Author: Bai Ding&Shew, GodRealmX

The USD0++ depegging issued by Usual has recently become a hot topic in the market and has also caused panic among many users. The project has risen more than 10 times since it was listed on the top CEX in November last year. Its stablecoin issuance mechanism based on RWA is similar to The token model is quite similar to Luna and OlympusDAO in the previous cycle. In addition, with the government background endorsement of French MP Pierre Person, Usual once received widespread attention and heated discussion in the market.

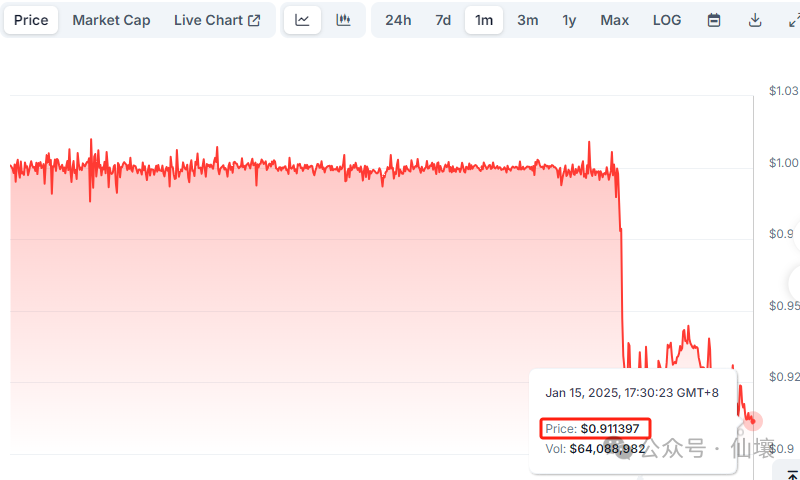

Although the general public once had a beautiful vision for Usual, the recent "farce" has brought Usual down from the altar. With Usual's official announcement on January 10 that it would revise the early redemption rules of USD0++, USD0++ was once decoupled from the anchor to nearly USD 0.9. As of the evening of January 15, 2025 when this article was published, USD0++ was still hovering around USD 0.9.

The controversy surrounding Usual has reached its peak, and the dissatisfaction in the market has completely erupted, causing an uproar. Although the overall product logic of Usual is not complicated, it involves many concepts and trivial details. For a variety of different tokens, many people may not have a systematic understanding of the cause and effect.

The author of this article aims to systematically sort out the causal relationship between Usual product logic, economic model and the USD0++ depegging from the perspective of DeFi product design, so as to help more people deepen their understanding and thinking about it. A view that seems a bit "conspiracy theory":

In a recent announcement, Usual set the unconditional floor price of USD0++ to USD0 to 0.87, with the aim of blowing up the USD0++/USDC revolving loan positions on the Morpha lending platform and eliminating the main users in the mining, withdrawal and selling, but not to the extent that USDC++/ The USDC vault has systemic bad debts (the liquidation line LTV is 0.86).

Below we will explain the relationship between USD0, USD0++, Usual and its governance token, and help everyone understand the tricks behind Usual.

Understanding Usual’s products from the tokens it issues

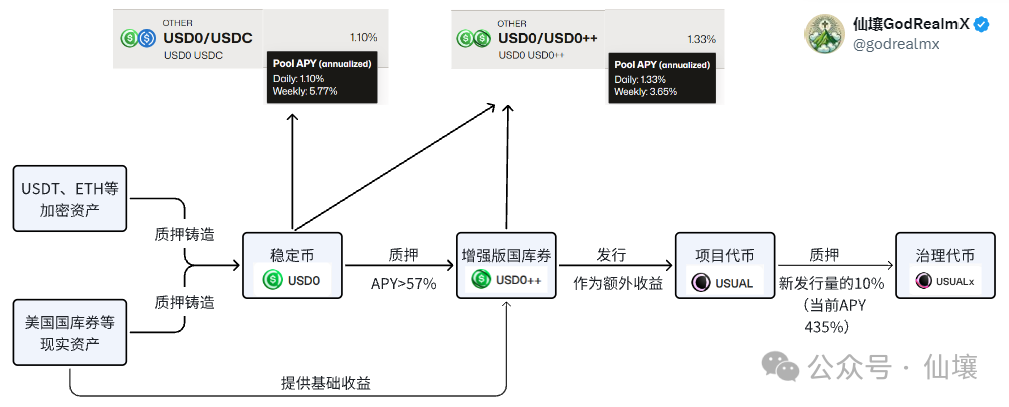

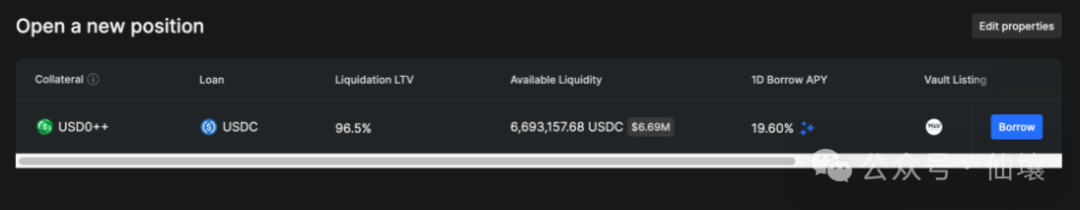

There are four main tokens in Usual's product system, namely stablecoin USD0, bond token USD0++ and project token USUAL. In addition, there is also governance token USUALx, but since the latter is not important, Usual's product logic is mainly based on The first three types of tokens are divided into three layers.

First layer: Stable currency USD0

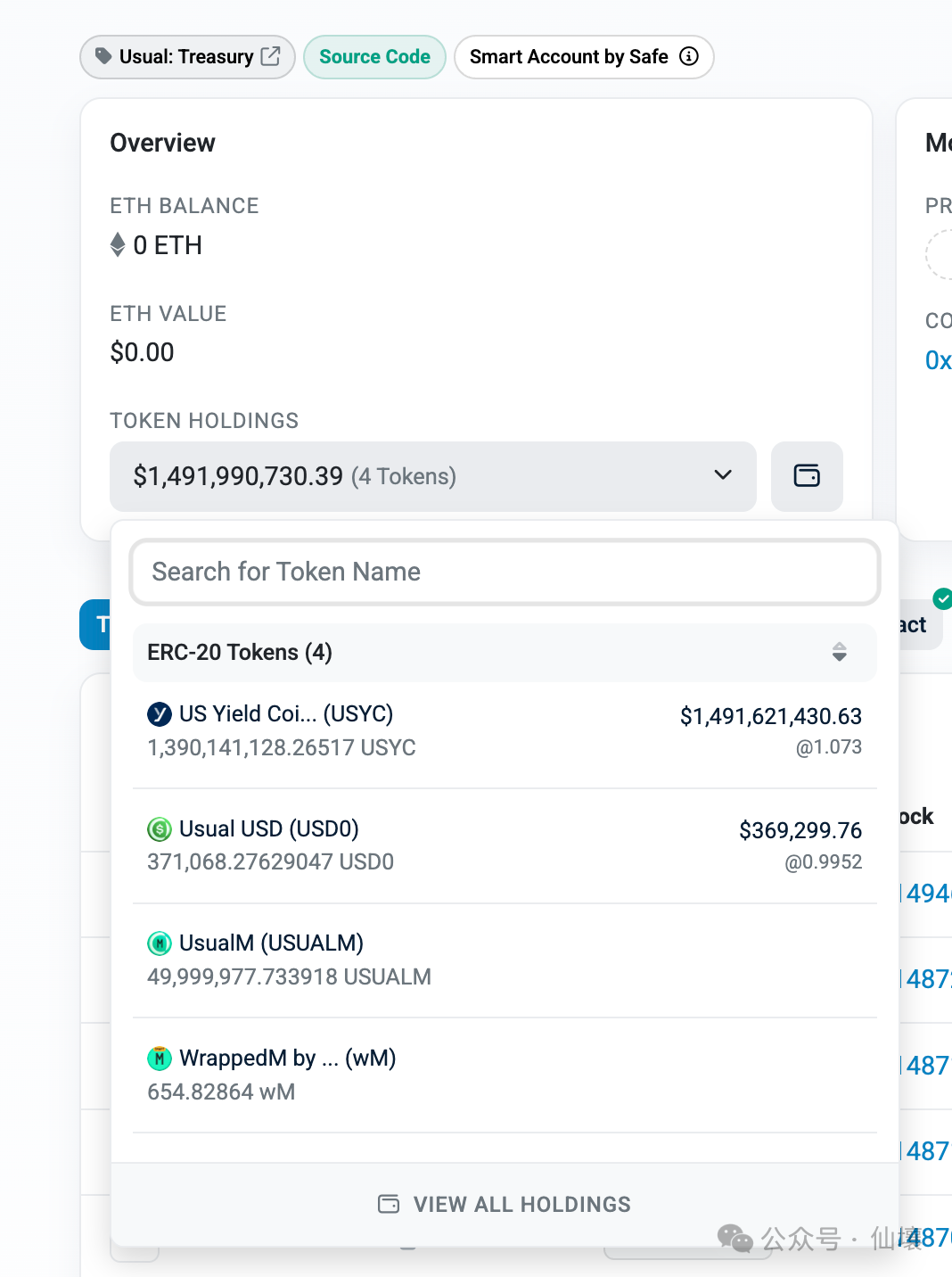

USD0 is an equal collateral stablecoin, using RWA assets as collateral. All USD0 is backed by RWA assets of equal value. However, most USD0 is minted with USYC, and some USD0 uses M as collateral. Collateral. (USYC and M are both RWA assets secured by US short-term Treasury bonds)

It can be found that the collateral on the USD0 chain is located at

The address 0xdd82875f0840AAD58a455A70B88eEd9F59ceC7c7 holds a huge amount of USYC assets.

Why does the vault used to store the underlying RWA assets contain a lot of USD0? This is because when users destroy USD0 to redeem RWA tokens, part of the handling fee will be deducted, and this part of the handling fee will be stored in the vault in the form of USD0.

The contract address for minting USD0 is 0xde6e1F680C4816446C8D515989E2358636A38b04. This address allows users to mint USD0 in two ways:

1. Directly mint USD0 with RWA assets. Users can inject tokens supported by Usual such as USYC into the contract to mint USD0 stablecoins;

2. Transfer USDC to the RWA provider and mint USD0.

The first solution is relatively simple. The user enters a certain amount of RWA tokens, and the USUAL contract calculates how much these RWA tokens are worth in US dollars, and then sends the corresponding USD0 stablecoin to the user. When the user redeems, the amount of USD0 entered by the user is calculated based on the amount of USD0 The RWA token price returns the RWA token of corresponding value. In this process, the USUAL protocol will deduct part of the handling fee.

It is worth noting that most RWA tokens currently have automatic compounding, and will continue to generate interest through additional issuance or value growth. RWA token issuers often hold a large amount of interest-bearing assets off-chain, the most common of which is U.S. Treasury bonds. The interest on the interest-earning assets is then returned to the RWA token holders.

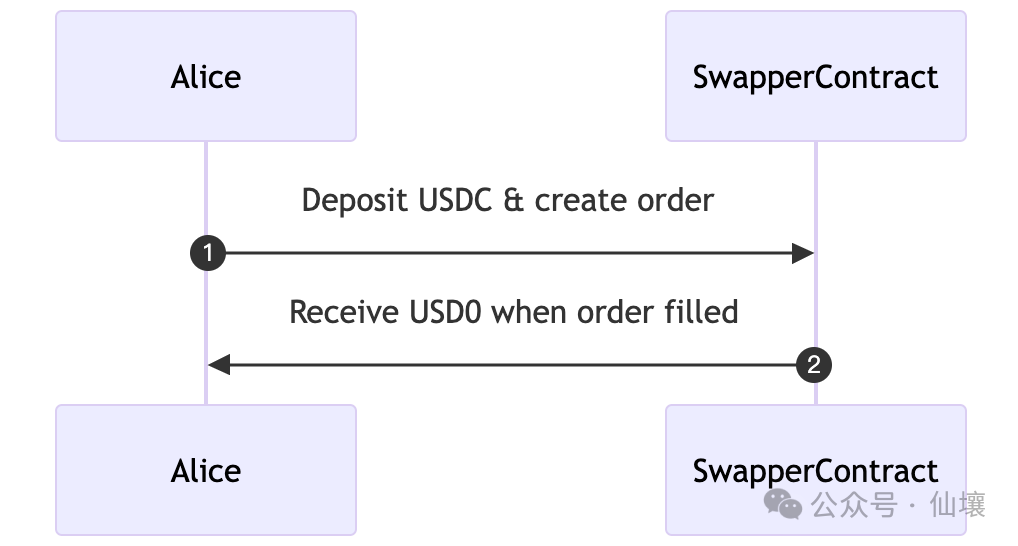

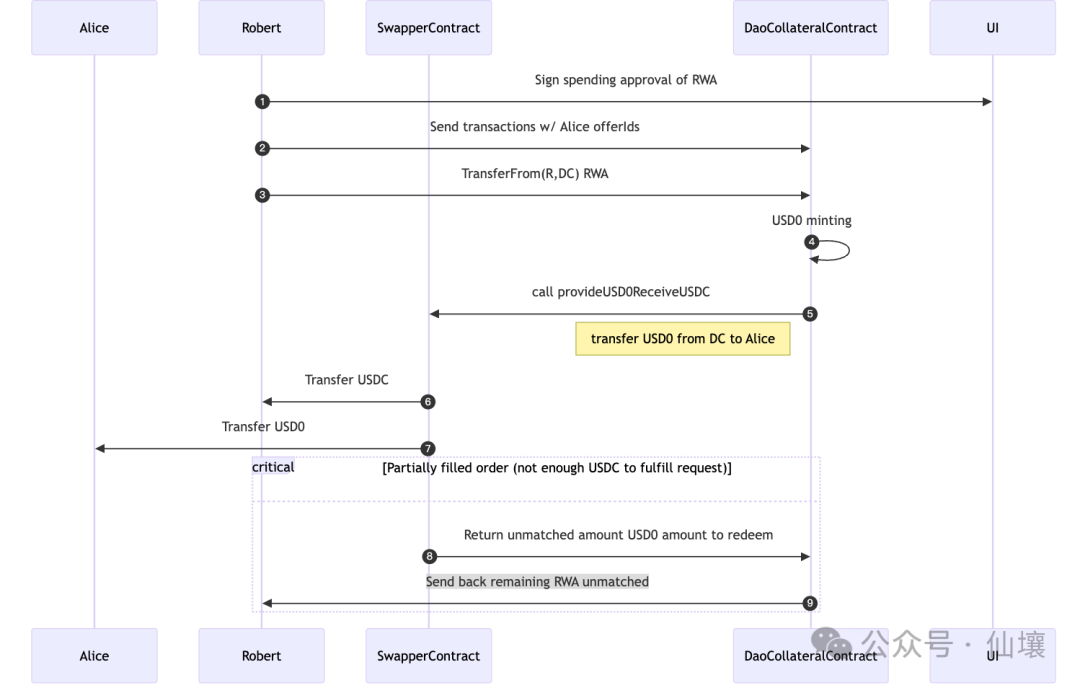

The second USD0 minting solution is more interesting. It allows users to mint USD0 directly with USDC. However, this process must involve the participation of RWA providers/payers. In simple terms, users must place orders through the Swapper Engine contract and declare The amount of USDC paid is sent to the Swapper Engine contract. When the order is matched, the user can automatically obtain USD0. For example, for user Alice, the process she perceives is as follows:

However, the actual process involves the participation of RWA providers/payers. Taking the following figure as an example, Alice’s request to exchange USDC for USD0++ is responded to by RWA provider Robert, who directly mints USD0 with RWA assets and then uses the Swapper Engine contract to exchange USD0++ with Alice’s request to exchange USDC for USD0++. Transfer USD0 to the user, and then take away the USDC assets paid by the user when placing an order.

Robert in the picture below is the RWA provider/payer. It is not difficult to see that this model is essentially similar to Gas payment. When you want to use a token that you don’t have to trigger some operations, you use other tokens to find someone to replace you. Trigger the operation, and the latter will try to transfer the "proceeds" after the triggering operation to you, and charge some handling fees from it.

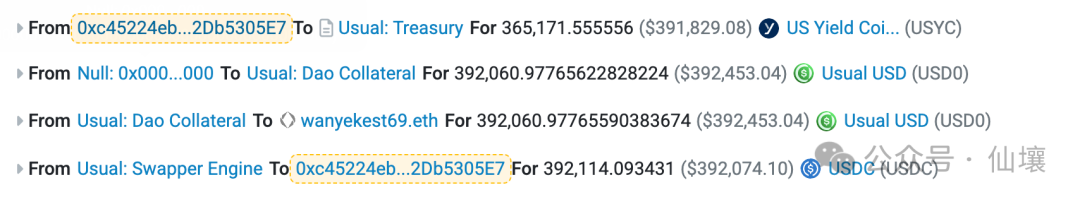

The following figure shows the series of transfer actions triggered when the RWA provider accepts the user's USDC assets and mints USD0 tokens for the user:

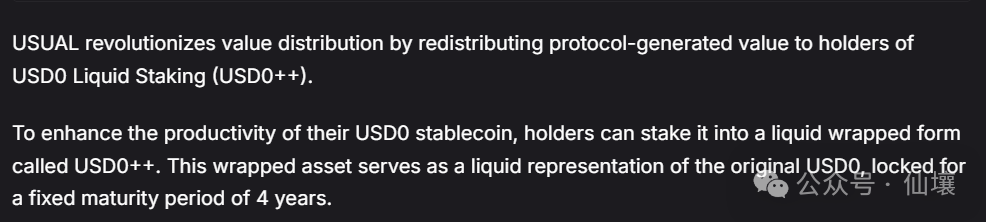

Second layer: Enhanced Treasury Bond USD0++

In the above article, we mentioned that users need to pledge RWA assets when minting USD0 assets, but the interest automatically generated by RWA assets will not be directly distributed to the person who minted USD0, so where does this part of the interest go in the end? The answer is that it flows to Usual The DAO organization will then redistribute the interest on the underlying RWA assets.

USD0++ holders can share the interest income. If you pledge USD0 to mint USD0++ and become a USD0++ holder, you can share the interest of the bottom-level RWA assets. But please note that only the bottom-level RWA corresponding to the USD0 that minted USD0++ The interest will be distributed to USD0++ holders.

For example, the underlying RWA asset currently used for collateral casting of USD0 is $1 million. $1 million of USD0 is cast, and then $100,000 of the USD0 is cast into USD0++. Then these USD0++ holders only get $100,000. The interest income from RWA assets and the interest on the other $900,000 of RWA assets became the income of the Usual project party.

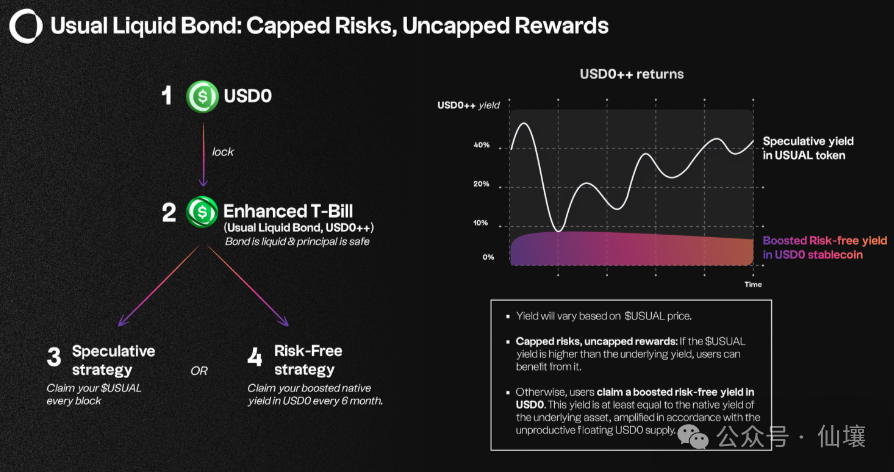

In addition, USD0++ holders can also receive additional USUAL token incentives. USUAL will issue and distribute tokens every day through a specific algorithm, and 45% of the newly added tokens will be allocated to USD0++ holders. The proceeds are divided into two parts:

- The income of the underlying RWA assets corresponding to USD0++;

- Daily income from the distribution of new USUAL tokens;

The above chart shows the sources of USD0++ income. Holders can choose to receive daily income denominated in USUAL, or receive income denominated in USD0 every 6 months.

With the support of the above mechanism, the APY of USD0++ pledge is usually maintained at more than 50%, and it is still 24% after the incident. However, as mentioned above, a large part of the income of USD0++ holders is issued in USUAL tokens. Given the recent turmoil at Usual, this rate of return is most likely not guaranteed.

According to Usual’s design, USD0 can be pledged 1:1 to mint USD0++, which is locked for 4 years by default. Therefore, USD0++ is similar to a tokenized four-year floating rate bond. When users hold USD0++, they can obtain interest denominated in USUAL. If users cannot wait 4 years and want to redeem USD0, they can first exit through secondary markets such as Curve and directly exchange the latter through the USD0++ / USD0 trading pair.

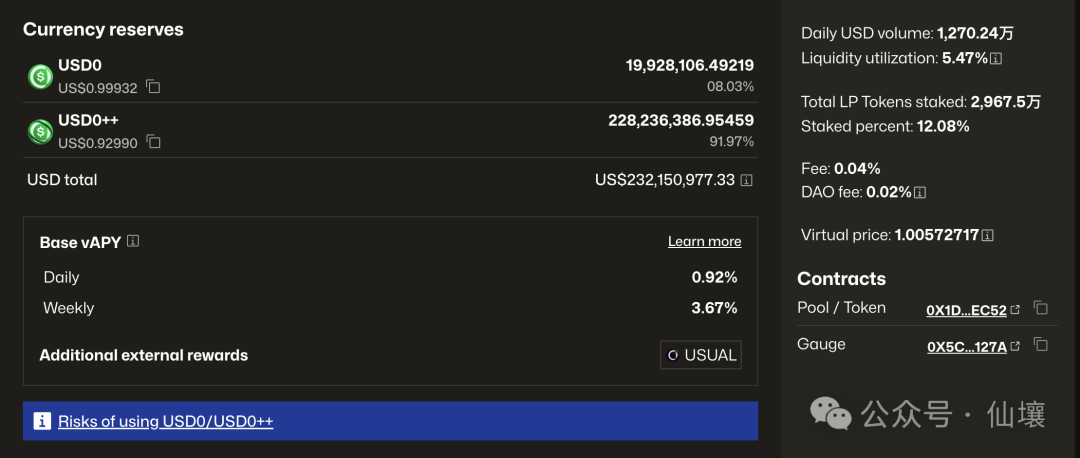

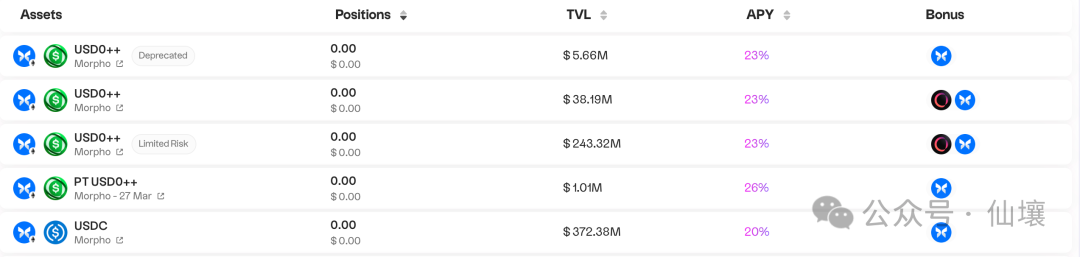

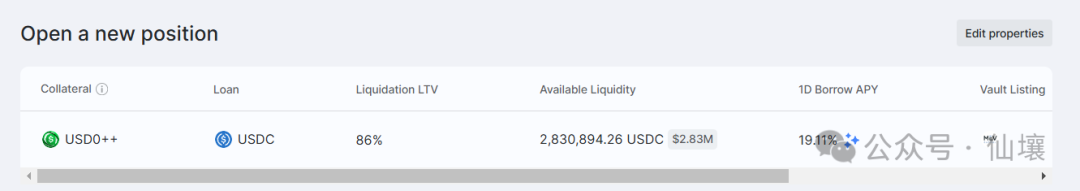

In addition to Curve, there is another solution, which is to use USD0++ as collateral in Morpho and other lending protocols to lend USDC and other assets. At this time, users need to pay interest. The following figure shows Morpho's lending pool using USD0++ to lend USDC. The current annualized interest rate is 19.6%.

Of course, in addition to the above indirect exit paths, USD0++ also has a direct exit path, which is also the cause of the recent depegging of USD0++. But we plan to elaborate on this part later.

The third layer: Project tokens USUAL and USUALx

Users can obtain USUAL by staking USD0++ or purchasing directly from the secondary market. USUAL can also be used for staking to mint governance tokens USUALx at a 1:1 ratio. Whenever USUAL is issued, holders of USUALx can receive 10% of it. According to the current documentation, USUALx also has an exit mechanism for converting to USUAL, but a certain fee is required upon exit.

At this point, the entire Usual three-layer product logic is as follows:

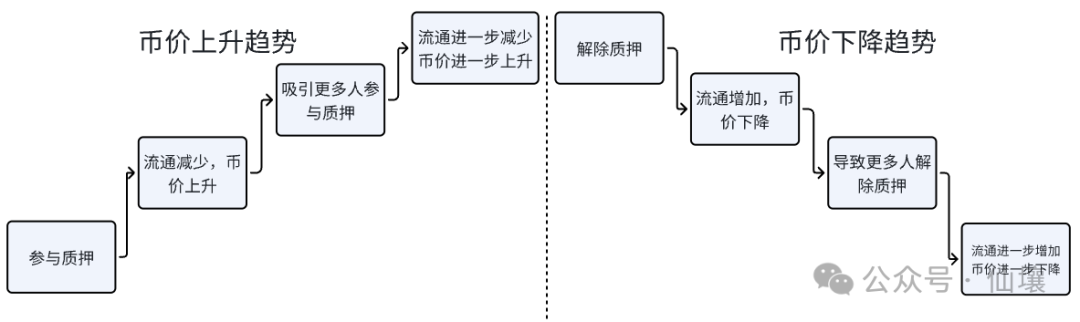

In summary, the RWA assets underlying USD0 earn interest, part of which is distributed to USD0++ holders. With the empowerment of USUAL tokens, the APY of USD0++ holders is further increased, which can encourage users to mint USD0 and re-coin USD0. It is minted as USD0++ to obtain USUAL, and the existence of USUALx can encourage USUAL holders to lock their positions.

The Anchor-off Incident: The "Conspiracy Theory" Behind the Modification of Redemption Rules - The Explosion of Revolving Loans and the Morpha Liquidation Line

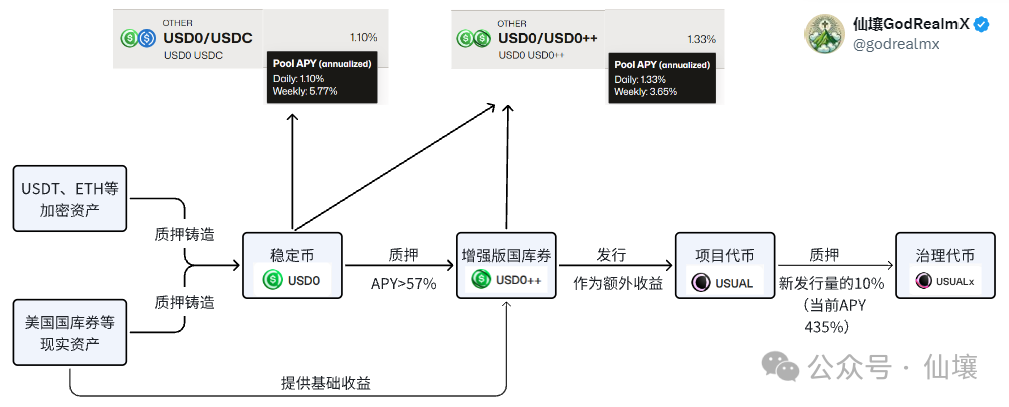

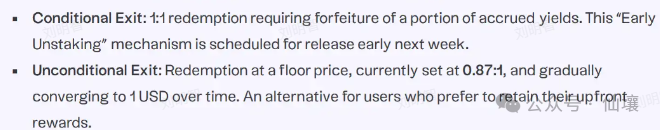

Usual’s previous redemption mechanism was to exchange USD0++ for USD0 at a 1:1 ratio, which is a guaranteed redemption. For stablecoin holders, an APY of more than 50% is very attractive, and the guaranteed redemption provides clear and safe With the exit mechanism and the French government’s backing, Usual successfully attracted many big investors. However, on January 10, the official announcement changed the redemption rules, so that users can choose between the following two redemption mechanisms:

1. Conditional redemption. The redemption ratio is still 1:1, but a considerable portion of the income issued in USUAL must be paid. 1/3 of this income will be distributed to USUAL holders, and 1/3 will be distributed to USUALx holders. , 1/3 burned;

2. Unconditional redemption, no deduction of income, but no guarantee, that is, the redemption USD0 ratio is reduced to a minimum of 87%. The official said that this ratio may return to 100% over time.

Of course, users can also choose not to redeem and lock USD0++ for 4 years, but this involves too many variables and opportunity costs.

So back to the point, why did Usual come up with such apparently unreasonable terms?

As mentioned earlier, USD0++ is essentially a tokenized 4-year floating rate bond. Direct withdrawal means forcing Usual to redeem the bond in advance. The USUAL protocol believes that when users mint USD0++, they promise to lock USD0 for four years. Withdrawal is considered a breach of contract and will require payment of a penalty.

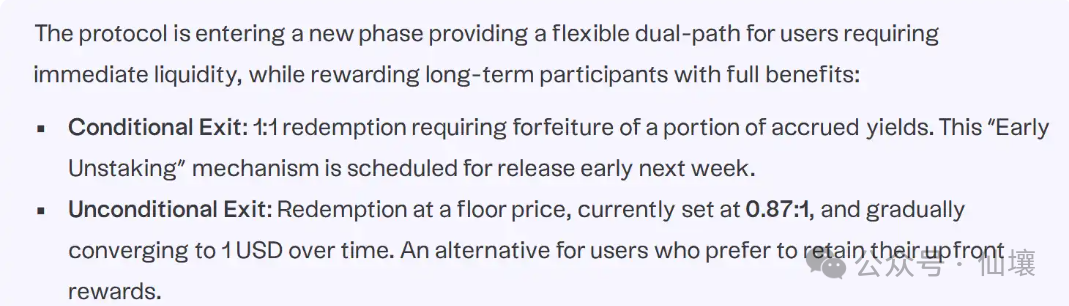

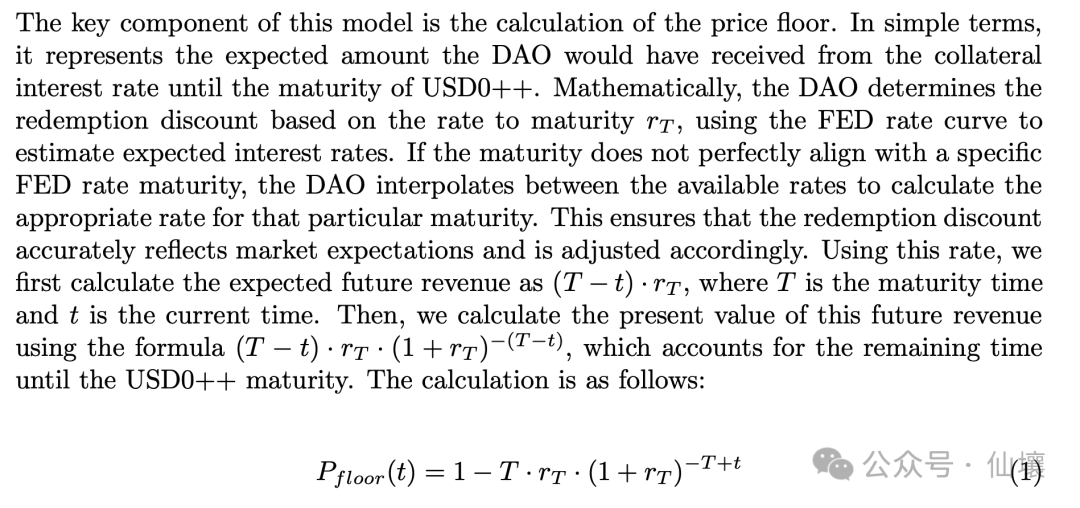

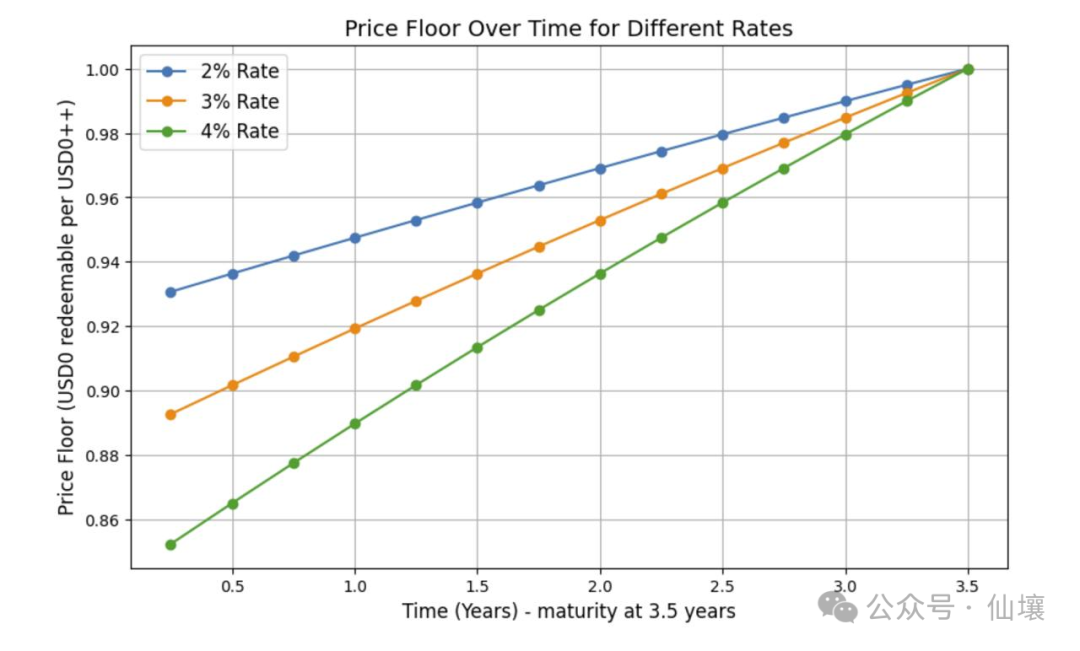

According to the USD0++ white paper, if a user initially deposits 1 USD in USD0, when the user wants to withdraw early, he or she needs to make up the future interest income of this 1 USD. The assets that the user will eventually redeem are:

1 USD — Future interest income. Therefore, the mandatory redemption floor price of USD0++ is lower than 1 USD.

The following figure shows the method of calculating the USD0++ base price from the USUAL official document (it seems a bit like bandit logic at the moment):

Usual’s announcement will only take effect on February 1, but many users immediately fled, causing a chain reaction. People generally believe that according to the redemption mechanism in the announcement, USD0++ can no longer maintain the rigid redemption with USD0, so USD0++ holders began to exit early;

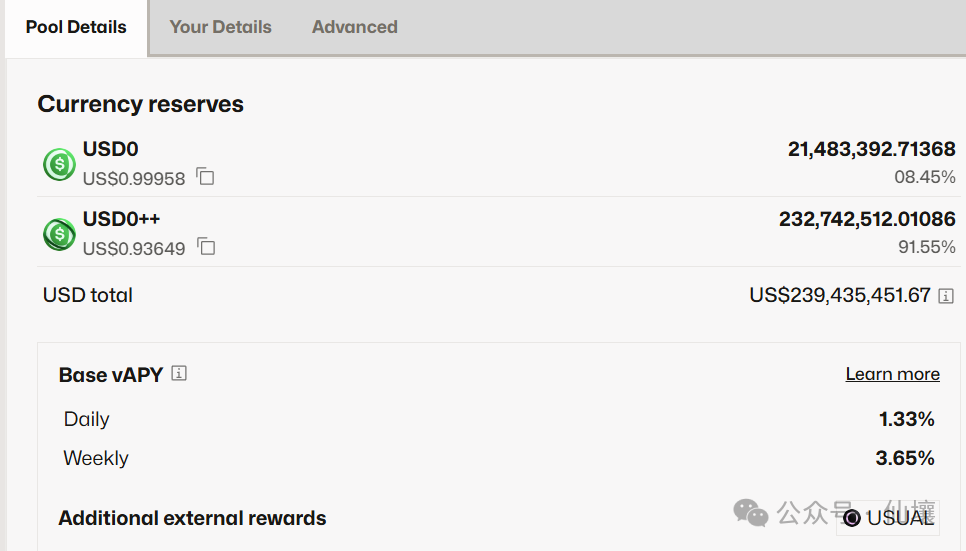

This panic naturally spread to the secondary market, and people frantically sold USD0++, causing a serious imbalance in the USD0/USD0++ trading pair in Curve, with the ratio reaching an exaggerated 9:91; in addition, the price of USUAL plummeted. Under market pressure, Usual decided to The announcement will be brought forward to next week to increase the cost for users to abandon USD0++ and redeem USD0 as much as possible, thereby protecting the price of USD0++.

Of course, some people say that USD0++ is not a stablecoin, but a bond, so there is no such thing as depegging. Although this view is correct in theory, we would like to object to it.

First, the unspoken rule of the crypto market is that only stablecoins have the word "USD" in their names. Second, USD0++ is originally exchanged for stablecoins at a 1:1 ratio in Usual, and people assume that its value is equivalent to stablecoins. ; Third, Curve’s stablecoin trading pool includes USD0++ trading pairs. If USD0++ does not want to be considered a stablecoin, it can change its name and ask Curve to delist USD0++, or switch it to a non-stablecoin pool.

So what is the motivation for the project to make the relationship between USD0++, bonds and stablecoins ambiguous? There are two possible reasons. (Note: The following views contain conspiracy theories and are our guesses based on some clues. Do not take them seriously. )

1. First, we need to accurately blast the revolving loan. Why is the unconditional redemption ratio set at 0.87, which is just a little higher than the liquidation line of 0.86 on Morpha?

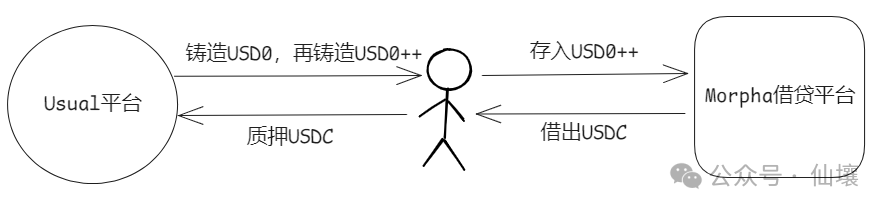

This involves another decentralized lending protocol: Morpho. Morpho is famous for creating a sophisticated DeFi protocol with 650 lines of minimalist code. Killing two birds with one stone is a DeFi tradition. Many users mint USD0++ to increase the utilization rate of funds. , USD0++ is put into Morpho to borrow USDC, and the borrowed USDC is used to re-mint USD0 and USD0++, thus forming a circular loan.

Revolving loans can significantly increase users’ positions in the lending protocol, and more importantly, the USUAL protocol will allocate USUAL token incentives to positions in the lending protocol:

Revolving loans have brought Usual a better TVL, but as time goes by, there is an increasing risk of leverage chain breakage, and these revolving loan users rely on repeatedly casting USD0++ to obtain a large number of USUAL tokens, which is a good way to mine, withdraw and sell. If Usual wants to develop in the long term, it must solve this problem.

Let's briefly talk about the leverage ratio of revolving loans. Assume that you borrow USDC, mint USD0++, deposit USD0++, and borrow USDC back and forth as shown in the figure above, and repeat this process and maintain a fixed deposit/loan value ratio (LTV) in Morpha. .

Assuming LTV = 50%, your initial capital is 100 USD0++ (assuming it is worth $100), the value of USDC borrowed each time is half of the USD0++ deposited, according to the geometric progression summation formula, the amount you can borrow in the end is When USDC approaches infinity, the total USDC you borrowed in your revolving loan approaches $200. It is not difficult to see that the leverage ratio is almost 200%. The revolving loan leverage ratio under different LTVs follows the simple formula shown in the figure below:

For those who previously participated in the Morpha to Usual revolving loan, the LTV may be higher than 50%, and the leverage ratio is even more alarming. It is conceivable how high the systemic risk behind it is. If it develops in this way for a long time, it will sooner or later lay a mine.

Here we will talk about the liquidation line value. Previously, the liquidation line LTV of USD0++/USDC on the Morpha protocol was 0.86, which means that when the ratio of the value of your borrowed USDC/deposited USD0++ is higher than 0.86, it will trigger Liquidation. For example, if you have borrowed 86 USDC and deposited 100 USD0++, your position will be liquidated as long as USD0++ falls below 1 USD.

In fact, Morpha’s liquidation line of 0.86 is very subtle, because the redemption ratio of USD0++ and USD0 announced by Usual is 0.87:1, and there is a direct correlation between the two.

We assume that many users, in recognition of the idea of USD0++ stablecoin, directly choose a very high LTV, even close to the liquidation line of 86%, for the above-mentioned revolving loan. In this way, they can maintain a large position with a very high leverage ratio and obtain a large amount of interest-bearing income. However, using an LTV of nearly 86% means that as long as USD0++ is decoupled, the position will be liquidated, which is also the main reason for the large amount of liquidation on Morpho after USD0++ was decoupled.

But it should be noted that even if the revolving loan user’s position is liquidated at this time, there is no loss for the Morpha platform, because at this time 86% < LTV of the liquidated position < 100%. If denominated in US dollars, the USDC borrowed It is still lower than the value of the collateral USD0++, and the platform still has no systemic bad debts (this is very critical).

After understanding the above conclusions, it is not difficult for us to understand why the liquidation line of USD0++/USD0 on Morpha was deliberately set at 86%, which is just a little lower than the 0.87 in the later announcement.

From the perspective of the two versions of the conspiracy theory, the first version is that Morpha is the result and Usual is the cause: the USD0++/USDC vault on the Morpha lending platform was set up by MEV Capital, the manager of Usual, who knew the future. The floor price will be set at 0.87, so the liquidation line was set slightly lower than 0.87 early on.

First, after the Usual protocol was updated and announced, it stated that the redemption floor price of USD0++ was 0.87, and the reason was explained in the USD0++ white paper with a specific discount formula and chart. After the announcement, USD0++ began to decouple and once approached 0.9 US dollars. But it is always higher than the guaranteed price of 0.87. Here we believe that the redemption ratio of 0.87:1 in the announcement is not set arbitrarily, but has been carefully calculated and is more affected by the interest rate in the financial market.

The coincidence is that the liquidation line on Morpha is 86%. As we mentioned earlier, if the floor price is 0.87, the USD0++/USDC vault on Morpha will not have systemic bad debts, and the revolving loan positions can be blown up, achieving Deleverage.

Another version of the conspiracy theory is that Morpha was the cause and Usual’s later announcement was the result: Morpha’s liquidation line of 0.86 was determined before the floor price of 0.87, and then Usual took into account the situation on Morpha and deliberately set the floor price higher than 0.86. A little bit higher. But in any case, there is definitely a strong correlation between the two.

2. Another motivation of the Usual project may be to save the price of the currency at the lowest cost

The economic model of USUAL-USUALx is a typical positive feedback flywheel. Its pledge mechanism determines that such tokens usually rise very rapidly, but once there is a downward trend, they will fall faster and faster and enter a death spiral. As the price of USUAL falls, the staking yield will also be greatly reduced due to the combined effect of the decline in price and the number of additional issuances, triggering panic among users and leading to a large-scale sell-off of USUAL, forming a death spiral of "the faster the price falls, the faster it falls".

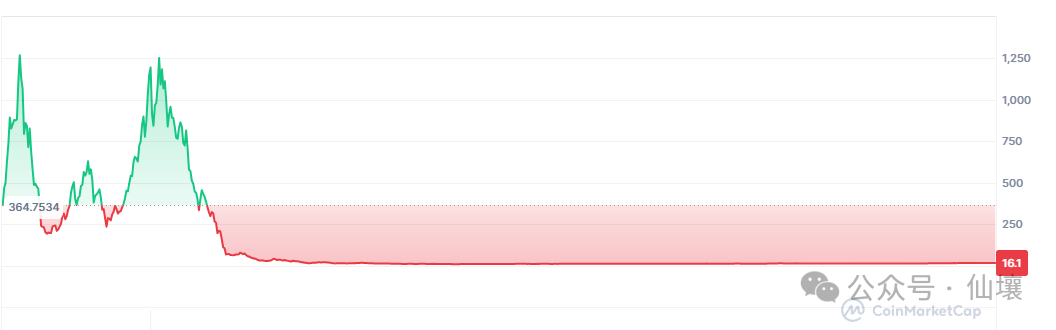

USUAL has been falling since it hit a high of 1.6. The project owner may have realized the danger and thought it had entered a death spiral. Once it enters a falling range, it can only try every means to raise the price of the coin to save the market. The most famous project of this type should be It was OlympusDAO in the last bull market. At that time, there should have been a strong injection of external liquidity, which made its token OHM form a double-peak shape (quoted from the opinions of some people who experienced it).

USUAL has been falling since it hit a high of 1.6. The project owner may have realized the danger and thought it had entered a death spiral. Once it enters a falling range, it can only try every means to raise the price of the coin to save the market. The most famous project of this type should be It was OlympusDAO in the last bull market. At that time, there should have been a strong injection of external liquidity, which made its token OHM form a double-peak shape (quoted from the opinions of some people who experienced it).

But we can also see from the OHM chart that such projects often cannot escape the fate of the currency price returning to zero in the end. The project owner is also clear about this, but time is profit. Some people have made estimates, and now the Usual team With monthly revenue of around $5 million, they should have needed to weigh the pros and cons and consider whether they could keep the project alive as long as possible.

However, their current actions seem to be to avoid paying real money, and only reverse the downward trend through changes in gameplay and mechanisms. In the conditional redemption, part of the USD0++ pledger's income is divided among USUAL and USUALx holders, and the remaining The lower 1/3 will be destroyed, and USUALx is obtained by staking USUAL.

The so-called conditional redemption is actually a clear way to empower USUAL tokens, prompting more people to pledge USUAL to obtain USUALx, reducing its circulation in the market and playing the role of under-damping protection.

But the project's intention is obviously not easy to achieve because there is a contradiction.

Since such projects need to set aside a large proportion of tokens in the token distribution to attract users as a considerable staking reward, they must be low-circulation tokens. The current circulation of USUAL is 518 million, but the total amount is 4 billion. , and its staking incentive model must rely on a steady stream of token unlocking if it wants to continue to operate. In other words, USUAL's inflation is very serious. If you want to curb inflation by destroying 1/3 of the amount, you must redeem it conditionally. The USUAL ratio collected must be high enough.

Of course, this ratio is set by the project owner. Under the conditional redemption model, the amount of USUAL that the redeemer needs to pay to the Usual platform from the interest is calculated as follows:

Among them, Ut is the number of USUAL that can be "accumulated" for each USD0++; T is the time cost factor, which defaults to 180 days (set by DAO); A is the adjustment factor. In simple terms, the official set a weekly redemption If the weekly redemption amount is greater than X, A=1; if the weekly redemption amount is less than X, A=redemption amount/X. Obviously, when there are too many redeemers, more Usual income needs to be paid. and A are adjusted by the project party.

But the problem is that if the conditional redemption channel requires users to pay too high a proportion of Usual income, users will directly choose unconditional redemption, which will easily cause the price of USD0++ to drop again until it reaches the guaranteed price of 0.87. It is hard to say that this is a successful strategy, considering the panic selling, release of pledges, and reduced credibility caused by the announcement issued by the project party.

However, there is another interesting saying in the market: Usual solved the DeFi mining, withdrawal and selling dilemma by its own unique way. Overall, the unconditional guaranteed price of $0.87 designed by the Usual project team, as well as The conditional redemption mechanism makes us suspect that the Usual protocol is deliberately manipulated to make large revolving loan holders spit out their profits.

What will the future hold and the problems that emerge

Before the payment ratio of USUAL with conditional redemption is announced, it is hard to judge which method most users will choose and whether USD0++ can return to the anchor. As for the price of USUAL, it is still the same contradictory issue: the project side wants to simply increase the price through gameplay mechanism. The trick is to replace real money with USUAL to reverse the death spiral, but the unconditional guaranteed price of 0.87 is not low enough. Many people will eventually choose to exit unconditionally rather than conditionally, and they will not be able to burn too much USUAL to reduce circulation.

Looking beyond Usual itself, this incident exposes three more direct problems.

First, Usual’s official documents have long stated that USD0 pledges have a 4-year lock-up period, but the specific rules for early redemption were not previously stated. So this Usual announcement is not a sudden new rule that has never been mentioned before, but The market is indeed in an uproar and even panic. This shows that many people who participate in DeFi protocols do not read the project documents carefully.

DeFi protocols have become increasingly complex. There are fewer and fewer simple and clear projects like Uniswap and Compound. This is not necessarily a good thing. The amount of funds that users participate in DeFi is often not too small. At least the official website of the DeFi protocol should be Read the document carefully and understand it.

Second, even if the official documents have already stated it, it is undeniable that Usual also sets and modifies the rules as it pleases, and the so-called T, A and other parameters are also in their own hands. There are neither strict DAO proposal resolutions nor inquiries for community opinions.

Ironically, the official document has always emphasized the governance attributes of USUALx tokens, but there is no governance link in the actual decision-making process. It must be admitted that most Web3 projects are still in a very centralized stage. Combined with the first point, the user's assets There are still some big security issues. We always emphasize TEE, ZK and other technologies that can better ensure asset security, but the decentralization and asset security awareness of project parties and users should also be paid attention to.

Third, the entire industry is indeed constantly evolving. With the lessons learned from projects such as OlympusDAO, Usual began to consider reversing the trend as soon as the price of the currency began to fall because of the similar economic model. It is often said that there are few truly implemented web3 projects, but the overall industry ecosystem is developing rapidly. The previous projects are not completely meaningless. The success or failure is seen by the latecomers and may exist in another way. Among those truly meaningful projects. At this time when the market and ecology are not so prosperous, we should not lose confidence in the entire industry.