As U.S. regulators continue to increase their scrutiny of cryptocurrencies, startups and founders in the space are looking for friendlier environments overseas to support their growth.

Hong Kong is one of them, which is seeking to restore its status as a financial hub, hoping to attract a new wave of entrepreneurs, technology experts and investors through favorable cryptocurrency regulations, and so far its strategy seems to be working.

In mid-April, Hong Kong’s annual Web3 Carnival attracted more than 50,000 attendees, with a noticeable increase in non-Chinese participants compared to last year, when the event felt like a gathering of crypto refugees fleeing restrictive policies in mainland China. At this year’s event, Hong Kong officials listened attentively to the speeches of founders who were dressed in tatters and struggling with jet lag.

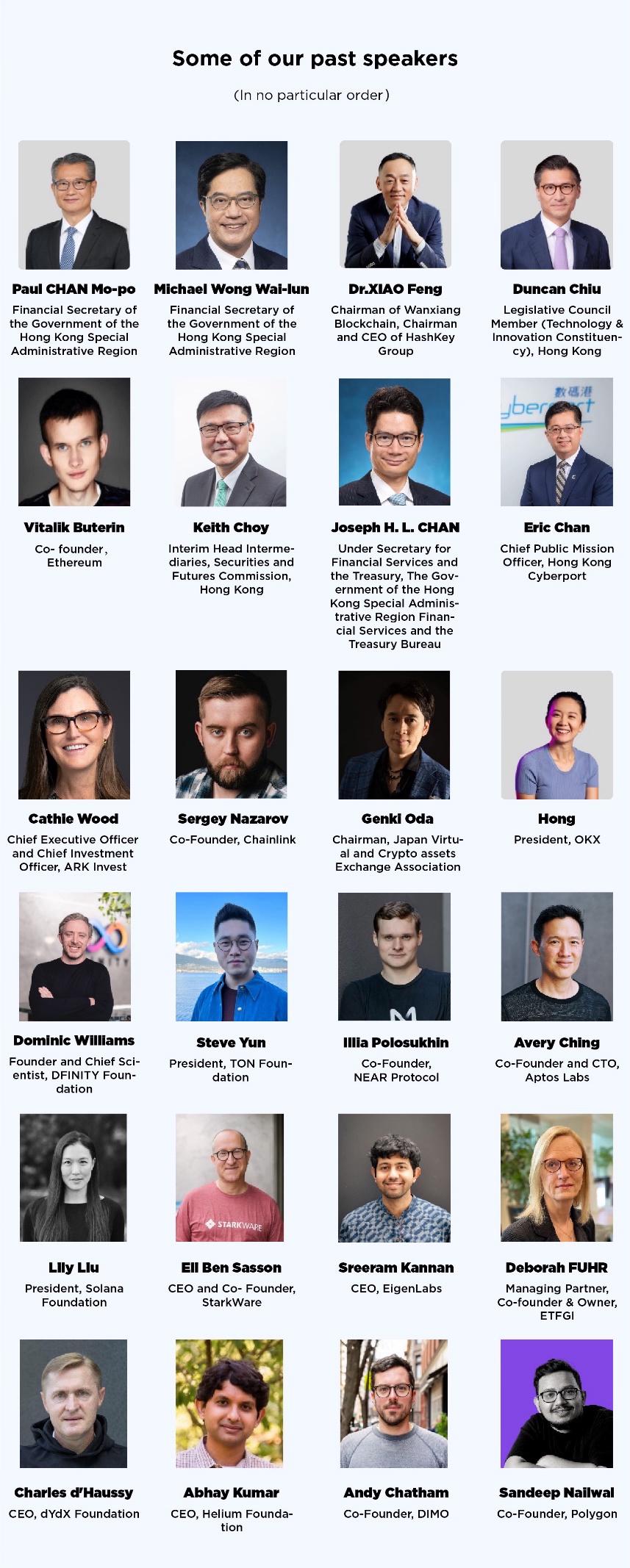

Cathie Wood, the billionaire founder of Ark Invest, did not attend the event in person but gave a speech via video, and Vitalik Buterin, the "nomadic" founder of Ethereum, also attended the event temporarily.

It’s a feeling of déjà vu: In the early days of the cryptocurrency industry, Hong Kong was a major hub for cryptocurrency companies run by foreign entrepreneurs, including the likes of FTX, Crypto.com and BitMex, and like other jurisdictions around the world, it cracked down on cryptocurrency activities to protect investors’ interests as market volatility spiraled out of control.

In June last year, the Hong Kong government legalized cryptocurrency trading for retail investors, and people's enthusiasm for Hong Kong's Web3 field has once again heated up. Since then, Hong Kong has implemented a series of measures to regulate cryptocurrency-related activities, including a sandbox for stablecoin issuance and a licensing system for cryptocurrency exchange operators. Hong Kong has followed in the footsteps of the United States and also listed a number of cryptocurrency exchange-traded funds.

These moves stand in stark contrast to the U.S. government’s tough stance on cryptocurrency businesses. Web3 Carnival participants from the U.S., Europe, the Middle East, India and other regions expressed optimism about Hong Kong’s momentum. For example, First Digital’s FDUSD, which was issued in accordance with Hong Kong’s digital asset rules and backed by U.S. Treasury bonds, has quickly become the world’s fourth-largest stablecoin by market value.

At the same time, people are aware of Hong Kong’s limitations as a cryptocurrency hub. First, Hong Kong is a relatively small market with a population of only 7 million, and the huge market of mainland China is inaccessible at least for now. In addition, the rules prioritize investor protection, which may lead to higher compliance costs and hinder those who prefer a freer environment.

Still, Hong Kong remains one of the few jurisdictions that has explicitly endorsed cryptocurrencies, along with the UAE, Japan and Singapore, and as Jack Jia, head of crypto at global payments company Unlimit, puts it: “Any cryptocurrency regulation in Hong Kong would be attractive to everyone from a reputation and image perspective.”

Open-minded officials

Hong Kong’s cryptocurrency regulation is not the most relaxed. In fact, Hong Kong’s strict scrutiny of exchange operators has prompted its cryptocurrency representative company HashKey to seek a license in Bermuda. The world’s largest cryptocurrency exchanges Binance, Coinbase and Kraken did not appear on the list of 22 applicants for Hong Kong’s virtual asset exchange license.

Hong Kong’s biggest appeal has proven to be its efforts to provide regulatory clarity for crypto activities.

“The SEC is notorious for saying everything is a security, but we won’t tell you exactly what license you need to apply for, and then we might reject your application anyway,” Jia said, describing the SEC’s approach to regulating cryptocurrency companies. “The SEC doesn’t have an established process, but the Hong Kong regulator has a process in place to hear opinions.”

Indeed, multiple cryptocurrency executives told TechCrunch that they have held closed-door meetings with Hong Kong government representatives, and Sergey Nazarov, co-founder of Chainlink, a San Francisco-based company that works on feeding real-world data into smart contracts (lines of code that execute predefined rules), is in discussions to provide its technology to Hong Kong’s main financial infrastructure.

“People don’t fully realize that capital markets and cryptocurrencies are very compatible, and coming to Hong Kong, I see that this compatibility will accelerate here first because the government and regulators are more open to this compatibility,” said Nazarov, who invited Hong Kong’s deputy finance minister, William Chan, to a fireside chat at Chainlink’s annual conference SmartCon in Barcelona last year.

Nazarov said that this year, Chainlink is bringing SmartCon to Hong Kong at the invitation of the Hong Kong government, and Hong Kong will become the first Asian city to host the conference.

“The fact that Hong Kong regulators are regulating stablecoins and digital assets means that Hong Kong can be a place where assets and payments can reliably operate in a system in a regulated way.” Nazarov added: “This is important because if there is no regulation, then hundreds of trillions of dollars and banks cannot be moved.”

Steve Yun, president of the Dubai-based TON Foundation, Telegram’s official blockchain partner, was also optimistic, saying Hong Kong may have the biggest competitive advantage over other aspiring cryptocurrency hubs because it is “trying to build a very comprehensive framework to make developers and entrepreneurs feel more comfortable and attract talent.”

Financial regulations in Hong Kong are complex, but Charles d'Haussy, CEO of Swiss dYdX Foundation, is no stranger to them, having previously served as head of fintech at Invest Hong Kong, the Hong Kong government's foreign direct investment arm.

“The Hong Kong government was very open to cryptocurrencies in the early days,” d’Haussy recalled, and there was a period of hostility as regulators sought to crack down on rampant cryptocurrency fraud, but “about a year ago, I think they realized there was a new market there and that regulations should be put in place to make sure that opportunity wasn’t missed.”

“You’ll see the Hong Kong Monetary Authority (HKMA) launching more and more CBDCs (central bank digital currencies), and the SFC issuing cryptocurrency exchange and ETF licenses,” d’Haussy added.

Entering China

When Hong Kong opened up to cryptocurrencies last year, there was widespread speculation that mainland China might follow suit. While that hope remains elusive as China continues to ban its citizens from trading cryptocurrencies, businesses are now recognizing Hong Kong’s potential as a gateway to another valuable resource from their neighbor.

While Hong Kong is a magnet for financial talent, its southern neighbor Shenzhen is home to some of the world’s largest tech companies, including Huawei, DJI and Tencent, and there’s no doubt that cryptocurrency firms are taking advantage of Hong Kong’s friendly regulatory environment and its easy access to developer resources in Shenzhen and other Chinese cities.

The TON Foundation is one player that is taking advantage of Hong Kong’s location. In order to become a super app, Telegram is working with TON to enable developers to build lightweight blockchain-based applications and run them on the communication tool. During the web3 Carnival week, the foundation held a training camp in Hong Kong, hoping to attract Chinese developers, especially those familiar with the WeChat mini-program empire.

“Right now, we’re reaching out to regions where there are a larger number of developers and entrepreneurs, especially those who have grown up using some kind of mini program through super apps, and those who are participating in the growth of this ecosystem,” Yun said.

For example, a16z-backed Aptos held a three-day hackathon in Shenzhen in February that attracted hundreds of applicants. Aptos is run by a team that previously worked on Meta’s Diem blockchain and is also working with Alibaba’s cloud computing unit to attract Chinese developers.

Some foreign founders have gone a step further and established a physical presence in Hong Kong, including zkMe, a company founded by a German entrepreneur to enable private certificate verification, which chose to set up its headquarters in Hong Kong.

“We are here to build a sustainable business and leverage the technical expertise here, and obviously working with the Greater Bay Area is also very beneficial,” said Alex Scheer, founder and CEO of zkMe, referring to the plan to integrate Hong Kong with nine neighboring Chinese cities through policies such as tax incentives for Hong Kong companies setting up in Shenzhen, where 14 of zkMe’s 16 team members are based.

Some founders are more optimistic about Hong Kong paving the way for China’s future embrace of cryptocurrencies, with Anurag Arjun, founder of Dubai-based modular blockchain company Avail, believing that governments that see the full benefits of crypto will eventually take a more accommodating stance.

"Over the past few years, the crypto industry has been developing very advanced technologies, such as zero-knowledge proof technology." He said that the underlying technology behind cryptocurrencies was not developed to support fraudulent NFTs or speculative transactions, but to enhance the industry's basic technology.

“We think Hong Kong is an important place given its strategic nature — the gateway to China in the future,” Arjun said. “If China opens up in the future — once we talk to more government officials and prove that our technology is applicable to more than just monetary elements — what we’ve done in Hong Kong will be a useful experience for expanding into China.”

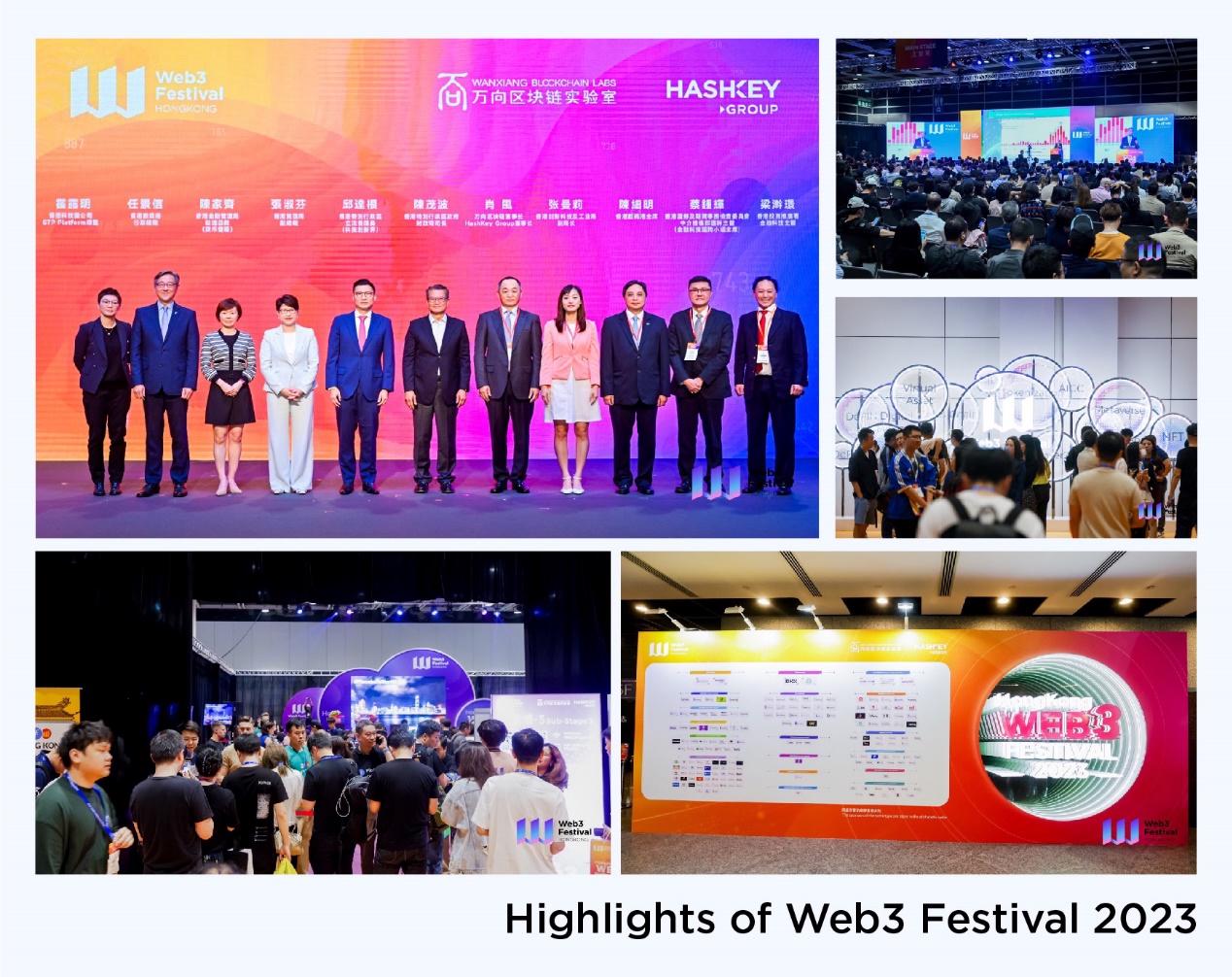

2025 Hong Kong Web3 Carnival Event Preview

The Hong Kong Web3 Carnival is a Web3 event brand jointly launched by Wanxiang Blockchain Lab and HashKey Group and hosted by W3ME. The 2025 Hong Kong Web3 Carnival will be held at the BCDE Hall on the 5th floor of the Hong Kong Convention and Exhibition Center from April 6 to 9, 2025. The event will last for four days and include 4 venues with a venue area of more than 14,000 square meters.

The previously held 2023 Hong Kong Web3 Carnival and 2024 Hong Kong Web3 Carnival brought together more than 250 cutting-edge exhibition projects, invited more than 800 industry leaders for in-depth exchanges, and attracted a total of more than 80,000 on-site audiences to participate in the event, while also supporting more than 300 colorful peripheral activities.

Financial Secretary of the Hong Kong Special Administrative Region Government Paul Chan, Ethereum co-founder Vitalik Buterin, ARK Invest CEO and CIO Cathie Wood have all served as guest speakers at the event.

As the third consecutive event, based on the reputation and global influence accumulated from the previous two events, the scale of the 2025 Hong Kong Web3 Carnival is expected to reach tens of thousands of people. It will continue to bring together elites and cutting-edge projects in the global Web3 field to jointly explore the infinite possibilities of Web3 technology and bring an unprecedented technological feast to global participants. What are you waiting for? Come and join us!

Ticket Discounts

After becoming the community partner of the 2024 Hong Kong Web3 Carnival, the 2024 Bitcoin Asia Summit, the 2024 Singapore TOKEN2049 and the 10th Blockchain Global Summit and the 2024 Shanghai Blockchain International Week, today, we are very pleased to announce that the IC Chinese Community will continue to be the official partner community of the 2025 Hong Kong Web3 Carnival, providing everyone with an exclusive 15% discount on tickets, discount code: ICCHINA .

Early bird tickets are currently only $299. Ticket purchase link :

https://lu.ma/hkweb3festival_2025?coupon=ICCHINA

Click the ticket purchase link above to enjoy exclusive ticket discounts. Ticket prices will gradually increase in the future, so it is better to buy as soon as possible if you are sure to attend the conference. You can also follow the conference official on X (@festival_web3) to learn about the latest event updates!

For more conference details, please read :

2025 Hong Kong Web3 Carnival is scheduled to be held in April next year