Written by: Maia, BeWater Venture Studio

TL;DR

- In terms of the issuance and application of BTC-anchored assets, centralized packaged BTC still occupies a dominant position of more than 75%. But at the same time, BTC LST represented by LBTC and SolvBTC.BBN has grown rapidly in recent months with the launch of Babylon, becoming another emerging force in the BTC-anchored asset market. The current BTC LST market size has reached 25.6K BTC. Driven by the demand for interest-bearing underlying assets, the BTC liquidity pledge and points derivative market is gradually becoming a new growth point in the BTCFi field.

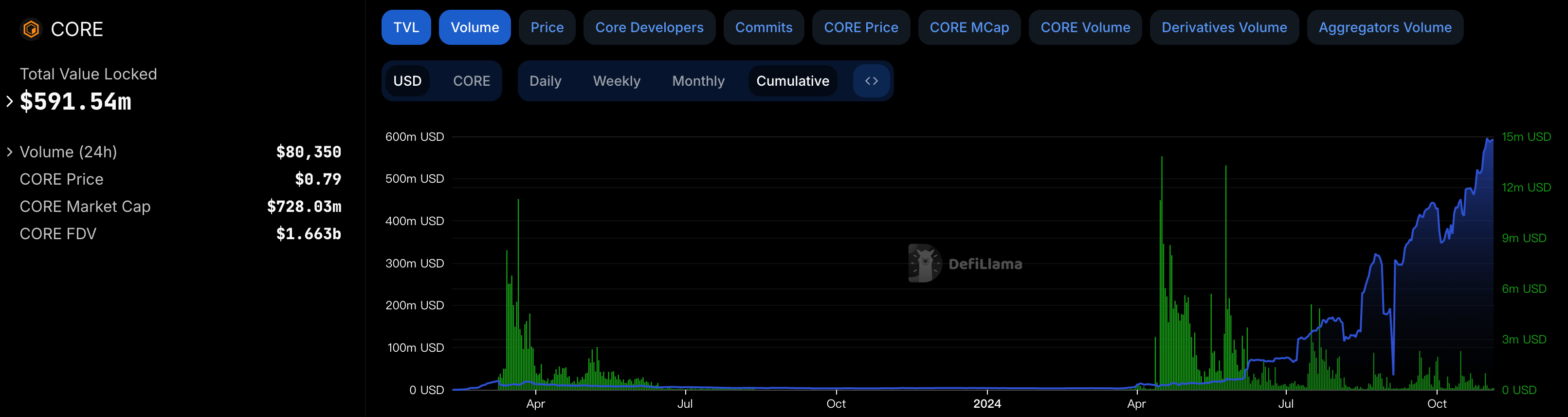

- @Coredao_Org is a L1 network driven by BTC, providing users with stable returns through non-custodial staking solutions and dual staking mechanisms. Its TVL has increased by 4757.9% in half a year to $591.5M. Core's growth strategy includes: (1) focusing on the incremental market of BTC-anchored assets to improve ecosystem liquidity and absorb the rapidly growing BTC LST assets (2) building a supporting native protocol and quickly integrating with the BTCFi project to establish a complete ecosystem application (3) using the airdrop and market performance of the native token $CORE to support the incentive structure and further promote participation and asset retention.

- @use_corn is an emerging ETH L2 network. The current Corn Kernels activity has accumulated TVL of $425.9M, laying the foundation for the mainnet launch. Corn's rapid growth is due to its effective capital accumulation in the incremental market BTC LST. By focusing on the interest-bearing properties of liquidity staking tokens and point derivative gameplay, the five pools launched by Corn in cooperation with Pendle attracted a total of $290.3M TVL, absorbing 11.4% of the total BTC LST market.

- @build_on_bob is a hybrid L2 network combining BTC and ETH. It has attracted a large amount of assets through extensive BTCFi project integration and one-click liquid staking services. Currently, BOB TVL has reached $65.7M, and the asset composition mainly comes from the existing $WBTC in the BTC anchored assets. BOB's performance is mainly due to: (1) The trust-minimized bridge architecture opens up asset channels from most networks and solves the liquidity fragmentation problem (2) The one-click liquid staking entrance and the supporting strong ecosystem have built a convenient staking entrance and complete application scenarios

This year, as the BTCFi narrative continues to evolve, the on-chain liquidity of BTC assets has gradually become the focus of attention of major ecosystems and protocols. With the launch of the BTC expansion plan and the rise of BTC LST, BTC is transforming from a static means of value storage to an asset that can participate in more on-chain revenue scenarios, increasing its application potential in the entire DeFi ecosystem.

@Coredao_Org, @build_on_bob and @use_corn are representative growth cases in the BTCFi field in the second half of the year: Core focuses on the large-scale BTC LST assets in the growth period; Corn cooperates with Pendle to introduce point derivative gameplay to quickly seize the incremental market; BOB attracts liquidity by enriching the ecology and liquid pledge services; the series of actions around "interest-bearing" in each ecology have greatly activated the liquidity of BTC assets. In the future, with the gradual release of BTC liquidity, the on-chain sedimentation scale of assets in the BTCFi ecosystem still has huge growth potential.

1 Background

1.1 BTC asset flow path on the chain

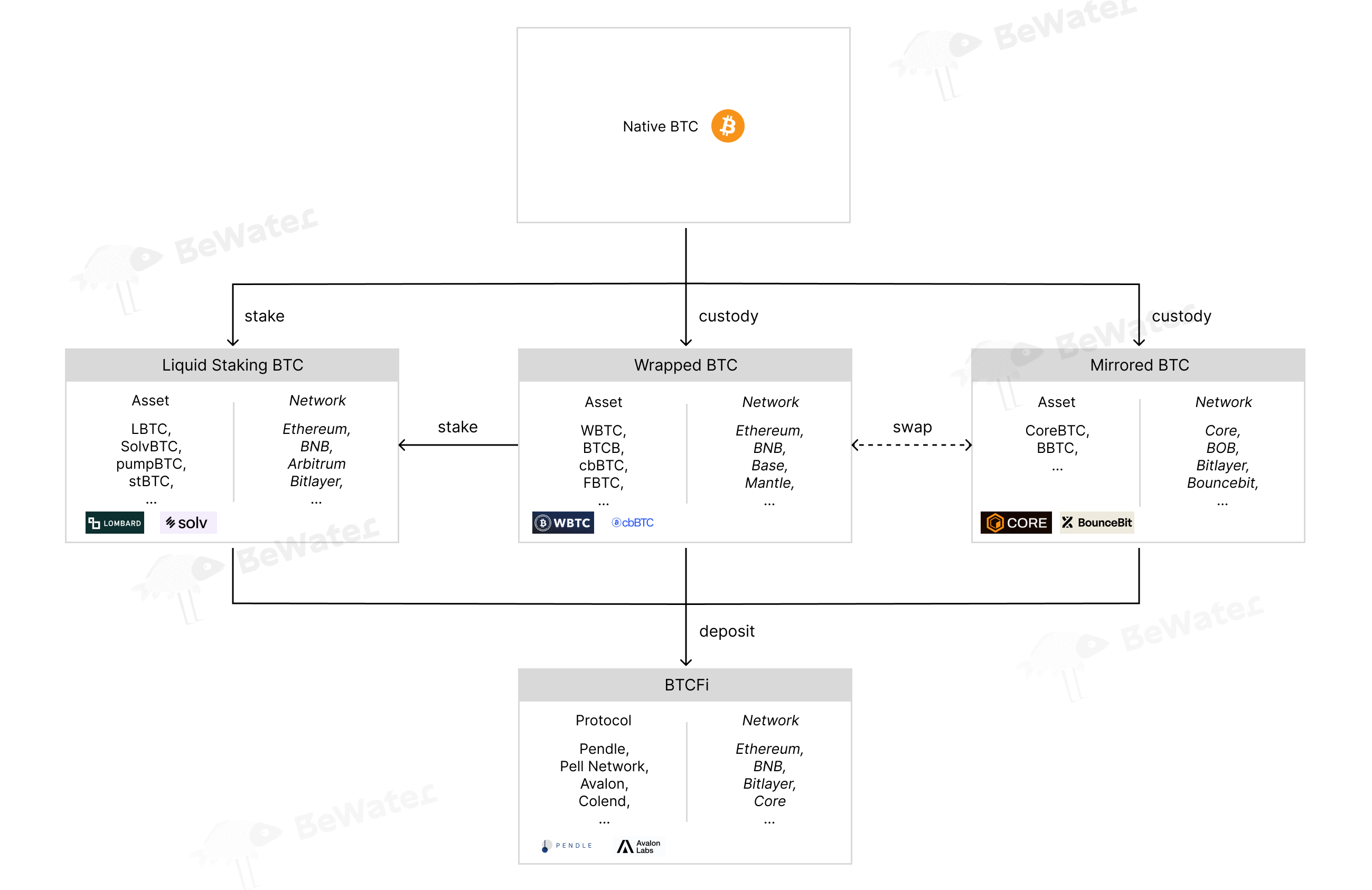

The flow direction of BTC and its anchored assets on the chain can be divided into the following three layers:

- Layer 1: Native BTC

- Second layer: (1) Wrapped BTC issued based on centralized custody (2) Mapped assets running on BTC L2 and SideChain (3) Liquidity pledged BTC

- The third layer: BTC derivative assets in various downstream DeFi scenarios

1.2 Current status of BTC asset market

Overview of BTC anchored asset issuance and application

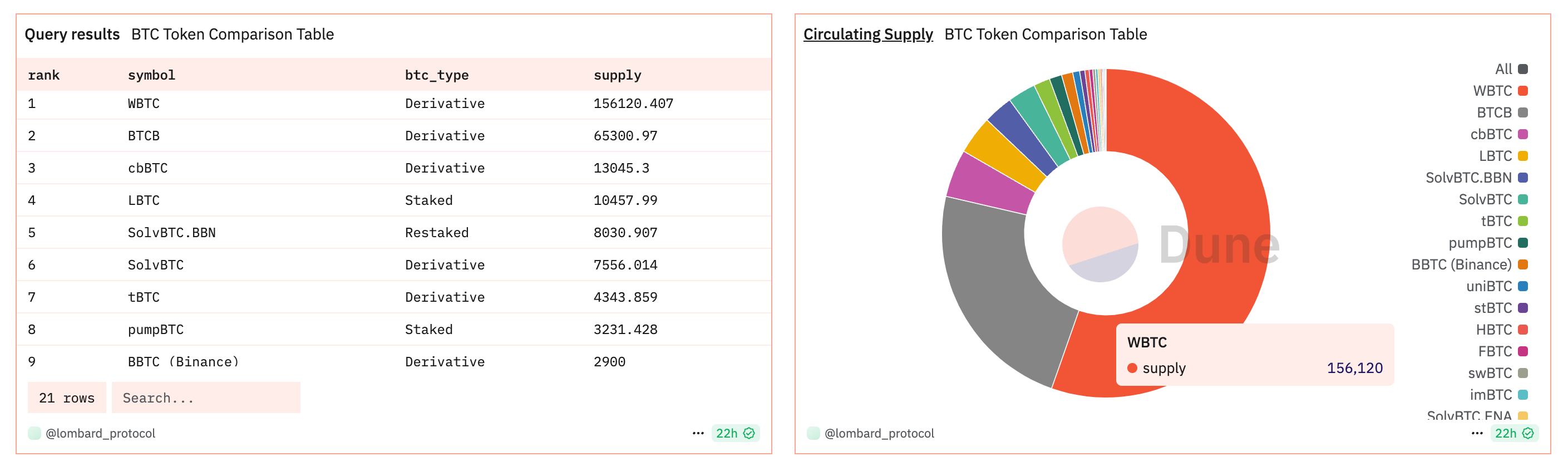

From the issuance of BTC-pegged assets on the three major networks of Ethereum, Arbitrum, and BNB, it can be seen that the wrapped BTC issued by centralized custody still occupies the vast majority of the market share, of which $WBTC (156.1K supply) and $BTCB (65.3K supply) together account for more than 75% of the total BTC-pegged asset circulation. In addition, BTC LSTs such as $LBTC (10.5K supply) and $SolvBTC.BBN (8K supply) have grown rapidly in recent months driven by the BTC (re)staking narrative, becoming another emerging force in the BTC-pegged asset market.

As the anchor token of the asset with the highest consensus and the largest market value, the main application scenarios of BTC anchor assets are concentrated in lending protocols. As for the largest $WBTC and $BTCB, their largest downstream applications are in Aave v3 and Venus protocols respectively, and TVL accounts for more than 20% of their total supply, reflecting the demand of large funds for relatively stable returns in the BTCFi field.

* https://dune.com/optimus/lombard*

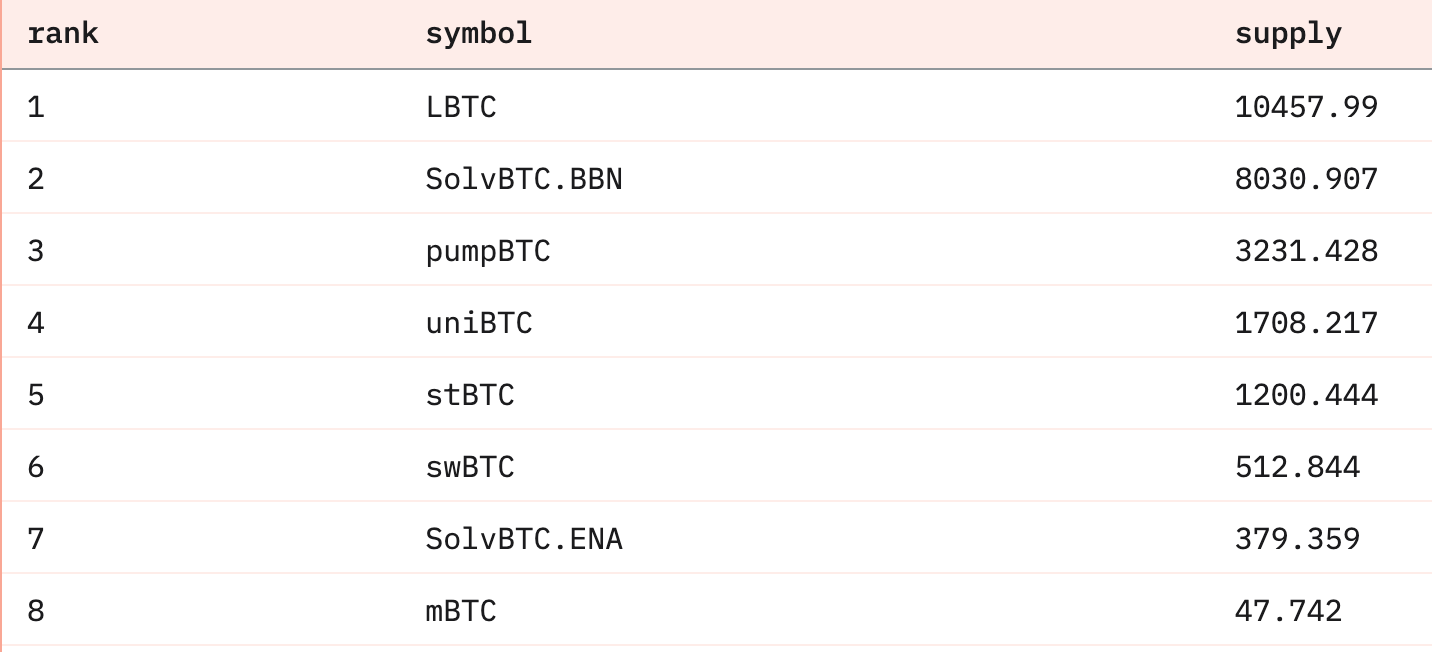

BTC LST issuance and application overview

At present, the total market volume of BTC LST is about 25.1K BTC, of which Lombard and Solv Protocol account for more than 70% of the market share. The absorption and issuance of BTC LST directly affects the flow and precipitation of BTC assets on various chains. Among them, Solv has a particularly significant impact on the TVL of each chain, bringing $309.7M and $177.8M net inflows to Core and Scroll respectively, significantly increasing the asset scale of these two chains.

Compared with the packaged BTC issued in a centralized custody model, BTC LST as an interest-bearing asset has expanded more application scenarios. In addition to the lending protocol, the points trading market has become another important downstream application of BTC LST. Avalon and Pendle are the protocols with the most BTC LST funds accumulated in the "lending" and "points derivative market" sectors, respectively, and have achieved win-win growth with the development of the BTCFi and BTC staking narratives.

https://dune.com/optimus/lombard

2 BTCFi Ecosystem Asset Sedimentation Strategy

2.1 Core: Focus on incremental assets and token incentives to drive ecosystem growth

Basic Situation

Core is a BTC-powered L1 scaling solution that allows users to earn passive income through non-custodial Bitcoin staking without having to transfer or wrap BTC. Since its launch in April 2024, more than 7,500 BTC have been staked on Core, and Core's network security is protected by the security protection of BTC. In July 2024, Core launched a dual staking mechanism for BTC and CORE. Users can not only stake BTC for risk-free basic returns, but also stake the native token CORE for additional rewards. The distribution of rewards will be linked to the number and duration of CORE staked. Since its launch, the dual staking mechanism has further promoted the growth of Core's TVL.

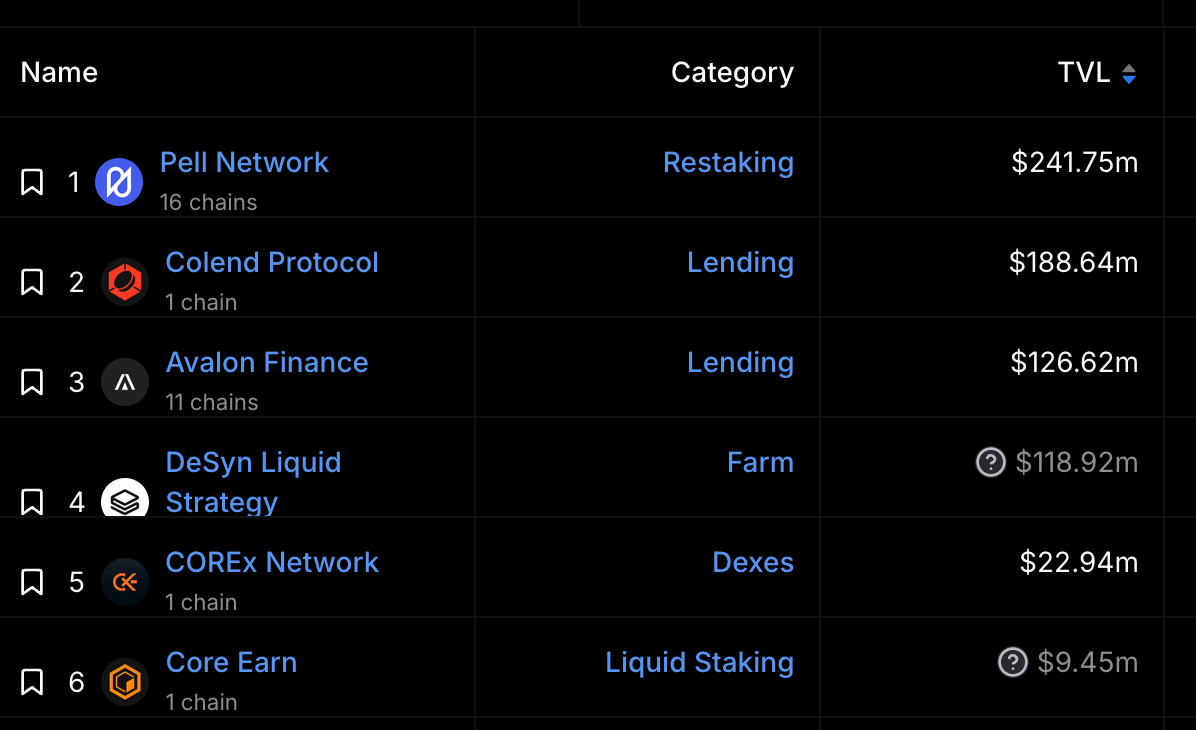

Today, Core's TVL has reached $591.5M, a six-month increase of 4757.9%, making it the 16th-ranked blockchain in terms of TVL. The growth of Core TVL shows several key nodes: In June, the launch of the native lending protocol @colend_xyz and the integration of derivative assets with @SolvProtocol drove the growth of TVL to $51.1M that month, an increase of 202.2%. In July, the introduction of the dual pledge mechanism led to new capital inflows, driving the growth of TVL to $92.6M that month, an increase of 121.3%. In August, the integration of the leading BTC Restaking protocol @Pell_Network in Core further triggered a larger scale of capital precipitation.

https://defillama.com/chain/CORE?volume=true

Growth Strategy

The growth of Core TVL is mainly driven by the following factors: (1) Focusing on the incremental market of BTC-anchored assets to improve ecological liquidity and absorb the rapidly growing Solv derivative assets; (2) Building supporting native protocols such as Colend and quickly integrating with projects such as Pell Network to establish a complete ecological application; (3) Using the airdrop and market performance of the native token $CORE to support the incentive structure, forming a multi-dimensional ecological synergy effect.

Deep integration and collaboration with Solv derivative assets

SolvBTC.BBN and SolvBTC are the fifth and sixth largest BTC derivative assets in the market, with a total issuance of 15.6K BTC, and are still in a stable growth stage. Since June, SolvBTC has expanded to the Core ecosystem and deeply integrated with the two major protocols, Colend and Pell Network, driving the growth of TVL of $51.1M that month. At present, Solv derivative assets account for 65% of Core TVL, which is not only due to the construction of the DeFi module of the Core ecosystem, which provides a stable interest-bearing scenario for the underlying assets, but also includes the high incentives provided by Core for SolvBTC applications and the airdrop expectations supported by the performance of $CORE tokens. It can be seen that the ecological development of Core is not limited to its own BTC native staking mechanism, but also focuses on introducing and incentivizing high-quality large-volume BTC assets to enhance the activity and lock-up volume of the entire network. Through deep integration and cooperation with Solv Protocol, Core not only increases TVL, but also provides diversified liquidity asset support for on-chain DeFi scenarios.

BTCFi ecosystem construction led by Colend and Pell Network

Colend is the native lending protocol on Core, responsible for most of the asset deposits in the ecosystem. Since the introduction of SolvBTC in June and the provision of maximum incentives, its TVL has grown significantly. 85% of the current TVL in the Colend protocol comes from the inflow of Solv Protocol derivative assets, showing its strong synergy with Solv. In addition, Colend is also the core application scenario of CORE token derivative assets, absorbing $17.4M of wCORE and $5.2M of stCORE. The interest-bearing scenario provided by Colend for CORE LST has boosted users' willingness to pledge CORE, while providing support for maintaining its value.

In addition, BTC Restaking has become a stable staking and interest-earning scenario for BTC derivative assets. In August, Pell Network, the leading project of BTC Restaking, quickly promoted the growth of ecosystem TVL after the launch of Core. The inflow of assets still mainly came from Solv Protocol, precipitating Solv derivative assets worth $108.3M. In terms of project incentives, Pell Network provides the highest multiple of points reward support for SolvBTC on Core, and Core also provides Pell Network with 5X Ignition Drop rewards, further enhancing the participation and application of BTC LST in the Pell Network protocol in the Core ecosystem. As of now, the accumulated TVL of Pell Network has reached $271.7M, of which nearly half of the contribution comes from the Core ecosystem.

* https://defillama.com/chain/CORE*

Incentive structure supported by airdrops and market performance of the native $CORE token

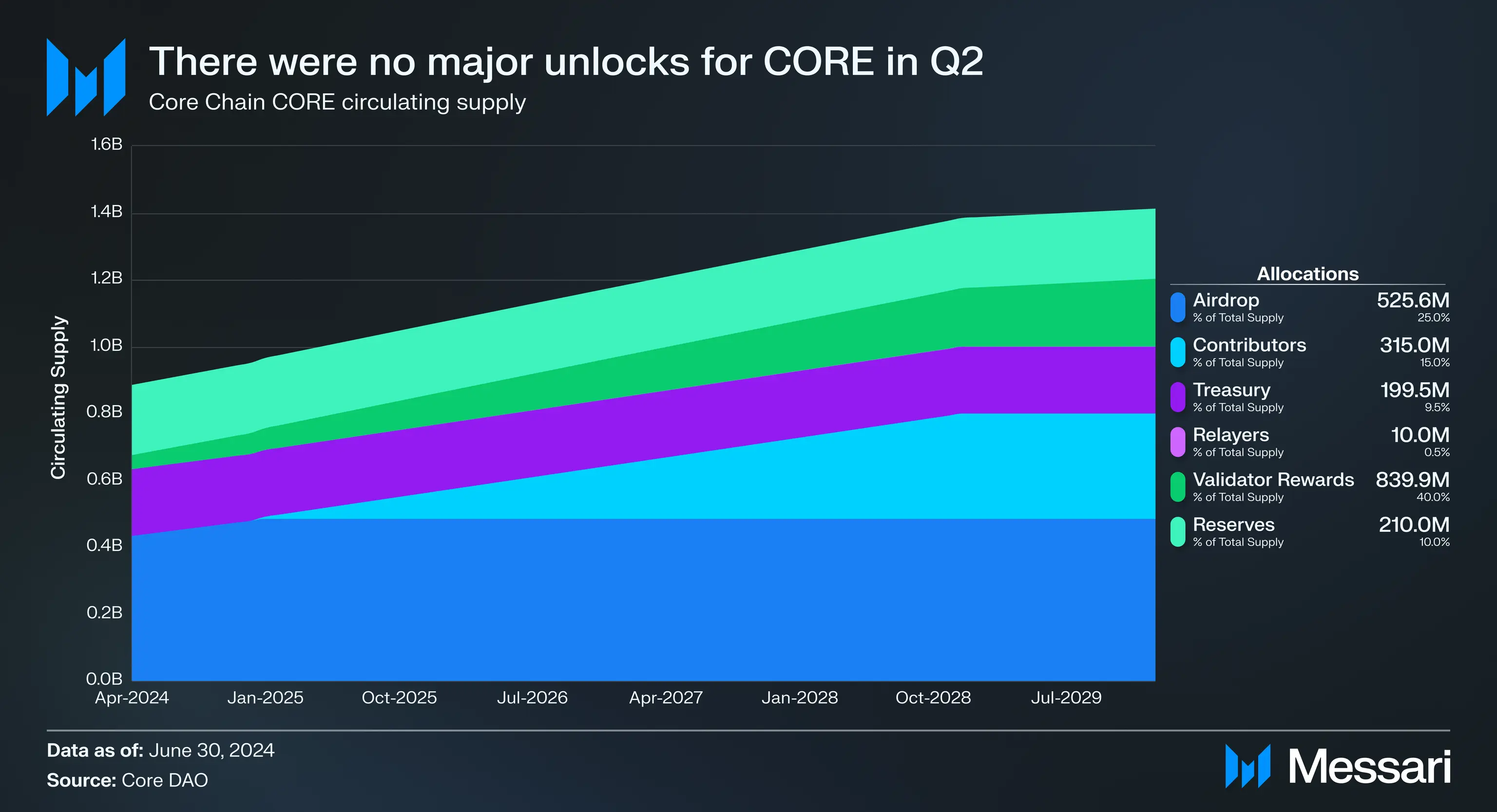

In May 2024, Core launched the Sparks incentive program, which aims to accelerate the adoption and expansion of the ecosystem by rewarding on-chain contributors. Season 2 is currently underway. Unlike projects that rely on point incentives and have unclear coin issuance expectations, Core launched its native token $CORE as early as 2023 and successfully completed its first airdrop, laying a huge community foundation. As an ecosystem native token, $CORE is mainly used to pay transaction fees, network staking, obtain rewards, and participate in on-chain governance. According to the Tokenomics design, user rewards account for 25.029% of the total supply of $CORE, totaling 525.6 million. Previously, Core's airdrop activities through the Satoshi App issued a large number of tokens to ecosystem participants, increasing users' long-term attention and continuous contribution to its ecosystem. The Season 2 airdrop plan will unlock 24.7 million $CORE, of which 17 million will be used to reward participants, continuing to drive users' enthusiasm for participation in the Core ecosystem.

https://messari.io/report/state-of-core-q2-2024?utm_source=iterable&utm_medium=email&utm_campaign=q2_quarterly&utm_content =state_of_core_q2_2024&destination=protocol_services_research&utm_source=Iterable&utm_medium=email&utm_campaign=campaign_UO - Wednesday 9/18&utm_source=iterable&utm_medium=email

2.2 Corn: Points derivative gameplay effectively attracts BTC LST market liquidity

Basic Situation

Corn is a recently launched ETH L2 network that uses hybrid tokenized Bitcoin (BTCN) as a gas fee and economic incentive tool, aiming to unify the interests of users, developers, and liquidity providers. The core of Corn's incentive mechanism lies in the veCHAIN model, and CORN token stakers will determine the distribution of network rewards.

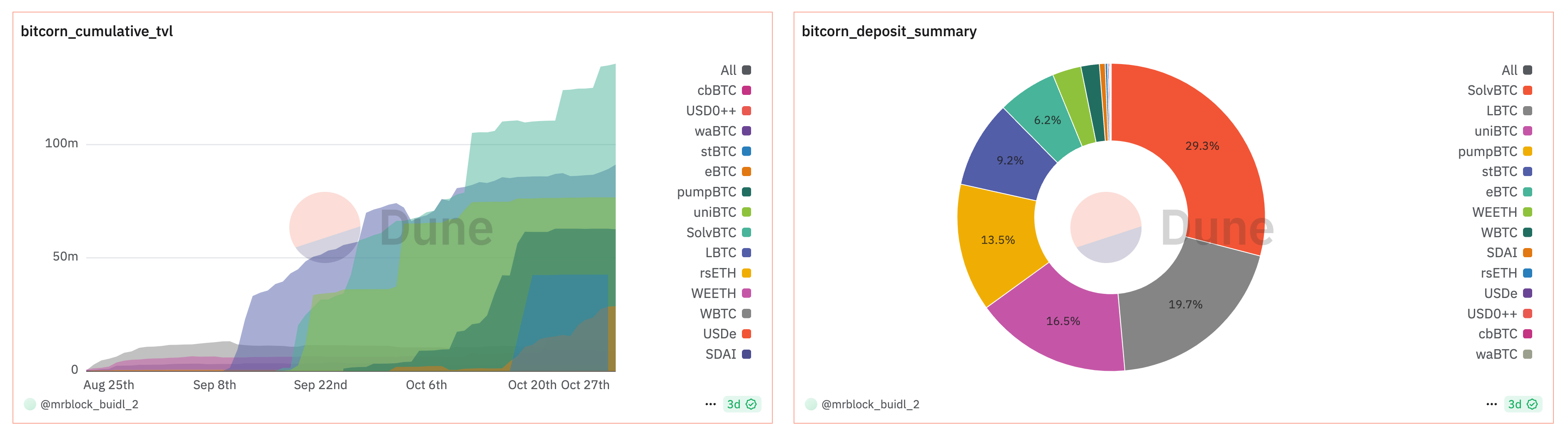

Corn has not yet launched its mainnet, but has effectively absorbed $425.8M in funds through deposit activities launched in conjunction with multiple parties, significantly exceeding the BTC extension layers that have already been launched, such as Merlin and BSquared. These deposits are mainly concentrated in the pools jointly launched on Pendle with several BTC LSTs, including LBTC, SolvBTC.BBN, eBTC, PumpBTC, and uniBTC, accounting for 85% of the current total TVL.

https://dune.com/mrblock_tw/corn

Growth Strategy

- Cooperate with Pendle to lead the BTC LST points derivative gameplay

The points derivatives market is one of the key strategic scenarios for BTC LST as an interest-bearing asset. As the leading protocol in this sector, Pendle took the lead in integrating various BTC LSTs in early September. At present, the cooperation between Corn, Pendle and BTC LST supports five major BTC LST assets: LBTC ($41.5M TVL, $1.1M 24h Volume), SolvBTC.BBN ($97.5M TVL, $300K 24h Volume), eBTC ($20.2M TVL, $658.4K 24h Volume), PumpBTC ($60.5M TVL, $437K 24h Volume), uniBTC ($70.6M TVL, $20.8K 24h Volume), absorbing 11.4% of the total BTC LST market. The cooperation among multiple parties has produced a good linkage effect:

For BTC LST holders, the point leverage market provides them with a variety of strategic gameplay, and Pendle has become the main application scenario for 10%-30% of the total supply of BTC LST. In addition, Corn also provides these pools with maximum multiplier point incentives to further attract more holders to participate. For Corn, BTC LST is the core contributor to the growth of TVL in its early stages. Currently, these pools are the only applications that generate external benefits in Corn's point mining activities, laying the foundation for its future mainnet launch.

* https://app.pendle.finance/trade/points*

TVL BootStrap Campaign

In Corn's existing point mining design, users can earn 1 Kernel point every 210 minutes for every $1 worth of assets they deposit. These deposits can be withdrawn at any time without incurring any penalties or fees, providing great flexibility. The goal of this activity is to attract initial liquidity through Kernel point incentives. However, currently, except for the BTC LST pool in cooperation with Pendle, other deposits have not brought more value to the network. The flexibility of withdrawing deposits at any time also brings the risk of short-term mining, which may lead to the expansion of Corn points, thereby diluting the expected value allocated to individuals.

2.3 BOB: Secure bridging and strong ecosystem help gather assets

Basic Situation

BOB is an innovative hybrid Layer2 network that combines the advantages of Bitcoin and Ethereum. It uses the characteristics of Ethereum smart contracts and EVM, and adopts rollup technology to improve transaction processing capabilities and scalability. At the same time, BOB's final transaction confirmation is completed on the Bitcoin blockchain, enjoying the high security provided by the BTC PoW consensus mechanism. Currently, BOB's total TVL has reached $65.7M, and its assets mainly come from $WBTC.

* https://defillama.com/chain/BOB?volume=true*

Growth Strategy

On the basis of the bridge architecture solving the trust and liquidity fragmentation problems, the growth performance of the BOB ecosystem in the past six months also benefited from the launch of a one-click liquid staking service under the narrative of BTC (re)staking, as well as strong market power and ecological cooperation, which formed a combined force to promote ecological growth.

Liquid staking services and ecosystem integration

BOB Stake integrates multiple liquidity staking service providers and DeFi platforms, and uses BOB Gateway to achieve the function of multi-protocol staking with a single Bitcoin transaction. Through BOB Stake, users can stake BTC to multiple LST protocols with one click, reducing time and costs. In addition, BOB Stake also deeply integrates the user's staked LST with the DeFi protocol, making BOB a convenient entry point for BTC liquidity staking and DeFi applications.

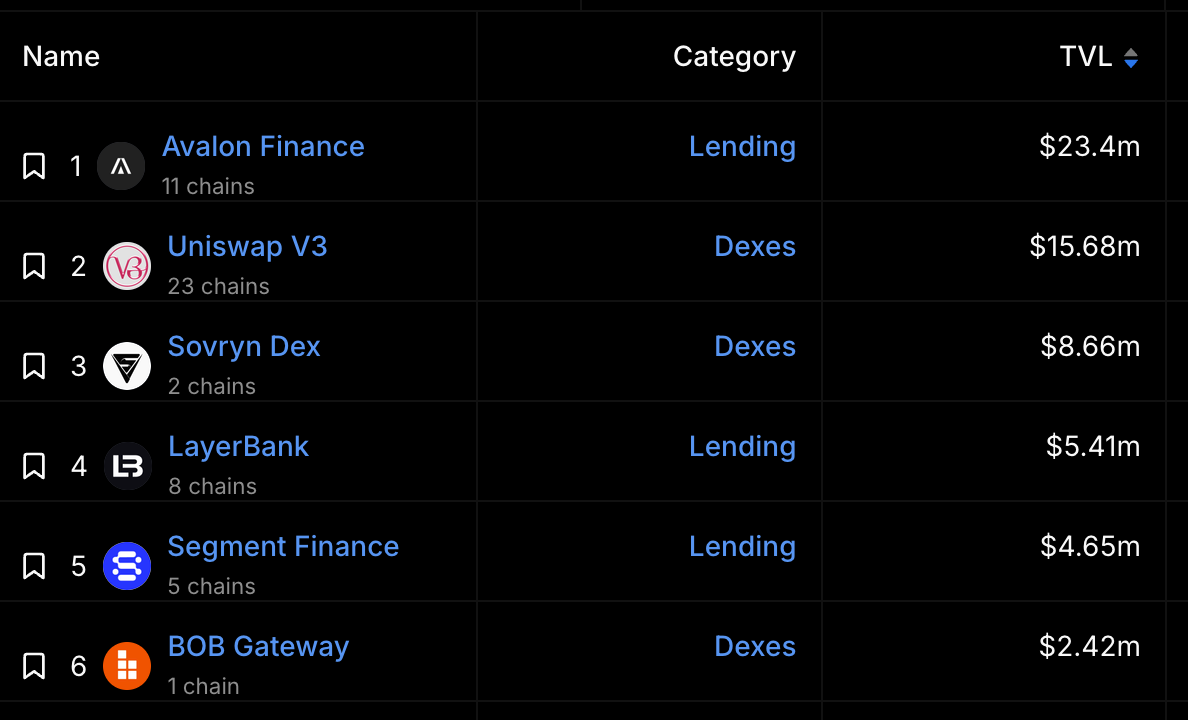

In terms of ecological construction, BOB Stake integrates a variety of pledge protocols with Babylon pledge as the core, and supports liquid pledge tokens LST including SolvBTC.BBN, uniBTC, and PumpBTC. BOB has also become the preferred BTC pledge platform for multiple aggregators and wallets, attracting more than 3 million users on the Staking Rewards platform. In addition, BOB has also integrated with dozens of DeFi protocols such as Avalon, Layerbank and Segment, providing BTC LST with a variety of interest-bearing application scenarios while continuously strengthening its market influence. At present, Avalon, as the main lending protocol in the BOB ecosystem, has attracted 35.6% of the asset deposits on the chain, almost all of which are composed of SolvBTC.BBN supply. However, the utilization rate is only 8.9%, indicating that the actual borrowing demand of the BOB ecosystem is low, and liquidity aggregation and ecological protocols need to be strengthened.

* https://defillama.com/chain/BOB*

Incentive ProgramBOB Fusion

BOB Fusion is the core incentive program in the BOB ecosystem, which aims to encourage users to earn points through cross-chain assets, lock-up participation, ecological project interaction and referral mechanisms. Supported deposit assets include BTC anchored assets, stablecoins, and ETH LST. In the current BOB Fusion Season 3 plan, the behavior of holding, lending, and trading interest-bearing assets such as SolvBTC.BBN has received the maximum multiple incentives compared to other assets. This incentive program has significantly promoted the development of the BOB ecosystem, attracting more than 147,000 users, more than 100 partners, and 60 ecological projects online.

3 Conclusion

By observing the three emerging forces of the BTC ecosystem, Core, BOB and Corn, we can see the differentiated approaches of different networks in asset sedimentation strategies. Core has successfully attracted a large amount of asset inflows through deep integration with the growth-stage Solv Protocol derivative assets and the innovative introduction of a dual staking mechanism to provide stable returns. Corn has successfully attracted a large amount of BTC LST funds through the point derivative gameplay jointly launched with Pendle, laying the foundation for its future mainnet launch. BOB has attracted a large amount of assets through extensive BTCFi project integration and one-click liquid staking services.

Judging from the flow of BTC anchored assets on the chain, the key to effectively realizing the sedimentation of ecological funds lies in opening up and incentivizing large-scale incremental anchored assets, and forming a composable interest-bearing strategy and providing multi-party incentive expectations through diversified DeFi applications. The synergy effect will promote the activity and liquidity of BTC anchored assets on various chains. At present, the TVL of BTC anchored assets in L2 and sidechain extension networks is about 1.6 billion US dollars, accounting for only 0.14% of the total market value of BTC. With the gradual release of BTC liquidity in the future, the sedimentation scale of BTC assets on various chains and the application scenarios of the BTCFi ecosystem still have huge growth potential.