A. Market perspective

1. Macro liquidity

- Monetary liquidity has improved. In the past few weeks, the U.S. stock market has experienced one of the most rapid adjustments since the outbreak. The softening of expectations for reciprocal tariffs in the United States has boosted market sentiment. The bottom signal of the U.S. stock market has emerged, but it has not yet been fully in place. The crypto market rebounded with the U.S. stock market.

2. Market conditions

List of top 300 stocks with the highest market capitalization:

- BTC rebounded this week, and MicroStrategy increased its BTC holdings by $600 million in the past week. The main market trend revolves around the BSC chain and the SOL chain.

Top 5 gainers | Increase | Top 5 decliners | Decline |

ZETA | 60% | NTGL | 60% |

LAYER | 60% | PI | 30% |

FARTCOIN | 50% | PLUME | 20% |

MEW | 40% | SATS | 15% |

BEAM | 40% | XCN | 10% |

- SOL: Market maker JUMP is back, and there are OTCs that need to be shipped in the near future.

- FORM: It is the BSC chain meme launch platform. The BSC chain launched a liquidity incentive plan with a total amount of US$100 million.

- HYPE: The on-chain exchange HYPE vault was attacked by a suspected JELLYJELLY market maker, and HYPE's centralized delisting process lost trust. Small coin contracts are easily manipulated.

3. On-chain data

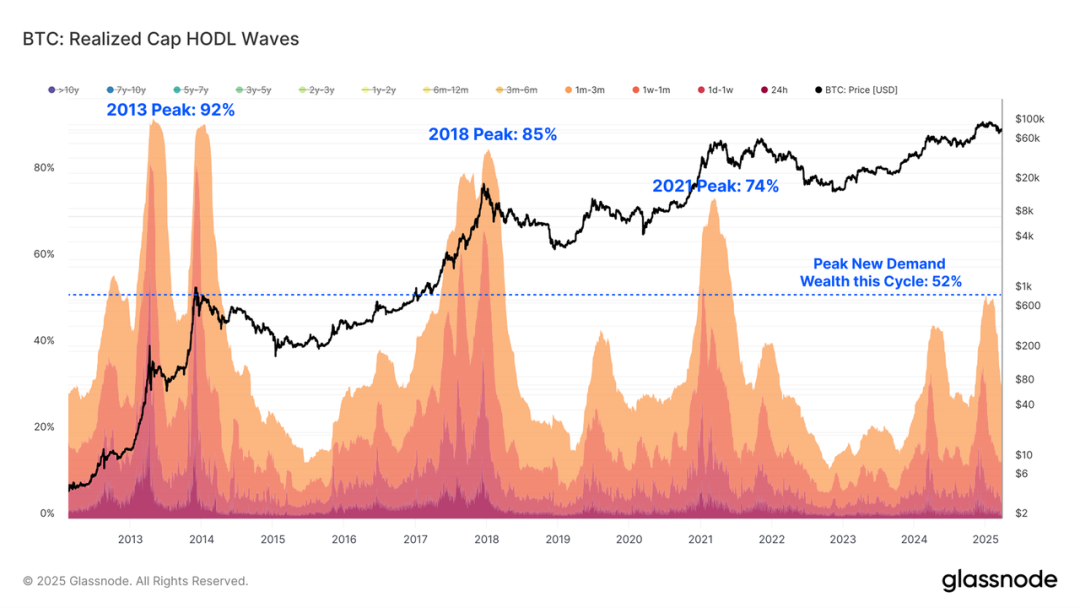

BTC new demand inflows continue to weaken, most short-term investors are now losing money, and the supply of long-term holders is starting to grow again. Short-term holders currently hold 40% of the wealth, reaching a peak of 50% in early 2025. This peak is still significantly lower than in previous cycles, when the wealth held by new investors peaked at 70-90% at the peak of the cycle, which may be related to this round of large institutional investors investing in ETFs.

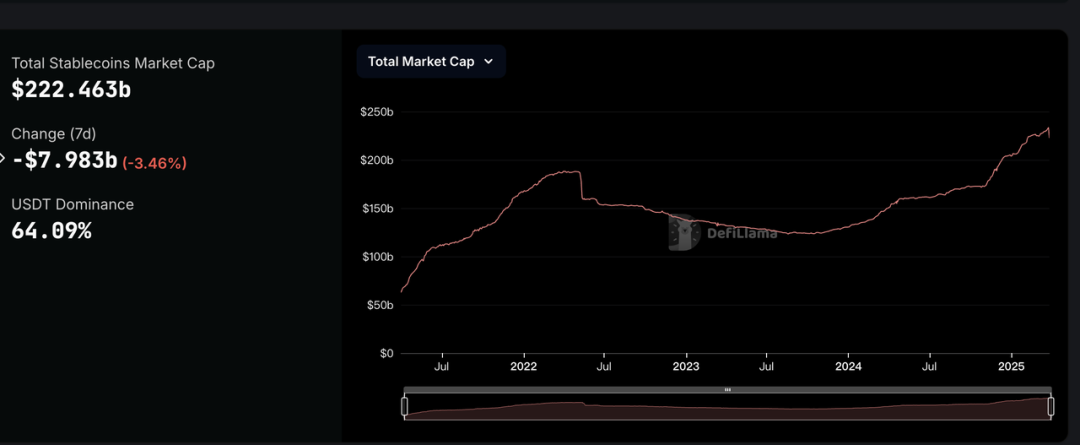

The market value of stablecoins has dropped sharply, and funds are seeking safety

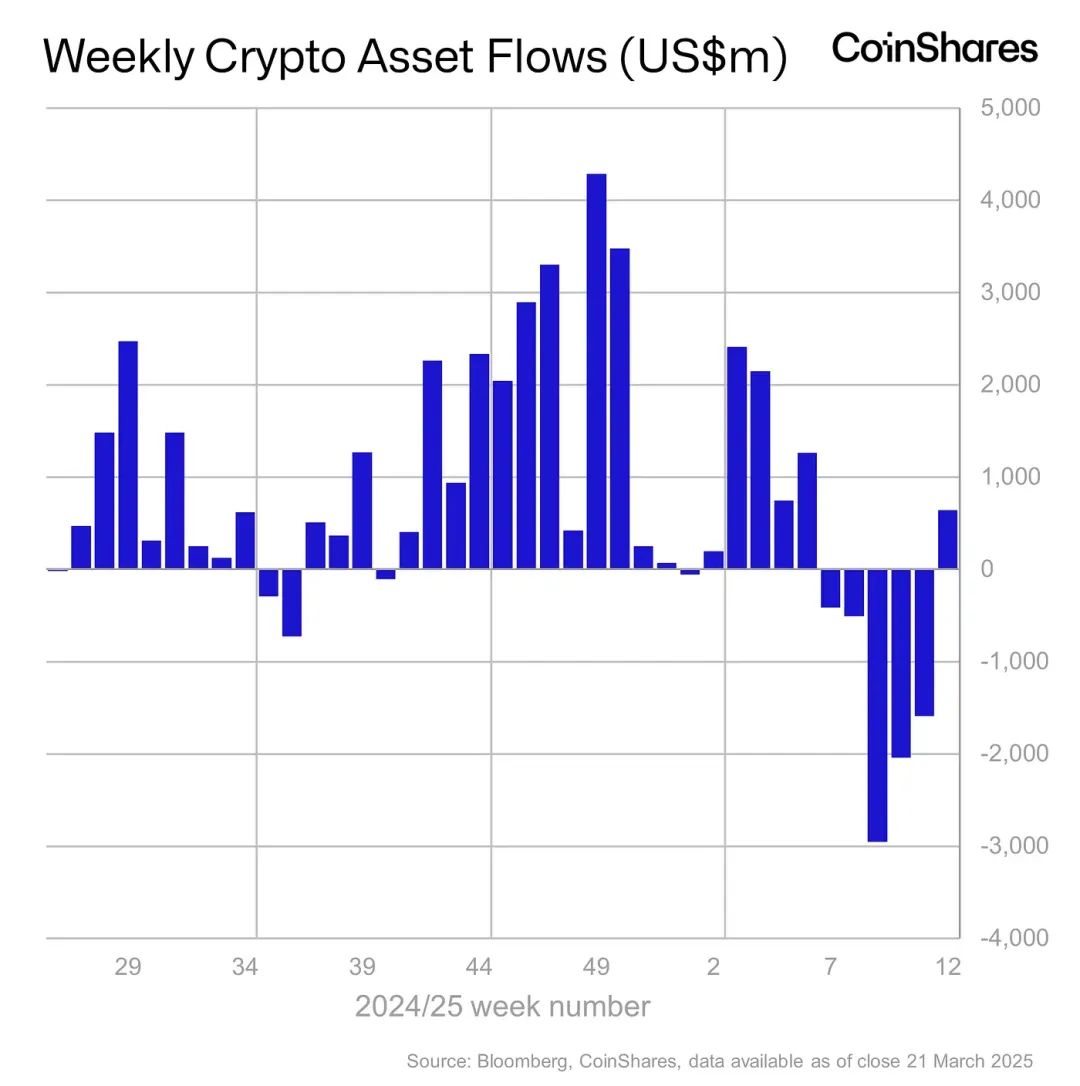

Institutional funds regained optimism, breaking five consecutive weeks of outflows.

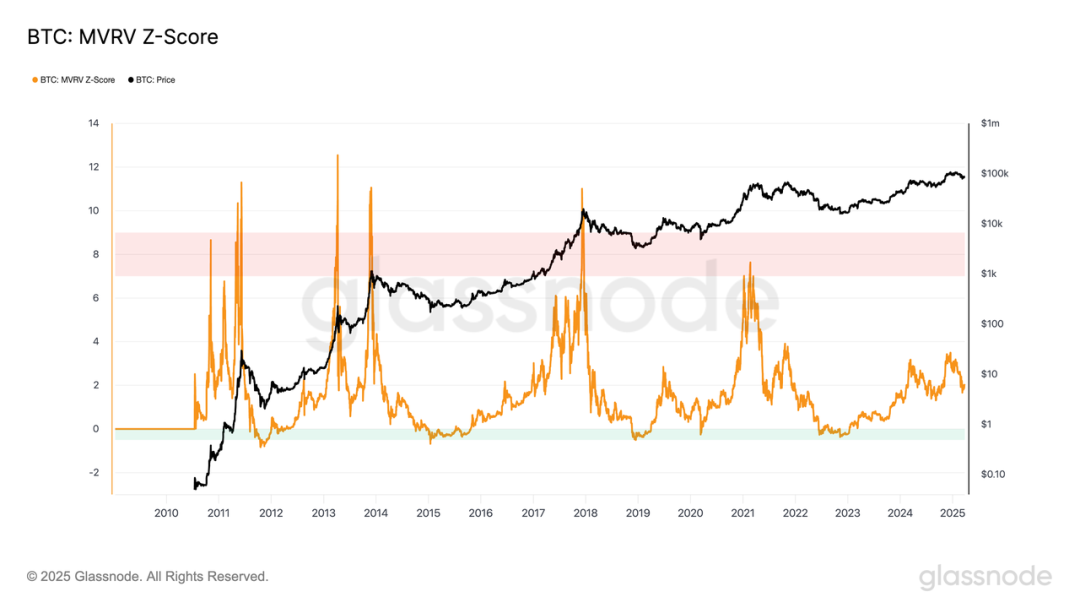

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is the top range; when the indicator is less than 2, it is the bottom range. MVRV falls below the key level of 1, and the holders are generally in a loss state. The current indicator is 2.0, close to the middle of the market.

4. Futures Market

Futures long-short ratio: 1.1, market sentiment is normal. Retail investor sentiment is mostly a reverse indicator, below 0.7 is more fearful, and above 2.0 is more greedy. The long-short ratio data fluctuates greatly, and its reference value is weakened.

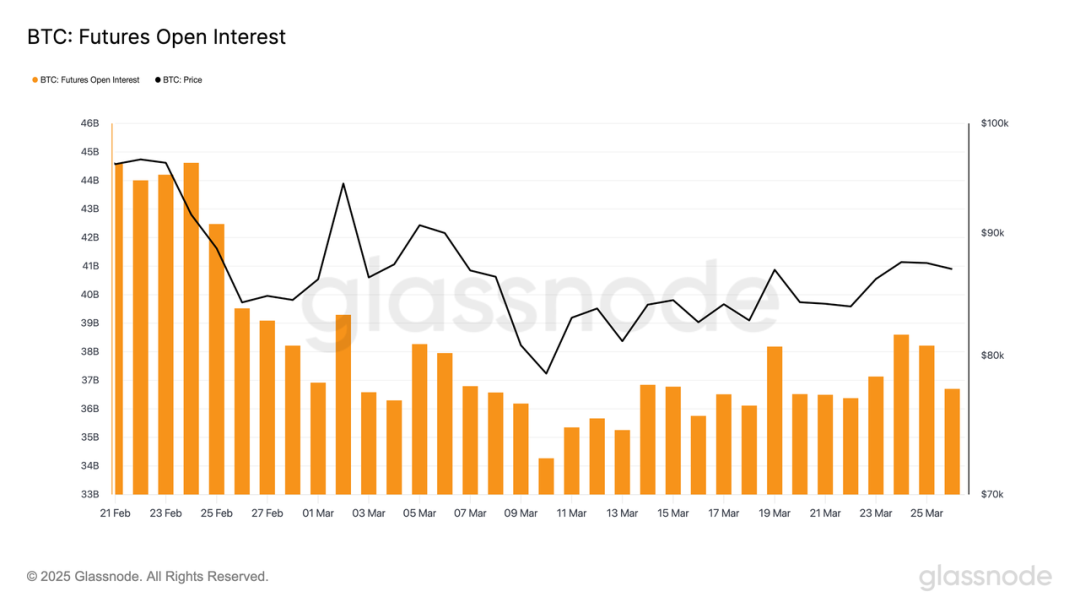

Futures open interest: BTC open interest fell slightly this week as the market lacked momentum.

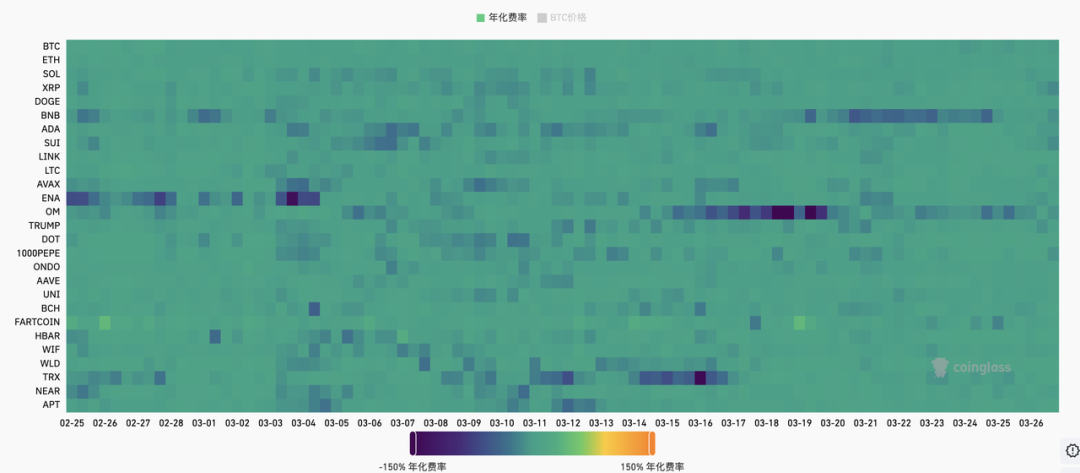

Futures funding rate: This week's rate is 0.01%, which is relatively low. The rate is 0.05-0.1%, with more long leverage, which is the short-term top of the market; the rate is -0.1-0%, with more short leverage, which is the short-term bottom of the market.

5. Spot Market

BTC rebounded this week. The market volatility dropped significantly, which is a period of sideways fluctuation and repair after the sharp drop. The market has a chance to breathe, and exchanges are accelerating the listing of VC coins.

B. Public chain ecology

1. BTC Ecosystem

Strategy continued to increase its holdings of nearly 7,000 bitcoins, and its newly launched perpetual preferred stock STRF was listed and traded on the Nasdaq, demonstrating its strategic determination to continue to maximize its Bitcoin holdings.

Michael Saylor, founder of Strategy, disclosed in an article on the X platform that the company had increased its holdings of 6,911 bitcoins at an average price of approximately $84,529 between March 17 and March 23, with a total investment of approximately $584.1 million and a BTC yield of 7.7% year-to-date. As of March 23, 2025, the total amount of bitcoins held by Strategy has reached 506,137, with a cumulative purchase cost of approximately $33.7 billion and an average holding cost of $66,608.

On March 26, Strategy's Strife perpetual preferred stock (STRF) was officially traded on the Nasdaq. The financing scale was increased from the original US$500 million to US$722.5 million, and a 10% annualized fixed dividend was set.

STRF is designed as a high-yield bond-like asset, with the core goal of directing as much money as possible to Bitcoin investment. As a debt-type instrument, STRF operates in the form of dividends rather than relying on capital appreciation returns. The launch of this product further demonstrates Strategy's strategic determination to continue to maximize Bitcoin holdings in any market environment.

2. ETH Ecosystem

Ethereum Pectra upgrade has been successfully launched on the new Hoodi testnet. The introduction of EIP-7702 will enable multi-currency payment of gas fees

The Ethereum Pectra upgrade has been successfully launched on the new Hoodi testnet. The launch of the Hoodi testnet follows problems with the previous Holesky and Sepolia testnets, and is intended to ensure that developers can fully test features such as validator exits. Currently, the Hoodi testnet is being closely monitored to ensure the stability and reliability of the upgrade in preparation for the subsequent mainnet deployment.

The Pectra upgrade aims to address several challenges facing the Ethereum network. One of the changes is the addition of smart contract functionality to wallets, allowing wallet software developers to build new convenience features, such as the ability to pay transaction fees in cryptocurrencies other than Ether (ETH).

Ethereum developers previously agreed that if all goes well on Wednesday, Pectra will be monitored for about another 30 days before eventually being enabled on the ethereum mainnet.

Celo successfully migrated to the Ethereum Layer 2 network, and the Ethereum network continued to expand.

Celo, an independent Layer 1 blockchain launched in 2020, has officially completed its migration to the Ethereum Layer 2 network on March 26. The migration took nearly two years and ultimately adopted Optimism's OP Stack technology. The upgrade aims to improve Celo's security, scalability, and interoperability with the Ethereum ecosystem. After the migration, Celo's block generation time was significantly reduced from 5 seconds to 1 second, and transaction speeds were significantly improved. At the same time, Celo will continue to maintain its ultra-low transaction fees of less than one cent.

For users, migration means faster transaction confirmation and lower costs. In addition, Celo now has native Ethereum bridge functionality, reducing dependence on third-party bridges and improving security.

Developers will also benefit from this upgrade, as they can more easily build applications on Celo as Celo is now fully compatible with the Ethereum Virtual Machine (EVM) and can easily use Ethereum’s development tools and resources.

Marek Olszewski, CEO and co-founder of cLabs, said the migration was Celo’s “journey home,” combining Ethereum’s powerful network with Celo’s speed and economy. Ethereum co-founder Vitalik Buterin also welcomed Celo’s joining.

Data TVL 46.288b, up 1.53% from last week.

3. TON Ecosystem

The fully chain-compatible HiBit DEX has landed on the TON ecosystem and is expected to play an important role in connecting the TON ecosystem with other blockchain networks.

On March 24, 2025, Hibit announced the completion of a new round of US$5 million in financing. This round of financing will be used to further improve the Hibit ecosystem, focusing on promoting Layer 2 infrastructure construction, Hibit DEX development, cross-chain interoperability technology optimization, and in-depth layout of the AI Agent economy.

As the first core application of the Hibit Layer 2 ecosystem, Hibit DEX combines the advantages of centralized exchanges (CEX) and decentralized exchanges (DEX), aiming to achieve an efficient trading experience at the level of millions of TPS and support permissionless token issuance. At the same time, Hibit DEX also deeply integrates the AI Agent economy and the Meme community to provide users with a richer trading ecosystem.

Relying on the cross-chain interoperability of Hibit Layer 2, the DEX is expected to play a key role in connecting the TON ecosystem with other blockchain networks. This capability not only attracts users and liquidity outside the TON ecosystem, but also conforms to the market's growing demand for seamless transmission of cross-chain assets and data, making interoperability solutions more strategically valuable. As a trading hub that supports multi-chain interactions, Hibit DEX has the potential to become a bridge for TON ecosystem users to enter other blockchain networks, while also providing convenient access to the TON ecosystem for users on other chains, thereby promoting the growth of transaction volume and network activity between Hibit and the TON ecosystem.

Data shows that the locked amount of TON DeFi is 170.3m, up 14.99%.

(Data source: https://defillama.com/chain/TON?groupBy=daily)

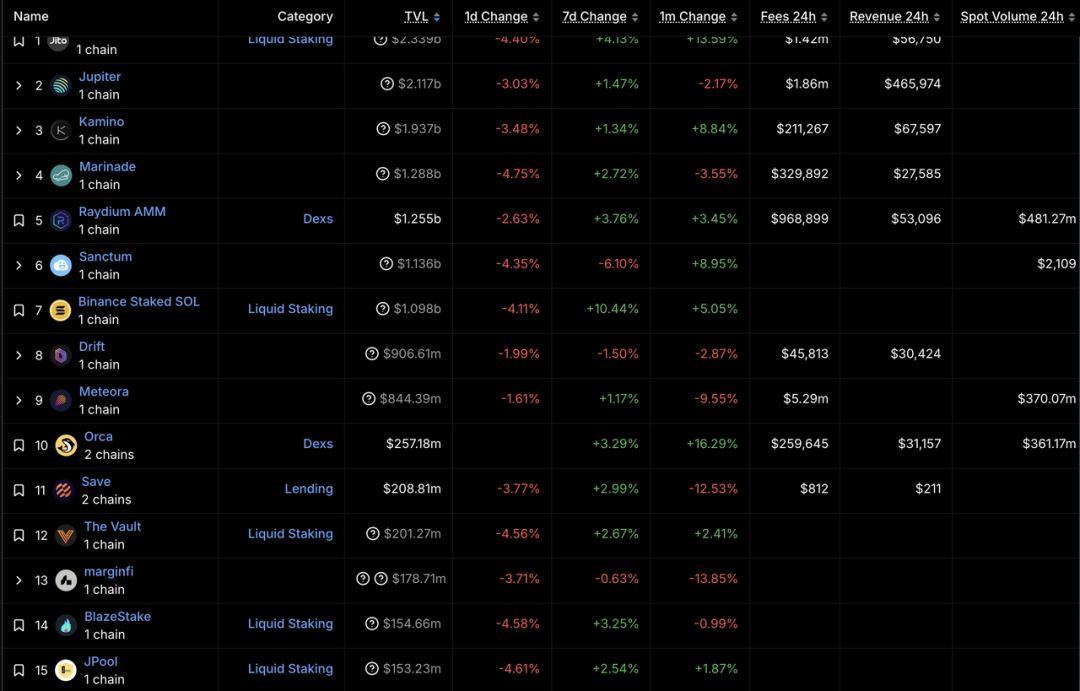

4. SOL Ecosystem

Pump.fun launched its native DEX PumpSwap, further squeezing the living space of Raydium.

On March 21, 2025, Pump.fun officially announced the launch of its decentralized exchange (DEX) - PumpSwap, marking the platform's transition from a single token issuance platform to a comprehensive platform that integrates token issuance and trading.

PumpSwap uses a constant product market maker (AMM) model, which operates similarly to Raydium V4 and Uniswap V2. PumpSwap has features and functions such as instant migration, 0 migration fee (originally 6 SOL), stronger liquidity, and creator revenue sharing. After that, a certain percentage of the protocol revenue will be shared with the token creator. Each transaction on PumpSwap is charged a 0.25% handling fee, of which 0.20% goes to liquidity providers and 0.05% is allocated to the protocol, but the fee distribution will change after the creator revenue sharing function goes online.

PumpSwap quickly gained market recognition after its launch, and in just one week, it occupied 21% of the Solana ecosystem DEX market share, with a trading volume of up to $1.5 billion. This breakthrough enables memecoins to be seamlessly migrated to PumpSwap for trading, further consolidating Pump.fun's dominant position in the memecoin trading field and forming a strong competition for Raydium. In just one week, PumpSwap processed more than 14 million transactions and accumulated transaction fee income of $3.03 million.

Previously, Raydium announced plans to launch the Meme coin issuance platform LaunchLab, which was generally seen by the market as a response to Pump.fun's self-built AMM ecosystem. However, if Raydium fails to launch LaunchLab in a timely manner and form a competitive advantage in token issuance and trading experience, its market share may be further compressed, and even affect its long-term survival space in the Solana ecosystem.

DeFi data: TVL 6.809b, down 0.24% from last week.