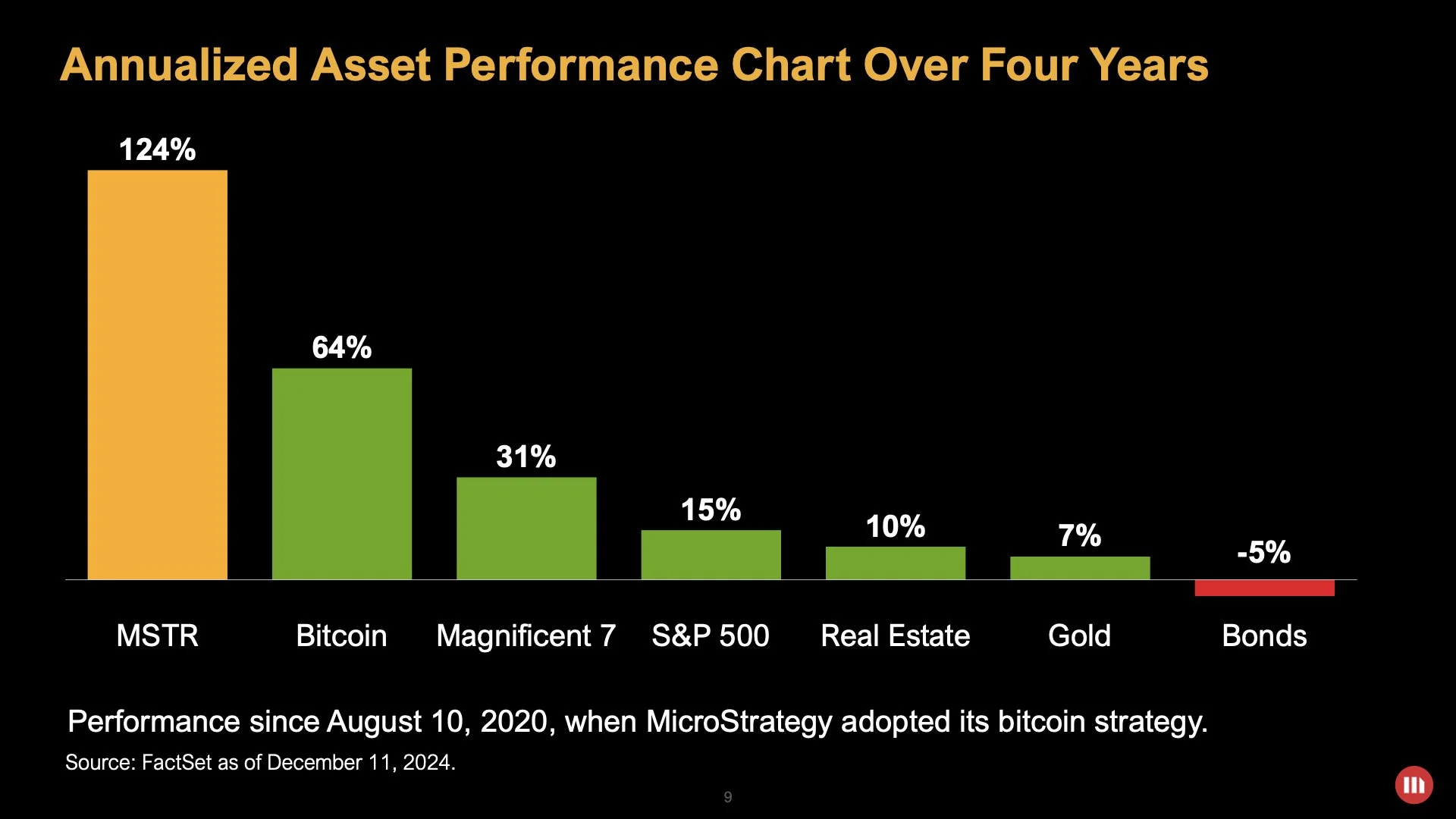

PANews reported on December 14 that according to News.bitcoin, Michael Saylor, executive chairman of Microstrategy (NASDAQ: MSTR), shared a chart showing the performance of Microstrategy stock relative to other major investments.

Since adopting the Bitcoin strategy on August 10, 2020, the firm has achieved an annualized return of 124%, outperforming all major asset classes. Factset data from December 11 showed that Bitcoin has achieved a strong annualized return of 64% in the same time frame. In comparison, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla have returned 31%, the S&P 500 has returned 15%, real estate has returned 10%, and gold has returned 7%. Bonds have performed poorly, with a return of negative 5%.