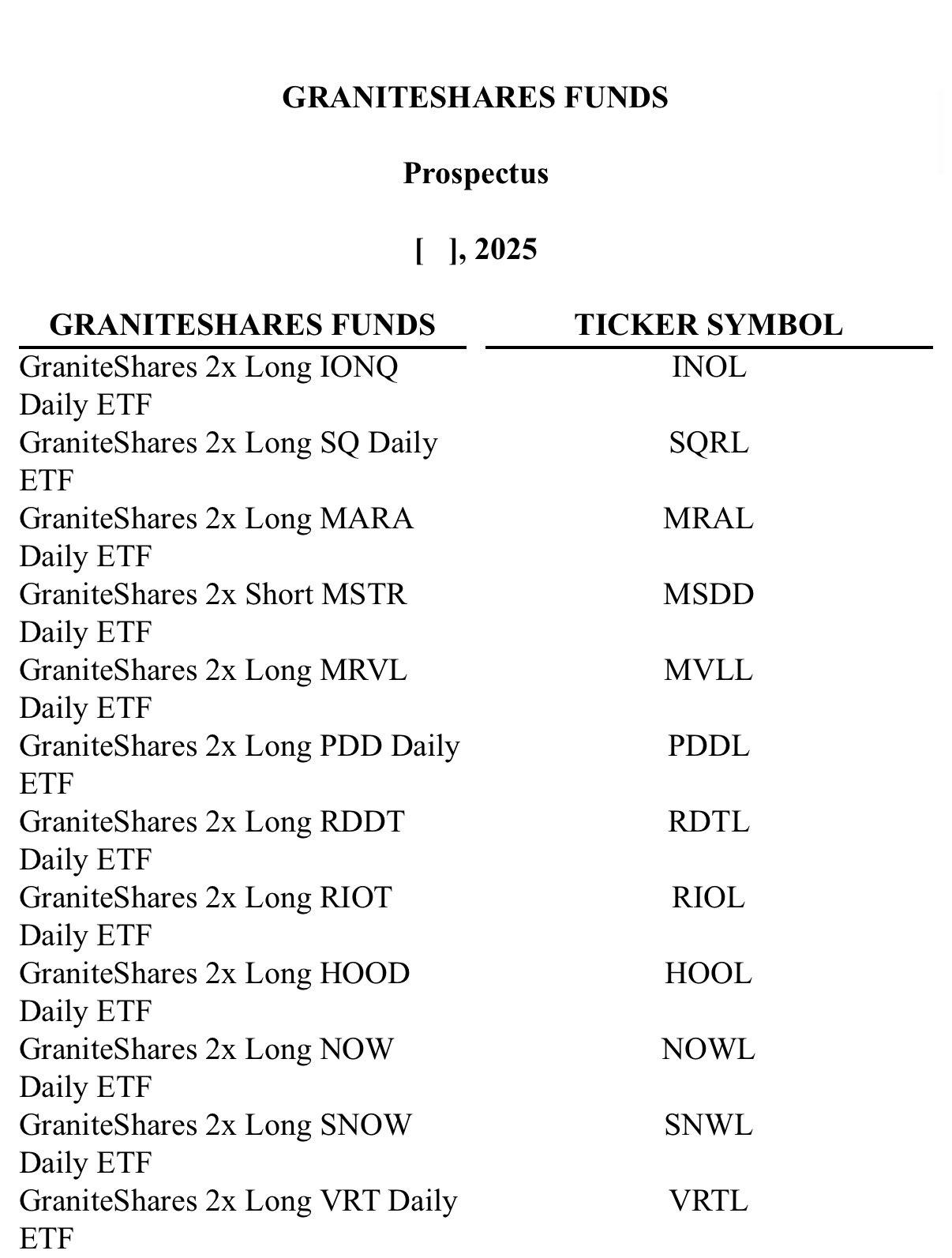

PANews reported on December 22 that according to Crypto.news, GraniteShares, a New York-based asset management company with over $10 billion in AUM, applied for a new leveraged ETF to track companies such as Riot Platforms, Marathon Digital, MicroStrategy and Robinhood. These funds will go long and short at the same time. An ETF that goes long 2x will generate twice the daily return of the corresponding stock.

Other companies have launched other types of cryptocurrency-focused ETFs. In addition to leveraged funds, YieldMax has launched covered call ETFs for several cryptocurrency companies. The company launched the Coin Option Income, MARA Option Income, and MSTR Option Income ETFs. These ETFs use a covered call strategy to provide monthly income to investors. In a covered call, the fund invests in stocks, sells call options, and collects a premium, which is distributed to investors every month.