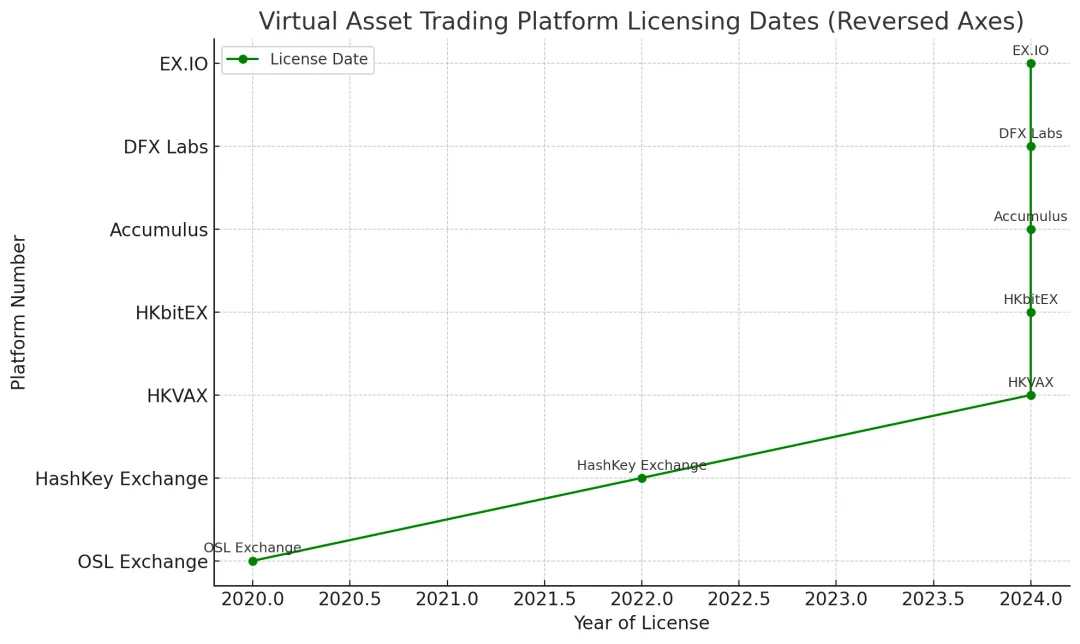

Recently, the Hong Kong Securities and Futures Commission (SFC) has updated the list of licensed virtual asset trading platforms on its official website. Since 2020, Hong Kong has issued virtual asset trading platform licenses in a two-year cycle. However, just two months after HKVAX was licensed, four new licensed platforms were added at once. Who are they? What impact will the addition of these new platforms have on the development of Hong Kong's Web3 industry? Today, Lawyer Mankiw will take you to find out.

▲Image source: SFC official website

What is a virtual asset trading platform operator?

With the rapid development of global virtual assets, especially the continuous approval of Bitcoin and Ethereum ETFs, the importance of virtual asset trading platforms as the "hub" of the market has become increasingly prominent.

Virtual Asset Trading Platform Operators (VATPOs) refer to centralized VAT platforms that operate businesses in Hong Kong or actively promote services to Hong Kong investors. Their main characteristics include:

1. Centralized operation ;

2. Operating in Hong Kong or promoting services to Hong Kong investors ;

3. Provide virtual asset trading services

Operators who meet the above conditions must apply for relevant licenses from the Hong Kong Securities Regulatory Commission and accept its supervision.

Under the Securities and Futures Ordinance (Cap. 571) and the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Cap. 615) (the Anti-Money Laundering Ordinance), compliant virtual asset trading platform operators are generally required to hold the following licenses:

1. License No. 1 (Securities Trading);

2. License No. 7 (for providing automated trading services);

3. AMLO license (anti-money laundering compliance).

Compared with entities that only need to hold the No. 9 license "asset management" to engage in virtual asset investment activities, the compliance threshold for virtual asset trading platforms is significantly higher. This difference is mainly due to the fact that the CSRC's supervision of VATP focuses more on market integrity, transaction security and investor protection, while the No. 9 license focuses on asset management and fund operation compliance.

If you are interested in learning more about the difference between VASP (“Virtual Asset Service Provider”) and VATP licenses (“Virtual Asset Trading Platform”), you can refer to Mankiw’s previous research article ( Hong Kong Virtual Currency License Application, What is the Difference Between VASP and VATP? | Mankiw Web3 Legal Education ) where we made an in-depth comparison between the two.

A quick overview of newly licensed platforms

HKbitEX

Background : Hong Kong Digital Asset Exchange Group (HKbitEX) is a subsidiary of Taiji Capital Group Co., Ltd. and holds Type 1, Type 7 and AMLO licenses issued by the SFC.

Business scope : Headquartered in Hong Kong, the business covers many regions in Asia.

Parent company overview : Taiji Capital was founded in 2018 and focuses on developing a digital financial ecosystem, combining blockchain and compliant Web3 technologies to support the development of the real economy. It has four wholly-owned subsidiaries: HKbitEX, Pioneer, O'Hash and ON1ON Limited.

Accumulus

Background : Accumulus is operated by Cloud Account Greater Bay Area Technology (Hong Kong) Co., Ltd., which is the overseas business headquarters of Cloud Account Technology (Tianjin) Co., Ltd., a Fortune 500 company in China.

Platform positioning : Focus on providing long-term and stable cryptocurrency trading services to Hong Kong users.

Parent Company Overview : Cloud Account is China's largest online human resources service company, with revenue of RMB 108.4 billion and tax payment of RMB 7 billion in 2023, and an estimated revenue of RMB 120 billion in 2024. The company is headquartered in Tianjin, China.

DFX Labs

Background : DFX Labs is a subsidiary of LianLian Digital (02598), a Hong Kong-listed company, and holds Type 1, Type 7 and AMLO licenses issued by the SFC.

Core business : Focus on providing compliant virtual asset trading services.

Parent Company Overview : Since its establishment in 2009, LianLian Digital has achieved a total payment volume (TPV) of RMB 2 trillion, covering more than 100 countries and regions around the world. The company is headquartered in Hangzhou, Zhejiang, China.

EX.IO

Background : EX.IO is operated by Thousand Whales Technology (BVI) Limited, whose major investors include Sina’s Huasheng Capital.

Platform Features : EX.IO is known as the first licensed institution in Hong Kong with a securities brokerage background.

Investor profile : Investors behind the company include Sina Group, Longling Capital and Weixin Jinke (HKG:2003). Sina Group made a strategic investment in Huasheng Capital in 2017, which is headquartered in Hong Kong, China.

Why is Hong Kong starting to speed up licensing?

This time, Hong Kong has demonstrated its determination to build Asia's Web3 highland with practical actions. The four new virtual asset trading platforms were subject to the "expedited licensing procedure". Dr. Ye Zhiheng, Executive Director of the Intermediary Department of the Hong Kong Securities Regulatory Commission, said that the licensing procedure for virtual asset trading platforms will be "accelerated." It can be seen that in the future, whether it is a virtual asset trading platform or other virtual asset-related licenses, the application procedures may be further simplified and the cycle may be further shortened.

Why did the Hong Kong Securities and Futures Commission suddenly speed up the issuance of licenses? There are several reasons:

1. Rapid development of the global virtual asset market

Recently, the global virtual asset market has shown a trend of rapid growth, especially the successive approval of Bitcoin spot ETFs, and more and more traditional financial institutions have entered the encryption field, which has driven the popularity of the entire industry. This requires Hong Kong to speed up the issuance of licenses to seize market opportunities and attract more investors and companies to do business in Hong Kong.

2. Regional competition pressure

In recent years, Singapore, Dubai and other places have made frequent moves in the regulatory framework of virtual assets and Web3, competing to attract global blockchain companies and investors. As one of the financial centers in Asia, Hong Kong needs to demonstrate its support for the innovative financial sector by accelerating the issuance of licenses in order to maintain its competitiveness.

3. The trend of capital layout in Web3 in mainland China

Judging from the backgrounds of the newly licensed institutions, many of their parent companies or major investors are from mainland China. This shows that mainland enterprises are deploying Web3 through Hong Kong. Hong Kong has followed this trend by issuing licenses quickly, strengthening its role as a bridgehead for mainland capital to extend outward.

Overall, the Hong Kong SFC’s accelerated licensing is not only driven by market demand, but also a proactive strategic choice aimed at laying a more solid foundation for the development of Hong Kong’s virtual asset industry, while strengthening its position as a global virtual asset center.

Impact of Hong Kong’s accelerated licensing on all parties

1. For the industry as a whole

The increase in licensed virtual asset trading platforms is undoubtedly good news for both the development of Hong Kong's Web3 industry and the world's virtual asset market. First, the addition of new licensed institutions will increase market competition, forcing platforms to reduce costs and increase efficiency and optimize service quality. Secondly, the inclusion of more platforms in the regulatory system will help improve industry transparency and market confidence. Finally, Hong Kong will consolidate its position as an international hub for virtual assets by introducing more licensed platforms.

2. For licensed institutions

The addition of new licenses may weaken the advantages of existing licensed institutions. On the one hand, the license is an official endorsement of virtual asset trading platforms. On the other hand, it is also a threshold and restriction for unlicensed institutions.

Under the premise that licensed platforms do not expand, virtual asset trading platforms that obtain licenses earlier can achieve a near-monopoly market position and gain absolute competitive advantage. However, as the number of licensed platforms increases, in the short term, the dominant position of early licensed platforms will be weakened. But in the long run, regardless of whether they are licensed institutions first or later, a fully competitive market environment will help major platforms reduce costs and increase efficiency, reduce transaction fees, and improve service quality, which will help Hong Kong's virtual asset trading platforms gain further international competitiveness.

3. For traders

For the majority of virtual asset traders, the increase in licensed exchanges is undoubtedly good news, which means that transaction fees may further decline, transaction efficiency will be further improved, and there will be more choices for trading platforms. By decentralized trading or diversified investment, the internal and external risks of centralized virtual asset platforms can be effectively hedged.

4. For Web3 practitioners

First, the Hong Kong government has demonstrated its determination to support the development of the Web3 industry through practical actions, which has enhanced the confidence of practitioners. Second, with the increase in licensed institutions and the improvement of the market ecology, more innovative projects and business models will have the opportunity to land in Hong Kong.

Overall, this licensing will have an impact on the market structure in the short term, but in the long run, it will enhance Hong Kong’s attractiveness and position in the global virtual asset market by strengthening competition and improving supervision, creating more opportunities and value for all parties.

Attorney Mankiw's Summary

The Hong Kong Securities and Futures Commission's rapid issuance of virtual asset trading platform licenses not only demonstrates its determination to build Asia's Web3 highland, but also injects new momentum into the market. The newly added licensed institutions will promote cost reduction and efficiency improvement in the industry through fierce market competition, promote service optimization, provide investors with more choices, and enhance the international influence of Hong Kong's virtual asset industry.

In this context, we also observe that Chinese mainland enterprises are gradually turning their attention to the Web3 field, using Hong Kong as a bridgehead for global layout. This not only reflects the recognition of mainland capital for Web3, but also demonstrates Hong Kong's strategic position as a major center for the development of virtual assets.

As a professional legal service provider in the Web3 field, Mankiw LLP will continue to be committed to providing comprehensive support to virtual asset trading platforms and Web3 entrepreneurs.

The Web3 wave has already swept in, and Hong Kong is welcoming a new round of industry opportunities. Mankiw LLP looks forward to working with more industry partners to jointly promote the prosperity and development of the Web3 ecosystem and help clients gain market opportunities on the basis of compliance.