Author: Ignas , DeFi Research

Compiled by: Tim, PANews

The issuance of new tokens has slowed down, but I believe it will accelerate soon because:

- The market is slowly recovering

- Many projects can no longer delay their releases.

These projects will serve as a testbed to pave the way for other projects.

In this post I want to highlight a few protocols that appear frequently in my Twitter feed. However, it seems that not everyone is familiar with what they do.

So, if you are one of those people on Twitter who posts spam and waits for token airdrops, but has no idea what they do, then this post is for you.

Initia: The "Garden of Eden" of Multi-Chain Ecosystem

Initia completed its first sale in Echonomist Group on Cobie’s Echo fundraising platform.

Cobie's Echo fundraising platform has only completed three project financings so far, so Initia is worth bullish. In addition, the mainnet launch + airdrop plan may be launched at any time (but it seems to have been postponed to April).

If I had to choose one word to sum up Initia, it would definitely be "intertwined" .

Initia is an L1 network that builds a modular application chain ecosystem by integrating different L2s.

This sounds like Ethereum, but Initia hopes to solve the problems that ETH maximalists are dissatisfied with Ethereum.

Unlike Ethereum L2, which operates in isolation, Initia deeply integrates L1 and L2 networks to build an intertwined ecosystem. These second-layer networks are called "Minitias". This design idea is similar to the subnet of the Avalanche protocol (recently renamed L1).

Unlike Ethereum, but similar to Avalanche, the OPinit stack supports three major virtual machine architectures: EVM, MoveVM, and WasmVM. This means that developers can choose the programming language they are most familiar with for development.

This may make ETH bulls salivate. Initia's on-chain liquidity mechanism allows staking INIT tokens alone, or using approved INIT-X liquidity pool tokens (trading pairs with INIT tokens) to obtain yield rewards through the Delegated Proof of Stake (DPoS) mechanism.

Built-in liquidity is good Ponzi economics, which forces 50% or more of INIT to be used as a trading pair. These LP tokens must be authorized through a whitelist.

Similar to Berachain, Initia also has a native decentralized exchange: InitiaDEX built on Layer 1 based on the Move programming language. It is the liquidity hub of the Omnitia ecosystem, and from what I understand, even between different L2s, most of the liquidity will flow through InitiaDEX (and the mandatory configured INIA liquidity pool).

Initia has many more features, such as a native cross-chain bridge (called Minitswap) and a Vested Interest Program (Rollups can earn rewards by creating DAPPs and expanding new use cases for INIT tokens), but for me, the four core features mentioned above are still the most prominent highlights of the project.

Initia integrates the demands of Ethereum native users for Ethereum into one product, creating an intertwined ecosystem.

Tokens and Fundraising

The token economics details have not yet been fully revealed. Initia only shared four relevant details:

- 50% of the supply is allocated to VIP and reserved liquidity pools

- Staking rewards not unlocked for Insiders

- Enjoy a discount of about 30% on the community round.

-15% for investors

We can expect the Initia project to adopt an airdrop method with vesting, because its co-founder Zon once wrote that "vesting is a gift. It prevents you from selling too early and forces you to keep your faith."

In September 2024, Zon also revealed to The Block that Initia completed a $14 million Series A financing with $350 million FDV, and investors included Theory Ventures, Delphi Ventures, Hack VC and other institutions.

The testnet has an incentive mechanism, so feel free to interact with the official testnet website, claim test tokens and participate in the ecosystem. All details can be found on its testnet page.

As usual, I don’t have high expectations for testnet activity.

Overall, the Initia ecosystem is well-established, but a key question remains: Will builders and users choose to participate deeply in it?

Fogo: The fastest Layer 1 blockchain

Fogo, another project that launched a token sale on Cobie’s Echo platform, raised $8 million at a $100 million valuation.

Fogo uses a highly optimized version of the Solana validator client Firedancer, developed by Jump Crypto, as the only execution client on its network.

Firedancer isn’t even live on the Solana network yet. Solana will soon benefit from the Firedancer client, but not all validators will switch to it right away. This means the Solana network will be limited in speed by the slowest node.

Fogo co-founder Doug Colkitt once said: "It's like owning a Ferrari but only being able to drive it in New York City's gridlocked traffic."

They revealed that Fogo's theoretical speed can reach up to 1 million transactions per second under ideal conditions (block time 20 milliseconds), but Fogo's developer network that has been launched has actually only reached about 54,000 TPS. In comparison, Solana's current theoretical upper limit is 65,000 TPS, but the actual processing speed at this stage is 4,300 TPS.

The MegaETH testnet achieved a high throughput of 20,000 TPS with a block time of 10 milliseconds.

In contrast, traditional financial systems can process about 100,000 operations per second with sub-second latency.

The Fogo team believes that decentralized networks must reach the level of traditional institutions in order to meet the use case requirements of high-frequency trading and instant payments.

It runs the Solana Virtual Machine (SVM), which means developers can easily migrate Solana applications, tools, and infrastructure to the Fogo chain without any modifications. A wave of forks is expected, and "shiny" new tokens (such as Jupiter, Kamino, Pumpfun, etc.) will appear on the Fogo chain.

Apparently, not all players in the Solana ecosystem are happy about this.

Notably, Fogo’s contributors include members from Douro Labs, the team behind the oracle network Pyth, which itself is closely associated with Jump Crypto.

Other notable features of Fogo:

- Multi-local consensus (“solar revolution”): Fogo divides validators into geographic “regions” that can operate semi-independently. Control of the network rotates to the next “region” regularly, preventing a single validator from gaining a dominant advantage. This means that consensus can be reached faster during normal operation because information does not always need to travel around the entire “Earth”.

- When the network launches, it will initially be staffed with a group of validators (20-50 people).

- GAS fee abstraction: support the use of any token to pay network fees.

Tokens and financing

Fogo has raised about $5.5 million in a seed round led by Distributed Global and joined by CMS Holdings. The company previously raised $8 million in funding from Echo Platform.

The developer network is live in late 2024, the testnet is coming soon, and the mainnet is expected to launch in mid-2025. There is not much information about the token or airdrop yet.

Succinct: Building Real World Software

“Cryptocurrency is failing in its mission.”

“We were promised a transparent, verifiable, trustless global coordination system. Instead, we got hacked cross-chain bridges, multi-signature L2 networks without fraud proofs, and committees of 21 validators controlling billions of dollars.”

(Note: This refers to EOS developed by Blockone)

This is the main problem that Succinct is solving.

“ZK zero-knowledge proof is one of the most critical technologies for blockchain to achieve scalability, interoperability and privacy protection, but its complexity currently makes it difficult for most developers to master it.”

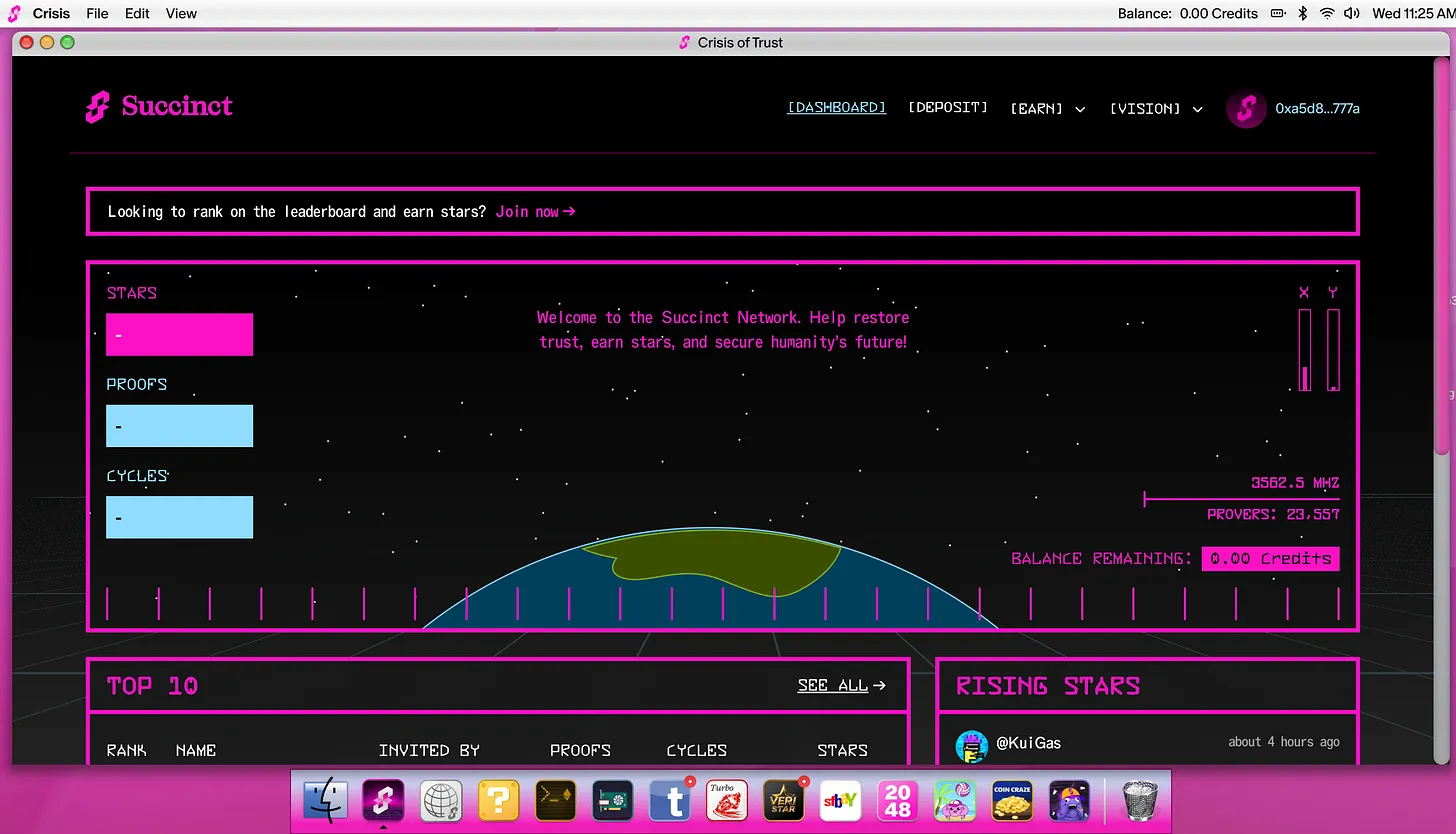

It’s hard to get excited about progress in zero-knowledge proofs right now, but Succinct managed to get my attention with a brilliant marketing campaign: they made their testnet and official website dashboard into a MacOS-style interface.

You can play games and earn points.

In summary, the problems we are facing now are:

- Each project needs to build its own proof system (for example, zkSync and Scroll achieve scalability through zero-knowledge proof technology, but the infrastructure is fragmented).

- Many rely on centralized service providers to generate proofs.

- This approach is costly and hinders innovation.

Therefore, Succinct ZKPs is a technology that can verify authenticity through cryptography without leaking data. However, due to the fragmentation of infrastructure and high implementation costs, it faces huge challenges in practical application.

Succinct provides a shared market for proof generation, so that each project no longer needs to "reinvent the wheel". Developers can focus on building applications (such as Rollup, cross-chain bridges, and oracles) and outsource the work of generating proofs to network nodes.

Notable partners: Polygon, Celestia, Avail, Gnosis

But the application scenarios are actually more diverse, such as private voting systems or anonymous transaction scenarios. Or users can also prove that they have enough funds in their wallets without actually showing the amount.

It’s a technical project, but it could be the key link that connects and protects the most vulnerable crypto projects.

Their testnet, Phase 1: Trust Crisis, was launched two months ago. Users can get star rewards by generating zero-knowledge proofs, but they need to pay 10USDC to cover the cost of proof generation. It is worth noting that invitation codes can only be obtained by actively participating in community interactions such as Twitter and Discord.

I imagine there will be certain criteria for the airdrop, but the details of the tokens are not yet public.

Tokens and financing

Succinct completed a US$55 million financing round, led by Paradigm, with participation from Robot Ventures, Bankless Ventures, Geometry and other institutions.

When the mainnet is officially launched, the TGE is expected to be conducted soon.

Resolv: A truly effective Delta-neutral stablecoin

Many people now believe that the next round of altcoin surge will be driven by the accelerated entry of institutional funds, especially stablecoins.

The current challenge is that the main beneficiaries of stablecoin adoption appear to be institutions and stablecoin issuers, while retail investors may only get leftovers.

The third round of retail investor squeeze?

I’ve written a few thoughts on protocols that could benefit from stablecoin adoption , but I want to add one more here: Resolv.

If you understand how Ethena works, then you already have the basics to learn Resolv.

The core concept of Ethena and Resolv is exactly the same, that is, to create stablecoins through a combination of crypto asset collateral and perpetual contract short hedging. But the uniqueness of Resolv lies in its architectural design and implementation path:

1. Dual Token Model vs. Single Token Model

Ethena adopts a single-token model (USDe), and all risks and benefits are borne by stablecoin holders and managed in the background by the protocol reserve.

Resolv adopts a dual-token model (USR + RLP) to achieve risk separation by clearly isolating risks into independent tokens.

USR is similar to USDe, maintaining its pegged exchange rate through a delta-neutral strategy and hedging ETH price risk by shorting futures. Users can earn income by staking USR and convert it to stUSR, which is similar to the function of a savings account.

RLP acts as an insurance mechanism for USR, maintaining the stability of USR by absorbing losses (for example, when the funding rate is negative). RLP holders take higher risks to obtain better returns. Its value fluctuates with the performance of the protocol, and is essentially a dynamic buffer mechanism: when the protocol is profitable, its value increases, and when it is losing money, its value shrinks.

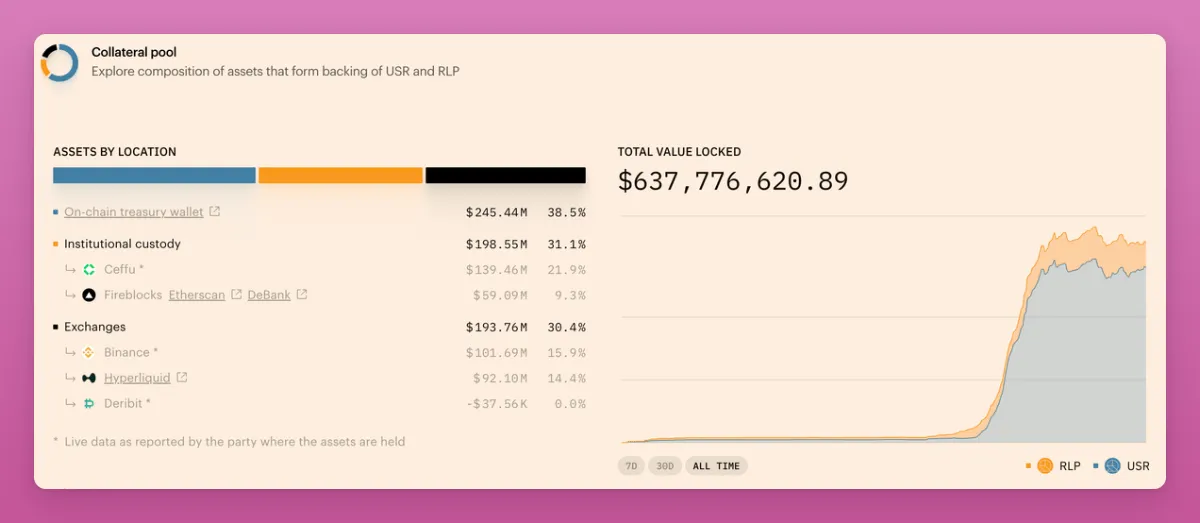

This mechanism enables risk-averse users to earn higher returns while protecting stablecoin users from market risks. As of this writing, USR (stable yield reserve) offers an annualized interest rate of 4.3%, while RLP (risk liquidity pool) offers an annualized rate of return of 6.7%.

Although not too high, Resolv’s strategy of obtaining airdrops through point mining has brought its total locked value (TVL) to US$637 million, which is a pretty good result.

2. Differences in the sources of mortgage assets

The core concept of Resolv is that it is fully backed by cryptocurrency. All collateral is ETH (BTC support was recently announced), and no real-world assets (RWA) are involved.

Initially, Ethena also only supported cryptocurrencies, but later launched a secondary stablecoin, USDtb, which is 90% backed by BlackRock’s tokenized money market fund BUIDL.

USDtb is in a sense an insurance token, similar to the USR token in the Resolv project, which aims to maintain the stability of USDe during bear markets by providing traditional asset returns when cryptocurrency yields decline.

Therefore, it can be said that Resolv is essentially more "crypto-native" and adheres to the concept of decentralization, while Ethena may be able to obtain additional stability guarantees by introducing a centralized asset strategy.

Tokens and financing

Resolv has not officially announced the details of its financing, but its investors include Delphi Labs, Daedalus and No Limit Holdings. In addition, the project is planning to raise funds through the Legion platform, and the community round is about to start.

Resolv will officially launch a points reward program starting in September 2024. Users can still participate and earn points by depositing stablecoins.

After depositing, you can maximize your points through Pendle pools or other strategies.

$RESOLV tokens are expected to be launched in early 2025.

Snapchain: Perhaps the largest consumer-grade Layer 1 public chain

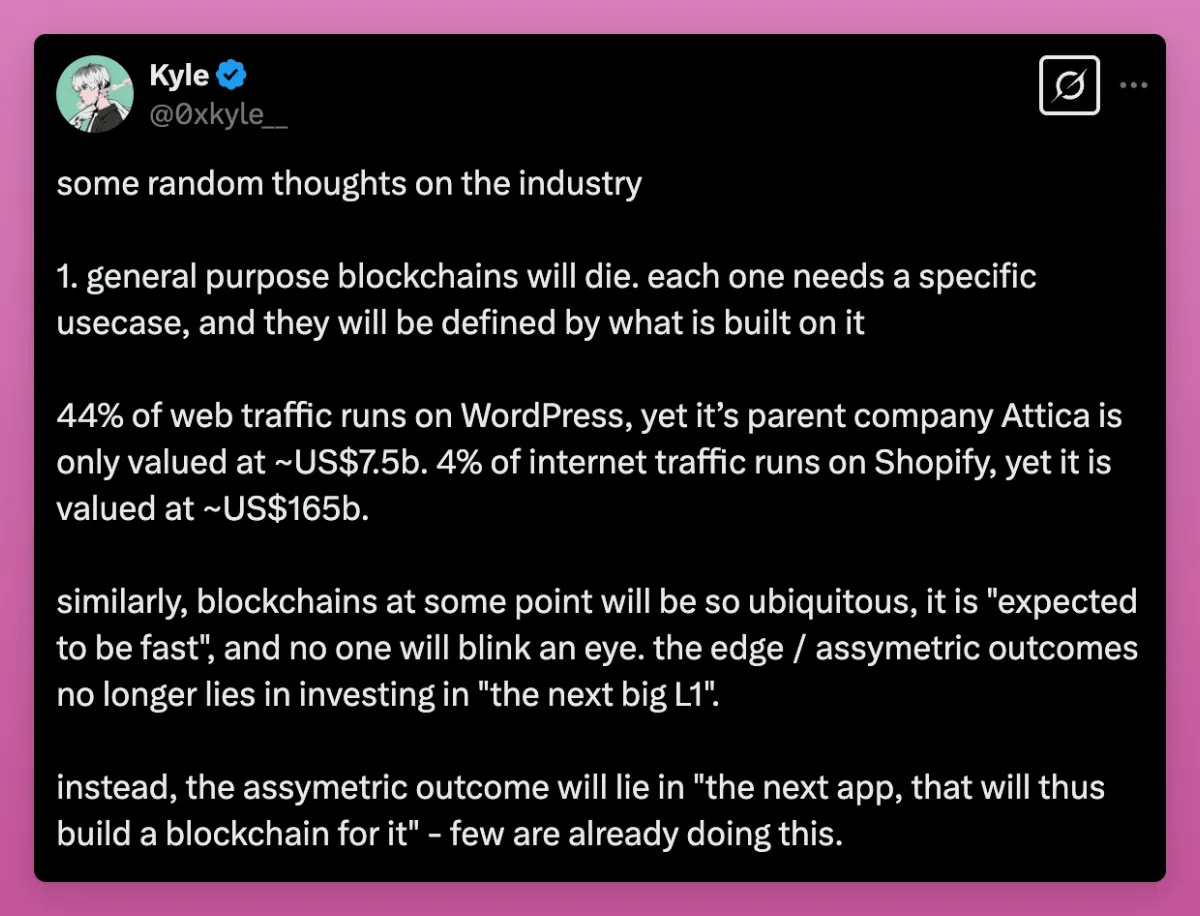

My biggest concern about emerging blockchains such as Fogo and Initia is whether they can really gain market adoption? What killer applications will be born on these chains? As Kyle said: "General-purpose blockchains will die. Each chain must have clear application scenarios, and these scenarios will be defined by what is built on the chain."

This is where Snapchain, a Layer 1 blockchain built specifically for the Farcaster social network, comes in.

Snapchain was born out of the pain points that decentralized social networks generally face when scaling, such as data synchronization difficulties and real-time update delays. Although the Lens protocol chooses to use zkSync technology, the Farcaster team is independently developing solutions that adapt to its ecosystem.

"Take Twitter as an example. The platform has 200 million daily active users, processes 10,000 transactions per second (TPS), and its daily growth in state data may be between 1TB and 10TB."

Farcaster's current system works well at a small scale, but breaks down when the number of users and nodes increases. Snapchain will solve this problem in a decentralized way.

When the mainnet is launched, it should be able to reach 9,000+TPS and support 2 million daily active users (the current number of daily active users is about 50,000).

I won’t get too bogged down in technical details, but here are two exciting highlights:

The first one refers to deleting data (i.e. data pruning), which is hilarious.

On the blockchain, most data needs to be stored permanently, but what if you just posted an emoticon and immediately regretted it? It must disappear! Forever!

Therefore, on Snapchain, old data (such as posts, likes, follows) can be deleted once it is no longer needed.

Crucially, users pay $2 or $3 per year for a processing speed of 500 transactions per hour and a storage limit of about 10,000 transactions.

Therefore, if you delete old transactions, you can make storage space for new transactions (or choose to pay more fees to keep old transactions).

The second cool thing is sharding technology. You know, before Ethereum turned to Layer 2 expansion solutions, it considered expanding through sharding technology.

Imagine all social media interactions (likes, posts, etc.) were recorded on the blockchain. Millions of pieces of data per day. If every node had to store and process everything, it would cause latency. Every full node would need to process every transaction, even if they were not involved. This model works for money transfers and smart contracts, but it is clearly not scalable enough for real-time social applications that require high scalability.

Snapchain solves this problem by making each user completely independent (when you sign up on Farcaster, you get an ID number, and if the number is small and front, it becomes a bragging right). Your posts will not affect my account.

Snapchain distributes users across multiple shards (BTW, this design was inspired by Near's model). Each shard only processes transactions for its own users. This means that as the number of users grows, the number of shards also increases, and the system throughput also increases.

To ensure that all shards remain in sync, there is also a final layer: a main chain that packages each shard and publishes a global block.

Ethereum cannot do this easily. Its transactions rely on shared state — smart contracts, tokens, and balances. This makes account-level sharding difficult to achieve.

Snapchain works because social actions are simple: They only affect the sender.

There is more about Snapchain, which can be found here . But I am optimistic about Farcaster and Snapchain because they are taking the strategy of "application first, then chain", that is, building actual application scenarios first and then adding blockchain to them.

Hyperliquid used this strategy to great effect, and even though Farcaster only has 50,000 daily active users and 900,000 total users, it is still one of the top consumer apps.

Launch Date and Tokens

In short: the genesis block has been successfully activated, and the mainnet is scheduled to be launched on April 15, 2025. It’s almost here!

I believe that once Snapchain is officially launched and Farcaster is ready to scale, this social ecosystem will be integrated into the Coinbase wallet.

Coinbase has integrated its social media feed into its wallet, and that’s a big deal.

However, I’m not sure exactly when the token will be launched, and the team has remained tight-lipped about it, but some recent rumors and funding news may indicate that it’s coming soon.

Financing

Snapchain itself is a technology component, not a separate entity raising funds. The development of Snapchain is funded by Merkle Manufactory, which is building the Farcaster protocol.

Most notably, in May 2024, Merkle Manufactory announced the completion of a $150 million financing round led by Paradigm and joined by other major investors including a16z crypto, Haun Ventures, USV, Variant, and Standard Crypto.