Written by: Chandler, Foresight News

On October 24, market data showed that the price of Bitcoin fell below $66,000. Since October 21, Bitcoin's upward momentum has weakened, falling from a high of $69,500 to a low of $65,260. Ethereum's trend is synchronized with Bitcoin, falling from a high of $2,770 to a low of $2,440. According to data from Coinglass, the market liquidation amount reached $279 million in the past 24 hours, of which long orders liquidation reached $202 million.

Has the market reached its peak again? Perhaps we can find some clues from the on-chain data.

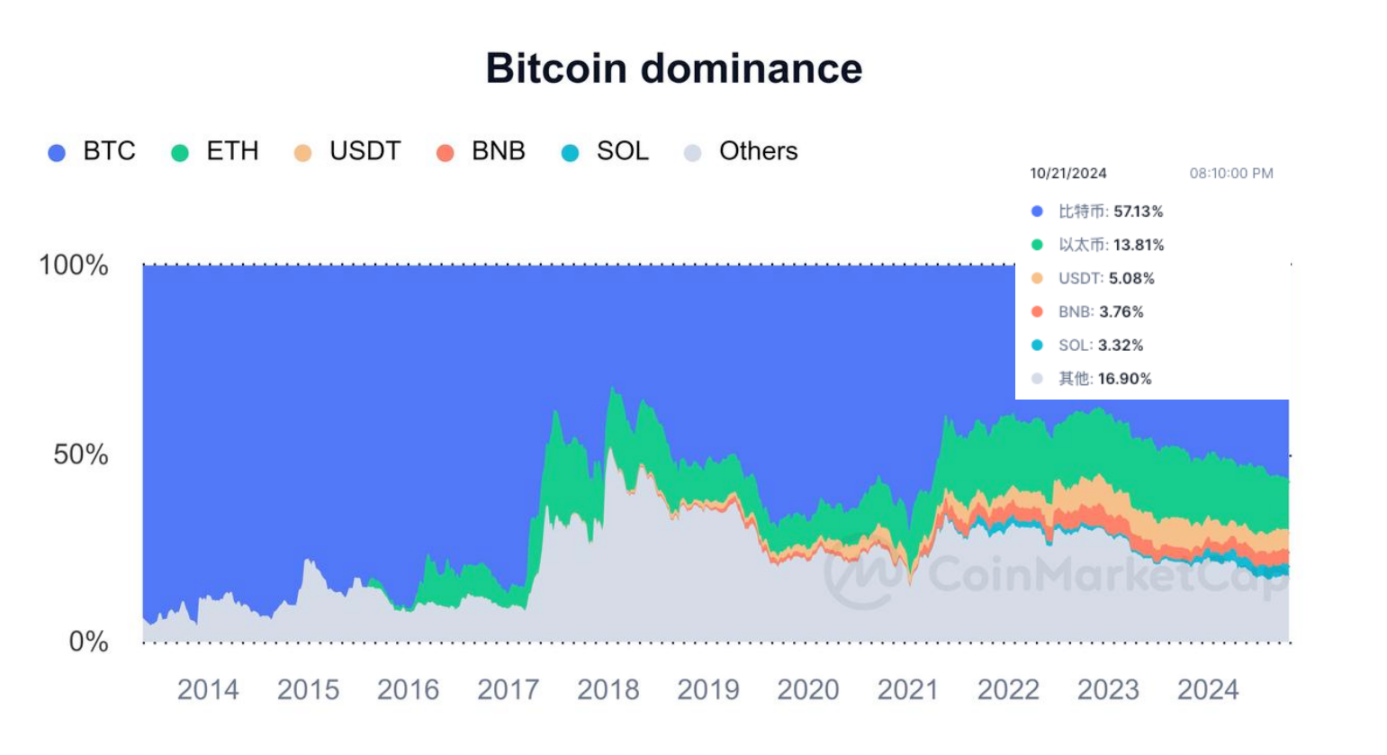

Bitcoin's market share rises to three-year high

Bitcoin Dominance Index (BTC.D) is an index that represents the current share of Bitcoin's market value in the cryptocurrency market. Since around September 2022, BTC's market share has been on an overall upward trend. According to Coinmarketcap data, BTC's market share has recently been close to 58%, up more than 8% throughout the year, reaching a high since April 2021.

According to historical data, the early stages of a bull market cycle are usually accompanied by an increase in Bitcoin's market share, while when the market enters the "Altcoin Season" of altcoins, Bitcoin's market share usually declines. At the same time, when Bitcoin's market share reaches a high point, the market tends to enter a sideways or correction phase. In theory, this is a manifestation of market liquidity and investment sentiment reaching a critical point. It is a natural result of the market starting to take profits after Bitcoin has attracted a large amount of capital inflows and the price has reached a high level.

The flow of funds for Bitcoin spot ETFs becomes the key

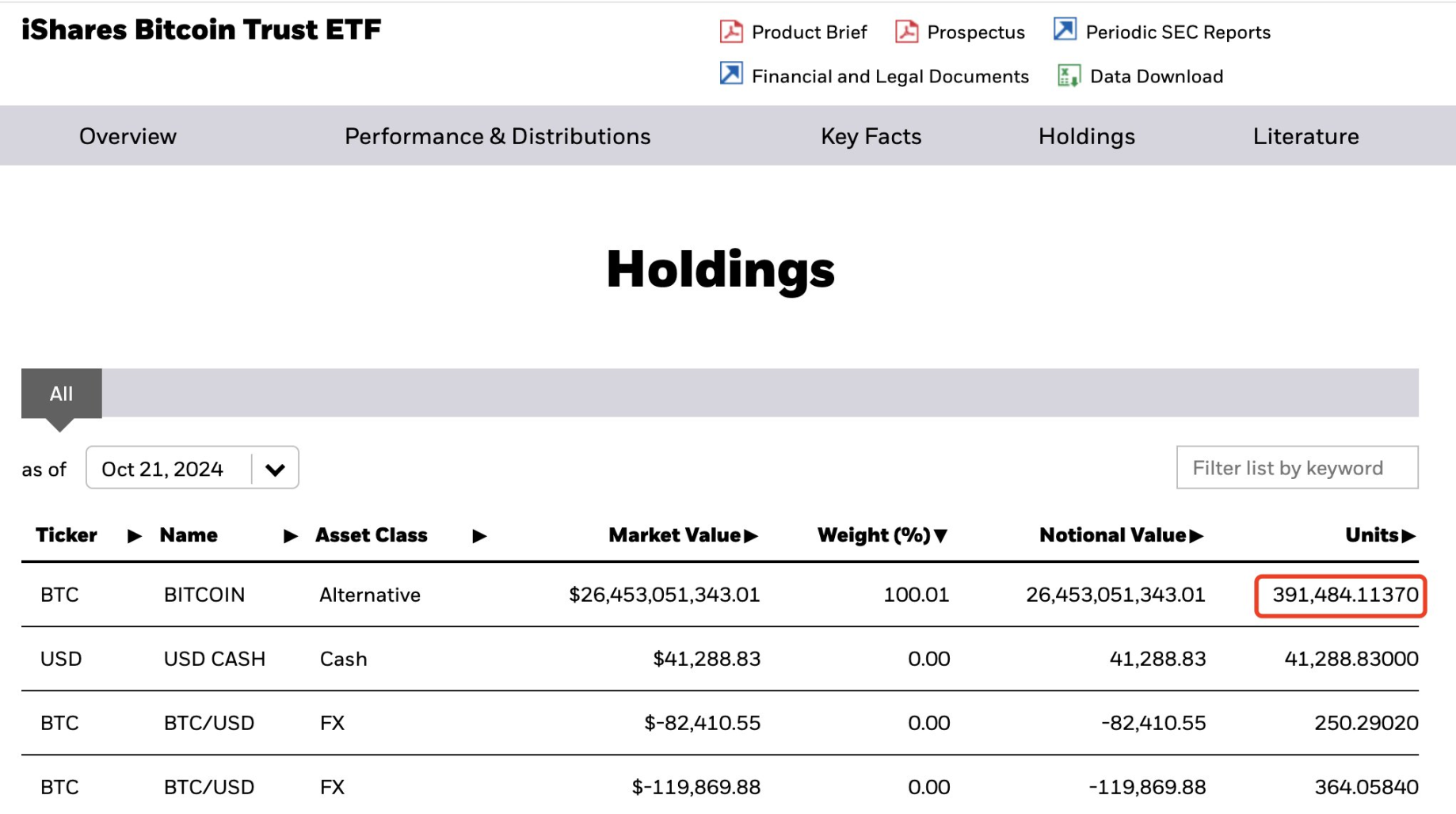

It is worth noting that the increase in Bitcoin's market share in this round of market is mainly driven by the large-scale inflow of funds from Bitcoin spot ETFs, especially the participation of institutional investors. According to data disclosed by Ki Young Ju, CEO of CryptoQuant, institutional holdings in US Bitcoin spot ETFs account for about 20%. Asset management companies hold about 193,000 Bitcoins. Thanks to spot ETFs, 1,179 institutions have joined in investing in Bitcoin this year.

From the data, from October 14 to October 21, Bitcoin spot ETFs continued to have net inflows for 7 consecutive days, especially BlackRock ETF IBIT, which had a net inflow of more than $1.5 billion, bringing its current holdings of BTC to 391,484 (worth approximately $26.45 billion). The price of Bitcoin also rose from $62,300 to more than $69,000.

With the first net outflow of Bitcoin spot ETF after 7 days of net inflow on October 22, Eastern Time, with a total net outflow of US$79.0905 million, the price trend of Bitcoin also began to fluctuate with stagflation and a downward trend. This phenomenon can be interpreted as the market has not broken through important technical support points, and investors' confidence in the short-term prospects of the market has declined. When institutional funds begin to decrease or flow out, prices will fall. If Bitcoin fails to break through effectively, the price trend may face further consolidation and volatility.

From another perspective, judging from the market's reaction, the rise of Bitcoin has attracted a lot of liquidity, which is particularly evident in the current market stage. At the same time, Bitcoin has gradually absorbed the liquidity of other altcoins during the period of volatility, further forming an obvious "blood-sucking" effect. In the process of Bitcoin's rise, the prices of other crypto assets often do not rise with it, causing market liquidity to further tilt toward Bitcoin. If Bitcoin fails to break through the key resistance level, the market may experience a short-term correction, liquidity will be further withdrawn from the altcoin market, and price volatility will also increase. Usually when Bitcoin reaches a new high, some liquidity may overflow into the altcoin market, which may usher in a larger-scale price increase.

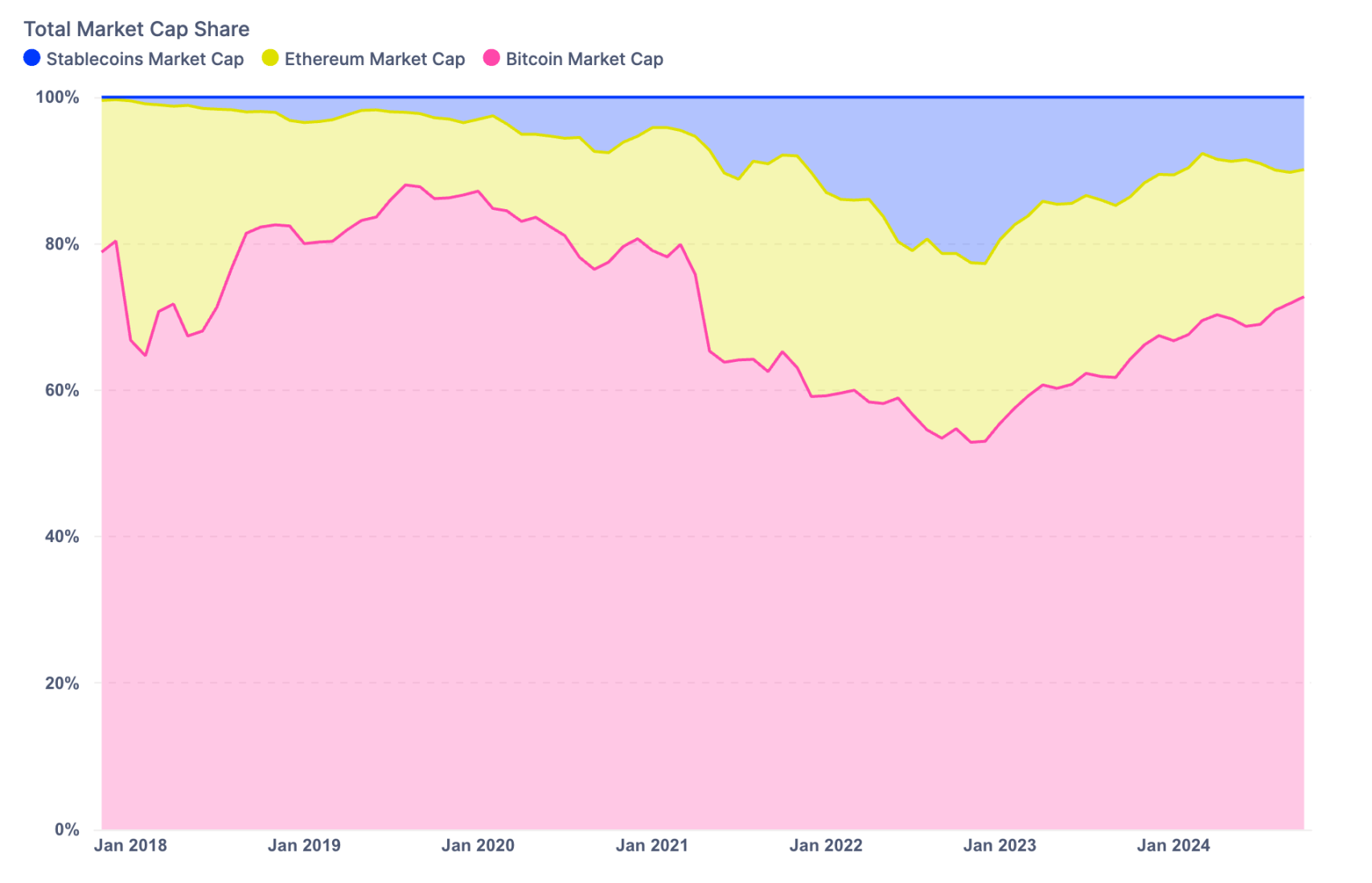

USDT market value hits a record high, USDT.D hits support

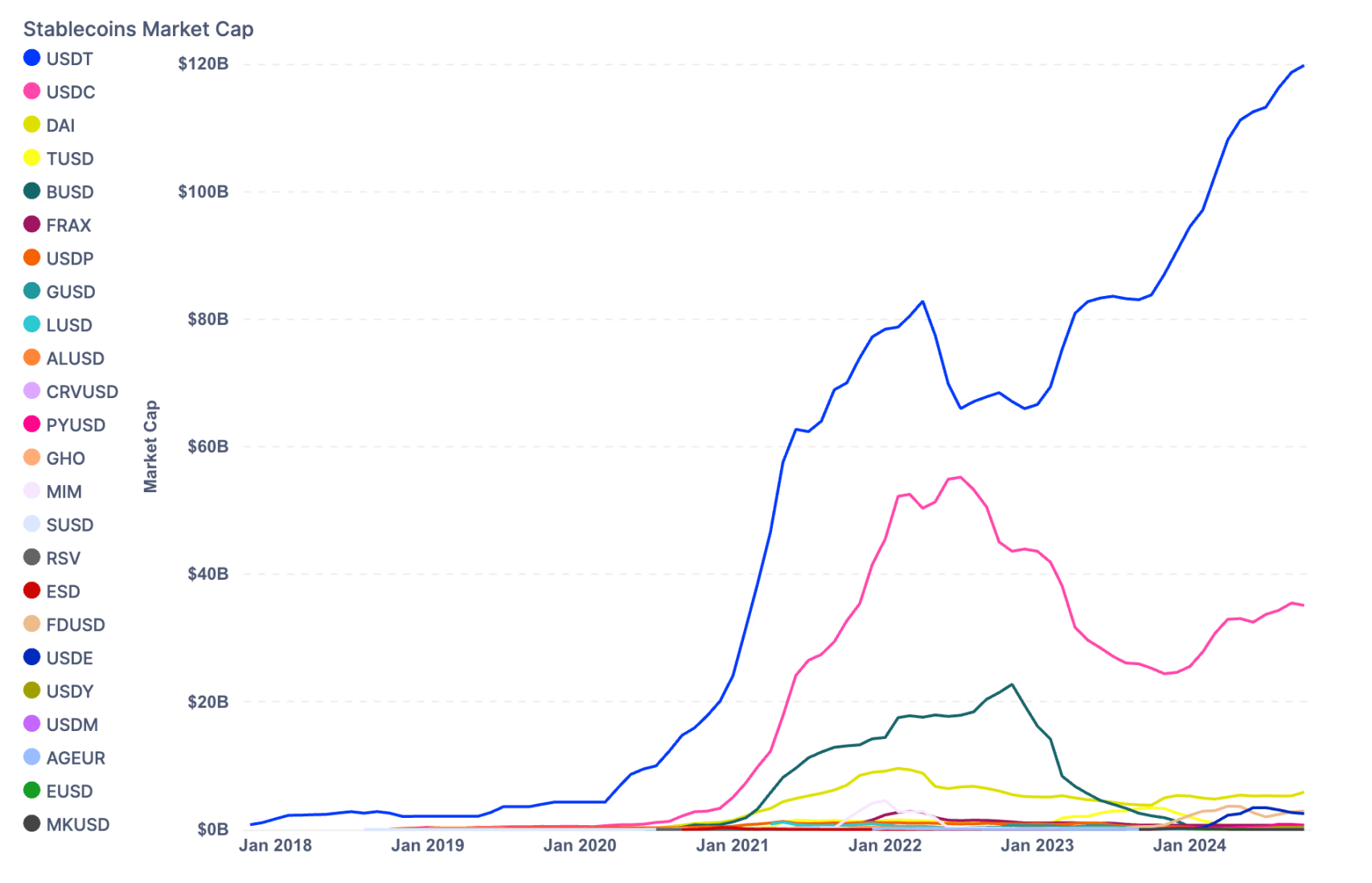

The total market value of stablecoins has increased its share by taking away Ethereum's share. Excluding other altcoins, its share of the total market value of BTC, ETH and stablecoins has increased from 7% to 10% in 2024. According to DefiLlama data, the total market value of stablecoins is now $172.778 billion, a new high since May 2022.

Among them, USDT's market value hit a record high of $120 billion, accounting for 69.49% of the total stablecoin market value. This is also the main driving force for stablecoins to seize market share from ETH in the past six months.

The collapse of Silicon Valley Bank (SVB) in March 2023 was a turning point in the competition for stablecoins, causing USDC's share to shrink significantly and USDT's supply to increase. But to a certain extent, the rise of USDT Dominance Index (USDT.D) is not a happy thing for the market. USDT.D can serve as a barometer of market sentiment and effectively predict the top and bottom of Bitcoin's price in different cycles.

As can be seen from the figure below, in this year's market, whenever USDT.D approaches or retests its long-term rising support line, Bitcoin tends to have a local price peak. This is because investors tend to transfer funds to stablecoins such as USDT to avoid risks during market fluctuations. Therefore, when USDT.D rises, it usually implies the withdrawal of market funds, which is the recent high point of Bitcoin prices.

Weakened demand side

From a medium- to long-term perspective, the absolute realized profits and losses in the current Bitcoin market are showing a significant downward trend. Since Bitcoin reached its all-time high of $73,000 in March 2024, the rate at which new capital flows into the market has slowed significantly. According to data provided by Glassnode, the current daily capital inflow into the market is about $730 million. Although this number is still not small, it is a significant decline compared to the peak of $2.97 billion in March.

This shows that the momentum of market demand has obviously weakened. Although funds are still flowing into the market, the scale is not enough to drive the long-term stable rise or fall of Bitcoin prices. Instead, it is more likely to experience sharp fluctuations under relatively small changes in funds. This lack of liquidity may cause Bitcoin to continue to show large price fluctuations in the short term. At the same time, the overall lack of clear direction in the market has made the wait-and-see sentiment of large funds even stronger.

In general, Bitcoin is currently in a market situation where high volatility and uncertainty coexist. The price trend in the past six months is more like a continuous and repeated fluctuation within the existing range. Before there is a real large-scale capital injection or outflow, it may be difficult for the price of Bitcoin to break the current volatile pattern.

This market phenomenon is closely related to the emotional fluctuations of market participants. Large funds are in a wait-and-see mood, and many institutional investors choose to wait for clearer market signals, such as further clarification of macroeconomic policies or adjustments to the Federal Reserve's future monetary policy, as well as the upcoming US presidential election. At the current stage, market sentiment is relatively fragile, and any sudden changes at the macro level may become a catalyst for market fluctuations.