Source: Cailianshe

Author: Xiaoxiang

China Business Network, November 15 (Editor Xiaoxiang) As Federal Reserve Chairman Powell said in his latest speech early Friday morning Beijing time that the Federal Reserve is not in a hurry to cut interest rates amid a strong economy, this hawkish remark quickly caused an uproar in the global market.

After Powell's speech, U.S. stocks closed near intraday lows, while the dollar surged along with U.S. Treasury yields, with the ICE dollar index hitting its highest level in a year. Traders lowered their expectations of the probability of a Fed rate cut in December from 80% the day before to around 50%, in stark contrast to the CPI release day the day before.

Powell said in a dialogue with local business leaders co-hosted by the Dallas Federal Reserve that day, " The economy has not sent any signal that we need to rush to lower interest rates . The better economic conditions enable us to act cautiously in making decisions."

On inflation, Powell pointed out that "inflation is moving closer to our 2% longer-run goal, but has not yet been achieved. We are committed to fulfilling this mission. With labor market conditions roughly balanced and inflation expectations well anchored, I expect inflation to continue to decline toward the 2% target, although there will be occasional bumps."

To combat inflation, the Federal Reserve raised interest rates to their highest level in 20 years last year and then kept them there for more than a year to ensure price pressures did not return. While inflation has fallen significantly since mid-2023, the slowdown in price growth has been uneven at times, including in the past two months.

In response, Powell reiterated that the Fed's policy rate path will depend on upcoming data and the evolution of the economic outlook, and will closely monitor core indicators of inflation in goods and services excluding housing, which have been declining over the past two years.

The Fed has cut rates at its two most recent meetings, first with a sharp 50 basis point cut in September amid signs the labor market may be weakening. At last week’s meeting, officials cut their benchmark rate by another 25 basis points to a range of 4.5% to 4.75%.

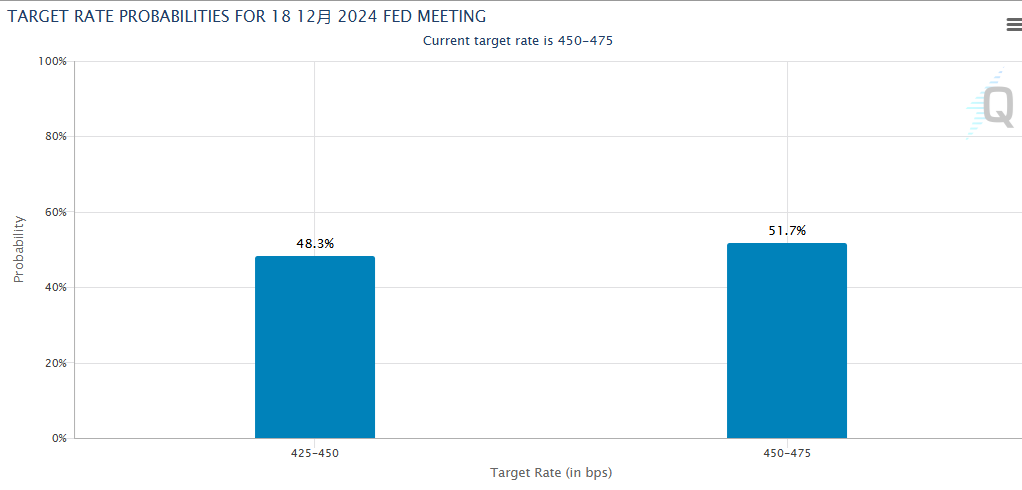

The next Fed meeting will be held on December 17-18. In his latest speech, Powell did not comment on the possibility of a rate cut at the December meeting. However, his relevant remarks have obviously hit the market's expectations for a rate cut next month. CME's Fed Watch tool shows that whether the Fed can achieve a third consecutive rate cut next month has once again become a fifty-fifty matter.

And the astute market traders undoubtedly quickly "took action" as soon as they heard the news.

Global markets face a “new storm”

U.S. Treasury yields of most maturities rose after Powell's speech overnight, especially short-term bond yields, which surged rapidly. The 2-year U.S. Treasury yield once rebounded 8 basis points to 4.36%.

Major U.S. stock indexes also fell. The Dow Jones Industrial Average fell 0.5%. The S&P 500 and Nasdaq both fell 0.6%, marking their biggest one-day declines this month.

In the foreign exchange market, the US dollar strengthened further against major currencies on Thursday. The ICE Dollar Index rose above the 107 mark during the session, hitting a one-year high and rising for the fifth consecutive trading day.

Zachary Griffiths, head of U.S. investment grade and macro strategy at CreditSights, said, "Powell's speech was more hawkish and his approach to the future of monetary policy was more risk management-oriented."

"Powell's speech was hawkish," said Neil Dutta, head of economic research at Renaissance Macro Research. "I think they will still cut rates in December because interest rate policy remains restrictive and they want to get to the neutral rate setting. But despite this, I think Powell (and the broader consensus) is complacent on the economic front. The downside risks in the short term are greater than people realize."

In fact, even if Powell's hawkish speech is put aside, a series of recent US economic data does not seem to support a rate cut. As shown in the figure below, the number of initial jobless claims in the United States has fallen to a six-month low, and inflation data is generally stronger than expected. The economic and inflation situation still seems to face the risk of "not landing".

Paul Nolte, market strategist and senior wealth advisor at Murphy & Sylvest, said that judging from the data of the past two days (consumer prices, producer prices and weekly unemployment claims), it is difficult for Powell to become super dovish. All information shows that job growth remains considerable and inflation continues to be above the 2% target.

This can't help but bring up a question: If the situation really occurs that "Powell suspends interest rate cuts as soon as Trump takes office" (it seems that the Federal Reserve is likely to slow down its easing pace early next year), how angry will the "King of Understanding", who has always been unhappy with Powell, be?

Michael Feroli, chief U.S. economist at JPMorgan Chase, predicts that Powell's speech may suggest that the Fed will slow down the pace of interest rate cuts before March next year. He wrote: "We still believe that the FOMC is likely to cut interest rates in December. But today's speech opens the door to slowing the pace of easing as early as January next year."