Written by: 1912212.eth, Foresight News

BTC lived up to expectations. At about 6 a.m. this morning, the price once again exceeded $70,000, once exceeding $71,000, with a 24-hour increase of more than 4%, and now hovering around $71,000. ETH, which made the Twitter community almost pessimistic, also fell to $2,382 and then fluctuated upward to above $2,600. After the correction in the past few days, some altcoins finally rebounded. Dogecoin soared 17% due to Musk's call, and has now risen above $0.16.

In terms of contract data, according to Coinglass, $173 million of positions were liquidated in the past 24 hours, including $69.7824 million of long positions and $103 million of short positions.

The market is trending upwards, what factors are at play?

The Fed is about to cut interest rates again

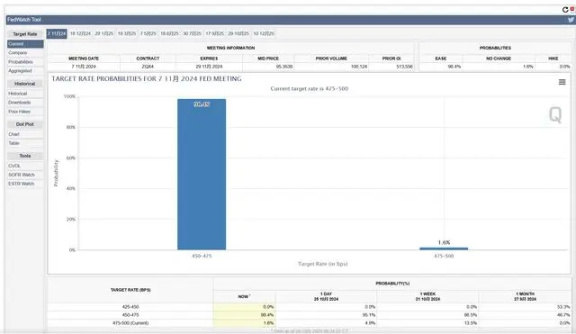

The Fed will hold its policy meeting on November 6-7. Right now, the market is almost certain that the central bank will cut interest rates by 25 basis points when it meets. According to the CME FedWatch tool, traders are currently pricing in a 98.4% chance of a 25 basis point rate cut in November, a 1.6% chance of no rate cut and a 0% chance of a 50 basis point cut.

The Fed's continued interest rate cuts will inject more funds into global liquidity and benefit risky assets. With the continuous increase in liquidity, the market sentiment of cryptocurrencies has improved significantly.

Microsoft plans to buy Bitcoin

More and more large companies are considering Bitcoin as a strategic reserve.

Microsoft listed issues to be discussed at its next shareholder meeting in a Form A filing with the U.S. Securities and Exchange Commission on Thursday. One proposal suggests the tech company should study Bitcoin as a hedge against inflation and other macroeconomic influences.

The document shows that the board of directors recommended that shareholders vote against the proposal, saying that Microsoft has "carefully considered this issue." The statement said: "Past evaluations have considered Bitcoin and other cryptocurrencies as options, and Microsoft will continue to monitor trends and developments related to cryptocurrencies to inform future decisions. As the proposal itself points out, volatility is a consideration in evaluating cryptocurrency investments, which require stable and predictable investments for enterprise financial applications to ensure liquidity and working capital. Microsoft has developed strong and appropriate processes to manage and diversify its enterprise finances for the long-term benefit of shareholders, and this requirement for a public evaluation is unreasonable."

Microsoft's largest shareholders include Vanguard, BlackRock and State Street.

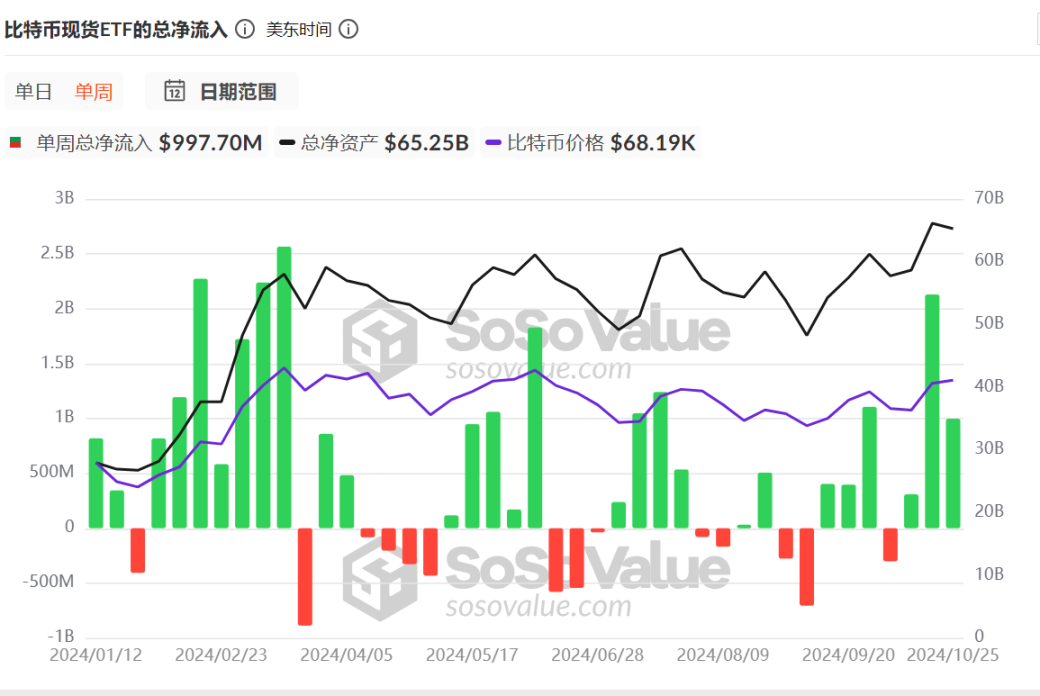

BTC spot ETFs continue to see inflows

Bitcoin spot ETF data shows that its purchase funds have been quite strong since this month. There were only 7 days of net outflow of funds, and the remaining 12 days were net inflows, and the inflow amount was quite large. On October 14, the single-day net inflow exceeded US$555.86 million.

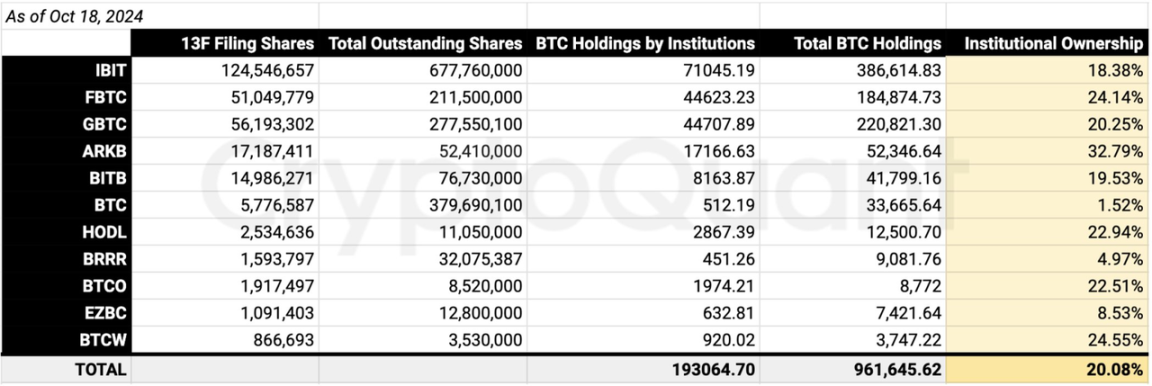

At present, the total net inflow of the US Bitcoin spot ETF has reached 21.93 billion US dollars, and its total on-chain holdings have exceeded 1 million BTC. In addition, according to data disclosed by Ki Young Ju, CEO of CryptoQuant, institutional holdings account for about 20% of the US Bitcoin spot ETF, and asset management companies hold about 193,000 BTC.

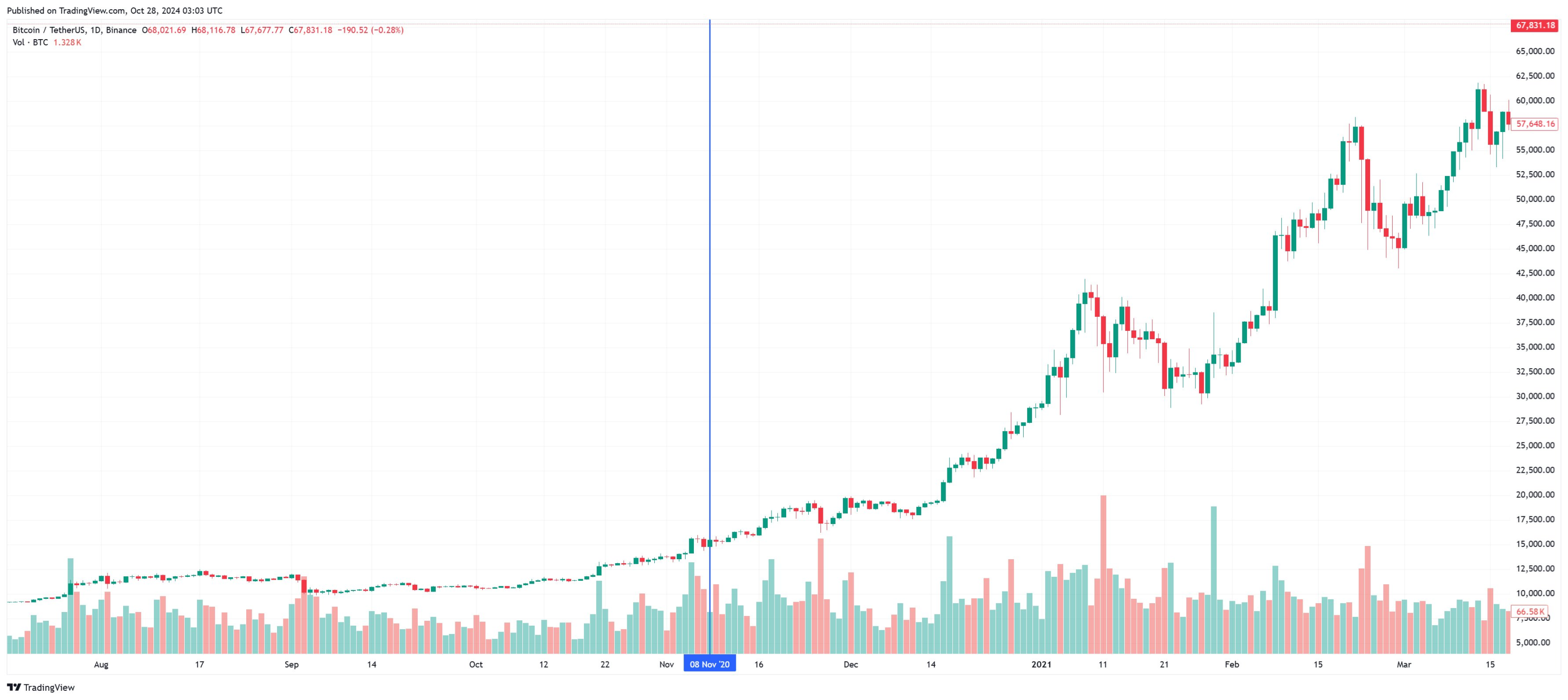

Bitcoin Golden Cross

A few days ago, market analyst Omkar Godbole said that Bitcoin’s 50-day simple moving average (SMA) has begun to rise and may exceed the 200-day SMA in a few days, confirming the so-called “golden cross”.

This pattern indicates that short-term price momentum is outstripping long-term momentum, which could lead to a bull market. Indicators based on moving averages are often criticized for being lagging signals that can trap traders on the wrong side of the market. While this view is generally correct, golden crosses have indeed foreshadowed major bull markets in the past.

Traders who held Bitcoin for a year after the first and second golden crosses and the May 2020 golden cross would have made triple-digit percentage gains. After the October 30, 2023 golden cross, Bitcoin doubled in value, reaching a new all-time high of over $73,000.

The market trend once again confirms that its upward trend is likely to continue.

US presidential election is coming soon

Generally speaking, the crypto market will see a good rise before and after the US election. There was even a rise after the results of the last US presidential election, but it fell in the first two days and the last two days.

In addition, for the crypto market, whether Harris or Trump comes to power, it is good news in the long run. Therefore, some funds choose to continue to bet on the subsequent market.