Preface

Vietnam’s cryptocurrency market is one of the largest in Asia. In fact, it has surpassed the European Union or the US in terms of cryptocurrency adoption rate. The main reason is that most Vietnamese citizens lack investment opportunities. Retail investors seek to hedge the uncertainty of local fiat currency and invest funds in potential growth areas.

According to data from Statista, the revenue of cryptocurrency exchanges in Vietnam is expected to reach 109.40 million USD by 2023, while the number of cryptocurrency users is expected to reach 12.37 million by 2027. In addition, according to a recent report released by The Wall Street Journal, the trading volume of cryptocurrency in Vietnam ranks among the top five.

With the increasing maturity of the cryptocurrency market in Vietnam, numerous infrastructure projects are emerging, and a large number of experienced investors remain steadfast during the market downturn. Especially now, investor confidence has returned, with 70% of people believing that the bear market cycle has ended or is about to end. Investment enthusiasm is reflected in the increased participation in various fields compared to the previous year.

Overview of Vietnam’s Economy and Macro Market

The global economic landscape remains uncertain due to ongoing challenges such as inflationary pressures and supply chain disruptions. Central banks are cautiously monitoring these factors and adjusting their Monetary Policies.

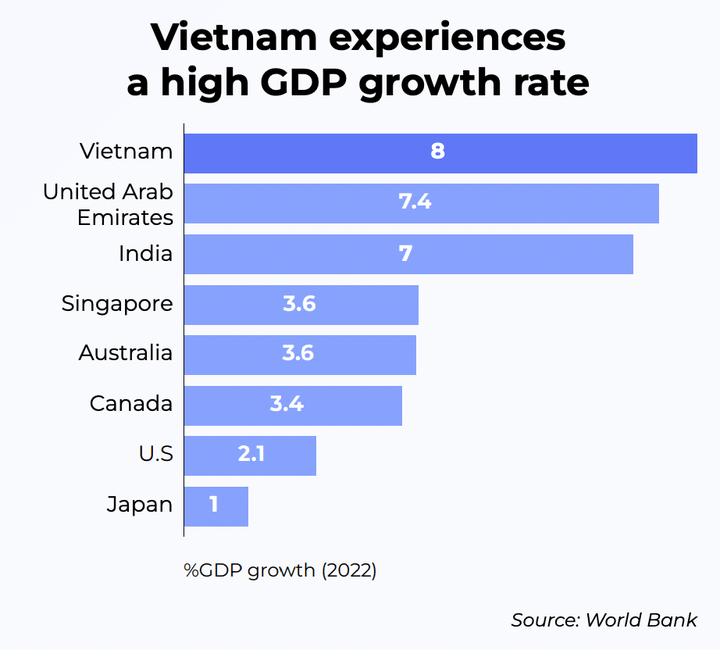

The data in the figure outlines the annual GDP growth percentages of multiple countries. Vietnam ranks among the fastest-growing countries with a growth rate of 8% in 2022. Meanwhile, developed economies such as Japan and the US show relatively low growth rates of 1% and 2.1% respectively, highlighting the diversified economic pattern. By the third quarter of 2023, the GDP growth rate will be 5.33%, and it is expected to be 5.10% in the fourth quarter. The per capita GDP is $15,514.

Vietnam ranks 35th in the world in terms of GDP (408.80 billion USD). The inflation rate is relatively low, 3.5% in October 2023, while the average in 2022 is 2%, while the European Union is about 8.83% and the US is close to 8%. The unemployment rate in 2022 is only 1.9%.

According to reports from Google, Bain & Analysis, and Temasek Holdings, Vietnam will become the fastest growing digital economy in South East Asia. It will grow from about 23 billion USD in 2022 to 49 billion USD in 2025 (faster than the Philippines and Indonesia). This huge growth rate is driven by e-commerce, transportation and food delivery, as well as social media.

According to a report by Bain & Company, Vietnam attracted more foreign investors than Indonesia and the Philippines in 2022 due to its macroeconomic situation and favorable environment for startups.

Vietnam’s Main Cryptocurrency Industry Sector

1.Blockchain infrastructure

The number of blockchain infrastructure projects has increased to 8. The most outstanding project is Aura Network, which has raised a total of 9 million USD from investment institutions such as Republic Crypto, Hashed, and Coin98 Ventures. TomoChain was acquired by Coin98 Finance. Remitano Network, an infrastructure network backed by the Vietnamese P2P exchange Remitano, launched its mainnet in October 2022. Firebird (formerly PolkaFoundry) is currently a Web3 gaming platform focused on blockchain games. Verichains discovered a private key extraction vulnerability with a risk exposure of up to 8 billion USD.

2.Decentralized Finance (DeFi)

Although the market is still in a bear market for a long time, the development momentum of projects this year is better than that of the same period last year. These include successful projects such as Fewcha, Octan Network, Orochi, Cavies, etc., which emerged after the Web3 Matching event held by Kyros Ventures in December 2022. The decentralized finance (DeFi) projects are as follows:

3.GameFi

Although there was no major breakthrough in the GameFi field in the first half of 2023, according to data from Finder and Bloomberg, Vietnam is still a global gaming power, with its GameFi participation rate and mobile end game production ranking among the top five in the world. Vietnam will definitely make a strong comeback in the GameFi field. Meanwhile, infrastructure projects such as Space3, SeekHype, W3W, and Oxalus have gained popularity after events such as Web3 Matching and GM Vietnam 2023.

Cryptocurrency Wallets and Electronic Wallets

In the past 4 years (2018–2022), the number of cryptocurrency wallet users in Vietnam has increased to 18.60 million. Compared to this, there are more than 420 million cryptocurrency wallet users worldwide. In Vietnam, a considerable proportion of cryptocurrency owners prefer to store their digital assets on centralized cryptocurrency exchanges. According todatawallet.comdata, the most commonly used centralized exchanges in the Vietnamese market are:

1、Binance stands out from many competitors through its strong liquidity depth. This enables users to smoothly conduct large transactions, increasing its attractiveness among Vietnamese investors.

2、OKX — OKX caters to the needs of institutional investors — it supports a variety of trading tools such as futures, options, and leveraged trading. The platform is committed to security and compliance to attract institutional investors.

3、Bybit — In the Vietnamese cryptocurrency trading market, Bybit is the most popular among traders and investors.

4、Gate.io — Gate.io attracts users in another way. It is unregulated and does not require KYC (Intellectual Property) or AML (Anti Money Laundering). Users can choose from counterfeit products and wealth management products.

5、BitcoinVN — Vietnamese Local Cryptocurrency Exchange (founded by Vietnam-Germany team).

n terms of e-wallet usage, online payments in Vietnam are made through e-wallet (QR code), with e-wallet MoMo being the largest participant, followed by Zalo Pay (part of one of Vietnam’s largest messaging applications). Another payment platform in Vietnam is VNPay.

Currently, about 42 million users in Vietnam have electronic wallets, which are expected to grow significantly in the near future. The fairly developed electronic wallet market may be an important foundation for the future cryptocurrency wallet market. Cryptocurrency asset owners will need more security and control (self-custody) to manage their assets, so we can see the growth of the cryptocurrency wallet market in the future. In addition, those who wish to join cryptoassets can choose to use third-party platforms such as AlchemyPay. AlchemyPay launched local payment functions in Vietnam this year, supporting domestic bank transfers and e-wallets MoMo and VT Pay. Vietnamese users can purchase cryptocurrency with Vietnamese legal tender on the Web3 platform.

Vietnam’s Most Famous Cryptocurrency Projects

1、Coin98

Coin98 was founded in Ho Chi Minh City in 2017 and has achieved great success. It is a DeFi platform where you can move and exchange assets between different blockchains, and earn interest by pledging. Coin98 has attracted the attention of the crypto world and brought opportunities to startups.

2、Kyber Network

Another project that has contributed to the cryptocurrency market in Vietnam is Kyber Network, founded in 2017. It is a decentralized exchange, DEX aggregator, and liquidity platform.

3、Axie Infinity

The third most famous cryptocurrency project in Vietnam is Axie Infinity (founded by SkyMavis in 2018), which is a “Play to Earn” platform (involving the NFT market) running on the Ethereum blockchain. Due to the use of the Axie Infinity platform online by Filipinos and Vietnamese during the Covid19 blockade, Axie Infinity achieved earth-shattering wins (with 2.50 million players and a market value of $10 billion at its peak). This was an early revolution in Vietnam’s GameFi field and brought opportunities to other startups.

Vietnamese Cryptocurrency Users Portrait

1. User Overview

The population between the ages of 25 and 34 is still the main group. Compared with the data from 2022, the proportion of participants between the ages of 18 and 24 has decreased from 38% to 26%. The proportion of investors is compared year by year.

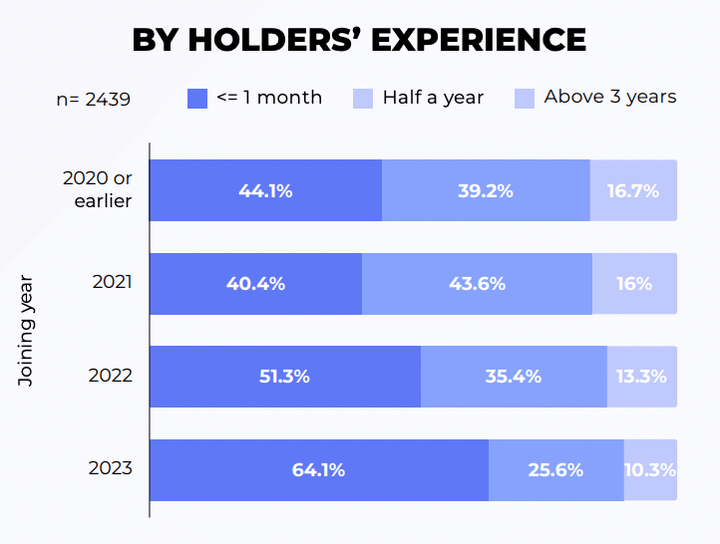

More than 90% of the respondents have more than one year of market experience. In 2022, the proportion of new users was 11%, while in 2023, the proportion of new users was only 6.5%. 2021 is still the year with the highest proportion of new users. This phenomenon also reveals that regardless of the market situation, Vietnamese new users are optimistic about the market at that time.

2. Individual Investors’ Views and Behaviors

The consensus on the price of Bitcoin (BTC) is generally concentrated in the range of $30,000 to $50,000 by the end of 2023. Only about 20% of investors believe that Bitcoin will fall below $20,000.

Nearly 70% of respondents said that the cryptocurrency winter will last less than a year or has already ended.

3.Information Acquisition Channels

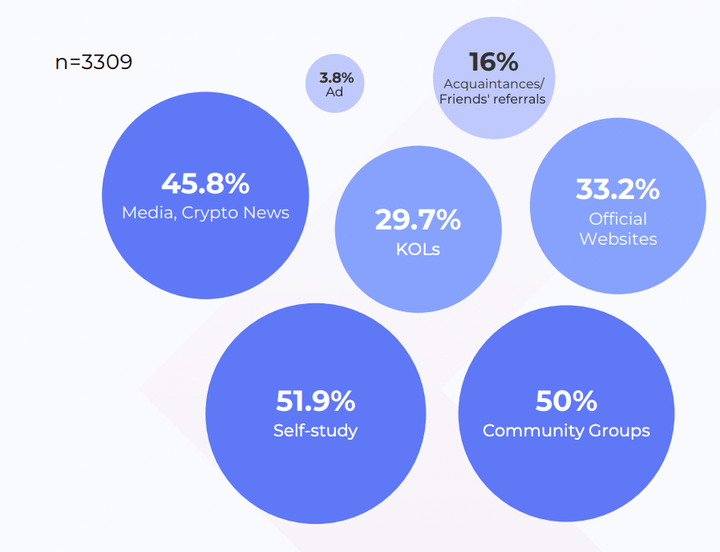

Vietnamese investors’ information acquisition channels are still mainly concentrated on social media, news, and community groups. In addition, the project’s official website is also a way for them to gain a deeper understanding of the project.

4.Recommendation-driven Investment Decisions

75% of respondents believe that friend recommendations will more or less affect their investment decisions. However, when asked if they rely on the opinions of trusted people for investment, most respondents still choose comprehensive project research. This shows that investors are very cautious before making investment decisions.

For client bases with different levels of market participation, investment novices tend to be skeptical during the project research process. There is a paradox here: the rest of the group tends to make investment decisions based on friend recommendations

Cryptocurrency Users Segmentation Track Engagement

Compared to 2022, the participation of tracks such as DeFi, GameFi, and NFT has increased, with significant growth trends in NFT and GameFi. Although airdrops once ranked first in community participation in 2021, this track has fallen to second from last in 2023.

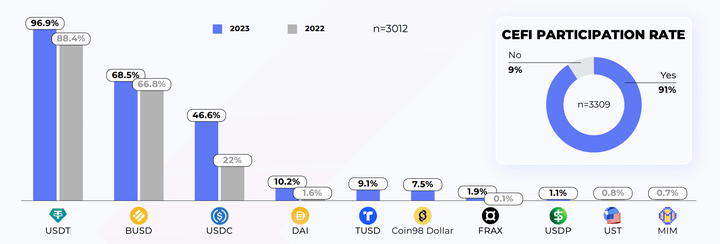

1.Ranking of stablecoin holdings

Compared to last year, the top four stablecoin adoption rates have not changed: USDT still ranks first, while USDC and DAI have the highest growth rates. TUSD and Coin98 Dollar (CUSD) are two new types of stablecoins that replaced UST and MIM in the previous year. 75.8% of investments hold two or more stable coins to achieve portfolio diversification and reduce risks.

2.Stablecoin Allocation Ratio

Although most market participants are optimistic about the price of Bitcoin, most users hold 25% -50% of their assets in the form of stablecoins. This phenomenon reflects that during the market downturn, users prefer less risky investment methods. It is worth noting that new users are the client base with the least proportion of stablecoin holdings. Most users choose to store stable coins in CEX.

Most respondents stated that continuous stability is the basis for their choice of commonly used stablecoins, accounting for 53.85%. The remaining data is basically consistent.

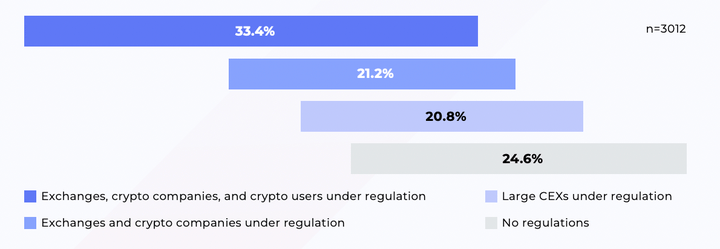

3.Cryptocurrency Governance Expectations

More than 70% of survey respondents hope that relevant departments will regulate and control Cryptocurrency. More than one-third of investors hope to improve comprehensive regulation across exchanges, crypto companies, and individual investors. Only one-fourth of users are looking forward to a completely decentralized crypto market.

4.DEX trend

Recent FUD times (fear, uncertainty, doubt) around CEX compliance and other issues have prompted users to migrate to decentralized trading platforms (DEXs), while the DEX/CEX adoption rate increased from 10% to 22% in the first half of the year (The Block).

Selection basis: DEX has no bankruptcy risk and allows users to manage assets on their own. Users can purchase DeFi products through simple operations. Under the trend of CEX transferring to DEX, purchasing stablecoins is more convenient and fast. In the short term, DEX will be used, but in the long term, CEX will have higher liquidity. CEX is more convenient and has customer service. Compared with DEX, CEX is easier to get started with and more trustworthy due to its more transparent organizational structure.

5.DeFi vs. Non-DeFi

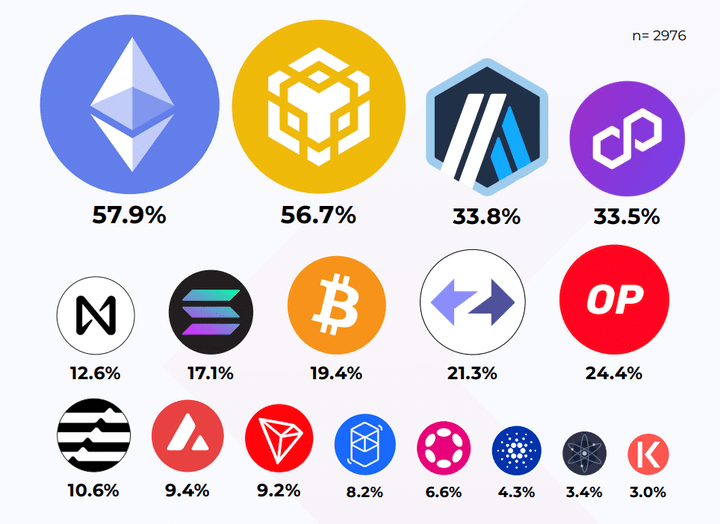

Investors in the DeFi field are more open: the vast majority of DeFi participants do not exclude investment in other tracks. DeFi is also a gateway to guide investors into different fields of the cryptocurrency market. The most popular DeFi ecosystem:

Notable changes: In 2023, the top three platforms changed, and Ethereum surpassed BNB Chain. Solana is no longer an outstanding platform. In comparison, newer Layer2 solutions such as Arbitrum, Optimism, and zkSync Era in the first half of the year have stronger appeal to many users.

6.Airdrop

The vast majority of wallet addresses receive airdrops between 1 and 5 times, with a median of 2 and a maximum of 3,000 airdrops.

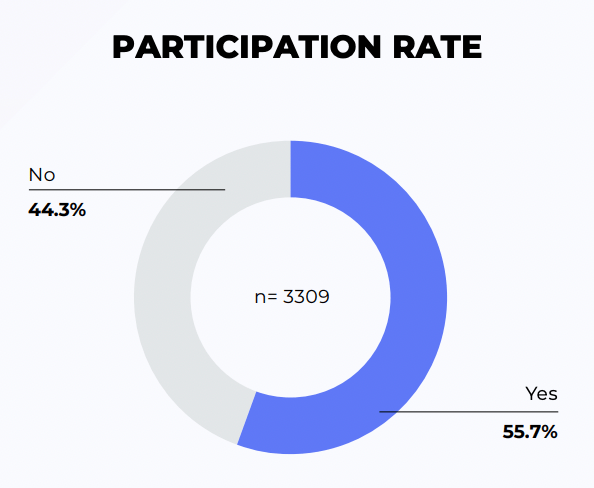

In 2021, airdrops were rated as the most popular community activity, but more than half of the users who participated in airdrops that year, about 55.7%.

Mainstream projects airdrop expectations: zkSync and LayerZero are the two most popular projects among Vietnamese users during this short period. Although Venom is still in the testnet stage, it is very attractive to the community.

User behavior after the airdrop: Investors who received the airdrop all showed actions of selling, accounting for up to 91.8% of the population.

7.NFTs and Web3

NFT Ecosystem: Although BNB Chain and Solana are the two most anticipated NFT ecosystems in 2022, Ethereum has also performed strongly this year. In 2023, emerging ecosystems are emerging, with Arbitrum, Aptos, and especially Bitcoin seizing Solana’s market share.

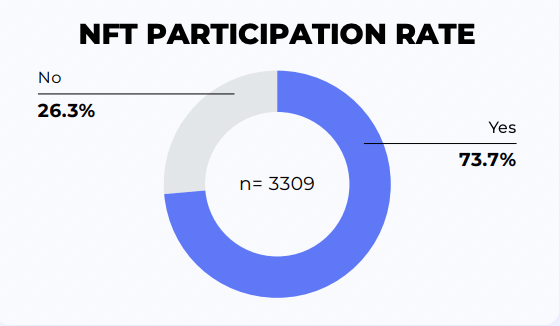

The users participation rate in NFT accounts for 73.7%.

The most common holding period for NFTs is 1 to 6 months, accounting for more than two-thirds of respondents.

NFT novices tend to sell assets earlier than other groups.

8.GameFi

Compared to 2022, the preferences of GameFi players have changed, with casual games replacing FPS/TPS as the first. There is no obvious difference between these segmented markets.

Overall:

Nearly 60% of respondents still hold stablecoins, accounting for more than half of their investment portfolios, while 75% expect regulatory governance or intervention.

In Vietnam, investment decisions influenced by friends are a popular trend, with a proportion 2.5 times higher than in the US.

About 70% of the population does not have a bank account and cannot access Financial Services. In fact, only about 33% of citizens have a bank account. Considering that about 70 million citizens collectively own a mobile phone (in the 97 million population), this indicates that the adoption potential of cryptocurrency users is huge, especially in the P2P exchange market.

In addition, retail investors in Vietnam are largely driven by their gambling nature — most of them cannot enter casinos, so the opportunity to invest in encrypted digital assets is very tempting to meet their needs. They tend to increase wealth, not just hedging inflation. This is similar to the characteristics of Chinese retail investors.

Vietnam’s Regulation Policy on Cryptocurrency

Regulatory friendliness: Vietnam has not yet included Cryptocurrency in the fiat currency system, so no Cryptocurrency tax is levied. Although discussions on cryptocurrency regulation are still ongoing, changes in the regulatory framework are limited. It is worth noting that peer-to-peer lending and virtual asset service providers were excluded from the new Anti Money Laundering Law in March of this year. (Baker & McKenzie, 2023)

Overall, the Vietnamese government has a positive attitude towards cryptocurrency regulation. Apart from stipulating that cryptocurrency cannot be used to pay for goods or services, the authorities have not enforced any other regulation. The government has issued an investment law that clarifies the status of cryptocurrency as a legal investment tool, which means that Vietnamese citizens can legally invest their funds in encrypted digital assets. The Anti Money Laundering (AML) policy, which will take effect in 2023, requires organizations that provide payment services (such as digital wallet services) to implement KYC measures.

BitcoinVN platform is the only cryptocurrency exchange regulated by the Vietnam National Securities Commission. (Founded by the Vietnam-Germany team)

In the history of the Vietnamese blockchain industry, two officially recognized legal entities have emerged. The first one is the Vietnam Blockchain Union (VBU), established by the Vietnam Digital Communications Association (VDCA) and officially launched on April 21, 2022. The other one is the Vietnam Blockchain Association (VBA), which was established one day later according to the 343/QD-BNV decision issued by the Ministry of the Interior.

Summary

Due to favorable government regulatory policies and the investment nature of Vietnamese citizens, Vietnam ranks third in the world in terms of encryption adoption rate (Chainanalysis October 2023 data).

Remittances are another important reason for the success of Cryptocurrency in Vietnam. In 2022, the total amount sent to Vietnam increased to about 19 billion USD. This makes Vietnam one of the three largest remittance receiving countries in the Asia-Pacific region and ranks among the top globally. According to World Bank data, the cost of remittance is about 7%, but the cost of using Cryptocurrency is much lower. In addition, peer-to-peer networks are popular in Vietnam without intermediaries. In addition, Vietnamese citizens have always had low trust in the local legal currency, the Vietnamese dong. Therefore, many people choose to hold Cryptocurrency to address issues such as the depreciation of fiat currency.

Currently, Cryptocurrency is receiving more and more attention in Vietnam, which is not limited to retailers. As mentioned above, many new projects are being developed, not only focusing on the previous application layer, but also paying more attention to infrastructure platforms and further research and development. At the same time, local technological development and trends are also changing with the global industry trend. Vietnam used to have more than 100 GameFi projects, but now the “Web3 Builder” wave is coming, especially after GM Vietnam 2023.

The high adoption rate of Cryptocurrency and the quality of skilled labor are the two main reasons for attracting foreign projects to develop new business potential in Vietnam. Since the bull market in 2021, most existing investors have continued to invest, resulting in a decrease in the proportion of new participants. Overall, investors have positive expectations for the future of Cryptocurrency and hope that the market can gradually be properly managed to a certain extent.

Here is the map of blockchain and Crypto projects in Vietnam:

Risk Warning: The above content is mainly sourced from the internet, for reference only, not as investment advice.

Please follow and join the MIIX Capital community to share and exchange industry updates and to learn more about the latest developments in the field.