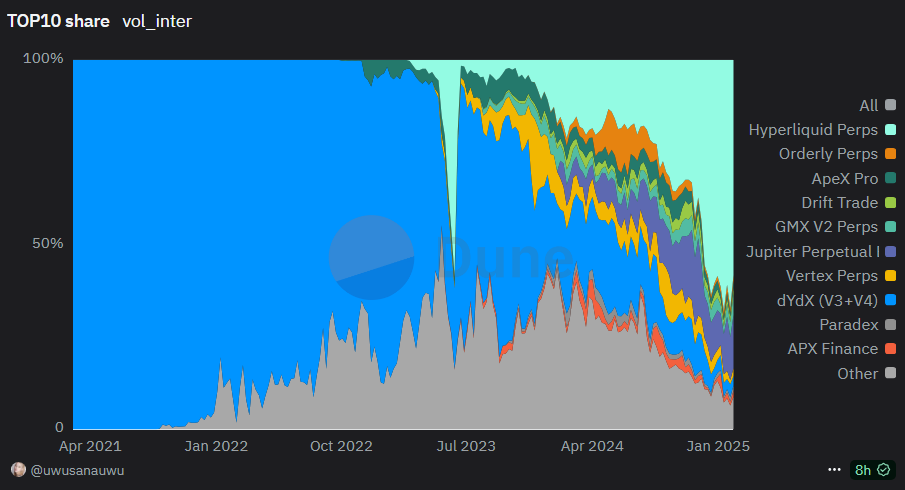

Hyperliquid is an on-chain Perpetual Contract Exchange, and has launched a Dutch auction mechanism to obtain a mechanism for issuing new spot seats. Hyperliquid's revenue mainly comes from contract transaction fees, HIP-1 auction fees, spot transaction fees and HLP MM PnL. Currently, Hyperliquid has become the largest on-chain derivatives exchange, with its trading volume accounting for about 60% of the market share.

HYPE can be considered to have a dual deflation mechanism. Part of the Hyperliquid platform revenue (i.e. USDC fees) will go into the Hyperliquid Assistance Fund to support the repurchase of HYPE. HypurrScan data shows that as of February 10, since the TGE in early December, the Hyperliquid Assistance Fund has spent approximately 149 million USDC to repurchase 14.693 million HYPE, accounting for 1.47% of the total, and has made a floating profit of approximately US$194 million.

On the other hand, the supply will be reduced by destroying HYPE in transaction fees. The HYPE part of the HYPE/USDC spot transaction fee is directly destroyed, which further reduces the supply in circulation. HYPEBurn data shows that as of February 10, 153,100 HYPEs have been destroyed in transaction fees.

Jupiter: Diversified business system beyond aggregator and 50% of protocol revenue for repurchase

As the largest DEX aggregator of Solana, Jupiter has almost no rivals in the aggregator field thanks to the hot market of Solana chain. According to DeFiLlama data, in the past 24 hours, Jupiter's aggregated transaction volume reached 3.224 billion US dollars, which is 7-8 times that of the second-ranked OKX (about 411 million US dollars).

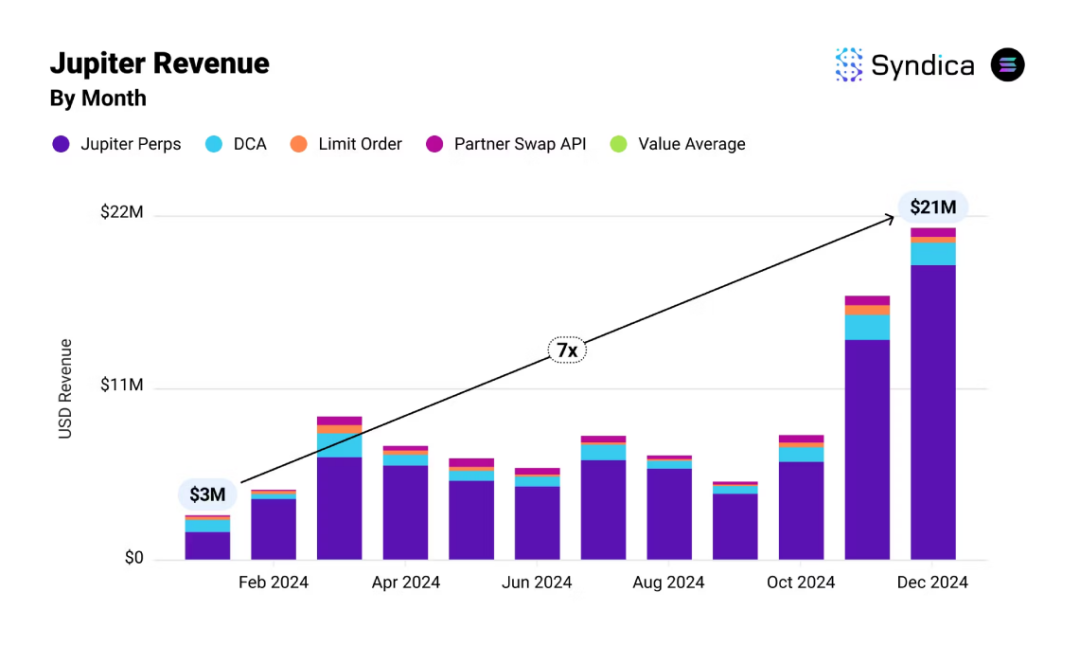

Unlike other aggregators that started out as aggregators, Jupiter is also actively expanding other businesses, including Jupiter Perp, DCA, Swap API, and fiat channels, and the largest business income comes from Jupiter Perp. Although Jupiter Perp is much inferior to Hyperliquid in the market share of multi-chain on-chain contract exchanges, it is an absolute leader on the Solana network.

According to Syndica data, in December 2024, Jupiter's protocol revenue reached US$21 million, a record high, more than 7 times higher than in January of the same year; throughout 2024, Jupiter's protocol revenue reached US$102 million.

In late January of this year, Jupiter officially announced that it would use 50% of the revenue from the agreement to repurchase JUP, which is equivalent to US$50.1 million per year for repurchase based on the full-year revenue in 2024.

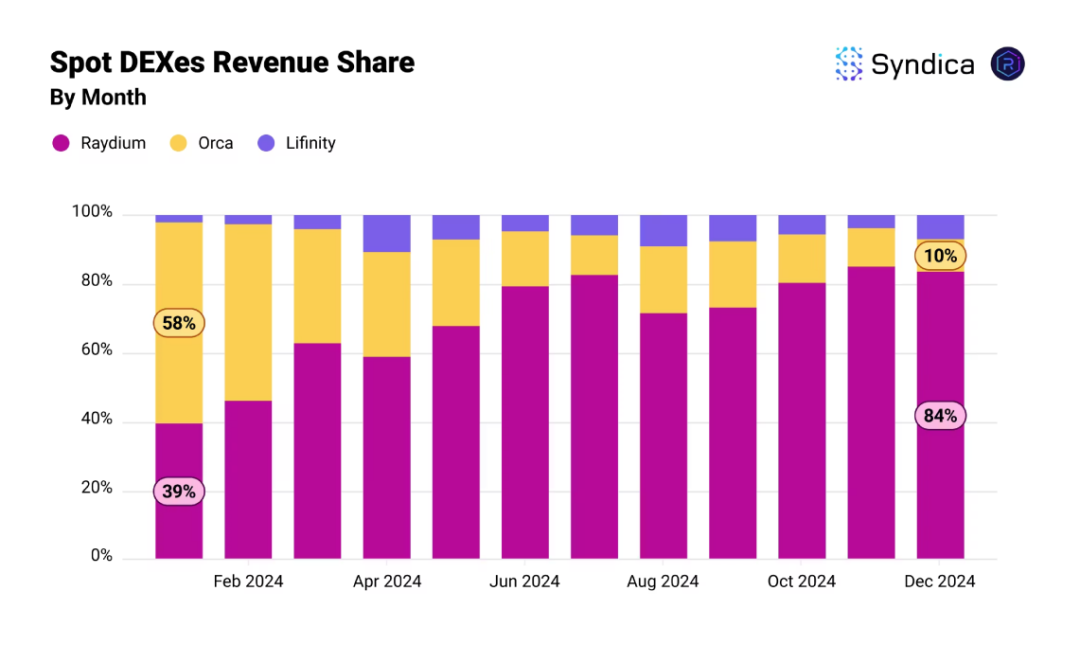

Raydium: Solana’s largest DEX with 12% of each transaction fee for buybacks

In the second half of 2024, Solana surpassed Ethereum DEX to become the network with the highest on-chain transaction volume. Solana DEX transaction volume exceeded US$630 billion in 2024, among which Raydium went from less than 40% market share at the beginning of the year to an absolute leader with a market share of more than 80% in Q4.

Compared with Jupiter, Raydium's revenue model is much simpler. Each transaction in Raydium Pool requires a certain transaction fee. For example, the transaction fee of the standard AMM Pool is 0.25%, and the transaction fee of the CLMM Pool has 8 different levels of 0.01% - 2%. Of the transaction fees collected, 84% is allocated to LP, 12% is used for RAY repurchase, and 4% is collected in the treasury.

DeFiLlama data shows that Raydium captured approximately $664.4 million in fees in 2024, equivalent to $79.728 million in fees spent on repurchases throughout the year.

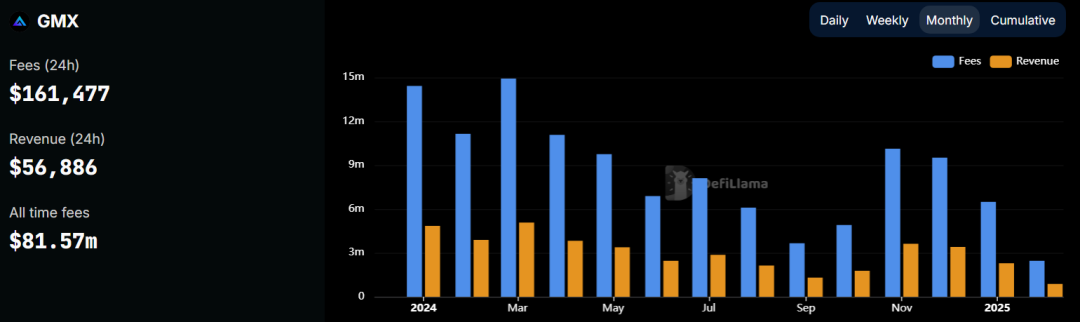

GMX: AMM Perp Representatives and Staking Dividends

As one of the early on-chain derivatives exchanges, GMX uses an automated market maker model (AMM) for perpetual contract trading, unlike the current mainstream order book model. Users provide assets (such as ETH, BTC, stablecoins) to GMX's GLP pool as the counterparty of GMX Traders. However, compared to the order book model, AMM Perp is not very suitable for running strategies, but more suitable for some low-frequency transactions. Therefore, the characteristics of GMX are high positions but low daily trading volume. Despite the challenges of order book Perps such as Hyperliquid, DeFiLlama data shows that GMX still captured approximately US$111 million in fees in 2024, of which 5 months captured fees exceeding US$10 million.

30% of the fees captured from GMX V1 transactions and 27% from V2 will be used as rewards for GMX stakers, which is equivalent to approximately $30-33 million in fee dividends based on full-year fees in 2024. Of the current GMX in circulation, 64% of GMX is staked, currently worth approximately $145 million.

Banana Gun: The old TG trading robot that has been challenged and dividends to holders

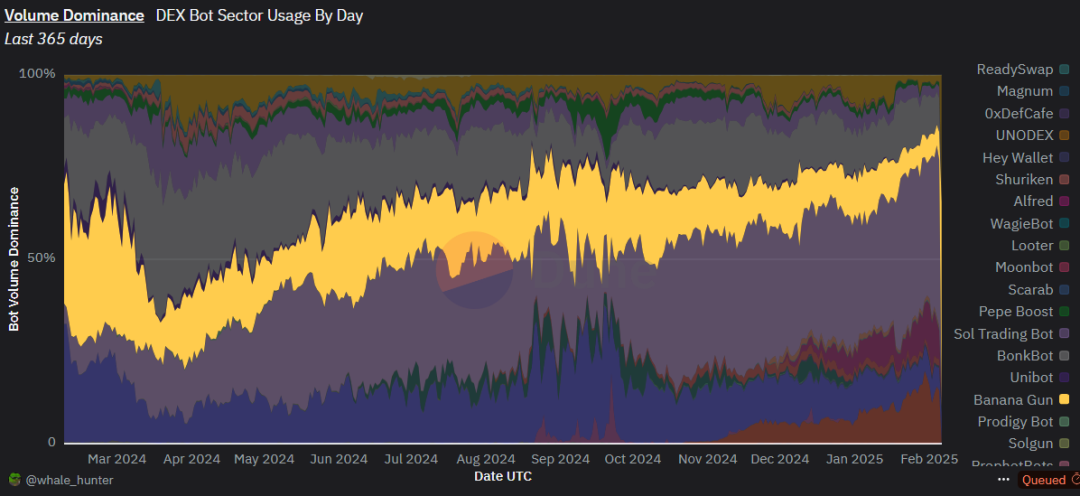

As one of the first Telegram robots to use vampire attacks, Banana Gun once captured nearly $9 million in monthly fee income in March 2024, and once occupied more than 30% of the market share of the multi-chain network TG trading robot track. However, with the substantial increase in competitors in the TG trading robot track, the on-chain meme trading shifted from Ethereum to Solana, and platform-based meme trading tools such as BullX, Photon and GMGN formed a trend of impact on TG Bot, Banana Gun's market share gradually slipped to 5%-10%.

Although the market share is declining, the pie of on-chain transaction volume is expanding significantly, so Banana Gun, as an old TG trading robot, is still one of the most profitable applications in 2024. Banana Gun charges a 0.5% fee for manual purchases and limit orders on Ethereum, and a 1% fee for Ethereum automatic sniping and other chains. According to DeFiLlama data, Banana Gun's full-year fee income in 2024 reached US$57.8 million.

BANANA holders who enter Banana Gun through the referral link of others only need to hold more than 50 BANANA in the wallet to automatically accumulate a 40% distribution of Banana Gun transaction fees every 4 hours, which is equivalent to distributing US$23.12 million in 2024 revenue to holders in the form of ETH/SOL or BANANA. The choice of BANANA comes from the repurchase of transaction fees on the secondary market.

In addition, users who use Banana Gun to trade will receive a small amount of BANANA as a reward through Banana Bonus trading rebate. Let traders become holders, and let holders become traders, which is the ecological cycle system that Banana Gun is building for BANANA and TG Bot.

Currently, most of the on-chain protocols in the market that are willing to share protocol revenue or repurchase are mostly related to asset transactions, including spot transactions, perpetual transactions and aggregate transactions. This shows that on-chain asset transactions can bring strong income, giving the team the motivation to empower. Compared with the 0.02%-0.075% fees of centralized exchanges, on-chain taxes of up to 1% are common.