Written by: Nan Zhi, Odaily Planet Daily

In early 2024, Binance began to frequently list coins through the Launchpool section, among which Binance Labs investment projects became the main force of coin listing, including Fusionist (ACE), Sleepless AI (AI), NFPrompt (NFP), etc. In the middle of the year, Binance suspended coin listing due to market downturn and VC coin "blood-sucking" market controversy. Recently, Launchpool has returned again, and the frequency of coin listing has increased significantly.

Yesterday, Binance Labs “selected” 12 projects in its portfolio to be showcased on the Innovation Stage at Binance Blockchain Week in Dubai to help them gain exposure and feedback.

Interestingly, the reply with the highest number of likes and exposure under Binance Labs’ tweet was “I’m tired, can KiloEx issue tokens soon?” (one of the 12 invested projects). Therefore, based on the relatively high probability of listing, Binance Labs’ renewed support, and the strong demand for issuing tokens, Odaily will summarize the project background and latest progress of these 12 projects in this article for readers’ reference and judgment on whether there is still an opportunity to participate in the interaction.

The 12 projects are aPriori, KiloEx, MilkyWay, Movement, OpenEden, Puffer Finance, Solayer, StakeStone, UXUY, ZEROBASE, Zest Protocol, and Zircuit.

aPriori

Project Business: aPriori is a liquidity staking platform in the Monad ecosystem, aiming to provide users with efficient staking solutions while maintaining the liquidity of assets.

Financing status: On July 30, it received strategic investment from Binance Labs; on July 25, it completed an $8 million seed round of financing, led by Pantera Capital; on January 30, it completed a $2.7 million Pre-Seed round of financing, led by Hashed and Arrington Capital.

Latest progress: Since Monad Network is not available, there is no direct progress at the moment.

KiloEx

Project business: A perpetual contract DEX similar to GMX. Due to counterparty reasons, most of the assets listed are mainstream currencies.

Financing: On March 21, Foresight Ventures invested; on August 4, 23, Binance Labs invested. The amount was not disclosed.

Latest progress: KiloEx was initially deployed on BNB chain and opBNB chain, and the focus of subsequent business development has shifted to multi-chain expansion. In reverse chronological order, Base, B², Taiko, Manta and other networks have been launched, and dappOS's intention network has also been connected (an opportunity to kill two birds with one stone).

MilkyWay

Project business: MilkyWay is a liquidity staking solution for the Celestia ecosystem, initially deployed and run on Osmosis, and is currently expanding its asset use cases and types.

Financing status: On April 30, it completed a US$5 million seed round of financing, with Binance Labs, Polychain, Hack VC and others participating in the investment.

Latest progress: The main development directions include expanding the use cases of the core asset milkTIA, introducing the asset into protocols such as Demex and Flame; launching new liquidity pledge assets such as milkINIT (INIT is the token of the module network Initia, which has raised US$22.5 million and will hold a TGE next month).

Movement

Project business: A modular network based on the Move language, designed to connect the EVM network with the Move network.

Financing situation: On May 1, it received investment from Binance Labs; on April 25, it completed its Series A financing, led by Polychain; on September 13, 2023, it completed a US$3.4 million Pre-Seed round of financing, led by dao 5, Borderless Capital, Blizzard Fund, and Varys Capital.

Latest progress: The Movement testnet Odyssey is in progress. According to official disclosure, there are currently 10 million addresses and more than 458 million transactions.

OpenEden

Project business: RWA tokenization protocol, which can currently be considered as a U.S. debt on-chain protocol, allows users to invest in U.S. Treasury securities through its native stablecoin TBILL.

Financing status: Received strategic investment from Binance Labs on September 12.

Latest progress: In June this year, Moody's Ratings awarded its licensed fund for tokenized US Treasury bonds an "A" rating, making it the first RWA token to receive a Moody's rating. The cumulative TVL reached US$150 million (KYC compliance certification is required to use its products, and it is not a wool-pulling project).

Puffer Finance

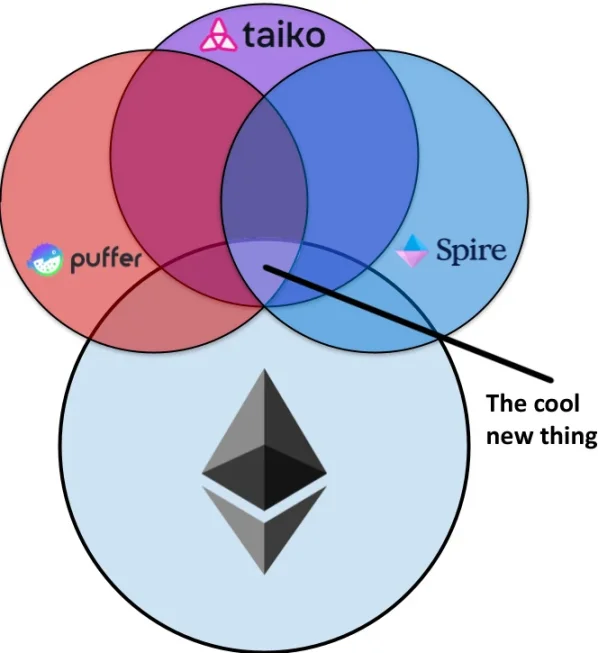

Project business: One of the re-pledge protocols based on Eigenlayer. Compared with other re-pledge protocols, it has launched the Based Rollup solution UniFi, which aims to solve the problem of Ethereum liquidity fragmentation and bring value back to Ethereum L1.

Financing situation: A total of four rounds of financing were carried out. On April 16, an $18 million Series A financing was completed, led by Electric Capital and Brevan Howard Digital; on January 30, it received a strategic investment from Binance Labs.

Latest progress: On October 22, UniFi Devnet was launched, open to whitelists and protocols, and the testnet and mainnet will be launched soon. Last week, the protocol token PUFFER airdrop was opened, and the withdrawal function of pufETH was also opened.

Solayer

Project business: Liquidity re-pledge protocol on the Solana network.

Financing situation: On August 27, it completed a US$12 million seed round of financing, led by Polychain and participated by Binance Labs and others; in July, it completed a Pre-seed round of financing, with Anatoly (founder of Solana) and others participating.

Latest progress: Jointly launched liquidity re-staking SOL with multiple exchanges, including Binance (BNSOL), Bybit (bbSOL), Bitget (BGSOL), etc. Users can convert their SOL tokens into these tokens on the exchange, and after staking, they can obtain staking rewards, liquidity incentives, AVS delegation and MEV rewards.

Partnered with OpenEden to launch RWA Yield USD sUSD, a token that allows for re-staking and will earn interest through U.S. Treasury bonds.

StakeStone

Project business: LSD (liquidity staking derivatives) protocol supported by ETH staking income.

Financing status: On March 25, it received investments from Binance Labs, OKX Ventures, and Skyland Ventures.

Latest progress: The main development direction is multi-chain expansion. Yesterday, SBTC and STONEBTC were launched on the berachain bArtio test network; the integration plan to Sonic (new version of Fantom) was announced, etc.

U X

Project business: Multi-chain DEX based on MPC wallet.

Financing situation: On May 9, it completed an $8 million Pre-A round of financing, with Binance Labs, Bixin Ventures and others participating in the investment; in August 2023, it received investment from MEXC Ventures; in April 2023, it completed a $3.2 million seed round of financing, with Waterdrip Capital and others participating in the investment.

Latest progress: According to the joint creation of 0xKevin, UXUY "All in TG (Telegram)", the first self-hosted multi-chain wallet on TG was launched, which supports any Bot to connect to any ecosystem through UXUY Wallet Bot without permission, including EVM/Solana/TRON/TON, etc.

ZEROBASE

Project business: ZEROBASE is a real-time ZK prover network designed for speed, decentralization and compliance. It allows ZK proofs to be generated within hundreds of milliseconds and ensures decentralized and fast consensus through mechanisms, thereby enabling large-scale commercial use.

Financing status: On October 19, it completed a financing of US$5 million, with Binance Labs and others participating in the investment.

Zest Protocol

Project business: Zest Protocol is a native Bitcoin lending protocol on the Stacks network. The protocol itself is not very impressive. When Binance Labs participated in the investment in May, it was one of the few investment projects in the Bitcoin ecosystem by Binance Labs in recent years. However, with Binance Labs investing in projects such as Hemi Network and Lombard, Binance Labs' investment in the Bitcoin ecosystem is no longer rare.

Financing status: On May 13, it completed a US$3.5 million seed round of financing, led by Tim Draper and participated by Binance Labs and others.

Latest progress: Launched the points system RoboZester, where users can earn points Oranges by completing various social media tasks, but no explanation on the

Zircuit

Project business: Zircuit is an EVM-compatible ZK rollup that allows users to earn multiple types of incentives in one stop, including staking income, protocol tokens, points, and future airdrops. Zircuit points out that new LRT protocols are constantly emerging, and even experienced users find it difficult to track and choose the safest and best protocols to deploy their funds. Zircuit aims to solve this problem and become the main liquidity hub for staking assets (ETH, BTC, LST, and LRT). User-invested funds will be deployed to safe and high-quality protocols by Zircuit.

Financing: On July 22, a financing round was completed, with participation from Binance Labs, Mirana Ventures, etc.; on June 11, Binance Labs made a separate investment. The amount and valuation were not disclosed.

Latest progress: Zircuit Liquidity Hub is launched, and staking users will receive airdrops from partners, including ZeroLend, Elara, Avalon Labs, Circuit, Ocelex, Gamma, etc. Users who stake on the Ethereum mainnet can migrate to the Liquidity Hub on Zircuit L2 for free.