-

PA一线 · 3 minutes ago

Important information from last night and this morning (April 24-April 25)

PA一线 · 3 minutes ago

Important information from last night and this morning (April 24-April 25)Cumberland deposited 2,261 BTC into CEX, worth more than $200 million; the U.S. SEC met with Ondo Finance to discuss compliant issuance of tokenized securities; RockawayX, an early supporter of Solana, launched a new $125 million fund.

-

Meme日报 · 14 minutes ago

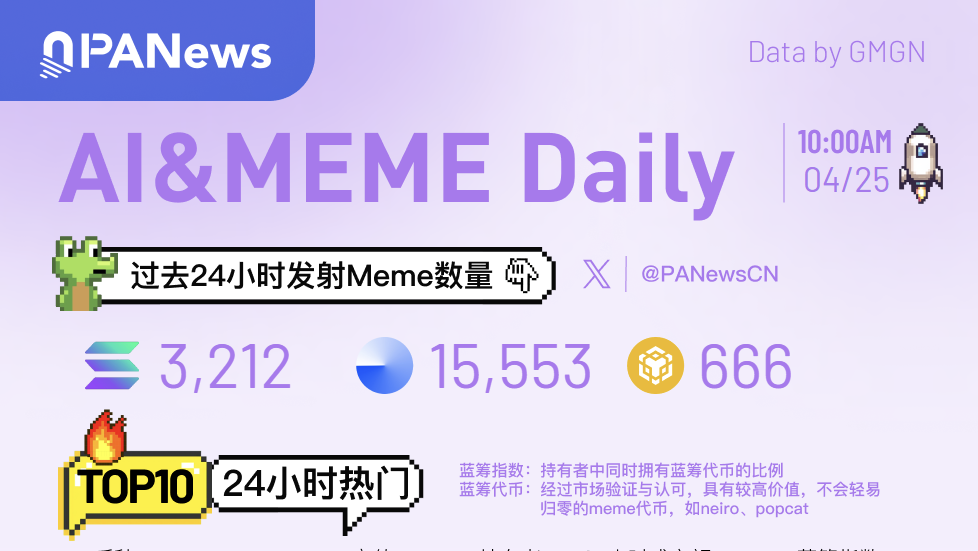

Ai&Meme Daily, a picture to understand the popular Ai&Memes in the past 24 hours (2025.4.25)

Meme日报 · 14 minutes ago

Ai&Meme Daily, a picture to understand the popular Ai&Memes in the past 24 hours (2025.4.25)$SOL resumes on-chain trading

-

PA一线 · 15 minutes ago

Multipolitan releases ranking of the most crypto-friendly cities in 2025: Ljubljana, Hong Kong, and Zurich rank in the top three

PA一线 · 15 minutes ago

Multipolitan releases ranking of the most crypto-friendly cities in 2025: Ljubljana, Hong Kong, and Zurich rank in the top threeLjubljana, the capital of Slovenia, ranked first in the world with 173 points, Hong Kong and Zurich tied for second with 172 points, and Singapore and Abu Dhabi ranked fourth and fifth respectively.

-

Frank · 20 minutes ago

Solana validators face changes: the foundation intends to decentralize, and half of the validators face survival challenges

Frank · 20 minutes ago

Solana validators face changes: the foundation intends to decentralize, and half of the validators face survival challengesThe Solana Foundation has introduced a new policy that attempts to increase the independence of validators by reducing their dependence on the foundation. But it seems that the final result may still be the optimization of large-scale small and medium-sized nodes.

- PA Daily | Binance will delist ALPACA, PDA, VIB and WING; Bitcoin spot ETF had a net inflow of US$917 million yesterday PA Daily | Bitcoin rises to fifth place in global asset market value ranking; Tesla holds $951 million in BTC PA Daily | Spot gold hits $3,500/ounce; Upbit will list DEEP in the Korean won market

M7 Research · 33 minutes ago

DARK: From AI Meme to Chip Control Puzzle

M7 Research · 33 minutes ago

DARK: From AI Meme to Chip Control PuzzleAI memecoin is a hot new coin under high control.

-

Tim · an hour ago

Top 10 public chains compete for RWA: Ethereum ranks first, Solana ranks only sixth

Tim · an hour ago

Top 10 public chains compete for RWA: Ethereum ranks first, Solana ranks only sixthWhich chains have strong momentum in the development of RWA? Which traditional institutions are planning RWA?

-

Techub News · 2 hours ago

Crypto narrative crisis: When “legend” construction gives way to marketing carnival

Techub News · 2 hours ago

Crypto narrative crisis: When “legend” construction gives way to marketing carnivalThe industry is experiencing a dangerous alienation. When users become data points to be optimized rather than souls to be enlightened, unsupported marketing is empty at best and a drain on resources at worst.

-

火币成长学院 · 3 hours ago

MCP in-depth research report: New infrastructure of protocols in the AI+Crypto trend

火币成长学院 · 3 hours ago

MCP in-depth research report: New infrastructure of protocols in the AI+Crypto trendAs a key protocol for the deep integration of AI and blockchain, the MCP (Model Context Protocol) is providing a new solution for the decentralized assetization of AI models with its decentralized, transparent and traceable characteristics.

-

PA一线 · 3 hours ago

Fed drastically withdraws regulatory guidance on crypto and dollar tokens

PA一线 · 3 hours ago

Fed drastically withdraws regulatory guidance on crypto and dollar tokensAccording to the Federal Reserve's official website, the Federal Reserve has revoked the 2022 regulatory letter requiring state member banks to report crypto asset activities in advance and the 2023 non-objection procedure letter regarding US dollar token activities, and jointly with the FDIC withdrew from two 2023 statements jointly issued with the OCC on crypto asset risks and liquidity risks.

-

链上观 · 4 hours ago

When geek spirit meets the meme wave, what should Ethereum do?

链上观 · 4 hours ago

When geek spirit meets the meme wave, what should Ethereum do?Can Ethereum find a new balance between technological idealism and market reality?

- Crypto Circulating Market Cap (7d)$3,041,970,736,907Market CapFear and Greed Index (Last 30 Days)Extreme Fear1 Days(3.33%)Fear21 Days(70%)Neutral6 Days(20%)Greed2 Days(6.67%)Extreme Greed0 Days(0%)

PA一线 · 13 hours ago

CME Group announces plans to launch XRP futures on May 19, pending regulatory review

PA一线 · 13 hours ago

CME Group announces plans to launch XRP futures on May 19, pending regulatory reviewCME Group announced today that it plans to launch XRP futures on May 19, pending regulatory review. Market participants will have the option to trade micro contracts (2,500 XRP) and larger contracts (50,000 XRP). CME's XRP futures will be cash-settled and based on the Chicago Mercantile Exchange CF XRP-USD Reference Rate, which serves as a daily reference rate for the XRP USD price, calculated at 4:00 pm London time each day. XRP futures will join the company's suite of crypto products, which includes Bitcoin and Ethereum futures and options, as well as the recently launched SOL futures.

-

PA一线 · 13 hours ago

Ether.fi transforms into a new DeFi bank and launches cash card in the United States

PA一线 · 13 hours ago

Ether.fi transforms into a new DeFi bank and launches cash card in the United StatesThe re-staking protocol Ether.fi announced its plan to add banking services to make it a new DeFi bank. The platform application will integrate traditional banking services with crypto functions, supporting users to use fiat currency for daily financial operations such as bill payments and salary payments, while retaining its core re-staking product - users can obtain liquid staking tokens (LST) by staking ETH and obtain additional income in the DeFi ecosystem.

-

Waterdrip · 14 hours ago

New logic of Web3 entrepreneurship under the new global trade order

Waterdrip · 14 hours ago

New logic of Web3 entrepreneurship under the new global trade orderThis article starts with the logic behind Trump’s tariff policy, looks forward to the ideas of a new round of blockchain entrepreneurship under macro-turmoil, and explores how the entry of traditional capital can bring reassessment opportunities to the crypto industry.

-

PA一线 · 14 hours ago

Trump's tariff stance on China has not softened

PA一线 · 14 hours ago

Trump's tariff stance on China has not softenedAccording to a report by CCTV.com citing the Wall Street Journal on the 23rd, senior US officials revealed that the Trump administration is considering multiple options. In the first option, the tariff rate on Chinese goods may be reduced to about 50%-65%. The second option is called the "tiered option", in which the US will classify goods imported from China into so-called "non-threat to US national security" and so-called "strategic goods to US national interests". US media said that in the "tiered option", the US will impose a 35% tariff on the first category of goods and a tariff rate of at least 100% on the second category of goods. White House Press Secretary Levitt said that Trump's position on tariffs on China "has not softened."

-

PA一线 · 14 hours ago

Cardano founder: Ethereum may not survive in the next 10-15 years

PA一线 · 14 hours ago

Cardano founder: Ethereum may not survive in the next 10-15 yearsCardano founder Charles Hoskinson questioned the long-term development of Ethereum in an AMA event on Wednesday, believing that the blockchain may not survive in the next 10-15 years. The Ethereum co-founder pointed out three major structural flaws: wrong economic model, virtual machine design and consensus mechanism, and criticized the Layer2 solution for becoming a "parasitic system" that failed to solve the core expansion problem and instead extracted the value of the main chain. Although Ethereum currently still maintains the largest locked volume (TVL), Hoskinson likens its situation to former technology giants MySpace and BlackBerry, predicting that users will gradually migrate to other ecosystems, especially the Bitcoin DeFi system.

-

PA一线 · 14 hours ago

Quantitative trading startup Theo completes $20 million in financing, led by Hack VC and others

PA一线 · 14 hours ago

Quantitative trading startup Theo completes $20 million in financing, led by Hack VC and othersTheo, a quantitative trading startup, has completed a $20 million financing. The platform is committed to providing ordinary investors with the returns of strategies that originally belonged to high-frequency trading companies. The company was co-founded by former Optiver traders Abhi Pingle and TK Kwon. In March 2024, it received a $4.5 million seed round of financing led by Manifold Trading, and in April 2025, it received an additional investment of $15.5 million led by Hack VC and Anthos Capital. Other investors include Flowdesk, Selini Capital, and individual investors from institutions such as Citadel and JPMorgan Chase.

-

MarsBit · 15 hours ago

Is it a brainless way to make money by shorting delisted coins? The market makers launched a counterattack and staged a polar reversal

MarsBit · 15 hours ago

Is it a brainless way to make money by shorting delisted coins? The market makers launched a counterattack and staged a polar reversalThis wave of violent fluctuations may be driven by market overshoot, market makers’ manipulation or retail investors’ FOMO sentiment, demonstrating the high risk and high speculation of low-market-cap tokens.

-

Felix · 15 hours ago

Bloomberg: Have U.S. Treasuries really lost their safe-haven appeal?

Felix · 15 hours ago

Bloomberg: Have U.S. Treasuries really lost their safe-haven appeal?Some market watchers believe April’s market moves could signal a shift in the global landscape and a reassessment of assets that are critical to the U.S. economic dominance.

-

Story中文 · 16 hours ago

In-depth analysis of Story: Is it really necessary to put intellectual property on the blockchain?

Story中文 · 16 hours ago

In-depth analysis of Story: Is it really necessary to put intellectual property on the blockchain?Reconstructing the IP management system in the AI era.

-

PA一线 · 16 hours ago

Binance Finance, One-click Coin Purchase, Flash Exchange, Leverage, Contract Launch Initia (INIT)

PA一线 · 16 hours ago

Binance Finance, One-click Coin Purchase, Flash Exchange, Leverage, Contract Launch Initia (INIT)Binance will convert the pre-market trading of INITUSDT U-margined perpetual contracts to the standard version of INITUSDT U-margined perpetual contracts at 19:00 (ET) on April 24, 2025. The transition period may be up to 1 hour. During the transition period, INITUSDT perpetual trading and existing positions will not be affected. In addition, Binance Finance, One-click Coin Buying, Flash Exchange Trading Platform, and Leverage will launch Initia (INIT).

PANews - Your Web3 Information Officer

Download PANews to track in-depth articles