introduction

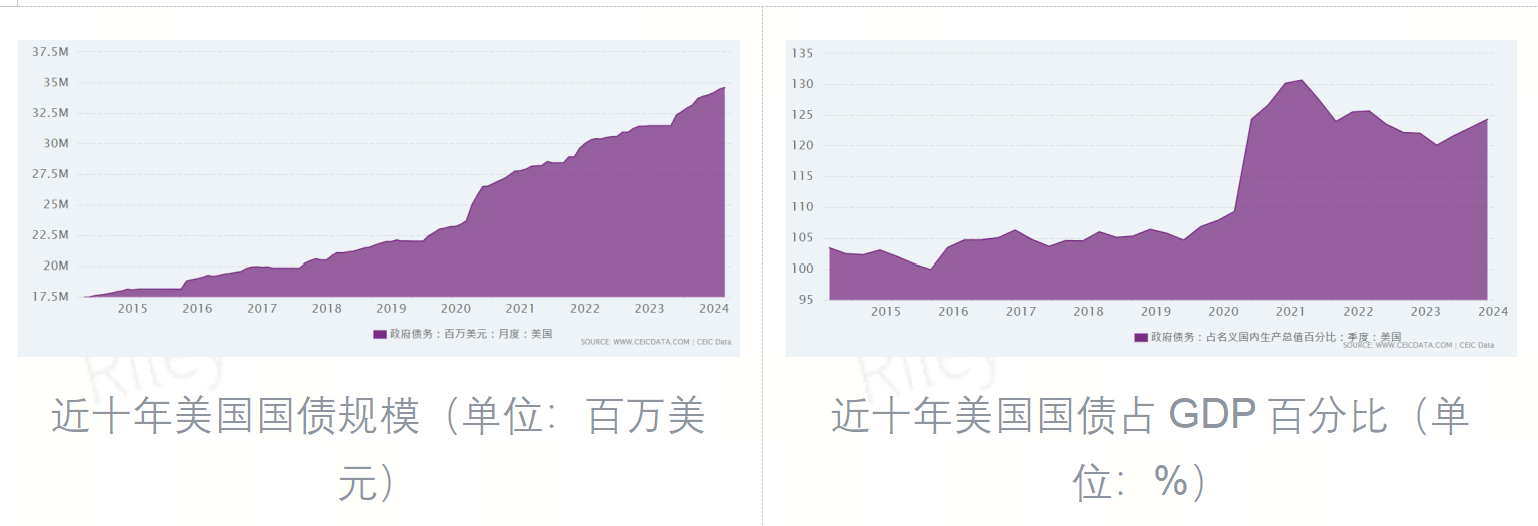

At the beginning of the new year, the size of the US national debt has exceeded 36.4 trillion US dollars. How can the US debt crisis be resolved? Can the international hegemony of the US dollar continue? How will Bitcoin react? How will the international settlement unit be replaced in the future?

We will start with the debt economic model of the United States, then explore the debt risks currently faced by the internationalization of the US dollar, and analyze whether the US debt repayment plan is feasible. Looking back to the past and present, let's see where US debt points Bitcoin.

The Establishment of the American Debt Economy Model

After the collapse of the Bretton Woods system, the US dollar hegemony grew rampantly on the debt-based economic model.

The Bretton Woods system collapsed and the US dollar became a credit currency

After World War II, the Bretton Woods system was established, the dollar was linked to gold, the International Monetary Fund (IMF) and the World Bank controlled the relevant rules, and an international monetary system centered on the dollar was formed. However, the famous "Triffin Dilemma" accurately predicted the disintegration of the Bretton Woods system: the demand for international settlement continued to grow, the dollar continued to flow out of the United States and settle overseas, and the United States had a long-term trade deficit; and the dollar, as an international currency, must maintain a stable value, which in turn requires the United States to have a long-term trade surplus. In addition, the Vietnam War exacerbated the double deficit. In 1971, President Nixon announced that the dollar was decoupled from gold. The dollar was transformed from a standard currency to a credit currency. Its value was no longer guaranteed by precious metals, but by the national credit of the United States.

The debt economic model is established and the dollar hegemony continues

On this basis, the United States established a debt economic model: global trade is settled in US dollars, the United States must maintain a huge trade deficit so that other countries can obtain large amounts of US dollars; countries around the world purchase U.S. Treasury bonds to preserve and increase the value of the dollar, and then invest in U.S. financial products to allow dollars to flow back to the United States.

As a world currency, the US dollar is an international public good and should maintain a stable value. However, after abandoning the gold standard, the US monetary authorities have the right to issue currency, and the US can change the value of the dollar according to its own interests. The dollar hegemony has been effectively continued through the debt economic model.

Dollar internationalization faces risks

The dollar faces risks from the U.S. Treasury debt economic model and commercial real estate debt.

The internationalization of the US dollar and the return of manufacturing are contradictory

The US debt economic model is an important support for the internationalization of the US dollar, but it is not sustainable. The Triffin dilemma still exists. On the one hand, the internationalization of the US dollar requires maintaining a long-term trade deficit, exporting US dollars and depositing them overseas. Once overseas investors are concerned about the solvency of US Treasury bonds, they may turn to other alternatives and require US Treasury bonds to pay higher interest rates to balance future repayment risks, causing the United States to fall into a vicious cycle of "weakened US dollar credit - rising prices of US dollar-priced commodities - stronger inflation resilience - high US Treasury bond interest rates - increased US interest burden - increased US debt repayment risks - weakened US dollar credit".

On the other hand, the United States needs to use a combination of economic measures to promote the return of manufacturing, which will reduce the trade deficit, lead to a shortage of US dollars, and a long-term substantial appreciation. This will hinder the use of the US dollar as an international settlement currency. Although the US President-elect Trump proposed the return of manufacturing, he also proposed high tariffs. Although high tariffs are conducive to the return of manufacturing in the short term, they will cause inflation in the long run. In fact, the two are also in conflict.

The idea of having both dollar hegemony and manufacturing is unrealistic. At present, the pressure for the dollar to appreciate is not clear, and it is expected that the trade deficit will not undergo a fundamental change in the short term, and the dollar will mainly face depreciation pressure.

Commercial real estate debt crisis

In addition to the risks of U.S. Treasury bonds, commercial real estate also has debt risks.

According to a recent report released by Moody's, due to the continued expansion of home office, the office vacancy rate in the United States is expected to rise from 19.8% in the first quarter of this year to 24% by 2026, and the office space required by the white-collar industry has decreased by about 14% compared with before the epidemic. McKinsey predicts that by 2030, the demand for office space in major cities around the world will fall by 13%, and the market value of global office properties may shrink significantly by US$800 billion to US$1.3 trillion in the next few years.

According to CICC research, by the end of 2023, commercial real estate loans accounted for 26% of total loans in the U.S. banking system, while commercial real estate loans accounted for only 13% of large banks and 44% of small and medium-sized banks. In the late 1980s and 2008, the United States experienced a wave of bankruptcies and restructurings caused by real estate risks. After the epidemic, commercial real estate risks in the United States still exist and have not improved. The United States has $1.5 trillion in commercial real estate debt due next year. If small and medium-sized banks go bankrupt, it may trigger a financial crisis.

Analysis of the U.S. debt repayment plan

How to break this vicious cycle depends mainly on how to repay such a large amount of US national debt. Borrowing new debt to repay old debt is similar to a "Ponzi scheme". Sooner or later, the US dollar will lose its credit and thus lose its status as a world currency. This is obviously not feasible. We will analyze whether the following repayment plan is feasible.

Sell gold to repay US debt?

Analysis of the Federal Reserve's asset side

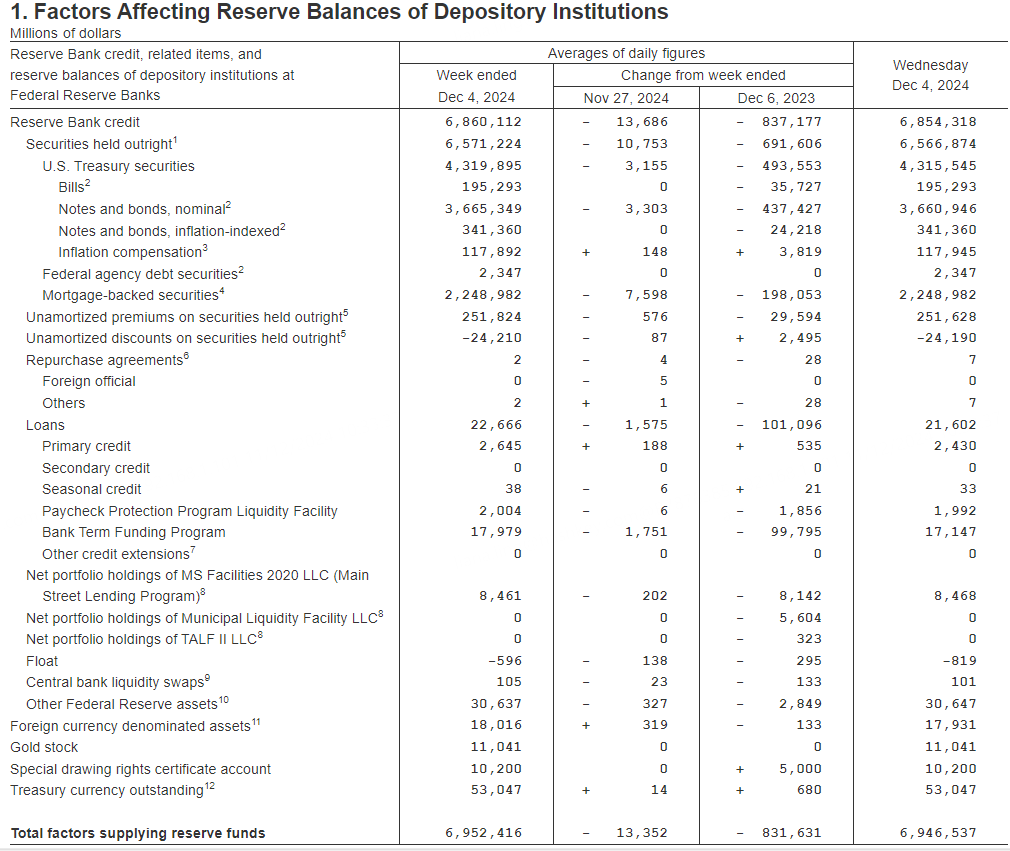

The figure below shows the details of the Federal Reserve’s assets as of December 4.

December 4th Federal Reserve Assets (Unit: Millions of US Dollars)

Source: Federal Reserve Balance Sheet: Factors Affecting Reserve Balances - H.4.1 - December 05, 2024

The main assets held by the Federal Reserve are bonds, including Treasury bonds and quasi-Treasury bonds, totaling approximately US$6.57 trillion, accounting for approximately 94.45% of total assets.

The gold holdings are $11 billion, but this part is calculated based on the price after the collapse of the Bretton Woods system. We refer to the exchange rate when the system completely collapsed, 1 troy ounce of gold = $42.22, and then calculate based on the spot price of about $2,700 per ounce on December 11, the value of this batch of gold is about $704.358 billion. Therefore, the adjusted gold accounts for about 10% of the total assets.

Therefore, some people proposed to sell gold to repay US debt. It seems that the scale of gold is large, but it is not feasible. Gold is a universal currency of international spontaneous consensus, and plays a key role in stabilizing currency and coping with economic crises. The huge gold reserves give the United States a strong voice in the international financial market, and its position is very important. If the Fed sells gold, it means that the Fed has completely lost trust in US debt, and it seems that "there is no way out". It would rather weaken its own influence to make up for the "sinkhole" of US debt. This will undoubtedly cause a liquidity crisis of US debt, which is a self-destructive Great Wall.

Bitcoin Check Acceptability Issue

Trump once said, "Give them a little cryptocurrency check. Give them a little Bitcoin, and then wipe out our $35 trillion." Although BTC plays a role similar to a value storage currency in cryptocurrencies, its value is still more volatile than traditional legal tender. Whether the check can be cashed at the value recognized by the other party remains to be seen. U.S. debt holders may not agree. Secondly, economies holding U.S. debt may not necessarily implement Bitcoin-friendly policies. For example, China may not accept Bitcoin checks due to regulatory issues within the economy.

Bitcoin reserves are not enough to repay

Secondly, the Bitcoin held by the United States is not enough to solve the debt crisis. According to the current data, according to Arkham Intelligence data on July 29, the US government holds $12 billion in Bitcoin, which is just a small part of the repayment of the $36 trillion in US debt. Some people speculate whether the United States can manipulate the price of Bitcoin. This is unrealistic. Cutting out the money is a question that the dealer thinks about. The United States faces a terrifying $36 trillion in US debt. Even if it manipulates the price of Bitcoin, it cannot use $12 billion to create a solution.

In the future, it is possible for the United States to establish a Bitcoin reserve, but it cannot solve the debt problem. Senator Cynthia Loomis has proposed that the United States establish a 1 million Bitcoin reserve, but the plan remains controversial.

First, establishing Bitcoin reserves will undermine the world's confidence in the US dollar. The world will see this as a signal that the US debt risk is about to collapse. Interest rates may soar sharply and a financial crisis will break out.

Second, the United States is currently negotiating whether to promote Bitcoin reserves through laws or executive orders. If Trump forces the purchase of Bitcoin through executive orders, it is very likely to be interrupted because it does not meet public opinion. The American public does not have a deep understanding of the possible dollar crisis. The Trump administration uses administrative means to purchase a large number of Bitcoins, which may face public doubts: "Would it be better if this part of the expenditure was used for other purposes?" Or even "Is it necessary to spend so much money on Bitcoin?" The challenges faced by legislative means are obviously more arduous.

Third, even if the United States successfully establishes a Bitcoin reserve, it can only slightly delay the debt collapse. Some people who support the use of Bitcoin reserves to repay U.S. debt cite the conclusion of asset management company VanEck: by establishing a reserve of 1 million Bitcoins, the U.S. national debt can be reduced by 35% in the next 24 years. It assumes that Bitcoin will grow at a compound annual growth rate (CAGR) of 25% to $42.3 million in 2049, while the U.S. national debt will climb from $37 trillion at the beginning of 2025 to $119.3 trillion in the same period at a compound annual growth rate of 5%. However, we can convert the remaining 65% of the debt into a specific amount, that is, as of 2049, the U.S. national debt still has about $77.3 trillion in national debt that cannot be solved with Bitcoin. How will this huge gap be filled?

Another bold idea is that if Trump continues to release positive news to push up the price of Bitcoin, and then uses other methods to make transactions between the world and the United States settled with Bitcoin, the US dollar can be decoupled from national credit and linked to Bitcoin. Can this solve the problem of huge US debt?

“Bretton Woods in the New Era”

Linking to Bitcoin is a disguised return to the Bretton Woods system, similar to the link between the US dollar and gold. Supporters believe that the similarities between Bitcoin and gold are: mining costs increase with supply, limited supply, and decentralization (de-sovereignty).

As the shallower gold is mined, the cost of gold mining increases, similar to the difficulty of Bitcoin mining. Both have a supply limit and can serve as a good store of value. Both have decentralized characteristics. Modern credit currency is enforced by sovereign states, while gold is naturally a currency that no country can control. Since the supply and demand of gold are distributed around the world and in various industries and are relatively stable, gold denominated in different currencies has a very low correlation with local risk assets. Needless to say, Bitcoin can avoid the supervision of sovereign governments due to its decentralized operation.

Threat to the internationalization of the US dollar

What is irrational is that the peg between the USD and BTC will threaten the internationalization of the USD.

First, if the U.S. dollar is linked to Bitcoin, it means that any group or person has the right to use Bitcoin to issue their own currency. Just like before the establishment of the Federal Reserve, during the free banking era from 1837 to 1866, the right to issue banknotes was free, and "wildcat banks" were prevalent - states, cities, private banks, railways and construction companies, stores, restaurants, churches and individuals issued about 8,000 different currencies by 1860, often in remote places where there were more wildcats than people, and because of its extremely low feasibility, it was nicknamed "wildcat banks".

Today, Bitcoin has the characteristics of decentralization. If the US dollar is pegged to Bitcoin, it will greatly weaken the international status of the US dollar. The interests of the United States need to defend the internationalization of the US dollar and promote the hegemony of the US dollar. It will not put the cart before the horse, and will not promote the anchoring of the US dollar and BTC.

Second, Bitcoin is highly volatile. If the U.S. dollar is pegged to Bitcoin, the real-time transmission of international liquidity could amplify the volatility of the U.S. dollar and affect the international community’s confidence in the stability of the U.S. dollar.

Third, the amount of Bitcoin held by the United States is limited. If the U.S. dollar needs to be pegged to Bitcoin, and the United States does not hold sufficient Bitcoin reserves, its monetary policy will be restricted.

Manipulating the dollar through BTC?

There is also a voice saying that Bitcoin is the "digital gold" of the future. So can the United States manipulate Bitcoin like it manipulates gold and thus control the US dollar?

Review of how the United States manipulates the dollar through gold

After the Jamaica System in 1976, the interests of large investment banks, governments, and central banks have become aligned. Legal tender is based on confidence. If the price of gold rises too quickly and shakes confidence in the currency, it will be difficult for the central bank to control liquidity and inflation targets.

Therefore, the United States can push capital to hold US dollars and push up the dollar by suppressing the price of gold. Conversely, it can raise the price of gold and cause the dollar to depreciate.

If the United States manipulates the price of Bitcoin, can it control the dollar? The answer is no.

It is unrealistic to manipulate the US dollar through BTC

First, Bitcoin operates on a decentralized network, and no single entity, including the U.S. government, can manipulate its price like it can with gold.

Secondly, Bitcoin captures global liquidity and is affected by too many complex and diverse international factors. Even if the US government wants to manipulate the price of Bitcoin, the effect will be greatly reduced.

Finally, even if the United States can manipulate the price of Bitcoin and push down the price of Bitcoin, the liquidity flowing out of Bitcoin will not necessarily hold the US dollar. This is because Bitcoin holders have a higher risk appetite than traditional US dollar holders and may turn to other high-risk assets. It should be noted that both the US dollar and gold belong to the category of high-liquidity, low-risk assets, with highly overlapping safe-haven properties and the same degree of recognition, so there is an obvious substitution effect, and there are still certain differences between Bitcoin and the US dollar.

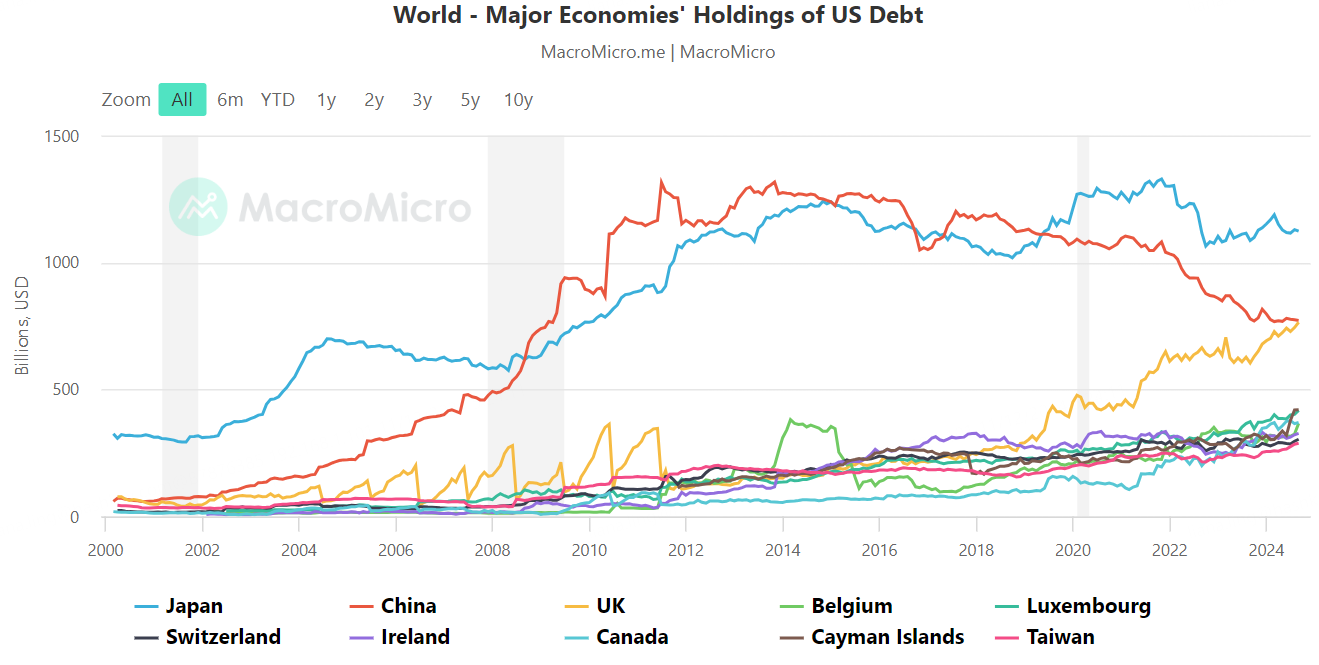

Kill the creditors Japan and the Jewish consortium?

US-Japan cooperation continues

Some people also say that the second alternative is to kill the creditor Japan, which is the largest holder of US Treasury bonds. This is impossible in the short term.

The Ishiba Cabinet needed to restore trust on the issue of black gold and was also constrained by the opposition party. Therefore, after taking office, it generally turned to pragmatism and sought to maintain its vested interests through strategic ties with the United States.

The United States is burdened externally by the Ukrainian crisis and the chaos in the Middle East, so it needs Japan to play the role of "deputy police chief" in the alliance system to share its strategic investment in the Asia-Pacific region.

Therefore, the overall cooperation between the United States and Japan in the field of economic security will continue, and the United States will not be in a hurry to get rid of Japan.

Jewish financial groups should not be challenged

In addition to state holders, Jewish financial groups also play an important role on Wall Street. About 80% of debt is held by domestic investors and financial institutions in the United States, such as pension funds, mutual funds and insurance companies. Most of the shareholders of these financial institutions are Jews, the so-called Jewish financial groups. Some people believe that the Federal Reserve may take advantage of the public's growing dissatisfaction with the "rich" and put part of the blame for the economic crisis on the Jewish financial groups. We believe that this move is too costly and not easy to achieve.

Firing at Jewish financial groups will affect economic stability, possibly leading to rising unemployment, sluggish innovation, and declining investor confidence and international competitiveness. This is an act of killing one thousand enemies and hurting oneself eight hundred, especially when the debt crisis is approaching. Taking such a move will only stimulate the accelerated economic collapse.

Secondly, after years of operation, the Jewish consortium is gradually increasing its influence on politics. For example, the proportion of Jews in Biden's team is relatively high, and the core members of the cabinet are particularly stable during his administration, which is different from other government periods. This may indicate that the Jewish consortium intends to move from behind the scenes to the front to gain power. In the future, it can be foreseen that the Jewish consortium will also actively operate political power to fight against the US government. It is not easy to target the Jewish consortium.

Impact of the debt crisis on international settlement units

Therefore, we will see imported inflation caused by the inability to repay U.S. debt and the increase in commodity tariffs. If it is linked to the U.S. commercial real estate debt crisis, the effects will be superimposed and inflation will soar rapidly. The financial crisis is imminent, and Bitcoin will fall in the short term along with the financial market, but rise in the long term.

Bitcoin short-term decline

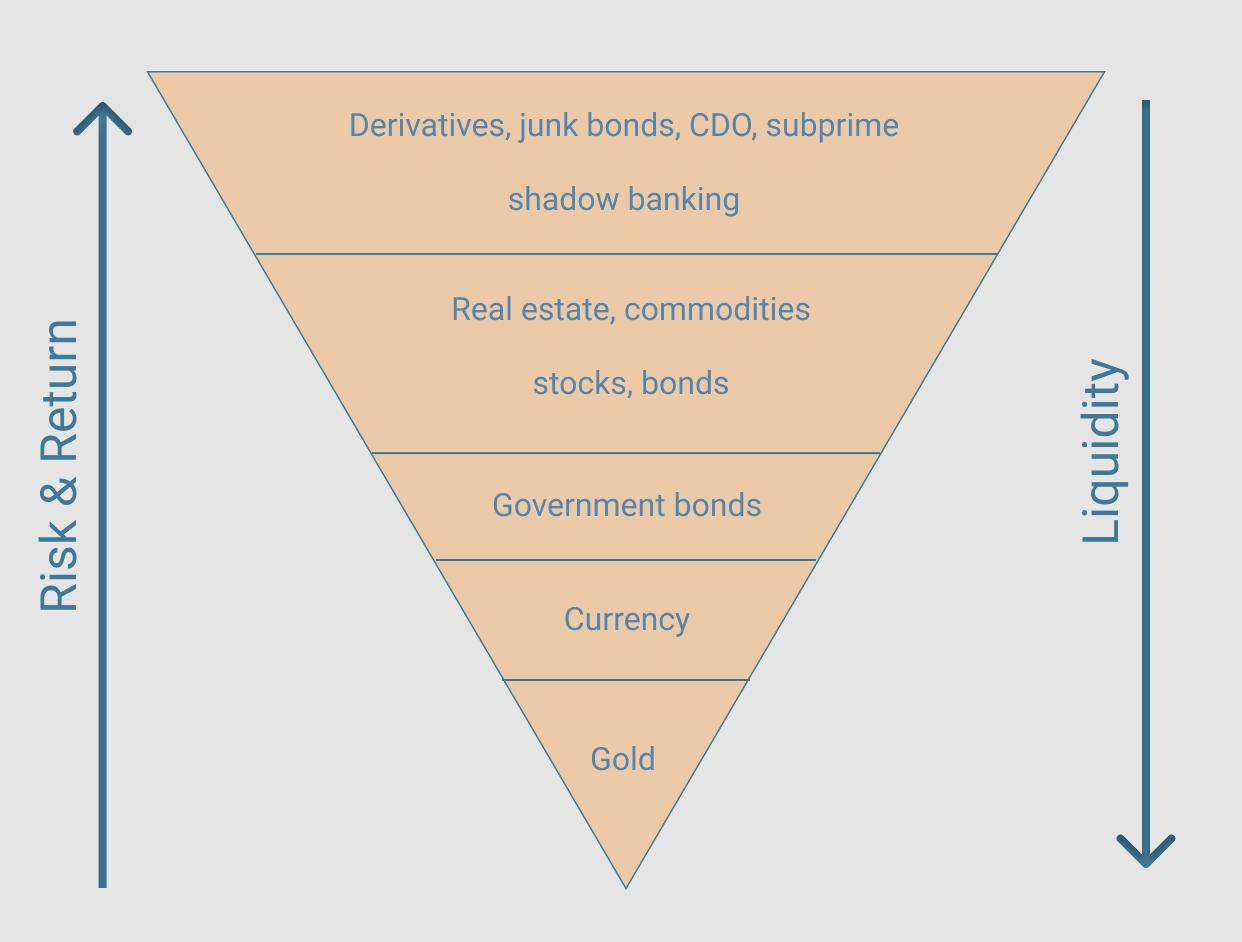

In Exter's Pyramid proposed by John Exter, the late deputy president of the Federal Reserve Bank of New York, Bitcoin is currently closer to a leveraged product at the top of the pyramid rather than a safe-haven asset at the bottom. It is a high-risk asset. If a financial crisis breaks out, short-term investment demand will decrease.

Bitcoin Becomes Noah's Ark

In the long run, Bitcoin will become the Noah's Ark in the financial crisis and is expected to become an important pillar of the future international settlement system.

First, Bitcoin is a strictly scarce liquid asset. With the sharp depreciation of the US dollar, Bitcoin can maintain its scarcity and has wide applicability worldwide. People are more willing to hold it as a long-term means of value storage. In other words, Bitcoin will be closer to the bottom of Exter's Pyramid, and its safe-haven properties will be highlighted. Despite the interference of short-term market sentiment, the precious nature of Bitcoin's value storage will still be discovered by the market.

Second, the behavior of investors and consumers will also change after the crisis. The collapse of US debt is an epic shock, and the financial crisis has left a mess. Trust in financial institutions, sovereign states/governments, and monetary authorities will collapse and reconstruct. Bitcoin, as a relatively independent asset that is not controlled by the state/government, has become the only choice for future investment.

Therefore, given that the debt economic model is unsustainable, it is only a matter of time before U.S. debt collapses, the internationalization of the U.S. dollar will be hit hard, and the world will usher in another wave of Bitcoin adoption.

Will Bitcoin become the international currency of tomorrow?

Once the US dollar system collapses, what will take over the baton from the US dollar and become the next generation of international settlement currency?

Looking back at the history of currency, the three major elements of currency are value scale, transaction medium and value storage. The most important of these is the transaction medium function. In this regard, Bitcoin is available around the clock, in any location, and can avoid sovereign state transactions. It can capture global liquidity and complete transactions more effectively than traditional finance. In terms of value scale, the application scenarios of Bitcoin are constantly expanding, and it can effectively measure the value of many goods and services. In terms of value storage function, as Bitcoin mining gradually proceeds and the supply decreases marginally, the value storage function will be further strengthened.

Is it possible for other legal currencies to replace the US dollar as the international settlement currency? At present, there is no other legal currency that can compete with the US dollar. Moreover, after the outbreak of the US debt crisis and the explosive destruction of the US dollar system, I believe everyone has more doubts about the traditional financial market. If there is really a free currency, can it lead all mankind to true freedom and true decentralization, and can it avoid the impact of traditional sovereignty on the economy?

Some people would say that some cryptocurrencies are more technically perfect than Bitcoin and can be traded smoothly, so why can't other cryptocurrencies become international settlement units? This is because value is based on consensus. Bitcoin is the most consensus-building cryptocurrency, which has the highest popularity, the widest recognition, and the strongest influence.

Therefore, on the whole, Bitcoin already has the potential to become the next generation of international settlement unit. It just depends on whether the times give it the opportunity.