Author | Mumu

Produced by|Baihua Blockchain

Since the beginning of this round of market, Bitcoin has been singing all the way, and Ethereum and some old "value projects" have become increasingly weak. ETH/BTC once hit the bottom, which has become the strongest "distress" for a group of senior crypto enthusiasts. They have gone through both bull and bear markets, but they still can't let go of the slump of ETH. The crypto community's dissatisfaction with ETH seems to have reached its peak.

The crypto community began to circulate a large number of complaints about Ethereum

01. Has Ethereum’s original intention changed?

Although ETH and BTC have different paths and there are not many direct conflicts, most people who have held ETH for a long time since the bear market began hope that ETH can outperform BTC, that is, ETH/BTC can have a good return. Based on the experience before this round of bear market, ETH can still outperform BTC most of the time.

Similar to the mentality of the Ethereum community who want to outperform BTC, Ethereum's original intention may be a differentiated development strategy, taking a path that the Bitcoin community has not taken and believes is difficult to take: a smart contract application platform based on blockchain, and plans to explore blockchain expansion to bring scalability and performance, and develop decentralized applications beyond digital gold.

Similar to some of the “copycat” projects that had emerged at the time, they all wanted to improve Bitcoin, differentiate their strategies, or become a more successful Bitcoin.

Screenshot of the Ethereum Foundation’s earlier official website

If early crypto users paid attention, they must have seen the above-mentioned background picture of the Ethereum Foundation’s official website, which looks “grand”. It clearly has a slogan: blockchain application platform, which was also the most accurate positioning given to Ethereum by the Ethereum community at the time. The background picture seems to be a high-rise building rising from the ground, which may indicate the expansion and construction of the blockchain.

Now, some people think that the original intention of Ethereum has changed. Since the Ethereum consensus mechanism was merged with POS, perhaps because the price could not rise, they attributed the decline of Ethereum to the POS formula mechanism, and believed that such a drastic change from POW to POS was a huge mistake. But in fact, the conversion of Ethereum to POS appeared in the early design roadmap from the beginning, and it was not a temporary change later. This is a choice and plan made under the needs of blockchain expansion and expansion of the account model of the smart contract public chain platform.

Recently, one of the biggest Bitcoiners on social media posted a chart showing the inflation rate after the Ethereum merger, which showed that the inflation rate of Ethereum has risen rapidly in the past six months, in an attempt to illustrate the wrong path of the Ethereum merger. But he was soon slapped in the face when an Ethereum community user posted the full picture of this statistical trend chart, and compared it with the annual inflation rate of Bitcoin (the ratio of newly issued to circulating quantities), which made the picture even clearer.

At first, many people scoffed at the unlimited issuance of Ethereum, believing that Ethereum would definitely issue unlimited amounts of tokens. The reality now is that Ethereum has merged EIP1559 through POS, which not only does not affect security, but also controls inflation, which is far lower than Bitcoin's current inflation rate, and has even distanced itself from other well-known POS public chains.

Ethereum has firmly taken the second place in Crypto and has become the "differentiation object" of a number of new public chain projects. The goal of many projects is to become a better "Ethereum". It can be said that the Ethereum route has not changed much except for the adjustment of the implementation details, and the original vision has been gradually realized.

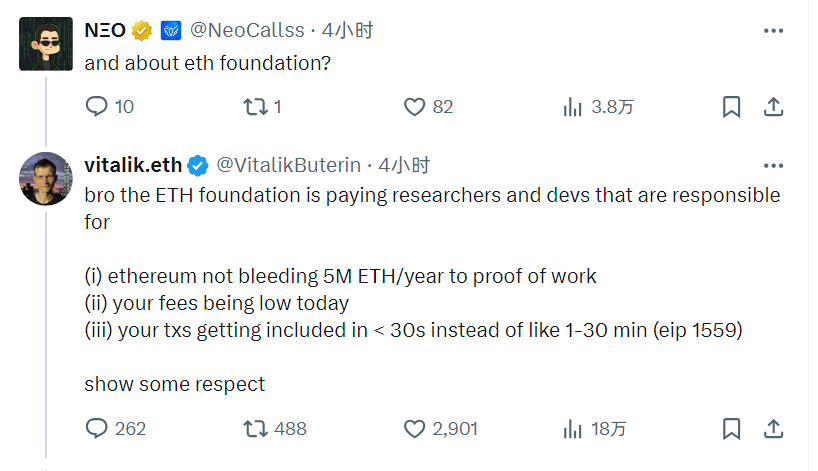

Recently, Vitalik responded to the foundation's questions about shipments on social networks, and attached 9 pieces of information related to ETH fundamentals.

Vitalik:

The ETH Foundation is paying researchers and developers for the following work:

(1) Ethereum no longer loses 5 million ETH to the Proof of Work (POW) mechanism every year

(2) Your current expenses are low

(3) Your transaction will be packaged in < 30 seconds, instead of 1-30 minutes (eip-1559)

(4) zk technology allows people to use ETH while maintaining privacy

(5) Account abstraction technology will allow ordinary people to use ETH safely without seed phrases or SBF-style central points of failure

(6) Local ETH events around the world, many of which barely mention the Foundation’s name

(7) Since 2016, ETH has never been shut down due to DoS attacks and consensus failures

(8) Various security efforts (both internally developed and funded) prevented many funding losses

(9) Libraries in various codes you use (wallets, DeFi applications, etc.)

From another perspective, the reason why Ethereum exists and is endowed with a market value of more than 300 billion US dollars is not necessarily just due to the amount of gas fees it captures, but more of its expansion and innovation in the field of encryption, so as to continuously undertake the value overflow of Bitcoin. Therefore, in the first two bull markets (2018 and 2021), ETH/BTC rose relatively high, which is one of the main underlying logics for Ethereum's long-term outperformance.

In this round of market, although Ethereum’s fundamentals are good, the author finds that many people only mention problems such as the on-chain liquidity fragmentation of the Ethereum ecosystem and the competition from new public chains, but ignore the most important thing, which is the Ethereum ecosystem’s acceptance of the overflow of Bitcoin’s value.

02. Is Bitcoin’s own unresolved problems an opportunity for Ethereum?

In terms of design, Bitcoin is undoubtedly a "god-level" work, but such a system does not mean "perfect". After all, many project designs want everything and take everything into account. They seem perfect but are actually complex and full of loopholes, making it difficult to break through quickly.

Satoshi Nakamoto left some unsolved problems or regrets for Bitcoin, waiting for future generations to optimize. For example, the contradiction between the decreasing issuance and ecological development threatens the sustainability of the Bitcoin system.

Simply put, as Bitcoin production continues to decrease until it reaches its upper limit, the increasingly smaller inflation rate will drive Bitcoin’s scarcity into a favorable factor for price increases. However, this may not be the case for the Bitcoin system, because production reductions will inevitably lead to a reduction in the income of POW miners, which will also reduce the enthusiasm of miners, and may also affect the security and stability of the system.

Of course, the Bitcoin community has proposed another solution, which is to develop the Bitcoin ecosystem. When the halving in the future leads to insufficient income for miners, the prosperity of the Bitcoin ecosystem can make up for the reduction in system rewards and continue to motivate miners to provide strong system protection. This is also the experience learned from the Ethereum community's blockchain expansion route. However, the high price and handling fees, as well as the low efficiency of the main network, make the Bitcoin ecosystem face considerable sustainable development challenges.

The problem of Bitcoin is still on the table. There is only one solution, which is to let Bitcoin continue to rise, and then there will be no problem. But this is obviously unlikely. So when capital pushes Bitcoin to the bottleneck, the value will overflow to other blockchains. At present, the only large-scale project that can carry most of the overflow of Bitcoin's value in the future is Ethereum, and there is no other.

03. Bitcoin L2 and Ethereum L2 are already in the same boat

The current Bitcoin ecosystem is developing rapidly, and many teams have brought many expansion solutions, especially the Layer2 solution borrowed from Ethereum. It can be said that the leading exploration of Ethereum Layer2 is leading the expansion solutions of Bitcoin Layer2. Bitcoin Layer2 and Ethereum Layer2 have the same goal, and some people say that Ethereum is the largest test network of Bitcoin.

Of course, there are still some problems with Bitcoin Layer2, such as the difficulty in inheriting Bitcoin's security, the slow block generation speed of Bitcoin itself affecting the settlement efficiency of Layer2 transactions, etc. Therefore, if idle BTC wants to participate in DeFi, it will still choose to cross to the Ethereum chain to obtain reliability and security.

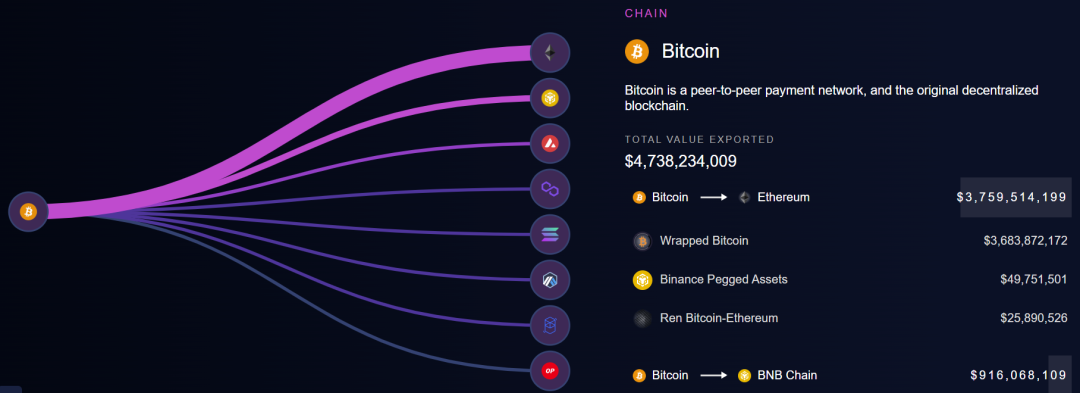

Image source: CryptoFlows

According to CryptoFlows data, Bitcoin has exported approximately US$3.8 billion in assets to Ethereum, mainly through stablecoin bridging and other means. This does not include Layer 2. Ethereum mainnet inflows account for the vast majority of Bitcoin cross-chain outputs, indicating the recognition of Ethereum by on-chain funds. In the future, with the continued development of BitcoinFi, the Ethereum ecosystem is bound to gain more inflow share.

In fact, let's change our perspective. In the era of multi-chain interconnection and chain abstraction where Web3 applications are widely implemented, the large crypto ecosystems are interconnected and interoperable. Isn't Ethereum currently on its way to becoming the largest side chain or generalized Layer 2 of Bitcoin? The best DeFi protocol in the Ethereum ecosystem is helping to activate dormant Bitcoin funds.

Whether it’s the scaling solution on the same ship or the cross-chain flow of funds, the future of Bitcoin and Ethereum seems to be getting more and more deeply tied together.

04. Summary

From the current perspective, Ethereum's original intention has not changed, and what should be achieved has been achieved. The only reason it has changed is that the "fickle" holders can't resist the temptation. In the context of the depletion of liquidity in the macro environment, the crypto narrative has shrunk, and it is understandable to chase Meme (the economy is bad, and people gather at the village entrance to try their luck), but the next global interest rate cut cycle will lead to the gradual release of liquidity or bring about changes. Don't forget that the adoption of crypto assets and the landing value of Web3 applications will eventually return.

As the first and second largest crypto assets, Bitcoin and Ethereum, which are bound to each other in the future, are not hostile to each other, nor are they black and white. No matter which camp the crypto community stands in, it should stop internal friction and "eating and smashing the pot" behavior, and move towards the next generation of the Internet with broader mass adoption. I hope that the other ETH will not disappoint us in the future.