For Hong Kong, digital asset finance is a historic train that cannot be missed.

Since the official release of the Virtual Asset Policy Declaration on October 31, 2022, Hong Kong has become one of the most determined and active jurisdictions in embracing Web3 and digital assets among the world's international financial centers. From the Hong Kong government's clear and solemn policy commitments to the institutional support at the execution level of the Securities and Futures Commission, the Hong Kong Monetary Authority and other agencies, Hong Kong is striding towards the forefront of innovation in digital asset finance.

Among them, the tokenization of real-world assets (RWA) is a key part of the Hong Kong government's digital asset financial strategy. In particular, on August 28, 2024, the Hong Kong Monetary Authority officially launched the "Ensemble" sandbox program, which will use experimental tokenized currencies to promote interbank settlement and focus on tokenized asset transactions. This marks the Hong Kong government's forward-looking layout in the field of tokenized assets and also demonstrates Hong Kong's determination to become a global RWA tokenization center.

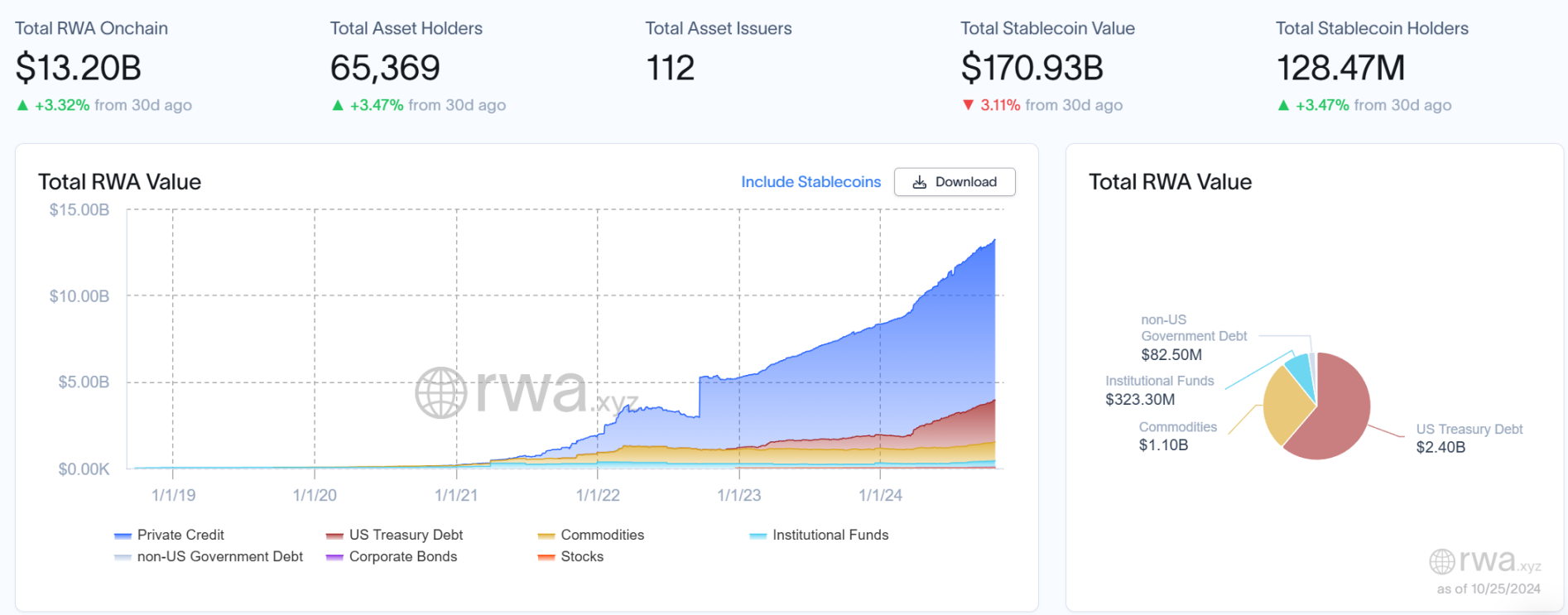

According to the latest data from the RWA research platform rwa.xyz, the current total RWA market size exceeds US$13 billion, and BlackRock's forecast is even more optimistic. By 2030, the market value of tokenized assets is expected to reach US$10 trillion, which means that the potential growth space in the next seven years may be as high as more than 75 times!

Source: rwa.xyz

Such a huge incremental space has laid the market foundation for Hong Kong to become a global RWA tokenization hub. It is worth noting that during this Hong Kong Fintech Week, OSL successively announced its cooperation with China Asset Management to launch a tokenized fund project for Hong Kong retail investors within the framework of the Ensemble project, and worked with Franklin Templeton to conduct a proof of concept for wealth management products (including money market fund tokens) on the distribution chain.

This article will give you a preliminary understanding of the "Ensemble" project, analyze the layout and potential of retail RWA products such as tokenized fund projects explored by OSL in the Hong Kong market, and whether Hong Kong has the potential to move towards a global leading position in digital asset finance.

Hong Kong’s Crypto Ambition Behind “Ensemble”

The "Ensemble" project is not a sudden whim of Hong Kong in the field of digital asset finance, but a far-reaching strategy for it to lay out its digital asset finance ticket and consolidate its position as an international financial center.

As early as March 2024, the Hong Kong Monetary Authority officially announced the "Ensemble" project, clearly stating its support for the development of Hong Kong's tokenized market, and will initially focus on tokenized deposits (that is, commercial bank deposits in digital form issued and provided by commercial banks to the public).

The "Ensemble" sandbox will then further study and test tokenized use cases, including the delivery of tokenized real-world assets (such as green bonds, voluntary emission reductions, aircraft, electric vehicle charging stations, electronic bills of lading and treasury management), and is more likely to develop into a new financial market infrastructure as a bridge between tokenized real-world assets and tokenized currencies in transactions.

Source: Hong Kong Monetary Authority

To put it bluntly, the Hong Kong government and financial regulators have been relaxing policies for the digital asset industry and promoting the innovative development of the industry for many years. The emergence of the "Ensemble" project is a digital asset financial experimental platform created by Hong Kong in this context. It not only helps Hong Kong establish a compliance-oriented testing system, but also provides an opportunity to test the waters for future digital asset innovation businesses.

As we all know, RWA tokenization refers to the tokenization of physical assets (such as bonds, gold, real estate and other commodities) into digital assets on the blockchain, thereby bringing some unique advantages that are difficult to match with both native assets on the chain and traditional financial assets:

- Improved cost-effectiveness: First, tokenization eliminates the need for intermediary brokers, significantly reducing transaction costs and improving efficiency;

- Better accessibility: Secondly, tokenization allows traditional assets to be divided into smaller portions, thereby improving accessibility and liquidity;

This means that RWA can become the main driving force for the increase in on-chain digital assets, enabling Web3 to effectively reach the huge asset pool of traditional markets, such as the global bond market (US$133 trillion) and the gold market (US$13.5 trillion) - under the framework of tokenization, these physical assets can not only enter the on-chain trading ecosystem, but also obtain DeFi income through lending and staking, introducing real-income asset support to the digital asset market and enhancing its value foundation.

It should be noted that since Compound detonated the DeFi summer in 2020, the volume of digital assets has ushered in a substantial development. As of October 25, 2024, the on-chain TVL is as high as 88 billion US dollars. However, compared with the trillions of dollars of tokenizable RWA assets (bonds, gold, stocks, real estate, etc.), this volume is still insignificant, so RWA tokenization will undoubtedly bring strong incremental momentum to on-chain assets.

Source: DefiLlama

It can be foreseen that with the gradual popularization of RWA tokenization, the on-chain world will usher in deeper changes, the boundaries between traditional finance and digital finance will become increasingly blurred, and the on-chain asset system will not only expand significantly in scale, but will also achieve breakthroughs in compliance and transparency, bringing more diversified choices to global investors.

This is exactly the significance of the "Ensemble" project: by building a highly innovative testing platform, Hong Kong is conducting forward-looking explorations for the deep integration of the digital asset financial ecosystem. Its new products and new models will become a "preview" of Hong Kong's next stage of digital asset innovation, providing strong momentum for Hong Kong as a global RWA tokenization hub.

The collaboration between OSL, China Asset Management and Franklin Templeton is precisely to jointly promote the integration of traditional finance and digital asset finance, enhance on-chain compliance and transparency, and lay a solid foundation for the future expansion of the digital asset market.

RWA tokenization, a crypto-era train that Hong Kong cannot miss?

Hong Kong's demand for RWA tokenization stems from its deep financial cultural background as an international financial center. First of all, RWA tokenization provides a new opportunity for the integration of digital assets and traditional finance, allowing funds, bonds, equity, etc. to be tokenized through blockchain technology and digital assets, thereby improving the liquidity and accessibility of assets.

At the same time, the huge and mature asset targets and scale required by the RWA market are exactly the comfort zone of Hong Kong as an international financial giant - it covers a wide range of financial services formats, has many years of accumulation and rich experience, a mature risk control system, a complete trading infrastructure and a large customer base.

Therefore, these advantages can help Hong Kong quickly put RWA assets on the chain, provide the market with compliant and secure transaction solutions, and become a bridge between Web2 and Web3.

Source: Miles Deutscher

In other words, it is to connect on-chain assets with real-world assets. This is also the solution that is extremely lacking and desired for the integration of digital asset finance and traditional finance. For this reason, under the framework of the "Ensemble" project, Hong Kong has set up four key themes for the experimental testing of RWA tokenization - fixed income, investment funds, securitization and trade finance, among which fixed income and investment funds are regarded as the initial experimental focus of RWA tokenization.

Take OSL's collaboration with Franklin Templeton in the Ensemble project to conduct a proof of concept for tokenized fund products as an example. As a leading representative of this exploration, this move is expected to promote the on-chain and transparency of fixed-income products and bring innovative changes to the asset management field:

- Compliance and security: OSL relies on the Hong Kong Monetary Authority’s compliance testing platform to ensure that tokenized funds meet regulatory standards and provide a safe and reliable investment channel for global investors;

- Improved liquidity and transparency: Tokenization enables fund products to be traded transparently on the blockchain, and assets can be divided into small amounts, which increases liquidity and allows investors to enjoy the liquidity and transparency advantages of a decentralized market;

- Efficiency improvement and cost optimization: Tokenization simplifies the management process of traditional funds, reduces intermediary costs, and makes fund products more inclusive, thereby attracting a wider range of retail investors;

In short, OSL’s collaboration with Franklin Templeton’s tokenized investment fund product will not only significantly improve settlement speed and efficiency in theory, but also lower the barrier to entry by allowing small investments, bringing a new source of liquidity to the market, which is expected to further promote the development and popularization of the RWA market.

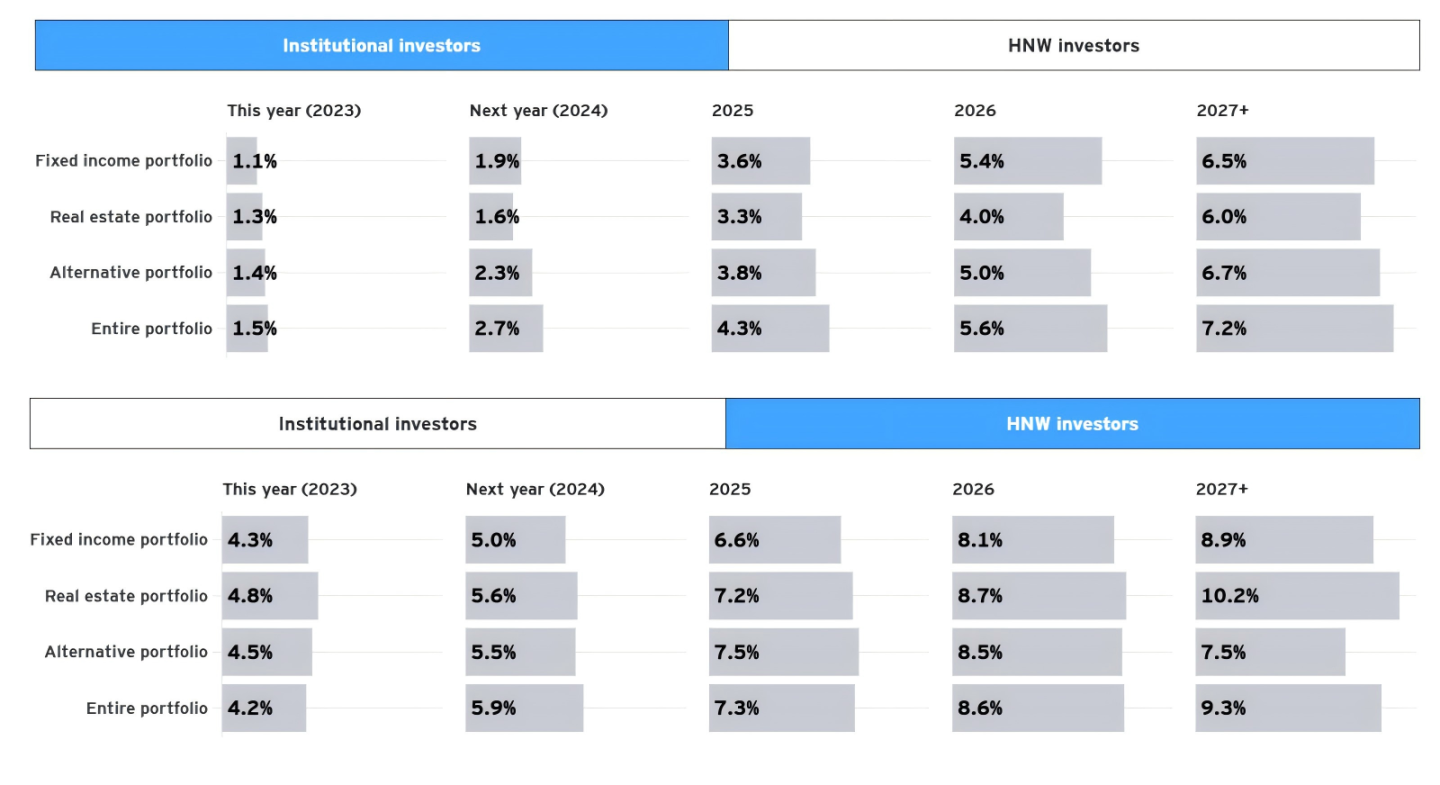

Source: EY

In the future, RWA tokenization represented by investment fund products will bring new sources of liquidity to the Hong Kong market and promote its global popularity:

According to EY's forecast, by 2026, institutions and high-net-worth investors are expected to allocate 5.6% and 8.6% of their portfolios to tokenized assets, which means that within three years starting from this year, the incremental increase in RWA tokenized investment allocations by institutions and high-net-worth investors will generally exceed 100%.

Will retail products be the tipping point for RWA?

Which is the most successful digital asset financial product in the world in the past five years?

The answer is not difficult to guess. It is neither the on-chain financial innovations such as Uniswap that ignited the DeFi Summer, nor the digital artworks such as CryptoPunks that set off the NFT craze. Instead, it is the stablecoins that everyone has long been accustomed to.

That’s right, stablecoins with RWA attributes for ordinary users have become one of the widely accepted use cases of digital assets - the number of accounts on the TRC20 version of USDT chain alone exceeds 40 million, truly making blockchain no longer a carnival for a few people, and greatly broadening and deepening the user base of Web3 and digital assets.

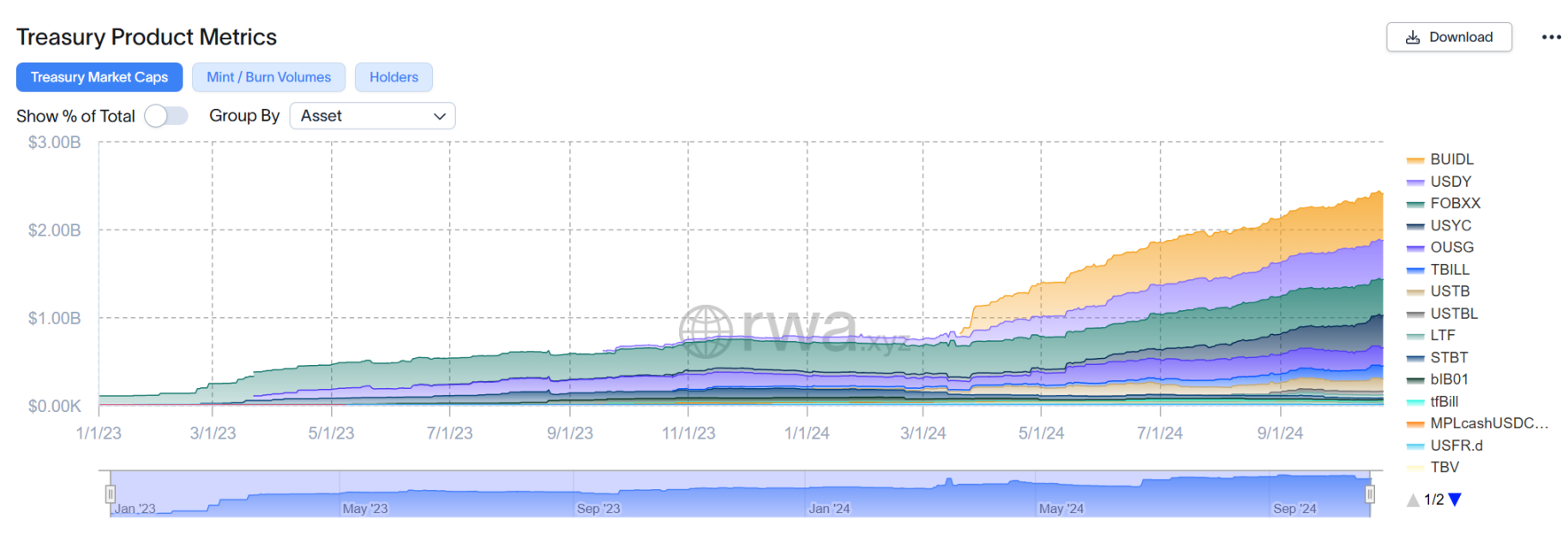

Major TradFi institutions such as BlackRock, Citibank, Franklin Templeton and JPMorgan Chase have also focused on such products, aiming to further expand the application of digital assets in daily financial life. Currently, the scale of circulating tokenized Treasury funds led by Franklin On-Chain U.S. Government Money Fund (FOBXX) and BlackRock U.S. Dollar Institutional Digital Liquidity Fund (BUIDL) has reached nearly US$1 billion, laying a solid foundation for the application of RWA tokenized products in the retail market.

Objectively speaking, retail RWA tokenized products have the inclusive advantage of attracting more ordinary investors to participate: in the past, ordinary investors who wanted to participate in U.S. Treasury bonds, real estate or high-end stocks in the traditional financial market often faced high capital thresholds and complicated transaction processes. Now, through RWA tokenization, these assets can be divided into smaller trading units, greatly reducing the investment threshold.

More importantly, retail RWA products enhance risk control capabilities through the transparent nature of blockchain, bring higher trust to investors, and promote the further application and popularization of digital assets in daily financial life. In the field of RWA tokenization in Hong Kong, there are also a number of digital asset companies that are promoting compliant RWA innovation and promotion.

OSL, as Hong Kong's first licensed virtual asset platform, has played a key role in this process. In particular, it is well aware of the strategic significance of retail RWA products to Hong Kong's digital asset ecosystem. Therefore, it is actively committed to introducing tokenized assets into the mass market, including relying on its own policy advantages as a compliant platform to expand traditional financial institution partners to provide customers with compliant RWA trading services.

- Hong Kong's first licensed platform with rich experience: As the first trading platform in Hong Kong to be awarded a virtual asset license, OSL has more than six years of rich experience in the digital asset industry;

- Extensive cooperation with top traditional financial institutions: OSL has established a solid cooperative relationship with financial institutions such as UBS, China Asset Management, Harvest Fund, and Franklin Templeton to jointly promote projects such as digital asset ETFs and investment fund tokenization;

- Compliance protection and insurance coverage: OSL follows strict regulatory requirements and provides a compliant and secure cooperation environment for financial institution partners. At the same time, it has obtained the world's largest insurance line of US$1 billion, becoming the single digital asset custodian with the highest insurance amount and the longest insurance period in the world;

- Full product line and full service license: OSL started out as an OTC business in Hong Kong and now has a full license to provide tokenization projects, providing a comprehensive solution - covering the issuance, custody, trading services, asset distribution and blockchain technology services of digital securities;

It should be noted that in terms of business model, RWA covers multiple levels from underlying infrastructure to upper-level DeFi, and OSL and others can provide underlying infrastructure services, responsible for tokenizing physical assets and hosting them on the chain; at the same time, they can also carry out middle-layer business, introduce asset returns into the DeFi field, and provide investors with more profit opportunities.

Overall, OSL's layout not only helps Hong Kong strengthen the connection between Web3 and traditional finance, but also brings investors higher trust and convenient participation experience through compliant asset management and risk control.

Conclusion

For the exploration of digital asset finance in Hong Kong, RWA tokenization is indeed a "paradigm shift" worth looking forward to. If a method can be found to legally combine on-chain digital assets and real-world assets, and if it is promoted in retail forms such as OSL and China Asset Management, it is not ruled out that it will be the next "trigger point" for digital asset finance.

From this perspective, the role played by OSL also highlights Hong Kong's advantages in global digital asset financial innovation. As one of the world's oldest virtual asset companies, OSL has deep digital asset expertise, which guarantees the compliance and transparency of the RWA tokenization project. This is also Hong Kong's unique natural advantage:

It should be noted that as an international financial center, Hong Kong has abundant traditional financial resources. Whether it is a mature risk control system, a complete trading infrastructure or a large customer base, they all support it in introducing RWAs such as funds, stocks, and gold onto the chain in the form of RWAs, thereby completely releasing its liquidity.

At present, we have the confidence to look forward to its early arrival.