Puffer has always adhered to principles consistent with Ethereum in its design and product evolution, and has demonstrated support for Ethereum's long-term vision.

Written by Linda Bell

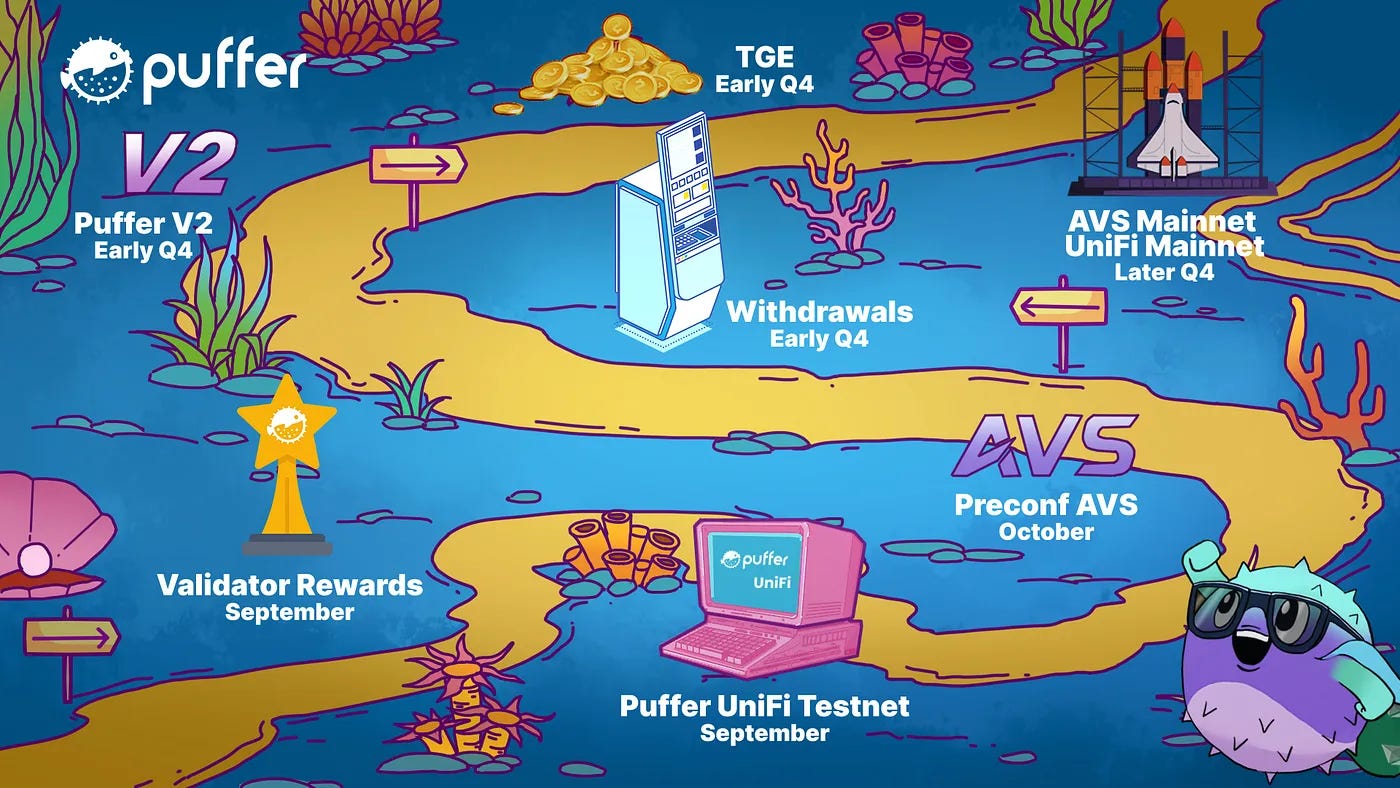

According to Puffer Finance's latest strategic roadmap, the platform has expanded from a native liquidity re-pledge protocol to an Ethereum decentralized infrastructure provider. Its product architecture has also been adjusted. In addition to Puffer LRT, Based Rollup Puffer UniFi and pre-confirmation solution UniFi AVS have also been added. In response to these adjustments, Puffer said, "Puffer's strategic roadmap represents the team's commitment to building the infrastructure needed to support Ethereum's growth and resilience. From UniFi AVS to PUFI TGE, they have been carefully designed to comply with Ethereum's core principles."

The birth of Puffer

On November 29, 2023, Puffer co-founder Jason Vranek presented Puffer's demo at the "Restaking Summit: Istanbul Devconnect" hosted by EigenLayer. Puffer is a native liquidity re-staking protocol that aims to alleviate the centralization and high entry barriers in the current staking market by designing a permissionless, slash-risk-reducing liquidity re-staking solution.

The original goal of the Puffer founding team was to use verifiable technology to reduce the risk of slashing in the liquidity pledge agreement. However, inspired by the solution proposed by Justin Drake, a researcher at the Ethereum Foundation in his 2022 paper "Liquid solo validating" to reduce the risk of slashing of individual validators through hardware technology, the Puffer team developed the Secure Signer secure signature technology at the end of 2022. This technology uses Intel SGX to store the validator's private key in the enclave to prevent the validator from slashing due to key leakage or operational errors. The development of Secure Signer also received funding from the Ethereum Foundation in the fourth quarter of 2022.

Of course, Puffer has also attracted the attention of many investment institutions and angel investors. So far, Puffer Finance has completed 4 rounds of financing, and the cumulative financing amount has reached 24.15 million US dollars. In June 2022, Puffer Finance completed a $650,000 Pre-Seed round of investment led by Jump Crypto. Then in August 2023, Puffer Finance completed a $5.5 million seed round of financing led by Lemniscap and Lightspeed Faction, with participation from Brevan Howard Digital, Bankless Ventures and others. This round of financing was used to further develop Secure-Signer. In April of this year, Puffer Finance once again completed a $18 million Series A financing, led by Brevan Howard Digital and Electric Capital, with participation from Coinbase Ventures, Kraken Ventures, Consensys, Animoca and GSR. This round of financing is mainly used to promote the release of the mainnet.

Puffer LRT Protocol: Native Liquidity Staking Protocol

Liquidity Re-staking Tokens (LRT) are an asset class developed around the EigenLayer ecosystem, which aims to further improve the capital utilization efficiency of Ethereum staked assets through the re-staking mechanism. Its operating principle is to stake ETH or Liquidity Staking Tokens (LST) that have been staked on the Ethereum PoS network to other networks through EigenLayer to obtain additional benefits beyond the Ethereum mainnet staking rewards.

Since Ethereum switched to the PoS mechanism, more and more staking products have emerged, driving the development of the staking market. However, some platforms such as Lido have occupied a large share of the staking market, which has raised concerns about the risks of network centralization. Looking back to September 2023, in the field of liquidity staking, Lido's share of the liquidity staking market once reached 33%. However, with the rise of liquidity re-staking protocols, Lido's market share began to gradually decline and has now dropped to around 28%. Ethereum contributor Anthony Sasson said that the vampire attack launched by Puffer had a major impact on Lido, involving more than $1 billion in capital flows.

As a permissionless decentralized native liquidity re-staking protocol, Puffer combines the dual strategies of liquidity staking and liquidity re-staking, and uses Secure Signer secure signature technology and Validator Tickets (VT) and other designs to help independent validators effectively participate in the Ethereum staking and re-staking process, thereby increasing returns while maintaining the decentralization level of the Ethereum network.

In addition, in order to prevent Puffer from becoming over-centralized in the network, the protocol strictly limits the number of its verification nodes and does not allow it to occupy more than 22% of the total number of Ethereum network nodes to ensure that it does not pose a threat to the trusted neutrality of Ethereum.

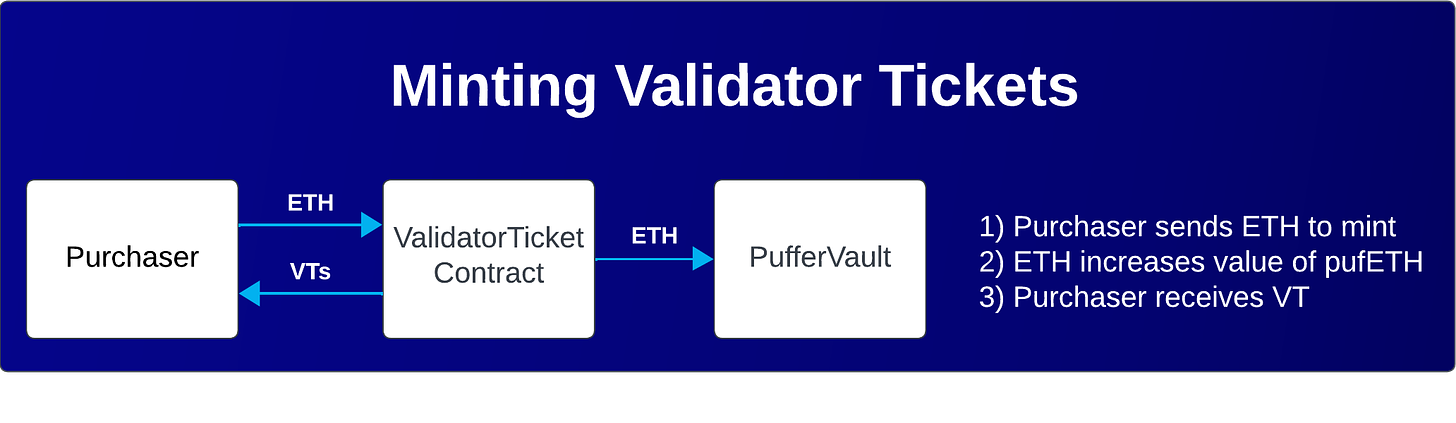

Reduce the staking entry threshold from 32 Ethereum to as low as 1 Ethereum

It takes 32 ETH to become a node in Ethereum, which is undoubtedly a high threshold for independent users. Puffer has lowered the entry threshold for participating in staking through a mechanism called Validator Tickets (VT), so that node operators only need to provide a deposit of 2 ETH (if using SGX, only 1 ETH is required) to run a verification node. VT is an ERC20 token that represents the node operator's one-day right to run an Ethereum validator, and the price of VT is set according to the expected daily income of running a validator. In other words, node operators need to lock a certain amount of VT to participate in staking, and gradually release it to liquidity providers during the staking period, while validators can obtain all rewards generated by PoS.

To give a simple example, similar to joining a restaurant, users can choose to pay monthly income or pay the expected income in the next year in advance to obtain operating rights, and Puffer's VT mechanism is the latter model. At the same time, node operators can obtain 100% of PoS rewards, thereby avoiding the "lazy node" phenomenon caused by insufficient income in the traditional staking model (that is, choosing to passively participate or exit consensus when the income is not ideal). In addition, VT, as a kind of equity note, can not only supplement the pledged funds, but also has liquidity and can be traded on the secondary market.

Double benefits through EigenLayer

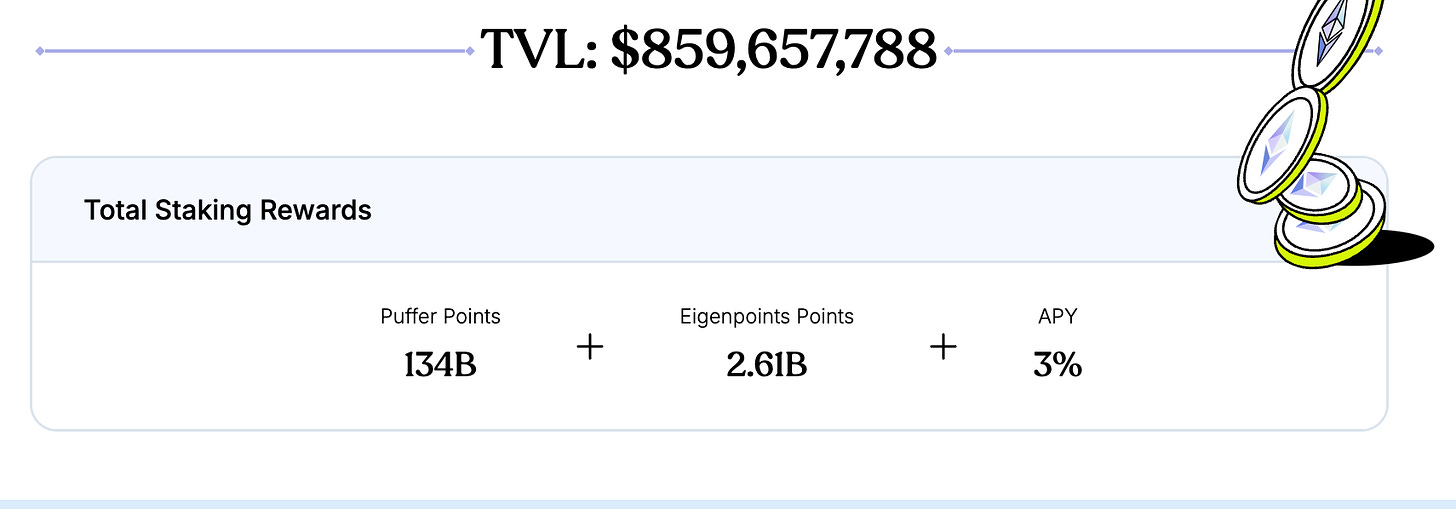

Puffer is a native liquidity staking protocol. The "native" here means that in addition to participating in the Ethereum PoS consensus, users can also directly use ETH for re-staking. This means that stakers can not only obtain verification rewards from Ethereum PoS, but also obtain additional income through the re-staking mechanism, achieving double returns. In addition, unlike traditional liquidity re-staking products, Puffer does not rely on third-party liquidity providers, but directly uses the native validator's ETH for re-staking, avoiding the centralization problems that may be caused by the dominance of a few large staking entities. In this way, Puffer not only increases the yield, but also enhances the decentralization of the network. At present, Puffer's total locked value has reached US$859.6 million, with an annualized yield of 3%.

Prevent Slash Risks with Secure-signer and RAVe

Puffer uses Secure-signer and RAVE (Remote Attestation Verification) remote attestation technology to effectively prevent Slash penalties caused by operational errors of verifiers. Among them, Secure-Signer is a remote signing tool based on Intel SGX hardware security technology, which can generate, store and execute signature operations in the enclave, thereby preventing the verifier from suffering Slash penalties due to double signing or other signature errors. The role of RAVE technology is to verify these remote attestation reports generated by Intel SGX to ensure that the node is indeed running a verified Secure-Signer program. After verification, the system will record its verifier key status on the chain to prevent malicious nodes from using unverified code or replacing key operating logic.

It is worth mentioning that as a public good, the Secure Signer code has been open sourced and can currently be viewed on Github.

Puffer launched its mainnet on May 9 this year. In order to further enhance the decentralization of the Ethereum network, Puffer plans to release V2 in the fourth quarter of this year. This upgrade focuses on enhancing user experience and introduces several key features:

- Fast Path Rewards (FPR): Allows users to extract consensus layer rewards directly from L2, avoiding the cost problem caused by high Gas fees during the EigenPod extraction process.

- Global mandatory anti-Slash: Puffer V2 will implement a protocol-wide anti-Slash mechanism to further enhance the security and decentralization of the network.

- Lower margin requirements: Puffer V2 also reduces the margin requirements for NoOps (non-operating nodes), requiring only a small amount of pufETH collateral to cover the slash risk caused by inactivity.

Puffer UniFi: 100 millisecond transaction confirmations with UniFi AVS

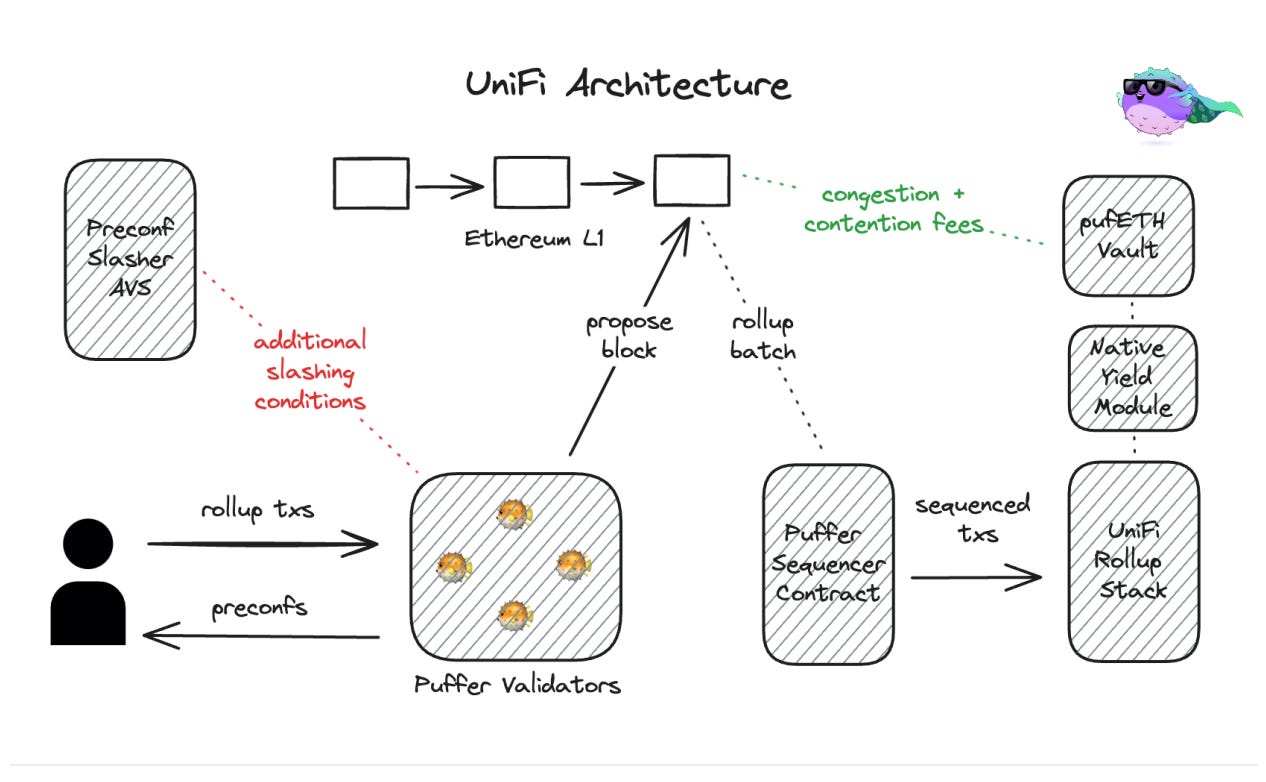

On July 6 this year, Puffer released the Litepaper of its Based Rollup solution Puffer UniFi. As a Based Rollup, UniFi improves the security and decentralization of the Ethereum network by utilizing Ethereum validators to sort transactions while feeding back transaction value to L1.

Since Ethereum implemented the "Rollup-centric" roadmap, a large number of L2 solutions have emerged in the market. According to L2Beat data, there are currently more than 100 Rollups on the market. However, although these expansion solutions have improved the scalability and user experience of Ethereum to a certain extent, they have also brought about problems such as liquidity fragmentation and centralized sorters. The first is the problem of liquidity fragmentation. Due to the lack of interoperability between different Rollups, liquidity and users are scattered in various independent L2 networks, making it difficult for the overall ecosystem to form effective synergy. Moreover, users need to rely on cross-chain bridges when transferring assets between different Rollups, which not only increases operating costs, but also poses certain security risks. In addition, most of the current Rollups use centralized sorters, which extract additional rent from user transactions through MEV, which will also affect the user's trading experience.

Puffer's UniFi solution hopes to solve these problems through decentralized transaction sorting based on verifiers. Unlike traditional centralized sorting solutions, although UniFi's transactions are processed by Puffer nodes, these nodes themselves are native staking nodes of Ethereum. Therefore, the UniFi solution assigns transaction sorting rights to decentralized verifiers, making full use of Ethereum's security and decentralization.

In addition, UniFi also addresses the problem of liquidity fragmentation through synchronous composability and atomic composability. Applications based on UniFi can rely on the sorting and pre-confirmation mechanisms it provides, so they can interoperate seamlessly with other Rollups or application chains that are also based on L1 sorting. At the same time, by using Puffer's TEE-multiprover technology, UniFi can also achieve atomic-level composability with L1, that is, UniFi allows instant L1 settlement and can directly access L1 liquidity to improve the efficiency of cross-layer transactions and applications, making it easier for developers to build more efficient applications.

However, although Based Rollup leaves transaction sorting to L1 validators to avoid the risks brought by centralized sorters, its transaction confirmation speed is still limited by the block time of L1 (about 12 seconds), making it impossible to achieve fast confirmation. To solve this problem, Puffer introduced the AVS service based on EigenLayer, providing UniFi with a pre-confirmation mechanism and achieving a transaction confirmation time of 100 milliseconds.

In Puffer UniFi AVS, through EigenLayer's re-staking mechanism, validators can use the ETH they staked on the Ethereum mainnet for UniFi's pre-confirmation verification service at the same time without staking new funds. This improves the efficiency of fund utilization to a certain extent and lowers the threshold for participation. UniFi AVS also takes advantage of the economic security of the Ethereum mainnet. If the validators participating in the pre-confirmation do not keep their promises, they will naturally face the risk of their ETH staked on the mainnet being fined, so there is no need to design additional fines for Puffer's pre-confirmation mechanism.

Validators who want to participate in Puffer UniFi AVS must have EigenPod ownership to ensure that the UniFi AVS service can perform Slash penalties to constrain the behavior of validators that violate pre-confirmation commitments. In addition, node operators need to run Commit-Boost on the server or environment where their validator client is located, which is responsible for handling the communication between the validator and the pre-confirmation supply chain.

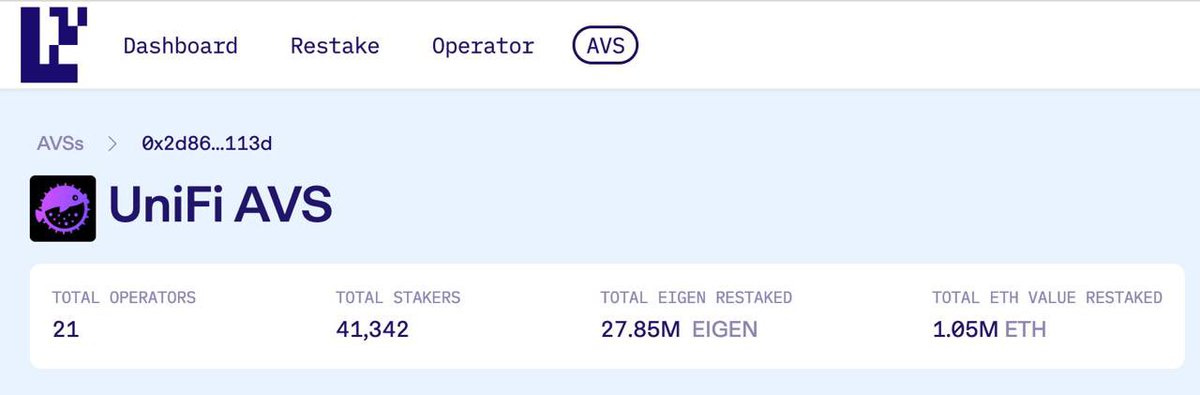

In just two weeks since its launch, the UniFi AVS platform has received 1.05 million ETH staked and more than 32,000 validators have participated. In the future, Puffer also plans to combine the Ethereum Foundation's neutral registration contract mechanism to allow any L1 proposer to voluntarily register as a pre-confirmation verification node. This means that every validator on the Ethereum mainnet can choose to become a pre-confirmation validator, further expanding the system's decentralization.

Summarize

As the Ethereum ecosystem grows, how to ensure that all projects and participants work towards the same goal has become a core issue that the community has long been concerned about. This alignment (Ethereum alignment) is considered the key to the long-term success of the Ethereum network. In the early days, the community broke it down into three dimensions: "cultural alignment", "technical alignment" and "economic alignment", and Vitalik Buterin proposed a new set of metrics in his recent article "Making Ethereum Alignment Legible", including open source, open standards, decentralization and security, and "positive-sum effect". Of course, no matter what standards are adopted, the core goal is to ensure that the protocol, community and project can be aligned with the overall development direction of Ethereum, thereby providing positive support for the sustainable development of the ecosystem.

It is worth affirming that Puffer has always practiced the same principles as Ethereum in its design and product evolution, and has demonstrated support for Ethereum's long-term vision. Through integration with EigenLayer, Puffer enables more independent validators to participate in the staking network, thereby improving the level of decentralization of Ethereum. Puffer's UniFi solution returns the transaction sorting rights to Ethereum's native staking nodes, aligning with Ethereum in terms of security and decentralization.

Puffer Finance has released its token economics, with 75 million PUFFER tokens (7.5% of the total supply) being used for the Crunchy Carrot Quest Season 1 airdrop. The eligibility snapshot for the Season 1 airdrop was completed on October 5, 2024, and users can claim them through the token claim portal between October 14, 2024 and January 14, 2025. With the official launch of the PUFFER token, it will be worth keeping an eye on whether Puffer can achieve further decentralization and user growth while advancing its goal of maintaining consistency with Ethereum.