Author: YBB Capital Researcher Ac-Core

TL;DR

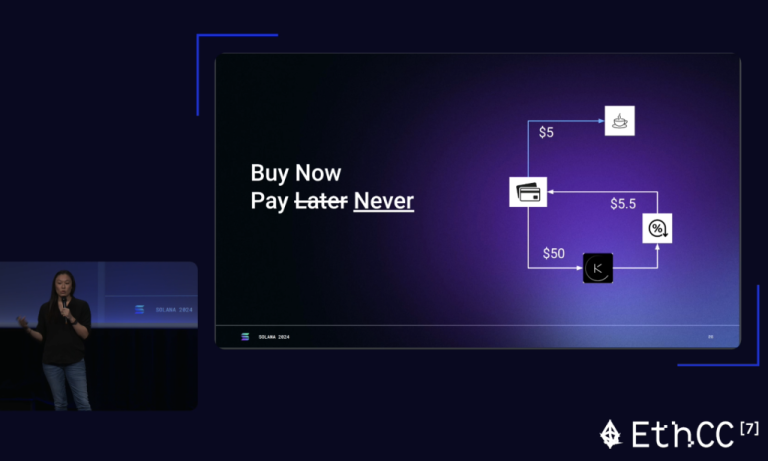

The concept of PayFi was proposed by Lily Liu, Chairman of the Solana Foundation, in her keynote speech at the 7th EthCC Conference, “The Emergence of PayFi: Realizing the Vision of Cryptocurrency”;

PayFi's core concepts: 1. Emphasis on "timely settlement", which is especially valuable in speculative transactions; 2. Supporting the new model of "Buy Now, Pay Never", providing creators with monetization, invoice financing and payment risk management. New Path;

The core advantage of PayFi in realizing its vision is to use Solana's high performance to break through the barriers between the real world and blockchain. At the same time, regulation and scalability are the biggest challenges to achieving widespread application.

Lily Liu gave a brilliant explanation of PayFi: "PayFi is about creating a new financial market around the time value of money. On-chain finance can realize new financial primitives and product experiences that traditional finance or even Web2 finance cannot achieve."

1. What is PayFi?

Image source: The 7th EthCC Conference

PayFi stands for Payment Finance. It is a new concept of innovative paradigm that integrates payment and finance proposed by Lily Liu, Chairman of the Solana Foundation, at the EthCC conference in July 2024. Its core is to emphasize "instant transactions" and thereby enhance speculation. The efficiency of transactions and various financial operations. According to the definition of the proposer Lily Liu, PayFi is a programmable financial structure that develops new financial innovations on top of the settlement layer and can autonomously process payment transactions. Here is a summary:

PayFi’s Vision

A system for building programmable money in an "open financial system that provides users with economic sovereignty and the ability to self-custody."

PayFi's application scenarios

New technologies have given rise to new markets. PayFi supports the “Buy Now, Pay Never” model and leverages on-chain finance and instant settlement capabilities to enable profits generated on the chain to cover immediate consumer demand in real time. For example, a user can invest $50 on-chain to earn interest, and the instant settlement and payment of interest can be used to buy a "free" cup of coffee.

In addition, PayFi can also support the monetization of creations based on the progress of goal completion (for example, a YouTuber gradually obtains advertising revenue while reaching 1 million views), provide bill financing, manage payment processing risks, and develop global Private credit pool. Lily Liu believes that PayFi will surpass DeFi in the future and lead a new financial trend.

Solana and PayFi

Lily Liu believes that Solana stands out among blockchains for its high performance, always showing the characteristics of fast transaction speed and low cost, and has advantages in the liquidity of capital and talent. Obviously, Solana is a strong candidate to realize the vision of PayFi. .

Three key factors for PayFi's success in blockchain

Lily Liu believes that the three key factors for the success of blockchain are: fast and low-cost transactions, a broad user base, and a strong developer community. She said that Solana is currently the only ecosystem that fully possesses these three elements.

The Future of PayFi and Solana

At the end of the speech, Lily Liu shared the scenarios of various financial applications on the Solana platform, such as supply chain finance, payday loans, credit cards, corporate credit, interbank repo market and insurance market. These applications show the integration of Solana and The combination with PayFi has great potential to change the traditional financial system in the future.

In the article "Understanding PayFi: Solana's Next New Narrative", Lily Liu stated that the core of PayFi lies in the time value of money, and explained it with three important cases:

Buy Now, Pay Later: Most people are familiar with "Buy Now, Pay Later", but "Buy Now, Pay Never" is almost the opposite. The former is to pay in installments and bear a certain interest cost. Optimize cash flow, while the latter invests funds in DeFi products, earns interest through lending, and then uses the interest to pay for consumption. Although this sacrifices cash flow, there is no need to use the principal.

For example, if a user buys a $5 cup of coffee, he can deposit $50 into the lending product. When the interest accumulates to $5, he can use the interest to pay for the coffee, and the funds will be returned to the user's account after they are unlocked. Automated execution of “programmed currency”.

Creator monetization: Many creators encounter cash flow problems during the content creation process. Creation requires time and money, and the returns are often delayed. This period may lead to a shortage of funds, which in turn affects the progress of creation. In Lily Liu’s conception PayFi can help creators realize their income faster. For example, if the expected income of a video is $10,000, but it takes a month to arrive, the creator can get $9,000 in cash immediately through PayFi and realize income in advance, although it will sacrifice some of the income, but can improve cash flow.

Accounts receivable: It is a common financial relationship between a company and its customers, which refers to the amount of money owed by customers to the company. Due to the existence of accounts receivable, companies sometimes face the problem of insufficient cash flow. In order to solve this problem, companies usually Pledge accounts receivable to financing companies or sell them at a discount to obtain immediate funds and maintain stable cash flow. PayFi aims to further simplify and optimize this process. By accelerating settlement through blockchain and improving capital turnover efficiency, Lowering the threshold will allow more companies to use this supply chain finance tool and accelerate capital flows.

2. How does PayFi connect to DeFi? RWA becomes a bridge to a new narrative

Image source: Coincu

The origin of blockchain technology can be traced back to the revolutionary white paper "Bitcoin: A Peer-to-Peer Electronic Cash System" published by Satoshi Nakamoto in 2008, which laid the foundation for a new era of decentralized payment and not only created The new form of currency has completely changed the payment system that is deeply rooted in traditional finance. PayFi uses digital assets and decentralized finance (DeFi) tools to manage the flow of funds through blockchain technology and smart contracts. Its core concept is to optimize funds. The main operating principles include:

Time Value of Money (TVM): PayFi emphasizes improving the time value of money and helping users improve the efficiency of using money. For example, users can deposit money into a lending platform and use the interest generated to pay for daily expenses. For example, if a user buys a cup of 5 When buying a cup of coffee worth $50, you can lock in $50 of funds, and when the interest is enough to pay for the coffee, the principal does not need to be used;

Smart Contract Automation: Smart contracts are at the core of PayFi, which can automatically execute complex financial operations based on predetermined conditions, thereby reducing intermediary involvement, speeding up transactions, and reducing costs;

Tokenization of Real World Assets (RWA): PayFi tokenizes real world assets such as real estate and accounts receivable to facilitate cross-border payments and capital flows. This not only improves the liquidity of physical assets, but also provides a platform for global transactions. Provides a new platform.

As the demand for sustainable value assets in the crypto ecosystem rises, perhaps RWA will naturally become a popular option. In the past two years, tokenized treasury bonds with a yield of 4-5% have become the first choice for on-chain capital, and the total value of preservation has increased rapidly. To $2 billion. With the emergence of inflation and central bank interest rate cut signals, Treasury yields will fall, and capital will seek other high-yield, low-risk assets. This provides an opportunity for PayFi to rise in the RWA field.

Typical PayFi scenarios may include

Cross-border payment financing: Arf has changed the traditional way of cross-border payment by providing on-chain liquidity solutions for financial institutions, supporting 24/7 instant, transparent and low-cost USDC-based settlement, eliminating the need for global pre-deposited fund accounts. Demand. Cross-border payment financing has extremely high capital efficiency and scalability;

Digital asset-backed enterprise cards: Rain provides Web3 teams with enterprise card settlement liquidity backed by USDC. Enterprises pledge funds to a vault, where a credit limit is set and cleared on-chain at the end of each settlement cycle. Asset, which automatically pays off balances on corporate cards, reinvents expense management;

Trade Finance: BSOS combines the enterprise resource planning (ERP) platform with on-chain liquidity to create real-world assets (RWA) in the supply chain, providing shorter-term financing options to meet the funding needs of enterprises.

Real World Assets (RWA) can include

Instant RWA Settlement: Even for highly liquid assets such as treasury bills or tokenized funds, settlement time is usually 2-4 days, as the underlying assets need to be liquidated before redemption. Subscription and redemption of these assets can be achieved in real time 24/7, ensuring fast and transparent transactions.

DePIN Financing: As the DePIN ecosystem expands rapidly, many projects are based on the idea of sharing the cost of large-scale infrastructure construction and redistributing future value. For example, TLay provides key trust infrastructure to accelerate the adoption of DePIN; Peaq is customized for DePIN. L1, and provides functionality that enables machines to efficiently transact with each other or interact with humans, supporting the development of the machine economy.

At the same time, the birth of stablecoins has become a bridge between fiat currency and blockchain, promoting the emergence of the first wave of real payment scenarios. Since 2014, stablecoins have achieved exponential growth, proving that the payment field has a strong interest in blockchain. The need for blockchain innovation is growing. Today, stablecoins already support about $20 billion in organic payments per year, close to Visa’s annual payment processing volume. Although the crypto ecosystem is constantly overcoming poor user experience, severe latency, high transaction costs, and compliance issues, Although the unlimited potential of stablecoins can be unlocked by overcoming challenges such as stability, there is still room for further development. If we look back at the history of payment systems, financing mechanisms have played an important role in promoting their development. For example:

Credit cards: Contribute $16 trillion in merchant payments annually, demonstrating how financing can drive widespread adoption and utility;

Trade finance: supports $10 trillion in B2B payments each year, underscoring the critical role finance plays in global commerce;

Cross-border payments: Supporting global remittances and settlements by prepaying $4 trillion in funding. Today, 1 in 6 households worldwide rely on remittances.

Without payment financing, global liquidity will be greatly limited. Similarly, without a financing mechanism, the utility and popularity of Internet native currencies will be hindered. PayFi was born to address these limitations. Lily Liu, President of the Solana Foundation, proposed the “ The concept of "PayFi" clearly explains its vision: "PayFi is a new financial market created around the time value of money. On-chain finance can realize new financial primitives and experiences that traditional finance and even Web2 finance cannot provide."

3. Thoughts on PayFi

Image source: Solana official website

In terms of the ability to create momentum in the crypto market, Solana has always been at the forefront, and various narratives continue to stimulate the activity of the speculative market. The biggest advantage of the new narrative PayFi is that it returns to the innovation of blockchain's natural subversion of traditional finance, borrowing the decentralization The security and safety attributes reduce the risk of fraud and improve the integrity of transactions, eliminate the middlemen in traditional financial payment processing, compile the complete transaction process on the chain, and overall lower the threshold for users to participate in finance. From a narrative perspective, PayFi has become a bridge connecting RWA and DeFi to the real world.

Although PayFi has the potential to be a large-scale blockchain application in the future, it still faces some challenges that may limit its widespread adoption. The first is the issue of regulation. Currently, financial institutions around the world have not yet fully understood or formulated regulations on blockchain operations. Legal framework: The first barrier to connecting to the real world is legality. Another obstacle is scalability. Blockchain networks may be congested during peak hours, affecting the speed and cost of transactions. Blockchains are difficult to coordinate in terms of speed. Market acceptance may be lacking. Currently, enterprises and users are still relatively unacceptable to new technologies. When it comes to blockchain, people are still afraid of it. If blockchain is to completely open up the channel to the real world, We will continue to optimize our ability to reach more areas, and the effect of breaking through circles still needs to be continuously optimized.

Reference articles:

1: PayFi: The Frontier of Blockchain Payment Finance