Author: Frank, PANews

2024 is destined to be a year of great significance in the development of cryptocurrency. From the official approval of Bitcoin and Ethereum ETFs to the US President-elect Trump's plan to use Bitcoin as a national strategic reserve, cryptocurrency has gradually become an emerging asset type recognized internationally. Bitcoin has broken through the $100,000 mark, MEME coins on Solana have emerged in an endless stream, and various original star projects have lost their luster, and the cryptocurrency market is in a state of ice and fire. Behind these changes, the public chain has always been the core battlefield of the crypto market, and all these competitions are also reflected in the competition of the public chain.

So from the perspective of data, which public chains have truly risen in 2024? Which public chains may not be underestimated, but actually decline? PANews conducted a review and summary on this.

Data description: This inventory targets Layer 1 and Layer 2, which are relatively popular, and focuses on TVL, token price, market value, number of active addresses, number of transactions, etc. throughout the year, from January 1, 2024 to December 29, 2024. Some public chains launched on the mainnet in mid-2024 use the initial data and year-end data when these public chain tokens are launched. TVL data uses Deflama, daily activity and daily transaction volume data come from Tokenterminal and the official browser, and price data comes from Coingecko.

The public chains reviewed this time include:

Layer1: Solana, Ethereum, BNB Chain, Sui, Aptos, TON, Avalanche, Cardano, Hyperliquid, Fantom (Sonic), Tron, Near

Layer 2: Base, Arbitrum, Optimism, zkSync, Polygon, Blast, Scroll, StarkNet, Taiko, Linea.

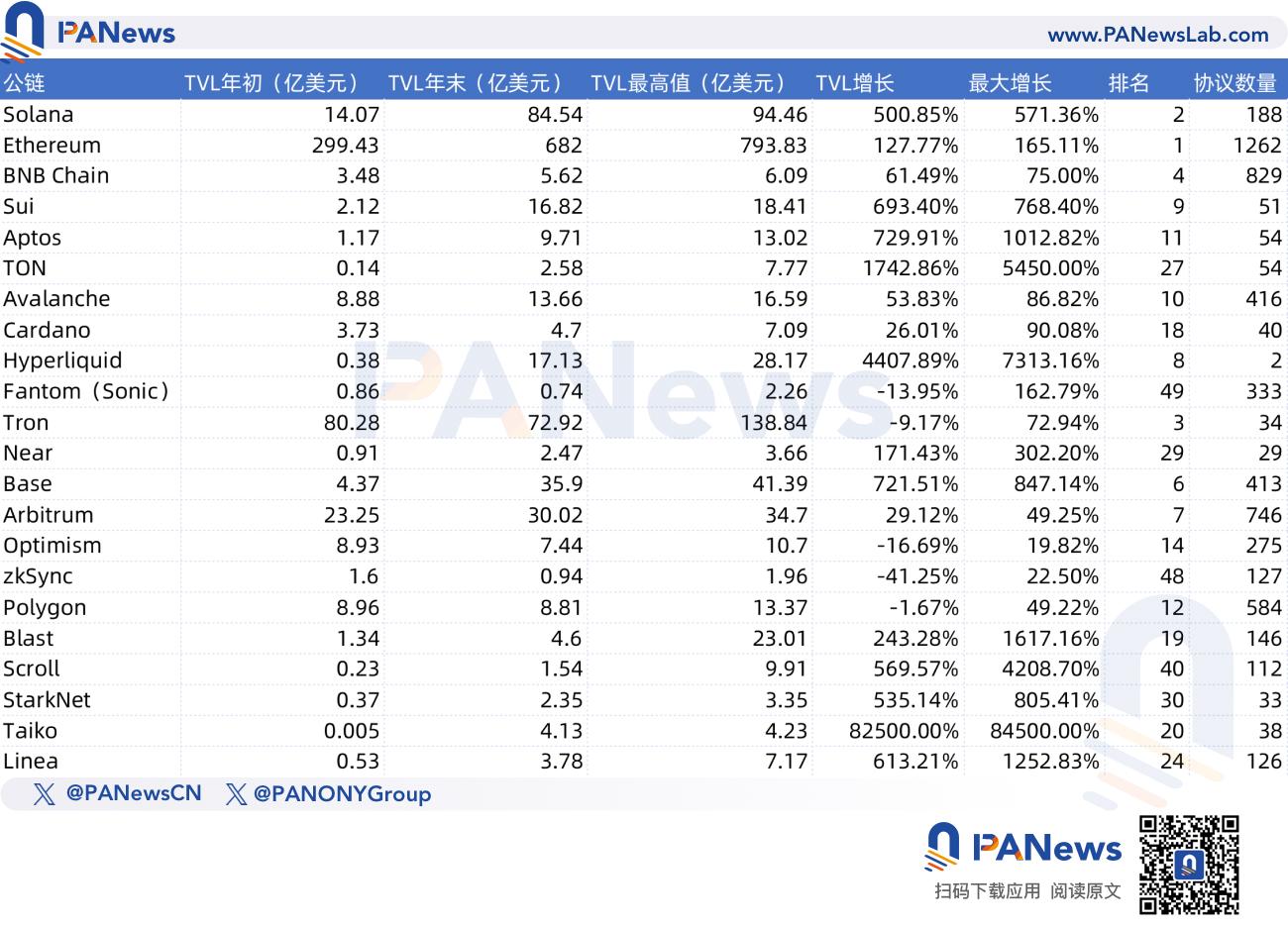

Layer1 TVL increased by an average of 7 times, with Hyperliquid and TON seeing the highest growth

In terms of TVL data, overall, the overall TVL data of the public chains analyzed has increased by 117.7% this year. Among them, the TVL of Layer 1 in 2024 increased by an average of 707.69%, and the TVL of Layer 2 projects increased by an average of 8515.22%. However, this is mainly because the TVL of L2 public chain Taiko was low when it was first launched, resulting in an increase of 825 times. Excluding Taiko, the average growth of other Layer 2 this year is 294.69%.

Among Layer 1, the ones with the highest TVL growth are Hyperliquid, TON, and Aptos, all of which have increased by more than 10 times. Among them, Hyperliquid's TVL has increased by 4407% since its launch. Among Layer 2, Taiko and Base are both the kings of growth this year. Taiko's TVL has increased by 82,500% from its launch to the end of the year, while Base's TVL has increased by about 721.51% throughout the year.

In addition to the growth, some public chains’ data not only failed to grow significantly after one year, but also experienced a certain decline. Among them, zkSync’s decline was the most serious, with TVL falling by 41.25% during the year, followed by Optimism (-16.69%), Fantom (-13.95%), Tron (-9.17%), and Polygon (-1.67%).

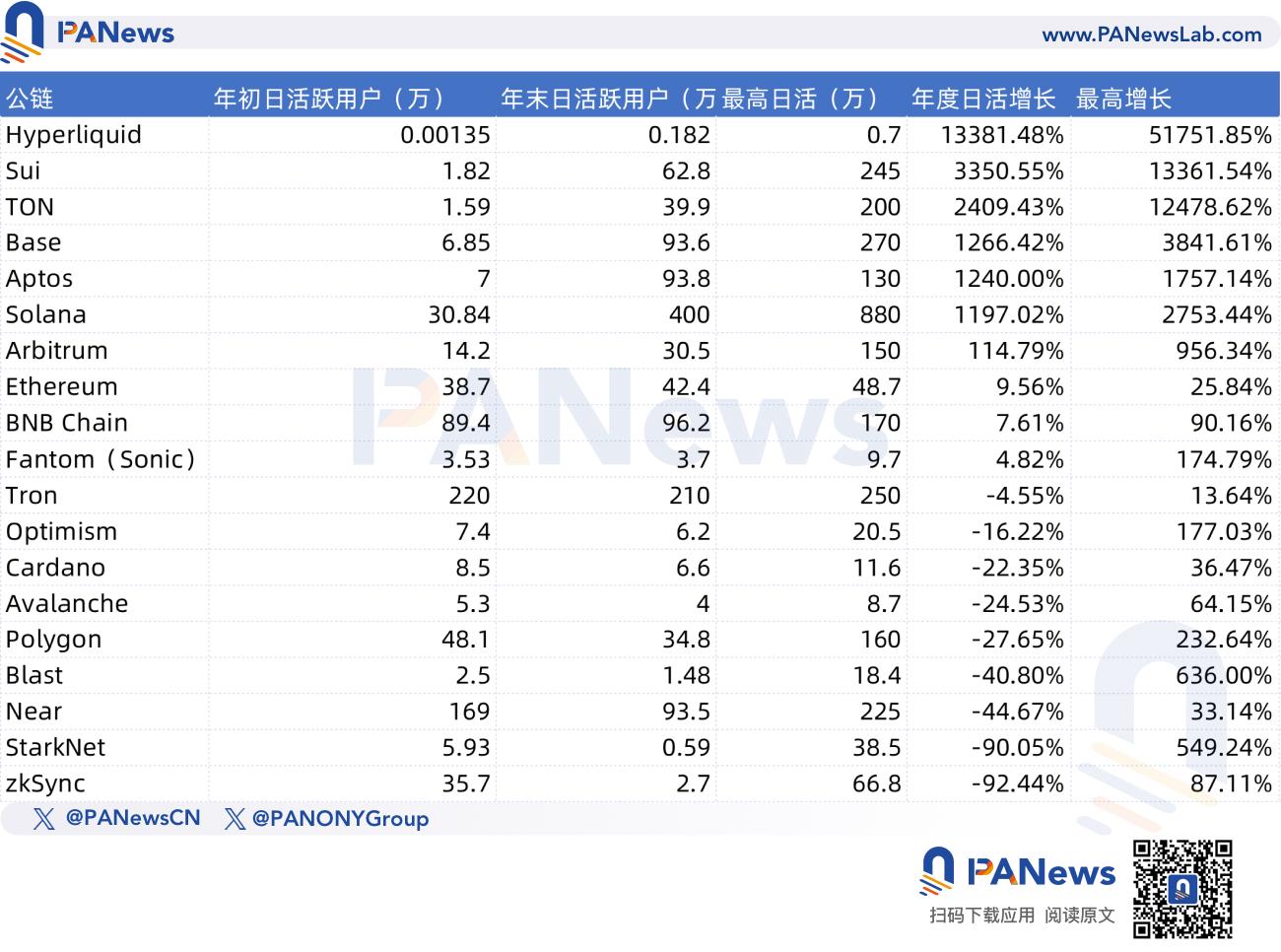

The daily activity of half of the public chains has declined, with Solana having the highest daily activity

In terms of network activity, the number of daily active addresses of Hyperliquid, Sui, and TON increased the most in 2024, with increases of 13381.48%, 3350.55%, and 2409.43%, respectively. In addition to these three public chains, the daily active data of several public chains such as Base, Aptos, and Solana also increased by more than 10 times during the year.

Surprisingly, among the 22 public chains analyzed, the daily active users of 9 public chains have declined to varying degrees this year. Among them, the daily active users of zkSync and StarkNet chains declined the most in 2024, exceeding 90%. In addition, the daily active users of Near, Blast, Polygon, Avalanche, Cardano, Optimism, and Tron have all declined to varying degrees compared to the beginning of the year.

At the beginning of the year, Tron had 2.2 million daily active addresses, ranking first among all public chains. After a year of changes, Solana has become the public chain with the highest number of daily active addresses with 4 million daily active users. In addition, among the highest daily active data, Solana has also become the public chain with the largest number of users with 8.8 million daily active users.

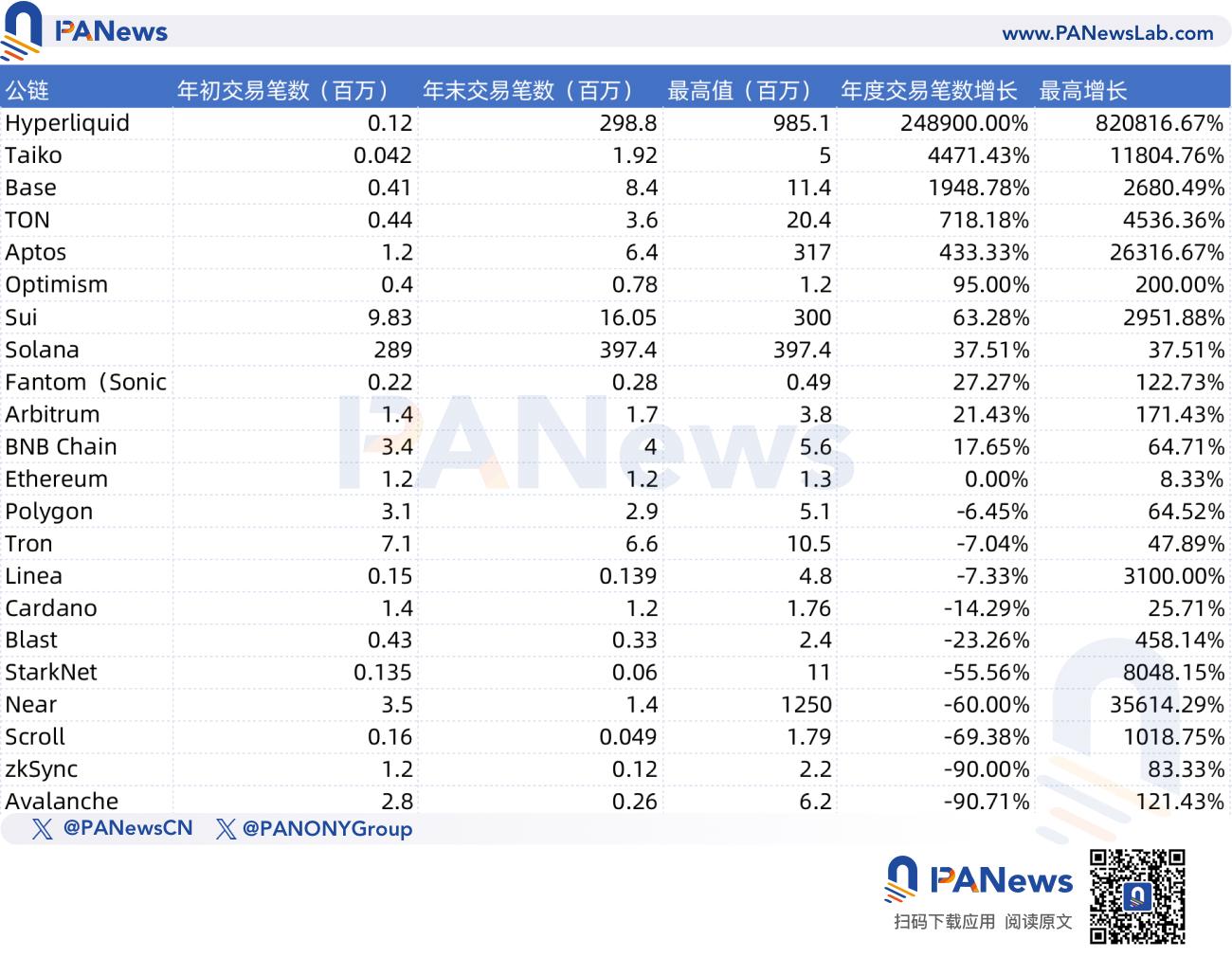

In terms of daily transaction volume, Hyperliquid once again became the public chain with the largest growth, with the number of transactions increasing by about 248,900% during the year, Taiko increased by 4,471.43%, and Base's transaction volume increased by 1,948.78%, all of which increased by more than 10 times. The number of transactions on the Avalanche (C-Chain) network declined the most, from 2.8 million at the beginning of the year to 260,000, a decrease of 90.71%. However, the main reason for this decline is that January 1, 2024 was the peak period of abnormal fluctuations in the number of Avalanche transactions. Excluding this abnormal fluctuation, the average daily number of transactions on Avalanche has basically remained at hundreds of thousands per day, without much fluctuation.

In addition, the decline of zkSync also reached 90%. In comparison, the decline of zkSync is indeed more obvious. Since the end of the airdrop, the number of on-chain transactions has dropped rapidly, from the original millions to more than 100,000 transactions per day.

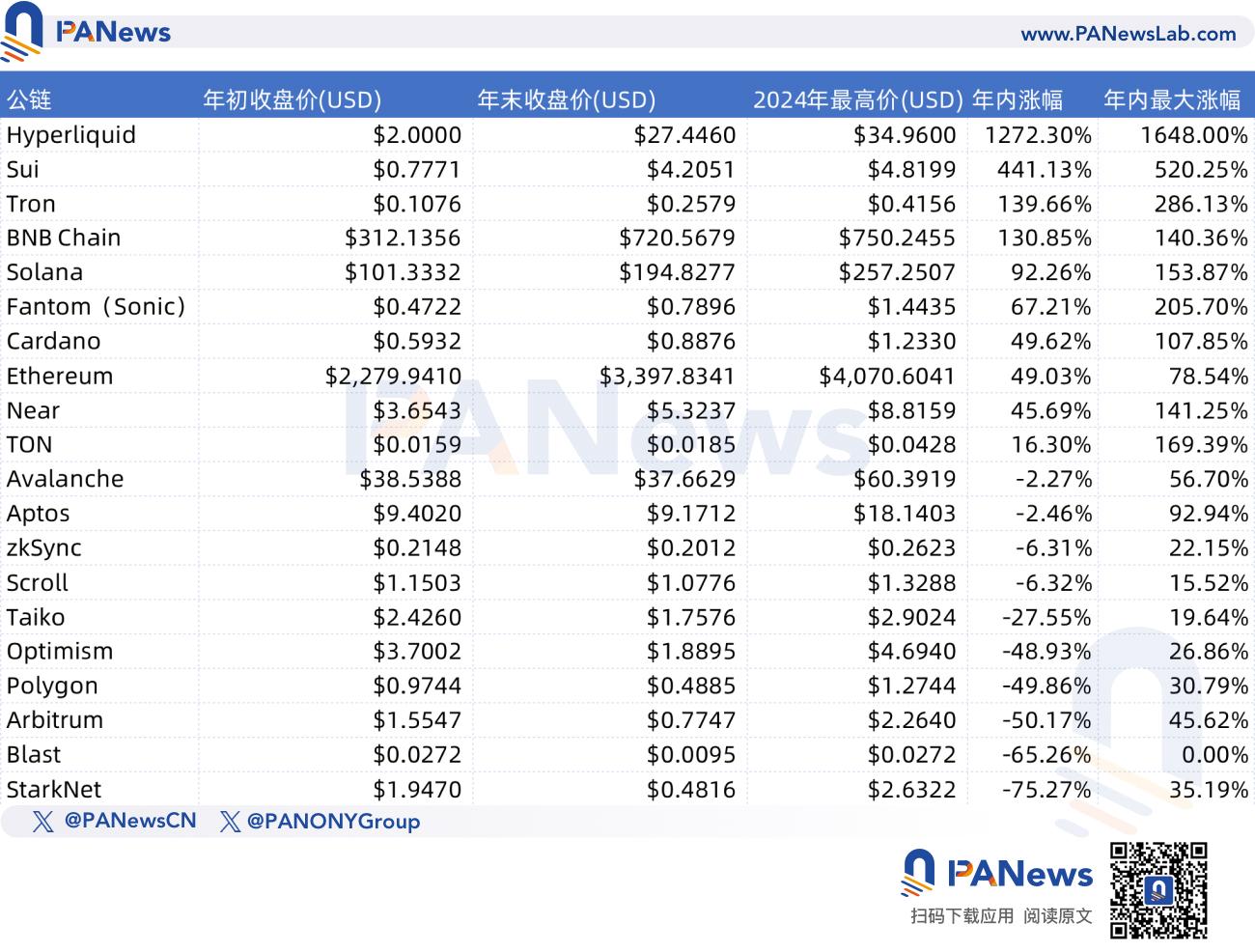

The price performance of the currency was mixed, with HYPE taking the lead

Some are happy while others are sad. In terms of token performance, half of the tokens rose and half fell throughout the year. Hyperliquid token performed the best, with a year-to-date increase of about 1272.30% and a maximum increase of 1648.00%. It became the only public chain token with an increase of more than 10 times. However, it should be taken into account that Hyperliquid's token HYPE was just issued at the end of November. Compared with other public chains, it does have a certain advantage in terms of increase based on the opening price. However, there were also some other public chain tokens issued during the year, and many of them did not increase much, and even fell.

In addition, other public chains with good token performance include Sui, TON, Tron, and BNB Chain, and their token prices have all increased by more than 100%. Solana has been very popular in the market this year, but in fact, compared with January 1, 2024, the price of its token SOL has only increased by 92.26%.

Compared with the beginning of the year, the token prices of 10 public chains have fallen to varying degrees. Excluding the two unissued tokens, Base and Linea, the ratio is exactly 50%. Among these falling tokens, StarkNet and Blast have the largest declines, reaching 75% and 65% respectively.

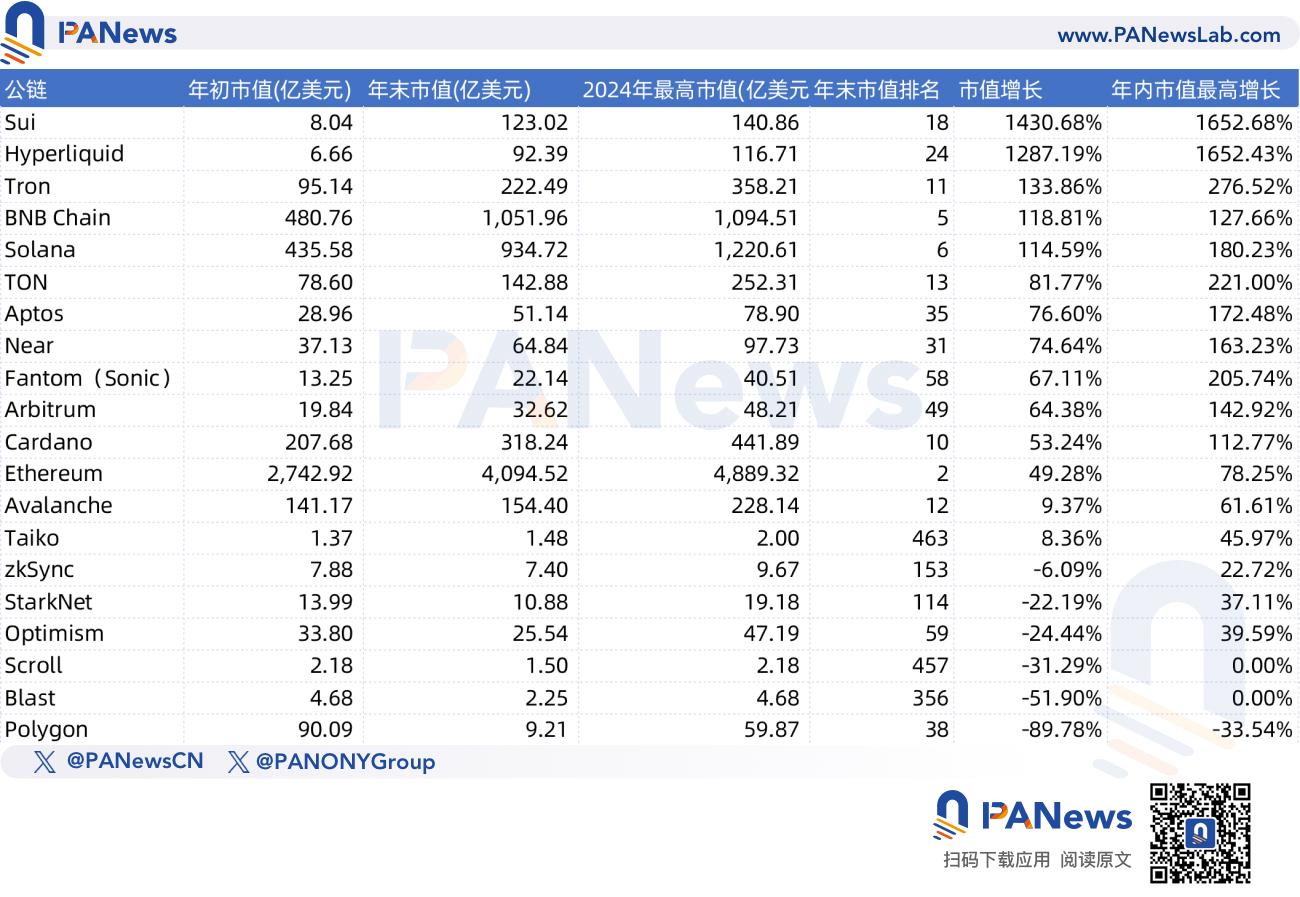

In terms of market capitalization, Ethereum still occupies the position of the big brother of the public chain. Its market capitalization was approximately US$274.2 billion at the beginning of the year and reached US$409.4 billion at the end of the year. The market capitalization increased by approximately 49.28% during the year. BNB's market capitalization has always ranked second, with an increase slightly higher than SOL.

Ethereum is the most dull, Solana is on full fire

In addition to the horizontal comparison, the development of the following public chains may need to be explained separately. In one sentence, it can be described as half fireworks and half quiet joy.

Solana is a public chain that must be mentioned in 2024. In this year, Solana's data changes are eye-catching, and it has completely walked out of the shadow of FTX's collapse. Not only has it made a major breakthrough in terms of volume, but it even has the momentum to compete with Ethereum. In the past year, Solana has led the trend of MEME and has become the public chain with the most users relying on the popularity of MEME.

At the beginning of the year, Solana's TVL ranked fourth, and rose to second at the end of the year. At the beginning of the year, the number of daily active users ranked only eighth, but at the end of the year, it became the public chain with the highest daily active users.

As the big brother of the public chain, Ethereum seems to be calm in this lively year of 2024. Many data at the end of the year are almost the same as at the beginning of the year. The daily activity has increased by 9% in the past few years, and the number of daily transactions has remained almost the same in the past few years. Only the TVL volume has increased by 127%. If we ignore the 49% increase in the price of ETH itself, it seems that this data has not changed much. The stagnation of the TVL currency standard itself is also the reason why the currency price performance is not outstanding.

The main reason for this change may be the diversion from Layer2. For Ethereum, whether it can maintain this stable state in the new year or have more ups and downs, perhaps more innovative content will be needed to lead.

Sui and Hyperliquid, a competition between rising stars and supernovas?

Hyperliquid is undoubtedly the supernova of the public chain track this year, giving the market many surprises. It ranks first in the growth rate of almost all data, such as daily active growth, transaction number growth, TVL growth (ranked second), and token price growth. However, there are some objective factors to consider in the rapid rise of Hyperliquid. First, it has the shortest birth time and is almost the youngest among the public chains analyzed. Second, although the growth rate is high, from the overall volume, it is still far behind public chains such as Ethereum or Solana. Especially data such as the number of active users. At present, the total number of Hyperliquid users is only 286,500, which is less than the number of daily active users of Solana at the beginning of the year. Other data such as TVL volume is about 1.7 billion US dollars, which is one-fifth of Solana.

However, Hyperliquid is already approaching Solana in terms of daily transaction volume, ranking second. In terms of market capitalization, it lags behind several public chains that have performed far worse this year. From this perspective, Hyperliquid still has great potential for development in 2025, but this development may require stronger and more continuous data support.

Sui is considered to be Solana's main competitor in the future. Judging from the performance of the data, the Sui network has also performed well this year. The TVL volume has increased by nearly 7 times this year, the daily activity has increased by 33.5 times this year, and the number of transactions has exceeded 300 million in a single day. The price of the token is also the public chain with the largest increase except for Hyperliquid, with an increase of about 441.13% this year, and the highest increase has exceeded 520.25%. In terms of growth level, Sui's growth rate in 2024 has exceeded Solana in some places, but another problem it faces now is the catch-up from projects such as Hyperliquid or Aptos. In 2025, whether the Sui ecosystem can explode may require finding some new outbreak points.

In addition to the above-mentioned representative public chains, in fact, other public chains are not content to be idle in 2024. Some are transforming to AI, represented by Near, and some are upgrading their brands by issuing new public chains, such as Fantom changing to Sonic. In addition, in the Layer 2 track, which is also one of the most popular public chain narratives in 2024, several star Layer 2s have issued airdrops this year, but their on-chain performance is generally poor. The best performing is the Layer 2 such as Base, which has no token plan so far. In addition, Taiko is also a Layer 2 with low market popularity but good on-chain performance. However, the current overall data volume is not large, and subsequent development remains to be seen.

Finally, by comparing the relationship between the various data of these 22 public chains, we can see that the tokens with the largest increase in 2024 are basically the public chains with the best growth in active users. From this perspective, perhaps the most important indicator for the development of public chains is still users. For investors, how to judge the future prospects of a project, the secrets behind it may also be hidden under these simple data.