Author: Monchi | Editor: Monchi

1. Bitcoin Market

Bitcoin price trend analysis this week

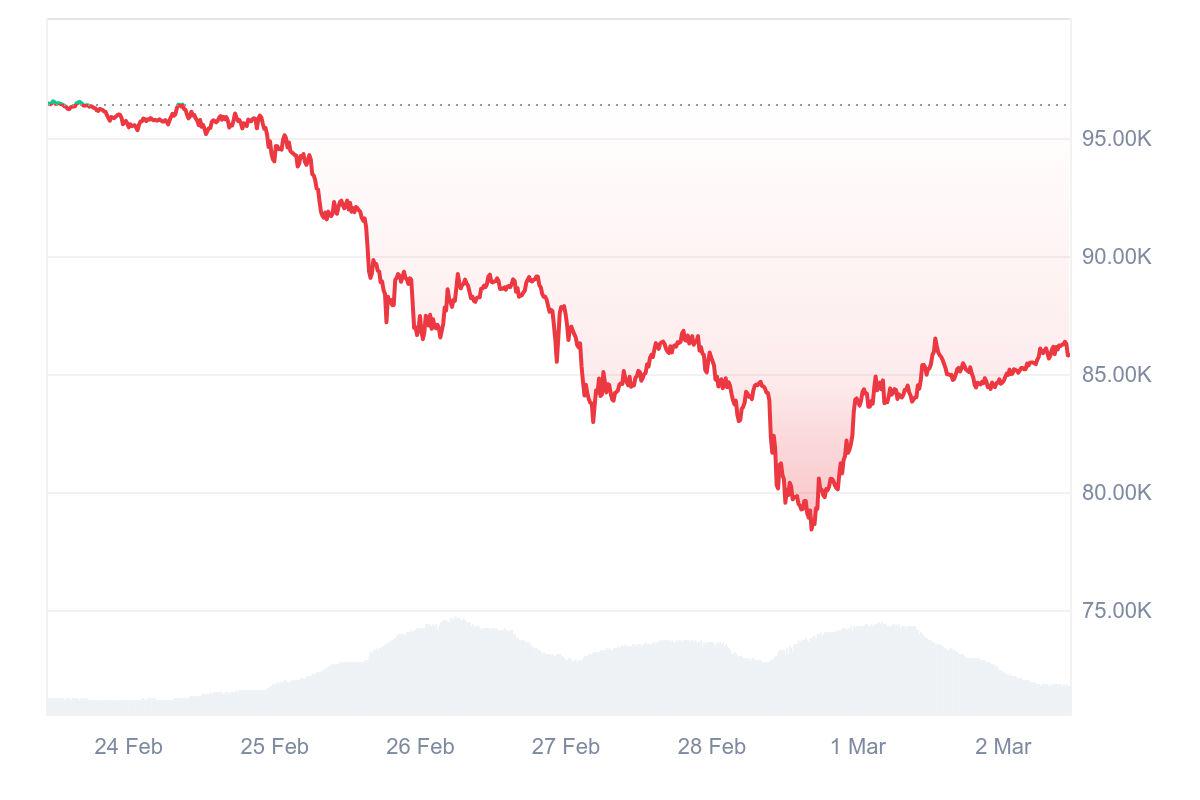

From February 24 to March 2, 2025, Bitcoin as a whole showed a volatile downward trend, experiencing multiple rounds of violent fluctuations, and rebounded after hitting a periodic low at the end of the month. The specific trends are as follows:

February 24: Bitcoin prices fluctuated between $95,000 and $96,500, and the market was relatively stable. However, at 9:30 p.m., the price began to fall below the range from $95,971, and fell to $94,006 in a short period of time, starting a new round of downward trend.

February 25: The market experienced significant downward pressure, and prices fell in steps. In the first stage, it fell from $94,990 to $92,621; in the second stage, it further fell below the $92,500 support level to $89,073; in the third stage, after a brief rebound to $89,844, it fell back to $86,200 under pressure again, with a more significant intraday decline.

February 26: Bitcoin prices briefly rebounded before continuing their downward trend. The price rebounded to $89,083 in the morning, but then entered a range of $87,700 to $89,200. Market sentiment weakened further in the evening, and the price quickly dropped to $85,516, followed by a short-term rebound, reaching a high of $87,834.

February 27: Bitcoin continued its downward trend, and market liquidity intensified. The intraday price fell below the key support level, hitting a low of $82,965, and then slowly recovered to $86,939, but the overall upward movement was weak, and it fell slightly again to $82,857 in the evening.

February 28: Market volatility intensified, and the price briefly rebounded to $84,671 before quickly falling back, hitting an intraday low of $79,691 and further falling to this week's low of $78,441. After hitting a temporary low, the market rebounded from oversold levels, and the price rebounded to $83,913.

March 1: Bitcoin price was trading sideways around $84,000, market sentiment gradually improved, and the overall trend was volatile upward. The price once climbed to $86,501 in the morning, and then fell back to around $85,000.

March 2: Volatility has narrowed somewhat, and prices are slowly moving upward. As of writing, Bitcoin has steadily climbed from $84,360 to $86,362.

During this period, Bitcoin experienced a substantial adjustment, with market sentiment gradually shifting from high-level fluctuations to panic selling, followed by an oversold recovery at the end of the month. Market bullish confidence is recovering, but it still faces resistance in the short term. It is necessary to pay attention to whether it can break through key price levels, and to pay attention to the further impact of market liquidity, macroeconomic environment, and capital flows on Bitcoin prices.

Bitcoin price trend (2025/02/24-2025/03/02)

2. Market dynamics and macro background

As of February 28, 2025, the price of Bitcoin is about $85,170, up about 5.3% from the previous day. However, this week has been an overall downward trend, with the price falling from about $95,000 on February 24 to the current level, a drop of more than 10%. According to coinglass data, BTC's return rate in February was -17.39%, and the return rate in January was 9.29%.

Fund Flow

This week, the Bitcoin spot ETF market saw a massive outflow of funds. On February 25, it hit a record high of $1.13 billion in single-day outflows. In February, the cumulative outflow was about $3.4 billion. In addition, investors' uncertainty about the market outlook caused funds to flow from the cryptocurrency market to traditional safe-haven assets.

Technical Analysis

From a technical perspective, Bitcoin price fell below the key support level of $90,000 and further dropped below $80,000. Analysts pointed out that a break below the secondary support level of $73,800 could trigger a larger decline. Technical indicators such as the relative strength index (RSI) show that the market has entered the oversold zone, suggesting a rebound in the short term. When the price of Bitcoin broke through $86,000, there were obvious signs of long entry.

- Market rebound possibility: The relative strength index (RSI) shows that the market has entered the oversold area, suggesting that a rebound may occur in the short term. Some traders believe that Bitcoin may rebound in the $88,000 area before deciding on the further direction of movement. This is consistent with the RSI signal, indicating that a rebound may occur in the short term.

- Resistance: Glassnode noted in a Feb. 28 message that the $96,000 to $98,000 area could become a strong resistance level for Bitcoin. According to the analysis, although some addresses in this price range are redistributing their Bitcoin, the supply cluster is still very dense. If the Bitcoin price rebounds to this level, it may encounter strong selling pressure, becoming an obstacle to price increases.

- Support levels and independent trends of altcoins: Crypto KOL Ansem said that the $70,000 area should be a strong support level for Bitcoin, and after this plunge, altcoins may have independent trends and move out of their own trends. He warned that there may be major fluctuations over the weekend, so be cautious about being bearish. This view provides more support levels for the current market and may affect the trend of Bitcoin in the short term.

Market sentiment

The current Bitcoin market sentiment is extremely fearful, with the Fear and Greed Index falling to 10, reflecting investors' concerns about the long-term policy environment and regulatory trends in the market, which in turn intensified the selling pressure. Hargreaves Lansdown analysts pointed out that the market's sluggish sentiment suppressed the potential for Bitcoin to rebound, especially under the influence of external factors such as Trump's tariff threats and Bybit hacker attacks. The lack of policy support has further exacerbated the tension. Investors' confidence in the future has been frustrated, resulting in market sentiment remaining in an unstable state.

Industry news and macro background

US President Trump announces additional tariffs

On February 27, 2025, US President Trump announced that he would impose a 25% tariff on imports from Mexico and Canada on March 4, and an additional 10% tariff on Chinese goods. This move has triggered market concerns about slowing global economic growth and rising inflation, leading to a decline in the attractiveness of risky assets including Bitcoin. The uncertainty of tariff policies has made investors more inclined to hold safe-haven assets such as the US dollar rather than high-volatility assets such as Bitcoin.

Bitcoin Reserve Bill Meets Resistance in Some States

Recently, some state governments in the United States have been cautious or even opposed to the Bitcoin Reserve Act. For example, the Montana House of Representatives rejected the Bitcoin Reserve Act, which hindered the legalization of Bitcoin in government reserve assets. This policy resistance may affect the market's acceptance of Bitcoin as a mainstream asset class and increase market uncertainty in the short term.

Global stock market volatility and safe-haven asset flows

Affected by the uncertainty of the Federal Reserve's future monetary policy, global stock market volatility has increased. The market expects that US interest rates may remain high before mid-2025, which puts overall risk assets under pressure. Investors seek safe-haven assets, causing the US dollar and US Treasury yields to rise, while high-risk assets such as Bitcoin face selling pressure.

3. Hash rate changes

From February 24 to March 2, 2025, the hash rate of the Bitcoin network showed significant fluctuations, and the overall trend showed a trend of fluctuating upward and then falling back. On February 24, the hash rate remained near 730 EH/s, and briefly fell back to 687.56 EH/s in the evening before rebounding. On February 25, the computing power gradually increased from 715 EH/s to 825.30 EH/s, and then slightly pulled back to 767.78 EH/s. On February 26, the hash rate continued its volatile upward trend, briefly touching 841.95 EH/s, and continued to rise to 857.99 EH/s after the pullback. On February 27, the computing power rose further, jumping from 808.62 EH/s to 895.70 EH/s, and operating stably in the range of 850 EH/s to 900 EH/s, and fell slightly to 876.81 EH/s in the evening. On February 28, the hash rate reached its highest point of the week, climbing rapidly from 801.19 EH/s to 992 EH/s, but then quickly fell back to 857.36 EH/s, and further dropped to 756.21 EH/s. On March 1, the Bitcoin network hash rate first rose to 786.98 EH/s, then fell back to 698.88 EH/s, and then rose again to 775.57 EH/s, showing an overall fluctuating adjustment trend. On March 2, the hash rate showed a significant upward trend, continuing to rise since the beginning of the day, and as of the time of writing, it has exceeded 934.61 EH/s, showing a strong momentum for network computing power growth.

Overall, the hash rate fluctuations this week were affected by miners' computing power adjustments, changes in market sentiment and energy supply factors. Although it experienced a significant correction in the short term, it remained at a high level overall, demonstrating the stability of the Bitcoin network and the continued activity of miners.

It is worth noting that the global Bitcoin mining landscape is also changing. On March 1, the United States and China's share of the global hash rate declined, although they are still in the lead. Currently, only nine countries in the world have a Bitcoin hash rate share of more than 1%, while 28 countries have a hash rate share of more than 0.1%. This trend reflects that the geographical distribution of Bitcoin mining is becoming more dispersed, which may further affect the future trend of network computing power and energy demand.

Bitcoin network hash rate data

4. Mining income

Between February 24 and March 1, 2025, Bitcoin miners’ earnings were under the dual pressure of falling Bitcoin prices and rising mining costs. On February 25, the price of Bitcoin fell below $90,000, a three-month low, with a single-day drop of more than 7%. This price fluctuation caused the earnings of some mining machines to be close to or below the shutdown price, and miners were therefore at risk of downtime. According to F2Pool data, even if the Bitcoin price remained at $120,000, 38% of mining machines were still on the verge of the shutdown price. At the current price level, more than half of the mining machines have reached the shutdown price, resulting in a significant reduction in miners’ earnings.

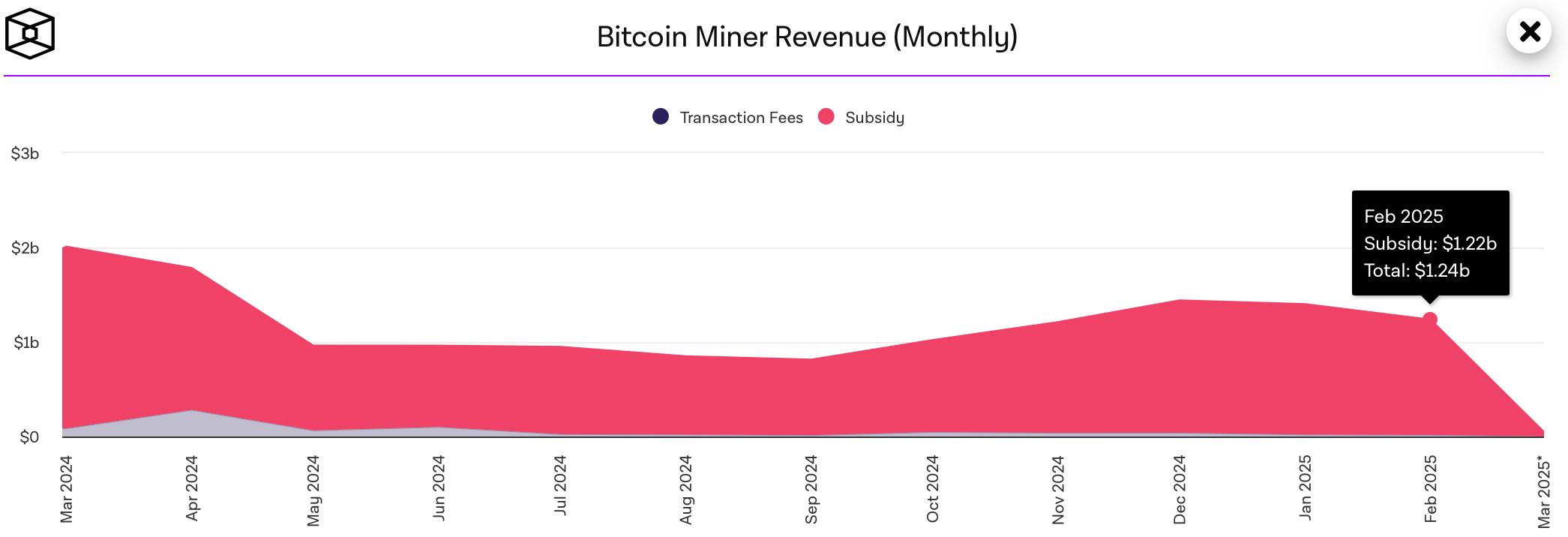

Data from The Block shows that in February 2025, the total revenue of Bitcoin miners was $1.24 billion, down 11.4% from $1.4 billion in January. This decline was mainly affected by the fluctuation of Bitcoin prices. At the same time, due to the intensified competition among miners, the mining difficulty in February was increased by 2.3%, further squeezing the profit margins of miners. In addition, the proportion of transaction fee revenue decreased, indicating the weakening of market activity during the decline in Bitcoin prices.

According to IntoTheBlock's report, Bitcoin miners' share of total on-chain transaction volume fell to 2.4% last Sunday, the lowest level since May 2023. This change indicates a significant decrease in miners' activity and share of on-chain transaction volume.

F2Pool also pointed out that when the price of Bitcoin was $80,000, a mining machine with a power consumption of 30 W/T was close to the break-even point, which further exacerbated the profit pressure faced by miners. Under the current market conditions, mining machines with low power consumption and high computing power are more competitive.

Overall, this week, the income of Bitcoin miners was squeezed by the double squeeze of falling Bitcoin prices and rising mining costs, and the profit margin was significantly compressed. In the future, the income of miners will be affected by multiple factors such as Bitcoin price trends, network difficulty adjustments, mining machine efficiency and energy costs.

Bitcoin miners monthly income data

5. Energy costs and mining efficiency

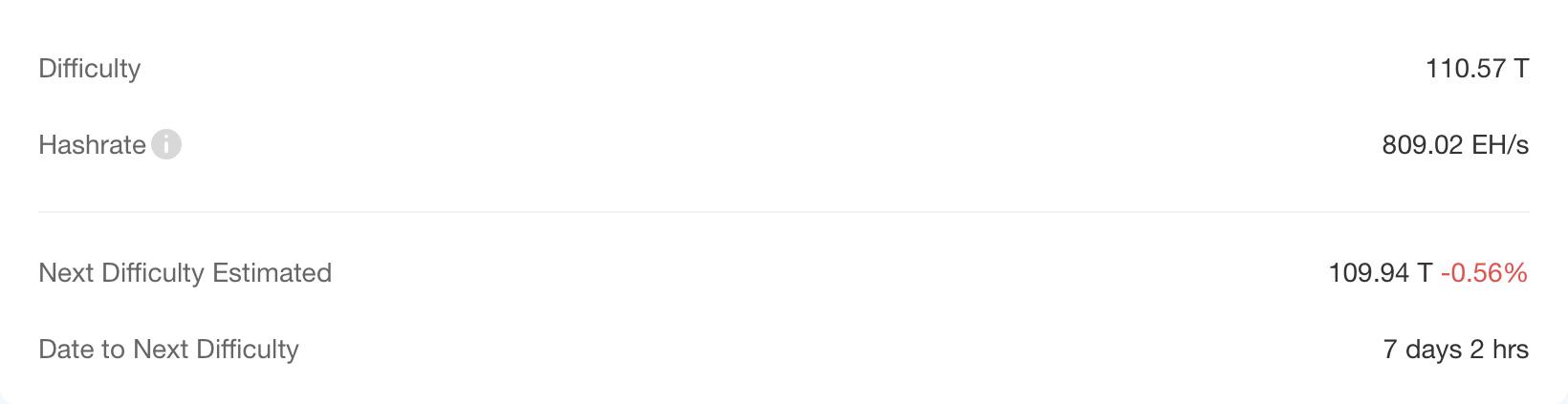

According to CloverPool data, as of March 2, 2025, the total network computing power is about 809.02 EH/s. Previously, the difficulty of Bitcoin mining was adjusted at block height 885,024 (4:29:38 am, February 24, Beijing time), and the mining difficulty was reduced by 3.15% to 110.57 T.

According to the latest data from MacroMicro, the total production cost of Bitcoin is about $85,975.44. However, the recent drop in Bitcoin prices to around $80,000 has caused the mining cost to market price ratio to rise to 1.05. This means that the current mining cost has exceeded the Bitcoin market price, and miners are facing the risk of losses. As the price of Bitcoin falls, some miners may shut down their mining machines due to reduced profitability, resulting in a decrease in computing power. In this case, the mining difficulty may be adjusted accordingly, affecting the overall mining efficiency.

In addition, according to news on March 1, the block time of the latest block 885840 was extended to 77 minutes. This may be due to increased competition among miners or uneven distribution of computing power, which further affected the mining efficiency of the overall network.

This week, Bitcoin mining faces challenges. Mining costs have exceeded market prices, and miners' profitability has been squeezed. Falling prices may cause some miners to withdraw, which in turn affects computing power and mining efficiency. Miners need to pay close attention to changes in market prices and mining difficulty, and adjust their operating strategies to cope with current challenges.

Bitcoin mining difficulty data

6. Policy and regulatory news

The Latest Progress of Bitcoin Reserve Legislation in US States

Bitcoin Reserve Bill Meets Resistance in Some States

- Montana: The House of Representatives rejected the Bitcoin Reserve Act, arguing that investing in Bitcoin is high-risk, but supporters believe it can increase returns on funds.

- South Dakota: The House Commerce and Energy Committee postponed HB 1202 until the "41st day" of this legislative session, which is essentially the same as a veto.

- Proposals have been blocked in five states across the country: In five states, including Montana, South Dakota, North Dakota, Pennsylvania and Wyoming, proposals related to Bitcoin reserves have been rejected or blocked.

Multiple states advance Bitcoin reserve bills

Georgia: The Senate has introduced Bill No. 228 (SB 228), which intends to authorize the state Treasury to invest unlimited amounts in Bitcoin and requires the formulation of relevant policies and procedures. It is currently awaiting review by the legislature.

Oklahoma: The Bitcoin Strategic Reserve Act (HB 1203) was passed by the House Committee and entered the full vote stage, allowing up to 10% of public funds to be invested in Bitcoin or digital assets with a market value of more than $500 billion.

Texas: The Strategic Bitcoin Reserve Act has passed the Commerce and Business Committee and will be sent to the Senate for consideration.

National Trends: Dennis Porter, co-founder of Satoshi Action Fund (SAF), said that seven states in the United States have passed committee reviews of Bitcoin Reserve Acts and the legislative process is moving forward.

Fidelity representatives met with the SEC crypto panel last week and mentioned the regulatory recognition of on-chain incentives such as liquidity mining

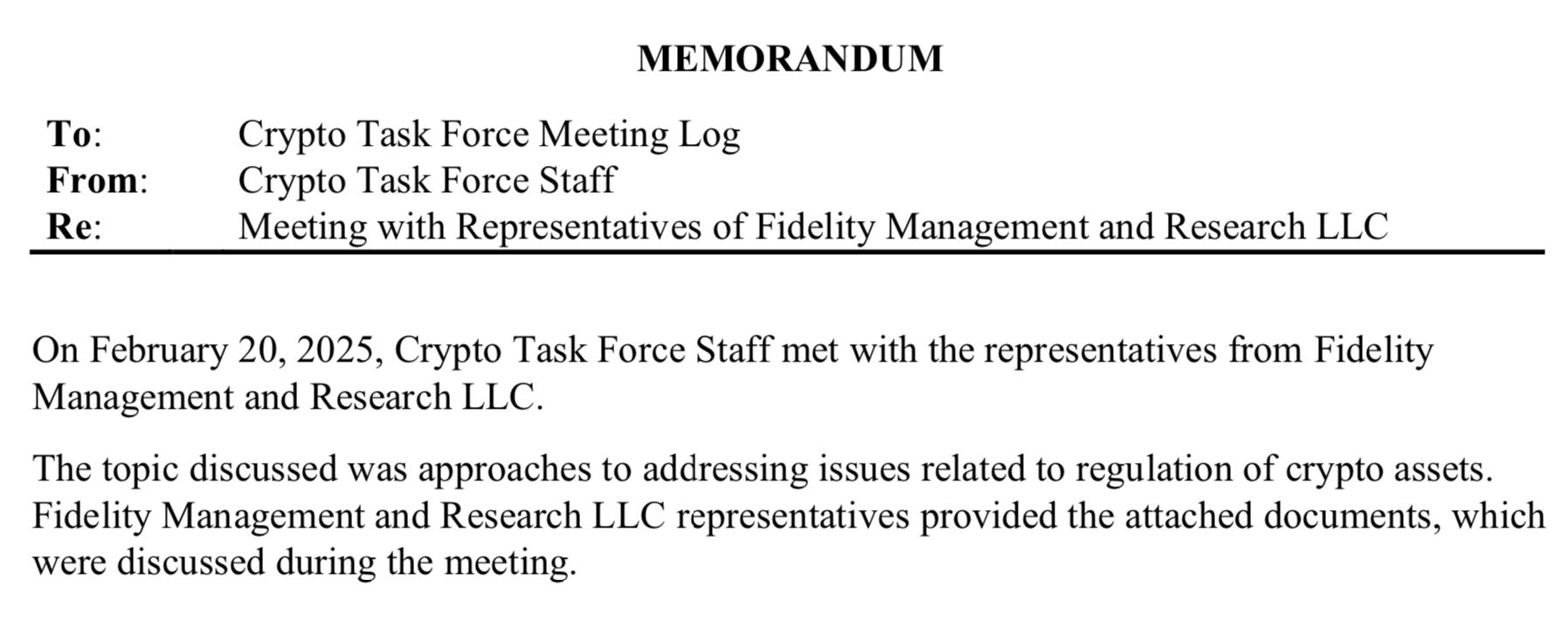

On February 25, according to the meeting memorandum document disclosed by the U.S. SEC today, on February 20, the U.S. Securities and Exchange Commission (SEC) Crypto Special Action Team met with representatives of Fidelity Investments. Fidelity representatives submitted the attached documents and discussed relevant content during the meeting:

The applicability of customer protection rules to the interaction between brokers and digital asset securities, and the discussion of brokers' customer asset isolation and custody requirements in digital asset securities transactions; Standardized listing rules for digital asset exchange-traded products (ETPs) to promote a standardized framework for the issuance and listing of digital asset ETPs; Clarify the fund sponsor's selection mechanism for asset pledges, and define the compliance path and operating specifications for funds when pledging crypto assets; Accounting treatment of blockchain-based tokens and financial instrument-related rewards, and explore the regulatory recognition methods for on-chain incentives such as pledge income and liquidity mining rewards.

Related images

7. Mining News

Bitcoin mining stocks Bitdeer and Cipher plunge as profitability continues to face headwinds

On February 26, Bitdeer's stock price fell 28% to $9.38 per share, while Cipher Mining's stock price fell 20% to $3.96 per share. Bitdeer Technologies reported annual revenue of $69 million, down 40% from the previous year. Cipher Mining's revenue increased to $151 million, but its full-year adjusted loss widened to $106.6 million.

More than half of mainstream Bitcoin mining machines are close to or have reached the shutdown price, and electricity costs of 16 profitable mining machines account for more than 60%

According to F2pool online data on February 27, with the Bitcoin price at about $84,803, more than half of the mainstream Bitcoin mining machines are on the verge of shutdown price or are already operating at a loss. Among the 135 mainstream mining machines, 68 mining machines (about 50.4%) have negative daily net income, which means that these devices are no longer profitable at the current electricity price (0.06 USD/kWh).

Among the 67 mining machines that still have profit margins, the electricity costs of 16 mining machines have exceeded 60%, among which the electricity costs of Whatsma M33S+ and Whatsma M30S+ account for as high as 99%, and the electricity cost of Ant S19 accounts for 100%, which is at the break-even point.

The latest generation of mining machines, such as the Antminer S21XP water-cooled version, has an electricity cost of only 35%, a daily net income of $15.12, and a shutdown price of only $29,757, making it the most risk-resistant mining machine on the market. Following closely behind are the Antminer S21eXP water-cooled version (shutdown price of $32,237) and TerafluxAI3680 (shutdown price of $37,197).

8. Bitcoin related news

Bitcoin holdings of global companies and countries (statistics for this week)

The latest data on Bitcoin holdings in El Salvador - El Salvador holds 6,093 Bitcoins with a total value of approximately US$518 million.

Metaplanet continues to increase its Bitcoin holdings - Metaplanet has increased its holdings by 135 Bitcoins in the past 5 days, and its total holdings have increased to 2,235 Bitcoins.

Bitcoin Depot has increased its holdings of Bitcoin several times - Bitcoin Depot recently increased its holdings of Bitcoin twice, purchasing 11.1 and 51 coins respectively, bringing its total holdings to 82.6 coins.

Rezolve Ai denies setting up a $1 billion Bitcoin treasury, with an actual initial investment of $100 million - Rezolve Ai clarified that it plans to raise $1 billion through convertible notes, with an initial investment of only $100 million to purchase Bitcoin, and plans to add an additional $900 million in the next three years. The plan is linked to its upcoming AI encryption payment platform.

Bitcoin rewards platform Fold increased its holdings of 10 bitcoins - Fold Holdings announced the purchase of 10 bitcoins, with an investment of approximately US$875,000.

Bitcoin whale "Spoofy" increased his holdings significantly during the market adjustment period - the well-known Bitcoin whale "Spoofy" increased his holdings by 4,000 bitcoins, worth approximately US$344 million, when the BTC price fell back to the US$82,000-85,000 range.

Eason Technology will invest $150,000 to purchase Bitcoin - Eason Technology announced that it will invest $150,000 to purchase Bitcoin for product research and development, and has no plans to include digital assets in its asset portfolio.

Michael Saylor: Bitcoin network will reach $20 trillion in 4 to 8 years

On February 24, MicroStrategy co-founder Michael Saylor said that Bitcoin represents digital capital. The network's current market value is 2 trillion US dollars, and it will reach 20 trillion US dollars in 4 to 8 years. Its growth rate will exceed any other asset in the world.

Related images

Bernstein reiterates continued bullishness on Bitcoin and maintains its $200,000 price target

On February 26, Bernstein reiterated that it would continue to maintain its $200,000 Bitcoin price target, believing that there are potential buying opportunities in the current price adjustment. Its research report described the current price correction as "another opportunity to participate in this cycle" and reiterated their bullish stance on the Bitcoin market structure. Bernstein also pointed out that Bitcoin has not yet reached its cyclical high and is expected to approach the $200,000 mark in the next 12 months. Their long-term forecast for Bitcoin is based on a simple argument: "Driven by the acceleration of institutional and sovereign demand, Bitcoin will become a booming 'digital gold' asset class."

CZ: Wait for the headline “Bitcoin “plunges” from $1,001,000 to $985,000”

On February 26, Zhao Changpeng (CZ) retweeted his 2020 tweet "Waiting for a new headline: Bitcoin 'plunged' from $101,000 to $85,000." on the X platform and said, "Waiting for a new headline: Bitcoin 'plunged' from $1,001,000 to $985,000." He also said, "I have always been optimistic, and this has been the case for the past 12 years, and it is still the case now." Subsequently, CZ also posted a message emphasizing: "No need to panic, Bitcoin will not die."

All crypto sectors have underperformed Bitcoin this year, with AI frameworks seeing the largest drop of 84%

On February 26, according to data disclosed by Delphi Digital, all cryptocurrency sectors have performed worse than Bitcoin this year. The average maximum decline in each segment is as follows: AI framework fell 84.05%, Agent projects fell 70.27%, Meme coins fell 51.74%, game infrastructure fell 51.54%, and modular solutions fell 47.48%.

Assure DeFi CEO: Key indicators show that Bitcoin has not peaked yet and will be bullish in the coming year

On February 27, according to the analysis of Chapo, CEO of Assure DeFi, Bitcoin's market value and realized value (MVRV) indicator shows that Bitcoin still has room to rise in this cycle. Chapo expects Bitcoin's MVRV to reach 3.2 in 2025, suggesting that Bitcoin will usher in another bull market in 2025. In April 2021, Bitcoin's MVRV reached this level when the price of Bitcoin was $58,253. Currently, Bitcoin's MVRV is 1.95 and the price is $84,416.

SkyBridge Capital founder predicts Bitcoin will reach $180,000 by the end of the year

On February 28, Anthony Scaramucci, founder of Skybridge Capital, predicted during a live broadcast that Bitcoin will reach $180,000 by the end of the year.

CryptoQuant CEO: Bitcoin bull market is not over, 30% correction is a common phenomenon

On February 28, CryptoQuant CEO Ki Young Ju said that a 30% pullback is a common phenomenon in the Bitcoin bull market cycle. In 2021, Bitcoin fell 53% and still hit a record high. Investors should not panic sell. In addition, he pointed out that the current market is in the distribution stage, and the spot trading volume of Bitcoin is highly active around $100,000. The future trend depends on whether the new liquidity is sufficient. Although the bull market is not over yet, if the price falls below $75,000, it may affect its bullish judgment.

Related images

U.S. Senator Cynthia Lummis: States may establish strategic Bitcoin reserves before the federal government

On March 1, U.S. Senator Cynthia Lummis said today that before the federal government establishes a strategic reserve of bitcoin, state-level bitcoin reserves may be realized first, and pointed out that there are not enough supporters in Congress to promote this matter. In addition, as the chairperson of the Senate Banking Digital Assets Subcommittee, she posted on the X platform: "I spend dollars and save bitcoin", further expressing her recognition of bitcoin as a long-term store of value asset.

CME Bitcoin futures premium narrowed, and the basis fell to about 4%, which may be close to the trend in 2017

On March 1, spot Bitcoin ETFs again saw a large outflow this week. Analysts believe that the core reason is that the CME Bitcoin futures premium narrowed (the basis fell to about 4%), which weakened the attractiveness of the "cash arbitrage" strategy, especially when the current 10-year US Treasury bond offers a risk-free return of about 4.3%, arbitrage funds are more inclined to turn to safer investments. There are other factors that affect market sentiment, but in essence, the adjustment of arbitrage strategies by professional traders is the key to capital outflow. Bitcoin's 30-day realized profit/loss ratio (Realized Profit/Loss Ratio) has not fallen below the trend line, suggesting that the bull market should continue, and the current trend may be closest to 2017.