This article was edited by the Ringing Finger Research team

This article was edited by the Ringing Finger Research team

Please indicate the source and link when reprinting

Preface

In the DeFi world, the TON blockchain is rising at an incredible pace, and Torch Finance is committed to becoming the preferred liquid staking token and stablecoin exchange service for yield tokens on TON. This article will explain how to achieve up to 80% annualized yield (APY) on the TON blockchain through Torch Finance's leveraged yield farming strategy.

Torch Finance Goals

With the TON Foundation investing $24 million to support liquid staking pools such as DeDust and STON, the market demand for high-return strategies continues to rise. Torch Finance's leveraged yield farm is launched to meet this demand, providing users with high-yield opportunities in the TON DeFi ecosystem.

Main Products

Leveraged Yield Farm:

This is a strategy to enhance returns, where users provide liquidity to DEX and use leverage to amplify returns. For example, if the base annualized return is 30%, using 3x leverage, the return can reach 90% (before interest deduction). In addition, users only need to invest USDT as a single asset, without complex operations, and can automatically receive rewards, saving time and costs for manual withdrawals.

Savings Accounts:

Users can earn interest by depositing tokens in a savings account, and these funds will be lent to participants in leveraged yield farming. The higher the demand, the higher the interest rate. This account is suitable for users who want stable income and maintain token balances.

TriTON:

TriTON is designed with a liquidity pool optimized for TON, stTON, and tsTON swaps, ensuring that users enjoy lower slippage when trading large amounts. Low slippage trading is particularly important because users can effectively reduce costs and increase returns in frequent asset conversions. The pool can also dynamically adjust as market demand changes to ensure liquidity and improve transaction efficiency.

Leverage Benefits and Strategies

What are Leveraged Yield Farming and Market Neutral Farming strategies?

Leveraged yield farming allows investors to borrow additional funds to magnify their yield farming positions. For example:

- No leverage : You invest $1,000 into DeDust's liquidity pool. Assuming an annualized rate of return of 30%, you can get $300 in profit after one year.

- Using 3x leverage : the total position increases to $3,000, and with the same 30% annualized rate of return, the annual return will reach $900.

Leveraged strategies can multiply your potential returns, but they also come with borrowing costs and liquidation risks. Torch Finance provides a simplified platform that allows users to easily manage risk while maximizing returns.

In order to reduce the risks brought by price fluctuations, Torch Finance introduced a market neutral farming strategy. This strategy allows users to maintain stable returns when asset prices rise or fall, avoiding directional risks.

Operational Example: 3x Leveraged Market Neutral Farming Strategy

Assume that you hold 1,000 USDT and the price of TON is $5. You decide to use 3x leverage to participate in yield farming, with a total position of $3,000, including:

- 1500 USD is deposited into the liquidity pool in the form of USDT.

- 1,500 USD is converted into TON and deposited into the liquidity pool.

Ultimately, your position becomes less sensitive to TON price changes, achieving theoretical market neutrality.

Risk and Risk Management

High returns usually come with high risks. When using leverage, you need to pay special attention to the following two risks:

- Liquidation risk : When your debt ratio exceeds 80%, the system will automatically liquidate your position and sell assets to repay the loan.

- Impermanent loss : When the price of assets in the liquidity pool changes relative to the initial price, it may lead to reduced returns. Even if a market neutral strategy is adopted, large fluctuations in the price of TON may still affect your final returns.

To help users manage risks, Torch Finance provides a health factor monitoring tool to keep you informed of the health of your positions. When prices fluctuate drastically, you can choose to close and reopen your positions to rebalance the risk of impermanent loss.

How to participate

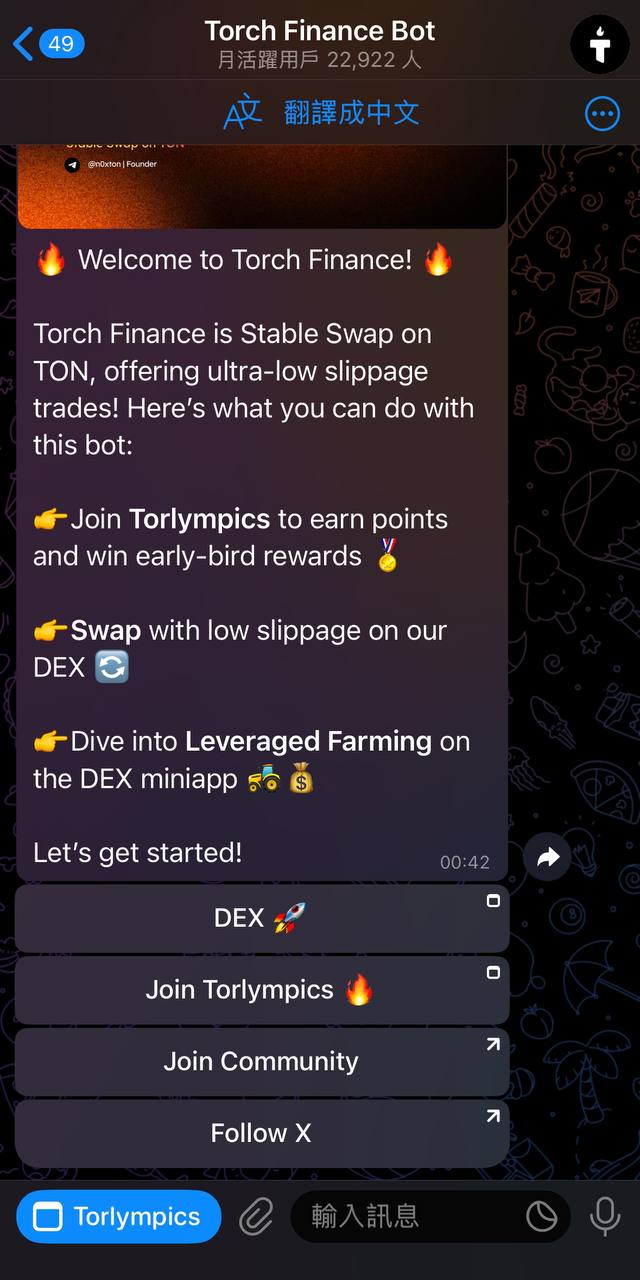

You can use Torch Finance's product features through Telegram in three simple steps:

1. Open Torch Finance’s Telegram bot:

https://t.me/torch_finance_bot/

2. Click on the DEX function

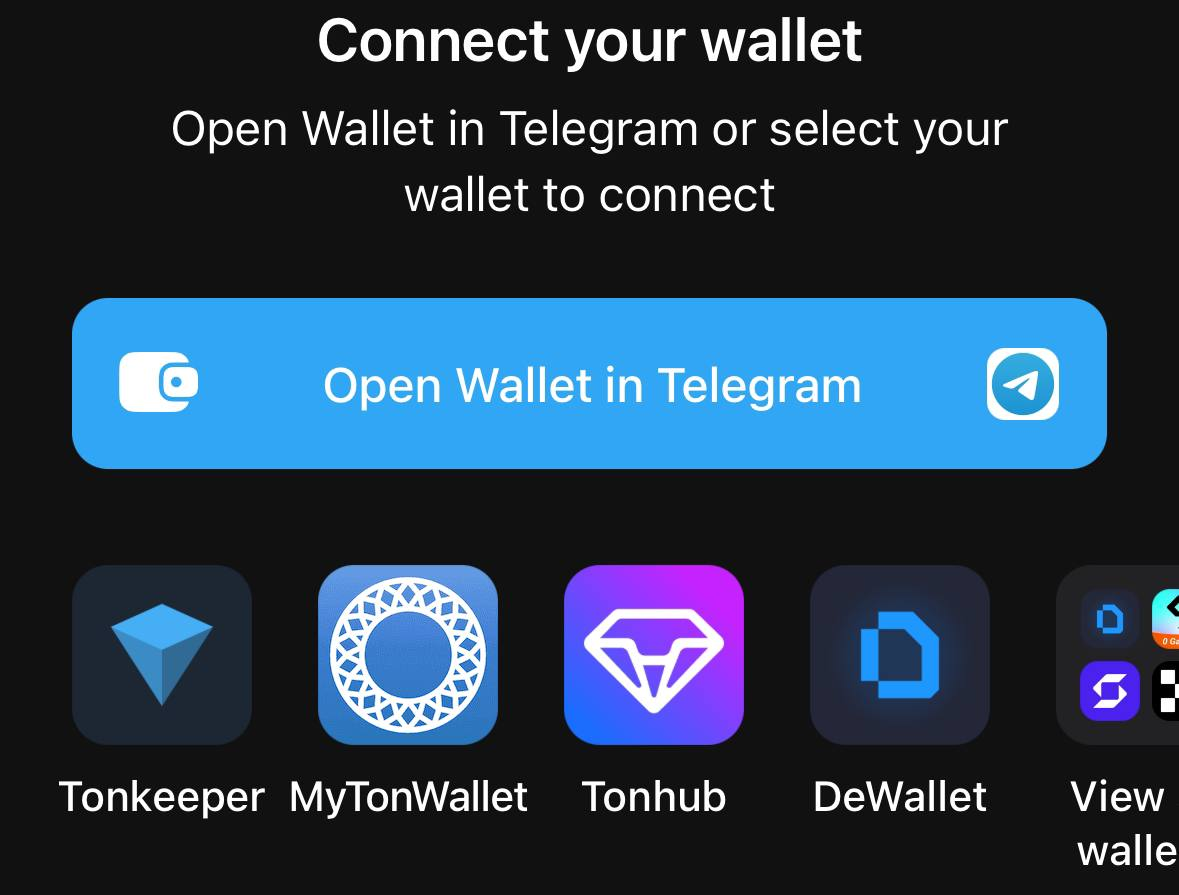

3. Connect your wallet, which can be the TON space wallet built into Telegram or other wallets that support the TON blockchain

Finger snap view

Torch Finance's leveraged yield farming strategy provides investors with the opportunity to earn high returns on the TON blockchain. Whether it is leveraged yield farming or savings, it shows that Torch Finance is committed to simplifying the operation process so that users can focus on improving their returns. However, high returns are accompanied by high risks, and liquidation risks and impermanent losses are potential challenges that cannot be ignored. Users are advised to use leverage with caution, always pay attention to health factors, and adjust positions in time when the market fluctuates to effectively manage risks and ensure that investments can achieve ideal returns.