The Significance of On-Chain Finance

On-chain finance represents a pivotal moment in the evolution of financial systems. It offers unprecedented transparency, security, and efficiency, transcending geographical boundaries and empowering individuals worldwide. By leveraging blockchain's immutable ledger, on-chain finance ensures trust in transactions, eliminates intermediaries and democratizes access to financial services.

AlphaXLabs: Fueling an Innovative Future in On-Chain Finance

In this era of on-chain finance, AlphaXLabs distinguishes itself with its innovative approach, forging connections between Web3, AI, and global communities. Let's delve into the rationale and principles that underpin AlphaXLabs' journey and explore how it navigates the dynamic landscape of on-chain finance.

Capitalizing on the Web3 Trend

The accumulation, management, and distribution of on-chain capital represent a rising trend in the Web3 landscape, harboring immense native potential. This approach, employing structured products to serve investment users, not only reduces global operational and communication costs but also facilitates access to global resources, fostering the creation of international communities.

Navigating the Global Web3 Environment

In the ever-evolving realm of Web3, the market landscape operates on a global stage. Web3's unique blend of technology and financial attributes dictates that for any project or fund to thrive, it must possess a global perspective and an international mindset.

In the post-pandemic era, the global economic structure is undergoing a substantial transformation, presenting a multitude of challenges. Different times call for different solutions to address the ever-evolving needs of humanity and society. Many capital firms and companies now prioritize excellence in their products and strive to deliver top-tier revenue services to a select group of private domain clients. The emphasis is on depth and quality, rather than superficial breadth.

AlphaXLabs has consciously chosen this distinctive positioning. Operating through a community-centric approach, it bridges the gap between capital and talent. By transforming revenue into a marketable commodity, AlphaXLabs focuses not on massive scale but on serving a select group of private domain clients.

This approach establishes a flattened communication paradigm, leveraging word-of-mouth and periodic screening to identify the right community members. Through this gradual strategy, AlphaXLabs taps into a continuously replenishing resource pool, constructing a robust moat around its operations.

In the crypto world, the crucial indicators for establishing on-chain community capital are service productization, revenue marketization, and member privatization. AlphaXLabs adheres to these standards as it constructs its comprehensive ecosystem. As the entire system comes into play, it requires continual iterations and enhancements of its products, revenue streams, and focus on privacy.

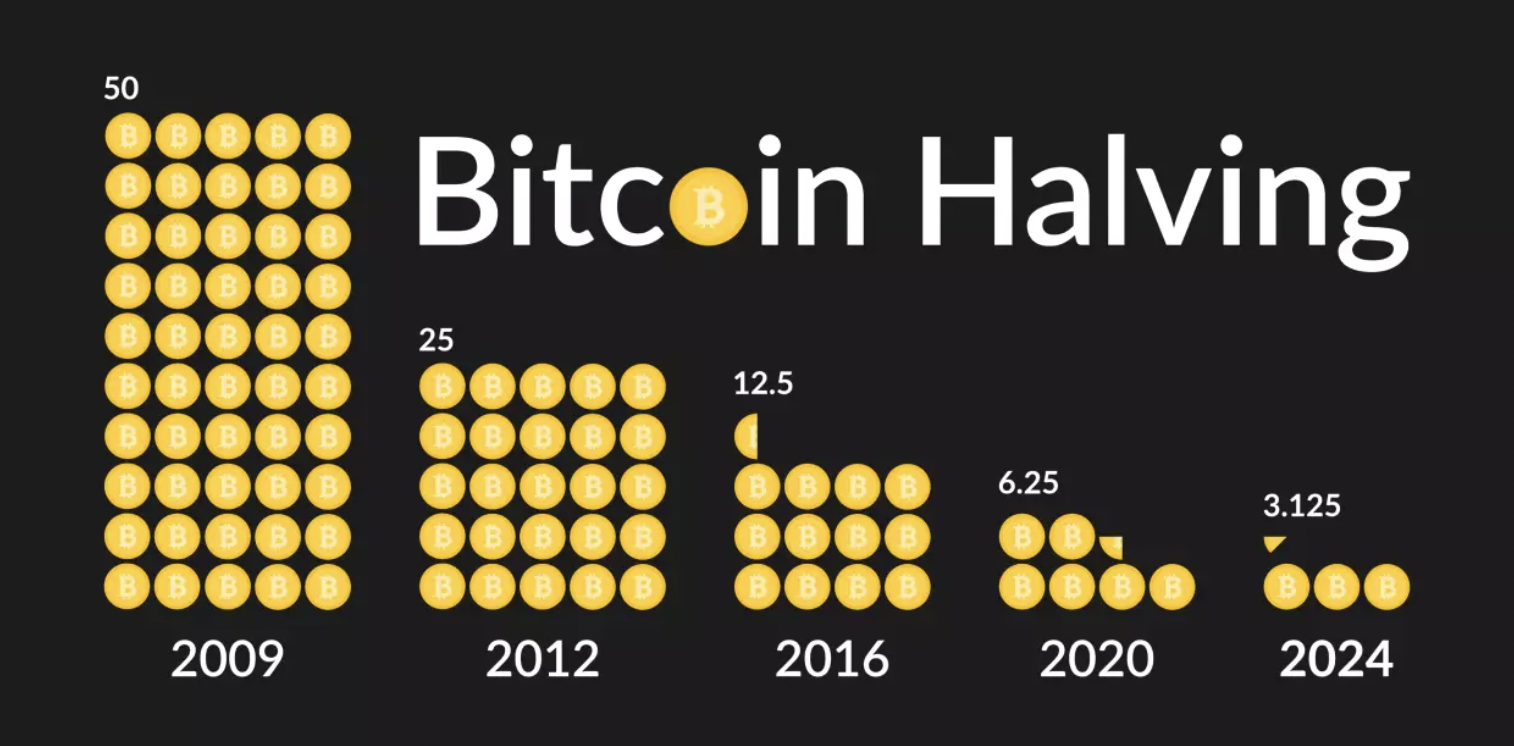

This holistic effect follows an upward trajectory—a gradual journey rather than an instantaneous transformation, much like the cycles observed in BTC asset price performance. BTC, introduced in 2008, embarked on its mining journey in 2009, underwent its first halving in 2012, leading to the bullish trend of 2013, but then hit a low point in 2015.

The second halving event occurred in 2016, fueling the bull market of 2017, followed by another low point in 2019. The third halving event took place in 2020, paving the way for the bullish trend of 2021. As we now find ourselves in a low point in 2023, AlphaXLabs and the crypto community eagerly anticipate the upcoming 2024 halving and the potential bull market of 2025.

While history may not repeat itself verbatim, it undeniably exhibits remarkable patterns that continue to shape the crypto journey.